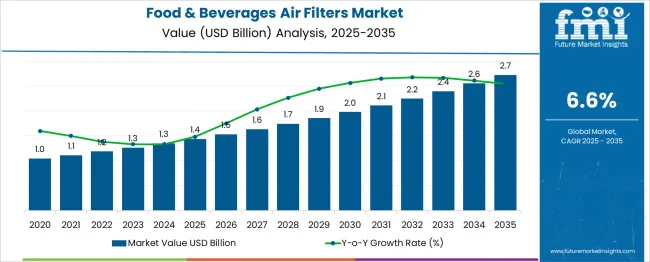

The Food & Beverages Air Filters Market is estimated to be valued at USD 1.4 billion in 2025 and is projected to reach USD 2.7 billion by 2035, registering a compound annual growth rate (CAGR) of 6.6% over the forecast period. This growth trajectory indicates steady demand fueled by the increasing importance of air filtration in maintaining food safety and hygiene standards in processing environments. The market’s value approximately doubles in ten years, signaling sustained expansion supported by regulatory requirements and rising awareness around contamination prevention in the food and beverage industry.

The steady CAGR shows that market players can expect a balanced and reliable growth environment, with no sudden spikes or declines disrupting market progress. Growth momentum in the initial years, from 2025 through 2028, is characterized by moderate adoption rates as companies begin upgrading filtration systems to comply with stricter standards. This phase is followed by accelerated adoption between 2029 and 2035, as technological advancements and increased production capacities further boost market penetration. The steady rise in market valuation from USD 1.4 billion to USD 2.7 billion highlights the importance of innovation, especially in filter media and energy-efficient technologies, to sustain the market’s growth. The market displays a strong and continuous momentum, with consistent year-on-year increases that provide substantial opportunities for manufacturers and suppliers in the food and beverage air filters sector.

| Metric | Value |

|---|---|

| Food & Beverages Air Filters Market Estimated Value in (2025 E) | USD 1.4 billion |

| Food & Beverages Air Filters Market Forecast Value in (2035 F) | USD 2.7 billion |

| Forecast CAGR (2025 to 2035) | 6.6% |

The Food & Beverages Air Filters market is experiencing consistent growth supported by the rising emphasis on hygiene, contamination control, and compliance with stringent food safety standards. Companies in the sector are increasingly adopting advanced air filtration solutions to maintain cleanroom environments and minimize the risk of airborne contaminants during production and packaging.

Industry announcements and investor presentations highlight the influence of regulatory frameworks mandating controlled air quality in processing facilities, which has encouraged widespread installation of high-efficiency filtration systems. The future outlook remains positive as growing consumer awareness around food safety, coupled with investments in modern manufacturing infrastructure, continue to shape demand.

Additionally, advancements in filter media technology and sustainability-focused innovations are enabling longer product lifespans and reduced energy consumption, making them more appealing for large-scale deployment. These drivers are expected to sustain the market’s upward trajectory in the coming years by addressing critical operational and compliance needs.

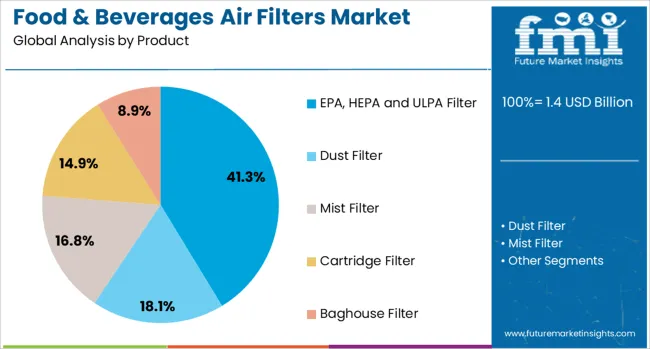

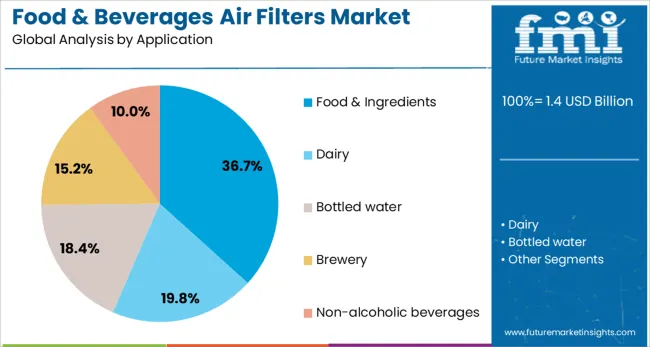

The food & beverages air filters market is segmented by product application and geographic regions. The product of the food & beverages air filters market is divided into EPA, HEPA, and ULPA filters, Dust filters, Mist Filters, Cartridge Filters, and Baghouse Filters. In terms of application, the food & beverages air filters market is classified into Food & Ingredients, Dairy, Bottled water, Brewery, and Non-alcoholic beverages. Regionally, the food & beverages air filters industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The EPA HEPA and ULPA filter segment is projected to account for 41.3% of the Food & Beverages Air Filters market revenue share in 2025, making it the largest product segment. This dominance is being attributed to their superior ability to capture fine particulates and microorganisms, which is essential for maintaining sterile and contamination-free environments in food production.

Technical publications and corporate press releases have noted that these filters deliver high-efficiency air purification, meeting rigorous regulatory and certification standards required in the industry. Their adoption has also been encouraged by technological enhancements that reduce operational costs through improved energy efficiency and extended service life.

Furthermore, companies have preferred these filters due to their reliability in sustaining cleanroom-grade conditions, which are increasingly demanded by global food safety protocols. These advantages, along with their proven performance in minimizing product recalls and ensuring compliance, have reinforced their leadership in the market.

The food and ingredients application segment is anticipated to hold 36.7% of the Food & Beverages Air Filters market revenue share in 2025, establishing it as the leading application segment. This leadership has been driven by the growing need to protect sensitive raw materials and finished products from airborne contaminants throughout the production cycle.

Industry statements and technology news have highlighted that manufacturers are prioritizing air quality in ingredient blending, packaging, and storage areas to meet increasingly strict hygiene requirements. Adoption has also been supported by the heightened risk of cross-contamination in high-volume production environments, which demands reliable and high-performance filtration solutions.

Companies have favored this application segment due to its ability to improve product quality, reduce downtime caused by contamination events, and comply with international food safety certifications. These factors collectively have strengthened the segment’s position as the most significant contributor to the market’s revenue in 2025.

The market has been witnessing consistent growth as the demand for maintaining high hygiene and air quality standards within production facilities continues to rise. Air filtration systems are used to remove contaminants such as dust, microorganisms, and chemical pollutants that can affect product safety and quality. The market expansion has been driven by stringent regulatory norms imposed by food safety authorities, requiring cleanroom environments and controlled atmospheres during processing and packaging. Increasing consumer awareness about food safety and product shelf life has also contributed to adoption.

The market growth has been heavily influenced by evolving regulatory frameworks focused on ensuring product safety and preventing contamination. Food safety standards issued by organizations like the FDA, USDA, and EFSA have mandated the use of advanced air filtration systems in processing and packaging environments. These regulations require filtration solutions capable of removing airborne pathogens, allergens, and particulate matter to minimize contamination risks. Compliance with these standards has become a critical factor in market expansion as manufacturers seek certifications and audit approvals. Additionally, industry best practices emphasize maintaining cleanroom conditions and controlled airflow, necessitating regular air filter upgrades and replacements. The enforcement of hygiene standards has driven technological innovation in filter media, including antimicrobial coatings and high-efficiency particulate air (HEPA) filters, to meet stringent operational demands.

Innovations in filtration technology have played a crucial role in enhancing the performance and reliability of air filters used in the food and beverage industry. Advanced filter media combining synthetic fibers, activated carbon, and nanomaterials have been developed to improve particulate capture and odor control. The integration of antimicrobial and anti-fungal treatments within filter materials has helped in inhibiting microbial growth, thereby maintaining cleaner airflow and reducing maintenance frequency. Modular and customizable filter designs have facilitated easy installation, replacement, and scalability in processing facilities. Energy-efficient filter systems have been designed to optimize airflow while minimizing power consumption. Moreover, real-time monitoring and smart filtration solutions employing sensors and IoT technology have allowed predictive maintenance, reducing downtime and operational costs. These technological enhancements have increased confidence in air filtration performance, supporting broader market adoption.

The continuous growth of the food and beverage manufacturing sector has been a major contributor to the rising demand for air filters. Expanding production capacities, especially in processed foods, dairy products, beverages, and packaged goods, has increased the need for maintaining contamination-free environments. Rapid urbanization and changing dietary preferences have driven the proliferation of modern manufacturing plants equipped with advanced air filtration systems. The adoption of automated and continuous processing lines has further necessitated efficient air quality control to prevent product spoilage and maintain operational hygiene. The trend towards ready-to-eat and convenience foods has increased sensitivity to air quality in production areas. Investments in facility upgrades and expansions in emerging economies have provided significant growth opportunities for air filter manufacturers targeting the food and beverages industry.

Challenges such as the high cost of advanced filtration systems and the need for frequent maintenance have impacted the food and beverage air filters market. Operational expenses related to filter replacements, energy consumption, and waste disposal have prompted manufacturers to seek cost-effective and sustainable solutions. Environmental regulations concerning filter disposal and emissions have encouraged the development of recyclable and eco-friendly filter media. Opportunities have arisen through the integration of energy-efficient designs and renewable materials that reduce the carbon footprint of filtration operations. The rising focus on sustainability within the food production supply chain is pushing demand for green filtration technologies. Collaborations between filter producers and food manufacturers to develop tailored solutions addressing specific contamination challenges present further growth potential. Balancing cost management with environmental responsibility remains a key market consideration.

| Country | CAGR |

|---|---|

| China | 8.9% |

| India | 8.3% |

| Germany | 7.6% |

| France | 6.9% |

| UK | 6.3% |

| USA | 5.6% |

| Brazil | 5.0% |

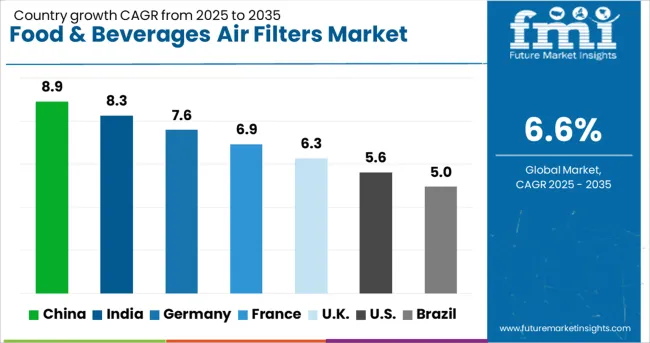

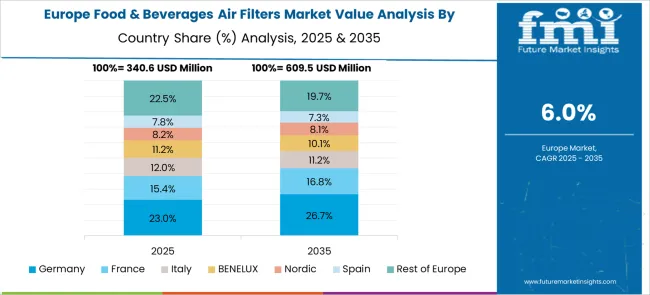

The market is projected to grow at a CAGR of 6.6% between 2025 and 2035, driven by increasing demand for contamination control and stringent hygiene regulations in processing environments. China leads with an 8.9% CAGR, supported by rapid growth in food processing industries and regulatory enforcement. India follows at 8.3%, fueled by expanding food manufacturing facilities and quality assurance measures. Germany, at 7.6%, benefits from advanced filtration technologies and strict safety standards. The UK, growing at 6.3%, experiences demand from modernized food production setups. The USA, with a 5.6% CAGR, is driven by ongoing investments in air purification systems for food safety. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is forecasted to grow at a CAGR of 8.9% between 2025 and 2035. The rising demand for contamination control in food processing plants has driven adoption of advanced filtration technologies. Leading manufacturers such as Camfil and Freudenberg have increased production of HEPA and ULPA filters designed for particulate and microbial removal. Government regulations focusing on food safety and hygiene have accelerated the upgrade of air filtration systems in processing and packaging facilities. Expansion in dairy, beverage, and packaged foods sectors supports consistent demand growth.

The market in India is expected to grow at a CAGR of 8.3% from 2025 to 2035. Growth is attributed to expanding packaged food production and rising quality standards. Local companies like Camfil India and Thermax focus on cost-effective filtration solutions for dust and microbial control. Investments in cold storage and beverage bottling plants are increasing adoption rates. Regulatory initiatives on food safety and workplace air quality drive compliance requirements. Export-oriented food processing units are also adopting advanced air filtration to meet international standards.

Sales in Germany’s food and beverages air filter market are projected to grow at a CAGR of 7.6% between 2025 and 2035. Market growth is fueled by stringent hygiene standards and automation in food manufacturing. Key players such as Freudenberg and AAF International emphasize innovation in energy-efficient and long-life filters. The bakery and brewing sectors show strong demand for contamination control systems. Environmental regulations on indoor air quality encourage the replacement of conventional filters with high-efficiency variants.

The United Kingdom is anticipated to grow at a CAGR of 6.3% over 2025 to 2035. The growth is supported by increasing automation and implementation of hygiene protocols in food manufacturing facilities. Industry leaders like Camfil UK and Donaldson Company have introduced advanced filter media to improve particulate capture and durability. The growth of ready-to-eat food products and chilled beverage production increases the need for reliable air filtration. Government food safety guidelines contribute to steady adoption.

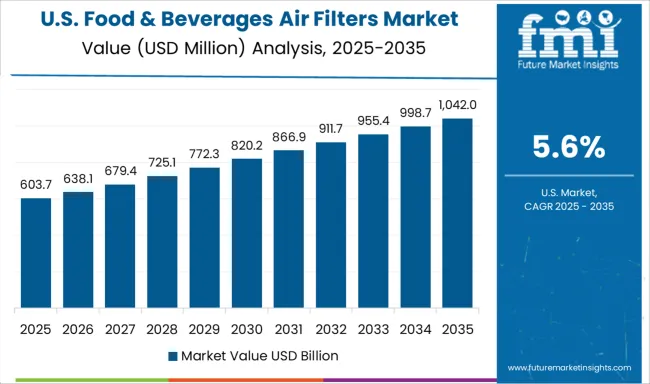

The food and beverages air filters demand in the United States is forecast to grow at a CAGR of 5.6% from 2025 to 2035. Market expansion is driven by the need for contamination-free environments in food processing and packaging plants. Top players including Camfil USA and AAF International provide solutions that meet FDA and USDA air quality standards. Growth in organic and specialty food sectors encourages adoption of high-efficiency filtration. The rise of cold chain logistics also demands improved air filtration systems to maintain product quality.

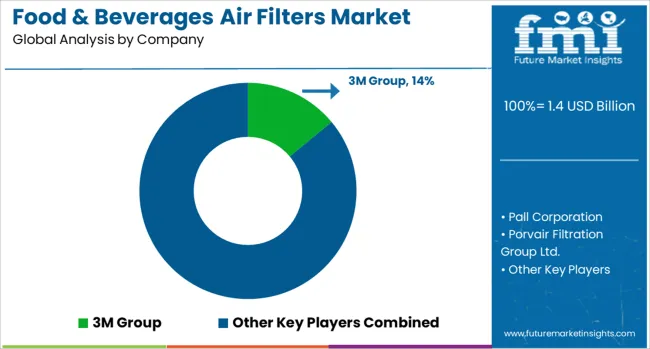

The market features key players delivering specialized filtration solutions designed to meet strict hygiene and safety standards in food processing environments. 3M Group holds a prominent position by offering advanced filtration technologies that effectively remove contaminants and ensure clean air quality. Pall Corporation is recognized for its high-performance filters tailored for sensitive food and beverage production lines, emphasizing durability and efficiency. Porvair Filtration Group Ltd. and Camfil Group contribute with a range of modular and customizable filters designed to accommodate diverse plant layouts and processing needs. Nano Purification Solution Ltd. focuses on innovative nanotechnology-based filters that enhance air purity while maintaining energy efficiency.

APC Filtration, Inc. and Air Filters, Inc. provide comprehensive product lines suitable for both large-scale and niche applications within the industry. Parker-Hannifin Corporation and Donaldson Company, Inc. bring extensive expertise in industrial filtration systems, supporting food and beverage manufacturers with reliable air quality management. Spirax - Sarco Engineering Plc offers complementary steam and filtration solutions, often integrated into processing systems for improved operational efficiency. Entry barriers in this market include rigorous regulatory requirements, need for product customization, and high costs associated with R&D and certifications. Leading manufacturers maintain competitive advantage through continuous product development, strategic collaborations, and adherence to global safety standards, positioning them strongly in this specialized sector.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.4 Billion |

| Product | EPA, HEPA and ULPA Filter, Dust Filter, Mist Filter, Cartridge Filter, and Baghouse Filter |

| Application | Food & Ingredients, Dairy, Bottled water, Brewery, and Non-alcoholic beverages |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | 3M Group, Pall Corporation, Porvair Filtration Group Ltd., Camfil Group, Nano Purification Solution Ltd., APC Filtration, Inc., Air Filters, Inc., Parker-Hannifin Corporation, Donaldson Company, Inc, and Spirax - Sarco Engineering Plc |

| Additional Attributes | Dollar sales by technology type and application segment, demand dynamics across fermentation, enzyme engineering, and genetic modification in food production, regional trends in adoption across North America, Europe, and Asia-Pacific, innovation in CRISPR gene editing, synthetic biology, and microbial strain development, environmental impact of resource-efficient processes, reduced food waste, and bio-based product lifecycle, and emerging use cases in alternative protein production, enhanced food preservation, and personalized nutrition solutions. |

The global food & beverages air filters market is estimated to be valued at USD 1.4 billion in 2025.

The market size for the food & beverages air filters market is projected to reach USD 2.7 billion by 2035.

The food & beverages air filters market is expected to grow at a 6.6% CAGR between 2025 and 2035.

The key product types in food & beverages air filters market are epa, hepa and ulpa filter, dust filter, mist filter, cartridge filter and baghouse filter.

In terms of application, food & ingredients segment to command 36.7% share in the food & beverages air filters market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Air Filters Market Growth - Trends & Forecast 2025 to 2035

Aircraft Filters Market Size and Share Forecast Outlook 2025 to 2035

Food and Beverages Color Fixing Agents Market Analysis by Product Type, Application and Region through 2035

Air-Dried Food Market Growth, Forecast, and Analysis 2025 to 2035

Hairball Cat Food Market

Air Compressor Filters and Compressed Air Dryers Market Growth - Trends & Forecast 2025 to 2035

Food and Beverage Air Filtration Market Analysis by Filter Type, End Use, and Region Through 2035

Air-dried Fish Dog Food Market Size and Share Forecast Outlook 2025 to 2035

Kids’ Food and Beverages Market Analysis by Product Type, Age Group, Category, Distribution Channel and Region through 2035

Air-dried Venison Dog Food Market Size and Share Forecast Outlook 2025 to 2035

Air-dried Chicken Dog Food Market Size and Share Forecast Outlook 2025 to 2035

Automotive Air Filters Market Size and Share Forecast Outlook 2025 to 2035

Low-Lactose Dairy Foods Market

Anti-Counterfeit Packaging for Food & Beverages Market Growth - Forecast 2025 to 2035

Ingredients Market for Plant-based Food & Beverages Size and Share Forecast Outlook 2025 to 2035

Air Fryer Paper Liners Market Size and Share Forecast Outlook 2025 to 2035

Air Struts Market Size and Share Forecast Outlook 2025 to 2035

Airless Paint Spray System Market Size and Share Forecast Outlook 2025 to 2035

Air Caster Skids System Market Size and Share Forecast Outlook 2025 to 2035

Food & Beverage OEE Software Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA