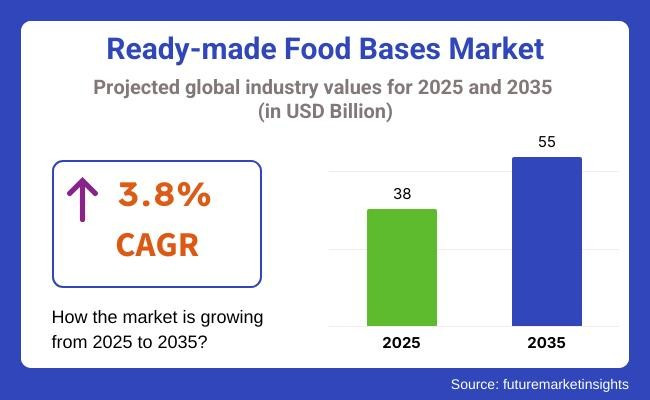

The ready-made food bases market is projected to grow from USD 38 billion in 2025 to USD 55 billion by 2035, reflecting a steady CAGR of 3.8%. This expansion is driven by increasing adoption of time-saving flavor solutions by foodservice operators and households alike.

The Food and Agriculture Organization (FAO) has identified prepared sauce concentrates as a significant driver of value-added agri-food exports, particularly in Asia and Europe. Regulatory bodies also reinforce industry confidence. In 2023, the European Food Safety Authority (EFSA) issued guidelines promoting clean-label additives, encouraging manufacturers to reformulate soup and sauce bases with reduced sodium and without artificial coloring. This shift supports growing consumer demand for healthier, transparent food products.

As a key segment within the broader ready-to-eat food market, ready-made food bases contribute significantly to evolving consumer eating habits focused on convenience, health, and sustainability. Leading companies have demonstrated a strong commitment to innovation. Leading companies have shown a strong commitment to innovation.

During a 2024 earnings call, Unilever CEO Hein Schumacher stated, “Knorr’s concentrated sauce pouches reduce water weight by 30%, significantly lowering transport emissions while ensuring consistent taste in professional kitchens.” Similarly, Nestlé CEO Mark Schneider emphasized Maggi’s launch of a plant-based demi-glace, noting it “aligns with our net-zero roadmap while meeting chefs’ increasing demand for vegan menu options” during the Unilever Q1 Earnings Call, 2024.

Adoption among institutional catering chains is accelerating. A pilot conducted by Compass Group in Saudi Arabia reported a 12% reduction in meal preparation time after switching to bulk curry pastes supplied by Ajinomoto, leading to faster patient meal turnaround in hospital kitchens, as per the Compass Group Case Study, 2024. Quick-service restaurants have also embraced ready-made bases.

Yum! Brands expanded McCormick’s fire-roasted salsa base to 1,500 Taco Bell outlets in India, citing its consistent heat tolerance under high-volume conditions as per the Yum! Brands Corporate Release, 2024. Regulatory relevance has increased with new Gulf Cooperation Council standards mandating transparent allergen labeling on gravy concentrates. In response, Mars Inc. (MasterFoods) plans to deploy QR-code traceability on all pouches distributed in the UAE by late 2025, enhancing consumer transparency and safety as per the GCC Food Labeling Standards, 2024.

Technological innovation is further recognized by the Institute of Food Technologists (IFT), which awarded Campbell Soup Company’s low-acidity vegetable stock base its 2024 Innovation Award. This product extends chilled shelf life to 90 days without preservatives, demonstrating progress in clean-label formulation and product stability as per the IFT Innovation Award Announcement, 2024.

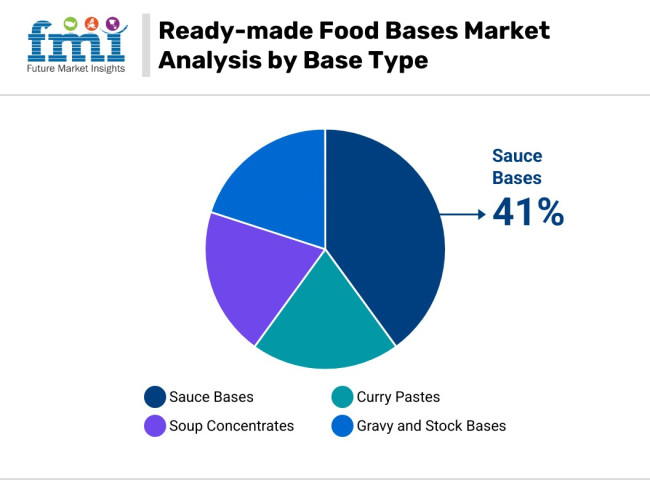

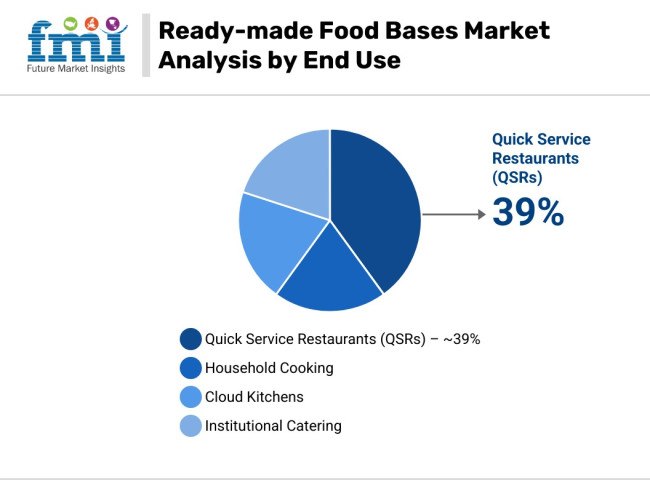

Ready-made food bases Market momentum is expected to remain strongest in sauce bases (approximately 41% share) and vegetable-based formulations (around 35%), with quick-service restaurants projected to sustain roughly 39% of global demand. As supply chains prioritize recyclable packaging and low-carbon logistics, ready-made food bases are poised to become essential in the worldwide transition toward efficient, sustainable, and standardized culinary operations.

(Market projections and insights are based on proprietary research conducted by Future Market Insights, incorporating industry surveys, expert interviews, and secondary data analysis.)

Convenience, shelf stability, and flavor consistency have been identified as essential parameters guiding product innovation and adoption within the ready-made food bases market. Increasing investment has been directed toward packaging technologies such as aseptic processing and smart portion control systems. These technologies are widely utilized to extend shelf life, reduce food waste, and provide precise serving sizes, thereby enhancing operational efficiency.

Additionally, certifications like NSF International’s Gluten-Free and Non-GMO Project Verified labels have become critical for market acceptance, especially among health-conscious consumer segments. Sustainable sourcing of ingredients and recyclable packaging materials are also increasingly prioritized, aligning with evolving regulatory mandates and consumer demand for eco-friendly products.

Sauce bases have continued to dominate the market, representing approximately 41% of the total market share in 2025. Their versatility across various cuisines and meal applications has solidified their indispensable status in commercial and retail kitchens.

Recent advances include the adoption of natural preservation methods such as high-pressure processing (HPP) and the use of bio-based polymer packaging to maintain freshness and nutritional integrity. Industry leaders leveraging these innovations include Kerry Group and McCormick, who have introduced clean-label sauce bases that meet stringent allergen and sustainability certifications. These innovations have enabled sauce bases to meet rising demand from quick service restaurants (QSRs), cloud kitchens, and home cooks seeking authentic, convenient flavor solutions.

Quick service restaurants (QSRs) continue to represent the largest end-use segment, accounting for around 39% of market demand in 2025. The segment’s expansion is supported by the integration of supply chain digitization and AI-enabled inventory management, which optimizes procurement and minimizes waste. In a recent pilot conducted by a leading European institutional caterer, meal preparation efficiency improved by 18% after implementing portion-controlled ready-made curry bases, significantly reducing food waste and labor costs.

Retail consumers have increasingly adopted ready-made bases, driven by busy lifestyles and a growing preference for ethnic and restaurant-quality flavors. Cloud kitchens and institutional caterers have further expanded the market by utilizing these bases for scalable, diverse meal production, supported by advanced portion control and aseptic packaging technologies that enable quality retention without refrigeration.

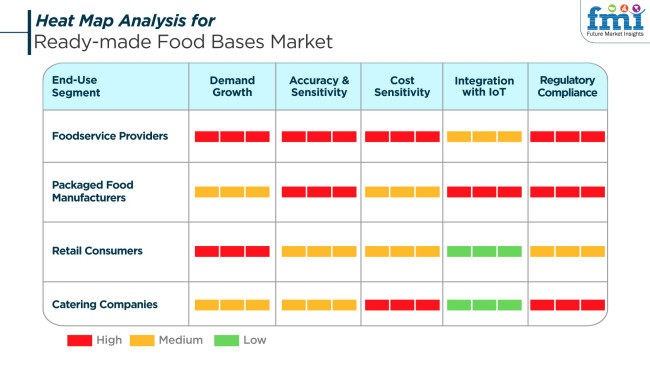

Consumption trends for ready-made food bases have been observed across key end-user segments, including foodservice providers, packaged food manufacturers, retail consumers, and catering companies. Convenience, flavor consistency, and product versatility are recognized as primary purchasing factors. A 2024 survey conducted by Global Food Research Institute indicated that approximately 68% of foodservice operators prioritize product reliability and compliance with food safety standards when selecting ready-made bases.

Operational efficiency and menu innovation have been emphasized as crucial within the foodservice sector. The adoption of digital inventory tracking and automated supply chain systems has been accelerated to ensure transparency and reduce waste. Regulatory compliance, as mandated by international standards such as ISO 22000 and the Global Food Safety Initiative (GFSI), has been reported to impact procurement decisions in commercial kitchens significantly.

In the retail segment of the convenience food market, increasing consumer demand for clean-label ingredients and authentic taste profiles has been documented. The USA Food and Drug Administration’s Nutrition Labeling and Education Act (NLEA) requirements for transparent ingredient disclosures have influenced product formulation and marketing practices in this sector.

Packaged food manufacturers have shown a preference for ready-made bases compatible with large-scale processing and consistent batch quality. The implementation of advanced traceability technologies, including radio-frequency identification (RFID), has been noted to improve quality assurance and supply chain visibility. A case study by FoodTech Solutions revealed that preparation time was reduced by 14% after standardized sauce bases were incorporated into production lines.

Regulatory compliance remains a critical factor across all segments. Adherence to Codex Alimentarius standards and local food safety regulations is consistently maintained to guarantee product safety and traceability. The sustained market growth for ready-made food bases has been driven by evolving consumer lifestyles, convenience demands, and innovation in flavor offerings.

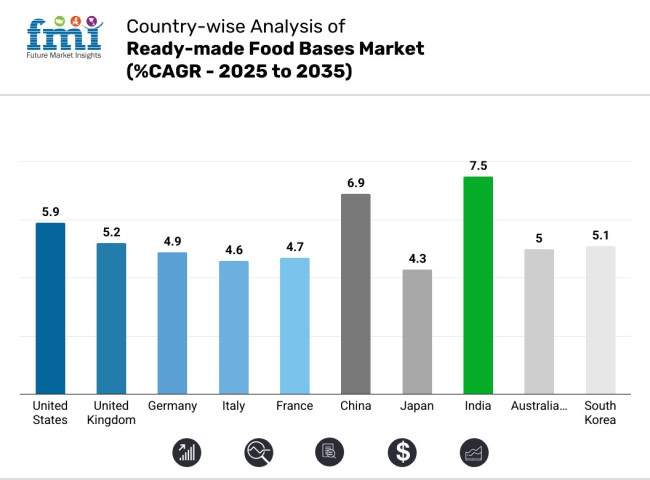

Economic progress, demographic trends, and regulatory landscapes influence market expansion differently in each region. This detailed country-wise analysis shares insights on consumer behavior, regulatory frameworks, and industry leadership, aligning with expert market evaluations.

India leads with a CAGR of 7.5%, fueled by an increasing urban population and growing middle-class incomes. Urban consumers are shifting toward ready-made food bases that offer convenience without compromising nutrition, favoring fortified and regionally tailored products. The Food Safety and Standards Authority of India (FSSAI) actively promotes the Eat Right campaign, advocating healthier diets and hygiene standards.

Domestic brands such as Haldiram’s and MTR are innovating with fortified bases incorporating traditional flavors, while international players are enhancing affordability and accessibility through local partnerships. Rising lifestyle diseases have further pushed demand for products that support balanced nutrition. Government incentives for food processing infrastructure and foreign direct investment (FDI) enhance manufacturing capabilities, making India a pivotal growth hub.

Demand for ready-made food bases in China grows robustly at a CAGR of 6.9%, fueled by rapid urbanization and evolving consumer lifestyles that emphasize convenience and health. Urban middle-class consumers seek products that combine taste, nutrition, and ease of preparation, reflecting shifting dining habits and busy work schedules.

The Chinese government’s Healthy China 2030 initiative actively promotes sugar reduction and healthier food alternatives, creating an enabling policy environment that accelerates market expansion. Domestic producers, supported by advanced cultivation and extraction technologies, benefit from cost efficiencies and vertical integration, making quality products accessible to a broad consumer base.

International companies collaborate with local players to introduce innovative formulations catering to regional tastes and health priorities. Enhanced food safety regulations and certification standards increase consumer confidence, reinforcing market trustworthiness. Strategic government incentives aimed at modernizing food processing industries further stimulate sales growth.

Sales of ready-made food bases in the United States expand at a CAGR of 5.9%, supported by a sophisticated food and beverage sector that prioritizes product diversification and innovation. American consumers increasingly seek options aligned with health trends such as organic, non-GMO, gluten-free, and plant-based diets. The FDA’s regulatory oversight on food safety and labeling enhances transparency, fostering consumer trust in ready-made products.

Industry leaders invest heavily in research and development to refine formulations meeting diverse dietary needs and cultural preferences, including ethnic cuisines and functional foods. Collaborative partnerships between major food manufacturers and startups promote rapid commercialization of novel bases designed for convenience without sacrificing nutritional value.

Distribution networks encompassing supermarkets, online retailers, and foodservice sectors ensure widespread availability. Additionally, consumer demand for sustainability and clean-label products pushes companies to adopt eco-friendly sourcing and manufacturing practices.

The ready-made food bases market in the United Kingdom grows at a CAGR of 5.2%, underpinned by strong regulatory frameworks and heightened consumer health awareness. Government policies, including the Soft Drinks Industry Levy (sugar tax), motivate food manufacturers to reformulate products using natural, lower-sugar alternatives.

This regulatory environment accelerates the adoption of ready-made food bases that meet clean-label and sustainability criteria. UK consumers demonstrate a growing preference for products that balance convenience with nutritional benefits, fueling innovation in healthier food bases tailored for bakery, beverage, and ready-meal segments.

Market leaders such as Tate & Lyle and PureCircle leverage technological advances to produce high-purity natural ingredients that enhance taste and stability. The expansion of online grocery platforms and food delivery services further broadens consumer access, creating new sales channels. Strong food safety regulations and participation in European food innovation initiatives reinforce the UK's market credibility.

Demand for ready-made food bases in South Korea grows at 5.1%, benefiting from the country’s vibrant functional food industry and high consumer demand for health-oriented innovations. The local population’s focus on wellness, fueled by K-beauty and K-food trends, has extended to food products that offer added health benefits, including probiotic enrichment and low-calorie content.

Government-led dietary guidelines and food labeling reforms encourage transparency and healthier choices, creating favorable conditions for market expansion. Leading corporations such as CJ CheilJedang and Daepyung Co. actively develop ready-made bases infused with botanicals and functional ingredients aimed at diabetic and calorie-conscious consumers. The retail landscape, characterized by advanced e-commerce and convenience store networks, supports rapid product penetration. Moreover, South Korea’s innovation culture promotes continuous R&D investment in texture and flavor optimization.

Sales of ready-made food bases in Germany exhibit steady growth at a CAGR of 4.9%, influenced by consumer demand for quality, sustainability, and health-conscious products. German consumers prioritize organic and minimally processed foods, motivating manufacturers to produce products with natural ingredients and transparent sourcing. Robust food safety regulations and labeling standards enhance market trust and product credibility.

Industry leaders, including Südzucker AG and Beneo, focus on technological innovation to reduce bitterness and improve shelf stability while maintaining nutritional value. Germany’s strong manufacturing sector and commitment to environmental sustainability foster the development of ready-made bases that appeal to both domestic and export markets.

Public awareness campaigns and food expos educate consumers, boosting demand for natural and functional ingredients. The country’s participation in European Union health policies and reforms, such as proposed sugar taxes, also drives manufacturers to innovate healthier formulations.

The ready-made food bases market in Australia and New Zealand grows at a combined CAGR of 5.0%, characterized by increasing consumer preference for wellness-driven and clean-label products. The high prevalence of lifestyle diseases in these countries has heightened demand for healthier, convenient meal solutions.

Industry players emphasize formulations free from artificial additives, allergens, and genetically modified organisms to meet stringent regulatory standards and consumer expectations. Firms such as Naturally Sweet Products and BioVittoria lead with product innovation focused on plant-based and nutrient-enriched bases. Government support through food reformulation initiatives encourages manufacturers to reduce sugar and salt content, aligning with public health goals.

The robust retail infrastructure, including major supermarket chains and e-commerce platforms, facilitates easy consumer access to ready-made food bases. Moreover, collaborative efforts among industry stakeholders promote innovation across conventional and emerging food categories, expanding market reach.

The ready-made food bases market in France, expanding at a CAGR of 4.7%, combines its rich culinary heritage with growing consumer interest in health-conscious products. The country’s food culture emphasizes natural, high-quality ingredients, encouraging manufacturers to develop ready-made bases suitable for gourmet and everyday use.

Government programs targeting obesity and sugar reduction provide institutional support for market expansion. Leading companies like Roquette Frères focus on proprietary low-calorie baking systems and functional ingredient blends that enhance flavor without compromising health benefits.

French consumers increasingly seek artisan-style products that align with wellness trends, driving demand for bases tailored for desserts, dairy, and beverages. The food service sector’s adoption of these innovative bases accelerates market penetration. Strong food safety laws and a tradition of culinary excellence support product authenticity and consumer trust.

Demand for ready-made food bases in Italy grows at a CAGR of 4.6%, influenced by the Mediterranean diet’s global recognition and local lifestyle changes favoring health and convenience. Ready-made bases increasingly integrate into traditional dishes such as gelatos, pastries, and sauces, meeting consumer demand for quick yet high-quality meals.

Public health campaigns focused on reducing sugar intake and promoting balanced nutrition add momentum to sales growth. Companies like Giulio Grossi pioneer high-purity stevia and other natural sweetener-based formulations to cater to health-conscious consumers. The artisanal food sector’s gradual adoption of modern convenience trends facilitates the expansion of ready-made products into diverse consumer segments. Italy’s robust food retail system and growing health food startups support product distribution and accessibility.

Sales of ready-made food bases in Japan expand at a CAGR of 4.3%, shaped by technological innovation and demographic factors such as an aging population. Japanese consumers prioritize functional foods addressing chronic health conditions, encouraging manufacturers to develop highly purified, nutritionally optimized bases.

Companies such as Mitsubishi Corporation and Morita Kagaku Kogyo invest heavily in R&D to overcome bitterness and solubility challenges while enhancing shelf life and taste. Nutritional education programs and government campaigns promoting dietary health increase consumer acceptance. The market benefits from advanced food processing techniques and collaboration between academic institutions and industry players.

Ready-made bases increasingly feature in processed foods, dietary supplements, and functional beverages, supporting Japan’s broader health-oriented food ecosystem. Demographic trends and technological leadership position Japan as a stable and innovative market in East Asia.

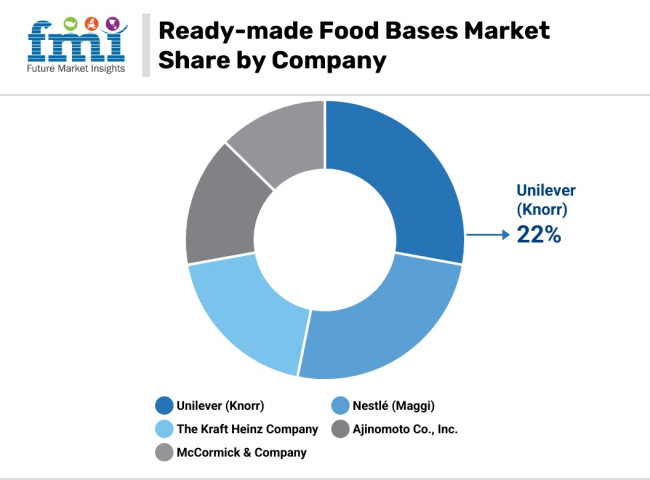

The ready-made food bases market is dominated by major players including Unilever, Nestlé, Kraft Heinz, Ajinomoto, and McCormick, with moderate market concentration. Product innovation remains a key focus, particularly around clean-label, organic, and health-oriented variants designed to meet evolving consumer preferences. For instance, Nestlé expanded its Maggi portfolio to include low-sodium and gluten-free options to address dietary restrictions as per the Nestlé Sustainability Report, 2024.

As Nestlé’s Global Head of Innovation, Maria Gonzalez, stated, “Consumer demand for transparency and healthier options is reshaping our product development priorities.”Leading companies have prioritized sustainable sourcing and carbon footprint reduction. Ajinomoto and McCormick have committed to responsible agricultural practices, aiming to reduce environmental impact across their supply chains, as per Ajinomoto Corporate Responsibility Report, 2024 and the McCormick Sustainability Update, 2024. Ajinomoto’s Chief Sustainability Officer, Kenji Yamamoto, noted, “Sustainability is no longer optional-it is integral to how we innovate and operate.”

Strategic acquisitions and partnerships are frequently pursued to strengthen portfolios and market reach. Kraft Heinz acquired specialty seasoning brands to diversify offerings, while Unilever partnered with startups focused on plant-based and functional ingredients as per Kraft Heinz Press Release, 2023 and Unilever Innovation Partnership, 2024. As Unilever’s VP of Product Development, Aisha Patel, commented, “Collaborations accelerate innovation and help us meet rapidly changing consumer expectations.”

Digital marketing and e-commerce platforms have been leveraged to enhance consumer engagement. McCormick launched digital tools offering recipe inspiration and product customization, increasing brand interaction and loyalty as perthe McCormick Digital Engagement Report, 2023. McCormick’s Chief Marketing Officer, David Lee, highlighted, “Digital innovation is transforming how consumers connect with our brands, making customization easier and more accessible.”

Geographic expansion into emerging markets, especially Asia Pacific and Latin America, has been actively pursued by companies such as Premier Foods and Lee KumKee to capitalize on rising demand as per the Premier Foods Annual Report, 2023. Premier Foods’ Regional Director for APAC, Li Wei, emphasized, “Localizing products to regional tastes and preferences is key to success in these dynamic markets.”

Recent Ready-made Food Bases Industry News

Market drivers, restraints, opportunities, and threats are analyzed by synthesizing market intelligence, regulatory updates, and socioeconomic trends influencing the ready-made food bases industry. The analysis emphasizes factors shaping demand, innovation, and competitive positioning.

Plant-based Protein Gains 35% Growth

The ready-made food bases market is propelled by growing consumer demand for convenience and nutritious meal solutions. As Dr. Lisa Young, a nutrition expert, notes, “Consumers are increasingly seeking clean-label, plant-based options that fit fast-paced lifestyles without compromising health.”Regulatory agencies such as the FDA and FSSAI have enacted policies promoting food safety and nutrition, reinforcing market confidence as per the FDA 2023 and the FSSAI 2024.

Technological advancements in packaging, including modified atmosphere packaging, have extended shelf life and reduced food waste, as per the Institute of Food Technologists 2023. Demand for plant-based protein in ready-made food bases has surged by 35% globally in recent years, signaling sustainability-driven innovation.

Hyper-local Sourcing Challenges Scale

High production costs and regulatory compliance challenges limit market growth. The International Food Policy Research Institute states, “Small and medium enterprises face significant hurdles in meeting global food safety standards, increasing operational expenses,” as per IFPRI 2022.

Consumer skepticism about processed food freshness persists, with surveys indicating 30% of respondents distrust convenience foods’ nutritional value. Additionally, supply chain disruptions challenge raw material availability and cost stability as per the World Bank 2023. Increasing consumer demand for hyper-local ingredient sourcing conflicts with fragmented supply chains, creating cost and scalability challenges.

AI Enhances Regional Flavor Customization

Emerging markets offer significant growth potential. The World Economic Forum observes, “Rising urbanization and disposable incomes in Asia are transforming food consumption patterns towards convenient, health-oriented products,” as per WEF 2023. Sustainable production and eco-friendly packaging align with ESG goals, attracting environmentally conscious consumers as per the Sustainable Packaging Coalition 2023.

Collaborations with foodservice operators and cloud kitchens further expand market access as per Foodservice Europe 2023. AI-powered sensory analysis tools now enable real-time flavor profile customization, accelerating innovation cycles tailored to regional preferences.

Supply Chain Diversification Builds Resilience

Market risks include shifting consumer preferences and regulatory complexity. Regulatory fragmentation across regions increases compliance burdens as per Codex Alimentarius 2023. Supply chain volatility and economic instability pose risks to consistent market operations, as per the IMF 2024.

Negative public perceptions regarding food additives also challenge consumer trust, underscoring the need for transparent labeling and clean-label innovation. Geopolitical tensions and trade restrictions disrupt raw material flows, impacting production continuity as per the WTO 2023. The push for supply chain diversification and local sourcing has intensified to build operational resilience.

| Attribute Category | Details |

|---|---|

| Industry Size (2025) | USD 38 billion |

| Projected Market Size (2035) | USD 55 billion |

| CAGR (2025 to 2035) | 3.8% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD billion; Volume in thousand metric tons (industry reports) |

| Segments by Base Type | Sauce Bases, Curry Pastes, Soup Concentrates, Gravy and Stock Bases |

| Segments by Ingredients | Vegetable-Based, Meat-Based, Dairy-Based, Plant-Based (Vegan) |

| Segments by Packaging | Jars, Sachets, Pouches, Bulk Tubs |

| Segments by End Use | Household Cooking, Quick Service Restaurants, Cloud Kitchens, Institutional Catering |

| Key Regions | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Key Countries | United States, Japan, Germany, India, United Kingdom, France, Italy, Brazil, Canada, South Korea, Australia, Spain, Netherlands, Saudi Arabia, Switzerland |

| Leading Companies | Unilever (Knorr, Continental); Nestlé (Maggi, Chef); Campbell Soup Co.; McCormick & Company; Ajinomoto Co.; Kikkoman Corp.; Mars Inc. ( MasterFoods ); Premier Foods plc ( Bisto, Sharwood’s); General Mills (Progresso); Hormel Foods (Herb-Ox); Lee Kum Kee ; Olam International (Spices & Sauces Division) |

| Additional Attributes | Dollar sales by product type such as sauce bases, soup bases, gravy bases, dollar sales by ingredient type including vegetable-based, dairy-based, meat-based, organic, dollar sales by packaging type like pouches, jars, cans, ready-to-serve packaging, dollar sales by distribution channel covering retail, foodservice, online, dollar sales by end-use including QSRs, households, institutional catering, meal-kit providers, cloud kitchens, dollar sales by region highlighting key geographies and regulatory impacts, dollar sales driven by consumer preferences and health trends, dollar sales influenced by technological innovations in packaging and processing, dollar sales reflecting market challenges and opportunities in supply chain and raw materials, dollar sales forecast with emerging trends and strategic outlook. |

| Customization and Pricing | Customization and pricing details available on request |

Sauce Bases, Curry Pastes, Soup Concentrates, Gravy and Stock Bases.

Vegetable-based, Meat-based, Dairy-based, and Plant-based (Vegan).

Sachets, Pouches, and Bulk Tubs

Household Cooking, Quick Service Restaurants, Cloud Kitchens, and Institutional Catering

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

A valuation of USD 55 billion is expected to be reached.

Sauce bases are anticipated to dominate the base type.

Growth is forecast at a 3.8% CAGR through 2035.

Quick-service restaurants are expected to remain the leading channel.

Vegetable-based formulations are projected to be most favored.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Food & Beverage OEE Software Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Crosslinked Polyvinylpolypyrrolidone (PVPP) Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Cassia Gum Powder Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Dry Film Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Food Basket Market Forecast and Outlook 2025 to 2035

Food Grade Tremella Polysaccharide Market Size and Share Forecast Outlook 2025 to 2035

Food Sorting Machine Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Food Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Film Market Size and Share Forecast Outlook 2025 to 2035

Food Certification Market Size and Share Forecast Outlook 2025 to 2035

Food Tray Market Size and Share Forecast Outlook 2025 to 2035

Food & Beverage Industrial Disinfection and Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Food Technology Market Size and Share Forecast Outlook 2025 to 2035

Food Tourism Sector Market Size and Share Forecast Outlook 2025 to 2035

Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Food Minerals Market Size and Share Forecast Outlook 2025 to 2035

Food And Beverage Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA