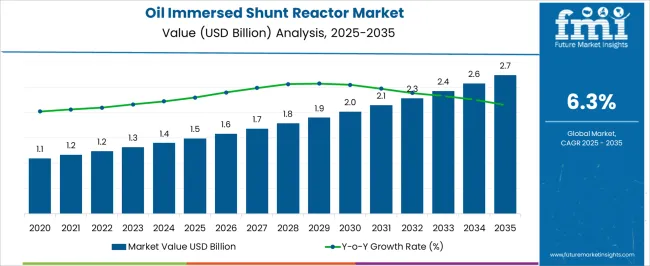

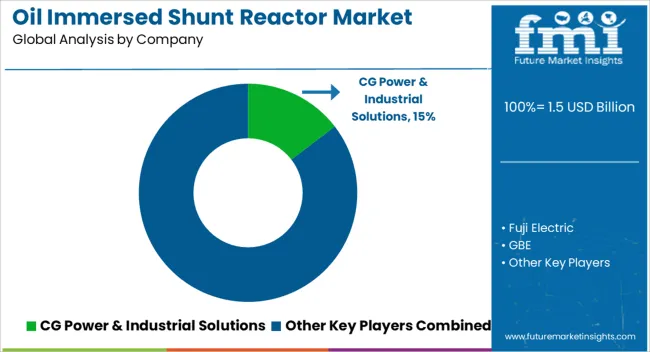

The oil immersed shunt reactor market is estimated to be valued at USD 1.5 billion in 2025 and is projected to reach USD 2.7 billion by 2035, registering a compound annual growth rate (CAGR) of 6.3% over the forecast period.

From 2021 to 2025, the market grows from USD 1.1 billion to USD 1.5 billion, moving through intermediate values of USD 1.2 billion, 1.2 billion, 1.3 billion, and 1.4 billion. This early-phase growth is characterized by steady, predictable increments, driven by rising demand for reactive power compensation and voltage regulation in electrical transmission networks. The adoption of oil immersed shunt reactors in the power industry, particularly in grid stability applications, propels this gradual increase. From 2026 to 2030, the market experiences moderate acceleration, advancing from USD 1.5 billion to USD 2.0 billion, with values passing through USD 1.6 billion, 1.7 billion, 1.8 billion, and 1.9 billion.

This phase sees a higher growth rate due to increasing investments in power infrastructure, particularly in emerging markets, and the growing need for effective voltage control solutions. From 2031 to 2035, the market continues to grow at a steady pace, reaching USD 2.7 billion, progressing through USD 2.1 billion, 2.3 billion, 2.4 billion, and 2.6 billion. The growth rate volatility index shows a more consistent upward trajectory during the final period, reflecting the maturing demand for oil immersed shunt reactors in global power systems.

| Metric | Value |

|---|---|

| Oil Immersed Shunt Reactor Market Estimated Value in (2025 E) | USD 1.5 billion |

| Oil Immersed Shunt Reactor Market Forecast Value in (2035 F) | USD 2.7 billion |

| Forecast CAGR (2025 to 2035) | 6.3% |

The data center infrastructure market is the largest contributor, accounting for approximately 30-35%, as RFID technology plays a crucial role in asset management, real-time tracking, and optimization within data center operations. The increasing need for efficient space and resource management within data centers drives this segment’s demand. The Internet of Things (IoT) market follows with around 20-25%, as the rise in connected devices and the need for real-time data exchange in data centers boosts the use of RFID technology for tracking and monitoring assets and equipment. The cloud computing market contributes about 15-18%, as the growth of cloud data centers increases the demand for RFID solutions to manage large-scale IT assets, servers, and resources. RFID helps ensure smooth operations and resource optimization in cloud facilities.

The enterprise IT and networking market accounts for approximately 18-22%, as data centers are integral to enterprise IT infrastructure. RFID technology is used to manage servers, hardware, and networks, supporting the growing demand for efficient IT management. Finally, the security and surveillance market contributes around 10-12%, as RFID is increasingly used in data centers for access control, personnel tracking, and ensuring the security of sensitive equipment. These parent markets collectively shape the demand for RFID solutions in data centers, with infrastructure and IoT markets being the dominant drivers.

The oil immersed shunt reactor market is gaining traction due to the rising need for reactive power compensation and voltage stabilization in high-voltage transmission networks. As global electricity demand increases and grid infrastructure becomes more complex, the requirement for reliable and efficient energy flow control mechanisms has intensified.

Oil immersed shunt reactors, known for their robust thermal performance and longer operational life, are widely deployed in transmission and sub-transmission applications to reduce energy losses and maintain voltage levels. The market outlook remains strong, supported by continuous investments in grid modernization, particularly in emerging economies and regions expanding their renewable energy capacity.

Demand is further driven by aging power infrastructure in developed markets, necessitating replacement and upgrades with efficient high-voltage equipment. Regulatory emphasis on transmission efficiency and grid reliability will continue to reinforce the adoption of oil immersed shunt reactors across varied end-use sectors

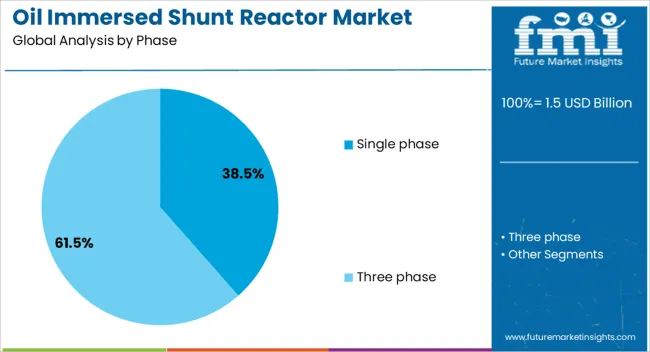

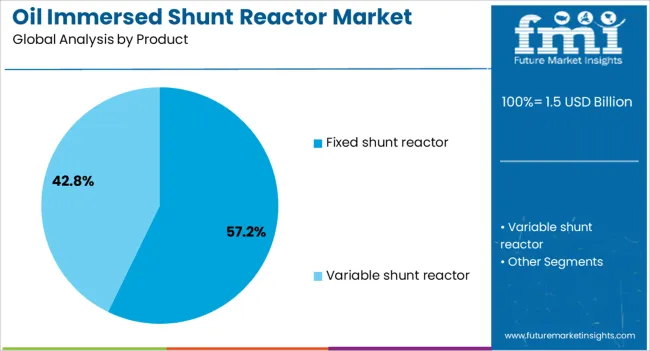

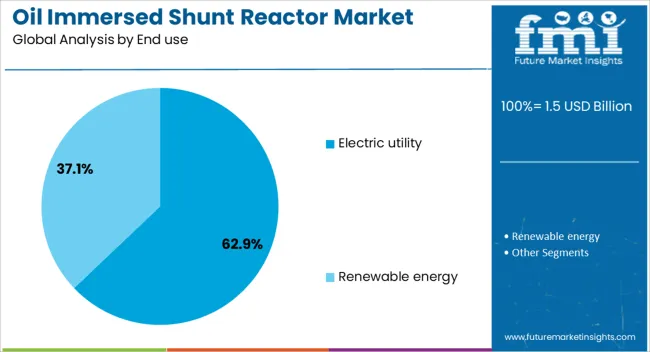

The oil immersed shunt reactor market is segmented by phase, product, end use, and geographic regions. By phase, oil immersed shunt reactor market is divided into single phase and three phase. In terms of product, oil immersed shunt reactor market is classified into fixed shunt reactor and variable shunt reactor. Based on end use, oil immersed shunt reactor market is segmented into electric utility and renewable energy. Regionally, the oil immersed shunt reactor industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The three phase segment holds a notable 61.5% market share in the oil immersed shunt reactor market. Three-phase oil-immersed shunt reactors are widely used in modern power systems because they provide an efficient and reliable solution for reactive power compensation and voltage stability in high-voltage transmission networks. By absorbing excess reactive power generated by long transmission lines or lightly loaded cables, they help maintain voltage within safe operating limits and reduce the risk of overvoltages, which can damage equipment.

The oil immersion provides effective cooling and insulation, ensuring long service life and safe operation under continuous heavy electrical stress. Their three-phase configuration further allows balanced operation, making them a preferred choice for large-scale grid applications.

The fixed shunt reactor segment dominates the product category with a 57.2% share, driven by its essential role in controlling voltage levels and reactive power in high-voltage transmission systems. These reactors are permanently connected to the network, offering consistent performance in stabilizing long transmission lines and preventing voltage rises during low-load conditions.

Their simplicity, durability, and low maintenance requirements make them a preferred choice for utility operators and grid planners. As countries continue to invest in upgrading power transmission corridors and extending high-voltage lines to integrate renewable sources, the role of fixed shunt reactors becomes increasingly important.

Innovations focused on reducing core losses and enhancing cooling efficiency are expected to improve product lifecycle and operational cost-effectiveness. The segment’s stability and critical function in grid infrastructure underscore its sustained dominance in the market

The electric utility segment commands a leading 62.9% market share, highlighting its pivotal role in deploying oil immersed shunt reactors for grid voltage management and reactive power control. Utilities are the primary adopters of shunt reactors, especially in regions with expanding transmission networks and growing integration of intermittent renewable energy sources.

As national grids undergo digitization and expansion to support future energy demands, oil immersed shunt reactors are increasingly used to maintain operational stability and reduce transmission losses. Regulatory mandates to improve grid efficiency and accommodate clean energy transitions are further accelerating deployment.

The segment’s growth is reinforced by large-scale infrastructure projects, particularly in Asia-Pacific, the Middle East, and parts of Africa. With utilities focusing on long-term asset reliability and grid resilience, the electric utility segment is expected to remain the dominant end-user in the oil immersed shunt reactor market

Oil immersed shunt reactors are widely used to absorb reactive power and regulate voltage fluctuations in high-voltage transmission lines, ensuring efficient power distribution. The market is being driven by the increasing demand for stable and reliable electricity, particularly in emerging economies where grid infrastructure is rapidly expanding. However, challenges such as the high initial installation cost, maintenance concerns, and environmental regulations regarding oil use may slow market adoption. Opportunities exist in technological advancements, such as the development of more efficient reactors, as well as the growing investments in grid modernization and energy storage systems. Companies that focus on energy-efficient designs and offer long-term reliability are well-positioned to succeed in this expanding market.

The growing demand for reliable and stable electricity is a key driver of the oil immersed shunt reactor market. As power grids become more complex and distributed, voltage stability has become increasingly critical, particularly in high-voltage transmission lines where reactive power can cause fluctuations. Oil immersed shunt reactors play a vital role in maintaining grid stability by absorbing reactive power, ensuring voltage levels remain within the desired range. This is essential for preventing equipment damage and optimizing the performance of electrical networks. The rising need for reliable power, especially in regions with expanding electrical infrastructure, is contributing to the increased demand for oil immersed shunt reactors, driving market growth.

The oil immersed shunt reactor market faces constraints related to high installation and maintenance costs. The initial investment in these reactors, which includes equipment, installation, and commissioning, can be significant, limiting adoption, especially in regions with lower electricity demand. Furthermore, regular maintenance of oil immersed reactors is necessary to ensure operational efficiency and prevent oil leakage or degradation, leading to increased operational costs. Regulatory challenges surrounding the use of oil in electrical equipment are also a concern, particularly in regions with strict environmental standards. These challenges make it essential for manufacturers to focus on cost-effective designs, enhanced reliability, and compliance with environmental regulations to overcome barriers to market growth.

Opportunities in the oil immersed shunt reactor market are strongest in grid modernization and the integration of energy storage systems. As countries invest in upgrading their electrical infrastructure, the demand for reliable voltage regulation solutions increases. Oil immersed shunt reactors, with their ability to absorb reactive power and stabilize voltage, are integral to these upgrades, particularly in regions with growing electricity consumption. The increasing integration of renewable energy sources, such as wind and solar, into power grids requires advanced voltage regulation solutions to maintain stability. Coupled with energy storage systems, which can provide backup power during fluctuations, oil immersed shunt reactors play a vital role in modernizing electrical grids to accommodate the increasing complexity of energy distribution.

The oil immersed shunt reactor market is witnessing trends toward more efficient reactor designs and the integration of digital monitoring systems. Manufacturers are focusing on improving the efficiency of shunt reactors by incorporating advanced materials and designs that enhance performance while reducing operational costs. Digital monitoring systems are being increasingly integrated into these reactors, allowing for real-time tracking of key parameters such as oil temperature, voltage levels, and reactive power absorption. These systems provide greater insight into reactor performance, enabling proactive maintenance and minimizing downtime. The adoption of digital technologies is not only improving the reliability of oil immersed shunt reactors but also enhancing their overall efficiency, which is driving market growth as utilities seek to optimize power distribution systems.

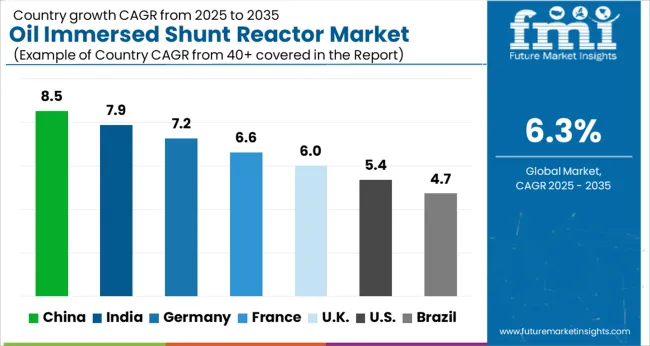

| Country | CAGR |

|---|---|

| China | 8.5% |

| India | 7.9% |

| Germany | 7.2% |

| France | 6.6% |

| UK | 6.0% |

| USA | 5.4% |

| Brazil | 4.7% |

The global oil-immersed shunt reactor market is growing at a CAGR of 6.3% from 2025 to 2035. China leads with a growth rate of 8.5%, followed by India at 7.9% and Germany at 7.2%. The UK and USA show moderate growth rates of 6.0% and 5.4%, respectively. The market is driven by the growing need for efficient power transmission systems, grid stability, and voltage regulation, particularly with the increasing integration of renewable energy sources. Government initiatives to improve grid reliability further fuel the adoption of oil-immersed shunt reactors worldwide. The analysis spans over 40+ countries, with the leading markets shown below.

The oil-immersed shunt reactor market in China is expected to grow at a CAGR of 8.5% from 2025 to 2035. The increasing demand for electricity in the country, driven by urbanization and industrialization, is one of the key factors fueling the growth of this market. As China’s power grid continues to expand and upgrade, the need for efficient power transmission and voltage control solutions is rising, driving the demand for oil-immersed shunt reactors. These reactors play a crucial role in regulating voltage levels in power transmission lines, preventing damage to equipment, and ensuring stable power distribution. China’s significant investments in renewable energy infrastructure, especially wind and solar power, are also creating opportunities for the use of these reactors in modern grid systems.

The oil-immersed shunt reactor market in India is projected to grow at a CAGR of 7.9% from 2025 to 2035. The rapid expansion of the country’s power transmission and distribution networks is the primary factor driving this market. India’s increasing energy consumption, coupled with the need for efficient power regulation systems to prevent equipment failure and ensure smooth electricity distribution, is creating a strong demand for oil-immersed shunt reactors. The country’s focus on strengthening its power grid, as well as its efforts to expand the use of renewable energy, is contributing to this growth. Oil-immersed shunt reactors are essential for controlling voltage fluctuations, especially in long-distance power transmission lines. Government initiatives to improve the power sector’s reliability and increase capacity further promote the adoption of such reactors in India.

The oil-immersed shunt reactor market in Germany is expected to grow at a CAGR of 7.2% from 2025 to 2035. The increasing focus on grid stability and energy efficiency, as well as Germany’s prominent role in Europe’s power generation, is driving the demand for oil-immersed shunt reactors. As Germany continues to modernize its grid infrastructure, particularly with the integration of renewable energy sources such as wind and solar power, there is a growing need for effective voltage regulation systems. Oil-immersed shunt reactors are critical in maintaining grid reliability and stability by mitigating voltage fluctuations. Germany’s strong regulatory environment and emphasis on energy transition initiatives, including the expansion of smart grids, are further boosting the adoption of these reactors.

The UK oil-immersed shunt reactor market is expected to grow at a CAGR of 6.0% from 2025 to 2035. The market is driven by the UK’s ongoing efforts to modernize its power transmission and distribution networks. With increasing reliance on renewable energy sources, the need for efficient voltage regulation and grid stability solutions has become more critical. Oil-immersed shunt reactors are widely used to control voltage levels and prevent damage to electrical infrastructure, particularly in long-distance power transmission. Additionally, the government’s focus on improving grid reliability and integrating smart technologies is further driving the demand for such reactors. As the UK continues its transition to a low-carbon economy, the need for a more resilient and stable power grid is expected to increase, leading to higher demand for oil-immersed shunt reactors.

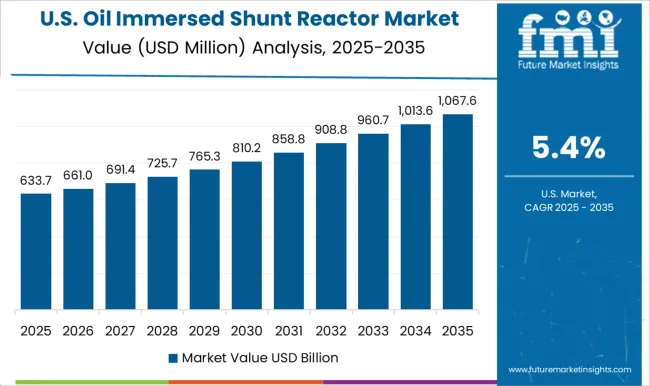

The USA oil-immersed shunt reactor market is expected to grow at a CAGR of 5.4% from 2025 to 2035. The market growth is driven by the increasing need to upgrade and stabilize the country’s aging power infrastructure. As the USA shifts towards more renewable energy sources, especially solar and wind, the demand for effective voltage regulation solutions becomes more pronounced. Oil-immersed shunt reactors are vital in mitigating voltage fluctuations and ensuring stable power transmission, especially in long-distance grid networks. The USA government’s emphasis on enhancing grid resilience and reliability, especially in light of increasing climate-related challenges, is expected to boost the adoption of oil-immersed shunt reactors.

The oil-immersed shunt reactor market is driven by the need for effective power grid management, particularly in high-voltage transmission systems. CG Power & Industrial Solutions competes by offering high-performance oil-immersed shunt reactors that cater to the needs of grid operators aiming to manage reactive power and improve voltage stability. Their solutions are designed for durability, high efficiency, and minimal maintenance, making them ideal for use in diverse electrical grids. Fuji Electric is a strong player in the market, providing reactors known for their advanced insulation and robust design. Their products focus on reliability and energy efficiency, tailored for large-scale power applications.

GBE specializes in providing innovative reactor solutions, including oil-immersed models designed for smooth integration into power transmission networks. Their products emphasize low losses and optimal voltage regulation, ensuring grid stability. GE offers a broad range of oil-immersed shunt reactors with advanced control systems and custom designs for specific grid requirements. Their focus is on providing highly flexible solutions that can meet various industry standards, improving grid efficiency and reducing transmission losses. GETRA is known for its efficient and cost-effective oil-immersed reactors, catering primarily to regional transmission networks, with an emphasis on high-quality materials and long-lasting performance.

Hitachi Energy and Hyosung Heavy Industries both compete by providing advanced reactor solutions with a strong emphasis on performance, safety, and low maintenance costs. Hitachi Energy's products are designed to ensure stable grid operation under fluctuating load conditions. Hyosung Heavy Industries focuses on integrating state-of-the-art technology to enhance the operational longevity of reactors, ensuring reliability in power transmission systems. Nissin Electric, SGB SMIT, and Siemens Energy also bring advanced technologies to the market, offering oil-immersed reactors optimized for high-performance grids and critical infrastructure. Product brochures from these manufacturers emphasize key attributes such as energy efficiency, high-load tolerance, and long operational life. Features like minimal leakage, low maintenance, and flexibility for various grid sizes are highlighted, offering solutions that not only improve grid performance but also minimize operational costs. The emphasis on safety and environmental compliance is central, particularly in industries requiring highly reliable power transmission infrastructure.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.5 billion |

| Phase | Single phase and Three phase |

| Product | Fixed shunt reactor and Variable shunt reactor |

| End use | Electric utility and Renewable energy |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | CG Power & Industrial Solutions, Fuji Electric, GBE, GE, GETRA, Hitachi Energy, Hyosung Heavy Industries, Nissin Electric, SGB SMIT, Shrihans Electricals, Siemens Energy, TMC Transformers, Toshiba Energy Systems & Solutions, and WEG |

| Additional Attributes | Dollar sales by product type (low voltage, medium voltage, high voltage), application (grid stabilization, power quality, transmission systems, voltage regulation), and region (North America, Europe, Asia-Pacific). Demand dynamics are driven by the increasing need for efficient grid management, renewable energy integration, and voltage regulation in growing power networks. Regional trends show robust growth in Asia-Pacific, particularly in India and China, as these countries focus on modernizing their power infrastructure, while North America and Europe continue to focus on enhancing grid stability and integrating renewable energy sources. |

The global oil immersed shunt reactor market is estimated to be valued at USD 1.5 billion in 2025.

The market size for the oil immersed shunt reactor market is projected to reach USD 2.7 billion by 2035.

The oil immersed shunt reactor market is expected to grow at a 6.3% CAGR between 2025 and 2035.

The key product types in oil immersed shunt reactor market are single phase and three phase.

In terms of product, fixed shunt reactor segment to command 57.2% share in the oil immersed shunt reactor market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Oily Waste Can Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Seal Market Size and Share Forecast Outlook 2025 to 2035

Oil Coalescing Filter Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Sensor Market Forecast Outlook 2025 to 2035

Oil Packing Machine Market Forecast and Outlook 2025 to 2035

Oil and Gas Pipeline Coating Market Forecast and Outlook 2025 to 2035

Oilfield Scale Inhibitor Market Size and Share Forecast Outlook 2025 to 2035

Oil-in-Water Anionic Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

Oil and Gas Field Services Market Size and Share Forecast Outlook 2025 to 2035

Oil Control Shampoo Market Size and Share Forecast Outlook 2025 to 2035

Oil Expellers Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Stimulation Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Oiler Kits Market Size and Share Forecast Outlook 2025 to 2035

Oil Pressure Sensor Market Size and Share Forecast Outlook 2025 to 2035

Oil Filled Power Transformer Market Size and Share Forecast Outlook 2025 to 2035

Oily Skin Control Products Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Oil Country Tubular Goods Market Size and Share Forecast Outlook 2025 to 2035

Oil Filled Distribution Transformer Market Size and Share Forecast Outlook 2025 to 2035

Oilfield Communications Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Electrification Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA