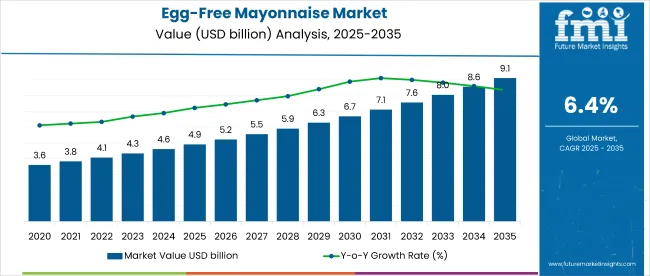

The global egg-free mayonnaise market is projected to grow from USD 4.9 billion in 2025 to USD 9.1 billion by 2035, registering a CAGR of 6.4%. The market expansion is being driven by increasing adoption of vegan and plant-based diets, rising awareness of animal welfare, and growing consumer preference for healthier, low-fat alternatives to traditional mayonnaise. Innovations in product formulations using plant-based ingredients and the expansion of distribution channels such as e-commerce and retail are further accelerating market growth.

The market holds a growing but niche percentage within its broader parent markets. It accounts for 3-5% of the global condiments and sauces market, driven by rising demand for vegan and allergen-free alternatives. Within the vegan and plant-based food market, egg-free mayonnaise represents about 8-10%, reflecting increasing consumer shifts toward plant-based diets.

In the dairy alternatives market, it holds a smaller share near 2-3%, as it serves a specific segment focused on egg substitutes rather than full dairy replacement. Overall, the egg-free mayonnaise segment continues to expand as consumers prioritize health, sustainability, and ethical food choices.

Government initiatives and consumer advocacy promoting sustainable food production and animal welfare are influencing market dynamics. Regulations encouraging plant-based food adoption, coupled with labeling standards for vegan products, are supporting market growth.

Additionally, health and food safety guidelines that promote reduced fat and cholesterol intake are pushing consumers towards egg-free mayonnaise. These factors collectively drive innovation and expansion in the market, ensuring compliance with evolving consumer preferences and regulatory frameworks.

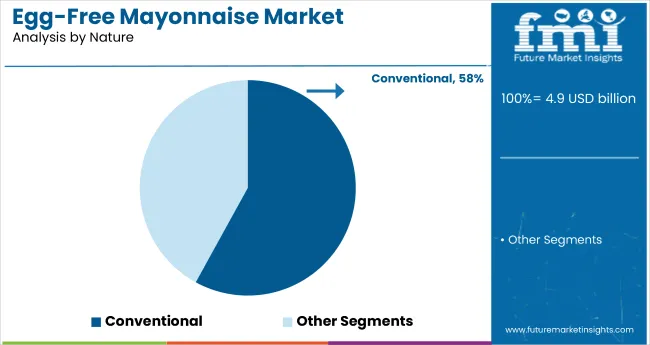

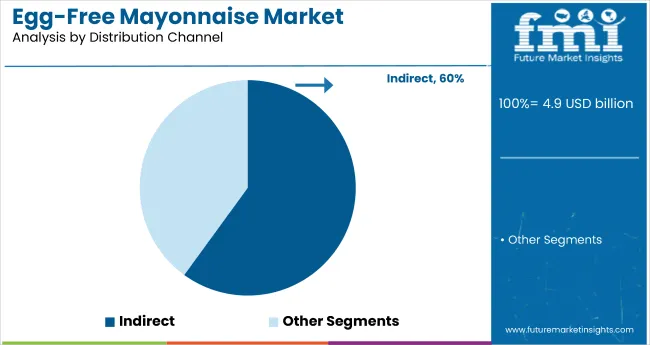

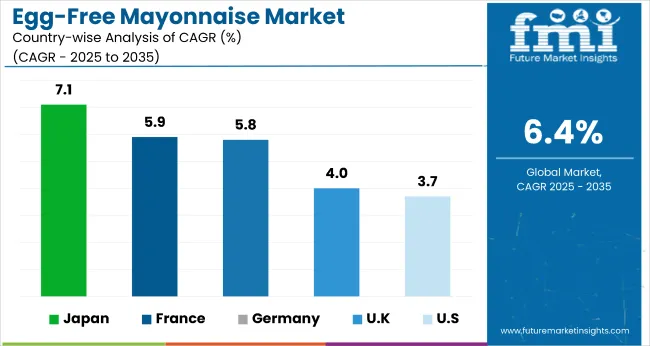

Japan is projected to be the fastest-growing market, expanding at a CAGR of 7.1% from 2025 to 2035. The indirect channel will lead the distribution channel segment with a 60% market share, while conventional egg-free mayonnaise will dominate the nature segment with a 58% share in 2025. The USA and Germany markets are also expected to grow steadily at CAGRs of 3.7% and 5.8%, respectively. The UK and France will grow at CAGRs of 4% and 5.9%, respectively.

Food processing operations reveal persistent friction between product development teams optimizing taste profiles to match traditional mayonnaise expectations and supply chain managers coordinating sustainable sourcing for alternative protein bases including aquafaba, pea protein, and modified starches. Manufacturing facilities struggle coordinating between high-speed emulsification equipment requiring precise temperature controls and packaging systems managing oxygen-sensitive formulations that maintain product integrity throughout extended distribution networks. Quality assurance departments encounter challenges establishing sensory evaluation protocols that accurately predict consumer acceptance across different demographic segments with varying taste preferences.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 4.9 billion |

| Industry Value (2035F) | USD 9.1 billion |

| CAGR (2025 to 2035) | 6.4% |

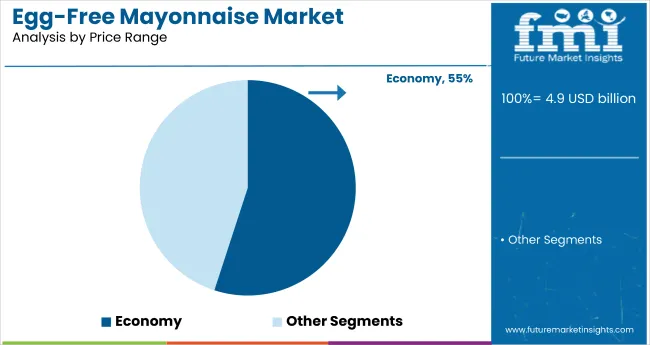

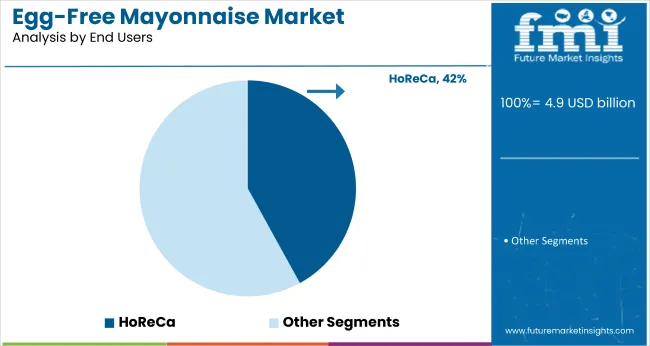

The global market is segmented by nature, price range, end users, distribution channel, and region. By nature, the market is bifurcated into organic and conventional. Based on price range, the market is classified into economy and premium. In terms of end users, the market is segmented into HoReCa, household, and food sector.

By distribution channel, the market is divided into direct and indirect (hypermarket/supermarket, food and drink specialty stores, convenience store, discount store, and online retail). Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Asia Pacific excluding Japan (APEJ), Japan, and Middle East & Africa (MEA).

The conventional segment is expected to lead the nature category with a 58% market share by 2025. Its familiar taste and competitive pricing appeal to mainstream consumers. Ongoing innovation in flavors and formulations reinforces its strong position, addressing the rising global demand for convenient and flavorful plant-based alternatives.

Economy is expected to dominate the price range with a 55% market share by 2025. These affordable options appeal to price-sensitive consumers, particularly in emerging markets, by offering essential ingredients and wide availability through mass retail and discount outlets, fueling broad adoption and market growth.

The HoReCa (Hotels, Restaurants, and Catering) channel is expected to dominate the end user segment with a 42% share by 2025. Rising demand for vegan menu options and convenient, versatile products is fueling its growth, as foodservice operators adapt to evolving consumer preferences for plant-based foods.

Indirect is expected to lead the distribution channel segment with a 60% market share by 2025. Its broad accessibility and consumer trust make it the preferred choice over direct sales. The extensive product range offered by supermarkets, convenience stores, and specialty outlets reinforces its dominant position in the market.

The global egg-free mayonnaise market is experiencing steady growth, driven by rising consumer demand for plant-based, vegan, and healthier food alternatives. Egg-free mayonnaise offers a nutritious and lower-fat substitute to traditional mayonnaise, aligning with growing health consciousness and ethical eating habits worldwide.

Recent Trends in the Egg-Free Mayonnaise Market

Challenges in the Egg-Free Mayonnaise Market

Momentum in Japan is fueled by rising vegan awareness, health-conscious consumers, and supportive regulations encouraging sustainable food production. Germany and France maintain steady demand, driven by strict food safety standards and increased penetration of plant-based products. Developed economies like the USA (3.7% CAGR), UK (4%), and Japan (7.1%) are growing at 0.58 to 1.11 times the global rate.

Japan leads with strong growth, propelled by the rise of vegan lifestyles and demand for allergen-free, natural ingredients. France and Germany show robust expansion, supported by strict regulations, organic certifications, and growing consumer health awareness.

The USA experiences steady growth, driven by health consciousness and expanding specialty vegan retail and foodservice channels. The UK posts the slowest growth among these nations, affected by post-Brexit regulatory challenges, but continues to witness consistent demand through convenience-focused products and retail expansion.

The report covers an in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The Japan egg-free mayonnaise revenue is growing at a CAGR of 7.1% from 2025 to 2035. Growth is driven by increasing vegan lifestyle adoption and demand for allergen-free, natural ingredients in foodservice and retail. As a technology-driven OECD economy, Japan prioritizes clean-label, organic products with enhanced taste and texture.

While overall consumer spending growth is moderate, demand for premium and specialty egg-free mayonnaise products is rising. Japan’s focus on health, sustainability, and innovation differentiates it from scale-centric emerging markets.

Sales of egg-free mayonnaise in Germany are growing at a 5.8% CAGR during the forecast period, slightly below the global average but strongly driven by regulations. EU food safety rules, organic certification standards, and heightened environmental awareness are accelerating the adoption of egg-free and plant-based mayonnaise products.

Key applications include retail, foodservice, and packaged meals. The German market focuses on high-quality ingredients and clean-label formulations combined with sustainable sourcing. Compared to emerging markets, Germany places greater emphasis on product quality and organic certification rather than price competitiveness.

The French egg-free mayonnaise market is projected to grow at a 5.9% CAGR during the forecast period, closely mirroring Germany’s trajectory. Demand is fueled by national health campaigns, environmental sustainability initiatives, and increasing veganism.

Retailers and foodservice providers are increasingly including egg-free mayonnaise in their vegan and allergen-friendly product offerings. The market favors both organic and conventional products, emphasizing taste and versatility. France benefits from EU funding programs that support sustainable food production and consumer education.

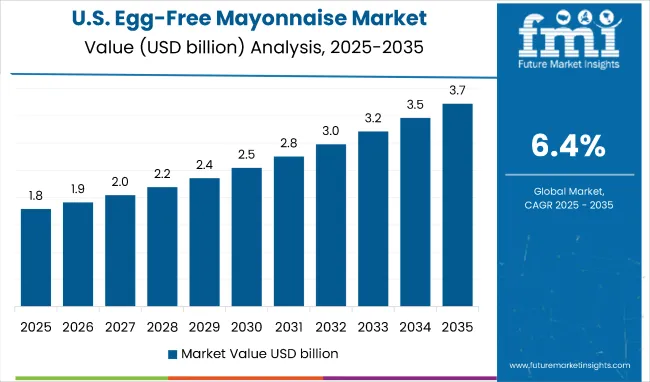

The USA egg-free mayonnaise market is projected to grow at a 3.7% CAGR from 2025 to 2035, equivalent to 0.58 times the global growth rate. Unlike rapidly expanding emerging markets focused on new product adoption, USA demand is driven by heightened health awareness, adoption of vegan lifestyles, and environmental concerns.

Expansion of retail outlets, vegan specialty stores, and foodservice channels supports steady market growth. While growth trails that of Japan, the USA market is characterized by premium pricing and a wide variety of products across brands.

The UK egg-free mayonnaise market is projected to grow at a 4% CAGR from 2025 to 2035, marking the slowest growth among leading OECD nations, at just 0.62 times the global rate. Growth is supported by a rising vegan population, expanding retail penetration, and foodservice innovation.

Post-Brexit regulatory changes have slightly delayed new product launches and reduced investment momentum. However, demand for convenient, affordable, and flavorful egg-free mayonnaise remains strong across supermarkets and online platforms. Government-led health initiatives promoting plant-based diets continue to support steady consumer demand.

The Egg-free Mayonnaise Market is experiencing strong growth, driven by rising demand for plant-based, allergen-free, and vegan-friendly condiments across global foodservice and retail sectors. Consumers are increasingly shifting toward health-conscious and sustainable eating, boosting the popularity of egg-free mayonnaise made from plant proteins such as soy, pea, and aquafaba. This market trend is further supported by the growth of flexitarian diets, environmental awareness, and technological advancements in emulsification that replicate traditional mayonnaise texture and taste without eggs.

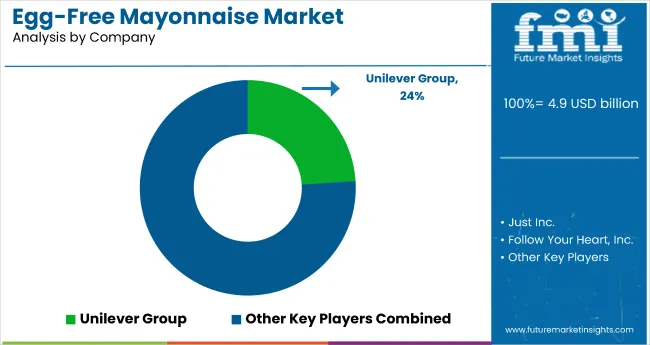

Leading players such as Unilever Group, Nestlé S.A., and Conagra Brands Inc. dominate the segment through established product lines and strong retail presence. Unilever, with its Hellmann’s Vegan Mayo, remains a market leader in global distribution, leveraging its expertise in sustainable sourcing and clean-label formulation. Nestlé S.A. has expanded its Plant-Based Garden Gourmet range to include egg-free mayonnaise alternatives enriched with natural oils and proteins. Conagra Brands Inc. continues to innovate through its Earth Balance and Annie’s product lines, catering to consumers seeking non-GMO and dairy-free dressings.

Emerging and specialty brands such as Follow Your Heart Inc., Eat Just Inc., and Veeba Food Services Private Limited are propelling market innovation. Follow Your Heart’s Vegenaise remains one of the most recognized vegan mayonnaise brands globally, known for its creamy texture and soy-based formula. Eat Just Inc., a pioneer in plant-based egg alternatives, has introduced aquafaba-based mayonnaise with enhanced stability and flavor performance. Veeba and Cremica Food Industries Ltd. are expanding the egg-free condiment segment in India through locally tailored flavor profiles and affordable pricing.

Traditional condiment companies like Crosse & Blackwell, Kensington & Sons LLC, and The C.F. Sauer Company are reformulating legacy mayonnaise products to meet vegan and clean-label standards, while Del Monte Foods Inc. and Spectrum Organic Products LLC emphasize organic, cold-pressed oil formulations. Nasoya Foods USA LLC contributes to the U.S. market with soy-based and gluten-free alternatives designed for both retail and foodservice applications.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 4.9 billion |

| Projected Market Size (2035) | USD 9.1 billion |

| CAGR (2025 to 2035) | 6.4% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | USD billion for value/volume in metric tons |

| Nature Analyzed | Organic and Conventional |

| Price Range Analyzed | Economy and Premium |

| End User Analyzed | HoReCa, Household and Food Sector |

| Distribution Channel Analyzed | Direct, Indirect (Hypermarket/Supermarket, Food and Drink Specialty Stores, Convenience Store, Discount Store, Online Retail) |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, Asia Pacific excluding Japan, Japan, Middle East & Africa |

| Countries Covered | United States, United Kingdom, Germany, France, Japan, China, India, Brazil, South Korea, Australia and 40+ countries |

| Key Players Influencing the Market | Crosse & Blackwell, Kensington & Sons LLC, Nestlé S.A., Zydus Wellness Limited, Del Monte Foods Inc., Spectrum Organic Products LLC, Unilever Group, Eat Just Inc., Veeba Food Services Private Limited, Follow Your Heart Inc., The C.F. Sauer Company, Cremica Food Industries Ltd., Nasoya Foods USA LLC, Conagra Brands Inc. |

| Additional Attributes | Market share by nature and price range, regional consumption patterns, consumer trends, distribution channel growth, sustainability initiatives, competitive benchmarking |

The global egg-free mayonnaise market is estimated to be valued at USD 4.9 billion in 2025.

The market size for the egg-free mayonnaise market is projected to reach USD 9.1 billion by 2035.

The egg-free mayonnaise market is expected to grow at a 6.4% CAGR between 2025 and 2035.

The key product types in egg-free mayonnaise market are organic and conventional.

In terms of end user, horeca segment to command 47.6% share in the egg-free mayonnaise market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA