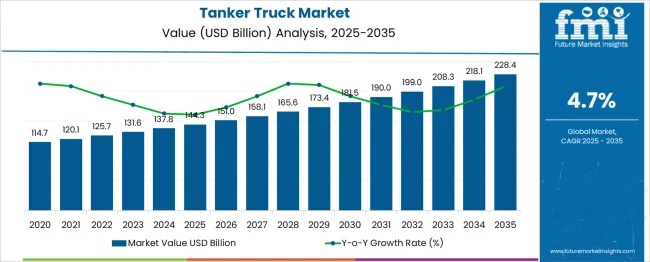

The Tanker Truck Market is estimated to be valued at USD 144.3 billion in 2025 and is projected to reach USD 228.4 billion by 2035, registering a compound annual growth rate (CAGR) of 4.7% over the forecast period. Throughout this period, a stable upward curve has been observed, absent of traditional trough phases that typically indicate sharp contractions. The incremental increases remain steady year-over-year, indicating an elastic response to industrial liquid transport demand and fleet modernization strategies. No specific year exhibits any contraction or plateauing behavior, which positions the market in a consistent growth regime with minor fluctuations in momentum. While peak years are marked by substantial absolute gains most notably in 2035—the absence of sharp dips highlights a lack of cyclicality or external disruption. The market's structure suggests that demand for fuel, chemicals, and food-grade liquid transportation services has remained constant.

The peak-to-trough ratio over the decade stands at approximately 1.58x, with growth distributed uniformly across the 11-year timeline. The absence of a pronounced trough also signals that regional demand from infrastructure, oilfield logistics, and government contracting did not experience notable downcycles. With tanker manufacturers optimizing vehicle efficiency and operators scaling capacity, the market enters 2035 with reinforced momentum and minimal signs of reversal or saturation.

| Metric | Value |

|---|---|

| Tanker Truck Market Estimated Value in (2025 E) | USD 144.3 billion |

| Tanker Truck Market Forecast Value in (2035 F) | USD 228.4 billion |

| Forecast CAGR (2025 to 2035) | 4.7% |

The tanker truck market is experiencing steady expansion driven by increased logistics demand, regulatory focus on safe liquid transportation, and ongoing upgrades in fleet technology. The surge in petroleum product distribution, chemical handling, and food-grade liquid transport has raised the need for customized tanker configurations. Infrastructure investment in rural and industrial supply chains is further supporting regional tanker deployment.

In addition, tightening emission norms and fuel efficiency targets are influencing vehicle procurement strategies across operators. Market participants are responding with design innovation focused on lightweight materials, modular tank construction, and digital fleet tracking systems.

The rising importance of corrosion resistance, payload optimization, and regulatory compliance is also shaping material and capacity decisions. Looking ahead, the industry is likely to benefit from expanded use in agriculture and construction sectors as tanker trucks evolve to meet diverse application requirements under dynamic environmental and regulatory conditions.

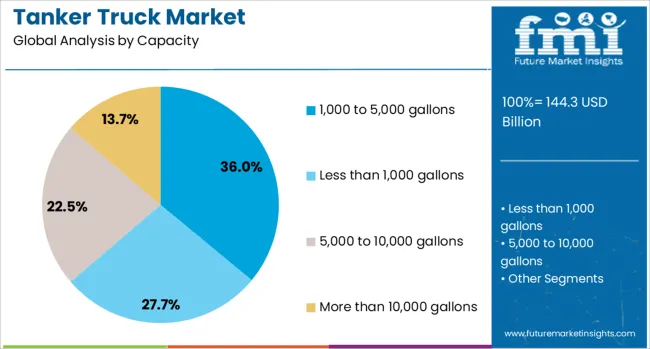

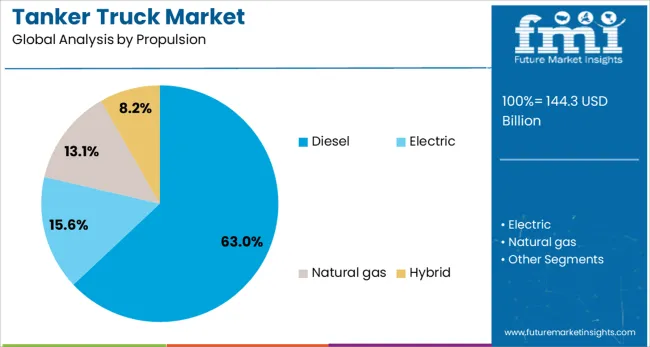

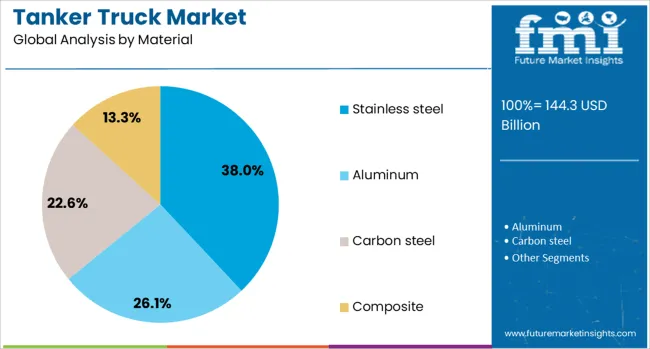

The tanker truck market is segmented by capacity, propulsion, material, application, and geographic regions. The tanker truck market is divided into 1,000 to 5,000 gallons, Less than 1,000 gallons, 5,000 to 10,000 gallons, and More than 10,000 gallons. In terms of propulsion, the tanker truck market is classified into Diesel, Electric, Natural gas, and Hybrid. Based on the material, the tanker truck market is segmented into Stainless steel, Aluminum, Carbon steel, and Composite. The tanker truck market is segmented by type into Multi-axle tankers, Single-axle tankers, and Articulated tankers. The tanker truck market is segmented into Oil & gas, Chemicals, Food and beverages, Water, Industrial liquids, Dry bulk goods. Regionally, the tanker truck industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The 1,000 to 5,000 gallons segment is projected to lead the capacity category with a 36.00% revenue share in 2025. This dominance is attributed to its operational versatility in short to mid-haul deliveries across municipal, fuel distribution, and chemical transport applications.

The segment’s manageable size allows efficient maneuvering in urban and semi-urban areas, while also meeting route-specific weight regulations. Fleet operators prefer this range for its balance between payload capacity and cost efficiency, especially in fragmented logistics networks.

The size also supports faster loading-unloading cycles, crucial for industries requiring high service frequency. As infrastructure in Tier-II and Tier-III cities expands, the need for flexible capacity vehicles is reinforcing the growth of this segment.

Diesel propulsion is expected to account for 63.00% of the revenue share in 2025, maintaining its position as the primary power source in tanker trucks. The segment’s leadership is reinforced by diesel engines' high torque output and fuel efficiency under heavy-load conditions.

Long-standing availability of diesel infrastructure, favorable power-to-weight ratios, and proven reliability in demanding terrains make diesel propulsion the default choice for operators prioritizing operational uptime. Despite emerging interest in electric and hybrid alternatives, diesel continues to dominate in sectors where range, refueling time, and load capacity remain critical.

The segment is also benefiting from advancements in cleaner diesel technology and emission control systems, keeping it aligned with evolving regulatory standards.

Stainless steel is set to command 38.00% of the market share by material in 2025, driven by its durability, non-reactivity, and hygienic properties. This material is preferred across industries such as food-grade liquids, dairy, and chemicals due to its corrosion resistance and ease of cleaning.

Operators are favoring stainless steel tanks for their extended lifecycle, structural strength, and ability to maintain product integrity during transport. The rising emphasis on safety, compliance with food and pharma transport standards, and sustainability goals is boosting its adoption.

In addition, its recyclability and reduced maintenance requirements make stainless steel a cost-effective long-term investment, especially in high-frequency usage applications.

Operational focus on short- and long-haul logistics in both rural and urban networks has expanded vehicle deployment across developing economies. Medium-capacity tankers are being preferred due to their maneuverability and cost optimization. Equipment upgrades in insulation, chassis compatibility, and pressure control have strengthened industry compliance, while fleet standardization trends continue influencing procurement and service-level upgrades across both public and private applications.

Tanker trucks transporting fuels, food-grade liquids, water, and chemicals remain indispensable to regional logistics. Vehicles with capacities between 5,000 and 10,000 gallons account for the highest demand due to their operational flexibility. Petroleum-based transport accounted for over 45% of the total deployment in 2024, with demand surging in last-mile delivery networks. Stainless steel and aluminum tanks have been used widely across chemical and dairy sectors due to corrosion resistance and hygiene. Demand from water supply utilities, refineries, and mobile fueling operators continues to stimulate procurement across OECD and ASEAN economies.

Diesel-based tanker trucks have remained dominant due to load-carrying efficiency and refueling infrastructure availability. Over 68% of global tanker trucks used diesel engines in 2024. However, compressed natural gas and electric propulsion vehicles have gained traction across regulated freight corridors. Single-compartment and multi-compartment configurations have been widely adopted to address payload segregation across hazardous and non-hazardous categories. Safety instrumentation, such as remote emergency shutoff and rollover prevention valves, has been integrated. OEMs have adapted specifications to regional gradients, axle load regulations, and tank stability metrics, enhancing equipment deployment in challenging terrain and climates.

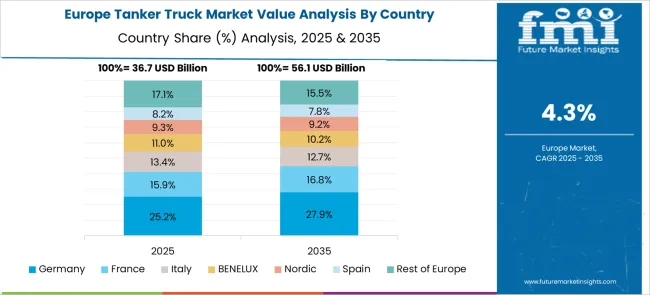

Asia Pacific remained the fastest-expanding region, with increasing investments in petrochemical supply chains and water logistics in India, Indonesia, and Vietnam. North America continued to account for over 30% of total market share, backed by fuel transport demand and replacement cycles for aging fleets. Europe maintained steady growth due to deployment in chemical, dairy, and municipal services. Latin American growth has been led by the mining and construction sectors. In the Middle East, cross-border refined oil and gas transport has supported rising tanker demand despite regulatory fragmentation across borders.

Fleet operators face challenges related to driver shortages, fluctuating fuel input costs, and increasingly complex regional safety mandates. Small and medium enterprises in logistics face capital limitations when acquiring compliant or fuel-efficient trucks. Modular tank designs are being adopted to improve asset utilization across changing payloads. Pressure-tested material requirements and reinforced structural norms in cross-border transport increase maintenance costs. Emerging emissions norms are forcing a shift toward alternate propulsion, despite refueling network limitations. OEMs have focused on retrofitting services and financing solutions to assist in bridging capability gaps in the transitional landscape.

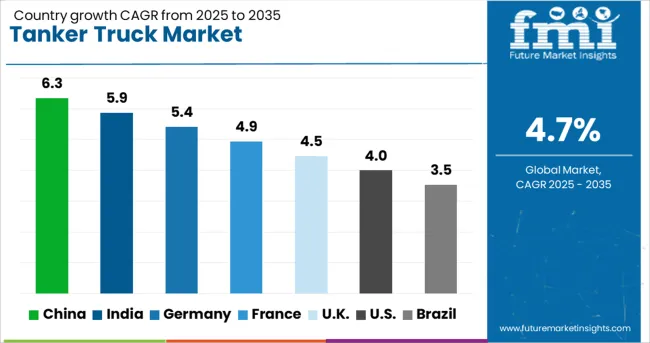

| Country | CAGR |

|---|---|

| China | 6.3% |

| India | 5.9% |

| Germany | 5.4% |

| France | 4.9% |

| UK | 4.5% |

| USA | 4.0% |

| Brazil | 3.5% |

Global demand for tanker trucks is projected to increase at a CAGR of 4.7% between 2025 and 2035. China leads with a CAGR of 6.3%, followed by India at 5.9% and Germany at 5.4%, representing growth premiums of +34%, +25%, and +15% respectively. The United Kingdom and United States trail the baseline at 4.5% and 4.0%, registering deficits of –4% and –15%. Rising fluid logistics in developing markets has boosted demand for insulated and corrosion-resistant tankers. ASEAN countries have prioritised mid-capacity trucks for urban delivery, while OECD members have aligned procurement with safety upgrades. Fuel, chemical, and food-grade segments have adopted stainless steel and aluminium formats based on compliance, weight, and payload needs across regional corridors.

China is expected to register a CAGR of 6.3% in the tanker truck market through 2035, placing it 34% above the global average. Expansion has centred around bulk transport for chemicals, edible fluids, and construction additives. Regional production hubs in Anhui and Hebei have ramped up output for electric tanker variants. EV-compatible chassis have been integrated with high-pressure-resistant tanks for inner-city use. Regulatory shifts have supported digital compliance systems that monitor spill risk and tank pressure fluctuations. Commercial operators in port-adjacent cities have added advanced lining materials to meet hygiene criteria for cross-category liquid logistics.

India is projected to achieve a CAGR of 5.9% in tanker truck demand from 2025 to 2035, outpacing the global figure by 25%. Industrial belts in Maharashtra and Andhra Pradesh have anchored demand for acid and agrochemical tankers. Infrastructure-led logistics corridors such as Delhi-Mumbai Industrial Corridor have fuelled deployment of GPS-linked fuel-grade trucks. Demand for hybrid-format tankers has risen in the edible oil and processed food industries. Emissions compliance initiatives have led to structural changes in medium-duty chassis frames. Tanker manufacturers are focusing on corrosion-preventive coatings suited to coastal and high-humidity zones.

Germany is forecast to expand its tanker truck market at a CAGR of 5.4% between 2025 and 2035, 15% higher than the global rate. Growth has centred on tankers designed for inter-EU chemical transfers. Weight-sensitive emissions compliance has shifted demand toward aluminium-bodied tankers. Cold-chain compatible units are being deployed across Bavaria for food-grade liquids. Enhanced cabin ergonomics and rear-axle braking upgrades have been implemented across medium-haul fleets. Regional logistic contracts are now requiring integrated spill-prevention technology for high-value liquid commodities.

United Kingdom is anticipated to record a CAGR of 4.5% in tanker truck demand through 2035, falling 4% below the global average. Market movement has centred on tankers for heating oil and bulk water delivery across suburban regions. Procurement activity remains strong in logistics hubs near Bristol and Manchester, where public-sector waste transport has required custom-grade tankers. Compliance with updated braking standards has prompted retrofits in commercial fleets operating near schools and hospitals. Seasonal fluid transport demand has expanded across Scotland, especially for de-icing fluid during winter logistics cycles.

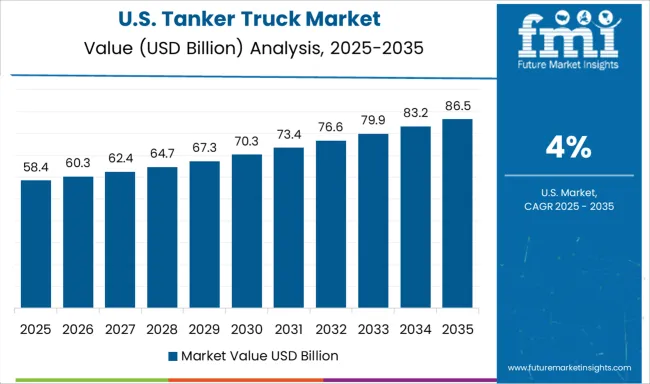

United States is expected to grow at a CAGR of 4.0% in the tanker truck market from 2025 to 2035, underperforming the global benchmark by 15%. Interstate freight movement has shown higher uptake of tankers in Texas, Ohio, and Georgia. Variability in state regulations has fragmented design standards, causing procurement bottlenecks among mid-sized operators. Investment in remote-monitoring tools has lagged behind OECD peers, particularly for tank pressure diagnostics. Stainless-steel units dominate corrosive fluid transport, while aluminium-bodied tankers are preferred for low-density fuel. Safety features such as anti-roll bars and tank baffle systems are being added to reduce load shift during emergency braking.

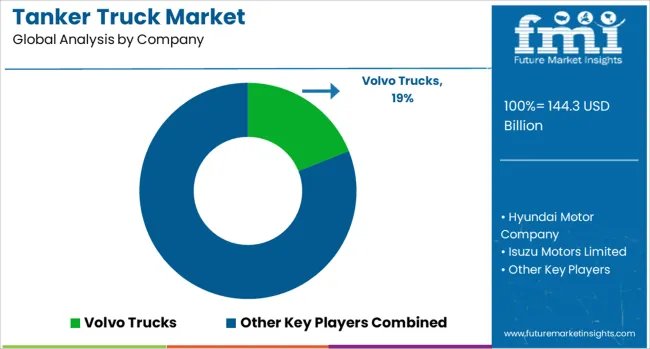

Volvo Trucks and Mercedes (Daimler) have maintained a dominant position in the global tanker truck market, backed by their high-volume production of Class 7 and 8 heavy-duty trucks integrated with advanced safety and fuel-efficiency systems. Scania AB and MAN Truck & Bus AG, both part of the TRATON Group, have been active in enhancing logistics compatibility and payload optimization for fuel, chemical, and food-grade liquid applications, particularly across Europe and Latin America. Hyundai Motor Company and Isuzu Motors Limited have remained influential in Asia, focusing on mid-capacity tankers with hybrid drivetrain integration and corrosion-resistant tanks for petrochemical transport.

IVECO S.p.A. and Tata Motors have expanded in the African and ASEAN markets by offering localized configurations tailored for diverse terrain and lower TCO requirements. Navistar International and Paccar Inc. have been active in the North American market, investing in CNG and hydrogen-compatible tanker fleets to support clean fuel distribution mandates. Industry competitiveness is increasingly influenced by regulatory compliance, fleet telematics integration, tank material advancements (e.g., aluminum and stainless steel), and multi-axle configurations to optimize transport economics in cross-border fuel and fluid delivery operations. Autonomous fleet testing is also accelerating across OEMs in long-haul tanker segments.

Fuel-efficient and LNG-powered tanker trucks gained traction, especially in China, where LNG trucks represented over 40% of new heavy-duty vehicle sales. France confirmed a large-scale military procurement of next-generation tankers for logistics modernization. Manufacturers in Japan and South Korea introduced updated low-emission tanker models. These developments reflect growing alignment with emission regulations and energy diversification, while enhancing fleet resilience and commercial fuel transport capabilities globally.

| Item | Value |

|---|---|

| Quantitative Units | USD 144.3 Billion |

| Capacity | 1,000 to 5,000 gallons, Less than 1,000 gallons, 5,000 to 10,000 gallons, and More than 10,000 gallons |

| Propulsion | Diesel, Electric, Natural gas, and Hybrid |

| Material | Stainless steel, Aluminum, Carbon steel, and Composite |

| Type | Multi-axle tankers, Single-axle tankers, and Articulated tankers |

| Application | Oil & gas, Chemicals, Food and beverages, Water, Industrial liquids, and Dry bulk goods |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Volvo Trucks, Hyundai Motor Company, Isuzu Motors Limited, IVECO S.p.A., MAN Truck & Bus AG, Mercedez (Daimler), Navistar International Corporation, Paccar Inc., Scania AB, and Tata Motors |

| Additional Attributes | Dollar sales by capacity and application (fuel, chemicals, water), demand driven by oil & gas and urban infrastructure, regional strength in North America, innovation in telematics and alternative fuels (LNG, hybrid), environmental gains via safety and emissions, and emerging use in multi-compartment delivery and smart fleet logistics. |

The global tanker truck market is estimated to be valued at USD 144.3 billion in 2025.

The market size for the tanker truck market is projected to reach USD 228.4 billion by 2035.

The tanker truck market is expected to grow at a 4.7% CAGR between 2025 and 2035.

The key product types in tanker truck market are 1,000 to 5,000 gallons, less than 1,000 gallons, 5,000 to 10,000 gallons and more than 10,000 gallons.

In terms of propulsion, diesel segment to command 63.0% share in the tanker truck market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Water Tanker Truck Market Size and Share Forecast Outlook 2025 to 2035

Truck with Mast Market Size and Share Forecast Outlook 2025 to 2035

Truck Mounted Cranes Market Size and Share Forecast Outlook 2025 to 2035

Trucks Market Size and Share Forecast Outlook 2025 to 2035

Truck Loader Crane Market Size and Share Forecast Outlook 2025 to 2035

Truck Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Truck Racks Market Size and Share Forecast Outlook 2025 to 2035

Truck Bedliners Market Outlook- Trends & Forecast 2025 to 2035

Truck Mounted Knuckle Boom Cranes Market – Growth & Demand 2025 to 2035

Truck Platooning Market

Truck Mounted Concrete Mixer Market

Semi-Truck Market Size and Share Forecast Outlook 2025 to 2035

Hand Trucks And Dollies Market Size and Share Forecast Outlook 2025 to 2035

Food Truck Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dump Trucks Market Size and Share Forecast Outlook 2025 to 2035

Fire Truck Market Growth - Trends & Forecast 2025 to 2035

Heavy-Truck Composite Component Market Size and Share Forecast Outlook 2025 to 2035

Crane Trucks Market Size and Share Forecast Outlook 2025 to 2035

Mining Trucks Market Size and Share Forecast Outlook 2025 to 2035

Bucket Trucks Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA