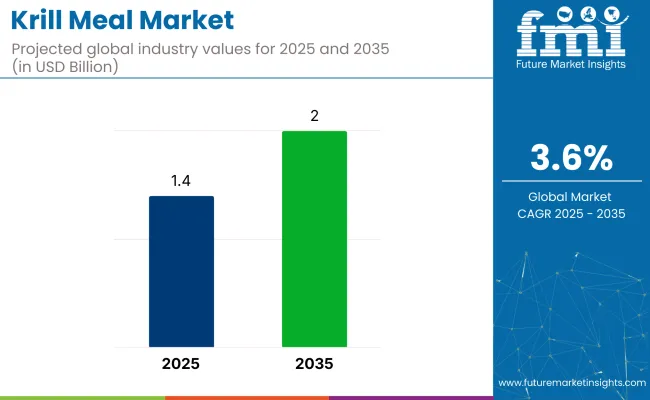

The global krill meal market is projected to grow from USD 1.4 billion in 2025 to USD 2.0 billion by 2035, reflecting a CAGR of 3.6%.

| Metric | Value |

|---|---|

| Estimated Size (2025E) | USD 1.4 billion |

| Projected Value (2035F) | USD 2.0 billion |

| CAGR (2025 to 2035) | 3.6% |

This expansion is likely to be driven by rising health awareness, the nutritional benefits of krill meal products, and increasing usage in the aquafeed and nutraceutical industries. Furthermore, growing demand for omega-3-rich products is expected to reinforce growth across key markets such as the USA, Japan, and India over the next decade.

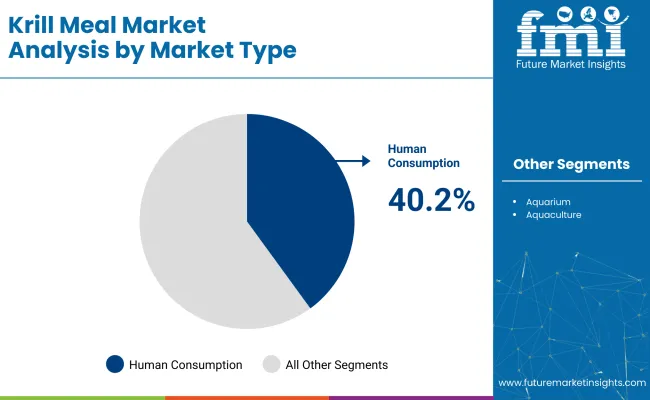

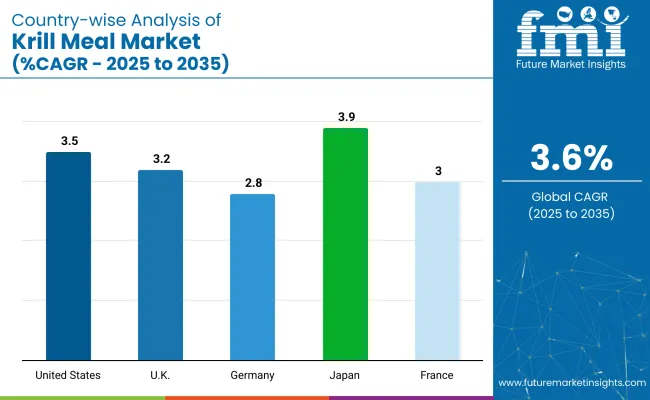

The market is likely to remain dominated by the USA with a leading share in overall market, expanding at a CAGR of 3.5% due to strong nutraceutical demand and advanced processing capabilities. Meanwhile, Japan and France closely follow this growth at prominent CAGRs of 3.9% and 3.0% respectively. Human consumption is anticipated to remain the dominant typesegment, holding a value share of 40.2% in 2035, while dietary supplements by end-use application account for 35% of the market share.

The market holds a relatively small but significant share within its parent markets. In the global seafood market, it accounts for less than 1%, given the dominance of fish, shellfish, and crustaceans for direct human consumption. Within the marine ingredients market, krill meal represents around 5-7% due to its specialized extraction for feed and nutraceuticals.

In the animal feed market, its share is under 1%, while in the Aquafeed Market, it contributes approximately 3-4% as a premium protein source. For the omega-3 ingredients market, it comprises roughly 2-3%, reflecting its use in high-value supplement formulations.

The market is segmented into market type, end-use application, distribution channel, and region.By market type, it includes human consumption, aquarium, aquaculture feed, and others (including pet food and industrial uses). By end-use application, the market is divided into pharmaceuticals, food and beverage, dietary supplements, and cosmetics.

The distribution channel segment includes pharmacies/drugstores, health & beauty stores, hypermarkets/supermarkets, direct selling, and online platforms. Regionally, the market covers North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, the Pacific, and the Middle East and Africa.

Human consumption is projected to remain the leading segment, driven by rising awareness of krill’s nutritional benefits and omega-3 content. This segment is anticipated to account for nearly 40.2% share of the market value by 2035 as consumer preference shifts towards marine-based dietary supplements. Demand from aquaculture feed will also remain strong due to krill meal’s high protein and lipid levels that enhance feed efficiency and fish health.

Dietary supplements are likely to be the fastest-growing segment, supported by consumer focus on preventive healthcare and cardiovascular health benefits. This segment is expected to account for over 35% market share by 2035, owing to krill meal’s bioavailability and superior nutrient profile. Food and beverage applications are expanding with new functional products entering the market, while pharmaceutical usage is rising for specialty extracts.

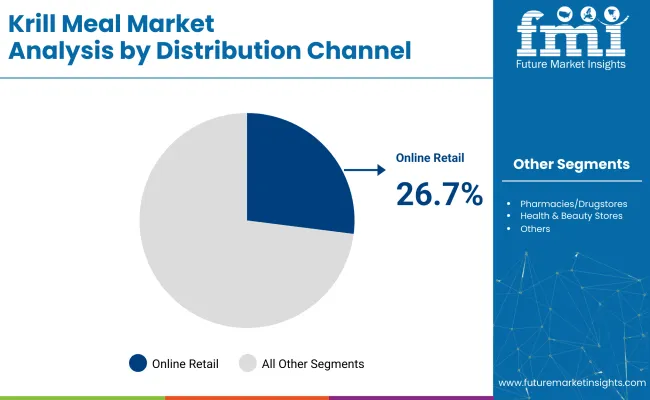

Online distribution channels are projected to grow rapidly due to increasing consumer preference for convenient purchasing and access to global brands. The online segment is estimated to hold around 26.7% of total sales by 2035 as manufacturers expand direct-to-consumer sales strategies. Pharmacies and drugstores will continue to serve as key retail channels for krill-based nutraceuticals.

Recent Trends in the Krill Meal Market

Challenges Facing the Krill Meal Market

Among the top five countries in the krill meal market, Japan is projected to have the highest CAGR at 3.9% from 2025 to 2035, driven by its strong preference for marine-based dietary products and advanced extraction technologies. The USA follows with a CAGR of 3.5%, supported by high omega-3 supplement demand and strong aquafeed industry.

France is expected to grow at 3.0%, backed by expanding functional foods and supplements markets. The United Kingdom will see a CAGR of 3.2%, while Germany has the slowest growth at 2.8% due to regulatory constraints despite eco-friendly product demand.

The report covers an in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The krill meal revenue in the USA is projected to grow at a CAGR of 3.5% from 2025 to 2035. The country is expected to remain the largest market due to advanced harvesting technologies, high demand for omega-3 supplements, and strong aquafeed industry presence. Strategic marketing and product diversification into nutraceuticals have been enhancing market reach.

Furthermore, stringent FDA approvals ensure product quality, increasing consumer confidence. The USA market is supported by robust distribution networks and innovation in krill extraction methods, thus solidifying its leadership in the global market landscape.

The revenue of krill meal in the UK is anticipated to expand at a CAGR of 3.2% from 2025 to 2035. The growth is likely to be driven by increasing consumer preference for marine-based dietary supplements due to their cardiovascular and cognitive health benefits.

Additionally, UK manufacturers are investing in sustainable krill harvesting aligned with EU environmental standards. Distribution channels are expanding through e-commerce platforms, allowing brands to target health-conscious consumers directly. Regulatory clarity on marine-based nutraceutical imports is further enabling market stability.

Thesales of krill meal in Germany are forecasted to grow at a CAGR of 2.8% from 2025 to 2035. The country remains an attractive market due to high demand for clean-label and sustainably sourced nutraceuticals.

German consumers’ preference for eco-friendly and natural products continues to support krill meal sales for human consumption and dietary supplements. However, companies face challenges due to strict EU sustainability regulations and high competition from alternative omega-3 sources such as algae oils, necessitating innovation to retain market position.

The krill meal industry in France is projected to register a CAGR of 3.0% from 2025 to 2035. Growth is driven by expanding dietary supplement markets and the incorporation of krill extracts in functional foods targeting cardiovascular health.

French nutraceutical firms are investing in R&D for new krill-based product formulations to gain a competitive advantage. However, environmental activism and regulatory hurdles on marine harvesting pose operational constraints, necessitating investment in sustainable sourcing certifications to maintain consumer trust.

The revenue from krill meal in Japan is expected to expand at a CAGR of 3.9% from 2025 to 2035. The country’s growth is underpinned by cultural dietary preferences for marine-based products and increasing elderly population demand for joint health and cognitive function supplements.

Japanese companies are leveraging krill meal’s high phospholipid content in nutraceutical formulations. Furthermore, technological advancements in krill oil extraction are supporting premium product launches in the market, strengthening Japan’s position in the Asia-Pacific region.

The market is moderately consolidated, with a few multinational leaders accounting for significant revenue shares alongside several regional nutraceutical firms. Tier-one companies such as Vitafusion, Nature’s Bounty, NOW Foods, Doctor’s Best, and Jarrow Formulas are competing based on product innovation, superior extraction technologies, sustainability certifications, and expanding distribution partnerships across online and offline channels. These firms leverage their brand reputation to penetrate premium dietary supplement segments globally.

Company strategies increasingly focus on sourcing traceable and eco-friendly krill meal, developing high-bioavailability formulations, and expanding direct-to-consumer platforms. Pricing competitiveness is maintained through economies of scale in raw material procurement, while innovation in extraction methods and functional blends (e.g., krill phospholipids with antioxidants) is enhancing product portfolios. Strategic partnerships with marine harvesting firms and e-commerce platforms are further strengthening market positions, particularly in North America and East Asia.

Recent Krill Meal Market News

In September 2024, Jarrow Formulas launched the Multi+ Multivitamin line, including Women’s, Men’s, and Mood Multi+ products. These multivitamins deliver 20 minerals and vitamins with 100% daily value and are formulated with proprietary blends for enhanced benefits such as hair health, mood support, and nitric oxide production for blood flow.

| Report Attributes | Details |

| Current Total Market Size (2025) | USD 1.4 billion |

| Projected Market Size (2035) | USD 2.0 billion |

| CAGR (2025 to 2035) | 3.6% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD billion/Volume in kilotons |

| By Market Type | Human Consumption, Aquarium, Aquaculture Feed, Others (pet food, industrial uses) |

| By End Use Application | Pharmaceuticals, Food and Beverage, Dietary Supplements, Cosmetics |

| By Distribution Channel | Pharmacies/Drugstores, Health & Beauty Stores, Hypermarket/Supermarket, Direct Selling, Online |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, the Pacific, the Middle East and Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia |

| Key Players | Vitafusion, Nature’s Bounty, NOW Foods, Doctor’s Best, Jarrow Formulas, Weber Naturals, Nature Made, Jamieson, Nordic Naturals |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis |

As per Market Use, the industry is categorized into Human Consumption, Aquarium, and Aquaculture Feed.

As per End Use Application, the industry is categorized into Pharmaceuticals, Food And Beverage, Dietary Supplements, and Cosmetics.

As per Distribution Channel, the industry is categorized into Pharmacies/Drugstores, Health & Beauty stores, Hypermarket/Supermarket, Direct Selling, and Online.

Industry analysis has been carried out in key countries of North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa.

The market size is valued at USD 1.4 billion in 2025.

The market is forecasted to reach USD 2.0 billion by 2035, reflecting a CAGR of 3.6%.

Human consumption is expected to lead the market with a 40.2% value share in 2025.

Online retail is anticipated to be the fastest-growing channel with a projected 26.7% share by 2035.

Japan is expected to be the fastest-growing market with a CAGR of 3.9% from 2025 to 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Krill Oil Supplements Market Size and Share Forecast Outlook 2025 to 2035

Analysis and Growth Projections for Krill Oil Phospholipid Business

Krill Oil Market Outlook – Share, Growth & Forecast 2025 to 2035

Antarctic Krill Market Analysis by Product Type and End Use Application Through 2035

Meal Voucher Market Size and Share Forecast Outlook 2025 to 2035

Meal Kit Market Size and Share Forecast Outlook 2025 to 2035

Meal Tray Sealing Machines Market Size and Share Forecast Outlook 2025 to 2035

Meal Replacement Bars Market Size, Growth, and Forecast for 2025 to 2035

Meal Replacement Products Market Analysis by Product type, source, application and region Through 2035

Meal Kit Delivery Service Market - Trends & Forecast 2025 to 2035

Meal Replacement Shake Market Trends - Powder & Liquid Analysis

UK Meal Replacement Products Market Trends – Growth, Demand & Forecast 2025-2035

Oatmeal market Analysis by Nature, Type and Sales Channel Through 2025 to 2035

Fishmeal and Fish Oil Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

USA Meal Replacement Products Market Insights – Size, Share & Forecast 2025-2035

Fish Meal Alternative Market Size and Share Forecast Outlook 2025 to 2035

Fish Meal Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Market Leaders & Share in the Fish Meal Industry

Ready Meals Packaging Market Size and Share Forecast Outlook 2025 to 2035

Vegan Meals Market Size, Growth, and Forecast for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA