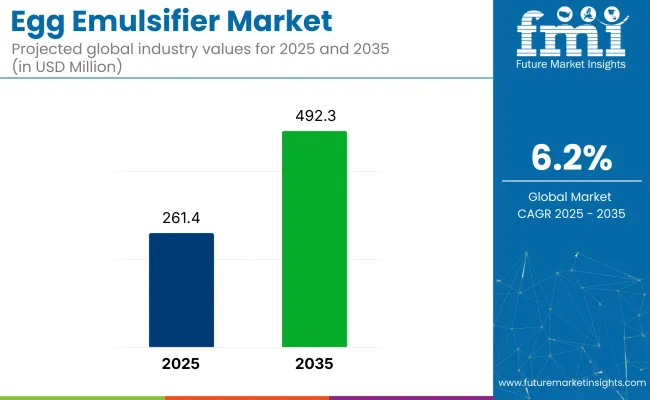

The egg emulsifier market to be valued at USD 261.4 million in 2025 and is projected to reach USD 492.3 million by 2035. This market is expected to grow at a CAGR of 6.2% over the forecast period. Growth stems from convergence across clean-label reformulation, regulatory disincentives for synthetic stabilizers, and intensified product development in emulsified food systems.

| Metric | Value |

|---|---|

| Estimated Size (2025) | USD 261.4 million |

| Projected value (2035) | USD 492.3 million |

| CAGR (2025 to 2035) | 6.2% |

With synthetic emulsifiers under scrutiny in Europe and parts of Asia, egg-derived inputs are re-entering processed food formulations under premium, additive-free labels. Yolk-based concentrates are favored for their lecithin richness and oil-binding capacity, especially in bakery batters, emulsified sauces, and rehydrated convenience products.

Emerging Asian economies have transitioned from bulk egg trade toward fractionated derivatives with technical specificity, aided by automation in drying and separation. In India, Vietnam, and Indonesia, contract processors have secured capacity expansion subsidies to boost output of spray-dried yolk powder and customized blends. Meanwhile, in North America and Western Europe, the focus has shifted toward high-purity emulsifiers for ketogenic, paleo, and allergen-free formulations.

Digital traceability, driven by supply assurance mandates in retail manufacturing, is beginning to influence input sourcing. Food processors are prioritizing origin-specific egg emulsifiers, especially those with third-party cage-free or organic validation. As frozen and refrigerated meal brands expand their footprint across online grocery channels, stable emulsification across fluctuating cold-chain conditions is seen as a technical differentiator. These structural shifts are reshaping supply chain incentives across producer, processor, and brand layers.

The industry registers to estimated 3.4% share of the emulsifiers market, driven by its use in natural oil-in-water applications. Within the egg and egg products market, it contributes around 1.9%, reflecting a niche yet growing function-specific role. In the broader food additives market, its share remains under 0.5%, as it represents a specialized sub-segment.

It holds roughly 2.1% of the functional ingredients market, owing to its dual role in enhancing stability and sensory attributes. In the bakery ingredients market, capture close to 4.6%, benefiting from the heavy reliance on emulsification in dough and batter systems. These proportions highlight its value in performance-centric applications despite limited total volume.

Beyond functional roles, the clean-label appeal of egg-derived additives aligns with evolving regulatory and consumer expectations, further supporting their inclusion across food and beverage applications. Manufacturers in processed food categories are thus increasingly leaning on egg-based emulsification to meet dual objectives, maintaining product integrity and aligning with clean ingredient decks. According to USDA, In November 2024, United States egg production totaled 8.92 billion.

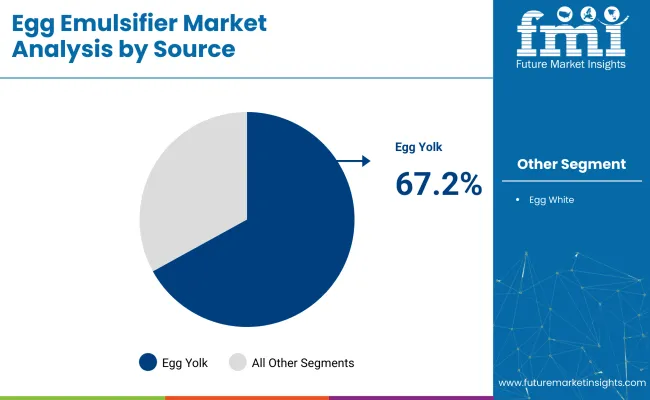

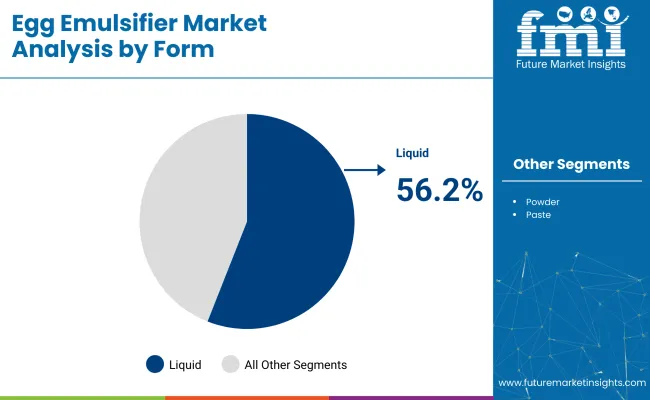

Egg yolk leads the source segment due to its rich phospholipid content and alignment with clean-label preferences, making it ideal for stabilizing emulsions in various food products. Liquid form remains dominant for its ease of use in industrial systems and superior dispersion. Bakery applications continue to drive demand, given emulsifiers' role in improving structure, shelf life, and consistency in baked goods.

Egg yolk are projected to lead the source segment, accounting for 67.2% of the global market share by 2025.

Liquid egg is expected to dominate the form segment, securing 56.2% of the global market share by 2025. Liquid form dominate the market because of their ease of incorporation into automated food manufacturing systems, reducing processing time and improving batch consistency.

The bakery segment is projected to hold the leading share in the market, estimated at over 38% of total application-based demand in 2025. This dominance stems from the critical role emulsifiers play in improving dough stability, volume, crumb structure, and shelf life of bakery products such as breads, cakes, muffins, and pastries.

The market's progression reflects dual pressure-manufacturer reformulation mandates and consumer expectations for functional stability without synthetic additives. Advances in yolk fractionation now deliver high-emulsification performance across processed food systems subject to variable temperature, acidity, and mechanical stress.

Processed Meal Expansion Elevates Technical Dependency

As premade sauces, frozen entrees, and commercial bakery items scale in volume, demand has intensified for reliable emulsifiers that maintain emulsion integrity during transport and storage. Egg-derived compounds, particularly yolk phospholipids, are being prioritized over mono- and diglycerides to meet ingredient-label mandates. Fast-moving consumer goods (FMCG) brands are shifting toward egg-based systems for dressings, dips, and dough mixes with prolonged refrigerated life and consistent batch performance.

Advanced Extract Processing Enables Broader Use Profiles

Thermomechanical refinements in yolk separation are allowing stable emulsifier deployment in products that previously required hydrocolloids or chemical stabilizers. Beverage developers in Asia and Europe are using these improved egg extracts in fortified milk drinks and plant-nutrition blends. Shorter ingredient declarations, enabled by protein-rich emulsifiers, are reinforcing adoption in functional meal replacements and clean-label dairy analogues.

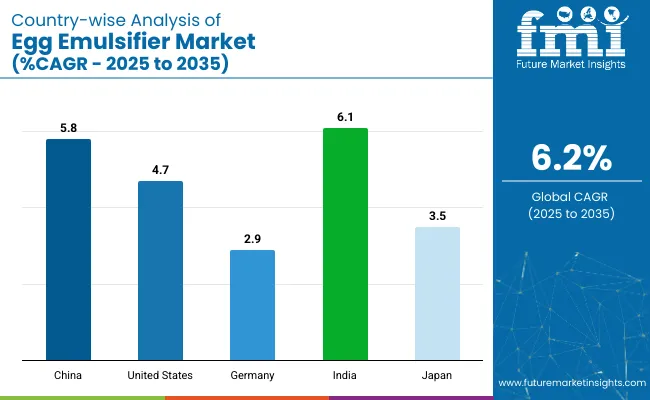

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 4.7% |

| Germany | 2.9% |

| Japan | 3.5% |

| China | 5.8% |

| India | 6.1% |

The egg emulsifier demand is projected to expand at a 6.2% CAGR from 2025 to 2035. Of the five profiled markets, India registers the swiftest pace at 6.1%, followed by China at 5.8% and the United States at 4.7%, whereas Japan posts 3.5% and Germany records 2.9%. These rates translate to growth premiums of -2% for India, -6% for China, and -24% for the United States versus the baseline, while Japan and Germany lag further at -44% and -53%, respectively.

Divergence has been driven by bakery-capacity expansion and hot-weather shelf-life requirements in India, e-commerce snack proliferation in China, retailer clean-label scorecards in the United States, convenience-store dessert turnover in Japan, and additive-reduction mandates under Europe’s reformulation strategy in Germany.

The report covers a detailed analysis of 40+ countries and the top five countries have been shared as a reference.

Demand for egg emulsifier in the United States is projected to grow at 4.7% CAGR from 2025 to 2035. Demand is being propelled by rising sales of chilled entrées, salad dressings, and snack dips that require stable oil-in-water dispersion throughout multistate distribution networks. Egg-derived phospholipids have been adopted by sauce and bakery mix producers responding to retailer clean-label scorecards that discourage synthetic additives.

The Food and Drug Administration’s restrictions on partially hydrogenated oils have encouraged a switch to yolk-based binders that preserve mouthfeel without artificial agents. Liquid formats integrate easily into continuous dough systems at industrial bakeries, ensuring volume consistency and crumb uniformity across nationwide quick-service chains.

The China egg emulsifier market is anticipated to grow at 5.8% CAGR during the forecast period. Expansion is being driven by rapid growth in packaged bakery goods distributed through convenience stores and e-commerce channels. Domestic patisserie brands depend on egg-based emulsifiers to achieve consistent batter aeration and moisture retention under high-throughput production lines.

The national ban on industrial trans fats has prompted manufacturers to eliminate certain synthetic additives, elevating demand for yolk-derived alternatives that satisfy regulatory audits. Rising disposable time among urban consumers has increased preference for ready-to-eat steamed buns, cakes, and filled pastries, all of which benefit from emulsifier-enabled softness during ambient storage.

The Germany egg emulsifier market is expected to grow at 2.9% CAGR between 2025 and 2035. Growth is supported by the National Reformulation Strategy, which encourages food companies to reduce artificial additives while maintaining organoleptic quality in processed items. Egg-derived emulsifiers provide a natural pathway to achieve stable emulsions in sauces, mayonnaises, and premium bread spreads marketed through discount supermarkets.

The European Union’s cap on industrial trans fats has triggered reformulation projects that replace mono- and diglycerides with lecithin-rich yolk fractions, ensuring compliance without sacrificing spreadability. Craft bakeries supplying high-protein breads rely on liquid yolk emulsifiers to manage dough extensibility during long fermentation cycles, yielding uniform crumb structure prized by health-conscious shoppers.

The India egg emulsifier market is valued at 6.1% CAGR during the forecast period. Expansion is being fuelled by a boom in industrial bakeries and quick-service restaurants that supply sweet buns, pastries, and filled cookies across tier-one and tier-two cities. Egg-based emulsifiers improve batter stability under high ambient temperatures, preventing oil separation during transport on unrefrigerated trucks.

Food Safety and Standards Authority of India guidelines now emphasise ingredient transparency, prompting processors to swap synthetic emulsifiers for naturally sourced yolk fractions. Domestic egg production clusters in Andhra Pradesh and Tamil Nadu ensure consistent raw material streams, enabling fractionators to offer competitively priced liquid emulsifier blends to bakery hubs in Maharashtra and Gujarat. Dairy dessert manufacturers have integrated egg phospholipids into caramel and fruit-based toppings to arrest phase separation, extending shelf life for modern trade channels.

The Japan egg emulsifier market is estimated to grow at 3.5% CAGR from 2025 to 2035. Market momentum is linked to the nation’s convenience culture, where on-the-go sandwiches, puddings, and roll cakes dominate cold-chain retail shelves. Egg-derived emulsifiers ensure consistent texture and extended freshness, critical for products cycled daily through convenience stores and vending machines.

The ministry of health, labour and welfare has tightened oversight of synthetic additive usage, prompting major confectionery groups to pivot toward yolk-based solutions that satisfy clean ingredient lists without compromising mouthfeel. Liquid yolk emulsifiers facilitate precise dosing in automated depositor lines common in Japanese factories, reducing batch variability and supporting lean manufacturing targets.

The egg emulsifier industry is shaped by dominant suppliers and specialized players focusing on yolk fractionation, liquid blending, and application-specific emulsifier solutions. Key companies like Cargill Inc., Kewpie Corporation, and Rose Acre Farms lead with integrated supply chains and diversified egg-based ingredient portfolios catering to bakery, sauce, and processed food sectors.

Rembrandt Enterprises and Bouwhuis Enthoven are known for high-purity yolk extracts suited for industrial emulsification. European processors such as Wulro BV, IGRECA, and Interovo Egg Group BV serve regional demand for liquid and powdered formats under strict additive regulations. SANOVO TECHNOLOGY GROUP plays a critical role in processing equipment and in-line emulsifier integration, while Dalian Hanovo Foods Co. Ltd strengthens Asia’s regional access with scalable egg-ingredient exports.

Recent Egg Emulsifier Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 261.4 million |

| Projected Market Size (2035) | USD 492.3 million |

| CAGR (2025 to 2035) | 6.2% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value and volume in tons |

| Source Analyzed (Segment 1) | Egg Yolk and Egg White. |

| Applications Analyzed (Segment 2) | Bakery, Confectionery, Beverages, Dairy Products, Processed Food, and Others. |

| Form Analyzed (Segment 3) | Powder, Liquid, and Paste |

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, Japan, South Korea, India, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players | Cargill Inc., Kewpie Corporation, Rose Acre Farms, Rembrandt Enterprises, Bouwhuis Enthoven, Wulro BV, IGRECA, SANOVO TECHNOLOGY GROUP, Interovo Egg Group BV, Dalian Hanovo Foods Co. Ltd. |

| Additional Attributes | Dollar sales, share, CAGR by application and region, top-performing formats, key sourcing trends, regulatory landscape, demand forecasts by end-use, buyer preferences, raw material volatility, competitor positioning. |

The industry is segmented into egg yolk and egg white.

The industry finds applications in bakery, confectionery, beverages, dairy products, processed food, and others.

The industry is segmented into powder, liquid, and paste.

The industry covers regions including North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

The industry is valued at USD 261.4 million in 2025.

It is forecasted to reach USD 492.3 million by 2035.

The industry is anticipated to grow at a CAGR of 6.2% during this period.

Egg Yolk are projected to lead the market with a 67.2% share in 2025.

Asia Pacific, particularly India, is expected to be the key growth region with a projected growth rate of 6.1%.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Evaluating Egg Emulsifier Market Share & Provider Insights

Egg Carton Market Size and Share Forecast Outlook 2025 to 2035

Egg Free Premix Market Size and Share Forecast Outlook 2025 to 2035

Egg Stabilizer Market Size and Share Forecast Outlook 2025 to 2035

Egg Protein Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Egg Powder Market - Size, Share, and Forecast Outlook 2025 to 2035

Egg White Powder Market Size and Share Forecast Outlook 2025 to 2035

Egg-free Mayonnaise Market Size and Share Forecast Outlook 2025 to 2035

Eggshell Membrane Powder Market Size and Share Forecast Outlook 2025 to 2035

Egg Boiler Market Size and Share Forecast Outlook 2025 to 2035

Egg Processing Machine Market Size and Share Forecast Outlook 2025 to 2035

Egg Grading Machines Market Size and Share Forecast Outlook 2025 to 2035

Egg Breaking Machine Market Size and Share Forecast Outlook 2025 to 2035

Egg Replacement Ingredient Market Analysis - Size, Share & Forecast 2025 to 2035

Egg White Cubes Market Size and Share Forecast Outlook 2025 to 2035

Egg Yolk Oil Market Analysis - Size, Growth and Forecast 2025 to 2035

Egg and Egg Products Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Egg Replacer Market Analysis - Size, Share, and Forecast 2025 to 2035

Egg Albumin Protein Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Egg White Substitute Market Analysis – Size, Share, & Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA