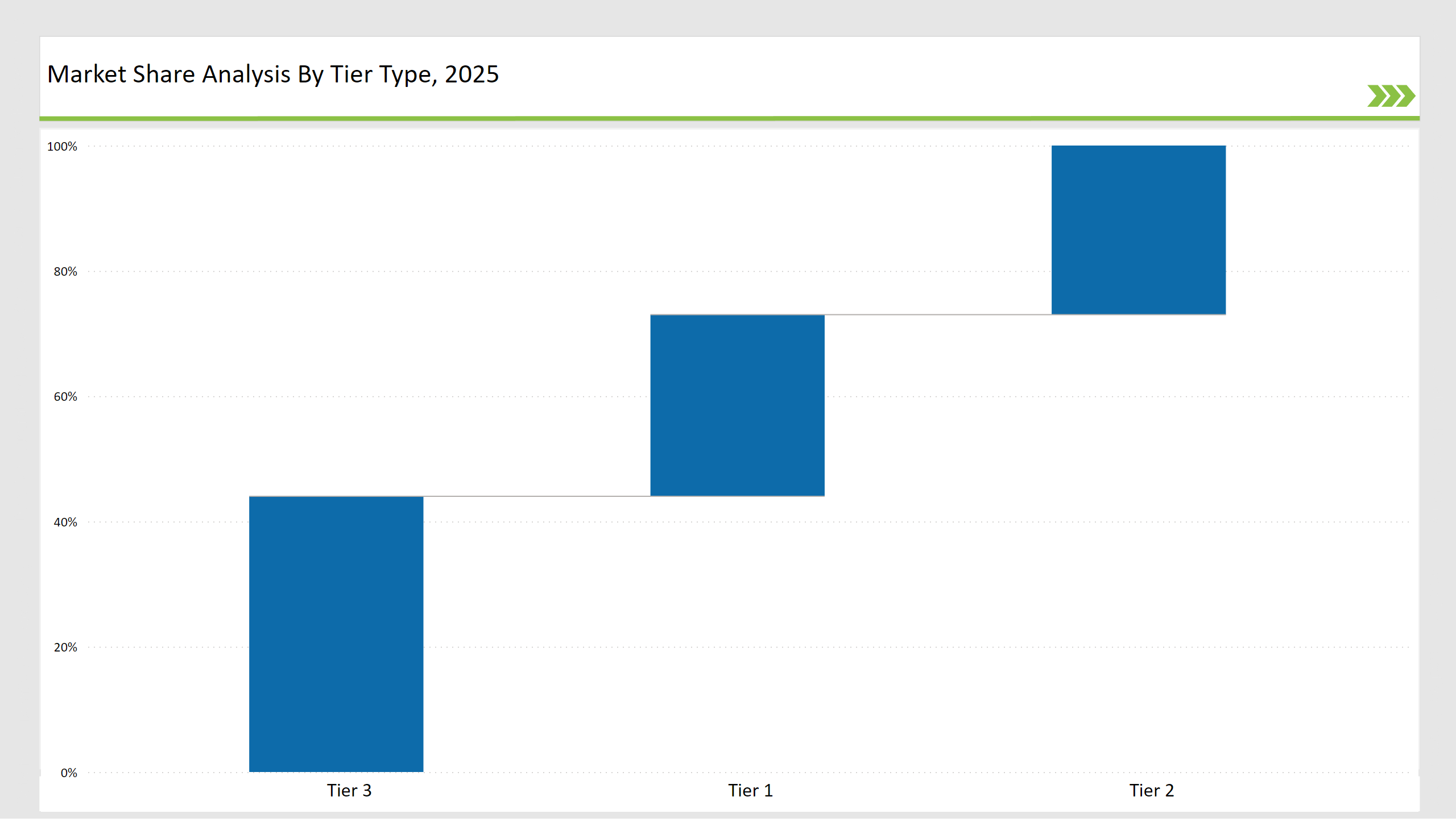

The Ready Meals Packaging Market is highly competitive and moderately fragmented. The players have been categorized as Tier 1, Tier 2, and Tier 3 players. The market leaders Amcor Plc, Mondi Group, and Tetra Pak hold 50% of the market share. Advanced packaging technology along with high durability and wide distribution networks are major reasons for such a strong market hold. Shift toward sustainable and convenient packaging solutions is forming the market trends.

The remaining 30% of the market share is captured by Tier 2 companies: Sealed Air Corporation and Sonoco Products Company. These companies provide frozen, chilled, and ambient ready meals by utilizing advanced barrier properties and cost-effective production.

Tier 3 companies are the rest 20% of the market share, small-scale manufacturers, niche suppliers, and regional distributors. These companies offer customized, cost-effective, and biodegradable packaging solutions tailored for specific industry requirements.

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (Amcor Plc, Mondi Group, Tetra Pak) | 14% |

| Rest of Top 5 (Sealed Air Corporation, Sonoco Products Company) | 9% |

| Next 5 of Top 10 (Huhtamaki, Berry Global, Winpak, Smurfit Kappa, Coveris) | 6% |

Type of Player & Industry Share (%), 2025

| Player Tier | Industry Share (%) |

|---|---|

| Top 10 Players | 29% |

| Next 20 Players | 27% |

| Remaining Players | 44% |

The Ready Meals Packaging Market is segmented based on primary end-use industries

To meet diverse industry requirements, vendors offer solutions such as

Sustainability trends influence the material, which experiences increasing demand for compostable trays, bio-degradable films, and lightweight packaging solutions.

Advancement in packaging technology, automation, and sustainability investments helped leading companies maintain their strong position. Their strategic partnerships with food manufacturers and continuous research initiatives drive market leadership.

Year-on-Year Leaders

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | Amcor Plc, Mondi Group, Tetra Pak |

| Tier 2 | Sealed Air Corporation, Sonoco Products Company |

| Tier 3 | Huhtamaki, Berry Global, Winpak, Smurfit Kappa, Coveris |

| Manufacturer | Latest Developments |

|---|---|

| Amcor Plc | Launched fully recyclable meal trays in January 2024. |

| Mondi Group | Introduced 100% paper-based food pouches in March 2024. |

| Tetra Pak | Expanded aseptic packaging for ready meals in February 2024. |

| Sealed Air Corporation | Developed high-barrier vacuum-sealed packaging in June 2024. |

| Sonoco Products Company | Strengthened its resealable meal tray offerings in May 2024. |

Ready meals packaging market is revolutionized by AI, IoT, and sustainable materials innovations. The companies are focusing on biodegradable packaging, smart tracking, and blockchain-based supply chain transparency. Future innovation will be focused on the reduction of environmental impact without performance compromise.

Furthermore, improvement in high-barrier materials and microwave-safe packaging will make products more usable. The use of smart sensors to track freshness is also gaining ground to meet consumer needs for quality assurance in real-time.

Leading manufacturers include Amcor Plc, Mondi Group, Tetra Pak, Sealed Air Corporation, and Sonoco Products Company.

The top 10 players collectively account for approximately 29% of the global market.

The market concentration is low, with leading players controlling below 30% of the industry.

Innovations focus on sustainability, smart packaging, AI-driven efficiency, and eco-friendly materials.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Ready to Use Intermittent Catheters Market Size and Share Forecast Outlook 2025 to 2035

Ready To Eat Seafood Snacks Market Size and Share Forecast Outlook 2025 to 2035

Ready to Drink Coffee Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Ready Mix Joint Compound Market Size and Share Forecast Outlook 2025 to 2035

Ready-to-Finish Bakery Products Market Analysis - Size, Share and Forecast 2025 to 2035

Ready to Drink Shakes Market Size and Share Forecast Outlook 2025 to 2035

Ready-to-eat Food Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Ready-made Food Bases Market Analysis - Size, Share, and Forecast 2025 to 2035

Ready-to-Use Therapeutic Food Market Trends and Forecast 2025 to 2035

Ready-to-Drink Beauty Beverage Market Analysis by Ingredients, Flavor, Form and Distribution Channel Through 2035

Ready-to-Serve Cocktails Market Trends - Innovation & Demand 2025 to 2035

Ready To Drink (RTD) Tea Market Trends - Functional & Refreshing Beverage Growth 2025 to 2035

Ready-to-eat Cups Market Analysis by Product Type, Nature, Packaging, Distribution Channel, and Region - Growth, Trends, and Forecast through 2035

Ready-To-Use Supplementary Food Market Analysis Hospital & Clinics, Charities, NGOs, And Others Through 2035

Ready-mix Concrete Market Trends & Outlook 2025 to 2035

Ready To Drink Cocktails Market Growth – Size, Trends & Forecast 2025-2035

Ready-to-Drink Beverage Market Analysis – Size, Share & Forecast 2024-2034

Ready-to-Eat Food Packaging Market Size and Share Forecast Outlook 2025 to 2035

Ready to Drink (RTD) Packaging Market Size and Share Forecast Outlook 2025 to 2035

Ready Meals Packaging Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA