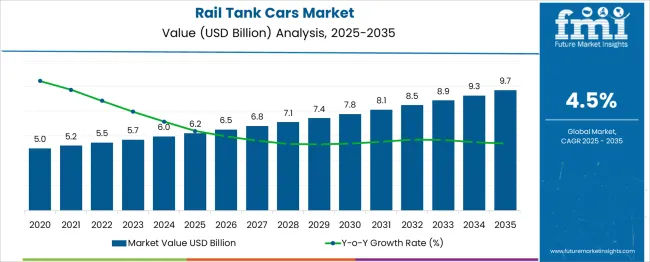

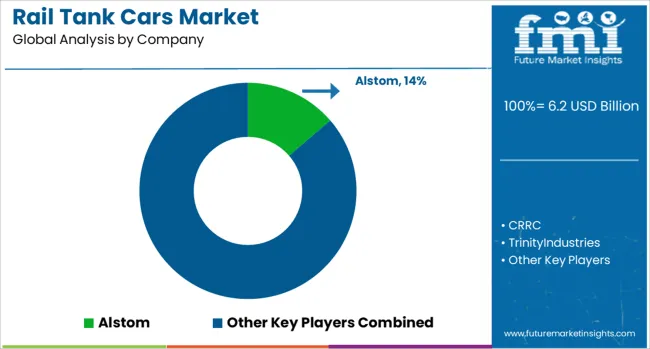

The Rail Tank Cars Market is estimated to be valued at USD 6.2 billion in 2025 and is projected to reach USD 9.7 billion by 2035, registering a compound annual growth rate (CAGR) of 4.5% over the forecast period. Competitive landscape dynamics in this market are characterized by incremental growth, consolidation among leading manufacturers, and differentiation based on technological enhancements, safety features, and regulatory compliance. The moderate CAGR reflects steady demand for bulk liquid transportation, driven by chemicals, fuels, and food-grade liquids, which incentivizes established players to optimize production capacities and improve operational efficiency rather than pursue aggressive market share disruption. Market participants are focusing on fleet modernization, compliance with international safety standards, and the incorporation of advanced monitoring and braking systems to differentiate offerings.

The annual growth trajectory, rising from USD 6.2 billion in 2025 to USD 7.4 billion by 2030 and reaching USD 9.7 billion in 2035, suggests that competitive intensity is more likely to manifest through service quality, product reliability, and cost management rather than price wars. Smaller players are entering niche segments, such as specialized chemical or cryogenic tank cars, leveraging technological customization to gain incremental share without displacing incumbents. Strategic collaborations and regional partnerships are also emerging as key competitive levers, enabling manufacturers to access new geographies and optimize supply chains. The market exhibits a balanced competitive landscape, where growth is steady, differentiation is driven by technology, and strategic positioning will determine long-term leadership in a moderately expanding market.

| Metric | Value |

|---|---|

| Rail Tank Cars Market Estimated Value in (2025 E) | USD 6.2 billion |

| Rail Tank Cars Market Forecast Value in (2035 F) | USD 9.7 billion |

| Forecast CAGR (2025 to 2035) | 4.5% |

The rail tank cars market is experiencing strong growth as freight transport demands evolve alongside industrial and energy sector expansion. The increasing movement of petroleum products, ethanol, liquefied gases, and specialty chemicals has driven demand for reliable, high-capacity tank car solutions. Regulatory emphasis on the safe and secure transit of hazardous and non-hazardous liquids has prompted manufacturers to prioritize compliance-driven innovation, including thermal protection systems, reinforced shells, and advanced braking technologies.

Infrastructure investments in rail freight corridors and intermodal logistics networks have further enabled the growth of tank car usage across domestic and cross-border supply chains. Additionally, growing concerns around highway congestion and carbon emissions are redirecting bulk transport strategies toward rail-based alternatives.

As railways become more integral to integrated logistics planning, tank cars equipped with monitoring technologies and adaptable for different cargo types are being prioritized. In the coming years, partnerships between chemical manufacturers, refiners, and rolling stock suppliers are expected to enhance adoption of advanced rail tank car fleets worldwide.

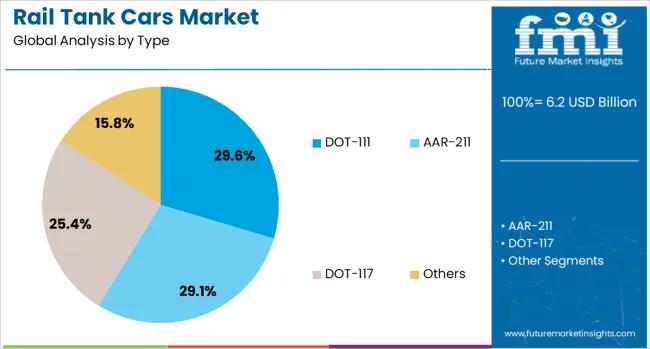

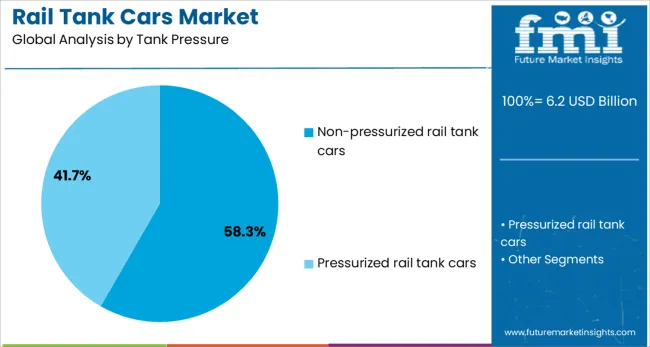

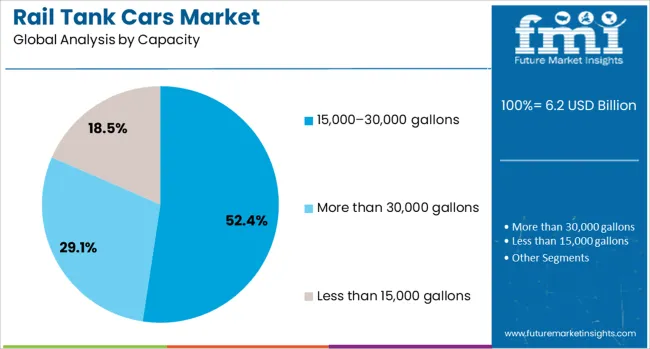

The rail tank cars market is segmented by type, tank pressure, capacity, application, and geographic regions. By type, the rail tank cars market is divided into DOT-111, AAR-211, DOT-117, and others. In terms of tank pressure, the rail tank cars market is classified into Non-pressurized rail tank cars and Pressurized rail tank cars. Based on capacity, the rail tank cars market is segmented into 15,000–30,000 gallons, More than 30,000 gallons, and less than 15,000 gallons. By application, the rail tank cars market is segmented into Oil and gas, Chemicals, Food and beverage, and others. Regionally, the rail tank cars industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

DOT-111 tank cars are expected to contribute 29.6% of the total revenue share in the rail tank cars market in 2025, reflecting their continued relevance in bulk liquid transportation. Their widespread deployment has been influenced by longstanding integration into the North American freight system and extensive compatibility with non-pressurized commodity hauling. Despite evolving safety regulations, DOT-111 models remain cost-effective options for transporting less hazardous materials, including certain agricultural products and fuels.

Retrofit programs and design enhancements have allowed these tank cars to meet baseline compliance while offering competitive operational efficiency. The economic viability of using DOT-111 cars, especially in markets where new-generation models are not yet mandatory, has contributed to their sustained use.

Their ability to be upgraded for specific safety standards and high availability across leasing fleets have also supported their continued utilization. As many freight operators phase in newer models, the legacy presence and infrastructure compatibility of DOT-111 cars are ensuring their ongoing role in the transitional rail fleet landscape.

Non-pressurized rail tank cars are projected to represent 58.3% of the market’s revenue share in 2025, highlighting their dominance in the transportation of bulk liquids under ambient pressure. Their market leadership is attributed to the wide range of liquid commodities that do not require containment under high pressure, such as ethanol, biodiesel, and various chemicals. These tank cars offer cost-effective operations due to lower manufacturing and maintenance requirements, contributing to their appeal for high-volume shippers.

Their structural simplicity allows for rapid loading and unloading, supporting quicker turnaround times in freight logistics. The demand has been reinforced by expanding chemical and fuel transport across North America and Asia, where these cars are widely integrated into rail terminals.

Adaptability to commodity-specific linings and fittings has made them suitable for diverse product categories, thereby broadening their utility. With consistent demand from agriculture, energy, and manufacturing sectors, non-pressurized rail tank cars continue to represent a reliable and efficient backbone of bulk rail transport operations.

Tank cars with a capacity range of 15,000 to 30,000 gallons are forecast to account for 52.4% of total revenue in the rail tank cars market in 2025, making them the leading capacity segment. Their widespread use is driven by the optimal balance they provide between payload volume and rail infrastructure limitations. These tank cars enable efficient transport of moderate to large quantities of liquids without exceeding weight restrictions imposed on many rail corridors.

Their configuration supports the storage and transit of both hazardous and non-hazardous materials, including petroleum derivatives, food-grade liquids, and industrial solvents. Operators favor this capacity range due to the cost-efficiency it offers in per-trip cargo value and reduced frequency of railcar cycling.

Additionally, this segment’s strong position has been strengthened by consistent demand from industries such as refining, chemical manufacturing, and agriculture. The ability to customize these tank cars with advanced safety linings, coatings, and monitoring systems further enhances their functional utility in regulated shipping environments.

The market has been growing due to increasing demand for bulk transportation of liquids, chemicals, fuels, and industrial gases. Rail tank cars have been used extensively to transport hazardous and non-hazardous fluids safely across long distances. The market has been driven by expanding industrial production, logistics optimization, and government regulations emphasizing safe and efficient bulk transportation. Advancements in tank car design, material strength, and safety systems have enhanced durability and reduced leakage risks, supporting adoption across diverse sectors including petroleum, chemical, and food processing industries.

The energy and chemical sectors have been significant drivers of the rail tank cars market due to the large-scale movement of crude oil, refined petroleum products, industrial chemicals, and liquefied gases. Rail tank cars have been preferred over road transport for bulk shipment because of higher efficiency, cost-effectiveness, and lower environmental impact. Specialized designs, such as insulated and pressure tank cars, have enabled the transportation of temperature-sensitive or pressurized materials while ensuring compliance with safety regulations. Increased exploration, production, and refinery activities in North America, the Middle East, and Asia-Pacific have amplified demand. Additionally, chemical manufacturers have leveraged rail tank cars for reliable delivery to downstream processing units, improving supply chain continuity. The focus on minimizing spillage, corrosion, and accident risks has further strengthened the adoption of high-quality rail tank cars for transporting sensitive materials across industrial networks.

Technological advancements in tank car construction have significantly influenced market growth. Modern rail tank cars have been equipped with enhanced structural integrity, crashworthiness features, and improved material strength to reduce rupture and leakage risks during transport. Coatings and linings have been optimized to prevent corrosion and contamination, extending the service life of tank cars. Monitoring systems such as temperature sensors, pressure gauges, and automated valves have been integrated to improve operational safety and reliability. Compliance with stringent international regulations and standards, including hazardous material transportation guidelines, has been achieved through these technological improvements. In addition, lightweight yet robust materials have been adopted to increase payload capacity while reducing energy consumption during transit. Such advancements have made rail tank cars safer, more durable, and more attractive to operators across energy, chemical, and industrial sectors globally.

The food and beverage industry has increasingly utilized rail tank cars to transport bulk liquids, edible oils, syrups, and other consumable liquids efficiently. Rail tank cars designed for sanitary applications have enabled compliance with hygiene standards and minimized the risk of contamination during transport. The growth of beverage production, dairy processing, and food-grade liquid manufacturing has resulted in higher demand for specialized tank cars. Temperature-controlled and insulated tank cars have allowed the safe shipment of perishable liquids over long distances. Manufacturers and logistics providers have focused on customizing tank cars for easy cleaning, quick loading and unloading, and traceability through digital monitoring systems. This trend has expanded market adoption in countries with growing food and beverage production capacities, highlighting the importance of rail tank cars as a reliable and scalable bulk liquid transport solution.

Emerging economies have presented substantial opportunities for the rail tank cars market due to expanding industrial output, infrastructure development, and increasing demand for bulk liquid logistics. Investments in railway networks and intermodal transport systems have facilitated efficient integration with ports, terminals, and road networks, improving supply chain efficiency. The rise in industrial chemicals, fuel, and agricultural liquids production in Asia-Pacific, Latin America, and the Middle East has created demand for both new and retrofitted rail tank cars. Fleet modernization programs, adoption of advanced safety features, and digital tracking technologies have strengthened operational performance in these regions. Additionally, environmental regulations promoting the shift from road to rail transport for hazardous liquids have reinforced the growth of tank car utilization. The combination of infrastructure expansion, industrial growth, and regulatory support is expected to sustain market momentum in emerging regions globally.

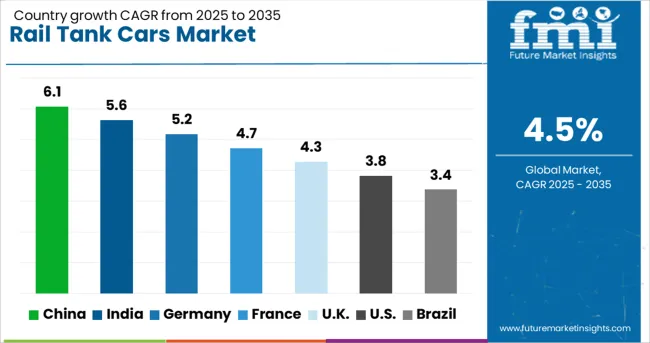

| Country | CAGR |

|---|---|

| China | 6.1% |

| India | 5.6% |

| Germany | 5.2% |

| France | 4.7% |

| UK | 4.3% |

| USA | 3.8% |

| Brazil | 3.4% |

The market is projected to grow at a CAGR of 4.5% between 2025 and 2035, fueled by rising demand for efficient bulk liquid transportation, petrochemical logistics, and chemical supply chain modernization. China leads with a 6.1% CAGR, driven by rapid industrial expansion and growing energy and chemical sectors. India follows at 5.6%, supported by modernization of freight rail infrastructure and increased liquid cargo movement. Germany, at 5.2%, benefits from well-established rail networks and regulatory focus on safe liquid transport. The UK, with a 4.3% CAGR, experiences steady adoption through industrial and logistics upgrades. The USA, at 3.8%, shows moderate growth due to modernization of existing tank car fleets. This report includes insights on 40+ countries; the top markets are shown here for reference.

The industry in China is projected to grow at a CAGR of 6.1% from 2025 to 2035, fueled by expanding chemical, petroleum, and bulk liquid transport requirements. Domestic manufacturers have been enhancing tank car design for higher volume efficiency and corrosion resistance. Investments in rail logistics hubs across Jiangsu and Shandong provinces have increased operational throughput. Companies are adopting advanced monitoring systems to ensure safety and regulatory compliance during hazardous material transport. Collaborative ventures with international engineering firms are accelerating development of high-capacity and multi-compartment tank cars.

India is expected to expand at a CAGR of 5.6% over the forecast period, driven by demand from petroleum and agrochemical logistics. Indian manufacturers are producing corrosion-resistant and multi-compartment tank cars to meet industry needs. Industrial regions such as Gujarat and Maharashtra are investing in enhanced rail loading and unloading infrastructure. Technological upgrades include sensors for real-time monitoring of pressure, temperature, and leakage. Government initiatives promoting safer hazardous material transport are also influencing fleet modernization.

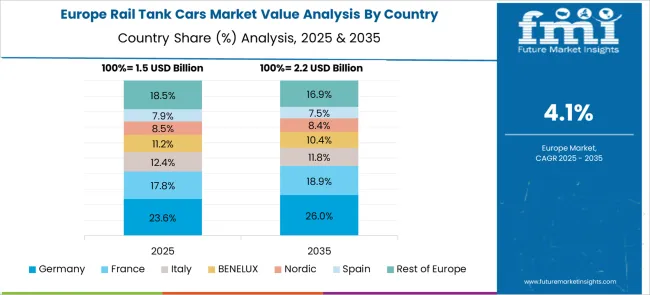

Germany’s industry is projected to grow at a CAGR of 5.2% between 2025 and 2035, supported by the chemical, fuel, and food-grade liquid transport sectors. Manufacturers are focusing on high-precision welding and modular designs to optimize capacity and safety. Adoption of digital tracking systems for fleet management is enhancing operational reliability. Partnerships between rail operators and industrial producers are expanding demand for customized tank cars for specialty chemicals and biofuels. Compliance with European safety standards is further encouraging innovation in tank car construction.

The United Kingdom is forecast to expand at a CAGR of 4.3% during 2025 to 2035, driven by the petroleum, chemical, and beverage logistics sectors. Fleet modernization is focused on improved corrosion resistance and modular tank configurations. Operators are integrating advanced telemetry for safety monitoring and real-time tracking. Demand is increasing for lightweight aluminum tank cars to reduce energy consumption and enhance transport efficiency. Industrial collaboration is fostering development of tailored solutions for bulk liquid handling.

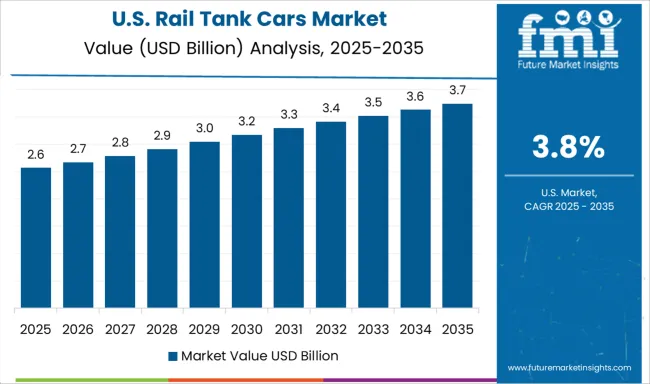

In the United States, the rail tank cars industry is anticipated to grow at a CAGR of 3.8% from 2025 to 2035, supported by demand in petroleum, chemical, and agricultural product transport. Manufacturers are enhancing corrosion resistance and implementing safety features such as pressure relief and thermal protection. Industrial hubs in Texas, Louisiana, and the Midwest are expanding rail logistics networks. Adoption of monitoring systems for leak detection and compliance with federal transport regulations is increasing. Customized tank cars for specialty chemicals and food-grade liquids are also gaining traction.

The market is dominated by established global and regional players supplying specialized rail solutions for transporting liquids, chemicals, petroleum products, and industrial gases. Alstom leverages advanced engineering to deliver high-capacity, durable tank cars with safety features tailored to hazardous material transport. CRRC focuses on modular designs and long-life steel construction, enhancing operational efficiency for bulk liquid logistics.

Trinity Industries and Wabtec provide customized rail tank solutions with corrosion-resistant coatings, meeting stringent regulatory requirements across multiple regions. The Greenbrier Companies combines fabrication expertise with aftermarket support, offering tank cars equipped with enhanced braking systems and pressure relief valves. GATX and VTG emphasize leasing models alongside manufacturing, providing flexible solutions for global supply chains.

Union Tank Car Company (UTLX) integrates digital monitoring technologies and predictive maintenance capabilities to extend service life and improve operational safety. National Steel Car and FreightCar America focus on high-strength, low-maintenance designs suitable for industrial and chemical transport applications. High capital investment, compliance with international rail safety standards, and technical expertise in metallurgy and pressure vessel design create significant entry barriers. Manufacturers advancing material technology, modular configurations, and integrated maintenance services are best positioned to meet evolving safety and efficiency demands in the rail tank car sector.

| Item | Value |

|---|---|

| Quantitative Units | USD 6.2 Billion |

| Type | DOT-111, AAR-211, DOT-117, and Others |

| Tank Pressure | Non-pressurized rail tank cars and Pressurized rail tank cars |

| Capacity | 15,000–30,000 gallons, More than 30,000 gallons, and Less than 15,000 gallons |

| Application | Oil and gas, Chemicals, Food and beverage, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Alstom, CRRC, TrinityIndustries, Wabtec, TheGreenbrierCompanies, GATX, VTG, UnionTankCarCompany(UTLX), NationalSteelCar, and FreightCarAmerica |

| Additional Attributes | Dollar sales by tank car type and cargo application, demand dynamics across petroleum, chemical, food-grade liquids, and industrial gases, regional trends in fleet expansion across North America, Europe, and Asia-Pacific, innovation in lightweight materials, corrosion-resistant coatings, and advanced monitoring systems, environmental impact of emissions, leak prevention, and end-of-life recycling, and emerging use cases in hazardous material transport, biofuel distribution, and automated logistics tracking. |

The global rail tank cars market is estimated to be valued at USD 6.2 billion in 2025.

The market size for the rail tank cars market is projected to reach USD 9.7 billion by 2035.

The rail tank cars market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in rail tank cars market are dot-111, aar-211, dot-117 and others.

In terms of tank pressure, non-pressurized rail tank cars segment to command 58.3% share in the rail tank cars market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Railway Communication Equipment Market Size and Share Forecast Outlook 2025 to 2035

Railway Rolling Stock Market Forecast and Outlook 2025 to 2035

Railway System Market Size and Share Forecast Outlook 2025 to 2035

Railway Air Conditioning System Market Size and Share Forecast Outlook 2025 to 2035

Railway Braking System Market Size and Share Forecast Outlook 2025 to 2035

Rail Transit Vehicle Glass Market Size and Share Forecast Outlook 2025 to 2035

Cars Market Size and Share Forecast Outlook 2025 to 2035

Railway CNC Wheel Lathe Market Size and Share Forecast Outlook 2025 to 2035

Rail System Dryer Market Size and Share Forecast Outlook 2025 to 2035

Railway Flatcar Market Size and Share Forecast Outlook 2025 to 2035

Rail Freight Market Size and Share Forecast Outlook 2025 to 2035

Railroad Market Size and Share Forecast Outlook 2025 to 2035

Rail Car Drying System Market Size and Share Forecast Outlook 2025 to 2035

Rail Gearbox Market Size and Share Forecast Outlook 2025 to 2035

Railway Roof Switches Market Size and Share Forecast Outlook 2025 to 2035

Tanker Truck Market Size and Share Forecast Outlook 2025 to 2035

Railway Window Market Size and Share Forecast Outlook 2025 to 2035

Railway Maintenance Machinery Market Size and Share Forecast Outlook 2025 to 2035

Rail Freight Digital Transformation Market Size and Share Forecast Outlook 2025 to 2035

Rail Logistics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA