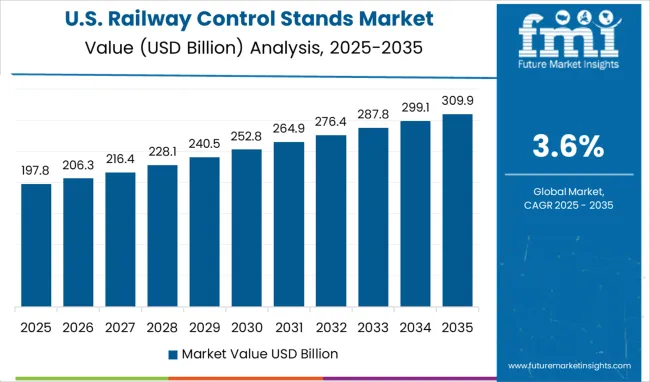

The Railway Control Stands Market is estimated to be valued at USD 1.6 billion in 2025 and is projected to reach USD 2.4 billion by 2035, registering a compound annual growth rate (CAGR) of 3.6% over the forecast period.

The railway control stands market is witnessing gradual yet steady expansion as modernization initiatives in rail infrastructure and vehicle fleets gain momentum globally. The emphasis on improving operator ergonomics, safety standards, and operational efficiency has encouraged railway operators to adopt advanced control stand solutions.

Rising investments in urban rail projects, coupled with technological advancements in mechatronics and human machine interfaces, have enhanced the functionality and appeal of modern control stands. Future growth prospects are expected to be shaped by growing demand for automation compatible designs, integration of digital diagnostics, and compliance with stringent regulatory frameworks.

Industry focus on enhancing the lifecycle performance of rail vehicles and minimizing downtime is paving the way for wider adoption of modular and customizable control stand configurations that cater to diverse operational needs.

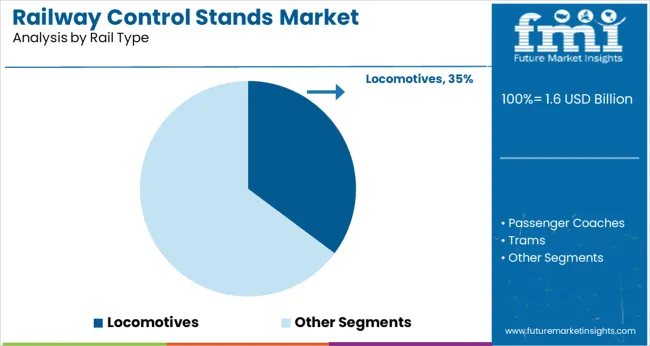

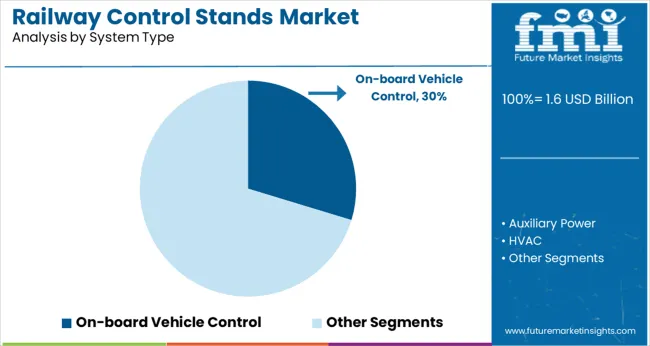

The market is segmented by Rail Type and System Type and region. By Rail Type, the market is divided into Locomotives, Passenger Coaches, Trams, Meters, and Freight Wagon. In terms of System Type, the market is classified into On-board Vehicle Control, Auxiliary Power, HVAC, Propulsion, Train Information, and Train Safety.

Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by rail type, locomotives are projected to hold 35.2% of the total market revenue in 2025, establishing themselves as the leading rail type segment. This leadership is attributed to the extensive deployment of locomotives in freight and long haul passenger operations which demand robust and versatile control solutions.

The locomotive segment has benefited from sustained investment in fleet renewal programs and retrofitting projects aimed at enhancing performance, fuel efficiency, and operator comfort. The ability of locomotive control stands to accommodate advanced control modules and ergonomic enhancements has reinforced their widespread adoption.

Moreover, the durability and adaptability required for diverse terrains and operational conditions have made locomotive specific control stands the preferred choice, maintaining their dominant share within the market.

In terms of system type, on board vehicle control is expected to account for 29.7% of the market revenue in 2025, positioning it as the top system type segment. This prominence is underpinned by the critical role of on board control systems in ensuring seamless interaction between the operator and vehicle subsystems during operation.

Adoption of on board vehicle control solutions has been accelerated by the need for integrated monitoring, real time feedback, and improved fault detection capabilities. Enhanced focus on operator safety and efficiency, coupled with increasing demand for intelligent control mechanisms, has reinforced the growth of this segment.

Additionally, the trend toward digitization and the integration of advanced electronics into vehicle cabins has enabled the development of more compact and efficient on board control solutions, further consolidating their leadership in the market.

By 2035, the railway control stands are predicted by FMI to reach over USD 1.6 million. It is estimated that the global railway control stands market share increased by 3.6% in the first half of 2025, which is a market share valued at USD 1.4 million. Though not equally distributed throughout all regions, this growth is stronger in developing markets. From 2020 to 2025, the railway control stands market was predicted to expand at a sluggish CAGR of 1.9%.

There is an increasing trend among governments across the world to invest in the improvement of railway infrastructure through the integration of new technologies. These efforts are aimed at improving operational efficiency. In addition, governments are developing technologically advanced trains and train monitoring systems.

However, installation and maintenance costs associated with railway control stands are expected to constrain market growth. The complexity of railway control and management solutions is also expected to slow adoption in the coming years.

Railway Control Stands Market:

| Attributes | Railway Control Stands Market |

|---|---|

| CAGR (2025 to 2035) | 3.6% |

| Market Value (2035) | USD 1834.67 million |

| Growth Factor | Increasing investments in railway infrastructure development to boost sales of railway control stands. |

| Opportunity | The demand and preference for safe, secure, and efficient transportation are creating opportunities for the railway control stands market. |

Train Control and Management Systems Market:

| Attributes | Train Control and Management Systems Market |

|---|---|

| CAGR (2025 to 2035) | 2.1% |

| Market Value (2035) | USD 5460 million |

| Growth Factor | Increasing investments & supportive government initiatives to boost growth. |

| Opportunity | Increasing investments in emerging regions to showcase productive future opportunities for key players. |

Railway Telematics Market:

| Attributes | Railway Telematics Market |

|---|---|

| CAGR (2025 to 2035) | 7.5% |

| Market Value (2035) | USD 18900 million |

| Growth Factor | The growing demand for the digitalization of railcar tracking and increasing rail freight transportation to boost sales. |

| Opportunity | Government authorities globally are investing in various smart city projects to improve transportation infrastructure, further creating opportunities. |

Increase in the Allocation of Budget for the Development of Railways

In emerging economies such as India and China, increased budgets are allocated to the development of their railway infrastructure. Accordingly, India allocated USD 1.4 billion for its railway sector in 2020 compared to USD 1.4 billion in 2020, an increase of 13%. Similarly, several countries around the world are continuously investing in their rail infrastructure and deploying the latest technologies.

For instance, in Saskatchewan, Canadian National Railways (CN) plans to invest USD 2.92 billion to enhance railway infrastructure. As a result, budget allocation is a major factor propelling the growth of the railway sector, which, in turn, is boosting the market for railway control stands.

Technological Advancement

The advent of technological advancements has resulted in the incorporation of high-speed rails and metro systems throughout the world. Some rails run at much higher speeds than traditional rails, with some of them being capable of reaching speeds of 200 km/hr. These rails operate at much higher speeds than traditional rails.

Owing to these mass rapid transit systems that can operate at high speeds, there seems to be an increasing concern about human safety and security. This has created a need for efficient control stands in these rail systems, resulting in a growing market for railway control stands.

Rapid Urbanization

It is a fact that rapid urbanization has improved the quality of living in many countries around the globe, especially those in developing countries. As urbanization grows in number and importance, the need for fast and efficient modes of transportation has increased. For this reason, governments around the world have been adopting high-speed trains and metros to provide mass transit services that are both time-efficient and cost-effective.

The railway control stand is an integral component of these railway systems. The government's initiatives to either embrace railway control solutions for their new rapid transit systems or to upgrade their current control systems to include these solutions have a beneficial impact on the market growth for railway control stands.

High Capital Expenditures, High Infrastructure, and Maintenance Costs

Installation of railway control stands is a complex process, as it requires the integration of several hardware components according to their technological compatibility. This installation or integration also requires adequate infrastructure. In addition to the infrastructure cost, maintenance costs are quite high for these systems. As a result, the high infrastructure and maintenance costs of these systems limit their adoption to some extent, limiting their market growth.

As an example, Indian railways announced in April 2020 that it was ready to launch the country's first 12,000 horsepower (HP) electric locomotive. The total cost of rolling out 800 high-horsepower locomotives over 11 years is expected to be around USD 200 billion, with the average locomotive costing USD 250 million. As a result, the railway control stands market is hindered by the high capital requirements associated with building and maintaining the train network.

An Increase in Demand for a Secure, Safe, and Efficient Transport System

In addition to being secure and cost-effective, railway transportation is the fastest-growing mode of transportation. The newest trains have cameras, sensors, and communication devices on board. Additionally, underground or ground-level trains are highly secured by fences and walls to prevent trespassing in most locations, promoting the growth of this market.

In addition, today's trains consume less energy due to their advanced acceleration, traction, and braking systems. This results in the reduction of energy consumption by around 30% based on the degree of automation. Additionally, these trains offer a flexible way to coordinate in terms of frequency, which raises the performance of the system overall and supports the expansion of the railway sector. As a result, the demand and preference for safe, secure, and efficient transportation are creating opportunities for the railway control stands market.

Based on rail type, the market is categorized into passenger coaches, trams, locomotives, metros & freight wagons. The freight wagons segment is expected to account for the largest market share of 35.6% during the forecast period.

Governments around the world are promoting public transportation, which is expected to have a significant impact on freight wagon growth. A variety of factors are supporting the growth of the global freight wagons market, from increasing government initiatives to increased preference for public transportation.

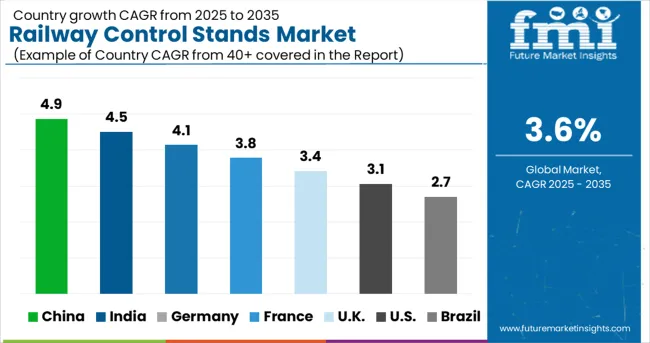

Asia Pacific region is projected to emerge as a promising market for railway control stands across the forecast period. This region is experiencing a high level of demand due to increased investments in railway infrastructure by economies such as India, China, and Japan. Increasing railway budgets in these economies may also favor shipments of railway control stands. Increasing urbanization in the aforementioned regions is also expected to positively influence sales of railway control stands.

Governments in developing countries are making significant investments to meet the latest end-use requirements for autonomous trains. As an example, India invested USD 1.4 billion in 2020 toward infrastructure development to meet the latest automation demand and is expected to invest a further USD 1.6 billion by 2025 to fulfill the required infrastructure requirements, which include railway infrastructure development. This is anticipated to offer numerous opportunities for railway control stands in the country.

North American railway control stands accounted for the largest share. Increasing customer demands for comfort and safety have led OEMs based in North America to produce locomotives for a wide range of trains, including light rail, tramways, metros, and conventional trains. Many emerging players offer advanced railway control stations in the region. Thermo King, a railway system manufacturer based in the USA, delivers HVAC systems that can remove viruses from the air in driver cabins.

Due to the huge area of these countries and the long distance traveled for goods and passengers, diesel locomotives are mostly used in the USA and Canada. As a result, electric locomotives would incur significantly higher infrastructure costs. In the United States, rolling stock is mostly used for freight transportation, while airlines are primarily used for passenger transportation.

| Countries | Statistics |

|---|---|

| United States | The railway control stands in the USA holds the maximum number of shares and has registered a market share of 18.4%. Recent years have seen the development, expansion, and modernization of existing transportation modes undertaken by the USA government. USA railways are being improved with enhanced safety systems and funding is being allocated to complete pending projects to promote rail passenger transportation. The railway system may be redesigned with the help of USD 80 billion in federal funding as part of the USA President’s USD 2.3 trillion infrastructure modernization plan. |

| Germany | Europe is identified to hold a significant market share of 4.8% in the railway control stands. In Germany, urban planners and local governments are merging rapid transit and tramway infrastructure with existing infrastructure. Additionally, commuters are seeking eco-friendly, reliable, and cost-effective transportation options. Germany, for example, is actively promoting the use of rapid transit systems to reduce traffic congestion. |

| China | China is projected to advance at a moderate pace, registering a CAGR of 4.2%. China has witnessed the strongest growth among the other world leaders, with CRCC, CRSC, and CREC capturing 20-25% of the global signaling, rail control, and electrification market. A major reason for this expansion is the expansion of the railway network, which has grown from 75,000 km in 2005 to 150,000 km by 2024. |

Numerous Opportunities for Emerging Players in Railway Control Stands Dynamics

A significant growth opportunity exists for the emerging players operating in the global market due to the improvement in infrastructure in developing nations and the growth in mining and industrial activities. Moreover, through the introduction of enhanced products, new entrants to railway control stands are gaining a competitive advantage and leveraging advancements in technology.

To remain competitive, these firms invest continually in research and development activities to keep up with consumer preferences and end-use industry requirements. Efforts are being made to strengthen their foothold in the industry. In addition to increasing their visibility within the forum, this will also enhance the further development of the railway control stands.

Key players operating the global railway control stand market include:

Key Developments for Railway Control Stands Market

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | billion for Value and MT for Volume |

| Key Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Oceania; and the Middle East & Africa |

| Key Countries Covered | USA, Canada, Brazil, Mexico, Chile, Peru, Germany, United Kingdom, Spain, Italy, France, Russia, Poland, China, India, Japan, Australia, New Zealand, GCC Countries, North Africa, South Africa, and Turkey |

| Key Segments Covered | Rail Type, System Type, Region |

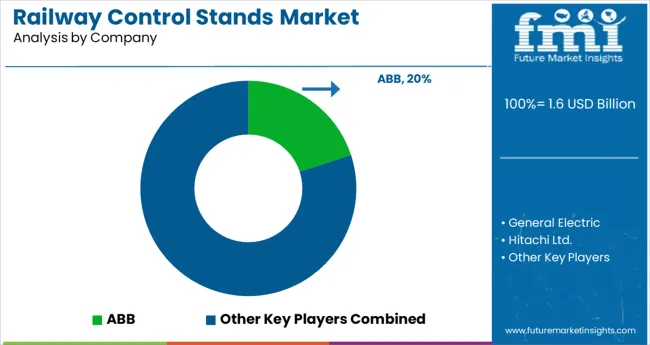

| Key Companies Profiled | Asea Brown Boveri (ABB); General Electric; Hitachi Ltd.; Mitsubishi Electric Corporation; Alstom SA; Bombardier Inc.; MEN Mikro Elektronik GmbH; Siemens AG; DEUTA-WERKE GmbH; EKE Group; Strukton Rail; Toshiba Corporation; Thales Group |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global railway control stands market is estimated to be valued at USD 1.6 billion in 2025.

It is projected to reach USD 2.4 billion by 2035.

The market is expected to grow at a 3.6% CAGR between 2025 and 2035.

The key product types are locomotives, passenger coaches, trams, meters and freight wagon.

on-board vehicle control segment is expected to dominate with a 29.7% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Railway Communication Equipment Market Size and Share Forecast Outlook 2025 to 2035

Railway Rolling Stock Market Forecast and Outlook 2025 to 2035

Railway System Market Size and Share Forecast Outlook 2025 to 2035

Railway Air Conditioning System Market Size and Share Forecast Outlook 2025 to 2035

Railway Braking System Market Size and Share Forecast Outlook 2025 to 2035

Railway CNC Wheel Lathe Market Size and Share Forecast Outlook 2025 to 2035

Railway Flatcar Market Size and Share Forecast Outlook 2025 to 2035

Railway Roof Switches Market Size and Share Forecast Outlook 2025 to 2035

Railway Window Market Size and Share Forecast Outlook 2025 to 2035

Railway Maintenance Machinery Market Size and Share Forecast Outlook 2025 to 2035

Railway Horn Market Size and Share Forecast Outlook 2025 to 2035

Railway Axlebox Housing Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Railway After-Cooler Market - Growth & Demand 2025 to 2035

Railway Fishplate Market Growth – Trends & Forecast 2025 to 2035

Railway Coupler Market Growth & Demand 2025 to 2035

Railway Generators Market Growth - Trends & Forecast 2025 to 2035

Railway Draft Gears Market Growth – Trends & Forecast 2025 to 2035

Railway Emergency Valves Market Trends and Forecast 2025 to 2035

Railway Air Filter Market – Growth & Demand 2025 to 2035

Railway Traction Motor Market Growth – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA