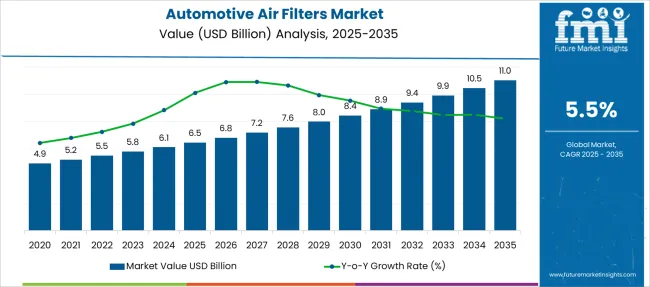

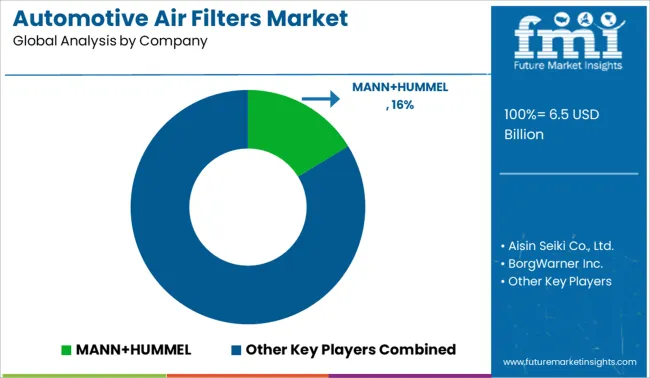

The Automotive Air Filters Market is estimated to be valued at USD 6.5 billion in 2025 and is projected to reach USD 11.0 billion by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period.

| Metric | Value |

|---|---|

| Automotive Air Filters Market Estimated Value in (2025 E) | USD 6.5 billion |

| Automotive Air Filters Market Forecast Value in (2035 F) | USD 11.0 billion |

| Forecast CAGR (2025 to 2035) | 5.5% |

The automotive air filters market is witnessing steady expansion as vehicle manufacturers and consumers prioritize engine efficiency and emission control. Growing environmental regulations aimed at reducing vehicular pollution have led to the increased use of high-performance air filtration systems.

Advances in engine technologies and the rising production of vehicles globally have also contributed to the demand for reliable air filtration solutions. Manufacturers are developing filters that can effectively trap fine particulates while maintaining optimal airflow to enhance engine performance.

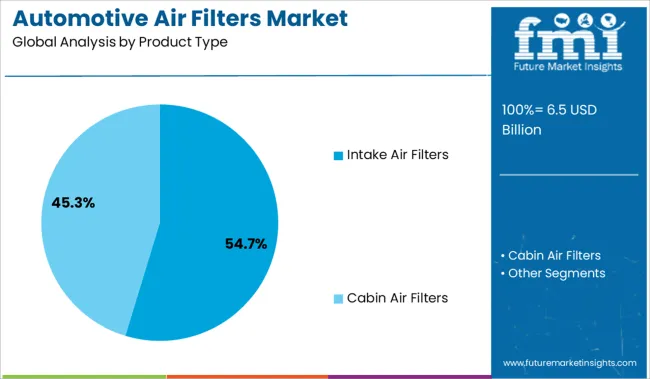

Additionally, growing awareness about vehicle maintenance and the benefits of improved fuel efficiency have encouraged consumers to invest in quality air filters. The market outlook remains positive due to continuous innovations in filter materials and increasing adoption in emerging markets. Segmental growth is expected to be driven by intake air filters as the preferred product type, synthetic materials dominating the filtering media segment, and passenger cars leading the vehicle type category.

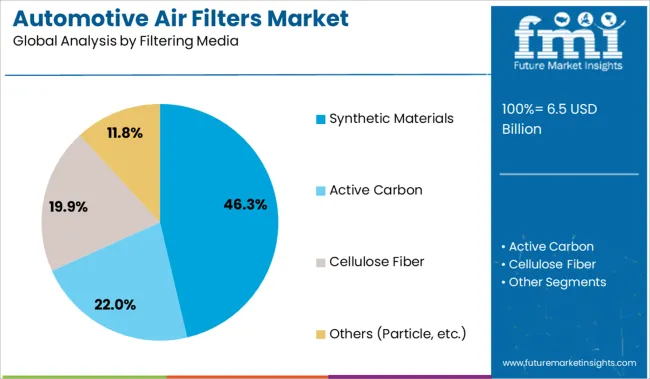

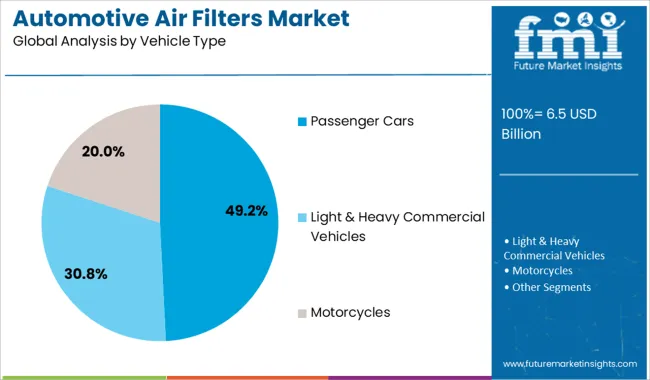

The market is segmented by Product Type, Filtering Media, Vehicle Type, and Sales Channel and region. By Product Type, the market is divided into Intake Air Filters and Cabin Air Filters. In terms of Filtering Media, the market is classified into Synthetic Materials, Active Carbon, Cellulose Fiber, and Others (Particle, etc.). Based on Vehicle Type, the market is segmented into Passenger Cars, Light & Heavy Commercial Vehicles, and Motorcycles. By Sales Channel, the market is divided into Aftermarket and OEM. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The intake air filters segment is projected to account for 54.7% of the automotive air filters market revenue in 2025, maintaining its dominance among product types. This segment has grown due to the critical role intake filters play in preventing contaminants from entering the engine while ensuring adequate airflow.

The increasing demand for cleaner engine operation and reduced wear has highlighted the importance of efficient intake air filtration. Automotive manufacturers and aftermarket suppliers have focused on enhancing filter durability and filtration efficiency.

The segment’s growth is further supported by the replacement cycle frequency and the widespread use of intake filters across various vehicle models. As emission standards tighten, intake air filters will remain essential for meeting regulatory and performance requirements.

Synthetic materials are expected to contribute 46.3% of the automotive air filters market revenue in 2025, emerging as the leading filtering media. The preference for synthetic media has been driven by their superior filtration capabilities, resistance to moisture, and longer service life compared to traditional cellulose filters.

Synthetic filters are able to capture finer particles and maintain airflow more effectively, improving overall engine performance and fuel efficiency. Additionally, advancements in non-woven fabric technology have allowed manufacturers to produce synthetic filters with enhanced strength and consistency.

Growing environmental concerns and regulatory demands have accelerated the adoption of synthetic media in both original equipment and aftermarket filters. This trend is anticipated to continue as manufacturers seek to balance filtration efficiency with durability.

Passenger cars are projected to hold 49.2% of the automotive air filters market revenue in 2025, establishing them as the largest vehicle type segment. The dominance of passenger cars is supported by their global production volumes and the frequency of air filter replacements within this category.

Increasing urbanization and disposable incomes have driven passenger car ownership, especially in developing economies, fueling demand for maintenance products including air filters. Furthermore, advancements in passenger car engine technologies have necessitated higher-quality filtration systems to meet stringent emission and performance standards.

The passenger car segment also benefits from a well-established aftermarket ecosystem, enabling easy access to replacement filters. As demand for cleaner and more fuel-efficient passenger vehicles rises, this segment is expected to sustain its market leadership.

The automotive air filters market is experiencing growth due to increasing vehicle production, stringent emission regulations, and rising consumer awareness of air quality. However, challenges such as high manufacturing costs, competition from alternative filtration technologies, and the prevalence of non-replaceable filters in certain regions may hinder broader adoption.

The automotive air filters market is expanding as global vehicle production increases and emission regulations become more stringent. As countries implement stricter environmental standards, there is a growing demand for advanced air filtration systems to ensure compliance and enhance engine performance. This trend is particularly evident in regions like Asia-Pacific, where rapid industrialization and urbanization are driving the need for efficient air filtration solutions in vehicles.

Despite the market's growth, challenges such as high manufacturing costs and competition from alternative filtration technologies persist. Advanced air filters often require specialized materials and manufacturing processes, leading to increased production costs. Additionally, the prevalence of non-replaceable filters in certain regions, coupled with the availability of washable filters, may limit the frequency of filter replacements, potentially affecting the demand for new filters.

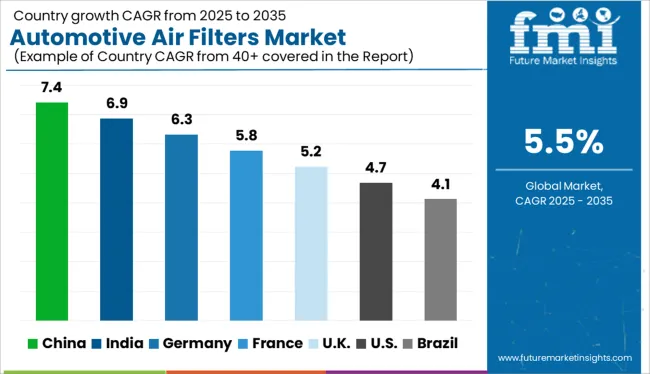

| Country | CAGR |

|---|---|

| India | 6.9% |

| Germany | 6.3% |

| France | 5.8% |

| UK | 5.2% |

| USA | 4.7% |

| Brazil | 4.1% |

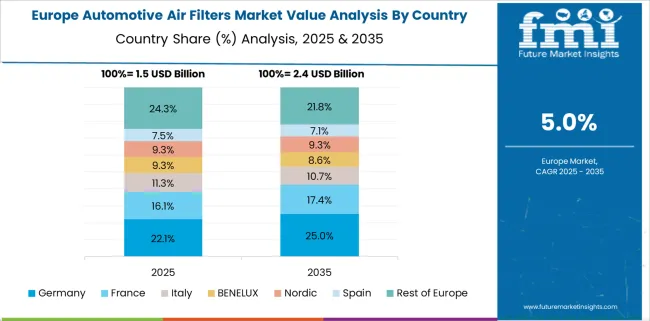

Global automotive air filters market demand is projected to rise at a 5.5% CAGR from 2025 to 2035. Of the five profiled markets out of 40 covered, China leads at 7.4%, followed by India at 6.9%, and Germany at 6.3%, while the United Kingdom records 5.2% and the United States posts 4.7%. These rates translate to a growth premium of +35% for China, +26% for India, and +15% for Germany versus the baseline, while the United States and the United Kingdom show slower growth. Divergence reflects local catalysts: increasing automotive production and environmental regulations driving demand for air filters in China and India, while more mature markets like the United States and the United Kingdom show more moderate growth due to established automotive sectors and stable air filter demand.

China’s automotive air filters market is projected to expand at a CAGR of 7.4% from 2025 to 2035. Growth has been driven by mounting concerns over vehicular emissions and rising adoption of passenger cars in urban zones. Engine and cabin air filters are being integrated into EV-hybrid platforms due to mandatory PM regulations. Local suppliers are offering HEPA-grade and multi-stage filter configurations tailored for polluted metro cities. OEMs are increasingly embedding enhanced filtration in mid-size sedans, while the aftermarket thrives on frequent replacement demand. This trend is being reinforced by evolving emission norms and improved consumer awareness of cabin air quality.

India’s automotive air filters market is expected to grow at a 6.9% CAGR through 2035. Commercial vehicles and two-wheelers dominate filter consumption due to prolonged usage and dust exposure. Domestic brands are focusing on washable filters to reduce ownership costs for price-conscious buyers. OEM collaboration has resulted in synthetic filter adoption for fuel-efficient variants. Semi-urban logistics and agricultural mobility have created demand for long-cycle engine filters. With increasing awareness of air pollution and engine efficiency, the replacement cycle for filters is tightening. Furthermore, government initiatives promoting vehicle fitness and reduced emissions are enhancing aftermarket activity across Indian cities.

Germany’s market is set to register a 6.3% CAGR, driven by strong OEM integration of premium filtration in vehicles with forced induction systems. Precision manufacturing in air intake modules, especially for turbocharged diesel engines, is creating demand for high-performance filters. Manufacturers are incorporating odor-canceling and antimicrobial features in cabin filters. As Germany tightens its Euro 7 emission targets, suppliers are re-engineering filters to comply with sensitive NOx and particulate output standards. The country’s position as a vehicle export leader is reinforcing filter production volumes for both domestic and regional markets across Europe.

The United Kingdom is forecasted to experience a 5.2% CAGR in its automotive air filters market through 2035. Frequent replacements among hybrid and older petrol vehicles drive the aftermarket. London’s Ultra Low Emission Zone (ULEZ) has contributed to demand for clean-air-compliant filters. Increased installation of pollen and allergen filters appeals to health-conscious consumers. Home-based servicing and e-commerce filter kits are trending, supported by a shift toward DIY maintenance. Manufacturers are developing shorter lifecycle filters tailored for urban environments. Post-Brexit incentives are also encouraging local filter manufacturing to offset import disruption risks and meet OEM contract requirements.

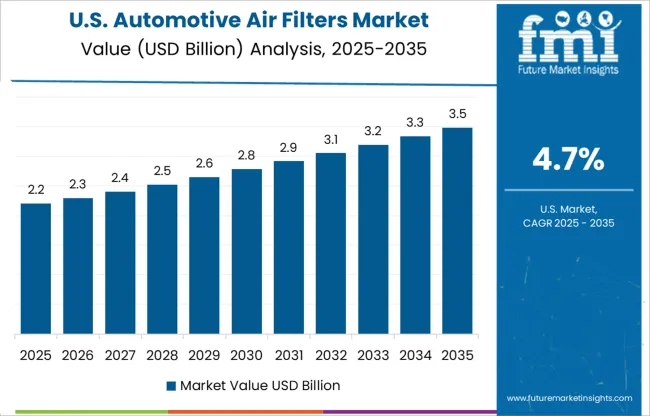

The USA automotive air filter market is projected to grow at a CAGR of 4.7% through 2035. Filter demand is supported by vehicle aging trends and the prominence of large-format SUVs and pickups. With wildfires and pollen affecting air quality, cabin filters with activated charcoal are witnessing increased sales. Franchised dealerships and service chains promote regular filter changes as part of preventative maintenance. High-mileage rural routes fuel demand for heavy-duty engine filters. Market share is shifting to synthetic and long-life filters due to rising oil change intervals. Regional differences in pollution and weather conditions influence filter choice across the country.

In the automotive air filters market, market share is being driven by filter efficiency, regional assembly support, and channel breadth. MANN+HUMMEL leads globally through its integrated liquid and air filtration portfolio, delivering cabin and intake filters via OEM contracts and aftermarket networks across Europe, North America, and Asia. Complementary suppliers like Bosch, Mahle, Donaldson, and Hengst offer similar-grade products with co-manufactured modules for OEMs and service packs in the USA Denso and Continental hold strength in Asian car brands, while K&N targets performance niches through reusable media sold online. Regulatory requirements around cabin air quality, particulate capture, and VOC filtration have shaped design claims and consumer trust globally.

| Item | Value |

|---|---|

| Quantitative Units | USD 6.5 Billion |

| Product Type | Intake Air Filters and Cabin Air Filters |

| Filtering Media | Synthetic Materials, Active Carbon, Cellulose Fiber, and Others (Particle, etc.) |

| Vehicle Type | Passenger Cars, Light & Heavy Commercial Vehicles, and Motorcycles |

| Sales Channel | Aftermarket and OEM |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | MANN+HUMMEL, Aisin Seiki Co., Ltd., BorgWarner Inc., Carter Fuel Systems, Continental AG, Denso Corporation, Donaldson Company, Inc., Freudenberg Group, Hengst SE, K&N Engineering, Inc., Mahle GmbH, Robert Bosch gmbh, Ryco Filters, Sogefi Group, and Tenecco |

| Additional Attributes | Dollar sales driven by OEM automotive production and aftermarket replacements, share led by high-efficiency paper and activated carbon filters, demand rising for cabin and engine air quality automation, retrofitting popular in older vehicle models, ergonomic housing design vital for DIY service, and biodegradable filter media gaining traction over synthetic.-րդ |

The global automotive air filters market is estimated to be valued at USD 6.5 billion in 2025.

The market size for the automotive air filters market is projected to reach USD 11.0 billion by 2035.

The automotive air filters market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in automotive air filters market are intake air filters and cabin air filters.

In terms of filtering media, synthetic materials segment to command 46.3% share in the automotive air filters market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Automotive-grade Inertial Navigation System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Thin IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hydrogen Leak Detection Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hybrid IGBTs Market Size and Share Forecast Outlook 2025 to 2035

Automotive Exhaust Extraction Hose Reels Market Size and Share Forecast Outlook 2025 to 2035

Automotive Electroplating Service Market Size and Share Forecast Outlook 2025 to 2035

Automotive Manufacturing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA