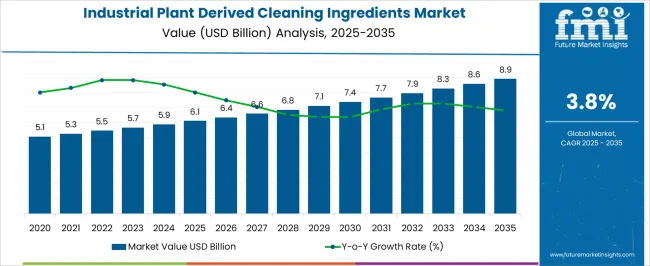

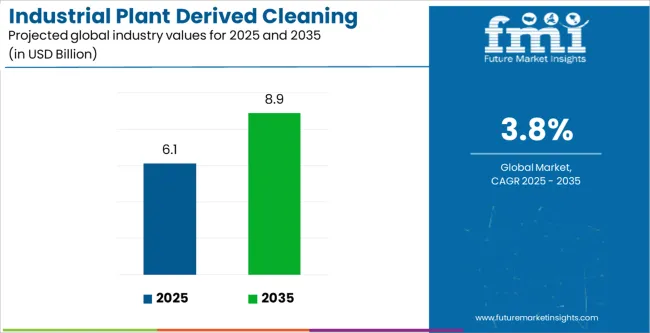

The Industrial Plant Derived Cleaning Ingredients Market is estimated to be valued at USD 6.1 billion in 2025 and is projected to reach USD 8.9 billion by 2035, registering a compound annual growth rate (CAGR) of 3.8% over the forecast period.

| Metric | Value |

|---|---|

| Industrial Plant Derived Cleaning Ingredients Market Estimated Value in (2025 E) | USD 6.1 billion |

| Industrial Plant Derived Cleaning Ingredients Market Forecast Value in (2035 F) | USD 8.9 billion |

| Forecast CAGR (2025 to 2035) | 3.8% |

The industrial plant derived cleaning ingredients market is experiencing strong growth, supported by increasing demand for sustainable and eco-friendly alternatives in cleaning and hygiene applications. Rising awareness among consumers and industries regarding the environmental impact of synthetic chemicals is creating significant momentum for plant-based formulations. Manufacturers are responding by expanding their portfolios with bio-based surfactants, solvents, and enzymes that deliver comparable or superior performance to conventional chemical ingredients.

Government initiatives and stricter regulations targeting carbon footprint reduction and chemical toxicity are also shaping market adoption, making plant-derived options more attractive across industries. Furthermore, partnerships between ingredient producers and cleaning product manufacturers are accelerating innovation and improving scalability in production.

Growth is being reinforced by investments in biotechnology and green chemistry, which are enabling more efficient extraction and processing of plant-based materials With strong support from both regulatory frameworks and consumer preferences, the market is positioned to achieve sustained expansion, with increasing penetration in household, commercial, and industrial applications globally.

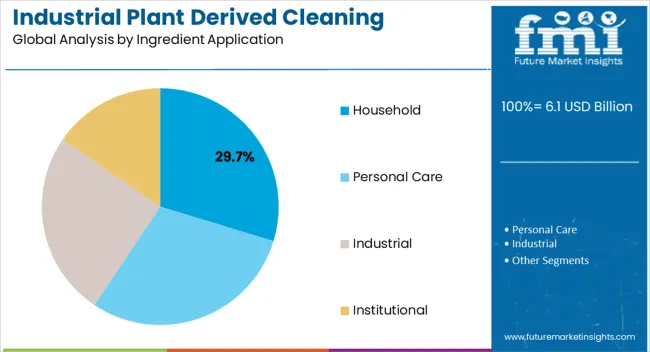

The industrial plant derived cleaning ingredients market is segmented by distribution channel, ingredient type, ingredient application, source, and geographic regions. By distribution channel, industrial plant derived cleaning ingredients market is divided into Offline and Online. In terms of ingredient type, industrial plant derived cleaning ingredients market is classified into Organic and Inorganic. Based on ingredient application, industrial plant derived cleaning ingredients market is segmented into Household, Personal Care, Industrial, and Institutional. By source, industrial plant derived cleaning ingredients market is segmented into Coconuts, Corn, Oranges, Sugarcane, and Flower Fragrances. Regionally, the industrial plant derived cleaning ingredients industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

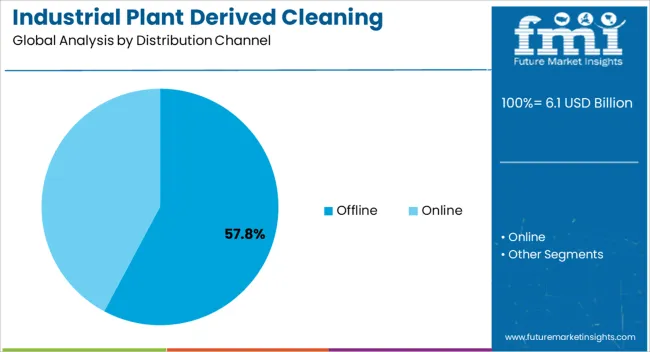

The offline distribution channel segment is projected to hold 57.8% of the industrial plant derived cleaning ingredients market revenue share in 2025, making it the leading distribution channel. This dominance is being driven by the wide availability of plant-based cleaning ingredients in supermarkets, specialty stores, and wholesale outlets that cater directly to both consumers and businesses. Many customers continue to prefer purchasing through offline channels as they offer product assurance, direct consultation, and the ability to compare different product ranges physically.

In addition, partnerships with large retail chains and distributors have significantly expanded the visibility and accessibility of these products, reinforcing customer trust. Offline distribution is also favored in regions where digital infrastructure is less developed, ensuring that products reach diverse consumer bases.

Marketing strategies such as in-store promotions and sampling programs are enhancing consumer awareness and adoption, further solidifying this channel’s market leadership As the trend toward sustainable consumption strengthens, offline distribution is expected to remain a critical pathway for plant-based cleaning ingredient adoption, particularly in regions with strong traditional retail networks.

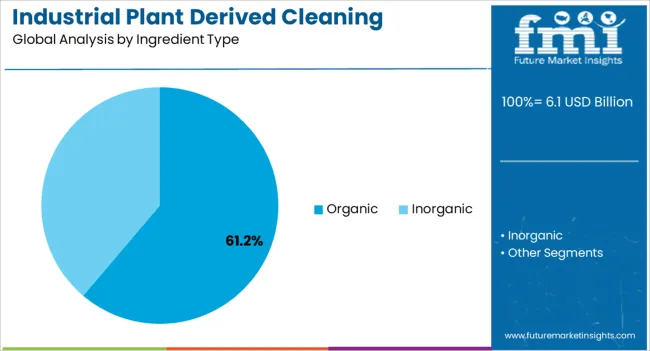

The organic ingredient type segment is expected to account for 61.2% of the industrial plant derived cleaning ingredients market revenue share in 2025, positioning it as the dominant ingredient category. This leadership is being reinforced by the rising consumer preference for certified organic cleaning solutions that ensure safety for both human health and the environment. Organic ingredients are widely perceived as safer alternatives due to the absence of synthetic pesticides, fertilizers, or genetically modified organisms in their production.

Regulatory certifications and eco-labeling are further boosting consumer trust and driving adoption across both residential and commercial markets. In addition, organic ingredients are increasingly favored by manufacturers seeking to align with sustainability goals and clean-label product positioning.

Continuous advancements in extraction and formulation technologies are enhancing the performance of organic components, enabling them to match or exceed the efficacy of conventional chemical alternatives As demand for transparent, traceable, and environmentally responsible cleaning products rises, the organic ingredient segment is anticipated to retain its leadership, supported by expanding supply chains and increasing global regulatory support.

The household application segment is projected to capture 29.7% of the industrial plant derived cleaning ingredients market revenue share in 2025, making it the leading application area. Its dominance is being driven by the strong shift in consumer preference toward eco-friendly and non-toxic cleaning products for daily use in kitchens, bathrooms, and general home care. The rising health awareness among households, particularly regarding allergies and chemical sensitivities, is creating strong demand for plant-derived alternatives.

This trend is further supported by the growing emphasis on family health and wellness, as well as the influence of eco-conscious lifestyles. Marketing campaigns highlighting biodegradability, safety, and natural origins are increasing consumer confidence and driving repeat purchases.

Additionally, household applications benefit from the widespread availability of diverse product formats, including sprays, detergents, and surface cleaners that incorporate plant-based ingredients As sustainability continues to shape consumer decisions and regulatory pressures encourage greener product adoption, the household segment is positioned to remain the most prominent application area, with consistent growth opportunities across both developed and emerging markets.

According to Future Market Insights research, during the projected period, the Global Industrial Plant Derived Cleaning Ingredients Market is expected to grow at a CAGR of 3.8%. The market value is projected to increase from US$ 5,474.3 Million in 2025 to US$ 7,948.8 Million by 2035. The Industrial Plant Derived Cleaning Ingredients Market was valued at US$ 5243.567 Million at the end of 2025 and is anticipated to exhibit a CAGR growth of 4% from 2025 to 2025.

| Attributes | Details |

|---|---|

| Market Size Value in 2025 | US$ 5,474.3 Million |

| Market Forecast Value in 2035 | US$ 7,948.8 Million |

| Global Growth Rate (2025 to 2035) | 3.8% CAGR |

| Forecast Period | 2025 to 2035 |

| Market Share CAGR (latest period) of the United Kingdom in Europe | 6.3% |

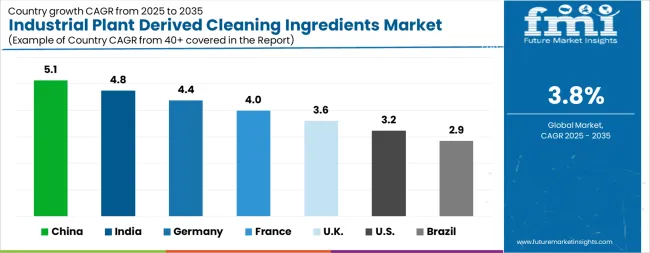

| Country | CAGR |

|---|---|

| China | 5.1% |

| India | 4.8% |

| Germany | 4.4% |

| France | 4.0% |

| UK | 3.6% |

| USA | 3.2% |

| Brazil | 2.9% |

The Industrial Plant Derived Cleaning Ingredients Market is expected to register a CAGR of 3.8% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 5.1%, followed by India at 4.8%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 2.9%, yet still underscores a broadly positive trajectory for the global Industrial Plant Derived Cleaning Ingredients Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 4.4%. The USA Industrial Plant Derived Cleaning Ingredients Market is estimated to be valued at USD 2.2 billion in 2025 and is anticipated to reach a valuation of USD 3.1 billion by 2035. Sales are projected to rise at a CAGR of 3.2% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 336.7 million and USD 165.5 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 6.1 Billion |

| Distribution Channel | Offline and Online |

| Ingredient Type | Organic and Inorganic |

| Ingredient Application | Household, Personal Care, Industrial, and Institutional |

| Source | Coconuts, Corn, Oranges, Sugarcane, and Flower Fragrances |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BASF SE, Procter & Gamble, Dow, Henkel AG & Co. KGaA, Sasol, SOLVAY, Croda International PLC, STEPAN Company, Huntsman International LLC, Eastman Chemical Corporation, Clariant, Westlake Chemicals Corporation, Albemarle Corporation, Reckitt Benckiser Group plc, Clorox Inc., Kimberly-Clark Corporation, and 3M |

The global industrial plant derived cleaning ingredients market is estimated to be valued at USD 6.1 billion in 2025.

The market size for the industrial plant derived cleaning ingredients market is projected to reach USD 8.9 billion by 2035.

The industrial plant derived cleaning ingredients market is expected to grow at a 3.8% CAGR between 2025 and 2035.

The key product types in industrial plant derived cleaning ingredients market are offline and online.

In terms of ingredient type, organic segment to command 61.2% share in the industrial plant derived cleaning ingredients market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Industrial Gas Market Size and Share Forecast Outlook 2025 to 2035

Industrial Furnace Market Size and Share Forecast Outlook 2025 to 2035

Industrial Weighing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Industrial Drum Market Size and Share Forecast Outlook 2025 to 2035

Industrial Food Slicers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Printer Market Size and Share Forecast Outlook 2025 to 2035

Industrial Fryers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Paper Sacks Market Size and Share Forecast Outlook 2025 to 2035

Industrial Chemical Packaging Market Size and Share Forecast Outlook 2025 to 2035

Industrial Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Industrial Valve Market Size and Share Forecast Outlook 2025 to 2035

Industrial Air Filtration Market Size and Share Forecast Outlook 2025 to 2035

Industrial Phosphates Market Size and Share Forecast Outlook 2025 to 2035

Industrial Elevators Market Size and Share Forecast Outlook 2025 to 2035

Industrial Boilers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Battery Market Size and Share Forecast Outlook 2025 to 2035

Industrial Nailers Market Size and Share Forecast Outlook 2025 to 2035

Industrial Relay Market Size and Share Forecast Outlook 2025 to 2035

Industrial Hose Assembly Market Size and Share Forecast Outlook 2025 to 2035

Industrial Noise Control Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA