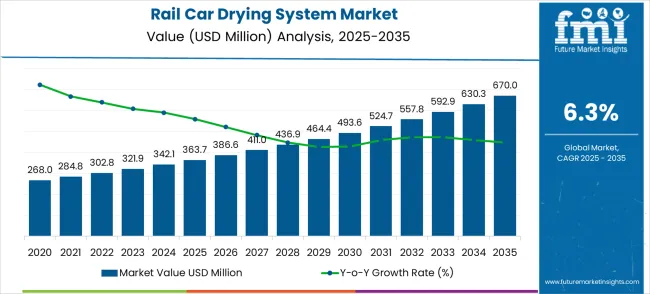

The global rail car drying system market is projected to grow from USD 363.7 million in 2025 to USD 670.0 million by 2035, recording an absolute increase of USD 306.3 million over the forecast period. This translates into a total growth of 84.2%, with the market forecast to expand at a compound annual growth rate (CAGR) of 6.3% between 2025 and 2035. The overall market size is expected to grow by nearly 1.84X during the same period, supported by the rising adoption of advanced drying technologies in rail operations and increasing demand for specialized moisture control systems following stringent operational safety requirements and equipment protection standards.

Between 2025 and 2030, the rail car drying system market is projected to expand from USD 363.7 million to USD 493.6 million, resulting in a value increase of USD 129.9 million, which represents 42.4% of the total forecast growth for the decade. This phase of growth will be shaped by rising penetration of automated drying systems in global railway operations, increasing maintenance standards requiring advanced moisture control solutions, and growing awareness among railway operators about the importance of proper equipment drying for operational reliability. Technology providers are expanding their drying system capabilities to address the growing complexity of modern rail car maintenance requirements across freight and passenger railway networks.

From 2030 to 2035, the market is forecast to grow from USD 493.6 million to USD 670.0 million, adding another USD 176.4 million, which constitutes 57.6% of the overall ten-year expansion. This period is expected to be characterized by expansion of intelligent drying technologies, integration of advanced monitoring and control systems, and development of standardized drying protocols across different railway operators. The growing adoption of predictive maintenance strategies and IoT-enabled rail car monitoring will drive demand for more sophisticated drying systems and specialized technical expertise.

Between 2020 and 2025, the rail car drying system market experienced steady expansion, driven by increasing railway modernization projects and growing awareness of moisture-related equipment failures in rail operations. The market developed as railway operators recognized the need for specialized drying equipment and maintenance procedures to properly service modern rail car systems. Regulatory agencies and railway manufacturers began emphasizing proper moisture control procedures to maintain equipment reliability standards and operational safety compliance.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 363.7 million |

| Forecast Value in (2035F) | USD 670.0 million |

| Forecast CAGR (2025 to 2035) | 6.3% |

The rail car drying system market is poised for steady expansion, projected to grow from USD 363.7 million in 2025 to USD 670.0 million by 2035, advancing at a CAGR of 6.3%, driven by efficiency gains in rail freight, passenger comfort, and safety compliance. By 2035, these pathways collectively unlock USD 280–350 million in incremental revenue opportunities.

Pathway A – Freight Railway Reliability. Desiccant-type systems ensure moisture-free cargo environments, protecting sensitive goods like chemicals, grains, and electronics. This represents a USD 90–110 million near-term opportunity.

Pathway B – Passenger Comfort & Safety. Membrane-type systems improve cabin air quality, prevent condensation-related damage, and enhance commuter experience, unlocking USD 70–90 million in growth potential.

Pathway C – Energy-Efficient Drying Technologies. Integration of smart sensors, low-energy compressors, and regenerative drying technologies reduces operational costs, creating USD 40–60 million in incremental revenue.

Pathway D – Emerging Market Adoption. Rapid railway network expansion in Asia-Pacific, Latin America, and Africa drives demand for cost-effective drying systems, representing a USD 30–45 million pool.

Pathway E – OEM Integration & Aftermarket Services. Partnerships with rolling stock OEMs and railway operators for embedded drying systems, alongside aftermarket service packages, are expected to add USD 25–35 million.

Pathway F – Environmental Responsibility & Regulatory Compliance. Systems designed to meet stricter rail safety and environmental standards—especially in Europe and North America—create a smaller but vital opportunity of USD 20–25 million.

Market expansion is being supported by the rapid increase in rail transportation demand worldwide and the corresponding need for specialized drying systems that ensure reliable rail car operation and equipment longevity. Modern railway operations rely on precise moisture control and compressed air management to ensure proper functioning of pneumatic systems including braking systems, door controls, and suspension management. Even minor moisture contamination can require comprehensive system maintenance to maintain optimal performance and safety compliance.

The growing complexity of rail car technologies and increasing safety regulations are driving demand for professional drying systems from certified equipment manufacturers with appropriate expertise and safety approvals. Railway regulatory agencies are increasingly requiring proper maintenance documentation following service activities to maintain operating permits and ensure safety standard compliance. Maintenance specifications and safety requirements are establishing standardized drying procedures that require specialized equipment and trained maintenance personnel.

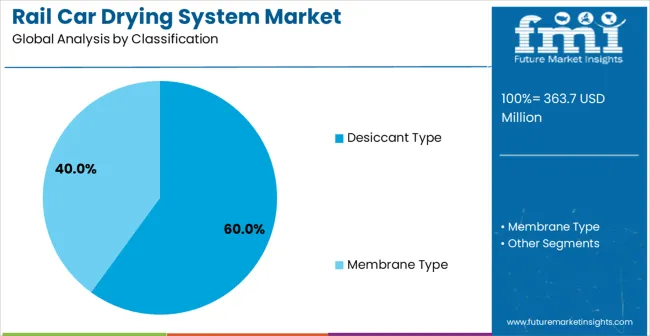

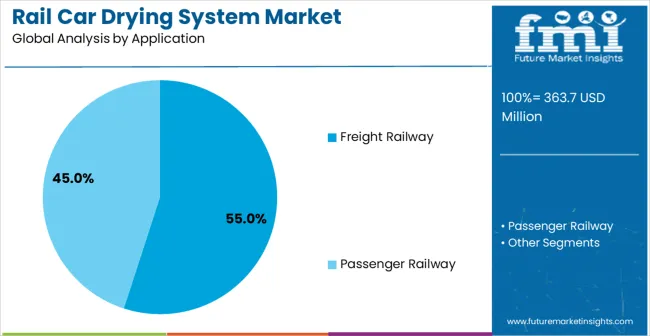

The market is segmented by system type, end-use, and region. By system type, the market is divided into desiccant type and membrane type. Based on end-use application, the market is categorized into freight railway and passenger railway. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

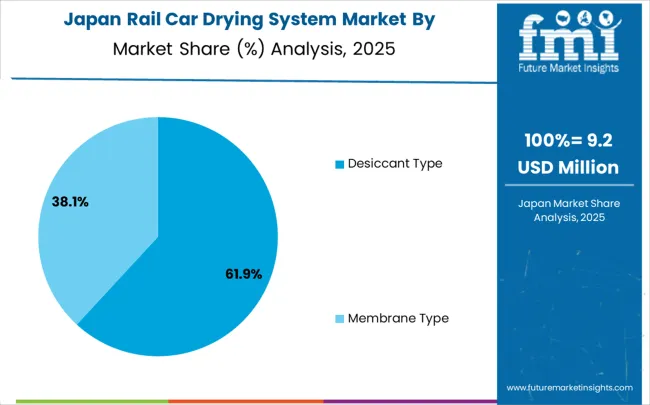

Desiccant type systems are expected to account for 60% of the rail car drying system market in 2025, consolidating their position as the preferred moisture control solution. These systems are widely adopted in railway maintenance for their ability to effectively remove moisture from compressed air systems. Desiccant systems utilize advanced absorption technologies and reliable regeneration processes, making them ideal for maintaining rail car pneumatic systems, particularly in high-performance applications like brake systems and suspension controls. The technology’s ability to operate effectively under varying temperature conditions further strengthens its role in diverse railway environments. As railway operators continue to prioritize efficiency and equipment longevity, desiccant systems remain integral to the effective maintenance of rail car performance.

The freight railway operations segment is projected to represent 55% of the rail car drying system market in 2025, establishing it as the dominant end-use category. Freight operators increasingly rely on rail car drying systems to maintain optimal performance and prevent moisture-related issues, such as rusting, contamination, or operational disruptions. These systems are essential for ensuring that freight cars, especially those used for transporting perishable goods, remain dry and maintain the quality of the cargo. The segment is fueled by rising transportation volumes, stringent environmental regulations, and the increasing demand for efficient rail freight solutions. As logistics companies prioritize operational efficiency, rail car drying systems are expected to remain integral to freight operations, reinforcing their market dominance in the coming years.

The Rail Car Drying System market is advancing steadily due to increasing railway modernization activities and growing recognition of moisture control importance. However, the market faces challenges including high equipment installation costs, need for continuous training on new drying technologies, and varying maintenance requirements across different railway operators. Standardization efforts and certification programs continue to influence equipment quality and market development patterns.

The growing deployment of smart monitoring systems is enabling automated moisture control at railway maintenance facilities, service centers, and operational depots. Intelligent drying units equipped with advanced sensor networks provide real-time performance monitoring and predictive maintenance capabilities for operators while expanding equipment manufacturer service offerings. These systems are particularly valuable for high-utilization railway operations and large-scale maintenance facilities that require continuous moisture control without operational disruption.

Modern drying system manufacturers are incorporating advanced energy recovery systems and automated optimization controls that improve operational efficiency and reduce energy consumption. Integration of heat recovery systems and intelligent control algorithms enables more precise moisture removal procedures and comprehensive energy management. Advanced technologies also support integration with renewable energy sources and maintenance practices including waste heat utilization and energy-efficient operation cycles.

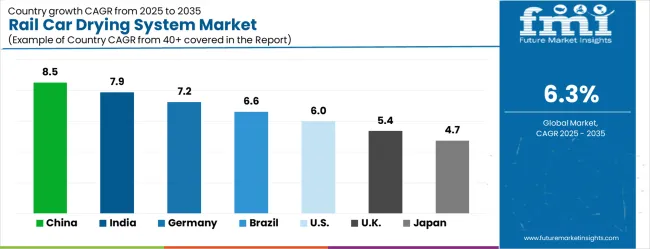

| Country | CAGR (2025-2035) |

|---|---|

| China | 8.5% |

| India | 7.9% |

| Germany | 7.2% |

| Brazil | 6.6% |

| United States | 6.0% |

| United Kingdom | 5.4% |

| Japan | 4.7% |

The rail car drying system market is growing rapidly, with China leading at an 8.5% CAGR through 2035, driven by massive railway infrastructure expansion, high-speed rail development, and expanding maintenance facility networks. India follows at 7.9%, supported by railway modernization initiatives and increasing freight transportation automation requirements. Germany grows steadily at 7.2%, emphasizing precision engineering, quality standards, and advanced rail technology expertise. Brazil records 6.6%, integrating drying technology into its expanding railway infrastructure development. The United States shows growth at 6.0%, focusing on freight rail efficiency, safety standards, and maintenance technology advancement. The United Kingdom demonstrates growth at 5.4%, supported by rail network modernization and passenger service improvements. Japan maintains expansion at 4.7%, driven by precision maintenance requirements and operational excellence standards. Overall, China and India emerge as the leading drivers of global Rail Car Drying System market expansion.

The report covers an in-depth analysis of 40+ countries with top-performing countries highlighted below.

The rail car drying system market in China is projected to grow at a CAGR of 8.5% from 2025 to 2035. The demand for rail car drying systems in China is increasing due to the rapid growth in rail transportation infrastructure, driven by the country’s ambitious plans for high-speed rail and freight network expansion. As China continues to modernize its railways, there is a significant need for efficient drying systems to ensure the operational efficiency and longevity of rail cars. The increasing frequency of both passenger and freight trains requires advanced drying solutions to reduce maintenance costs and improve turnaround times. China's industrial growth and the rising volume of freight shipments are contributing to the expanding demand for rail car drying systems.

The rail car drying system market in India is set to grow at a CAGR of 7.9% from 2025 to 2035, driven by the country’s continuous efforts to modernize its railway infrastructure. The Indian government’s push for upgrading rail systems and improving operational efficiency is fueling the demand for advanced drying technologies. India’s vast railway network, one of the largest in the world, requires regular maintenance and care to ensure smooth operations, including the use of drying systems to avoid rust and corrosion. As freight transportation and logistics continue to grow in India, efficient rail car drying becomes essential for preventing delays and optimizing service levels. Additionally, the rise in passenger travel also calls for systems that can reduce downtime and improve railcar performance.

The rail car drying system market in Germany is expected to grow at a CAGR of 7.2% from 2025 to 2035. As a leader in the global rail transport industry, Germany’s demand for rail car drying systems is propelled by the country’s commitment to improving railway infrastructure and operational efficiency. Germany's advanced rail systems are increasingly focused on minimizing operational costs while maximizing efficiency, and the need for innovative drying systems plays a critical role in these objectives. Germany’s railways are also integrating advanced technologies to improve both passenger and freight operations, including state-of-the-art drying solutions that reduce downtime and maintenance costs. Environmental regulations are pushing German rail operators to adopt energy-efficient drying technologies.

The rail car drying system market in Brazil is expected to expand at a CAGR of 6.6% from 2025 to 2035, driven by the country’s expanding rail network and increasing demand for freight transportation. Brazil's rail network, particularly in the freight sector, has seen consistent growth due to the rise in agricultural exports and the need for efficient cargo transport. As Brazil works to modernize its rail infrastructure and improve the efficiency of rail freight services, rail car drying systems are becoming essential for maintaining the quality and durability of cars. The government’s focus on infrastructure development, especially in the transportation and logistics sectors, is likely to drive market demand. The growing demand for more efficient, environmentally friendly technologies is fueling the adoption of modern drying solutions in the country.

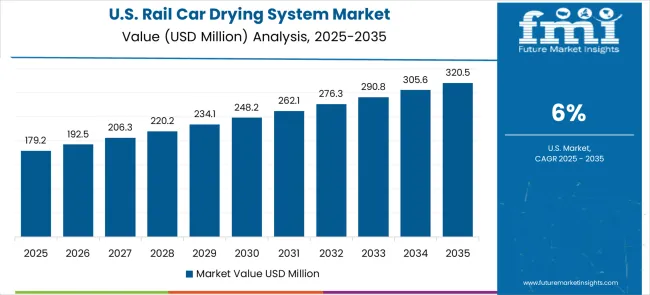

The rail car drying system market in the United States is expected to grow at a CAGR of 6.0% from 2025 to 2035. The USA is one of the largest rail operators globally, with extensive passenger and freight rail networks. The need to improve operational efficiency and reduce maintenance costs is a key factor driving the demand for rail car drying systems. In particular, the USA market is seeing an increase in the adoption of advanced drying technologies as operators seek to reduce downtime and improve the turnaround time of rail cars. Environmental regulations and a focus on reducing energy consumption are encouraging the adoption of more energy-efficient drying solutions.

The rail car drying system market in the United Kingdom is projected to grow at a CAGR of 5.4% from 2025 to 2035. The UK rail sector is focused on improving operational efficiency, with the adoption of advanced technologies such as automated drying systems becoming crucial. The government’s focus on modernizing the rail infrastructure and increasing the frequency of train services is leading to a growing demand for drying solutions that can enhance performance and reduce maintenance. The increase in passenger and freight rail transportation in the UK is contributing to the need for efficient and cost-effective drying systems.

The rail car drying system market in Japan is projected to grow at a CAGR of 4.7% from 2025 to 2035. Japan is known for its technologically advanced rail systems, particularly its high-speed trains. The market for rail car drying systems is driven by the increasing need for efficient maintenance and a focus on minimizing downtime to keep trains running on schedule. Japan’s high-speed rail network, which is critical to both passenger and freight transport, requires cutting-edge drying technologies to maintain operational efficiency. The demand for environmentally friendly solutions in Japan’s rail sector is pushing the market towards energy-efficient drying technologies.

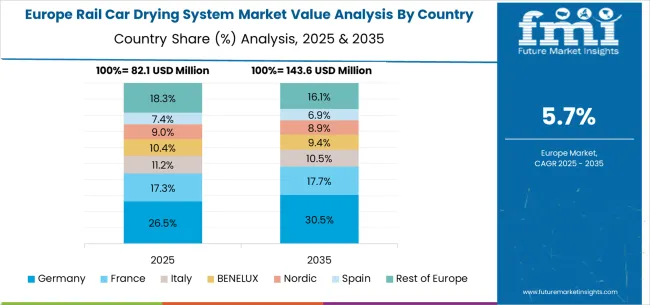

The rail car drying system market in Europe is projected to grow from USD 82.1 million in 2025 to USD 143.6 million by 2035, registering a CAGR of 5.7% over the forecast period. Germany will remain the leader, increasing from 26.5% in 2025 to 30.5% by 2035, supported by its advanced rail technology sector, railway electrification, and robust railway manufacturing ecosystem. France will hold 17.3% in 2025, softening slightly to 17.7% by 2035, reflecting steady adoption in passenger and freight rail modernization. Italy will represent 11.2% in 2025, declining slightly to 10.5% by 2035, reflecting moderate but stable adoption in rail equipment upgrades.

The BENELUX region will account for 10.4% in 2025, easing to 9.4% by 2035, reflecting consolidation in regional railway supply hubs. The Nordic countries will hold 9.0% in 2025, nearly steady at 9.5% by 2035, reflecting adoption driven by strong railway electrification programs and stringent rail safety standards. Spain will contribute 7.4% in 2025, softening to 6.9% by 2035, reflecting slower adoption in its rail modernization programs. Meanwhile, the Rest of Europe will decline from 18.3% in 2025 to 16.1% by 2035, reflecting slower growth in Eastern European railway modernization compared to Western Europe.

The rail car drying system market is defined by competition among specialized equipment manufacturers, railway technology companies, and industrial automation providers. Companies are investing in advanced drying technologies, intelligent monitoring capabilities, regulatory compliance, and technical support services to deliver reliable, efficient, and cost-effective drying solutions. Strategic partnerships, technological innovation, and geographic expansion are central to strengthening product portfolios and market presence.

Wabtec Corporation, United States-based, offers comprehensive rail car drying solutions with a focus on operational reliability, safety compliance, and technical expertise. Hedson Technologies provides specialized drying equipment integrated with railway maintenance technologies. Atlas Copco emphasizes advanced compressed air and drying solutions with global service capabilities. Norgren (IMI Precision Engineering) delivers precision pneumatic and drying systems with extensive railway applications.

AVENTICS (Emerson) offers drying solutions integrated into comprehensive automation portfolios. Tsunami Trident Pneumatics Pvt. Ltd. provides specialized drying systems for regional railway markets. Eldridge USA delivers maintenance equipment and drying solutions with technical support. Meier Prozesstechnik, SolvAir, and Graham-White offer specialized drying expertise, proven technologies, and equipment reliability across global and regional railway networks.

| Items | Values |

|---|---|

| Quantitative Units(2025) | USD 363.7 million |

| System Type | Desiccant Type Systems, Membrane Type Systems, and Hybrid Drying Solutions |

| End-Use | Freight Railway Operations, Passenger Railway Services, and Specialized Rail Applications |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Wabtec Corporation, Atlas Copco, Norgren (IMI Precision Engineering), AVENTICS (Emerson), Eldridge USA, Meier Prozesstechnik, Graham-White |

| Additional Attributes | Dollar sales by system type, end-use application, and technology platform, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established equipment manufacturers and emerging technology providers, buyer preferences for conventional versus advanced drying systems, integration with digital maintenance monitoring platforms and predictive maintenance systems |

The global rail car drying system market is estimated to be valued at USD 363.7 million in 2025.

The market size for the rail car drying system market is projected to reach USD 670.0 million by 2035.

The rail car drying system market is expected to grow at a 6.3% CAGR between 2025 and 2035.

The key product types in rail car drying system market are desiccant type and membrane type.

In terms of application, freight railway segment to command 55.0% share in the rail car drying system market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Railway Communication Equipment Market Size and Share Forecast Outlook 2025 to 2035

Railway Rolling Stock Market Forecast and Outlook 2025 to 2035

Rail Transit Vehicle Glass Market Size and Share Forecast Outlook 2025 to 2035

Railway CNC Wheel Lathe Market Size and Share Forecast Outlook 2025 to 2035

Rail Freight Market Size and Share Forecast Outlook 2025 to 2035

Railroad Market Size and Share Forecast Outlook 2025 to 2035

Rail Gearbox Market Size and Share Forecast Outlook 2025 to 2035

Railway Roof Switches Market Size and Share Forecast Outlook 2025 to 2035

Railway Window Market Size and Share Forecast Outlook 2025 to 2035

Railway Maintenance Machinery Market Size and Share Forecast Outlook 2025 to 2035

Rail Freight Digital Transformation Market Size and Share Forecast Outlook 2025 to 2035

Rail Logistics Market Size and Share Forecast Outlook 2025 to 2035

Railway Control Stands Market Size and Share Forecast Outlook 2025 to 2035

Railway Horn Market Size and Share Forecast Outlook 2025 to 2035

Railway Axlebox Housing Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Railway After-Cooler Market - Growth & Demand 2025 to 2035

Rail Brace Market Analysis - Size, Share & Forecast 2025 to 2035

Railway Fishplate Market Growth – Trends & Forecast 2025 to 2035

Railway Coupler Market Growth & Demand 2025 to 2035

Railway Generators Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA