About The Report

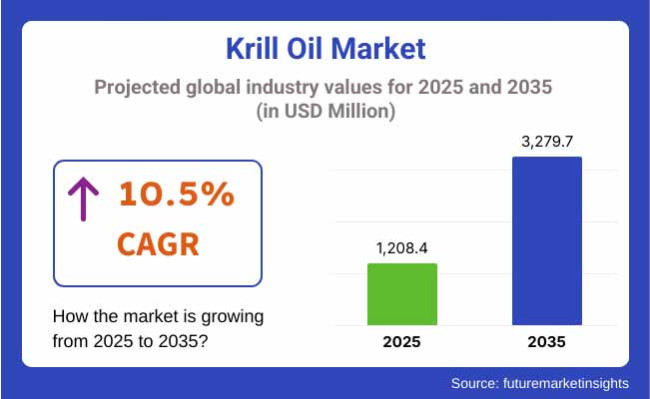

Krill oil market value stood at USD 997.4 million in 2023. The global market is projected to reach USD 1,208.4 million by 2025. Global sales are projected to hit a compound annual growth rate (CAGR) of a phenomenal 10.5% during the entire review period (2025 to 2035), with revenues derived from sales hitting USD 3,279.7 million in 2035.

Rich in Antioxidant Astaxanthin, Phospholipids, and Omega-3 Fatty Acids, Krill Oil is one of the most widely sought supplements due to its multiple advantages spanning from cardiovascular health to brain function and anti-inflammation. Overlapping trends toward natural and sustainable supplements have driven market expansion.

Due to its better bioavailability and reduced likelihood of oxidation, customers are shifting towards krill oil over traditional fish oil. Increased knowledge regarding krill oil supplements, owing to its benefits towards health, particularly with respect to its use in the cure for cardiovascular disease, blood cholesterol level, joint inflammation, and cognitive function improvement, would also be a step towards expansion.

Aside from this, growing geriatric populations and the prevalence of chronic diseases have also driven demand for dietary supplements, placing krill oil at the center as a significant segment of wellness and preventive medicine. e-Commerce and direct-to-consumer sales have significantly broadened access to krill oil vitamins.

Some of the factors driving the global krill oil products market include Convenient purchase of krill oil products, which are available on online retail platforms, and increasing consumer dependence on online shopping experiences. And brands continue to launch new ones, including flavored softgels, vegan krill oil, and blends with other ingredients like vitamin D and CoQ10.

The regulatory scenario is also affecting the krill oil market. Amid increasing scrutiny over sustainability issues regarding krill harvesting, companies are weighing eco-friendly methods of extraction amid sourcing from certified fisheries.

A handful of key companies, including Aker BioMarine and Neptune Wellness Solutions and Rimfrost, have emerged in the industry, veterans funneling cash into research and development in an effort to bolster product efficacy and purity.

The market for krill oil is bolstered by a growing preference for preventive healthcare solution and dietary supplementation. Additionally, the application of advanced extraction techniques to ensure the purity and potency of krill oil is expected to offer further potential for the market. The growing investments towards research and development activities and increasing consumer preference for omega-3 supplements are the major driving forces contributing to the growth of the market.

The following table provided a comparative aspects of change of CAGR during a span of 6 months for the base year (2024) and the current year (2025) for global krill oil category. This qualitative analysis pinpoints performance alterations and goes on to convey revenue realization trends helping stakeholders arrive at a better understanding of the growth trajectory during the subject year. H1 spans January to June More on H1 The second half of the year, H2, has July through December.

| Particular | Value CAGR |

|---|---|

| H1 | 10.1% (2024 to 2034) |

| H2 | 10.3% (2024 to 2034) |

| H1 | 10.4% (2025 to 2035) |

| H2 | 10.5% (2025 to 2035) |

First half such as 2025 to 2035, such market is estimated to register CAGR of 10.4%, second half of the same decade is estimated to be at 10.5% growth rate. They are predicted to grow at an increasingly growing CAGR to the next phase (H1 2025 - H2 2035). The sector increased in H1 2025 to 30BPS in the new assessment and H2 2025 to 20BPS.

In addition, krill oil is expected to continue growing for the next 10 years owing to constant product innovation, increasing investment in omega-3 research and changing consumer preference towards natural health supplements. As all of this points towards sustainable harvesting methods and advanced processing technologies for product development, the market can look ahead to higher product effectiveness, regulatory approvals, and total consumer adoption.

The krill oil market has been predominantly dominated by a handful of well-established marine oil companies with an integrated supply chain, volume-driven production, and robust brand portfolios. These companies are investing in sustainable harvesting, scientific research, and product innovation based on omega-3 fatty acid (EPA & DHA), phospholipids, and astaxanthin content.

With a fully integrated value chain from harvesting Antarctic krill to producing refined oil, Aker BioMarine is the number one player in the Tier 1 space, alongside some strong branded ingredients (such as Superba™ Krill), as well as its use in nutraceuticals and functional foods globally. Also, Enzymotec Ltd. (now part of Frutarom/IFF) has entered the highly specialized market with krill-based lipid solutions that target cardiovascular, cognitive, and joint health.

These companies achieve market dominance by developing R&D-backed health claims, staying compliant with regulations, and forming strategic partnerships with supplement and pharmaceutical companies.

Companies that focus primarily on a niche market with a limited production capacity and regional scope fall into Tier 2. Examples like Rimfrost AS, which specializes in sustainably harvested krill oil that they say prioritizes premium purity and freshness, and Nutraceutical International Corporation that sells private-label krill oil supplements branded under health brands. These companies compete on quality assurance, value-added formulations (i.e., soft gels, emulsions), and health-conscious branding for the segments of consumers in North America, Europe, and Asia-Pacific.

Emerging krill oil brands, small-scale marine oil processors, and new entrants targeting regional dietary supplement markets or direct-to-consumer (D2C) online platforms fall into Tier 3. Many krill oil brands source krill from bulk suppliers and concentrate on branding, unique formulations (e.g., vegan capsules, combined omega blends), and affordability.

Kori Krill Oil and Sports Research are among those that have attracted consumer attention through social media marketing, clean-label positioning, and subscription-based sales models. Tier 3 companies typically source their manufacturing from third parties, but differentiate themselves through unique packaging, sustainability stories, and health claims.

Krill Oil Market: Rising Demand for Bioavailable Omega-3s Driving Popularity of Krill Oil

Shift: We want it non-configurational when manufacturers promise low levels of heavy metals or no cholesterol, making it even more appealing for consumers targeting their cardiovascular health, cognitive support, and inflammation reduction needs, who are looking to focus on omega-3 with EPA and DHA from algae oil.

But unlike regular fish oil, where Omega-3s are in triglyceride form (not as readily absorbed), Omega-3s in krill oil are bound to phospholipids, leading to increased bioavailability and dose-dependent efficacy. This has spurred demand in the dietary supplements segment, particularly among the health-conscious millennials, the aging population, and fitness enthusiasts.

Strategic Response: In response to this demand, Aker BioMarine introduced Superba Boost™, a concentrated krill oil that contains a higher concentration of phospholipids and choline compared to Superba™ krill oil. It was aimed at the premium end of the supplements market in North America and Europe.

Rimfrost launched Rimfrost Krill Superba2™, which highlights clinical-grade quality and purity, advancing debate for acceptance in the field of both medical nutrition and functional food applications. In Asia, Enzymotec (now Frutarom) introduced its krill oil to the Japanese and South Korean markets, where patients gave equal importance to nutraceuticals and pharmaceuticals, in pharma-grade softgels sold under the KReal brand, ultimately becoming the market leader. The bioavailability advantage is at the heart of krill oil’s ascent in the crowded Omega-3 field.

Purchase Decisions Driven by Sustainability Certifications

Shift: As concerns grow about overfishing, marine ecosystem health, and climate change, consumers are asking for sustainably sourced krill oil. Green-minded customers look for things like third-party certifications (like MSC (Marine Stewardship Council), carbon neutrality, and traceable harvesting, who in turn push for brands to improve transparency and sustainability initiatives.

Strategic Response: Aker BioMarine, the largest krill oil company in the world, focuses on its MSC certification, completely transparent supply chain, and desire to harvest as little impact as possible on Antarctic waters to secure exclusive supply agreements in the USA with Whole Foods Market and CVS Health; USA supplement brand Nutrigold on the other hand massively promotes its krill oil to be non-GMO, certifiably sustainable and 100% traceable to ethical consumers and natural retailers.

Minami Nutrition has branded its krill oil line with eco-packaging and carbon offsetting certifications to support EU green transition guidelines and cater to eco-conscious consumers in Europe. Sustainability has evolved from an identifier to an expectation in most premium markets.

Bubbling into the functional foods and drinks market is expanding

Shift: In addition to supplements, functional food and drinks that are fortified with Omega-3s are taking hold. Because it has a neutral taste and very high stability, krill oil is being incorporated into ready-to-drink beverages, protein bars, dairy products and health snacks that offer appeal among consumers on the go and those who shop for sports nutrition products.

Strategic Response: Nestlé Health Science partnered with Aker BioMarine to incorporate a phospholipid-rich krill oil into its BOOST nutritional beverages for senior nutrition, resulting in a 5% growth in sales within the health beverage segment.

Herbalife Nutrition introduced Omega-3 fortification in protein bars in Latin America to support joint health and heart wellness among fitness-focused demographics, utilizing krill oil. Nutraceuticals CRUDES Swisse Wellness launched krill oil-infused yogurt drinks in Australia, targeting young adults and active consumers in chains such as Woolworths. These innovations are opening up new product formats, bringing krill oil to new territories outside the humble pill.

Preventive Health Focus Drives Growth in Regional Market in Asia Pacific

Shift: Growing health consciousness, an aging population and increasing disposable income are driving the market demand for preventive nutrition in the Asia Pacific region, particularly in China, Japan, South Korea and India, and fuelling demand for krill oil for heart, joint and brain health. Support from the regulatory bodies for nutraceuticals and increasing sales of health products online also aids in accelerating the market penetration.

Strategic Response: BY-HEALTH, a Chinese nutraceutical giant, launched krill oil softgels under its Keylid brand, achieving double-digit growth via Tmall and JD. Com e-commerce platforms. DHC Japan launched krill oil capsules with coenzyme Q10 as a daily brain-and-heart-health booster, riding the wave of Japan’s increasingly aging population.

Seoul-based CJ CheilJedang introduced Red Omega Krill Oil via pharmacies and online, integrating beauty-from-within messaging, tying krill oil to skin health and anti-aging. These regional players are tailoring formulations and marketing narratives to address culturally relevant health concerns, making a more lasting impact with increased market penetration.

Specialized New Concentrated and Multi-Ingredient Krill Oil Formulations

Shift: Increased demand for concentrated krill oil and multi-ingredient formulations (e.g., krill oil + astaxanthin, CoQ10, vitamin D3, or curcumin) as consumers look for convenience and multifunctionality. Such combinations are strengthening value propositions, particularly in the premium supplement sector, appealing to performance-sensitive consumers.

Strategic Response: They are very interesting because you will only be faced with customers in a vast system of buyers. To cater to these value-focused and performance-driven buyers, NOW Foods has introduced its Krill and Fish Oil Blends for broad-spectrum Omega-3 support.

Pharmavite (Nature Made) released Triple Action Heart Formula with krill oil, CoQ10, and magnesium, targeting pharmacy chain shoppers like Walgreens and Rite Aid customers. Towards premiumization and increased functionality in Omega-3 supplementation

Consumer Trusting Based on Clinical Research and Scientific Validation

Shift: As nutraceutical consumers become increasingly selective, so too is demand for products that are based on clinical trials and scientific evidence. With peer-reviewed research supporting its efficacy in helping reduce triglycerides, improve joint health, and enhance cognitive function, krill oil is gaining attention.

Scientific validation is paramount in pharmacist recommendations, premium pricing and consumer loyalty so that consumers tend to transfer to Europe and North America, where health claims are strictly regulated.

Strategic Response: Aker BioMarine sponsored the KRILL Trial, Omega-3 Index and similar studies that communicated krill oil’s benefits of superior absorption rates and cardiovascular benefits, and built its B2B power through partners such as Life Extension and GNC.

Rimfrost worked with European research organizations to research krill oil’s impact on cognitive aging, in support of claims submissions to the EFSA. Reckitt's MegaRed utilized clinical data to substantiate joint health claims, resulting in optimal shelf placement in Target and Walmart outlets.

The following table shows the estimated growth rates of the top five territories. These markets are set to experience high consumption through 2035.

| Country | CAGR, 2025 to 2035 |

|---|---|

| USA | 2.5% |

| Germany | 3.0% |

| China | 2.8% |

| Japan | 2.4% |

| India | 3.2% |

Growing health and dietary trend is raising sales potential for krill oil in the USA What is more, krill oil contains EPA and DHA in the phospholipid type, hence improving bioavailability. There are points why krill oil outranks fish oil among the health-bent.

The krill oil supplements market is anticipated to grow in the coming years, owing to the growing geriatric population, along with the increasing prevalence of cardiovascular disorders and joint-associated diseases.

Its availability has also been expanded to the retail distribution through pharmacies, supermarkets, and even e-commerce platforms. Ongoing research showcasing krill oil advantages for neuronal cognition and irritation are also fueling demand for krill oil within the USA market.

Germany benefits from an established nutraceutical and dietary supplement market, laying the groundwork for the growth of krill oil. Natural-functional health is one of the leading groups of food associated with needs in Germany; there is a growing need for omega-3 supplements.

Compared to regular fish oil, the advantages of krill oil [which include better absorption and less fishy taste] have made it an attractive option for health-conscious consumers. The country’s stringent laws regulating the quality and labeling of supplements have also instilled consumer confidence in krill oil products. Additionally, Germany’s sustainable sourcing message resonates with environmentally conscious consumers who have a preference for responsibly harvested krill oil.

In China, the rising demand for krill oil supplements has been supported by the increasing number of the middle-class population and growing health awareness. Where a large portion of the populace priorities preventive health, krill oil appears to be on the rise as a high-end omega-3 supplement.

They will also enjoy greater access to broader online shopping platforms such as Alibaba and JD. Global as well as local krill oil brands are readily available to customers through the company. In addition, aging population demographics in China and the growing prevalence of lifestyle diseases such as heart disease and arthritis have contributed to rising acceptance for omega-3 supplements such as krill oil supplements. Furthermore, regulatory advancements and government-led initiatives aimed at promoting healthy aging also contribute to market growth.

Japan’s focus on longevity and preventive health care has also helped fuel interest in krill oil as a dietary supplement. It enjoys one of the highest life expectancies in the world, and shoppers are looking for functional foods and supplements that support cardiovascular and cognitive health. Krill oil boasts a phospholipid-rich composition that appeals to Japanese customers seeking high-end, bioavailable supplements.

Some key distribution channels include pharmacies, health food stores, and online marketplaces, which enable easy access to krill oil products. In addition, considering the marine-based nutrition culture in Japan, which has been established, and krill oil supplements can be proposed as a substitute for fish oil supplements.

| Segment | Value Share (2025) |

|---|---|

| By Form | 58% |

It is available in different forms such as liquid, capsules, and soft gels for different consumer habits and applications. Out of these, capsules and soft gels hold the highest market share in this category, as they are convenient, provide accurate dosage, and are also shelf-stable.

Krill oil in an encapsulated form is being preferred by a lot of consumers as it conceals the strong odor and taste from a marine-based supplement, making it easier to consume. In The soft gel format is particularly favored due to its ease of use in swallowing and faster absorption.

Liquid krill oil, although not a direct-to-consumer sales behemoth, is a cornerstone of formulations in functional foods, beverages, and pharmaceuticals. Because of its high concentration of omega-3 fatty acids, phospholipids, and astaxanthin, which are known to be anti-inflammatory and antioxidant, it is often used in health drinks, fortified foods, and in infant nutrition products.

Liquid krill oil is also used as a primary ingredient in pet and animal nutrition products, particularly for joint health, cardiovascular support, and cognitive support in aged pets. The increasing demand for plant-based and other alternative omega-3 sources poses a threat to the sales of krill oil of every type. Nevertheless, continuing survey and outreach of the product's unique bioavailability, sustainability, and health advantages over fish oil will continue to spur demand, especially in the pharmaceutical and supplement industries.

| Segment | Value Share (2025) |

|---|---|

| By End Use | 42% |

Krill oil has applications in dietary supplements, functional foods and beverages, pharmaceuticals, pet food and animal feed, and others. Among these industries, the dietary supplements category makes a significant contribution and is one of the most widely consumed products of krill oil due to omega-3 fatty acids improving heart and cognitive function, and reducing inflammation. As consumers continue to embrace preventive healthcare and prefer natural alternatives to synthetic medications, demand for krill oil-based products will fuel growth in the krill oil market.

The krill oil market is a part of the functional food & beverage industry offering, which includes health-enhancing products such as fortified dairy (milk), protein powders, and energy drinks. Its phospholipid-bound omega-3 structure has a superior absorption ability compared to traditional fish oil, making it a favorite functional food ingredient. Still, its pungent taste and scent present challenges that require innovative encapsulation and flavor-masking solutions.

The pharmaceutical sector is increasingly utilizing krill oil for its therapeutic potential in the treatment of cardiac dysfunction, arthritis, and cognitive disorders. The pharmaceutical industry has been encouraged by clinical studies demonstrating its effectiveness in decreasing triglycerides and managing inflammatory conditions.

Some of the top players competing in the krill oil market are Aker BioMarine and Omega Protein Corporation and others which would be able to increase their share in the Krill Oil Market through brand visibility, product development, and innovation. By providing superior krill oil supplements with additional features such as enhanced bioavailability and improved omega-3 absorption, they were able to boost the preferences of health-conscious consumers.

This diversity attracts more consumers while enabling these companies to remain competitive against other omega-3 supplement brands.Additionally, these manufacturers have introduced various packaging innovations to enhance the stability, convenience, and shelf life of their products.

Things like single-serve capsules, resealable pouches, and light-resistant packaging preserve krill oil freshness and effectiveness. Further rising number of opportunities in the krill oil market is attributed to alliances and partnerships formed within the krill oil market. Brands are turning to health and wellness influencers, supplement retailers, and e-commerce platforms to increase visibility and reach a wider audience.

For instance

Market segmented into Liquid, Capsules, and Soft Gel.

Market segmented into Dietary Supplements, Functional Food and Beverages, Pharmaceuticals, Pet Food and Animal Feed, and Others.

Market segmented into North America, Latin America, Europe, South Asia & Pacific, East Asia, and the Middle East & Africa (MEA

The global krill oil market is projected to grow at a CAGR of 21.5% during the forecast period.

The market is estimated to reach approximately USD 3,279.7 million by 2035.

The dietary supplements segment is expected to witness the fastest growth due to increasing consumer awareness of the health benefits of omega-3 fatty acids and phospholipids.

Key growth drivers include rising demand for omega-3 supplements, increasing focus on heart and brain health, and growing adoption of krill oil as a sustainable alternative to fish oil.

Leading companies in the market include Neptune Biotech, Aker BioMarine AS, Alpha B&H Co., Fuji Chemicals, Krill Canada & Rimfrost A.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2017 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2017 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Form, 2017 to 2033

Table 4: Global Market Volume (MT) Forecast by Form, 2017 to 2033

Table 5: Global Market Value (US$ Million) Forecast by End Use, 2017 to 2033

Table 6: Global Market Volume (MT) Forecast by End Use, 2017 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 8: North America Market Volume (MT) Forecast by Country, 2017 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Form, 2017 to 2033

Table 10: North America Market Volume (MT) Forecast by Form, 2017 to 2033

Table 11: North America Market Value (US$ Million) Forecast by End Use, 2017 to 2033

Table 12: North America Market Volume (MT) Forecast by End Use, 2017 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 14: Latin America Market Volume (MT) Forecast by Country, 2017 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Form, 2017 to 2033

Table 16: Latin America Market Volume (MT) Forecast by Form, 2017 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by End Use, 2017 to 2033

Table 18: Latin America Market Volume (MT) Forecast by End Use, 2017 to 2033

Table 19: Europe Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 20: Europe Market Volume (MT) Forecast by Country, 2017 to 2033

Table 21: Europe Market Value (US$ Million) Forecast by Form, 2017 to 2033

Table 22: Europe Market Volume (MT) Forecast by Form, 2017 to 2033

Table 23: Europe Market Value (US$ Million) Forecast by End Use, 2017 to 2033

Table 24: Europe Market Volume (MT) Forecast by End Use, 2017 to 2033

Table 25: East Asia Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 26: East Asia Market Volume (MT) Forecast by Country, 2017 to 2033

Table 27: East Asia Market Value (US$ Million) Forecast by Form, 2017 to 2033

Table 28: East Asia Market Volume (MT) Forecast by Form, 2017 to 2033

Table 29: East Asia Market Value (US$ Million) Forecast by End Use, 2017 to 2033

Table 30: East Asia Market Volume (MT) Forecast by End Use, 2017 to 2033

Table 31: South Asia Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 32: South Asia Market Volume (MT) Forecast by Country, 2017 to 2033

Table 33: South Asia Market Value (US$ Million) Forecast by Form, 2017 to 2033

Table 34: South Asia Market Volume (MT) Forecast by Form, 2017 to 2033

Table 35: South Asia Market Value (US$ Million) Forecast by End Use, 2017 to 2033

Table 36: South Asia Market Volume (MT) Forecast by End Use, 2017 to 2033

Table 37: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 38: Middle East and Africa Market Volume (MT) Forecast by Country, 2017 to 2033

Table 39: Middle East and Africa Market Value (US$ Million) Forecast by Form, 2017 to 2033

Table 40: Middle East and Africa Market Volume (MT) Forecast by Form, 2017 to 2033

Table 41: Middle East and Africa Market Value (US$ Million) Forecast by End Use, 2017 to 2033

Table 42: Middle East and Africa Market Volume (MT) Forecast by End Use, 2017 to 2033

Table 43: Oceania Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 44: Oceania Market Volume (MT) Forecast by Country, 2017 to 2033

Table 45: Oceania Market Value (US$ Million) Forecast by Form, 2017 to 2033

Table 46: Oceania Market Volume (MT) Forecast by Form, 2017 to 2033

Table 47: Oceania Market Value (US$ Million) Forecast by End Use, 2017 to 2033

Table 48: Oceania Market Volume (MT) Forecast by End Use, 2017 to 2033

Figure 1: Global Market Value (US$ Million) by Form, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by End Use, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2017 to 2033

Figure 5: Global Market Volume (MT) Analysis by Region, 2017 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Form, 2017 to 2033

Figure 9: Global Market Volume (MT) Analysis by Form, 2017 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by End Use, 2017 to 2033

Figure 13: Global Market Volume (MT) Analysis by End Use, 2017 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 16: Global Market Attractiveness by Form, 2023 to 2033

Figure 17: Global Market Attractiveness by End Use, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Form, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 23: North America Market Volume (MT) Analysis by Country, 2017 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Form, 2017 to 2033

Figure 27: North America Market Volume (MT) Analysis by Form, 2017 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by End Use, 2017 to 2033

Figure 31: North America Market Volume (MT) Analysis by End Use, 2017 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 34: North America Market Attractiveness by Form, 2023 to 2033

Figure 35: North America Market Attractiveness by End Use, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Form, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 41: Latin America Market Volume (MT) Analysis by Country, 2017 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Form, 2017 to 2033

Figure 45: Latin America Market Volume (MT) Analysis by Form, 2017 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by End Use, 2017 to 2033

Figure 49: Latin America Market Volume (MT) Analysis by End Use, 2017 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Form, 2023 to 2033

Figure 53: Latin America Market Attractiveness by End Use, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Europe Market Value (US$ Million) by Form, 2023 to 2033

Figure 56: Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 57: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Europe Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 59: Europe Market Volume (MT) Analysis by Country, 2017 to 2033

Figure 60: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) Analysis by Form, 2017 to 2033

Figure 63: Europe Market Volume (MT) Analysis by Form, 2017 to 2033

Figure 64: Europe Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 65: Europe Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 66: Europe Market Value (US$ Million) Analysis by End Use, 2017 to 2033

Figure 67: Europe Market Volume (MT) Analysis by End Use, 2017 to 2033

Figure 68: Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 69: Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 70: Europe Market Attractiveness by Form, 2023 to 2033

Figure 71: Europe Market Attractiveness by End Use, 2023 to 2033

Figure 72: Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: East Asia Market Value (US$ Million) by Form, 2023 to 2033

Figure 74: East Asia Market Value (US$ Million) by End Use, 2023 to 2033

Figure 75: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: East Asia Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 77: East Asia Market Volume (MT) Analysis by Country, 2017 to 2033

Figure 78: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: East Asia Market Value (US$ Million) Analysis by Form, 2017 to 2033

Figure 81: East Asia Market Volume (MT) Analysis by Form, 2017 to 2033

Figure 82: East Asia Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 83: East Asia Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 84: East Asia Market Value (US$ Million) Analysis by End Use, 2017 to 2033

Figure 85: East Asia Market Volume (MT) Analysis by End Use, 2017 to 2033

Figure 86: East Asia Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 87: East Asia Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 88: East Asia Market Attractiveness by Form, 2023 to 2033

Figure 89: East Asia Market Attractiveness by End Use, 2023 to 2033

Figure 90: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia Market Value (US$ Million) by Form, 2023 to 2033

Figure 92: South Asia Market Value (US$ Million) by End Use, 2023 to 2033

Figure 93: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: South Asia Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 95: South Asia Market Volume (MT) Analysis by Country, 2017 to 2033

Figure 96: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia Market Value (US$ Million) Analysis by Form, 2017 to 2033

Figure 99: South Asia Market Volume (MT) Analysis by Form, 2017 to 2033

Figure 100: South Asia Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 101: South Asia Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 102: South Asia Market Value (US$ Million) Analysis by End Use, 2017 to 2033

Figure 103: South Asia Market Volume (MT) Analysis by End Use, 2017 to 2033

Figure 104: South Asia Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 105: South Asia Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 106: South Asia Market Attractiveness by Form, 2023 to 2033

Figure 107: South Asia Market Attractiveness by End Use, 2023 to 2033

Figure 108: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 109: Middle East and Africa Market Value (US$ Million) by Form, 2023 to 2033

Figure 110: Middle East and Africa Market Value (US$ Million) by End Use, 2023 to 2033

Figure 111: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 112: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 113: Middle East and Africa Market Volume (MT) Analysis by Country, 2017 to 2033

Figure 114: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: Middle East and Africa Market Value (US$ Million) Analysis by Form, 2017 to 2033

Figure 117: Middle East and Africa Market Volume (MT) Analysis by Form, 2017 to 2033

Figure 118: Middle East and Africa Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 119: Middle East and Africa Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 120: Middle East and Africa Market Value (US$ Million) Analysis by End Use, 2017 to 2033

Figure 121: Middle East and Africa Market Volume (MT) Analysis by End Use, 2017 to 2033

Figure 122: Middle East and Africa Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 123: Middle East and Africa Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 124: Middle East and Africa Market Attractiveness by Form, 2023 to 2033

Figure 125: Middle East and Africa Market Attractiveness by End Use, 2023 to 2033

Figure 126: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Figure 127: Oceania Market Value (US$ Million) by Form, 2023 to 2033

Figure 128: Oceania Market Value (US$ Million) by End Use, 2023 to 2033

Figure 129: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 130: Oceania Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 131: Oceania Market Volume (MT) Analysis by Country, 2017 to 2033

Figure 132: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Oceania Market Value (US$ Million) Analysis by Form, 2017 to 2033

Figure 135: Oceania Market Volume (MT) Analysis by Form, 2017 to 2033

Figure 136: Oceania Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 137: Oceania Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 138: Oceania Market Value (US$ Million) Analysis by End Use, 2017 to 2033

Figure 139: Oceania Market Volume (MT) Analysis by End Use, 2017 to 2033

Figure 140: Oceania Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 141: Oceania Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 142: Oceania Market Attractiveness by Form, 2023 to 2033

Figure 143: Oceania Market Attractiveness by End Use, 2023 to 2033

Figure 144: Oceania Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Krill Oil Supplements Market Size and Share Forecast Outlook 2025 to 2035

Analysis and Growth Projections for Krill Oil Phospholipid Business

The Oil & Gas Terminal Automation Market is segmented by Offering (Hardware, Software, Services) and Region by FMI.

The Oil and Gas Fittings Market is segmented by Product Type (Flanges, Elbows, Tees, Reducers, Couplings, and Others), Material (Carbon Steel, Stainless Steel, Alloy Steel, and Others), Application (Upstream, Midstream, and Downstream), and Region. Forecast for 2026 to 2036.

Oil-to-Milk Solid Cleansers Market Size and Share Forecast Outlook 2026 to 2036

Oil and Gas Flow Control Equipment Market Size and Share Forecast Outlook 2026 to 2036

Oily Waste Can Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Seal Market Size and Share Forecast Outlook 2025 to 2035

Oil Coalescing Filter Market Size and Share Forecast Outlook 2025 to 2035

Oil-immersed Iron Core Series Reactor Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Sensor Market Forecast Outlook 2025 to 2035

Oil Packing Machine Market Forecast and Outlook 2025 to 2035

Oil and Gas Pipeline Coating Market Forecast and Outlook 2025 to 2035

Oilfield Scale Inhibitor Market Size and Share Forecast Outlook 2025 to 2035

Oil-in-Water Anionic Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Field Services Market Size and Share Forecast Outlook 2025 to 2035

Oil Control Shampoo Market Size and Share Forecast Outlook 2025 to 2035

Oil Expellers Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Stimulation Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Oiler Kits Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.