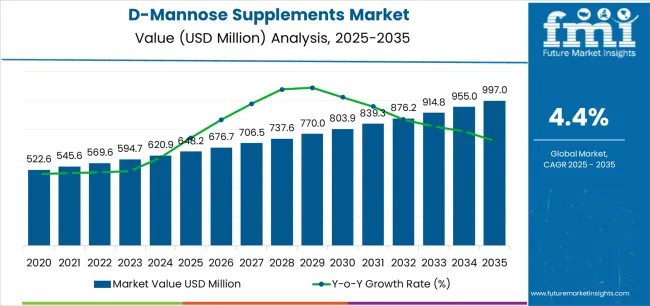

The D-mannose supplements market's trajectory from USD 648.2 million in 2025 to USD 997.0 million by 2035 represents substantial expansion, demonstrating accelerating adoption of natural health solutions and growing consumer awareness of urinary tract health management across pharmaceutical companies, nutraceutical manufacturers, and health-focused retailers worldwide.

The market operates within a dynamic landscape characterized by expanding health consciousness, preventive healthcare initiatives, and growing demand for natural alternatives to conventional pharmaceutical interventions across dietary supplement applications, urinary health products, and wellness-oriented consumer segments. Market dynamics reflect increasing investment in natural health product development, accelerating adoption of evidence-based nutritional supplements, and rising demand for specialized formulations that support urinary tract function and overall wellness protocols.

Consumer purchasing patterns demonstrate shifting preferences toward scientifically-backed supplement solutions that combine natural sourcing, standardized potency, and convenient delivery formats. Healthcare practitioners and informed consumers prioritize product quality, bioavailability, and clinical validation when selecting D-mannose formulations for preventive health management including urinary tract support, immune system enhancement, and general wellness optimization procedures.

The market benefits from expanding research into natural sugar compounds and their therapeutic applications across nutraceutical, pharmaceutical, and functional food sectors, driving demand for high-quality supplement products that enable targeted health interventions. Growing emphasis on preventive healthcare and natural wellness solutions creates opportunities for manufacturers offering validated D-mannose products with comprehensive quality documentation and efficacy support capabilities.

Technology advancement influences market evolution through integration of advanced extraction methods, enhanced bioavailability formulations, and improved manufacturing processes that optimize product quality and consumer outcomes. Manufacturers focus on developing supplement solutions that accommodate varying dosage requirements, delivery preferences, and quality standards while maintaining consistent potency throughout extended shelf life periods.

The D-mannose supplements market demonstrates strong growth fundamentals driven by expanding health awareness, preventive healthcare adoption, and increasing demand for natural wellness products across multiple consumer demographics and healthcare applications.

The first half of the decade (2025-2030) will witness market growth from USD 648.2 million to approximately USD 770.0 million, adding USD 121.8 million in value, representing 35% of the total forecast period expansion. This phase will be characterized by rapid adoption of standardized formulations, driven by healthcare practitioner endorsements and increasing consumer demand for clinically-supported natural health products across wellness applications.

The latter half (2030-2035) will experience accelerated growth from USD 770.0 million to USD 997.0 million, representing an addition of USD 227.0 million or 65% of the decade's expansion. This period will be defined by mass market penetration of premium D-mannose formulations, integration with comprehensive wellness programs, and seamless distribution through both traditional and digital retail channels.

| Period | Primary Revenue Buckets | Share | Notes |

|---|---|---|---|

| Today | Capsules (health stores, online) | 52% | Traditional formats, established distribution |

| Soft candies (convenience retail) | 31% | Consumer-friendly options, mass market | |

| Powders (specialty health) | 17% | Professional recommendations, bulk applications | |

| Future (3-5 yrs) | Enhanced capsule formulations | 48-51% | Improved bioavailability, targeted release |

| Premium soft candy products | 28-32% | Functional confectionery, lifestyle integration | |

| Specialized powder systems | 21-24% | Custom dosing, professional markets | |

| Online direct sales | 38-42% | E-commerce platforms, subscription models | |

| Offline retail channels | 35-38% | Pharmacy chains, health food stores | |

| Healthcare practitioner channels | 23-27% | Professional recommendations, clinical settings |

| Metric | Value |

|---|---|

| Market Value (2025) | USD 648.2 million |

| Market Forecast (2035) | USD 997.0 million |

| Growth Rate | 4.4% CAGR |

| Leading Product | Capsules |

| Primary Sales Channel | Online Sales |

The market demonstrates strong fundamentals with capsule formulations capturing dominant share through convenient dosing and consumer preference optimization. Online sales channels drive primary distribution, supported by increasing digital commerce adoption and direct-to-consumer marketing initiatives. Geographic distribution remains concentrated in developed markets with established supplement industries, while emerging economies show accelerating adoption rates driven by health awareness campaigns and rising disposable income levels.

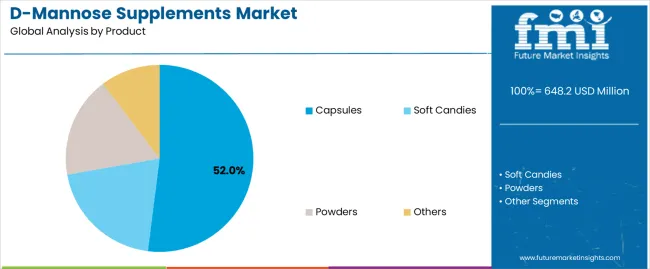

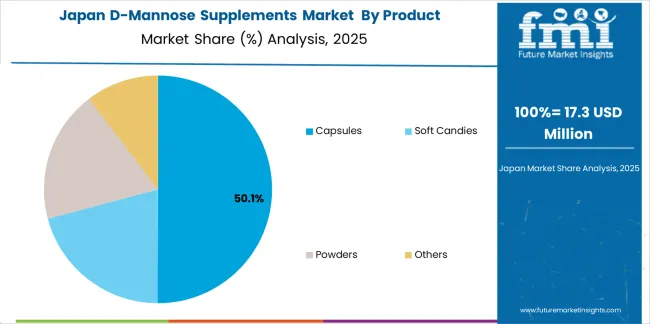

Primary Classification: The market segments by product into capsules, soft candies, and powders, representing evolution from traditional supplement formats to diverse consumer-friendly delivery methods for comprehensive health and wellness optimization.

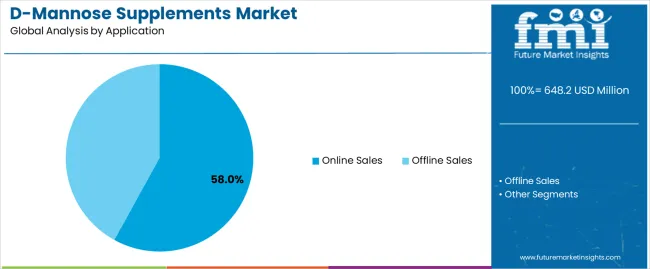

Secondary Classification: Application segmentation divides the market into online sales and offline sales channels, reflecting distinct distribution requirements for digital commerce platforms, traditional retail environments, and healthcare practitioner recommendations.

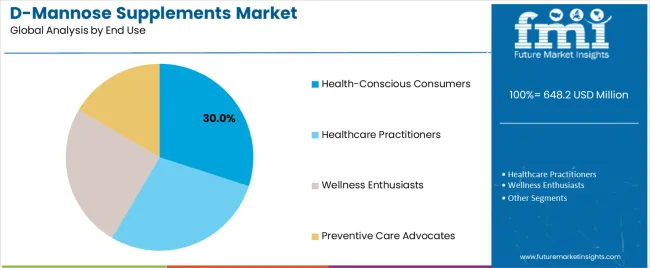

Tertiary Classification: End-use segmentation covers health-conscious consumers, healthcare practitioners, wellness enthusiasts, and preventive care advocates, while distribution channels span e-commerce platforms, pharmacy chains, health food stores, and specialty supplement retailers.

Regional Classification: Geographic distribution covers China, India, Germany, Brazil, United States, United Kingdom, and Japan, with developed markets leading adoption while emerging economies show accelerating growth patterns driven by health awareness programs and supplement market development initiatives.

The segmentation structure reveals product evolution from traditional supplement capsules toward diverse delivery formats with enhanced consumer appeal, while distribution diversity spans from digital-first approaches to integrated omnichannel strategies requiring comprehensive market access solutions.

Market Position: Capsule formulations command the leading position in the D-mannose supplements market with 52% market share through proven convenience factors, including standardized dosing, shelf stability, and consumer familiarity that enable health-conscious users to achieve consistent supplementation across diverse lifestyle and wellness environments.

Value Drivers: The segment benefits from consumer preference for traditional supplement formats that provide precise dosing control, quality assurance, and integration with existing vitamin regimens without requiring taste considerations. Advanced capsule technologies enable enhanced bioavailability, delayed-release mechanisms, and combination with complementary nutrients, where dosing precision and product reliability represent critical consumer requirements.

Competitive Advantages: Capsule formulations differentiate through proven manufacturing standards, quality control consistency, and compatibility with established supplement distribution channels that enhance market accessibility while maintaining optimal potency standards suitable for diverse consumer applications.

Key market characteristics:

Soft candy formulations maintain a 31% market position in the D-mannose supplements market due to their consumer appeal advantages and palatability benefits for users seeking pleasant consumption experiences. These products appeal to consumers preferring enjoyable supplement routines with enhanced taste profiles for daily wellness applications. Market growth is driven by functional confectionery trends, emphasizing convenient supplementation solutions and consumer satisfaction through optimized flavor formulations.

Powder formulations account for 17% market share through professional healthcare applications and custom dosing capabilities that support therapeutic protocols. These products appeal to practitioners requiring flexible dosing options and patients needing personalized supplementation approaches for specific health objectives.

Market Context: Online sales demonstrate strong growth in the D-mannose supplements market, with a 58% share, driven by the widespread adoption of e-commerce platforms and increasing consumer preference for convenient, discreet purchasing experiences that maximize product accessibility while maintaining competitive pricing standards.

Appeal Factors: Digital consumers prioritize product information access, price comparison capabilities, and integration with existing online shopping behaviors that enable coordinated wellness purchasing across multiple supplement categories. The segment benefits from substantial e-commerce infrastructure investment and digital marketing programs that emphasize direct-to-consumer relationships for supplement optimization and customer retention applications.

Growth Drivers: E-commerce platforms incorporate D-mannose supplements as essential wellness products, while subscription services increase demand for convenient delivery capabilities that comply with consumer preferences and minimize purchasing friction.

Market Challenges: Product authenticity concerns and quality verification complexity may limit standardization across different online platforms or marketplace scenarios.

Application dynamics include:

Offline sales capture 42% market share through pharmacy chains, health food stores, and specialty supplement retailers. These channels demand high-quality products capable of supporting in-person consultation while providing brand visibility and consumer education capabilities.

Market Context: Health-conscious consumers dominate the market with 5.4% CAGR, reflecting the primary demand source for D-mannose supplement technology in preventive wellness and natural health optimization.

Business Model Advantages: Health-conscious consumers provide direct market demand for premium supplement formulations, driving quality standards and innovation while maintaining consistency requirements and performance validation expectations.

Operational Benefits: Health-conscious consumer applications include wellness optimization, preventive healthcare, and lifestyle integration that drive consistent demand for supplement products while providing access to latest formulation technologies.

| Category | Factor | Impact | Why It Matters |

|---|---|---|---|

| Driver | Health awareness expansion & preventive healthcare adoption (wellness trends, natural health focus) | ★★★★★ | Growing wellness market requires natural supplement solutions with proven health benefits and safety properties proven effective across consumer applications. |

| Driver | E-commerce growth & digital health platforms (online retail, subscription services) | ★★★★★ | Transforms distribution from "traditional retail" to "direct consumer access"; companies that offer online presence and subscription features gain competitive advantage. |

| Driver | Scientific research validation & clinical evidence (efficacy studies, healthcare endorsement) | ★★★★☆ | Modern consumers need evidence-based supplements; demand for clinically-validated and scientifically-supported products expanding addressable market. |

| Restraint | Regulatory compliance complexity & quality standardization (especially for international markets) | ★★★★☆ | Smaller supplement companies defer market expansion; increases compliance costs and slows product development in regulated markets. |

| Restraint | Competition from alternative supplements (cranberry products, other urinary health solutions) | ★★★☆☆ | Traditional urinary health supplements offer established consumer recognition and broader availability, potentially limiting D-mannose adoption in conventional markets. |

| Trend | Premium formulation development & bioavailability enhancement (advanced delivery systems, combination products) | ★★★★★ | Advanced formulation properties, bioavailability optimization, and efficacy enhancement transform operations; technology integration and performance improvement become core value propositions. |

| Trend | Subscription-based wellness programs & personalized nutrition (customized dosing, health tracking integration) | ★★★★☆ | Smart wellness systems for specific health goals and protocols; personalized supplementation and targeted optimization capabilities drive competition toward connected solutions. |

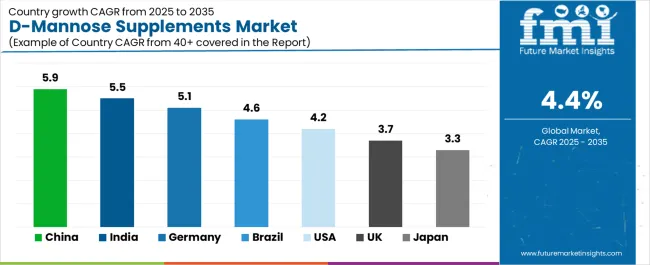

The D-mannose supplements market demonstrates varied regional dynamics with Growth Leaders including China (5.9% growth rate) and India (5.5% growth rate) driving expansion through health awareness campaigns and supplement market development initiatives. Steady Performers encompass Germany (5.1% growth rate), Brazil (4.6% growth rate), and developed regions, benefiting from established wellness industries and natural health adoption. Mature Markets feature United States (4.2% growth rate), United Kingdom (3.7% growth rate), and Japan (3.3% growth rate), where health optimization and preventive care requirements support consistent growth patterns.

Regional synthesis reveals Asian markets leading adoption through wellness expansion and natural health development, while North American countries maintain steady expansion supported by supplement industry advancement and consumer health investment. European markets show strong growth driven by natural wellness applications and preventive healthcare integration trends.

| Region/Country | 2025-2035 Growth | How to win | What to watch out |

|---|---|---|---|

| China | 5.9% | Focus on online wellness platforms | Regulatory changes; local competition |

| India | 5.5% | Lead with affordable premium products | Import restrictions; distribution barriers |

| Germany | 5.1% | Provide clinically-validated formulations | Over-regulation; lengthy approvals |

| Brazil | 4.6% | Offer value-oriented wellness solutions | Currency fluctuations; import duties |

| United States | 4.2% | Push subscription-based models | Compliance costs; market saturation |

| United Kingdom | 3.7% | Focus on natural health applications | Economic impacts; Brexit complications |

| Japan | 3.3% | Emphasize quality manufacturing | Traditional preferences; adoption rates |

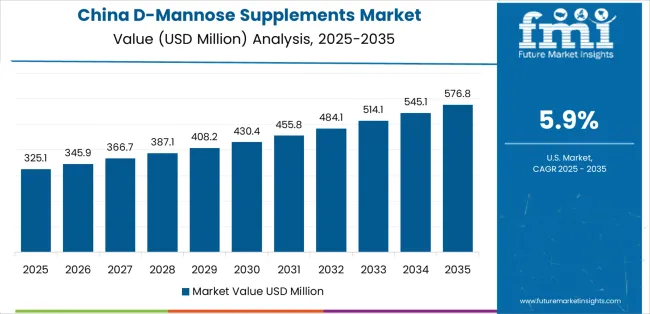

China establishes fastest market growth through aggressive wellness infrastructure development programs and comprehensive e-commerce platform expansion, integrating D-mannose supplements as standard wellness products in online health stores and digital wellness ecosystems. The country's 5.9% growth rate reflects government initiatives promoting natural health products and domestic wellness capabilities that mandate availability of evidence-based supplements in digital health platforms and traditional medicine integration facilities. Growth concentrates in major urban centers, including Beijing, Shanghai, and Shenzhen, where wellness technology showcases integrated health platforms that appeal to health-conscious consumers seeking natural supplementation capabilities and preventive health applications.

Chinese manufacturers are developing cost-effective supplement formulations that combine domestic production advantages with international quality standards, including enhanced bioavailability and improved manufacturing capabilities. Distribution channels through e-commerce platforms and wellness app integrators expand market access, while government support for natural health development supports adoption across diverse consumer and healthcare segments.

Strategic Market Indicators:

In Mumbai, Delhi, and Bangalore, wellness-focused consumers and healthcare practitioners are implementing D-mannose supplements as standard wellness products for preventive health and natural wellness applications, driven by increasing health awareness campaigns and natural medicine programs that emphasize importance of evidence-based supplementation capabilities. The market holds a 5.5% growth rate, supported by government health initiatives and wellness modernization programs that promote natural supplements for consumer and healthcare facilities. Indian consumers are adopting supplement products that provide consistent quality and performance features, particularly appealing in urban regions where health optimization and wellness excellence represent critical lifestyle requirements.

Market expansion benefits from growing pharmaceutical capabilities and international quality partnerships that enable domestic production of premium supplement formulations for consumer and healthcare applications. Technology adoption follows patterns established in health products, where quality and effectiveness drive purchasing decisions and consumer deployment.

Market Intelligence Brief:

Advanced wellness market in Germany demonstrates sophisticated D-mannose supplement deployment with documented health effectiveness in natural wellness applications and healthcare facilities through integration with existing supplement systems and wellness infrastructure. The country leverages pharmaceutical expertise in natural health technologies and quality systems integration to maintain a 5.1% growth rate. Wellness centers, including Bavaria, Baden-Württemberg, and North Rhine-Westphalia, showcase premium formulations where supplement systems integrate with comprehensive health platforms and wellness management systems to optimize consumer health and preventive effectiveness.

German manufacturers prioritize product quality and EU compliance in supplement development, creating demand for premium formulations with advanced features, including clinical validation and data management systems. The market benefits from established wellness infrastructure and willingness to invest in validated natural health technologies that provide long-term health benefits and compliance with international quality standards.

Market Intelligence Brief:

Brazil's market expansion benefits from diverse wellness demand, including health modernization in São Paulo and Rio de Janeiro, natural health facility upgrades, and government wellness programs that increasingly incorporate natural supplementation solutions for preventive applications. The country maintains a 4.6% growth rate, driven by rising health awareness and increasing recognition of natural supplement benefits, including effective health support and enhanced wellness outcomes.

Market dynamics focus on affordable premium supplement solutions that balance quality performance with affordability considerations important to Brazilian wellness consumers. Growing health industrialization creates continued demand for natural supplement systems in new wellness infrastructure and health modernization projects.

Strategic Market Considerations:

United States establishes market leadership through comprehensive wellness programs and advanced supplement industry infrastructure development, integrating D-mannose supplements across healthcare and consumer applications. The country's 4.2% growth rate reflects established wellness relationships and mature supplement technology adoption that supports widespread use of natural health products in healthcare and consumer facilities. Growth concentrates in major health centers, including California, New York, and Florida, where wellness technology showcases mature deployment that appeals to health-conscious consumers seeking proven supplementation capabilities and health optimization applications.

American wellness providers leverage established distribution networks and comprehensive quality support capabilities, including formulation development programs and consumer education support that create customer relationships and market advantages. The market benefits from mature regulatory standards and wellness requirements that support supplement use while supporting technology advancement and health optimization.

Market Intelligence Brief:

United Kingdom's wellness market demonstrates integrated D-mannose supplement deployment with documented health effectiveness in natural wellness applications and healthcare facilities through integration with existing supplement systems and wellness infrastructure. The country maintains a 3.7% growth rate, supported by health optimization programs and wellness effectiveness requirements that promote natural supplements for consumer applications. Wellness facilities across England, Scotland, and Wales showcase systematic formulations where supplement systems integrate with comprehensive health platforms to optimize quality and wellness outcomes.

UK wellness providers prioritize product reliability and health compatibility in supplement procurement, creating demand for validated formulations with proven effectiveness features, including performance monitoring integration and health management systems. The market benefits from established wellness infrastructure and quality requirements that support natural health technology adoption and consumer effectiveness.

Market Intelligence Brief:

Japan's market growth benefits from precision wellness demand, including advanced health facilities in Tokyo and Osaka, quality integration, and health enhancement programs that increasingly incorporate supplementation solutions for wellness applications. The country maintains a 3.3% growth rate, driven by wellness technology advancement and increasing recognition of natural supplement benefits, including accurate health support and enhanced wellness outcomes.

Market dynamics focus on high-quality supplement solutions that meet Japanese quality standards and health effectiveness requirements important to wellness consumers. Advanced health technology adoption creates continued demand for sophisticated supplement systems in wellness facility infrastructure and health modernization projects.

Strategic Market Considerations:

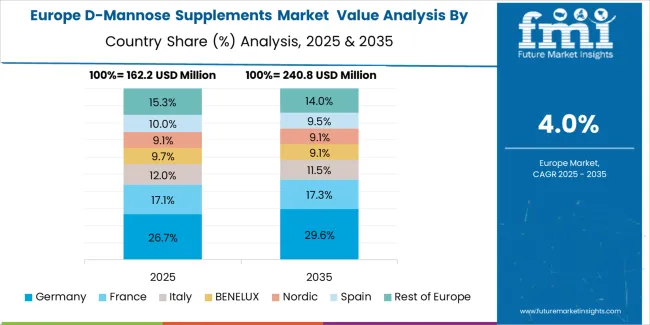

The European D-mannose supplements market is projected to grow from USD 98.4 million in 2025 to USD 142.6 million by 2035, registering a CAGR of 3.8% over the forecast period. Germany is expected to maintain its leadership position with a 41.7% market share in 2025, supported by its advanced wellness infrastructure and major natural health centers.

United Kingdom follows with a 29.1% share in 2025, driven by comprehensive wellness programs and natural health development initiatives. France holds a 16.2% share through specialized supplement applications and health compliance requirements. Italy commands a 7.8% share, while Spain accounts for 5.2% in 2025. The rest of Europe region is anticipated to gain momentum, expanding its collective share from 2.4% to 2.8% by 2035, attributed to increasing wellness adoption in Nordic countries and emerging health facilities implementing supplement modernization programs.

| Stakeholder | What they actually control | Typical strengths | Typical blind spots |

|---|---|---|---|

| Global brands | Distribution reach, broad product catalogs, brand recognition | Wide availability, proven quality, multi-region support | Product refresh cycles; consumer dependency on brand validation |

| Technology innovators | Formulation R&D; advanced delivery technologies; enhanced bioavailability properties | Latest technologies first; attractive ROI on effectiveness | Service density outside core regions; scaling complexity |

| Regional specialists | Local compliance, fast delivery, nearby consumer support | "Close to customer" support; pragmatic pricing; local regulations | Technology gaps; talent retention in consumer service |

| Full-service providers | Complete wellness programs, subscription integration, consumer tracking | Lowest operational risk; comprehensive support | Service costs if overpromised; technology obsolescence |

| Niche specialists | Specialized formulations, custom products, therapeutic applications | Win premium applications; flexible configurations | Scalability limitations; narrow market focus |

| Item | Value |

|---|---|

| Quantitative Units | USD 648.2 million |

| Product | Capsules, Soft Candies, Powders, Others |

| Application | Online Sales, Offline Sales |

| End Use | Health-Conscious Consumers, Healthcare Practitioners, Wellness Enthusiasts, Preventive Care Advocates |

| Regions Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan |

| Countries Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan, Canada, France, Australia, and 20+ additional countries |

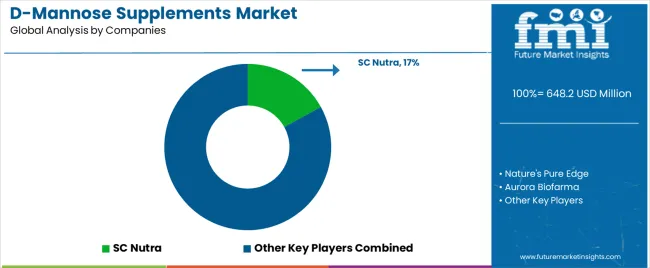

| Key Companies Profiled | SC Nutra, Nature's Pure Edge, Aurora Biofarma, Cytoplan, Bladapure, Power Health, Novomins, AZO Products, Amhes Pharma |

| Additional Attributes | Dollar sales by product and application categories, regional adoption trends across China, India, and Germany, competitive landscape with supplement manufacturers and wellness providers, consumer preferences for quality effectiveness and convenience factors, integration with wellness platforms and health management systems, innovations in formulation technology and bioavailability enhancement, and development of advanced supplement solutions with enhanced performance and health optimization capabilities. |

The global d-mannose supplements market is estimated to be valued at USD 648.2 million in 2025.

The market size for the d-mannose supplements market is projected to reach USD 997.0 million by 2035.

The d-mannose supplements market is expected to grow at a 4.4% CAGR between 2025 and 2035.

The key product types in d-mannose supplements market are capsules, soft candies, powders and others.

In terms of application, online sales segment to command 58.0% share in the d-mannose supplements market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Supplements And Nutrition Packaging Market

ACF Supplements Market Size and Share Forecast Outlook 2025 to 2035

PDRN Supplements Market Size and Share Forecast Outlook 2025 to 2035

Feed Supplements Market Analysis - Size, Share & Forecast 2025 to 2035

Gummy Supplements Market Size and Share Forecast Outlook 2025 to 2035

Fiber Supplements Market Size and Share Forecast Outlook 2025 to 2035

Vegan Supplements Market Analysis by Ingredient Type, Form, Customer Orientation , Sales Channel and Health Concer Through 2035

Andro Supplements Market

Beauty Supplements Packaging Market Size and Share Forecast Outlook 2025 to 2035

Urology Supplements Market Size and Share Forecast Outlook 2025 to 2035

Peptide Supplements Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Calcium Supplement Market Analysis - Size, Share & Forecast 2025 to 2035

Calorie Supplements Market Analysis by Form, Packaging, Flavor, Sales Channel and Region Through 2025 to 2035

Dietary Supplements Packaging Market Analysis – Trends & Forecast 2025-2035

Carnitine Supplements Market Size and Share Forecast Outlook 2025 to 2035

Krill Oil Supplements Market Size and Share Forecast Outlook 2025 to 2035

Melatonin Supplements Market Size and Share Forecast Outlook 2025 to 2035

Green Tea Supplements Market Analysis - Size, Share, and Forecast 2025 to 2035

Probiotic Supplements Market Analysis - Size, Share, and Forecast 2025 to 2035

Probiotic Supplements Market Share Analysis – Key Trends & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA