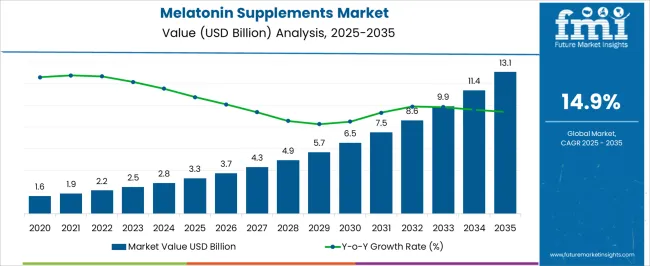

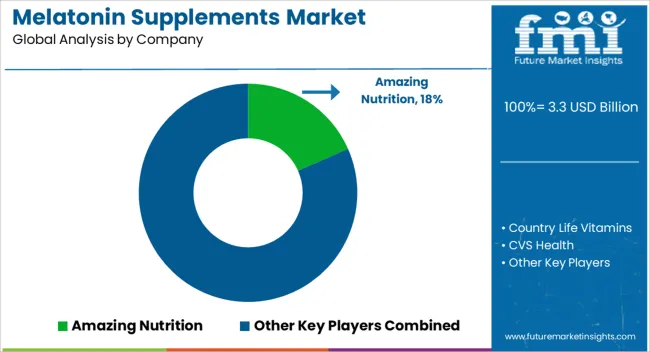

The melatonin supplements market is projected to reach USD 3.3 billion in 2025 and USD 13.1 billion in 2035, growing at a CAGR of 14.9%. The early adoption phase (2020–2024) was characterized by limited awareness, with initial demand driven by health-conscious consumers and niche wellness retailers. As the market enters the scaling phase in 2025, wider acceptance occurs across mainstream retail, pharmacies, and online platforms. Marketing efforts, clinical endorsements, and increased product variety drive consumer uptake.

Distribution networks expand, and recurring usage among existing consumers contributes to revenue growth. The market sees rapid expansion, positioning itself for sustained momentum in the coming decade. From 2030 to 2035, the market is expected to reach USD 13.1 billion, maintaining a CAGR of 14.9%. The consolidation phase witnesses leading players strengthening their positions through brand recognition, global distribution, and strategic partnerships. Smaller competitors focus on specialized segments or exit. Market adoption approaches saturation, with repeat consumers forming the largest base. Companies concentrate on customer retention, product differentiation, and efficiency in supply chains. By 2035, the market exhibits mature competitive dynamics, predictable growth, and established standards in product offerings, labeling, and distribution channels.

| Metric | Value |

|---|---|

| Melatonin Supplements Market Estimated Value in (2025 E) | USD 3.3 billion |

| Melatonin Supplements Market Forecast Value in (2035 F) | USD 13.1 billion |

| Forecast CAGR (2025 to 2035) | 14.9% |

The melatonin supplements market is influenced by multiple parent markets reflecting varied consumer demand. Sleep Disorder Management dominates with 30% of the market, as individuals with insomnia and irregular sleep patterns increasingly turn to supplements. Stress & Anxiety Relief contributes 18%, with consumers seeking improved relaxation and mental wellness. Aging & Senior Health represents 15%, driven by older adults addressing sleep disturbances associated with aging. Shift Work & Travel accounts for 12%, covering individuals managing jet lag and irregular work schedules.

Sports & Fitness contributes 8%, where athletes use melatonin for recovery and sleep optimization. Mental Wellness & Lifestyle Supplements hold 7%, integrating melatonin with broader wellness regimens. Children & Pediatric Sleep Support represents 5%, primarily for regulated pediatric formulations. Sleep Clinics & Healthcare Providers account for 3%, leveraging supplements as part of treatment protocols. Remaining niche segments, including Research & Experimental Usage, make up 2%, mainly in clinical or academic settings. Revenue contributions mirror adoption trends: USD 1.6 billion in 2020, growing to USD 3.3 billion in 2025, and projected to be USD 13.1 billion in 2035, reflecting a CAGR of 14.9%. Sleep Disorder Management and Stress Relief remain primary revenue drivers, while Aging, Shift Work, and Sports segments are expected to gain incremental share, supporting broad market expansion and sustained growth across regions.

The melatonin supplements market is experiencing robust growth driven by increasing awareness of sleep health, rising cases of insomnia, and growing acceptance of natural sleep aids. Lifestyle changes, higher stress levels, and excessive screen exposure have contributed to disrupted sleep patterns, creating a sustained demand for melatonin-based products.

Advancements in formulation science have enabled the development of controlled-release and high-bioavailability products, improving efficacy and consumer satisfaction. Regulatory acceptance in several key markets and the availability of over-the-counter options have further boosted consumption.

Additionally, marketing strategies focused on wellness, preventive healthcare, and holistic living are expanding the consumer base beyond sleep disorder patients to include wellness-focused individuals. The outlook remains positive as innovation, wider distribution, and increased clinical validation continue to enhance the credibility and reach of melatonin supplements globally.

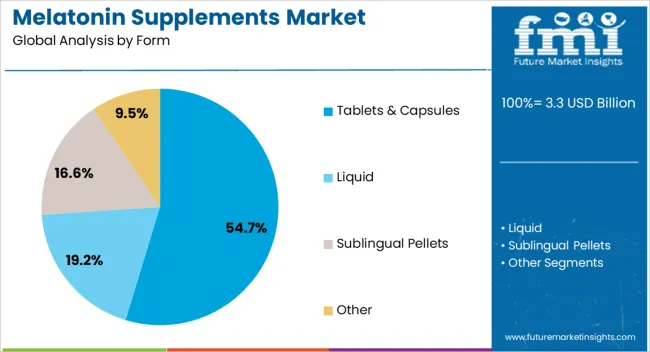

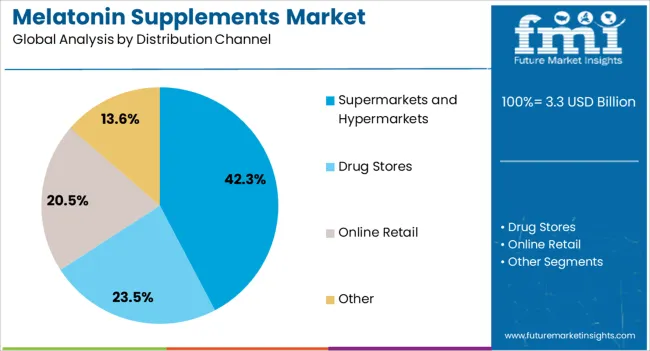

The melatonin supplements market is segmented by form, distribution channel, end-use industries, and geographic regions. By form, melatonin supplements market is divided into Tablets & Capsules, Liquid, Sublingual Pellets, and Other. In terms of distribution channel, melatonin supplements market is classified into Supermarkets and Hypermarkets, Drug Stores, Online Retail, and Other.

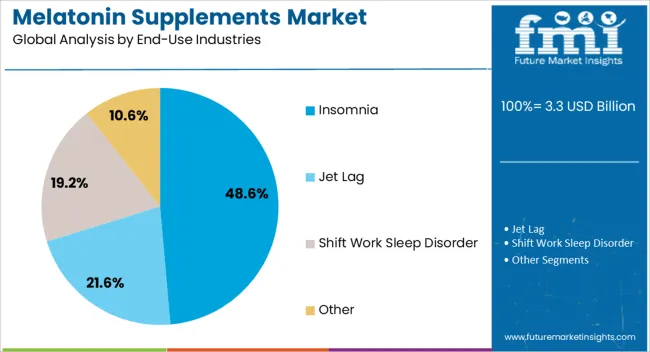

Based on end-use industries, melatonin supplements market is segmented into Insomnia, Jet Lag, Shift Work Sleep Disorder, and Other. Regionally, the melatonin supplements industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The tablets and capsules segment is projected to account for 54.70% of total market revenue by 2025, making it the dominant form category. Its leadership is supported by consumer preference for precise dosage formats, ease of consumption, and long shelf stability.

The segment benefits from established manufacturing processes, cost efficiency in large-scale production, and compatibility with controlled-release technologies. Tablets and capsules are also favored for their portability and convenience, making them suitable for both daily use and travel.

As a result, this form remains the most trusted and widely adopted choice among melatonin supplement consumers.

The supermarkets and hypermarkets segment is expected to hold 42.30% of total market revenue by 2025 within the distribution channel category, positioning it as the largest sales avenue. Its prominence is due to the broad reach, in-store promotions, and consumer trust associated with established retail chains.

The ability for shoppers to make informed purchase decisions through direct product comparison and access to promotional offers has further driven sales.

The segment also benefits from expanding health and wellness sections in retail outlets, increasing shelf space and visibility for melatonin supplements.

The insomnia segment is forecasted to contribute 48.60% of total market revenue by 2025 under the end use industries category, making it the primary driver of market demand. This dominance is due to the high global prevalence of insomnia and the growing preference for non-prescription sleep aids.

Melatonin supplements are increasingly recommended as part of lifestyle-based interventions for sleep disorders, especially for individuals seeking alternatives to pharmaceutical sedatives.

The segment is further supported by educational campaigns emphasizing the role of melatonin in regulating sleep cycles and promoting overall well-being.

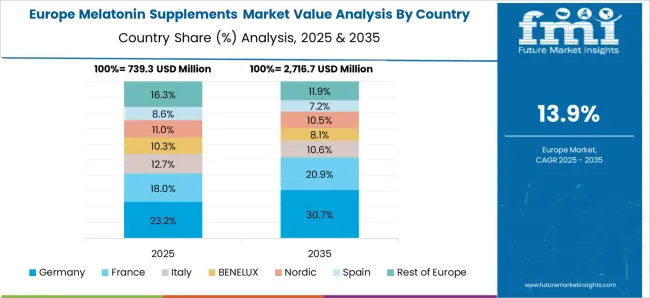

The melatonin supplements market is expanding due to rising consumer focus on sleep health, stress management, and natural wellness solutions. North America and Europe lead with high-quality, clinically tested supplements for adults and aging populations, while Asia-Pacific shows rapid growth driven by increasing awareness and urban lifestyles. Manufacturers differentiate through controlled-release formulations, dosage variations, and combination products. Regional variations in regulatory frameworks, consumer preferences, and distribution channels influence market adoption, brand positioning, and competitive dynamics globally.

Growing awareness of sleep disorders, circadian rhythm disruptions, and stress-induced insomnia is driving melatonin supplement adoption. North America and Europe emphasize scientifically validated, high-purity melatonin products for adults and older consumers seeking safe sleep aids. Asia-Pacific markets show rapid growth due to urbanization, high-stress occupations, and rising interest in natural wellness products. Differences in awareness, healthcare guidance, and consumer education influence dosage preferences, product formats, and adoption levels. Leading manufacturers provide controlled-release, high-potency formulations, while regional players focus on affordable, single-ingredient options. Health awareness contrasts shape adoption, brand differentiation, and market competitiveness globally.

Melatonin supplement adoption is influenced by formulation type and delivery mechanism. North America and Europe prioritize tablets, gummies, sublingual sprays, and combination products with vitamins or herbal extracts to enhance efficacy and convenience. Asia-Pacific markets favor cost-effective capsules or tablets suitable for mass-market adoption. Differences in dosage forms, bioavailability, and flavor profiles affect consumer acceptance, compliance, and repeat purchase. Leading suppliers offer scientifically validated, standardized formulations and multi-dose options, while regional players focus on simple, affordable solutions. Formulation and delivery contrasts drive adoption, consumer satisfaction, and competitiveness in the global melatonin supplements market.

Compliance with dietary supplement regulations, labeling accuracy, and dosage limits strongly influences market adoption. North America and Europe require adherence to FDA, EFSA, and national health authority guidelines, ensuring quality, safety, and truthful claims. Asia-Pacific regulations vary; advanced markets follow international standards, while emerging regions apply local regulatory requirements. Differences in compliance rigor affect market entry, consumer trust, and distribution strategies. Suppliers providing certified, compliant, and tested melatonin supplements gain premium adoption, while regional players deliver locally approved and cost-efficient alternatives. Regulatory and labeling contrasts shape adoption, brand credibility, and competitive positioning globally.

Availability and accessibility through retail, e-commerce, pharmacies, and health stores significantly impact adoption. North America and Europe emphasize online platforms, subscription services, and pharmacy partnerships to meet consumer convenience and safety expectations. Asia-Pacific markets rely on both modern retail and traditional health outlets to reach wider audiences. Differences in distribution infrastructure, channel preference, and urban-rural penetration affect product reach, sales volume, and brand visibility. Leading suppliers invest in omnichannel strategies and direct-to-consumer models, while regional manufacturers prioritize local distribution networks. Channel and accessibility contrasts drive adoption, market penetration, and competitiveness in the global melatonin supplements market.

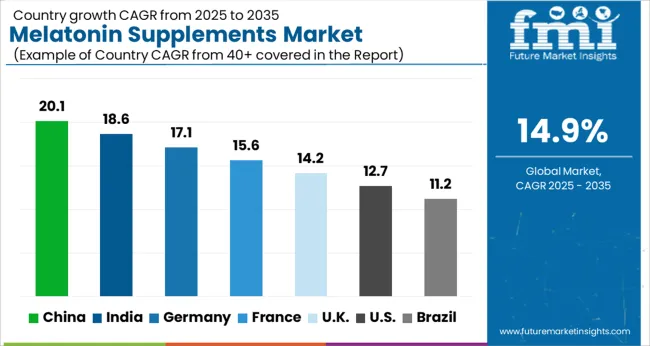

| Country | CAGR |

|---|---|

| China | 20.1% |

| India | 18.6% |

| Germany | 17.1% |

| France | 15.6% |

| UK | 14.2% |

| USA | 12.7% |

| Brazil | 11.2% |

The global melatonin supplements market is projected to grow at a 14.9% CAGR through 2035, driven by rising demand in sleep management, dietary supplements, and wellness products. Among BRICS nations, China led with 20.1% growth as large-scale production and distribution networks were established and adherence to health and safety regulations was ensured, while India at 18.6% growth expanded manufacturing and supply chains to accommodate rising regional consumption. In the OECD region, Germany at 17.1% sustained output under stringent regulatory frameworks, while the United Kingdom at 14.2% operated mid-scale facilities targeting both retail and healthcare channels. The USA, growing at 12.7%, supported steady demand across dietary and wellness applications, complying with federal and state-level quality and safety standards. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The melatonin supplements market in China is projected to grow at a CAGR of 20.1% due to increasing awareness of sleep health and rising demand for natural sleep aids. Adoption is being driven by the need for products that support sleep regulation, reduce insomnia symptoms, and improve overall well being. Manufacturers are being encouraged to supply high quality, safe, and effective supplements. Distribution through pharmacies, health stores, and e-commerce platforms is being strengthened. Research into dosage optimization, formulation improvements, and bioavailability enhancement is being conducted. Growth in health consciousness, lifestyle stress management, and wellness trends is considered a key factor supporting the expansion of the melatonin supplements market in China.

The melatonin supplements market in India is expected to grow at a CAGR of 18.6%, driven by rising concerns about sleep disorders and increased consumer interest in natural health products. Adoption is being supported by melatonin formulations that aid in regulating circadian rhythms, reducing sleep latency, and improving sleep quality. Manufacturers are being encouraged to provide safe, effective, and affordable products. Distribution through pharmacies, wellness stores, and online health platforms is being expanded. Awareness campaigns and health programs are being conducted to educate consumers on proper usage. Increasing urban lifestyle stress, late working hours, and rising wellness trends are recognized as primary drivers of the melatonin supplements market in India.

Germany is experiencing growth in the melatonin supplements market at a CAGR of 17.1%, supported by increasing adoption of natural sleep aids and consumer preference for dietary supplements. Adoption is being strengthened by formulations that improve sleep quality, assist with insomnia, and enhance overall well being. Manufacturers are being encouraged to supply high quality, tested, and effective products. Distribution through pharmacies, health stores, and e commerce platforms is being maintained. Research in bioavailability enhancement, sustained release formulas, and new delivery methods is being conducted. Rising focus on wellness, aging population, and lifestyle management are considered key growth drivers for the melatonin supplements market in Germany.

Growing consumer interest in natural health and wellness products is supporting the melatonin supplements market in the United Kingdom, expected to grow at a CAGR of 14.2%. Adoption is being emphasized for supplements that promote sleep regulation, reduce insomnia symptoms, and enhance daily energy levels. Manufacturers are being encouraged to provide safe, high quality, and effective products. Distribution through health stores, pharmacies, and online platforms is being strengthened. Awareness programs and educational campaigns are being conducted to promote proper usage. Increasing lifestyle stress, late work schedules, and rising demand for wellness products are recognized as primary growth factors for the melatonin supplements market in the United Kingdom.

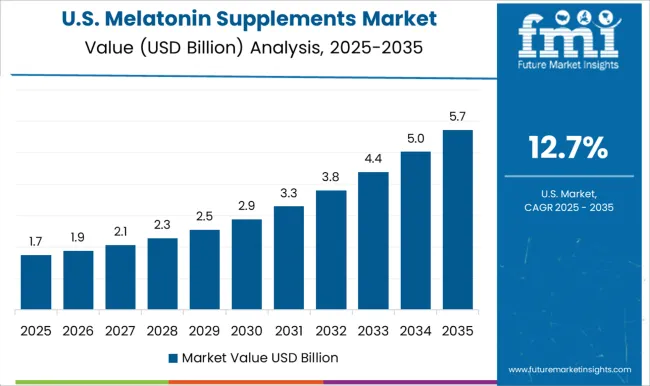

The melatonin supplements market in the United States is projected to grow at a CAGR of 12.7%, driven by consumer awareness of sleep health and preference for natural supplements. Adoption is being supported by formulations that improve sleep quality, reduce insomnia, and aid in circadian rhythm management. Manufacturers are being encouraged to supply effective, safe, and reliable products. Distribution through pharmacies, e-commerce platforms, and health stores is being maintained. Research on optimized dosage, improved absorption, and innovative delivery methods is being conducted. Increasing lifestyle stress, late work hours, and focus on wellness and preventive health are considered key factors driving the growth of the melatonin supplements market in the United States.

The melatonin supplements market has experienced significant growth in recent years, driven by rising awareness of sleep disorders, stress-related conditions, and the increasing preference for natural sleep aids. Melatonin, a hormone that regulates the sleep-wake cycle, has become a popular dietary supplement among adults and older populations seeking non-prescription sleep support. Leading suppliers in this market, including Amazing Nutrition, Country Life Vitamins, CVS Health, Douglas Laboratories, GNC, Jarrow Formulas, Just Potent, Life Extension, Natrol, Nature Made, Puritan’s Pride, Pure Encapsulations, Swanson Health Products, Vitacost, and Walgreens, have established a strong foothold by providing a diverse range of melatonin formulations. These include capsules, tablets, gummies, liquid drops, and fast-dissolving forms, catering to the convenience and preference of different consumer segments. Innovation and product differentiation are critical strategies employed by these leading suppliers to maintain market competitiveness. Companies are emphasizing high-quality, clinically tested formulations and are integrating advanced delivery mechanisms to enhance bioavailability and efficacy. Many suppliers focus on clean-label ingredients, non-GMO certifications, and vegan-friendly options to meet the growing consumer demand for natural and safe products.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.3 Billion |

| Form | Tablets & Capsules, Liquid, Sublingual Pellets, and Other |

| Distribution Channel | Supermarkets and Hypermarkets, Drug Stores, Online Retail, and Other |

| End-Use Industries | Insomnia, Jet Lag, Shift Work Sleep Disorder, and Other |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Amazing Nutrition, Country Life Vitamins, CVS Health, Douglas Laboratories, GNC, Jarrow Formulas, Just Potent, Life Extension, Natrol, Nature Made, Puritan’s Pride, Pure Encapsulations, Swanson Health Products, Vitacost, and Walgreens |

| Additional Attributes | Dollar sales vary by product type, including tablets, capsules, gummies, and liquid formulations; by application, such as sleep disorders, jet lag, and circadian rhythm support; by end-use, spanning individual consumers, healthcare providers, and wellness retailers; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by rising sleep disorder prevalence, growing awareness of natural sleep aids, and expanding nutraceutical adoption. |

The global melatonin supplements market is estimated to be valued at USD 3.3 billion in 2025.

The market size for the melatonin supplements market is projected to reach USD 13.1 billion by 2035.

The melatonin supplements market is expected to grow at a 14.9% CAGR between 2025 and 2035.

The key product types in melatonin supplements market are tablets & capsules, liquid, sublingual pellets and other.

In terms of distribution channel, supermarkets and hypermarkets segment to command 42.3% share in the melatonin supplements market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Melatonin Sleep Supplements Market Growth – Trends & Forecast 2025 to 2035

Melatonin Products Market Size and Share Forecast Outlook 2025 to 2035

Melatonin Market Analysis by Form, Source, Distribution Channel and Region through 2035.

Supplements And Nutrition Packaging Market

ACF Supplements Market Size and Share Forecast Outlook 2025 to 2035

PDRN Supplements Market Size and Share Forecast Outlook 2025 to 2035

Feed Supplements Market Analysis - Size, Share & Forecast 2025 to 2035

Gummy Supplements Market Size and Share Forecast Outlook 2025 to 2035

Fiber Supplements Market Size and Share Forecast Outlook 2025 to 2035

Vegan Supplements Market Analysis by Ingredient Type, Form, Customer Orientation , Sales Channel and Health Concer Through 2035

Andro Supplements Market

Beauty Supplements Packaging Market Size and Share Forecast Outlook 2025 to 2035

Urology Supplements Market Size and Share Forecast Outlook 2025 to 2035

Peptide Supplements Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Calcium Supplement Market Analysis - Size, Share & Forecast 2025 to 2035

Calorie Supplements Market Analysis by Form, Packaging, Flavor, Sales Channel and Region Through 2025 to 2035

Dietary Supplements Packaging Market Analysis – Trends & Forecast 2025-2035

D-Mannose Supplements Market Size and Share Forecast Outlook 2025 to 2035

Carnitine Supplements Market Size and Share Forecast Outlook 2025 to 2035

Krill Oil Supplements Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA