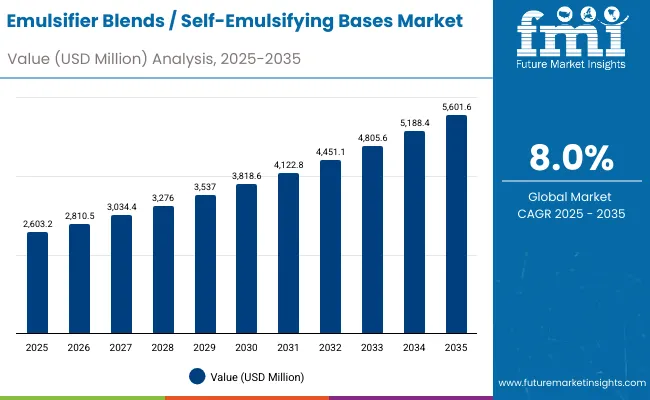

The Emulsifier Blends / Self-Emulsifying Bases Market is expected to record a valuation of USD 2,603.2 million in 2025 and USD 5,601.6 million in 2035, with an increase of USD 2,998.4 million, which equals a growth of nearly 193% over the decade. The overall expansion represents a CAGR of 8.0% and more than a 2X increase in market size.

Emulsifier Blends / Self-Emulsifying Bases Market Key Takeaways

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 2,603.2 million |

| Forecast Value in (2035F) | USD 5,601.6 million |

| Forecast CAGR (2025 to 2035) | 8.00% |

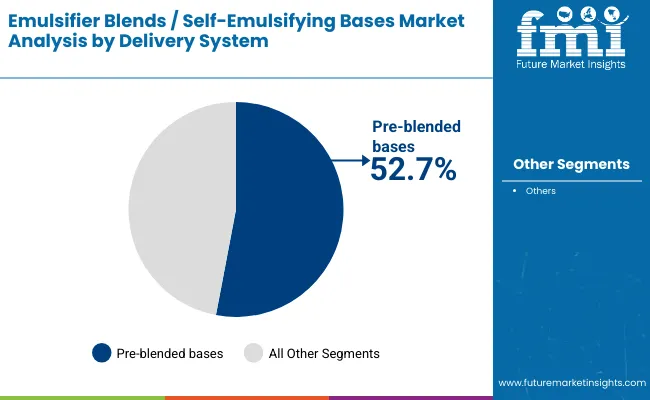

During the first five-year period from 2025 to 2030, the market increases from USD 2,603.2 million to USD 3,818.6 million, adding USD 1,215.4 million, which accounts for about 40% of the total decade growth. This phase records strong adoption in creams, lotions, and hair conditioners, supported by the preference for stable oil-in-water blends. Demand is further supported by consumer awareness of natural-origin emulsifiers such as polyglyceryl esters, which align with the clean beauty trend. Pre-blended bases dominate this phase, capturing over 52.7% share due to their ability to reduce formulation complexity and accelerate product development cycles for both multinational brands and indie cosmetic companies.

The second half from 2030 to 2035 contributes USD 1,783.0 million, equal to about 60% of total growth, as the market jumps from USD 3,818.6 million to USD 5,601.6 million. This acceleration is powered by the widespread integration of multifunctional self-emulsifying systems across pharmaceutical and dermocosmetic applications. The shift toward powdered and liquid concentrate systems gains traction for cost efficiency and ease of handling in large-scale production. Asia, led by China and India, becomes the growth engine, with CAGR values above 14% and 16% respectively, as dermocosmetic and sun care demand expands rapidly. By 2035, innovations in cold-process emulsifiers and energy-efficient blends reshape the competitive edge of the industry.

From 2020 to 2024, the Emulsifier Blends / Self-Emulsifying Bases Market expanded steadily, reaching USD 2,603.2 million in 2025. Growth during this period was largely hardware-centric in nature, but within emulsifier systems, oil-in-water and polyglyceryl esters led demand, supported by their compatibility with clean-label requirements. The competitive landscape was shaped by specialty ingredient leaders such as Gattefossé, Croda, and Evonik, who captured share by offering innovative blends with strong sensorial properties. At this stage, pre-blended systems and PEG-free formulations emerged as early differentiators, but accounted for less than half of total sales.

Demand is expected to expand further to USD 5,601.6 million in 2035, and the revenue mix will shift as cold-process and all-in-one self-emulsifying systems gain more traction. Traditional leaders face rising competition from suppliers emphasizing green chemistry, bio-based esters, and energy-efficient emulsification methods. To remain competitive, established players are increasingly focused on pre-blended and multifunctional formats that enhance formulation stability, speed up development, and meet sustainability goals. The competitive advantage is shifting from traditional chemistry to holistic system design, regional responsiveness, and the ability to provide tailored solutions to skin care, haircare, and dermocosmetic brands.

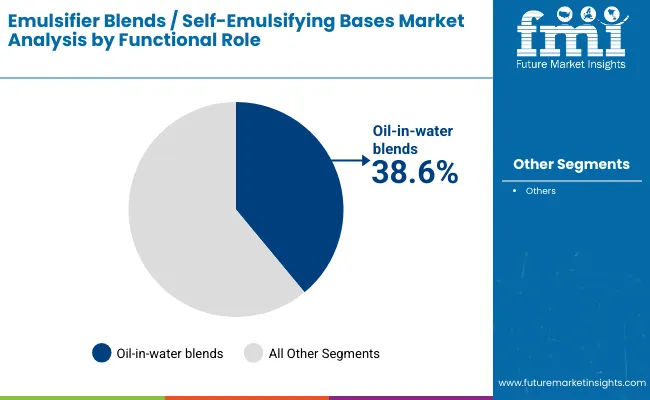

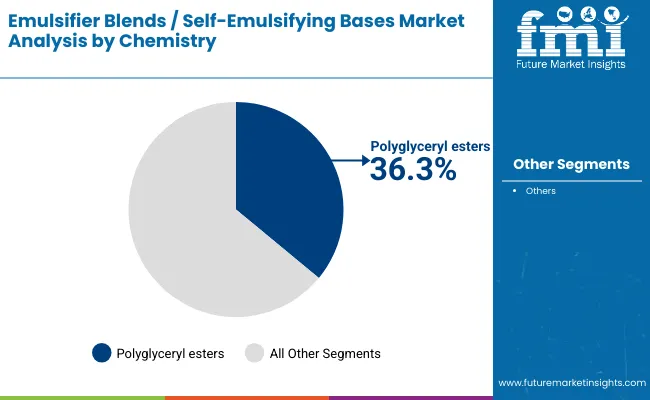

Advances in multifunctional emulsifier chemistry have expanded their application in cosmetics and pharmaceuticals. Oil-in-water blends dominate due to their stability, versatility, and consumer-preferred texture, making them central to creams and lotions. Polyglyceryl esters are driving clean-label innovation as they are PEG-free, biodegradable, and skin-friendly, supporting premium dermocosmetic launches.

The growing demand for pre-blended bases stems from their ability to streamline formulation processes, reduce development costs, and ensure consistent performance across regions. Cold-process emulsifiers are gaining attention for enabling energy savings during production. Regional growth is being driven by Asia, where China and India show CAGR values above 14% and 16% respectively, supported by rising disposable income and demand for natural skin and sun care products. In developed regions like the USA and Europe, clean beauty and pharmaceutical-grade emulsifiers are driving long-term adoption.

Segment growth is expected to be led by oil-in-water blends in functional roles, polyglyceryl esters in chemistry, and pre-blended bases in delivery systems, reflecting a shift toward convenience, clean-label compliance, and high efficiency.

The market is segmented by functional role, chemistry, delivery system, physical form, application, end use, and geography. Functional roles include oil-in-water blends, water-in-oil blends, cold-process emulsifiers, and all-in-one self-emulsifying systems, catering to diverse formulation requirements. By chemistry, polyglyceryl esters, sucrose esters, PEG-free blends, and fatty alcohol combinations form the major categories. Delivery systems include pre-blended bases, powdered self-emulsifying systems, and liquid concentrates.

Physical form segmentation covers flakes/pellets, paste, and liquid formats. Applications span creams and lotions, sun care, hair conditioners, and color cosmetics. End-use industries comprise skin and sun care brands, haircare brands, and pharmaceutical & dermocosmetic players. Regionally, the scope spans North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa.

| Functional Role | Value Share% 2025 |

|---|---|

| Oil-in-water blends | 38.6% |

| Others | 61.4% |

The oil-in-water blends segment is projected to contribute 38.6% of the Emulsifier Blends / Self-Emulsifying Bases Market revenue in 2025, maintaining its lead as the most widely adopted functional role. This is supported by their stability, versatility, and consumer-preferred sensorial profile, making them indispensable for creams and lotions.

Their compatibility with diverse actives and stable performance across different pH conditions reinforce their dominance in personal care formulations.

While cold-process and all-in-one systems are gaining ground, oil-in-water blends are expected to remain the backbone of emulsification due to their reliability and scalability across industries.

| Chemistry | Value Share% 2025 |

|---|---|

| Polyglyceryl esters | 36.3% |

| Others | 63.7% |

Polyglyceryl esters represent 36.3% of the global market in 2025, translating to USD 944.96 million in value. Their PEG-free, biodegradable, and skin-friendly nature has made them highly desirable in clean beauty and premium dermocosmetic products.

These esters enhance emulsion stability while meeting regulatory and consumer expectations for natural-origin emulsifiers. Driven by demand in Asia and Europe, polyglyceryl esters are expected to retain leadership as the chemistry of choice for next-generation emulsifier systems.

| Delivery System | Value Share% 2025 |

|---|---|

| Pre-blended bases | 52.7% |

| Others | 47.3% |

Pre-blended bases capture 52.7% of the market in 2025, equal to USD 1371.89 million, making them the dominant delivery format. Their convenience reduces formulation complexity, accelerates time-to-market, and ensures consistency across product batches. They are widely adopted by both global and indie brands seeking ready-to-use emulsifier systems that save R&D costs while maintaining high performance. As demand for multifunctional blends grows, pre-blended systems are expected to see continued momentum, reinforcing their role as the preferred delivery solution in personal care and pharmaceutical emulsification.

Rising Demand for PEG-Free and Clean-Label Emulsifier Systems

One of the strongest drivers for the market is the growing consumer and regulatory shift toward PEG-free, natural-origin emulsifiers such as polyglyceryl and sucrose esters. Consumers are increasingly concerned about petrochemical-derived ingredients, leading to the rise of "clean beauty" and dermocosmetic formulations. Brands are reformulating their skin and sun care products with PEG-free emulsifier blends to strengthen their sustainability positioning. This demand directly accelerates adoption of self-emulsifying bases that are bio-based, biodegradable, and compliant with EU and USA cosmetic regulations.

Growth of Dermocosmetics and Pharmaceutical Topicals

The expansion of dermocosmetic and topical pharmaceutical categories is fueling uptake of advanced emulsifier systems. Self-emulsifying bases provide reliable stability for active ingredients such as retinoids, corticosteroids, and sunscreens, ensuring effective delivery without compromising texture. Their multifunctionality simplifies formulation for sensitive-skin and therapeutic applications, where precise stability is critical. With dermocosmetics gaining traction in Asia-Pacific and premium categories in Europe, demand for high-performance emulsifier blends is scaling significantly.

High Formulation Costs of Multifunctional Blends

While pre-blended and all-in-one systems offer convenience, they often carry higher upfront costs compared to traditional emulsifiers. Smaller brands and regional players, particularly in cost-sensitive markets, may hesitate to adopt these systems due to tighter margins. Additionally, reliance on specialty suppliers for advanced blends creates cost variability, restraining adoption in emerging regions where local alternatives dominate.

Technical Limitations in Cold-Process Emulsifiers

Cold-process emulsifiers are increasingly promoted for energy efficiency, but they present challenges in achieving long-term stability across diverse formulations. Issues such as separation under stress conditions or incompatibility with certain active ingredients restrict their use. Until further technical improvements are achieved, formulators may be reluctant to rely heavily on cold-process systems, limiting growth in this segment despite sustainability appeal.

Pre-Blended Systems Becoming the Standard in Mid-Tier and Indie Brands

A notable trend is the rapid adoption of pre-blended bases by mid-sized and indie cosmetic brands that lack extensive formulation infrastructure. These ready-to-use blends reduce development cycles, ensure compliance, and deliver batch consistency. As contract manufacturers also prioritize speed and efficiency, pre-blended systems are becoming an industry standard, shifting the competitive advantage toward suppliers who can offer highly customized blends.

Expansion of Emulsifier Blends into Asia’s High-Growth Markets

China and India are not only driving volume growth but also shaping the innovation landscape. In China, polyglyceryl esters already hold nearly 40% share within the chemistry segment, reflecting strong clean-label demand. India, with a CAGR of 16.2%, is emerging as a key hub for affordable dermocosmetics and herbal-inspired formulations. Suppliers are tailoring emulsifier blends for region-specific needs such as sun protection in hot climates and lightweight, non-greasy formats favored by younger consumers. This geographic expansion trend is reshaping the global balance of demand toward Asia.

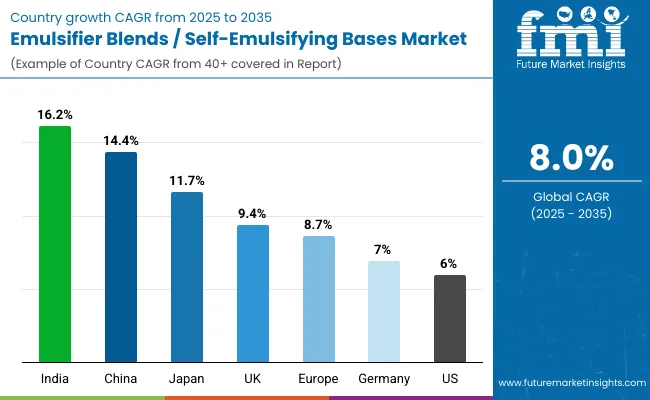

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 14.4% |

| USA | 6.0% |

| India | 16.2% |

| UK | 9.4% |

| Germany | 7.0% |

| Japan | 11.7% |

| Europe | 8.7% |

China and India stand out as the fastest-growing markets, with projected CAGRs of 14.4% and 16.2% respectively between 2025 and 2035. Growth in these countries is propelled by the rising penetration of dermocosmetics, premium skincare, and sun care solutions, supported by younger demographics with increasing disposable incomes. In China, polyglyceryl esters are already gaining traction as the leading chemistry due to clean-label and PEG-free preferences, aligning with consumer demand for natural and safe ingredients.

India’s expansion is further supported by herbal-inspired cosmetics and lightweight emulsifier systems suited to hot and humid climates, pushing adoption across both multinational and local brands. Together, these two countries are expected to reshape the global demand balance, positioning Asia-Pacific as the growth hub of emulsifier blends.

Developed markets like the USA, UK, Germany, and Japan continue to hold significant value potential, though at relatively moderate growth rates compared to Asia. The USA is projected at a 6.0% CAGR, driven by stability in dermocosmetic and pharmaceutical emulsifier applications, while Europe maintains steady expansion at 8.7%, reflecting strict sustainability and clean beauty regulations. Germany and the UK together reinforce Europe’s influence with a combined emphasis on premium skincare and advanced haircare formulations. Japan, with its 11.7% CAGR, highlights strong consumer affinity for high-quality emulsions in anti-aging and sun protection products. These mature markets provide a platform for advanced innovations, while Asia’s rapid growth ensures the long-term acceleration of the global market.

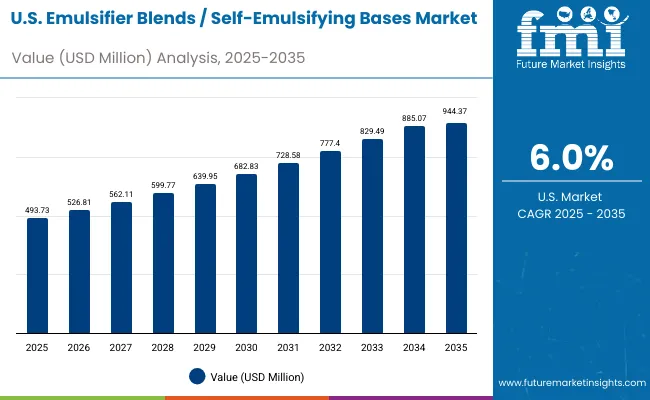

| Year | USA Emulsifier Blends / Self-Emulsifying Bases Market (USD Million) |

|---|---|

| 2025 | 493.73 |

| 2026 | 526.81 |

| 2027 | 562.11 |

| 2028 | 599.77 |

| 2029 | 639.95 |

| 2030 | 682.83 |

| 2031 | 728.58 |

| 2032 | 777.40 |

| 2033 | 829.49 |

| 2034 | 885.07 |

| 2035 | 944.37 |

The USA market for emulsifier blends / self-emulsifying bases is projected to grow at a CAGR of 6.0%, supported by stable demand in skin care and pharmaceutical topicals. Oil-in-water blends hold a dominant share, reflecting their use in creams and lotions, while dermocosmetic formulations strengthen the role of PEG-free blends. Pre-blended systems are gaining traction as mid-sized brands streamline their development cycles, while pharmaceutical applications continue to integrate emulsifier bases for drug delivery creams and ointments. Sustainability and clean-label requirements are shaping procurement strategies among established personal care companies.

The UK market is forecast to grow at a CAGR of 9.4%, supported by applications in premium skincare, hair conditioners, and sun protection. Local brands emphasize natural and sustainable emulsifier bases, reinforcing strong demand for polyglyceryl esters and sucrose esters. Rising innovation in multifunctional blends is enabling formulators to reduce the number of raw materials while achieving stable emulsions. Partnerships between universities, beauty accelerators, and indie brands are fostering new launches in color cosmetics and skin barrier creams.

India is witnessing the fastest growth globally, with the market forecast to expand at a CAGR of 16.2% through 2035. Rapid urbanization, rising disposable income, and strong demand for herbal-inspired cosmetics are boosting adoption. Affordable pre-blended systems are finding traction among local and regional brands, while multinationals expand sun care and haircare portfolios tailored to India’s hot and humid climate. Educational institutions and start-ups are experimenting with emulsifier systems for new-age formulations such as lightweight, non-greasy creams and natural conditioners.

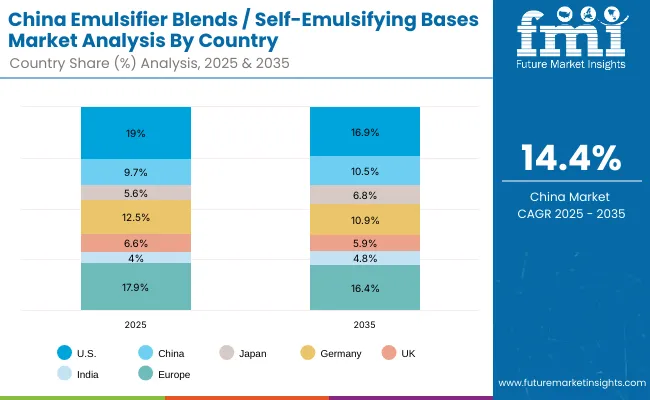

| Countries | 2025 Share (%) |

|---|---|

| USA | 19.0% |

| China | 9.7% |

| Japan | 5.6% |

| Germany | 12.5% |

| UK | 6.6% |

| India | 4.0% |

| Europe | 17.9% |

| Countries | 2035 Share (%) |

|---|---|

| USA | 16.9% |

| China | 10.5% |

| Japan | 6.8% |

| Germany | 10.9% |

| UK | 5.9% |

| India | 4.8% |

| Europe | 16.4% |

The China market is expected to grow at a CAGR of 14.4%, the highest among leading economies after India. This rapid growth is powered by strong demand for clean-label formulations, with polyglyceryl esters already capturing nearly 40% share of the chemistry segment. Expanding dermocosmetic demand and local innovation in emulsifier technology are accelerating adoption across skin care and sun protection categories. Domestic suppliers are increasingly competitive, offering cost-effective blends that appeal to both multinational and domestic brands. Government initiatives encouraging sustainable formulations further reinforce long-term market potential.

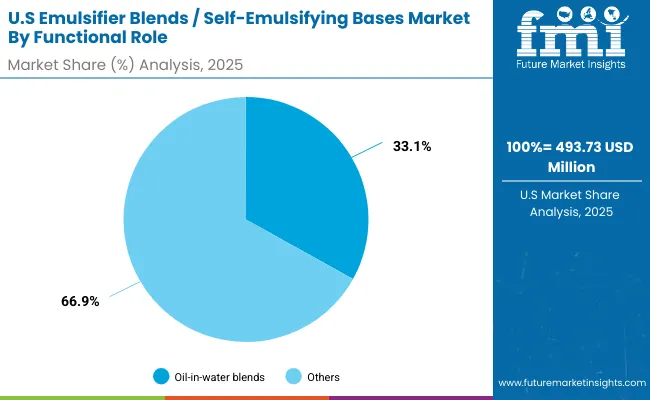

| USA By Functional Role | Value Share% 2025 |

|---|---|

| Oil-in-water blends | 33.1% |

| Others | 66.9% |

The USA market for emulsifier blends / self-emulsifying bases is projected at USD 493.73 million in 2025. Oil-in-water blends contribute 33.1%, while other functional roles account for the remaining 66.9%, reflecting the enduring dominance of traditional emulsifier systems. Oil-in-water blends remain central to creams, lotions, and hair conditioners, as they provide stability and sensorial appeal demanded by both premium and mass-market personal care brands. Pharmaceutical topicals also rely heavily on these emulsifiers for stable drug delivery bases.

Growth is supported by the rapid uptake of pre-blended systems, which simplify R&D pipelines for mid-tier and contract manufacturers. PEG-free blends are seeing steady momentum as USA dermocosmetic brands expand clean-label portfolios. A rising preference for multifunctional emulsifiers that reduce ingredient counts while enhancing skin feel further reinforces this trend. Over the forecast period, clean-label formulations and regulatory-driven reformulations are expected to be the key catalysts for growth.

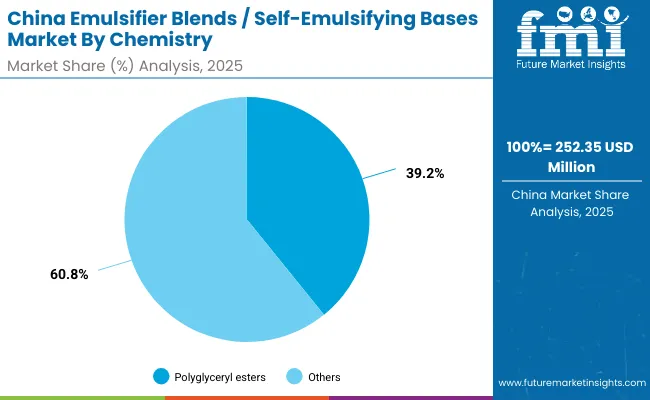

| China By Chemistry | Value Share% 2025 |

|---|---|

| Polyglyceryl esters | 39.2% |

| Others | 60.8% |

The China market is valued at USD 252.35 million in 2025, with polyglyceryl esters accounting for 39.2% (USD 98.92 million). These PEG-free, biodegradable emulsifiers are strongly aligned with consumer demand for natural and safe ingredients, making them the leading chemistry type in China. Their adoption is particularly high in sun care and facial creams, where performance and clean-label compliance are non-negotiable.

China’s growth outlook is reinforced by its forecast CAGR of 14.4%, among the highest globally. Domestic brands are aggressively integrating self-emulsifying bases to differentiate in a crowded beauty market, while international companies leverage local production to meet regional demand. The combination of rapid urbanization, expanding dermocosmetic consumption, and innovation in energy-efficient cold-process emulsifiers makes China a hotspot for accelerated adoption. By 2035, China is expected to increase its global market share beyond 10%, strengthening Asia-Pacific’s leadership in emulsifier blend consumption.

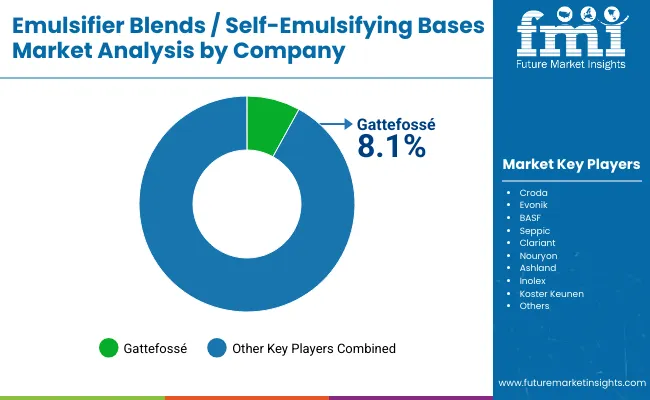

The Emulsifier Blends / Self-Emulsifying Bases Market is moderately fragmented, with leading suppliers, regional specialists, and emerging innovators competing across personal care, dermocosmetic, and pharmaceutical applications. Gattefossé holds the largest single share at 8.1%, leveraging its strength in multifunctional pre-blended systems and cold-process emulsifiers. Other global leaders such as Croda, BASF, Evonik, Seppic, Clariant, Nouryon, Ashland, Inolex, and Koster Keunen collectively dominate the remainder, each with distinct chemistry and formulation expertise.

Competitive differentiation is increasingly shaped by sustainability and clean-label innovation rather than traditional performance alone. Companies are prioritizing PEG-free and biodegradable blends, energy-efficient cold-process solutions, and multifunctional systems that streamline product development. Mid-sized players are expanding regional relevance by tailoring blends to local preferences, such as herbal-inspired formulations in India and lightweight emulsions in Southeast Asia. As the market moves toward 2035, the competitive edge will rest on the ability to provide integrated formulation ecosystems that combine pre-blended convenience, regulatory compliance, and consumer-preferred sensorial qualities. Collaborations with contract manufacturers, beauty accelerators, and pharmaceutical companies are expected to accelerate, further reshaping market dynamics.

Key Developments in Emulsifier Blends / Self-Emulsifying Bases Market

| Item | Value |

|---|---|

| Quantitative Units | USD Million |

| Functional Role | Oil-in-water blends, Water-in-oil blends, Cold-process emulsifiers, All-in-one self-emulsifying systems |

| Chemistry | Polyglyceryl esters, Sucrose esters, PEG-free blends, Fatty alcohol combinations |

| Delivery System | Pre-blended bases, Powdered self-emulsifying systems, Liquid concentrates |

| Physical Form | Flakes/pellets, Paste, Liquid |

| Application | Creams & lotions, Sun care, Hair conditioners, Color cosmetics |

| End Use | Skin & sun care brands, Haircare brands, Pharmaceutical & dermocosmetic |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Croda, Evonik, BASF, Gattefossé, Seppic, Clariant, Nouryon, Ashland, Inolex, Koster Keunen |

| Additional Attributes | Dollar sales by functional role and chemistry, adoption trends in PEG-free and clean-label emulsifiers, rising demand for multifunctional pre-blended systems, sector-specific growth in dermocosmetics, skin and sun care, and pharmaceuticals, revenue segmentation by delivery system formats, regional growth driven by Asia-Pacific markets, sustainability and energy-saving trends in cold-process emulsifiers, and innovations in polyglyceryl esters, sucrose esters, and fatty alcohol blends. |

The Emulsifier Blends / Self-Emulsifying Bases Market is estimated to be valued at USD 2,603.2 million in 2025.

The market size for the Emulsifier Blends / Self-Emulsifying Bases Market is projected to reach USD 5,601.6 million by 2035.

The Emulsifier Blends / Self-Emulsifying Bases Market is expected to grow at a CAGR of 8.0% between 2025 and 2035.

The key product types in the Emulsifier Blends / Self-Emulsifying Bases Market are oil-in-water blends, water-in-oil blends, cold-process emulsifiers, and all-in-one self-emulsifying systems.

In terms of functional role, the oil-in-water blends segment will command 38.6% share in the Emulsifier Blends / Self-Emulsifying Bases Market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Emulsifiers Market Size and Share Forecast Outlook 2025 to 2035

Emulsifiers in Personal Care Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Emulsifiers, Stabilizers, and Thickeners Market Size and Share Forecast Outlook 2025 to 2035

Emulsifier-Free Skincare Market Growth – Size, Trends & Forecast 2024-2034

Demulsifier Market

Co-Emulsifiers Market Size and Share Forecast Outlook 2025 to 2035

Lab Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

Egg Emulsifier Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

AKD Emulsifier Market Growth - Trends & Forecast 2025 to 2035

Evaluating Egg Emulsifier Market Share & Provider Insights

Food Emulsifiers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Analyzing Food Emulsifier Market Share & Growth Trends

Bread Emulsifier Market Analysis by Source, Product Type and Application Through 2035

In-line Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

Bitumen Emulsifiers Market Size and Share Forecast Outlook 2025 to 2035

Hybrid Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

UK Food Emulsifier Market Analysis – Size, Share & Forecast 2025–2035

United States Food Emulsifier Market Trends – Growth, Demand & Forecast 2025–2035

Fragrance Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

ASEAN Food Emulsifier Market Report – Trends, Demand & Industry Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA