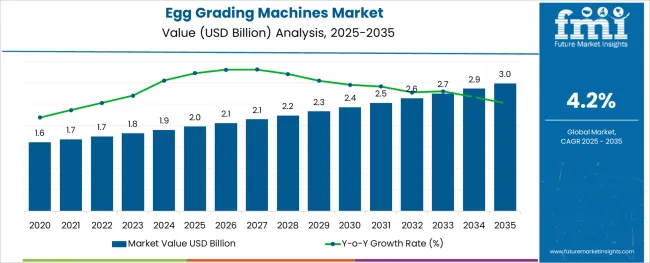

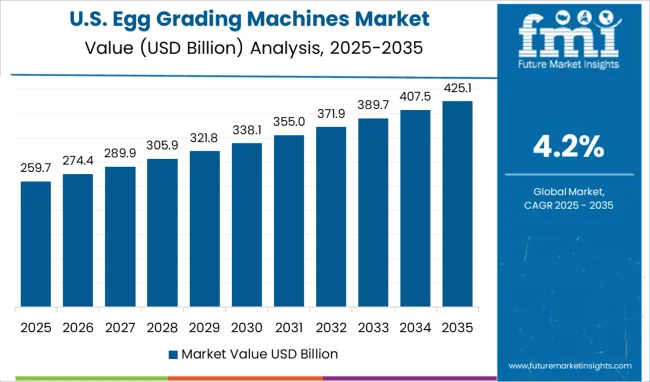

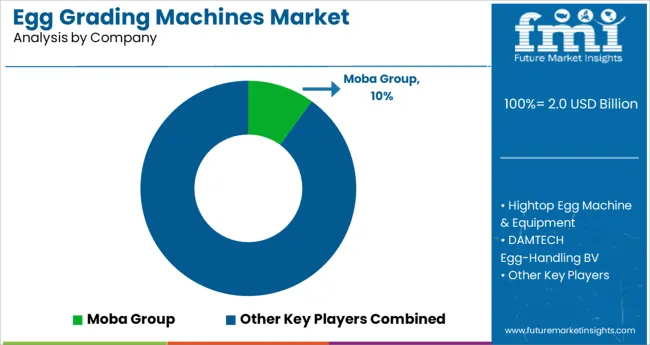

The Egg Grading Machines Market is estimated to be valued at USD 2.0 billion in 2025 and is projected to reach USD 3.0 billion by 2035, registering a compound annual growth rate (CAGR) of 4.2% over the forecast period.

The egg grading machines market is progressing steadily as the poultry industry prioritizes efficiency, hygiene, and compliance with food safety standards. Rising demand for high-quality, uniform eggs and increasing adoption of automation in poultry processing have been central to this growth.

The need to handle large volumes with precision and minimize labor dependency has driven producers to upgrade to advanced grading solutions. Continuous improvements in machine design, enhanced durability, and integration with data management systems are contributing to better operational outcomes and profitability.

Future growth is expected to benefit from increasing consumption of packaged eggs, tightening quality regulations, and the global trend toward sustainable and humane egg production. These dynamics are shaping both investments in high-capacity systems and the broader acceptance of automated solutions in diverse operational scales.

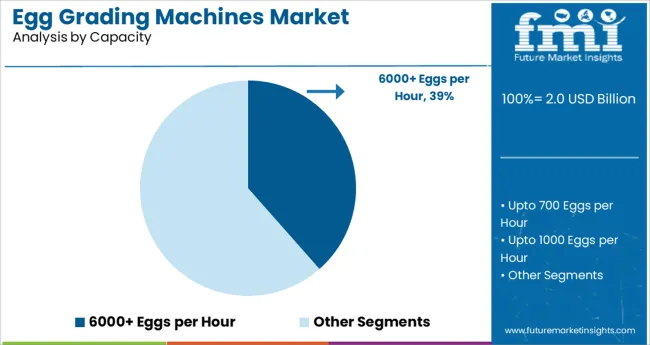

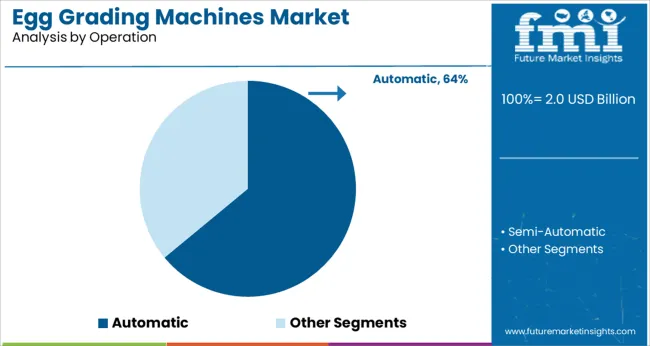

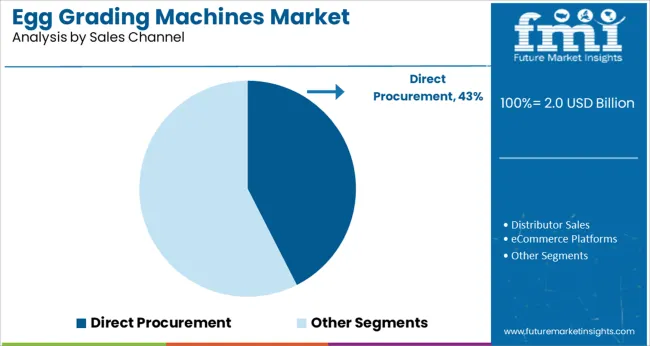

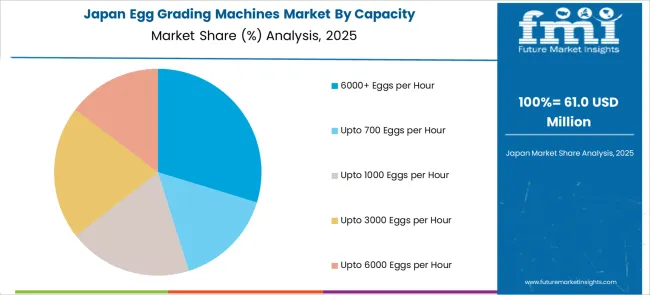

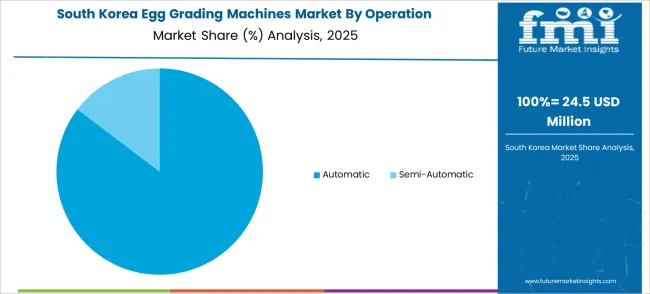

The market is segmented by Capacity, Operation, and Sales Channel and region. By Capacity, the market is divided into 6000+ Eggs per Hour, Upto 700 Eggs per Hour, Upto 1000 Eggs per Hour, Upto 3000 Eggs per Hour, and Upto 6000 Eggs per Hour. In terms of Operation, the market is classified into Automatic and Semi-Automatic. Based on Sales Channel, the market is segmented into Direct Procurement, Distributor Sales, eCommerce Platforms, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The market is segmented by Capacity, Operation, and Sales Channel and region. By Capacity, the market is divided into 6000+ Eggs per Hour, Upto 700 Eggs per Hour, Upto 1000 Eggs per Hour, Upto 3000 Eggs per Hour, and Upto 6000 Eggs per Hour. In terms of Operation, the market is classified into Automatic and Semi-Automatic. Based on Sales Channel, the market is segmented into Direct Procurement, Distributor Sales, eCommerce Platforms, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by capacity, the 6000 plus eggs per hour category is expected to hold 38.5% of the total market revenue in 2025, establishing itself as the leading capacity segment. This leadership is being driven by the growing need for high-output systems capable of supporting large-scale commercial operations.

Machines in this category are favored for their ability to maintain consistent grading quality at high speeds while reducing handling damage and ensuring compliance with hygiene standards. The preference for such systems has also been reinforced by their superior throughput and ability to meet the demands of integrated supply chains serving retail and export markets.

Enhanced machine reliability and reduced per-unit operating costs have further motivated investments in higher capacity units, particularly among producers facing rising labor costs and competitive pressures. This alignment of efficiency, quality, and cost-effectiveness has positioned the 6000 plus eggs per hour segment as the dominant choice.

Segmenting by operation reveals that automatic machines are projected to capture 64.0% of the market revenue in 2025, affirming their dominance. This prominence is being attributed to the industry’s shift away from manual and semi-automatic processes toward fully automated systems that ensure uniformity, speed, and compliance with regulatory benchmarks.

Automatic machines have been adopted widely for their ability to minimize human error, reduce contamination risks, and sustain optimal performance in continuous operation environments. Their advanced control systems, integration with conveyors and packing lines, and ease of monitoring have improved operational transparency and worker safety.

Additionally, automatic systems have demonstrated greater adaptability to varying egg sizes and customer specifications, which has increased their appeal among commercial producers seeking scalability and versatility. The significant gains in productivity and traceability delivered by automation have firmly anchored this segment’s leading position in the market.

By sales channel, direct procurement is forecast to command 42.5% of the market revenue in 2025, securing its role as the top distribution route. This leadership is being reinforced by the preference of large and medium-scale egg producers to engage directly with manufacturers and authorized suppliers for tailored solutions, installation support, and after-sales services.

Direct procurement allows buyers to specify configurations that align with their unique operational needs and negotiate comprehensive service agreements. The growing complexity of egg grading machinery and the need for training and maintenance have made direct relationships with suppliers more advantageous.

Furthermore, producers have found that bypassing intermediaries ensures better pricing transparency, access to the latest technology, and faster response times for technical support. These benefits have collectively solidified the appeal of direct procurement, enabling it to maintain its leading share in the market.

Previously the market thrived at a slow CAGR of 3.3% between 2020 and 2025. This was due to the pandemic along with the rising vegan movements all around the world.

The shortage of logistics elements, quality management teams, and the shutdown of production units have been proved as a nightmare for the FMCG industries. Rumors of eggs getting covid-19 or other meat retaining the virus has led people to stop eating eggs and other meats, affecting the poultry gear industry adversely.

The limited logistics option along with no manpower at the poultry hubs led to the weak supply chain that further increased the prices, affecting the overall egg grading machines market. This includes the egg grading machines along with other food processing gear. Though the market has recovered now and is expected to have a higher growth rate of 4.2% between 2025 and 2035.

The major drivers for the egg grading machines market are the restoration of egg production units post-covid-19, government schemes around poultry farms, and rising demand for honey globally. Other than these, the factors can be explained as easy logistical operations, better technology, industries 4.0, and its components.

The demand for organized machines that make the segregation part easy for the end user has been transforming the industry since the pandemic’s end. The new machines that integrate the grading procedures with the packaging solutions have been attracting poultry and distribution companies to adopt these to reduce the manpower at their production hubs.

Modern-day grading and packaging machines offer ease and storage among the urban population fostering the demand for eggs as they have no time for cooking food. Eggs are being consumed in all ways as in cooked eggs or boiled eggs. These machines are the best for various types of eggs, such s duck eggs, hen eggs, goose eggs etc.

The application of eggs in cosmetic products such as talcom powder and other facial make up kits is well-known. Egg is agood source of protein and so it offers strength to the hair and hydrates the skin. This effect is called as egg’s instant filming effect on the skin.

Restraints

The biggest factor that hinders the sale of egg-grading machines is the prevalence of bird flu and other diseases among hens and ducks. This affects the demand for grading and packing machines. Other than this covid-19 has already affected the sales of eggs production around the world. The rising vegan movement that includes people boycotting products that contain eggs or meat is also slowing down the growth of eggs grading machines market.

In 2025, the demand for a medium-sized egg grading machine has increased. The capacity of grading upto 1000 eggs per hour is the most sold segment. With a CAGR of 4.6% between 2025 and 2025, Upto 100 eggs segment leads the capacity category.

This is due to the presence of the larger medium-sized poultry farms that work on an average supply chain model along with the cheap prices of these small-sized machines help the farm digitize their space with minimal expense, increasing productivity.

In 2025, the demand for automatic machines has increased. The operability of automatic machine is at the top in the operation type category with a CAGR of 3.9% (2025 to 2035). The factors behind this explosive growth of this segment are very common and can be analysed easily.

The first factor is the penetration of digitization and automation in every direction and each industry. The second factor being the increased efficiency and enhanced productivity. The last one can be determined as the expanded supply chain because of the quick grading and packaging.

United States holds the biggest share in the global egg grading machines market with an anticipated share of USD 3 Million in 2035. Through this value, the USA market for egg grading machines market is expected to grow at a CAGR of 4.6% between 2025 and 2035.

The USA has become the biggest region because of the higher consumption, more FMCG startups, and the presence of breakfast giants such as McDonald’s, Burger King, Subway, etc. Other than this, people are becoming more aware of them. Egg companies have now introduced different grades that is ultimately going to fuel the sales of egg grading machines.

While the United Kingdom is expected to cross a value of USD 165.6 Million by 2035. Through these values, the United Kingdom market for Egg grading machines market is likely to grow at a CAGR of 4.2% between 2025 and 2035. The increased small-scale businesses have fueled the growth of the egg grading machines market in the region while vegan movements have hampered the demand for these machines.

China becomes the fastest growing region in the global egg grading machines market with an anticipated share of USD 414 Million in 2035. Through this value, the US market for egg grading machines market is expected to grow at a CAGR of 5.7% between 2025 and 2035.

Higher production and exports are pushing China to produce more eggs along with the famous campaigns associating eggs with strength while its higher consumption through the cosmetic industry.

Japan is expected to cross a value of USD 201.48 Million by 2035. Through the value, the Japanese market for egg grading machines market is likely to grow at a healthy CAGR of 4.4% between 2025 and 2035.

Advanced machines with enhanced conveyor tables and reliable materials are used along with the application of eggs in cosmetics products. Athletes with higher physical activities consume a high-protein diet, eventually fueling the sales of eggs. This lastly fuels the demand for the egg grading machines.

South Korea is anticipated to cross a value of USD 96.6 Million by 2035. Through the value, the South Korean market for egg grading machines market is likely to grow at a robust CAGR of 3.1% between 2025 and 2035. The growth is attributed to the increasing demand for wholesome superfood.

Poultry has become a new business model for many business owners while mushroom have been there for long. Countries like India and China are launching new startups that produce different standard of eggs in the most organic way possible. Also, better promotional tactics with enhanced supply chain and health trends are fueling the sales of egg grading machines units across the globe.

The rising demand for eggs and the advent of advanced technologies have made the competition high and tight. Brands are experimenting with segment-based technology and prices to understand the customer's intent.

The eCommerce and internet have made it easier for end users to choose the machine that will suit the best to them, according to their shape and size. Moreover, the rising demand for automated machines has pushed vendors to produce highly automatic egg-grading machines.

Recent Market Developments:

| Report Attributes | Details |

|---|---|

| Commercial Egg grading machines Market Size (2025) | USD 2.0 billion |

| Projected Market Value (2035) | USD 3.0 billion |

| Global Market Growth Rate (2025 to 2035) | 4.2% CAGR |

| The USA Market Value (2035) | USD 690 Million |

| United Kingdom Market Value (2035) | USD 165.6 Million |

| Key Companies Profiled | MOBA; Sanovo Group; NABEL; Prinzen; Kyowa; Seyang; Plasson Do Brasil; Zenyer; Mintai; Sime-Tek; Zorel; Riva Selegg; EggTec; Colker GmbH |

The global egg grading machines market is estimated to be valued at USD 2.0 billion in 2025.

It is projected to reach USD 3.0 billion by 2035.

The market is expected to grow at a 4.2% CAGR between 2025 and 2035.

The key product types are 6000+ eggs per hour, upto 700 eggs per hour, upto 1000 eggs per hour, upto 3000 eggs per hour and upto 6000 eggs per hour.

automatic segment is expected to dominate with a 64.0% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Egg Carton Market Size and Share Forecast Outlook 2025 to 2035

Egg Free Premix Market Size and Share Forecast Outlook 2025 to 2035

Egg Stabilizer Market Size and Share Forecast Outlook 2025 to 2035

Egg Protein Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Egg Powder Market - Size, Share, and Forecast Outlook 2025 to 2035

Egg White Powder Market Size and Share Forecast Outlook 2025 to 2035

Egg-free Mayonnaise Market Size and Share Forecast Outlook 2025 to 2035

Eggshell Membrane Powder Market Size and Share Forecast Outlook 2025 to 2035

Egg Boiler Market Size and Share Forecast Outlook 2025 to 2035

Egg Processing Machine Market Size and Share Forecast Outlook 2025 to 2035

Egg Breaking Machine Market Size and Share Forecast Outlook 2025 to 2035

Egg Replacement Ingredient Market Analysis - Size, Share & Forecast 2025 to 2035

Egg White Cubes Market Size and Share Forecast Outlook 2025 to 2035

Egg Yolk Oil Market Analysis - Size, Growth and Forecast 2025 to 2035

Egg Emulsifier Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Egg and Egg Products Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Egg Replacer Market Analysis - Size, Share, and Forecast 2025 to 2035

Egg Albumin Protein Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Egg White Substitute Market Analysis – Size, Share, & Forecast Outlook 2025 to 2035

Egg Packaging Market by Packaging Type & Material from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA