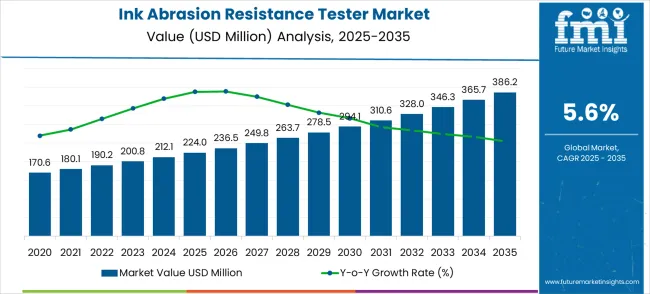

The ink abrasion resistance tester market, valued at USD 224.0 million in 2025, is projected to expand to USD 386.2 million by 2035, reflecting a CAGR of 5.6%. The long-term value accumulation curve demonstrates a steady and gradual upward trajectory, signifying consistent demand across packaging, printing, and labeling sectors. In the initial years, from 2025 through 2027, growth remains modest, moving from USD 224.0 million to approximately USD 249.0 million. This stage illustrates the adoption of abrasion testing as an essential quality control measure in high-volume printing environments where brand integrity and regulatory compliance drive the use of durable testing equipment.

As the market moves into the 2027 to 2030 period, the curve steepens with value accumulation reaching USD 295.0 million. This phase indicates broader acceptance of abrasion testers across industries such as consumer goods, pharmaceuticals, and industrial labeling. Investments in high-speed digital and flexographic printing lines enhance the need for reliable abrasion resistance testing, ensuring longevity of print quality on varied substrates. Market players leverage technological upgrades, including automation, enhanced data integration, and compliance-driven features, positioning the market in a stronger mid-phase growth cycle.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 224.0 million |

| Market Forecast Value (2035) | USD 386.2 million |

| Market Forecast CAGR (2025–2035) | 5.6% |

Between 2030 and 2033, the curve shows further acceleration, reaching approximately USD 342.0 million. This reflects cumulative adoption in emerging economies where packaged goods manufacturing expands at a faster pace. Sustainability initiatives create demand for abrasion resistance testers suited for eco-friendly inks and biodegradable packaging materials. The shift toward smart packaging and e-commerce labeling also fuels adoption, as durability testing becomes a prerequisite for maintaining print readability throughout logistics cycles. This stage represents a critical period in the value accumulation curve, where innovation and market expansion intersect.

The final segment of the curve, from 2033 to 2035, shows the market stabilizing at USD 386.2 million. While growth remains positive, the slope of accumulation softens as adoption in developed economies nears saturation. The recurring demand from replacement equipment, calibration services, and integration with Industry 4.0 platforms sustains revenue streams. The long-term value accumulation curve highlights the market’s ability to generate predictable growth through continuous innovation and diversified application bases. For stakeholders, this consistency provides confidence in long-term investments, while signaling that future value creation will rely more on technological differentiation and service-based expansions rather than simple unit growth.

Ink Abrasion Resistance Tester Market Opportunity Pools

The market is entering a phase of steady growth, driven by demand for quality control equipment, manufacturing industry expansion, and evolving testing and automation standards. By 2035, these pathways together can unlock USD 72-95 million in incremental revenue opportunities beyond baseline growth.

Pathway A -- Packaging Industry Leadership (Print Quality Control) The packaging printing segment already holds the largest share due to its critical durability requirements and quality standards. Expanding e-commerce packaging, green materials testing, and brand protection initiatives can consolidate leadership. Opportunity pool: USD 25-35 million.

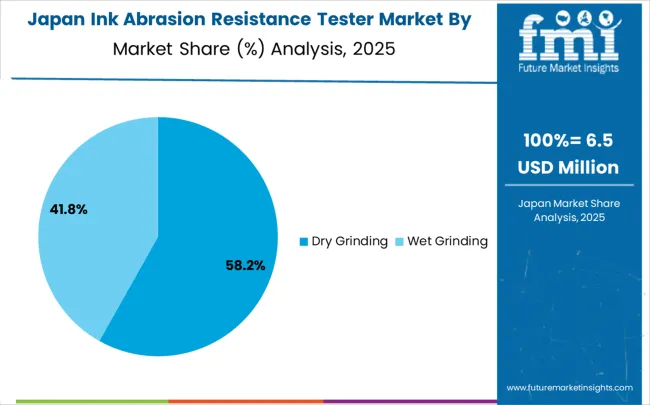

Pathway B -- Dry Grinding Innovation (Standard Testing Methods) Dry grinding methods account for the majority of demand. Growing industry focus on standardized testing protocols and measurement consistency will drive higher adoption of advanced dry abrasion testing systems. Opportunity pool: USD 20-28 million.

Pathway C -- Automotive & Electronics Applications Growth Automotive interior and electronic product testing markets are expanding, especially with advancing material technologies. Testers designed for specialized applications (heat resistance, chemical exposure) can capture significant growth. Opportunity pool: USD 12-18 million.

Pathway D -- Emerging Market Expansion Asia-Pacific, Latin America, and Africa present growing demand due to rising manufacturing quality standards and industrial development. Targeting quality control laboratories and manufacturers will accelerate adoption. Opportunity pool: USD 10-15 million.

Pathway E -- Advanced Material Testing With developing advanced inks, coatings, and printed electronics, there is opportunity to create specialized testers for next-generation materials requiring unique testing protocols. Opportunity pool: USD 6-10 million.

Pathway F -- Automated & Smart Testing Systems Integration with manufacturing systems, real-time monitoring, and predictive analytics offers premium positioning for Industry 4.0 and smart factory applications. Opportunity pool: USD 4-7 million.

Pathway G -- Laboratory Services & Testing Third-party testing laboratories and certification services create opportunities for high-throughput, multi-standard testing equipment designed for commercial testing operations. Opportunity pool: USD 3-5 million.

Pathway H -- Training & Consulting Services Comprehensive operator training, testing protocol development, and quality system consulting create value-added opportunities beyond equipment sales. Opportunity pool: USD 2-3 million.

Why is the Ink Abrasion Resistance Tester Market Growing?

Market expansion is being supported by the rapid increase in packaging and printing industry development worldwide and the corresponding need for precision testing equipment that provides superior measurement accuracy and quality assurance capabilities. Modern manufacturing operations rely on consistent product quality and material durability testing to ensure optimal performance including packaging materials, automotive components, and electronic products. Even minor quality variations can require comprehensive testing protocol adjustments to maintain optimal product standards and customer satisfaction.

The growing complexity of material testing requirements and increasing demand for automated quality control solutions are driving demand for ink abrasion resistance testers from certified manufacturers with appropriate testing instrument capabilities and measurement expertise. Manufacturing companies are increasingly requiring documented testing accuracy and repeatability to maintain product quality and regulatory compliance. Industry specifications and testing standards are establishing standardized abrasion testing procedures that require specialized testing technologies and trained quality control professionals.

The market is segmented by test type, application, and region. By test type, the market is divided into dry grinding and wet grinding. Based on application, the market is categorized into packaging printing, automotive interior, electronic products, and others. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

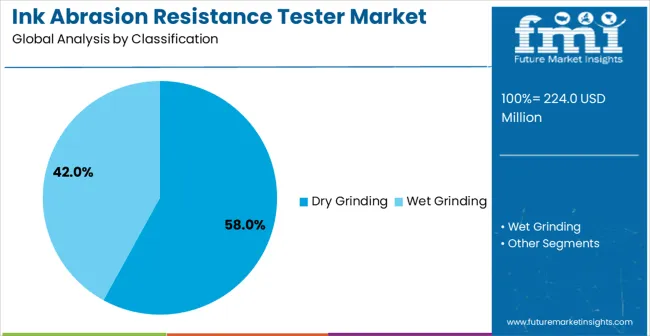

In 2025, the dry grinding ink abrasion resistance tester segment is projected to capture around 58% of the total market share, making it the leading product category. This dominance is largely driven by the widespread adoption of dry abrasion testing methods that provide optimal testing conditions for most ink and coating applications, catering to a wide variety of material testing requirements. The dry grinding method is particularly favored for its ability to deliver consistent testing results with standardized abrasive materials and controlled testing environments, ensuring measurement reliability. Quality control laboratories, printing companies, packaging manufacturers, and research institutions increasingly prefer dry grinding systems, as they meet diverse testing requirements without imposing excessive environmental controls or material preparation complexity. The availability of well-established testing protocols, along with comprehensive standardization guidelines and technical support from leading testing equipment manufacturers, further reinforces the segment's market position. This testing method benefits from consistent demand across regions, as it is considered a versatile solution for manufacturers requiring reliable abrasion resistance measurement across various ink and coating types. The combination of testing reliability, protocol standardization, and measurement consistency makes dry grinding ink abrasion resistance testers a preferred choice, ensuring their continued dominance in the material testing equipment market.

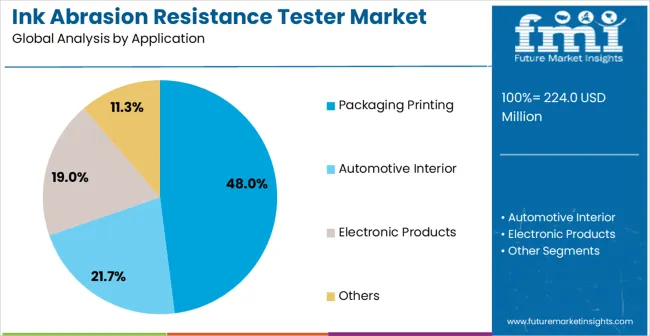

The packaging printing segment is expected to represent 48% of ink abrasion resistance tester demand in 2025, highlighting its position as the most significant application sector. This dominance stems from the critical importance of ink durability in packaging applications, where print quality and resistance to handling wear are essential to brand integrity and product protection. Packaging printing applications often require extensive durability testing that ensures ink adhesion and appearance quality throughout various distribution and consumer handling scenarios, requiring precise and reliable testing equipment. Ink abrasion resistance testers are particularly well-suited to packaging environments due to their ability to simulate real-world abrasion conditions and provide quantitative durability measurements that correlate with actual packaging performance, even during high-volume production scenarios. As packaging industry continues to expand globally and manufacturers focuses improved print quality and brand protection standards, the demand for ink abrasion resistance testers continues to rise. The segment also benefits from increased focus within the packaging industry, where manufacturers are increasingly prioritizing quality assurance and brand consistency as differentiators to maintain market competitiveness and consumer satisfaction. With packaging applications requiring comprehensive durability validation and regulatory compliance, ink abrasion resistance testers provide an essential solution to maintain effective quality control while ensuring consistent print performance across production runs. The growth of e-commerce packaging demands, coupled with increased focus on green packaging materials and print durability requirements, ensures that packaging printing applications will remain the largest and most stable demand driver for ink abrasion resistance testers in the forecast period.

The market is advancing steadily due to increasing quality control requirements and growing recognition of automated testing advantages over manual inspection methods. The market faces challenges including higher initial equipment costs compared to basic testing methods, need for specialized operator training and calibration procedures, and varying testing standards across different industry applications. Quality standardization efforts and testing technology advancement programs continue to influence equipment development and market adoption patterns.

The growing development of advanced automated testing systems is enabling superior measurement precision with improved repeatability characteristics and enhanced data collection capabilities. Enhanced automation technologies and optimized testing protocols provide reliable measurement performance while maintaining consistent testing conditions and comprehensive data analysis. These technologies are particularly valuable for quality control laboratories that require precise testing performance supporting demanding quality assurance applications with consistent measurement results.

Modern ink abrasion resistance tester manufacturers are incorporating advanced digital features and connectivity capabilities that enhance data management and testing workflow effectiveness. Integration of advanced data logging systems and optimized result analysis software enables superior quality control management and comprehensive testing documentation capabilities. Advanced digital features support use in diverse manufacturing environments while meeting various quality standards and regulatory specifications.

| Country | CAGR (2025–2035) |

|---|---|

| China | 7.6% |

| India | 7.0% |

| Germany | 6.4% |

| Brazil | 5.9% |

| United States | 5.3% |

| United Kingdom | 4.8% |

| Japan | 4.2% |

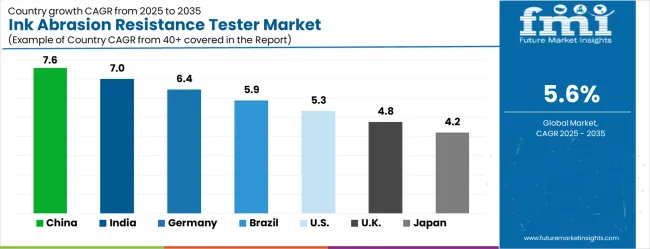

The market is growing steadily, with China leading at a 7.6% CAGR through 2035, driven by expanding manufacturing quality control infrastructure and increasing adoption of advanced testing equipment. India follows at 7.0%, supported by rising industrial quality standards and growing awareness of material testing solutions. Germany grows strongly at 6.4%, integrating testing technology into its established manufacturing and quality control infrastructure. Brazil records 5.9%, focusing manufacturing modernization and quality assurance enhancement initiatives. The United States shows solid growth at 5.3%, focusing on testing technology advancement and quality control innovation. The United Kingdom demonstrates steady progress at 4.8%, maintaining established testing applications. Japan records 4.2% growth, concentrating on technology advancement and testing precision optimization.

The report covers an in-depth analysis of 40+ countries; top-performing countries are highlighted below.

China is expected to record a CAGR of 7.6% between 2025 and 2035, supported by rapid industrialization in printing, packaging, and labeling sectors. Rising exports of packaged goods and consumer products are reinforcing demand for advanced ink durability testing. Domestic manufacturers are investing in quality assurance to comply with international trade regulations, leading to wider adoption of abrasion resistance testers. Large-scale printing units and packaging plants in Guangdong, Zhejiang, and Jiangsu provinces are increasing procurement of precision testing instruments. Innovation by local players combined with imports from global testing equipment suppliers is shaping competitive growth. Rising focus on quality consistency across flexible packaging, corrugated boxes, and high-volume printing operations further accelerates adoption in China.

India is forecasted to grow at a CAGR of 7.0% between 2025 and 2035, driven by growing demand in packaging, labeling, and publishing industries. Expanding FMCG and pharmaceutical markets have reinforced the need for abrasion resistance testing to ensure print quality in high-volume production. Local manufacturers are increasing adoption to meet international packaging standards, especially in food and drug exports. States such as Maharashtra, Gujarat, and Tamil Nadu have become significant centers for adoption due to dense printing clusters. Collaborative partnerships between Indian equipment suppliers and global testing technology providers are enhancing accessibility. The trend of automation in quality control systems also boosts deployment.

Germany is expected to grow at a CAGR of 6.4% between 2025 and 2035, supported by its advanced printing and packaging industries. The country maintains strict quality standards for labeling and consumer product packaging, which has increased demand for abrasion resistance testers. Companies in automotive, pharmaceutical, and industrial packaging rely heavily on durable print quality, creating consistent adoption. German testing equipment suppliers are investing in high-precision instruments integrated with digital monitoring systems. Strong regulatory compliance and the requirement for export packaging have reinforced procurement across multiple industries. Printing hubs in Bavaria, Baden Württemberg, and North Rhine Westphalia are emerging as leading centers of adoption.

Brazil is projected to grow at a CAGR of 5.9% between 2025 and 2035, supported by packaging, beverage labeling, and printing industries. Increasing demand for consumer goods and processed food exports is driving the need for print quality assurance. Packaging companies are focusing on abrasion resistance testing to ensure compliance with international trade requirements. Local equipment distributors are collaborating with European and Asian manufacturers to expand availability of high-performance testing machines. Adoption is concentrated in São Paulo and Rio de Janeiro due to their industrial and manufacturing base. Rising investments in the beverage industry and processed food packaging are also boosting deployment of abrasion resistance testers.

The United States is expected to record a CAGR of 5.3% from 2025 to 2035, influenced by packaging, publishing, and pharmaceutical labeling sectors. Strict quality compliance regulations for consumer goods packaging have reinforced demand for abrasion resistance testers. Packaging converters and large-scale printing companies prioritize durability testing to reduce rejections and enhance customer satisfaction. Leading equipment suppliers in the USA are offering advanced abrasion resistance testers with digital controls and automation features. Adoption is concentrated in states such as California, Texas, and New Jersey, where packaging and pharmaceutical manufacturing bases are strong. The continuous push for high-quality, export-oriented packaging accelerates adoption.

The United Kingdom is forecasted to grow at a CAGR of 4.8% between 2025 and 2035, supported by rising demand in publishing, labeling, and consumer goods packaging. Stringent standards for pharmaceutical labeling and food safety packaging have boosted adoption of abrasion resistance testers. Companies in Greater London, Manchester, and Birmingham are actively deploying testing equipment to ensure compliance. Import dependency on European and Asian testing equipment suppliers is shaping competitive dynamics. Increasing awareness about sustainability in packaging has also influenced demand for high-quality testing. Market adoption is reinforced by integration of abrasion testing within broader quality assurance frameworks in the UK.

Japan is projected to grow at a CAGR of 4.2% between 2025 and 2035, influenced by its advanced printing, electronics, and packaging industries. High focus on precision and compliance has encouraged companies to invest in abrasion resistance testers. Japanese packaging companies serving global electronics and automotive industries demand consistent print quality, reinforcing adoption. Companies such as Shimadzu and other domestic testing suppliers have strengthened product innovation by offering high-accuracy equipment. Adoption is concentrated in Tokyo, Osaka, and Nagoya industrial hubs. Growth is further supported by integration of automated and digital monitoring systems in abrasion testing instruments, ensuring accuracy and operational efficiency.

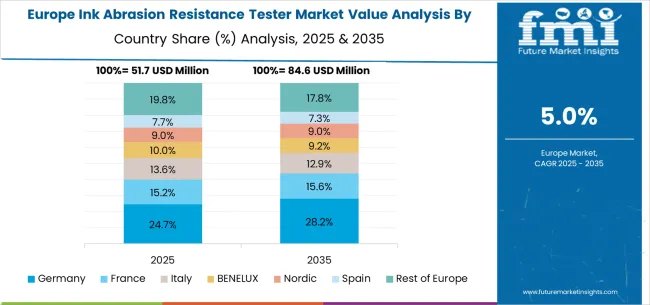

The ink abrasion resistance tester market in Europe is forecast to expand from USD 60.1 million in 2025 to USD 103.6 million by 2035, registering a CAGR of 5.6%. Germany will remain the largest market, holding 36.0% share in 2025, easing to 35.5% by 2035, supported by strong manufacturing infrastructure and advanced quality control systems. The United Kingdom follows, rising from 28.0% in 2025 to 28.5% by 2035, driven by manufacturing companies and testing innovation initiatives. France is expected to decline slightly from 22.0% to 21.5%, reflecting manufacturing industry consolidation. Italy maintains stability at around 10.0%, supported by manufacturing facilities and quality control centers, while Spain grows from 3.5% to 4.0% with expanding manufacturing and testing equipment demand. BENELUX markets ease from 0.4% to 0.3%, while the remainder of Europe hovers near 0.1%--0.2%, balancing emerging Eastern European growth against mature Nordic markets.

The market is defined by competition among specialized testing equipment manufacturers, quality control instrument companies, and measurement solution providers. Companies are investing in advanced testing technology development, measurement accuracy optimization, automation improvements, and comprehensive technical support capabilities to deliver reliable, precise, and efficient testing solutions. Strategic partnerships, technological innovation, and market expansion are central to strengthening product portfolios and quality control industry presence.

Presto offers comprehensive ink abrasion resistance tester solutions with established testing equipment expertise and quality control measurement capabilities. Labthink Instruments Co. Ltd. provides specialized testing instruments with focus on material testing and measurement precision. Pacorr delivers advanced testing solutions with focus on quality control and testing reliability. TESTRON specializes in testing equipment with advanced measurement technology integration.

IGT Testing Systems offers professional-grade testing equipment with comprehensive quality assurance capabilities. HAIDA INTERNATIONAL delivers established testing solutions with advanced measurement technologies. Sutherland provides specialized testing equipment with focus on measurement precision optimization. Taber Industries, Thwing-Albert Instrument Company, Guangzhou Biaoji Packaging Equipment Co., Ltd., HANGZHOU PNSHAR TECHNOLOGY CO., LTD., Cell Instruments, and Victor Manufacturing Sdn Bhd offer specialized manufacturing expertise, testing reliability, and comprehensive product development across global and regional testing equipment market segments.

| Item | Value |

|---|---|

| Quantitative Units | USD 224.0 million |

| Test Type | Dry Grinding, Wet Grinding |

| Application | Packaging Printing, Automotive Interior, Electronic Products, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan, and 40+ countries |

| Key Companies Profiled | Presto, Labthink Instruments Co. Ltd., Pacorr, TESTRON, IGT Testing Systems, HAIDA INTERNATIONAL, Sutherland, Taber Industries, Thwing-Albert Instrument Company, Guangzhou Biaoji Packaging Equipment Co., Ltd., HANGZHOU PNSHAR TECHNOLOGY CO., LTD., Cell Instruments, Victor Manufacturing Sdn Bhd |

| Additional Attributes | Dollar sales by test type and application segment, regional demand trends across major markets, competitive landscape with established testing equipment manufacturers and emerging measurement technology providers, customer preferences for different test types and manufacturing applications, integration with quality control systems and manufacturing protocols, innovations in testing technology effectiveness and automation features, adoption of digital connectivity capabilities with enhanced data management for improved quality assurance workflows |

The global ink abrasion resistance tester market is estimated to be valued at USD 224.0 million in 2025.

The market size for the ink abrasion resistance tester market is projected to reach USD 386.2 million by 2035.

The ink abrasion resistance tester market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in ink abrasion resistance tester market are dry grinding and wet grinding.

In terms of application, packaging printing segment to command 48.0% share in the ink abrasion resistance tester market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Inkjet Printers Market Size and Share Forecast Outlook 2025 to 2035

Ink Resin Market Size and Share Forecast Outlook 2025 to 2035

Ink Cartridge Printer Market Size and Share Forecast Outlook 2025 to 2035

Ink-Cartridge Market Size and Share Forecast Outlook 2025 to 2035

Ink Additives Market Growth – Trends & Forecast 2025 to 2035

Inkjet Printer Market in Korea – Growth & Demand Forecast through 2035

Ink Receptive Coatings Market Trend Analysis Based on Inks, Applications, and Region 2025 to 2035

Inkjet Coders Market Growth - Trends & Outlook 2025 to 2035

Key Players & Market Share in the Inkjet Printers Industry

Inkjet Paper Market Trends & Industry Growth Forecast 2024-2034

Inkjet Label Market Trends & Industry Growth Forecast 2024-2034

Ink Tank Printer Market

Ginkgo Biloba Extract Market Size and Share Forecast Outlook 2025 to 2035

Sinker Type EDM Market Size and Share Forecast Outlook 2025 to 2035

Sinker Drill Market Size and Share Forecast Outlook 2025 to 2035

Sink Bowls Market Size and Share Forecast Outlook 2025 to 2035

Painkillers Market Size and Share Forecast Outlook 2025 to 2035

Trinket Box Market Size and Share Forecast Outlook 2025 to 2035

Drinkable Yogurt Market Size and Share Forecast Outlook 2025 to 2035

Drinking Fountain Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA