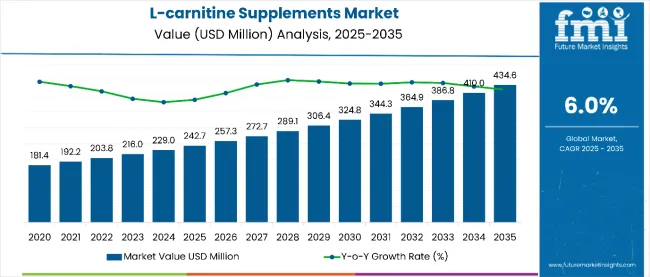

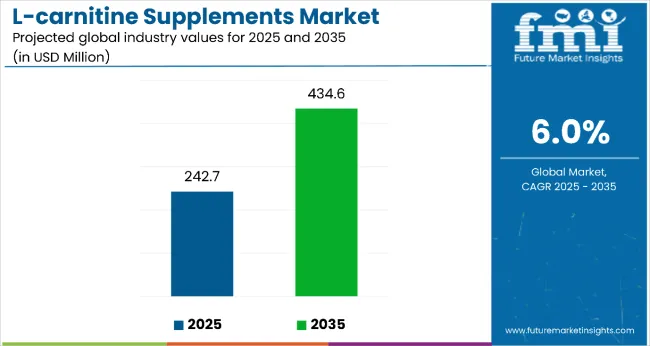

The global L-carnitine supplements market is estimated at USD 242.7 million in 2025 and is projected to reach USD 434.6 million by 2035, recording a CAGR of 6% during the forecast period. Market expansion is driven by increasing use of L-carnitine for weight management, post-exercise recovery, and healthy aging, alongside its application in pharmaceutical nutritional interventions. Over the forecast horizon, an absolute dollar opportunity of USD 143.3 million is anticipated.

By 2030, the market is forecasted to reach USD 289.06 million, contributing USD 46.36 million during the first half of the decade. The remaining USD 96.94 million is expected in the latter half, indicating a moderately back-loaded growth pattern.

Leading players such as Lonza Group Ltd. and Northeast Pharmaceutical Group Co., Ltd. are enhancing competitiveness through process innovation and portfolio expansion. A key strategic shift involves the introduction of vegan L-carnitine supplements to meet rising demand among health-conscious and fitness-focused consumers. Advancements in formulation efficiency and diversified product offerings are expected to strengthen market positioning over the next decade.

The L-carnitine supplements market accounts for notable shares across several parent industries. Within the food and beverage sector, its share is around 1.5%, reflecting growing incorporation into functional foods and drinks. In the pharmaceutical segment, the market represents approximately 2.3%, primarily for clinical nutrition and therapeutic interventions. The dietary supplements category contributes 5.0% to the market, as consumer interest in performance and metabolic health supplements rises. Additionally, animal feed supplements account for 4.8%, driven by the expanding use of L-carnitine in livestock and pet nutrition for improved growth and energy metabolism.

Increasing adoption of L-carnitine in functional drinks and energy beverages has strengthened market momentum. Brands such as Lonza Group Ltd. have broadened their portfolios to include L-carnitine-based supplements formulated for enhanced athletic recovery and weight management. Vegan L-carnitine variants are gaining popularity, supported by the clean-label movement and plant-based nutrition trends. Growing consumer awareness of L-carnitine’s benefits in fat metabolism, cardiovascular health, and energy production further supports its integration into sports nutrition and medical nutrition products, particularly in high-demand markets such as North America and Asia-Pacific.

L-carnitine supplements are gaining traction due to clinically validated benefits in fat metabolism, post-exercise recovery, and healthy aging. These attributes have made L-carnitine a preferred ingredient for fitness enthusiasts, aging consumers, and individuals focused on metabolic health. Increased awareness of preventive healthcare and lifestyle-driven wellness has further accelerated adoption across multiple consumer segments.

The rising prevalence of obesity and cardiovascular disorders has reinforced the role of L-carnitine in weight management and energy production. Growing integration of this ingredient in functional foods, beverages, and sports nutrition products highlights its expanding application base. Manufacturers are introducing plant-based and vegan L-carnitine formulations, aligning with consumer demand for clean-label, non-animal-sourced supplements.

Innovation in delivery systems, such as gummies, ready-to-drink (RTD) beverages, and sustained-release capsules, has enhanced convenience and absorption rates, driving differentiation in competitive markets. With ongoing developments in clinical nutrition and nutraceutical formulations, the market outlook remains strong, positioning L-carnitine supplements as a core component in performance enhancement, wellness maintenance, and therapeutic nutrition.

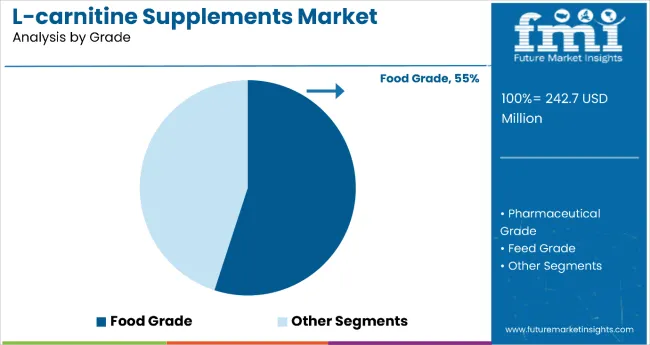

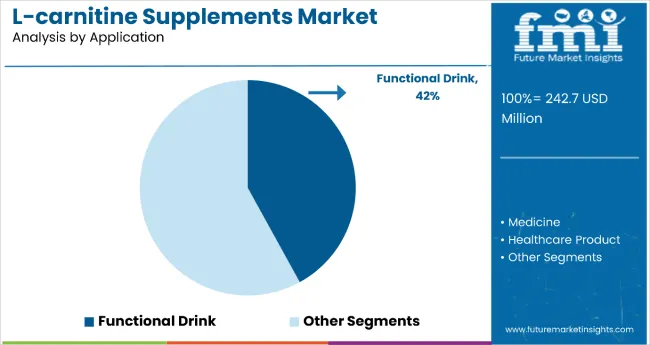

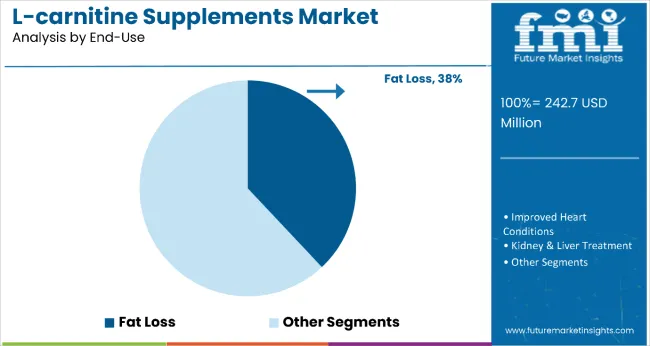

The market is segmented by grade, application, end-use, and region. By grade, the market includes food grade, pharmaceutical grade, and feed grade. Based on application, it is categorized into functional drinks, medicine, healthcare products, and animal food. The end-use segment encompasses fat loss, improved heart conditions, kidney & liver treatment, boosting immunity, improving male infertility, brain function, bone mass, infant nutrition, anti-aging, skin care, metabolism, and pain relief. Regionally, the market spans North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa.

The food-grade category dominates with a 55% share, supported by increasing incorporation of L-carnitine in functional foods and beverages. Consumers seeking weight management and energy enhancement have driven demand for fortified food-grade ingredients. This segment benefits from its compatibility with various formulations and strong acceptance in both retail and foodservice channels.

The functional drinks category leads with a 42% share, attributed to expanding demand for energy beverages, sports recovery drinks, and weight-loss solutions. L-carnitine’s compatibility with liquid formulations and synergistic potential with other bioactive compounds has made it essential in performance-focused beverages. The segment continues to gain traction due to on-the-go consumption trends.

Fat loss remains the most prominent end-use category with a 38% market share. L-carnitine’s proven ability to facilitate fatty acid oxidation has driven its use in weight management and metabolism-boosting supplements. The segment is further supported by global obesity concerns and the growing fitness culture.

In 2024, global L-carnitine supplement consumption rose by 15% year-on-year, with North America and Asia-Pacific contributing over 60% of total demand. Expansion is primarily driven by heightened awareness of metabolic health, growing fitness culture, and the inclusion of L-carnitine in functional food and beverage categories.

However, the market faces headwinds from ingredient cost fluctuations, inconsistent regulatory guidelines, and skepticism among certain consumer segments regarding efficacy. Emerging trends such as plant-based formulations, clean-label certifications, and RTD functional drinks are strengthening product visibility and relevance across diverse applications.

Key Drivers Fueling L-Carnitine Supplement Market Expansion

Market growth is anchored in rising demand for weight management solutions, performance enhancement, and overall wellness. L-carnitine’s role in fatty acid oxidation and energy metabolism has made it a critical ingredient in sports nutrition and clinical formulations. Its proven benefits in cardiovascular health, diabetes management, and male fertility have broadened its clinical relevance.

Consumer demand for multi-functional supplements has led to L-carnitine’s integration into capsules, gummies, and beverages. The growing availability of vegan and bioavailable formats has further reinforced adoption among ethically conscious consumers, while innovations in sustained-release technology and enhanced absorption methods have improved efficacy and differentiation.

Major Restraints Challenging L-Carnitine Supplement Market Development

Despite robust potential, high raw material costs, regional disparities in awareness, and regulatory complexities create obstacles for manufacturers. L-carnitine synthesis via fermentation or chemical processes is cost-intensive, impacting pricing strategies. Regulatory restrictions on dosage limits and health claims vary across jurisdictions, complicating global market alignment.

Consumer misconceptions around synthetic formulations and safety concerns also dampen penetration in conservative markets. Additionally, limited supply of pharma-grade and plant-based variants has caused distribution challenges, requiring advanced supply chain management and capacity expansion strategies.

Emerging Key Trends Influencing L-Carnitine Supplement Market Direction

The market is undergoing structural transformation as brands pivot toward vegan, clean-label, and multifunctional formulations. Plant-based L-carnitine is gaining prominence due to ethical sourcing trends and transparency-focused consumers. Combination products featuring L-carnitine with CoQ10, green tea extract, and electrolytes are emerging as premium offerings for performance enhancement and energy metabolism.

RTD beverages infused with L-carnitine dominate convenience-driven formats, while nutraceutical brands are adopting bioavailability-enhancing technologies for product differentiation. Regionally, Asia-Pacific is emerging as a key growth hub driven by urban fitness adoption and preventive health priorities, while North America maintains dominance through high product innovation and premiumization.

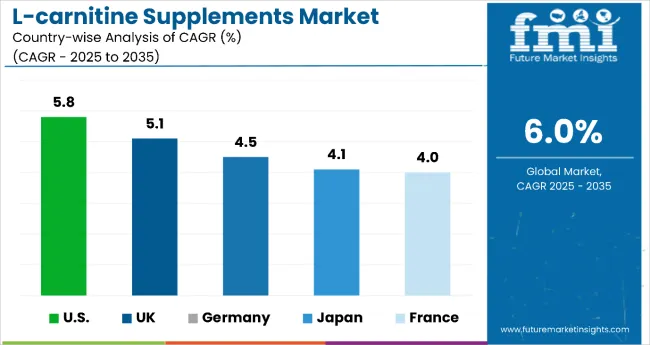

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.8% |

| United Kingdom | 5.1% |

| Germany | 4.5% |

| France | 4.0% |

| Japan | 4.1% |

The L-carnitine supplements market across leading countries displays diverse growth dynamics from 2025 to 2035. The United States is projected to lead with a CAGR of 5.8%, supported by strong demand for performance and weight-management products.

The United Kingdom follows at 5.1%, driven by rising adoption of fat-burning and plant-based formulations. Germany and France demonstrate moderate growth rates of 4.5% and 4.0%, respectively, due to increased demand for cardiovascular and metabolic health products. Japan records a steady CAGR of 4.1%, reflecting consistent demand for sports recovery and energy metabolism products.

The report covers an in depth analysis of 40+ countries; five top performing OECD countries are highlighted below.

The USA L-carnitine supplemented market is forecasted to expand at a CAGR of 5.8% during 2025 to 2035, driven by obesity management initiatives and active lifestyle adoption. High penetration of functional drinks and performance supplements has reinforced demand, while energy drink manufacturers continue to integrate L-carnitine into product portfolios. The USA also leads in innovative delivery formats, such as RTD beverages and gummies.

The L-carnitine supplements market in UK is expected to grow at 5.1% CAGR through 2035, fueled by expanding demand for vegan L-carnitine formulations and functional beverage adoption. A strong retail presence and innovation in sports nutrition products have supported steady growth. Plant-based L-carnitine supplements dominate premium segments.

L-carnitine supplements market in Germany is projected to register a CAGR of 4.5% from 2025 to 2035, underpinned by growing awareness of cardiovascular health and clinical nutrition. Functional beverages and capsule-based supplements are widely adopted for energy metabolism and fitness applications.

The French L-carnitine supplements market is expected to grow at a CAGR of 4.0% during the forecast period, supported by increasing consumer interest in weight-loss supplements and natural health products. Functional food applications featuring L-carnitine have expanded significantly in premium grocery channels.

Demand for L-carnitine supplements market in Japan is forecasted to achieve a CAGR of 4.1% between 2025 and 2035, driven by its aging population and preference for health-centric products targeting energy and recovery. L-carnitine’s integration into sports and RTD functional beverages remains a key growth driver.

The global L-carnitine supplements market is moderately fragmented, comprising multinational corporations and specialized regional players competing for market share. Leading companies are implementing strategies such as product diversification, technological advancements in synthesis, and expansion of distribution networks to strengthen their positions.

Lonza Group Ltd. dominates the market through its premium Carnipure® L-carnitine, widely recognized for efficacy in sports nutrition, energy metabolism, and weight management. Northeast Pharmaceutical Group Co., Ltd. maintains strong regional dominance with a comprehensive product portfolio and efficient production capabilities. KaiyuanHengtai Chemical Co., Ltd. focuses on certified food-grade and feed-grade formulations, while ChengDa Pharmaceuticals Co., Ltd. has built a competitive edge in animal nutrition solutions.

Smaller and emerging players are targeting niche categories such as vegan formulations and cost-effective solutions for price-sensitive markets. Their strategies include clean-label claims, plant-based sourcing, and functional beverage integration. Despite strong growth potential, challenges such as raw material price fluctuations, regulatory complexities, and the need for continuous innovation remain critical for long-term competitiveness.

Key Developments

Lonza announced its “One Lonza” restructuring strategy, consolidating its operations into three CDMO platforms: Integrated Biologics, Advanced Synthesis, and Specialized Modalities. The plan includes exiting the CHI business and targeting approximately 20% CER sales growth in 2025. This structural shift aims to enhance scalability, execution speed, and focus on high-value service models.

| Item | Value |

|---|---|

| Quantitative Units | USD 242.7 Million |

| Grade | Food Grade, Pharmaceutical Grade, and Feed Grade |

| Application | Functional Drink, Medicine, Healthcare Product, Animal Food |

| End-use | Fat Loss, Improved Heart Conditions, Kidney & Liver Treatment, Boosting Immunity, Improving Male Infertility, Brain Function, Bone Mass, Infant Nutrition, Anti-aging, Skin Care, Metabolism, Pain Relief |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia, Oceania, the Middle East and Africa |

| Country Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia , and 40+ countries |

| Key Companies Profiled | Northeast Pharmaceutical Group Co., Ltd., Huanggang Huayang Pharmaceutical Co. , Ltd, Lonza Group Ltd., Ceva Santé Animale S.A., Tokyo Chemical Industry Co., Ltd., Kaiyuan Hengtai Chemical Co., Ltd, ChengDa Pharmaceuticals Co., Ltd., Huanggang Huayang Pharmaceutical Co. , Ltd., HuBeiYuancheng Saichuang Technology Co., Ltd., Cayman Chemical |

| Additional Attributes | Dollar sales by product type and end-use sector, strong demand in weight management and fitness industries, increasing use in functional beverages and nutraceuticals, innovations in vegan and natural formulations, expanding presence in animal feed and pharmaceuticals for global markets |

The global l-carnitine supplements market is estimated to be valued at USD 242.7 million in 2025.

The market size for the l-carnitine supplements market is projected to reach USD 434.6 million by 2035.

The l-carnitine supplements market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in l-carnitine supplements market are food grade, pharmaceutical grade and feed grade.

In terms of application, functional drink segment to command 47.6% share in the l-carnitine supplements market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Supplements And Nutrition Packaging Market

ACF Supplements Market Size and Share Forecast Outlook 2025 to 2035

PDRN Supplements Market Size and Share Forecast Outlook 2025 to 2035

Feed Supplements Market Analysis - Size, Share & Forecast 2025 to 2035

Gummy Supplements Market Size and Share Forecast Outlook 2025 to 2035

Fiber Supplements Market Size and Share Forecast Outlook 2025 to 2035

Vegan Supplements Market Analysis by Ingredient Type, Form, Customer Orientation , Sales Channel and Health Concer Through 2035

Andro Supplements Market

Beauty Supplements Packaging Market Size and Share Forecast Outlook 2025 to 2035

Urology Supplements Market Size and Share Forecast Outlook 2025 to 2035

Peptide Supplements Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Calcium Supplement Market Analysis - Size, Share & Forecast 2025 to 2035

Calorie Supplements Market Analysis by Form, Packaging, Flavor, Sales Channel and Region Through 2025 to 2035

Dietary Supplements Packaging Market Analysis – Trends & Forecast 2025-2035

D-Mannose Supplements Market Size and Share Forecast Outlook 2025 to 2035

Carnitine Supplements Market Size and Share Forecast Outlook 2025 to 2035

Krill Oil Supplements Market Size and Share Forecast Outlook 2025 to 2035

Melatonin Supplements Market Size and Share Forecast Outlook 2025 to 2035

Green Tea Supplements Market Analysis - Size, Share, and Forecast 2025 to 2035

Probiotic Supplements Market Analysis - Size, Share, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA