The melatonin products market is projected to expand significantly from USD 2.3 billion in 2025 to USD 8.9 billion by 2035, reflecting a compound annual growth rate (CAGR) of 14.3%. The year-on-year (YoY) values indicate steady growth, moving from USD 2.3 billion in 2025 to USD 3.5 billion by 2028 and reaching USD 4.5 billion by 2030. This trend illustrates that consumer demand for sleep-regulating supplements has been reinforced by increased awareness of sleep quality, work-life pressures, and lifestyle-driven health priorities.

The growth demonstrates that melatonin products are being accepted as a preferred option for addressing sleep irregularities and fatigue management, making them a critical category within the broader dietary supplement and wellness markets. The steady YoY expansion underscores the market’s resilience and rising adoption across diverse demographics. By 2035, with the market anticipated to reach USD 8.9 billion, it is evident that melatonin products are becoming integral to consumer wellness routines. The YoY growth pattern suggests that manufacturers offering scientifically backed formulations, convenient delivery formats, and consistent product efficacy are likely to capture significant market share. In this opinion, the trajectory reflects not only an increase in consumption but also the strategic positioning of melatonin as a mainstream health aid rather than a niche supplement.

Stakeholders who focus on accessibility, regulatory compliance, and clear communication of benefits are expected to benefit most from the expansion. The market’s robust CAGR and incremental growth demonstrate a compelling opportunity for product innovation, distribution expansion, and brand differentiation within the increasingly competitive health and wellness segment.

| Metric | Value |

|---|---|

| Melatonin Products Market Estimated Value in (2025 E) | USD 2.3 billion |

| Melatonin Products Market Forecast Value in (2035 F) | USD 8.9 billion |

| Forecast CAGR (2025 to 2035) | 14.3% |

The melatonin products market holds a substantial portion across its parent markets, reflecting its widespread adoption and diversified applications. In the dietary supplements market, melatonin commands around 43% of the share, driven by its popularity as an over-the-counter sleep aid and growing consumer awareness of sleep health. Within the pharmaceuticals market, it captures approximately 10%, largely attributed to prescription-based interventions for sleep disorders and related medical conditions. The sleep aids market sees melatonin representing roughly 35% of the total, as it remains a preferred choice among consumers seeking effective non-prescription solutions. Natural health products contribute close to 12% of the market share, highlighting the preference for plant-derived or naturally sourced sleep-supporting compounds. Functional foods and beverages incorporating melatonin account for about 15%, showing increasing interest in integrated dietary solutions that promote sleep.

Across these segments, regional variations influence market share distribution, with North America leading the adoption, followed by Europe and Asia-Pacific. The growth trajectory is shaped by consumer demand trends emphasizing natural, convenient, and accessible solutions, alongside the inclusion of melatonin in novel product forms such as gummies, tablets, and beverages. Despite challenges posed by competition from alternative therapies and regulatory considerations, the market share distribution remains concentrated in key parent markets, signaling sustained demand for melatonin-based products across multiple applications and regions, with the dominance of dietary supplements and sleep aids clearly evident.

The current market scenario reflects strong growth in both developed and emerging economies, supported by a combination of rising healthcare costs, preference for over-the-counter solutions, and increased acceptance of self-directed health management.

Regulatory frameworks in major markets have facilitated the accessibility of melatonin as a dietary supplement, further expanding its reach across multiple distribution channels. Manufacturers are investing in innovative delivery formats, improved bioavailability, and clean-label formulations to align with evolving consumer expectations.

The future outlook indicates sustained demand driven by growing adoption among working-age populations, athletes, and older adults, while product diversification and targeted marketing are expected to strengthen market positioning.

Over the forecast period, technological advancements in extraction and synthesis, along with global expansion strategies, are anticipated to bolster production efficiency, enhance product quality, and maintain competitive pricing, thereby underpinning stable long-term growth.

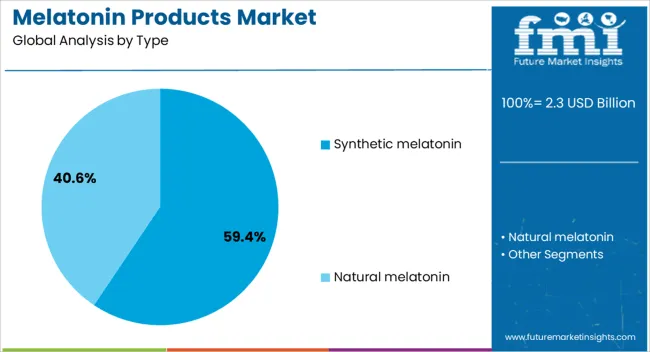

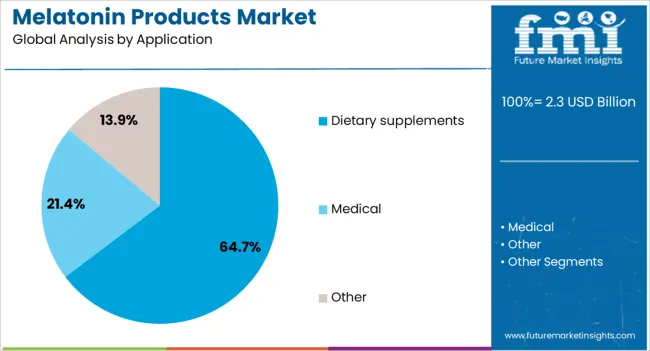

The melatonin products market is segmented by type, application, form, distribution channel, and geographic regions. By type, melatonin products market is divided into Synthetic melatonin and Natural melatonin. In terms of application, melatonin products market is classified into Dietary supplements, Medical, and Other.

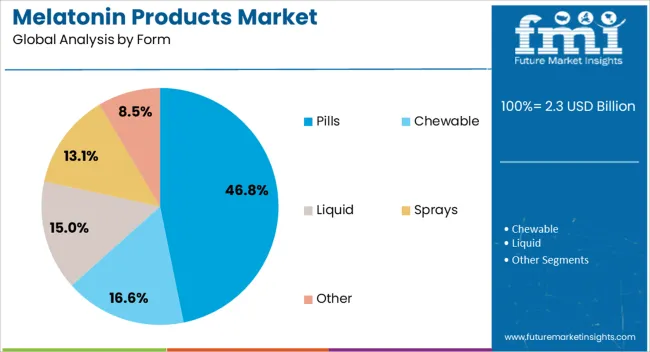

Based on form, the melatonin products market is segmented into Pills, chewables, liquids, Sprays, and others. By distribution channel, melatonin products market is segmented into Online retail, Pharmacies, and Other. Regionally, the melatonin products industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The synthetic melatonin segment, accounting for 59.40% of the type category, has been leading the market due to its cost-effectiveness, consistency in potency, and scalability in production. Manufacturers have preferred synthetic sources as they enable stable supply chains and standardized dosing, which are critical for meeting stringent regulatory and quality requirements.

The segment’s dominance has been reinforced by its broad availability in various product forms, ensuring accessibility for diverse consumer needs. Additionally, synthetic melatonin benefits from lower susceptibility to seasonal raw material fluctuations compared to natural sources, supporting stable pricing and uninterrupted market presence.

Innovations in synthesis techniques have improved purity and reduced production costs, further enhancing its competitive advantage. Regulatory acceptance in key regions has also facilitated its incorporation into mainstream retail and e-commerce channels, ensuring the segment’s continued leadership in the overall market structure.

The dietary supplements segment, holding 64.70% of the application category, has retained its lead position due to growing consumer preference for self-care solutions that support sleep and circadian rhythm regulation. The segment has benefited from increased marketing by nutraceutical brands, educational campaigns on sleep health, and greater willingness among consumers to adopt preventive wellness products.

Its share is further supported by the wide range of supplement formats, flavors, and dosage options catering to varied age groups and health requirements. Over-the-counter availability has expanded its consumer base, while competitive pricing and frequent promotional strategies have driven volume sales.

The global e-commerce boom has also accelerated access, particularly in emerging economies where offline retail penetration is still developing. Sustained innovation in clean-label, vegan, and allergen-free formulations is expected to solidify the segment’s position further, making it a consistent revenue driver in the melatonin products market.

The pills segment, representing 46.80% of the form category, continues to dominate due to its convenience, precise dosing capability, and long-established consumer familiarity. This form factor has been favored in both retail and online channels as it offers extended shelf life, ease of packaging, and cost-efficient bulk distribution.

Manufacturers have leveraged pill formats to incorporate advanced coating technologies that enhance stability, control release profiles, and improve swallowing comfort. The segment’s appeal is reinforced by its alignment with traditional supplement-taking habits, particularly among older demographics and frequent supplement users.

Competitive manufacturing costs and streamlined production processes have further enabled scalability, allowing companies to maintain consistent supply even during demand surges. As product differentiation increases through combination formulations and functional blends, the pills segment is expected to retain its market share while benefiting from incremental innovation and targeted marketing strategies aimed at health-conscious consumers.

The melatonin products market is growing as consumers seek natural remedies for sleep disorders and lifestyle-related fatigue. Opportunities lie in product diversification into functional foods and e-commerce expansion. Trends point toward gummy-based, vegan-friendly, and personalized formulations. However, regulatory restrictions, safety concerns, and counterfeit risks remain challenges. With innovation and regulatory compliance, melatonin is set to strengthen its role in the global wellness and dietary supplement industry.

The demand for melatonin products is being driven by rising cases of insomnia, jet lag, and lifestyle-related sleep disorders. With increasing stress levels, irregular work schedules, and the popularity of digital devices disrupting sleep cycles, consumers are actively seeking natural remedies over prescription-based medications. Melatonin supplements, available in tablets, gummies, and liquid formats, are gaining traction as safer alternatives to synthetic drugs. Health-conscious consumers prefer these products due to their non-habit-forming properties. This surging demand is strengthening melatonin’s position in the global dietary supplements and wellness market.

Opportunities are emerging as melatonin is being infused into functional food and beverage formulations such as teas, chocolates, and fortified drinks. Companies are exploring product diversification to attract younger demographics seeking innovative and convenient solutions for sleep wellness. Regulatory approval in new markets and e-commerce distribution are also expanding revenue streams. The growing awareness around holistic health and preventive wellness provides a pathway for manufacturers to capture wider consumer segments. This creates opportunities for premium positioning, brand loyalty, and global expansion in sleep-related consumer health categories.

A significant trend shaping the melatonin products market is the shift toward gummy-based supplements, which are preferred for their convenience, taste, and portability. Vegan and plant-based formulations are also gaining popularity, aligning with the preferences of health-conscious and ethically minded consumers. Personalized wellness solutions, including melatonin dosage tailored to individual sleep patterns, are emerging. Digital health platforms recommending sleep supplements as part of broader wellness plans are reinforcing this trend. These evolving product forms and consumer preferences are redefining how melatonin is perceived in the global supplement landscape.

The melatonin products market faces challenges associated with varying regulatory standards across regions. In some countries, melatonin is classified as a prescription drug, limiting its over-the-counter availability. Safety concerns over long-term usage, dosage mismanagement, and potential side effects also contribute to consumer hesitancy. Counterfeit or low-quality products in unregulated markets further complicate trust in melatonin-based solutions. Manufacturers must navigate compliance hurdles, conduct rigorous clinical studies, and emphasize transparent labeling to ensure credibility. Overcoming these challenges is vital for building long-term consumer trust and expanding global adoption.

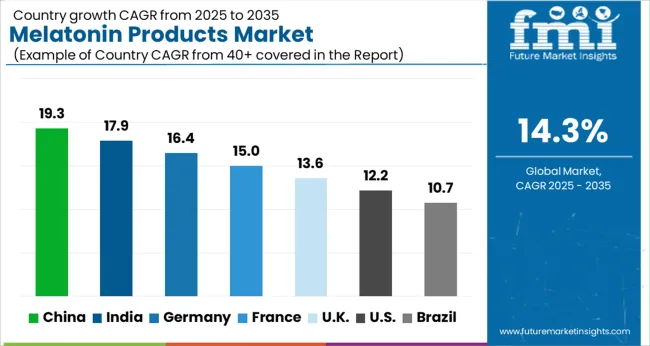

| Country | CAGR |

|---|---|

| China | 19.3% |

| India | 17.9% |

| Germany | 16.4% |

| France | 15.0% |

| UK | 13.6% |

| USA | 12.2% |

| Brazil | 10.7% |

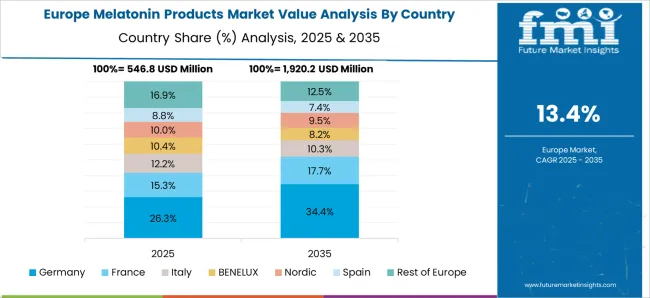

The global melatonin products market is projected to grow at a CAGR of 14.3% from 2025 to 2035. China leads the expansion with a forecast CAGR of 19.3%, followed by India at 17.9% and Germany at 16.4%. The United Kingdom is set to witness a 13.6% growth rate, while the United States is expected to grow steadily at 12.2%. Rising cases of insomnia, stress-related disorders, and increasing awareness of sleep health are driving global demand for melatonin supplements. With greater acceptance of natural sleep aids, the market is experiencing strong momentum in both developed and emerging economies. Asia is leading due to lifestyle shifts and wider consumer reach, while Europe and North America remain important due to established supplement markets and expanding product innovation. This report includes insights on 40+ countries; the top markets are shown here for reference.

The melatonin products market in China is forecast to expand at a CAGR of 19.3%, the highest globally. Rising cases of sleep disorders linked to fast-paced lifestyles and urban stress are driving greater use of melatonin supplements. Increased consumer preference for natural remedies over pharmaceutical solutions has encouraged wider adoption. The availability of melatonin in diverse product forms, including gummies, tablets, and functional beverages, is appealing to younger demographics. E-commerce platforms are playing a crucial role in distribution, making melatonin products accessible across urban and rural areas. Domestic manufacturers are scaling production, while international brands are strengthening their presence to capture China’s expanding wellness-driven market. This positions China as a dominant force in shaping the future of melatonin products globally.

The melatonin products market in India is projected to grow at a CAGR of 17.9%. Increasing awareness of sleep health and the rise of stress-related disorders among urban populations are fueling demand. Indian consumers are showing preference for natural supplements, with melatonin becoming a popular alternative to prescription sleep aids. The younger demographic, particularly working professionals and students, is adopting melatonin products to manage irregular sleep cycles. Distribution is expanding through both retail pharmacies and online platforms, enhancing accessibility. Domestic players are entering the segment, while global supplement brands are targeting India’s fast-growing consumer base. Rising disposable incomes and increased health consciousness suggest that melatonin supplements will continue gaining traction across the Indian wellness market.

The melatonin products market in Germany is expected to grow at 16.4% CAGR. Sleep disorders are a rising health concern in the country, creating demand for natural solutions like melatonin. German consumers place strong emphasis on health and wellness, making them receptive to supplements with clinically supported benefits. Product innovation, such as sugar-free gummies and vegan capsules, caters to specific consumer preferences. Strict regulatory frameworks ensure high product quality, which increases consumer trust and adoption. Pharmacies and health food stores remain dominant distribution channels, while online sales are rapidly gaining share. International brands see Germany as a gateway to broader European demand for melatonin products. This strong consumer base makes Germany one of the most influential markets in Europe.

The melatonin products market in the United Kingdom is projected to grow at a CAGR of 13.6%. Rising stress levels, long working hours, and increasing sleep-related health issues are fueling demand for melatonin supplements. British consumers are drawn toward natural alternatives, with growing adoption of melatonin gummies and sprays for convenience. Regulatory controls on supplement strength influence market offerings, pushing brands to innovate with safe and compliant formulations. Online platforms and wellness retail outlets are expanding consumer access across the country. The UK is also witnessing growing awareness campaigns on sleep health, which indirectly support the market. With consumers seeking lifestyle-focused wellness solutions, melatonin products are gaining popularity as part of daily routines.

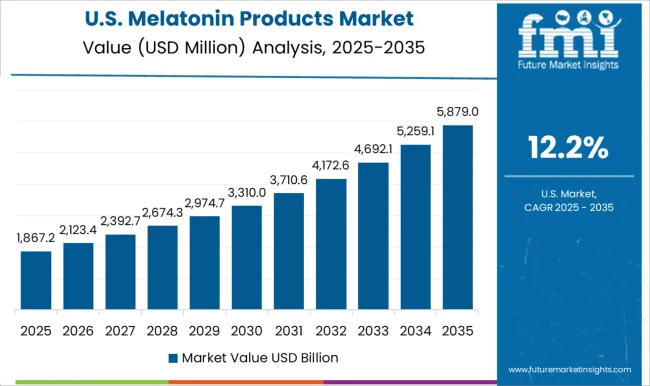

The melatonin products market in the United States is forecast to expand at a CAGR of 12.2%. The USA is a well-established dietary supplement market, with melatonin being one of the most widely used sleep aids. Growing cases of insomnia, anxiety, and disrupted sleep cycles are encouraging broader adoption. Consumers are seeking non-habit-forming and natural solutions, leading to strong demand for melatonin-based products. Innovation in formulations, including dissolvable tablets, flavored gummies, and liquid drops, caters to diverse consumer preferences. Pharmacies, supermarkets, and online retailers are major sales channels, ensuring widespread availability. The USA market benefits from high consumer awareness, strong purchasing power, and product variety, positioning it as a key contributor to the global melatonin segment despite slower growth compared to Asia.

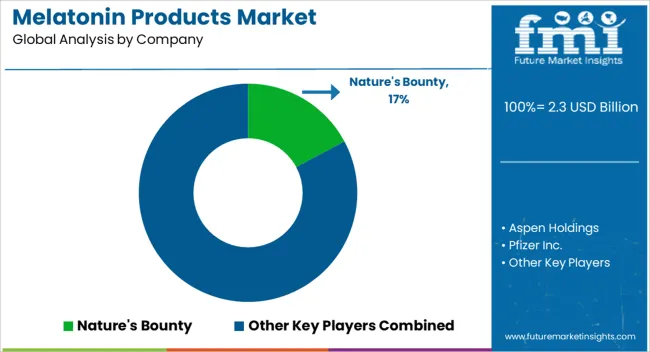

The melatonin products market is being shaped by nutraceutical leaders, pharmaceutical firms, and wellness brands responding to growing global demand for sleep aids and circadian health support. Nature's Bounty leads with a broad range of melatonin supplements, including gummies, tablets, and liquids, appealing to mainstream wellness consumers. Aspen Holdings and Pfizer Inc. emphasize regulated, clinically validated solutions, targeting efficacy and compliance across multiple regions. Natrol, LLC (an Aurobindo company) has secured a strong USA presence with its diversified melatonin offerings, becoming a trusted brand for over-the-counter sleep support. Biotics Research Corporation, Solgar, and Now Foods focus on natural formulations, clean-label positioning, and integration into wider wellness routines.

Retail-driven brands such as GNC and Sundown Naturals strengthen accessibility through extensive distribution networks, catering to lifestyle-focused consumers. Jamieson, a leading Canadian brand, continues international expansion with its melatonin products as part of a comprehensive supplement portfolio. Nature Made maintains a strong USA presence by combining brand credibility with mass-market reach. Schiff Nutrition International Inc. and Jarrow Formulas Inc. compete with premium formulations that emphasize quality, science-backed ingredients, and niche consumer preferences. The market is defined by a mix of commoditized retail products and differentiated offerings based on brand reputation, delivery formats, and product quality, positioning melatonin as a high-growth segment in the global nutraceutical landscape.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.3 Billion |

| Type | Synthetic melatonin and Natural melatonin |

| Application | Dietary supplements, Medical, and Other |

| Form | Pills, Chewable, Liquid, Sprays, and Other |

| Distribution Channel | Online retail, Pharmacies, and Other |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Nature's Bounty, Aspen Holdings, Pfizer Inc., Natrol, LLC (an Aurobindo company), Biotics Research Corporation, Solgar, Now Foods, GNC, Sundown Naturals, Jamieson, Nature Made, Schiff Nutrition International Inc., and Jarrow Formulas Inc. |

| Additional Attributes | Dollar sales by product type (tablets, gummies, liquids, capsules) and distribution channel (online, pharmacies, supermarkets) are key metrics. Trends include rising demand for sleep aids, increasing consumer preference for natural supplements, and growth in wellness-focused lifestyles. Regional adoption, regulatory approvals, and product innovations are driving market growth. |

The global melatonin products market is estimated to be valued at USD 2.3 billion in 2025.

The market size for the melatonin products market is projected to reach USD 8.9 billion by 2035.

The melatonin products market is expected to grow at a 14.3% CAGR between 2025 and 2035.

The key product types in melatonin products market are synthetic melatonin and natural melatonin.

In terms of application, dietary supplements segment to command 64.7% share in the melatonin products market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Melatonin Supplements Market Size and Share Forecast Outlook 2025 to 2035

Melatonin Sleep Supplements Market Growth – Trends & Forecast 2025 to 2035

Melatonin Market Analysis by Form, Source, Distribution Channel and Region through 2035.

Products from Food Waste Industry Analysis in Korea Size, Share and Forecast Outlook 2025 to 2035

Products from Food Waste in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Products from Food Waste Market Analysis - Size, Growth, and Forecast 2025 to 2035

USA Products from Food Waste Market Growth – Trends, Demand & Outlook 2025-2035

Teff Products Market

Detox Products Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Algae Products Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Pulse Products Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy Products Market Analysis by Product Type, End Use, Distribution Channel and Region through 2035

Almond Products Market Size and Share Forecast Outlook 2025 to 2035

Bamboo Products Market Analysis – Trends & Growth 2025 to 2035

Luxury Products For Kids Market - Trends, Growth & Forecast 2025 to 2035

Chicory Products Market Size and Share Forecast Outlook 2025 to 2035

Crystal Products Market Size and Share Forecast Outlook 2025 to 2035

Make-Up Products Packaging Market Size and Share Forecast Outlook 2025 to 2035

Suncare Products Market Size and Share Forecast Outlook 2025 to 2035

Ziplock Products Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA