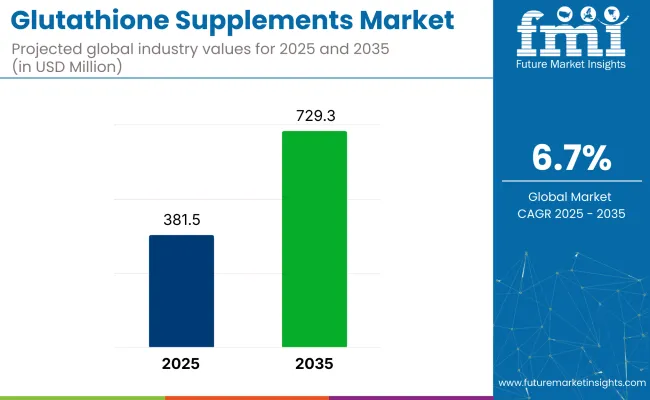

The global glutathione supplements market is valued at USD 381.5 million in 2025 and is slated to reach USD 729.3 million by 2035, which shows a CAGR of 6.7%. Factors driving this growth include the increasing prevalence of chronic diseases, declining natural glutathione levels with age, and rising consumer awareness regarding antioxidant benefits.

| Metric | Value |

|---|---|

| Market Size (2025) | USD 381.5 million |

| Market Size (2035) | USD 729.3 million |

| CAGR (2025 to 2035) | 6.7% |

Additionally, technological advancements in bioavailable formulations, including liposomal glutathione, are expected to enhance product efficacy and accelerate market expansion globally.

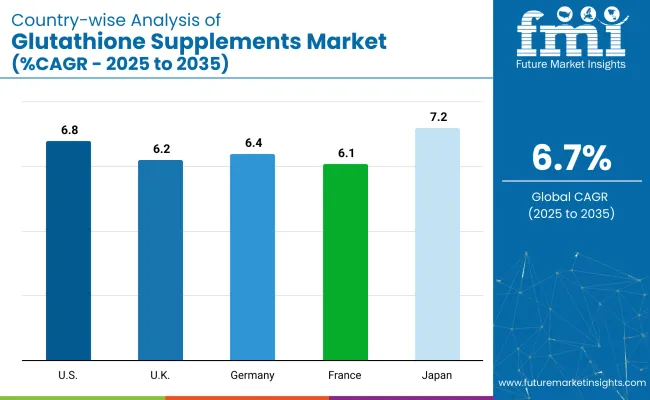

Japan is projected to grow at a CAGR of 7.2%, driven by rising demand for anti-aging and skin health supplements. The USA is expected to register a CAGR of 6.8% owing to its increasing aging population and preference for immune-boosting clean-label formulations. Germany is estimated to grow at a CAGR of 6.4%, supported by higher spending on natural antioxidant-based supplements.

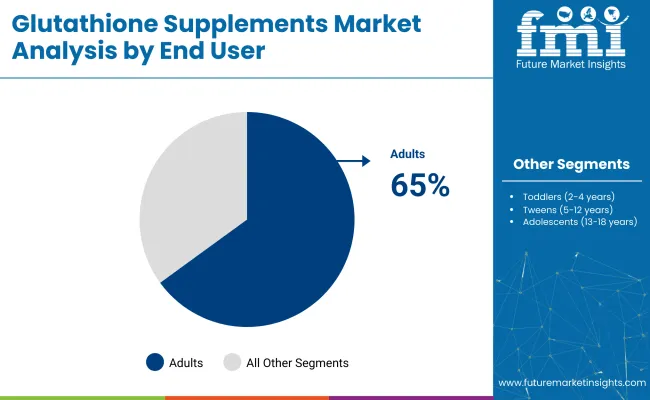

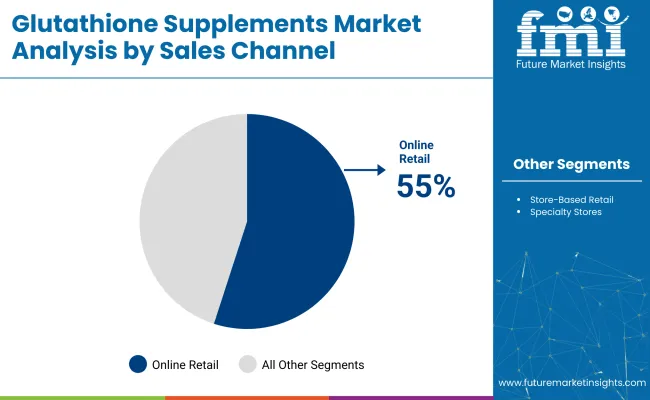

Adults are expected to lead the end user segment with a 65% market share in 2025. Online retail will dominate the sales channel segment with a 55% share, supported by increasing e-commerce penetration and consumer preference for convenient purchasing options.

Government regulations are becoming stricter to ensure the safety and efficacy of glutathione supplements, with authorities such as the USA FDA and EFSA enforcing guidelines on clean-label claims, bioavailability standards, and permissible daily intake levels. In response, manufacturers are focusing on innovations such as liposomal glutathione technology to enhance absorption and effectiveness. Additionally, natural fermentation techniques are being adopted to produce vegan, non-GMO, and allergen-free formulations.

The market accounts for approximately 2-3% of the overall dietary supplements market, driven by its niche antioxidant benefits and targeted immune support. Within the nutraceuticals market, it holds a share of around 1-2%, as broader categories like vitamins and minerals dominate. In the functional foods and beverages market, its contribution is under 1%, since it is mainly consumed as a supplement rather than integrated into food products.

However, within the antioxidant supplements segment, glutathione supplements account for nearly 5-7%, reflecting their strong positioning as a master antioxidant among health-conscious consumers seeking cellular detoxification and skin health benefits.

The glutathione supplements market segments include product forms, flavour type, end user, sales channel, functionality, and region. The product form segment covers capsules, gummies, tablets, powders, liquid, and topical ointments. The flavour type segment includes citrus, orange, berry, lemon, blueberry, mint, and others (such as chocolate, unflavoured, vanilla, and herbal blends).

The end user segment comprises toddlers (2-4 years), tweens (5-12 years), adolescents (13-18 years), and adults (above 18). The sales channel segment consists of store-based retail (hypermarket/supermarket, convenience store, medical stores, specialty stores (health & wellness)) and online retail (company website, third party website, social media selling).

The functionality segment includes immunity support, mood support, antioxidant support, beauty support, blood pressure support, bone and joint health support, cognitive support, and overall energy and detox support. The regional segment includes North America, Latin America, Europe, South Asia, East Asia, Oceania, and the Middle East & Africa.

Capsules are projected to remain the most lucrative segment, holding a market share of 30% in 2025.

Berry flavours are expected to remain the most lucrative segment, accounting for a market share of 25% in 2025.

Adults (above 18) are expected to remain the most lucrative segment, holding a market share of approximately 65% in 2025.

Online retail is expected to remain the most lucrative sales channel, accounting for a market share of 55% in 2025.

Third-party websites such as Amazon and iHerb are leading this segment due to their strong global presence and trust factor among buyers.

Social media selling is emerging rapidly with influencer-led marketing, particularly for beauty and detox supplement categories.

Antioxidant support is expected to remain the most lucrative segment, holding a market share of approximately 37.2% in 2025.

The global glutathione supplements market is growing steadily, driven by rising health consciousness, increasing demand for antioxidant-rich supplements, and advancements in bioavailable and clean-label glutathione formulations.

Recent Trends in the Glutathione Supplements Market

Challenges in the Glutathione Supplements Market

Japan is projected to witness the highest growth rate in the glutathione supplements market, with a CAGR of 7.2% from 2025 to 2035, driven by strong R&D, aging population demand, and premium formulations. The USA follows with a CAGR of 6.8%, supported by rising health-conscious consumers and robust online sales channels.

Germany is expected to grow at 6.4% due to increasing demand for natural and allergen-free supplements. The UK shows a CAGR of 6.2%, fuelled by millennial preferences for antioxidants, while France records the lowest among these at 6.1%, driven by beauty-focused supplement consumption.

The report covers an in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The USA glutathione supplements market is projected to grow at a CAGR of 6.8% from 2025 to 2035.

The UK glutathione supplements revenue is expected to grow at a CAGR of 6.2% from 2025 to 2035.

Sales of glutathione supplements in Germany are expected to register a CAGR of 6.4% from 2025 to 2035.

Sales of glutathione supplements in France are anticipated to grow at a CAGR of 6.1% from 2025 to 2035.

The Japan glutathione supplements sales are forecasted to grow at a CAGR of 7.2% from 2025 to 2035, the highest among the top countries.

The global glutathione supplements market is characterized by a mix of established and emerging players, indicating a moderately fragmented landscape. Leading companies are actively engaging in strategies such as product innovation, strategic partnerships, and expansion into new markets to strengthen their positions.

Top companies like NOW Foods, Life Extension, and Jarrow Formulas are focusing on developing advanced formulations, including liposomal and nano-encapsulated glutathione, to enhance bioavailability and meet consumer demand for effective supplements. These innovations are often accompanied by rigorous clinical studies to substantiate health claims, thereby building consumer trust.

Recent Glutathione Supplements Industry News

| Report Attributes | Details |

| Current Total Market Size (2025) | USD 381.5 million |

| Projected Market Size (2035) | USD 729.3 million |

| CAGR (2025 to 2035) | 6.7% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD million/Volume (Metric Tons) |

| By Product Form | Capsules, Gummies, Tablets, Powders, Liquid, and Topical Ointments |

| By Flavour Type | Citrus, Orange, Berry, Lemon, Blueberry, Mint, Others |

| By End User | Toddlers (2-4 years), Tweens (5-12 years), Adolescents (13-18 years), Adults (above 18) |

| By Sales Channel | Store-based Retail (Hypermarket/Supermarket, Convenience Store, Medical Stores, Specialty Stores (Health & Wellness)), Online Retail (Company Website, Third-party Website, Social Media Selling) |

| By Functionality | Immunity Support, Mood Support, Antioxidant Support, Beauty Support, Blood Pressure Support, Bone a nd Joint Health Support, Cognitive Support, Overall Energy a nd Detox Support |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia |

| Key Players | NOW Foods, Life Extension, Alliwise, ELMNT Health, BioSchwartz, Horbaach, NutriFlair, DaVinci Laboratories, Nature's Craft, Swanson, Piping Rock, NutriVein, BioFinest, We Like Vitamins, Toniiqq, Jarrows Formula, Bulk Supplements, Fresh Nutrition, aSquared Nutrition, Solgar, Pure Encapsulations Inc, BoldFit, Swisse, Nature's Island, Hikari, Aqua Skin, Shandong Jincheng Bio-pharmaceutical Co., Kohjin Life Sciences, Kirkman Group, Healthy Origins |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis. |

As per form type, the industry has been categorized into Capsules, Gummies, Tablets, Powders, Liquid, and Topical ointments.

As per flavors type, the industry has been categorized into Citrus, Orange, Berry, Lemon, Blueberry, Mint flavors, and Others.

This segment is further categorized into Toddlers (2-4 years), Tween (5-12 years), Adolescents (13-18 years), and Adults (above 18).

As per the sales channel, the industry has been categorized into Store-based retail (Hypermarkets, Supermarkets, Convenience stores, Medical stores, Specialty stores) and Online retail (Company websites, Third party websites, and Social Media Selling).

This segment is further categorized into Immunity Support, Mood Support, Antioxidant support, Beauty support, Blood Pressure Support, Bone and Joint Health support, Cognitive support, and Overall energy and detox support.

Industry analysis has been carried out in key countries of North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa.

The market is valued at USD 381.5 million in 2025.

The market is projected to reach USD 729.3 million by 2035.

The market is expected to grow at a CAGR of 6.7%.

Capsules are the leading product form with a 30% market share in 2025.

Japan is projected to have the highest CAGR at 7.2% during this period.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Glutathione Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Supplements And Nutrition Packaging Market

ACF Supplements Market Size and Share Forecast Outlook 2025 to 2035

PDRN Supplements Market Size and Share Forecast Outlook 2025 to 2035

Feed Supplements Market Analysis - Size, Share & Forecast 2025 to 2035

Gummy Supplements Market Size and Share Forecast Outlook 2025 to 2035

Fiber Supplements Market Size and Share Forecast Outlook 2025 to 2035

Vegan Supplements Market Analysis by Ingredient Type, Form, Customer Orientation , Sales Channel and Health Concer Through 2035

Andro Supplements Market

Beauty Supplements Packaging Market Size and Share Forecast Outlook 2025 to 2035

Urology Supplements Market Size and Share Forecast Outlook 2025 to 2035

Peptide Supplements Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Calcium Supplement Market Analysis - Size, Share & Forecast 2025 to 2035

Calorie Supplements Market Analysis by Form, Packaging, Flavor, Sales Channel and Region Through 2025 to 2035

Dietary Supplements Packaging Market Analysis – Trends & Forecast 2025-2035

D-Mannose Supplements Market Size and Share Forecast Outlook 2025 to 2035

Carnitine Supplements Market Size and Share Forecast Outlook 2025 to 2035

Krill Oil Supplements Market Size and Share Forecast Outlook 2025 to 2035

Melatonin Supplements Market Size and Share Forecast Outlook 2025 to 2035

Green Tea Supplements Market Analysis - Size, Share, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA