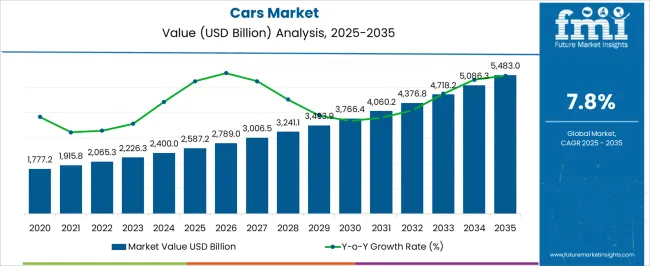

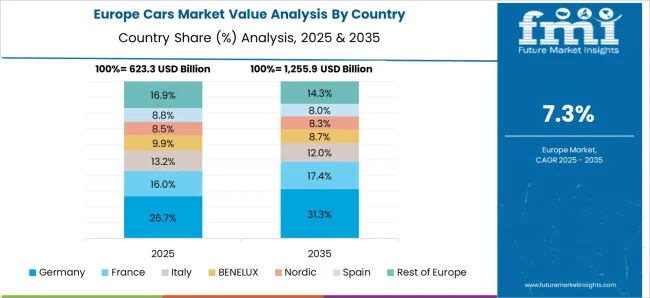

The cars market, projected to grow from USD 2,587.2 billion in 2025 to USD 5,483.0 billion by 2035 at a CAGR of 7.8%, exhibits significant regional growth imbalances, particularly when comparing Asia-Pacific, Europe, and North America. Asia-Pacific is expected to dominate market expansion, driven by large-scale vehicle production, rising adoption of electric and hybrid models, and increasing consumer demand across emerging economies.

The steep year-on-year growth from USD 2,587.2 billion to USD 5,483.0 billion underscores the region’s ability to absorb large volumes of production and sales, reflecting strong industrial infrastructure and expanding urban mobility networks. Europe represents a moderately paced growth region, with incremental adoption of high-performance and low-emission vehicles. Regulatory frameworks, stringent emission standards, and mature consumer bases contribute to slower but steady market expansion. The incremental annual growth aligns with a stable regulatory environment, enabling consistent demand primarily in Western European countries, although the adoption of electric vehicles accelerates market share.

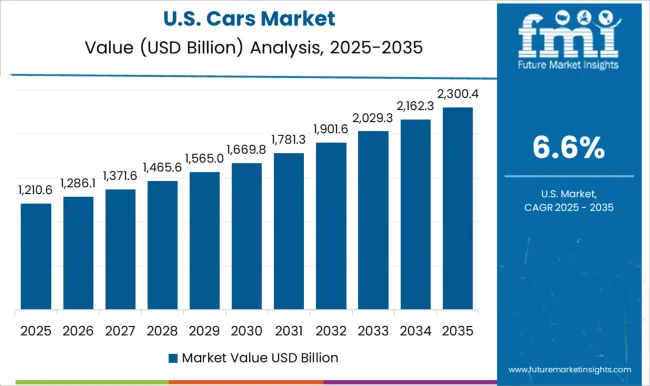

North America shows relatively steady but less aggressive growth, supported by stable economic conditions, established automotive manufacturers, and moderate consumer adoption of technologically advanced vehicles. Market expansion is influenced by incentives for electrification, but mature infrastructure and saturation in certain segments constrain rapid growth compared to Asia-Pacific. The regional growth imbalance highlights Asia-Pacific as the primary driver of market expansion, while Europe and North America contribute incremental but consistent growth, reflecting differences in market maturity, regulatory pressures, and consumer adoption patterns.

| Metric | Value |

|---|---|

| Cars Market Estimated Value in (2025 E) | USD 2587.2 billion |

| Cars Market Forecast Value in (2035 F) | USD 5483.0 billion |

| Forecast CAGR (2025 to 2035) | 7.8% |

The cars market represents a major segment within the global automotive industry, emphasizing personal mobility, transportation efficiency, and technological innovation. Within the broader passenger vehicle sector, it accounts for about 42%, driven by demand in urban, suburban, and long-distance travel. In the electric and hybrid vehicles segment, its share is approximately 7.8%, reflecting adoption of sustainable propulsion technologies and regulatory incentives.

Across the automotive manufacturing and assembly industry, it contributes around 35%, supporting mass production, supply chain integration, and component innovation. Within the connected and autonomous vehicles category, it represents 5.6%, highlighting integration of advanced driver assistance systems, infotainment, and telematics. In the overall transportation and mobility ecosystem, the market accounts for approximately 40%, with a focus on performance, safety, and consumer preferences for convenience and reliability. Recent developments in the cars market have focused on electrification, connectivity, and automation.

Groundbreaking trends include the rise of battery electric vehicles, plug-in hybrids, connected car platforms, and semi-autonomous driving technologies. Key players are collaborating with technology providers, energy suppliers, and software companies to enhance vehicle intelligence, range, and charging infrastructure. The adoption of lightweight materials, advanced batteries, and vehicle-to-everything (V2X) communication systems is gaining traction to enhance efficiency and safety. The innovations in digital sales platforms, mobility-as-a-service integration, and predictive maintenance are shaping the consumer experience.

The global cars market continues to evolve as consumer expectations shift toward enhanced comfort, fuel efficiency, and advanced in-car technologies. Demand is being shaped by lifestyle preferences, urban mobility trends, and regulatory emphasis on emissions reduction. Automakers are responding with diversified product lines, including crossovers, hybrids, and intelligent vehicle systems to cater to a broad consumer base.

While electric and hybrid models are gaining traction, internal combustion engine variants still maintain strong market presence, especially in emerging economies. The post-pandemic recovery in automotive sales, backed by improved semiconductor availability and supply chain adjustments, has further supported growth.

Sustained investments in R&D, digital platforms for car sales, and autonomous vehicle capabilities are expected to influence future expansion. The market’s resilience lies in its adaptability to economic fluctuations, evolving regulatory landscapes, and rapid technological advancements

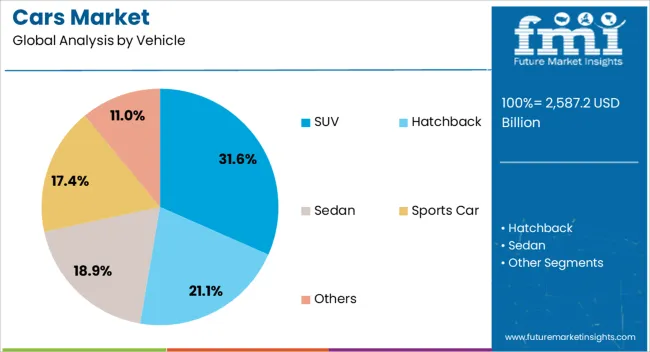

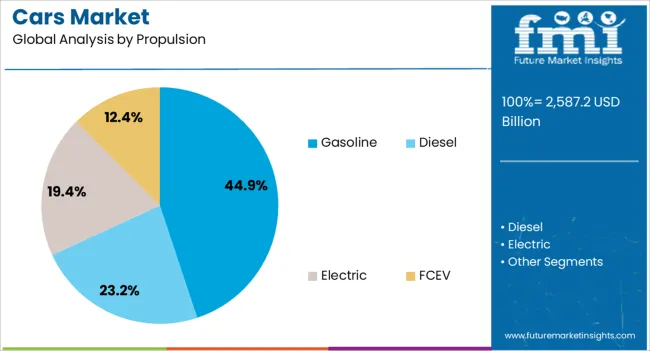

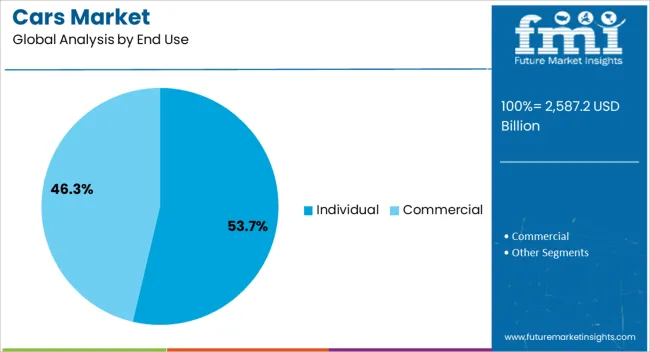

The cars market is segmented by vehicle, propulsion, end use, sales channel, and geographic regions. By vehicle, cars market is divided into SUV, Hatchback, Sedan, Sports Car, and Others. In terms of propulsion, cars market is classified into Gasoline, Diesel, Electric, and FCEV. Based on end use, cars market is segmented into Individual and Commercial.

By sales channel, cars market is segmented into Franchised dealer, Peer-to-peer, and Independent dealer. Regionally, the cars industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The SUV segment holds the leading position in the vehicle category with a 32% share, supported by rising consumer preference for multi-utility, high-clearance vehicles that offer a balance of comfort, performance, and safety. This segment's popularity is largely driven by growing demand from families and individuals seeking spacious interiors, flexible cargo options, and advanced infotainment systems.

Automakers are expanding SUV offerings across compact, mid-size, and full-size categories to meet varied price and usage requirements. Enhanced fuel efficiency, coupled with hybrid and plug-in variants, is further supporting SUV adoption across developed and developing markets alike.

The versatility of SUVs for both urban commuting and off-road travel, along with strong resale value, continues to solidify their dominance. Ongoing technological enhancements in suspension, all-wheel-drive systems, and driver-assistance features are expected to maintain the segment's upward trajectory in the near future.

Gasoline-powered cars continue to lead the propulsion category with a 45% market share, reflecting their broad availability, affordability, and established fueling infrastructure. Despite the rise in electrified vehicle options, gasoline vehicles remain the preferred choice in regions with less-developed EV ecosystems or higher electricity costs.

This segment is sustained by ongoing improvements in engine efficiency, reduced emissions technologies, and turbocharging systems that enhance performance without significantly increasing fuel consumption. Consumer familiarity with gasoline vehicles and lower upfront purchase costs further support continued adoption.

Automakers are also focusing on hybrid gasoline models, which blend combustion reliability with improved environmental performance. While regulatory trends favor a long-term shift to electrification, gasoline cars are projected to retain a strong presence in the market over the medium term due to their convenience, range, and infrastructure compatibility.

The individual end-use segment dominates the market with a 54% share, highlighting the significant role of personal vehicle ownership in shaping automotive demand. Rising income levels, increased urbanization, and a desire for private mobility have all contributed to growth in this segment, especially in developing countries. Individuals prioritize factors such as fuel economy, connectivity, aesthetics, and after-sales service when making purchasing decisions.

The shift towards digital car buying platforms and financing flexibility has further simplified access for individual buyers. Automakers are targeting this segment with tailored offerings, including compact and mid-size models that strike a balance between affordability and modern features.

Additionally, growing consumer awareness of vehicle sustainability and running costs is influencing choices within the individual buyer segment. As car ownership continues to symbolize independence and convenience, especially in the post-pandemic era, this segment is expected to maintain its dominant position in both mature and emerging automotive markets.

The global market has been expanding due to increasing demand for personal mobility, technological innovations, and rising consumer expectations for comfort, safety, and performance. Manufacturers are introducing diverse vehicle types, including electric, hybrid, and autonomous models, to cater to evolving preferences and stricter emission regulations. The integration of advanced infotainment, connectivity, and driver assistance systems has enhanced vehicle functionality. Growth in urban population centers, rising middle-class income, and expansion of automotive financing options have contributed to market penetration.

The adoption of electric and hybrid cars has emerged as a key growth driver in the automotive market. Rising environmental awareness, government incentives, and emission reduction mandates have encouraged the transition from internal combustion engines to battery-electric and plug-in hybrid vehicles. Improvements in battery energy density, charging infrastructure, and vehicle range have enhanced adoption rates, making electric mobility increasingly practical. Automakers are investing in modular platforms, lightweight materials, and regenerative braking systems to optimize efficiency and reduce carbon footprint. Fleet operators, ride-sharing companies, and urban mobility providers are integrating electric vehicles to meet sustainability targets. As global emission standards tighten, electrification continues to reshape consumer choices, production priorities, and technology deployment in the automotive sector, influencing long-term market expansion.

Technological innovation has been transforming the cars market by integrating connectivity, automation, and smart vehicle systems. Advanced driver-assistance systems (ADAS), autonomous driving features, and vehicle-to-everything (V2X) communication improve safety, navigation, and traffic efficiency. Infotainment systems, voice recognition, and predictive maintenance technologies enhance user experience and operational reliability. Manufacturers are investing in over-the-air software updates, artificial intelligence algorithms, and sensor integration to support adaptive driving and energy optimization. The integration of lightweight composites, high-efficiency powertrains, and advanced aerodynamics contributes to fuel efficiency and reduced emissions. Technological advancements allow differentiation among models, create competitive advantages, and provide opportunities for market expansion by offering enhanced performance, convenience, and sustainability to consumers globally.

Government regulations, safety standards, and emission mandates significantly shape the cars market. Compliance with crashworthiness, airbag, pedestrian safety, and fuel efficiency standards ensures vehicle eligibility for sale in various regions. Environmental regulations targeting CO2 and pollutant emissions require investment in low-emission technologies, electrified powertrains, and alternative fuels. Certifications and compliance with international automotive standards influence production, design, and material selection. Manufacturers adopt rigorous testing protocols and advanced monitoring systems to meet legal requirements and enhance consumer trust. Enforcement of safety, emission, and energy efficiency regulations drives innovation, operational efficiency, and market growth, ensuring that cars meet contemporary environmental and safety expectations while maintaining performance standards.

Changing consumer preferences are influencing product offerings and market growth strategies in the cars segment. Increased demand for SUVs, crossovers, electric vehicles, and luxury models reflects lifestyle changes, convenience expectations, and technological awareness. Ride-sharing services, subscription models, and vehicle leasing are creating alternative avenues for market penetration. Manufacturers are leveraging digital marketing, e-commerce platforms, and personalized configurations to enhance customer engagement. Expansion into emerging markets with rising disposable incomes, urbanization, and supportive financing options provides opportunities for sustained sales growth.

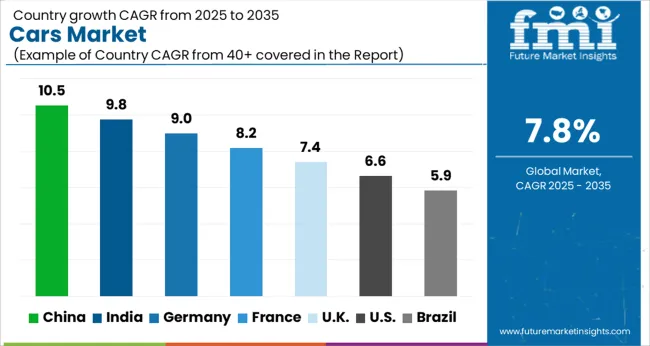

| Country | CAGR |

|---|---|

| China | 10.5% |

| India | 9.8% |

| Germany | 9.0% |

| France | 8.2% |

| UK | 7.4% |

| USA | 6.6% |

| Brazil | 5.9% |

The market is projected to grow at a CAGR of 7.8% from 2025 to 2035, reflecting increasing consumer demand and advancements in vehicle technologies. China leads at 10.5%, driven by rapid adoption of electric vehicles and expanding automotive manufacturing capabilities. India follows at 9.8%, supported by rising vehicle sales and government incentives for green mobility. Germany records 9.0%, reflecting strong engineering expertise and premium vehicle production. The UK reaches 7.4%, influenced by investments in EV infrastructure and automotive innovation. The USA registers 6.6%, with growth fueled by demand for electric and hybrid vehicles alongside technological advancements. The market is expected to evolve with increasing focus on sustainable and smart mobility solutions. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is witnessing a CAGR of 10.5%, driven by strong domestic demand for passenger cars, growth of electric vehicles, and expanding middle-class consumers seeking personal mobility solutions. Local and international manufacturers focus on high-quality compact, sedan, and SUV models, integrating advanced safety features, infotainment systems, and fuel-efficient engines. Government incentives for new energy vehicles, coupled with rising urban mobility needs, support growth. Dealership networks and e-commerce platforms facilitate broader access, while investment in R&D and localized production enhances competitiveness in both domestic and export markets.

India is expanding at a CAGR of 9.8%, supported by rising passenger vehicle demand, increased financing options, and government initiatives for electric mobility. Compact cars, hatchbacks, and SUVs dominate the market, while automakers invest in localized production to reduce costs and improve availability. Adoption of hybrid and electric vehicles is gradually increasing, driven by policy incentives and growing environmental awareness. Dealership networks, online sales platforms, and after-sales services strengthen consumer confidence and fuel market growth.

Germany is witnessing a CAGR of 9.0%, led by premium, luxury, and electric vehicle adoption. High consumer preference for performance, safety, and technology integration drives demand. German manufacturers emphasize innovation in autonomous driving, electric mobility, and advanced infotainment systems. Regulatory policies supporting emission reduction and EV adoption further stimulate growth. Export-oriented production also contributes to competitiveness, with German brands maintaining a strong global presence.

The United Kingdom is expanding at a CAGR of 7.4%, supported by demand for electric, hybrid, and premium cars. Automotive manufacturers emphasize compliance with EU and UK emission standards, innovative safety systems, and smart mobility solutions. Electric vehicle adoption is increasing due to government incentives and growing charging infrastructure. Consumer demand for compact and luxury vehicles continues to expand. Automotive financing solutions and online purchase platforms support accessibility and market penetration.

The United States is growing at a CAGR of 6.6%, driven by consumer preference for SUVs, pickup trucks, and electric vehicles. Automakers focus on fuel efficiency, safety systems, and smart technology integration, including connected and autonomous vehicle features. EV adoption is increasing with incentives, infrastructure growth, and expanding charging networks. Financing schemes, dealership networks, and online car buying platforms facilitate market penetration. Demand is also supported by both domestic and imported models.

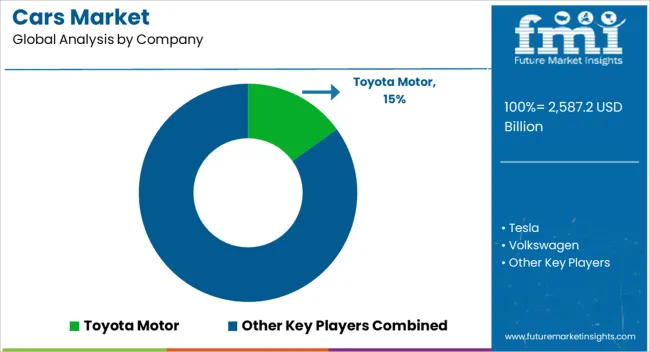

The global market remains highly competitive, dominated by established automotive giants such as Toyota Motor, Volkswagen, Ford Motor, General Motors, Honda Motor, and Hyundai Motor. These companies maintain market leadership through extensive product portfolios, global manufacturing and distribution networks, and continuous investment in research and development to enhance vehicle performance, safety, and fuel efficiency. Toyota and Volkswagen leverage scale advantages and brand loyalty, while Ford and GM focus on North American market dominance and expansion into electric and hybrid vehicles.

Tesla has emerged as a disruptive force, accelerating the shift toward electric vehicles (EVs) with innovative battery technology, over-the-air software updates, and strong brand positioning in the EV segment. Legacy automakers such as BMW and Honda are increasingly prioritizing EVs, connected car technologies, and autonomous driving features to remain competitive. Regional players like Suzuki Motor and Tata Motors focus on cost-effective, compact, and fuel-efficient models tailored to emerging markets. Strategic alliances, joint ventures, and technology partnerships are key strategies employed across the market to capture growth, meet regulatory standards, and adapt to evolving consumer preferences. Companies capable of combining innovation, sustainability, and affordability are poised to strengthen their competitive position in the global market.

| Item | Value |

|---|---|

| Quantitative Units | USD 2587.2 Billion |

| Vehicle | SUV, Hatchback, Sedan, Sports Car, and Others |

| Propulsion | Gasoline, Diesel, Electric, and FCEV |

| End Use | Individual and Commercial |

| Sales Channel | Franchised dealer, Peer-to-peer, and Independent dealer |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Toyota Motor, Tesla, Volkswagen, BMW, Ford Motor, General Motors, Honda Motor, Hyundai Motor, Suzuki Motor, and Tata Motors |

| Additional Attributes | Dollar sales by vehicle type and segment, demand dynamics across passenger, commercial, and luxury categories, regional trends in electric and hybrid adoption, innovation in safety features, connectivity, and fuel efficiency, environmental impact of manufacturing and emissions, and emerging use cases in autonomous driving, shared mobility, and connected vehicle ecosystems. |

The global cars market is estimated to be valued at USD 2,587.2 billion in 2025.

The market size for the cars market is projected to reach USD 5,483.0 billion by 2035.

The cars market is expected to grow at a 7.8% CAGR between 2025 and 2035.

The key product types in cars market are suv, hatchback, sedan, sports car and others.

In terms of propulsion, gasoline segment to command 44.9% share in the cars market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cable Cars and Ropeways Market Growth - Trends & Forecast 2025 to 2035

Boxcar Scars Market – Demand, Growth & Forecast 2025 to 2035

Rail Tank Cars Market Size and Share Forecast Outlook 2025 to 2035

Disposable Trocars Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

High-performance Electric Sports Cars Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA