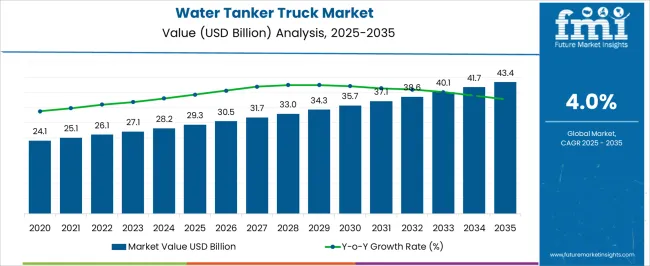

The water tanker truck market is projected to grow from USD 29.3 billion in 2025 to USD 43.4 billion by 2035, with a compound annual growth rate (CAGR) of 4.0%. A saturation point analysis highlights the steady growth and gradual approach to market saturation. In 2024, the market value is USD 29.3 billion, marking the baseline, followed by incremental growth reaching USD 25.1 billion in 2025. This early-stage expansion is driven by increasing demand for water transport solutions in both urban and rural areas, where water supply systems face challenges. The market continues its growth trajectory, reaching USD 26.1 billion in 2026 and USD 27.1 billion in 2027, driven by rising infrastructure needs and enhanced water distribution systems. By 2028, the market value climbs to USD 28.2 billion, as water tanker trucks are increasingly adopted for emergency services and industrial applications. However, as the market matures, it approaches a saturation point with slower incremental growth, as reflected in the market value of USD 43.4 billion in 2035. This gradual approach to saturation reflects the market’s stable demand for water tanker trucks across industries and regions.

| Metric | Value |

|---|---|

| Water Tanker Truck Market Estimated Value in (2025 E) | USD 29.3 billion |

| Water Tanker Truck Market Forecast Value in (2035 F) | USD 43.4 billion |

| Forecast CAGR (2025 to 2035) | 4.0% |

The water tanker truck market is expanding steadily as demand rises across sectors such as construction, mining, agriculture, and municipal services. Governments and private stakeholders are increasingly deploying these vehicles for applications ranging from dust control and firefighting to potable water supply in remote or temporary settlements. The market is benefiting from growing urbanization and infrastructure investment, particularly in emerging economies where water accessibility remains uneven.

Technological upgrades in tank construction, pump mechanisms, and fuel efficiency are further enhancing vehicle functionality, lifecycle, and cost-effectiveness. Manufacturers are prioritizing robust designs with higher payload capacity, corrosion resistance, and ease of maintenance, addressing the operational challenges in demanding terrains.

In the near future, emission-compliant engines, smart tracking systems, and modular designs are expected to influence purchase decisions Expansion of construction projects, government-led sanitation initiatives, and increasing environmental controls in industrial zones are anticipated to drive continued growth in the water tanker truck market across both developed and developing regions.

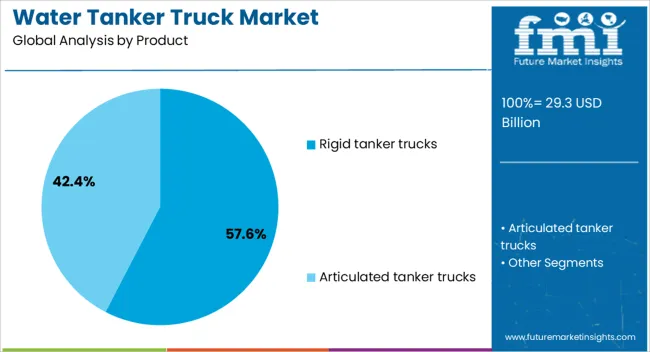

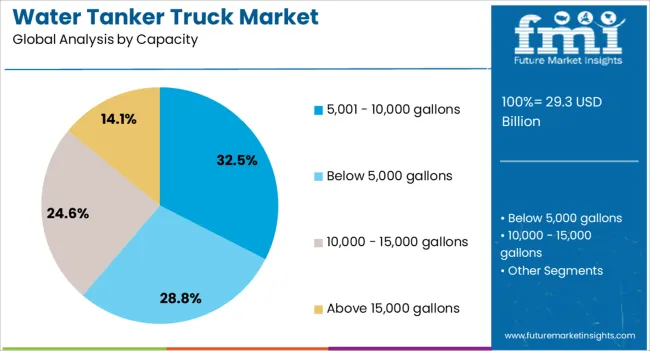

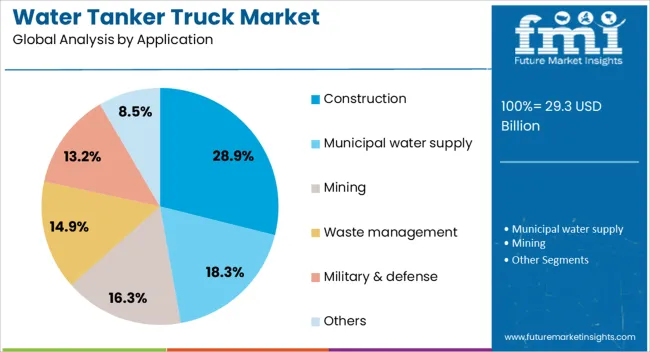

The water tanker truck market is segmented by product, capacity, application, end use, and geographic regions. By product, water tanker truck market is divided into Rigid tanker trucks and Articulated tanker trucks. In terms of capacity, water tanker truck market is classified into 5,001 - 10,000 gallons, Below 5,000 gallons, 10,000 - 15,000 gallons, and Above 15,000 gallons. Based on application, water tanker truck market is segmented into Construction, Municipal water supply, Mining, Waste management, Military & defense, and Others. By end use, water tanker truck market is segmented into Government, Industrial, Commercial, and Agriculture. Regionally, the water tanker truck industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Rigid tanker trucks are projected to account for 57.6% of the total revenue share in the water tanker truck market in 2025, making them the most prominent product category. The dominance of this segment is attributed to the structural simplicity and operational stability offered by rigid chassis configurations, which are especially beneficial in off-road and heavy-load scenarios. These vehicles are preferred for their durability, lower maintenance requirements, and consistent performance in high-usage applications such as mining, municipal water delivery, and construction site hydration.

The integrated build of the tank and chassis minimizes leak points and enhances vehicle control during transit. Increased demand for reliable water transport in rough terrains and long-haul conditions has reinforced the adoption of rigid tanker trucks.

Additionally, advancements in hydraulic systems and pumping mechanisms compatible with rigid configurations have further supported market penetration Their adaptability to different tank capacities and the lower total cost of ownership compared to articulated variants continue to make them the default choice in commercial fleets.

The 5,001 to 10,000 gallons capacity segment is expected to contribute 32.5% of the total market revenue in 2025, establishing itself as the leading capacity range in the water tanker truck market. This dominance is driven by the optimal balance these vehicles strike between operational efficiency and maneuverability. Vehicles within this range offer sufficient capacity to meet the needs of medium to large-scale construction and industrial applications while maintaining flexibility for access across varied terrains and urban spaces.

The segment’s growth has been bolstered by increasing demand for water distribution in semi-urban infrastructure projects, large residential developments, and mid-sized mining operations. These capacities are also widely chosen for their ability to minimize refilling cycles, reducing downtime and improving productivity in time-sensitive operations.

Manufacturers have focused on optimizing chassis strength, tank durability, and flow systems for this range, enhancing safety and performance The growing emphasis on sustainable logistics and the need for efficient water transport in environmental management have further amplified demand for this segment.

The construction application segment is projected to hold 28.9% of the water tanker truck market revenue share in 2025, making it the most significant end-use category. This leading position is primarily driven by the extensive use of water tanker trucks for dust suppression, soil compaction, and concrete curing in infrastructure and real estate projects. The rise in urban development, road expansions, and large-scale public works has led to increased deployment of these vehicles at construction sites where water accessibility is often limited.

Water tanker trucks enable continuous operation without reliance on external supply sources, improving project timelines and compliance with environmental regulations. Their role in controlling particulate emissions and supporting foundational work in arid or unstable soil conditions has been widely acknowledged across the industry.

Additionally, stricter environmental regulations around dust mitigation and worker safety have prompted contractors to adopt more sophisticated and capacity-optimized water delivery solutions The alignment of construction logistics with regulatory and operational demands has solidified the importance of this segment in the overall market landscape.

The water tanker truck market is experiencing robust growth, driven by increasing urbanization, industrialization, and the rising demand for efficient water distribution across various sectors. Water tanker trucks play a crucial role in supplying water for construction, agriculture, municipal services, and firefighting, among other applications. As infrastructure development accelerates and water scarcity becomes a more pressing issue, the need for reliable water transport solutions is intensifying. The market is also witnessing technological advancements, with manufacturers focusing on enhancing fuel efficiency, incorporating alternative fuels, and improving vehicle durability to meet the evolving demands of end-users. Additionally, the adoption of electric and hybrid water tanker trucks is gaining momentum, aligning with global initiatives. Overall, the market is poised for significant expansion, driven by both infrastructural needs and technological innovations.

The increasing population in urban areas is driving the demand for efficient water supply solutions, significantly influencing the market. As urban centers expand, the need for transportation of water to meet the daily requirements of residents becomes crucial. Water tanker trucks play a pivotal role in ensuring a consistent supply of clean and fresh water to urban households and businesses. Additionally, urban areas often face challenges such as infrastructure constraints and inadequate plumbing facilities, making traditional water delivery systems ineffective. The use of water tanker trucks serves as a reliable alternative, providing flexibility and accessibility to water supply. Furthermore, with the rise in industrial activities and construction projects in urban settings, the demand for water tanker trucks is projected to grow alongside the need for water in these sectors.

One major obstacle is the high initial cost of water tanker trucks, which can be a barrier, particularly for smaller businesses and municipalities with budget constraints. The complexity of maintaining and operating large fleets of water tanker trucks, especially in regions with challenging terrain or poor road conditions, also adds to the cost. Moreover, the need for specialized infrastructure, such as filling stations and maintenance facilities, complicates the deployment of water tanker trucks in remote or underserved areas. Regulatory requirements related to environmental standards and vehicle emissions add to the cost of manufacturing and operating water tanker trucks, which can delay widespread adoption. Overcoming these challenges requires strategic investments in infrastructure, along with continuous innovations in design and manufacturing.

The water tanker truck market presents numerous opportunities for growth and innovation. One key opportunity lies in the development of hybrid and electric water tanker trucks, which would reduce fuel consumption and greenhouse gas emissions. These innovations would make water transport more sustainable and cost-efficient in the long term. Furthermore, the growing demand for on-demand water delivery services presents an avenue for companies to expand their services, especially in areas with unreliable water supply infrastructure. The integration of GPS tracking and IoT-enabled devices for real-time monitoring and fleet management offers the potential to improve the efficiency and reliability of water delivery operations. As industries and municipalities continue to invest in infrastructure and look for sustainable solutions, there is ample room for market expansion, particularly in emerging economies with fast-growing urban populations.

Automation and digitalization are expected to play a major role in transforming water tanker truck operations, with the integration of IoT devices for monitoring water levels, vehicle health, and route optimization. The growing adoption of telematics and fleet management software will improve operational efficiency and reduce downtime. Additionally, increasing demand for eco-friendly transportation solutions is driving the development of electric and hybrid water tanker trucks, which align with the global push for lower emissions. The shift toward digital payment systems for water delivery services is also emerging, offering more convenience and efficiency. These trends indicate that the market is evolving with technological advancements, resulting in enhanced performance, lower costs, and more sustainable solutions for water distribution.

| Country | CAGR |

|---|---|

| China | 5.4% |

| India | 5.0% |

| Germany | 4.6% |

| France | 4.2% |

| UK | 3.8% |

| USA | 3.4% |

| Brazil | 3.0% |

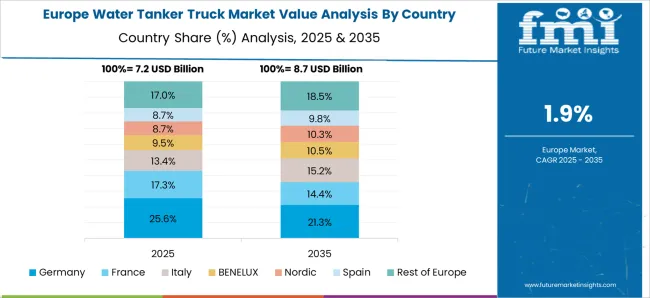

The global water tanker truck market is projected to grow at a CAGR of 4.0% from 2025 to 2035. Among the key markets, China leads with a growth rate of 5.4%, followed by India at 5.0%, and France at 4.2%. The United Kingdom and the United States show more moderate growth rates of 3.8% and 3.4%, respectively. This growth is driven by the increasing demand for efficient water distribution solutions in agriculture, construction, and industrial sectors. Emerging markets like China and India are experiencing rapid growth due to industrial expansion, while developed markets focus on infrastructure modernization. The analysis includes over 40 countries, with the leading markets shown below.

China is expected to lead the global water tanker truck market, growing at a projected CAGR of 5.4% from 2025 to 2035. The country’s rapid urbanization and growing industrial and agricultural sectors are key drivers of market growth. As the demand for water supply in urban areas, agriculture, and large-scale construction projects increases, water tanker trucks are becoming essential for transporting water efficiently. China’s government initiatives to support infrastructure development and improve water distribution systems are also expected to drive the market. The rising need for water trucks in rural and remote areas to support agricultural irrigation is further fueling the demand for water tanker trucks in China.

The water tanker truck market in India is projected to grow at a CAGR of 5.0% from 2025 to 2035. The growing urban population and increasing agricultural and industrial needs for water transportation are key factors driving the demand for water tanker trucks. With a rising demand for water supply in both urban and rural areas, India’s water tanker truck market is expected to expand rapidly. The government’s focus on improving water infrastructure and the growing need for water trucks in irrigation, construction, and industrial sectors will continue to fuel market growth in India.

The water tanker truck market in France is expected to grow at a CAGR of 4.2% from 2025 to 2035. The country’s ongoing industrialization and the need for efficient water distribution in both urban and rural areas are key drivers of market growth. France’s increasing focus on sustainable water management systems, particularly for agricultural irrigation and municipal water supply, is fueling demand for water tanker trucks. Additionally, the growing construction sector, which requires large volumes of water for various processes, will continue to contribute to the market’s growth.

The water tanker truck market in the United Kingdom is projected to grow at a CAGR of 3.8% from 2025 to 2035. The UK’s demand for water tanker trucks is primarily driven by the increasing need for water supply in the construction, agricultural, and industrial sectors. As the UK continues to invest in infrastructure development, including water distribution systems and irrigation projects, the demand for water tanker trucks will continue to rise. Furthermore, the need for water trucks to meet growing urbanization and public water supply requirements will contribute to the market’s expansion.

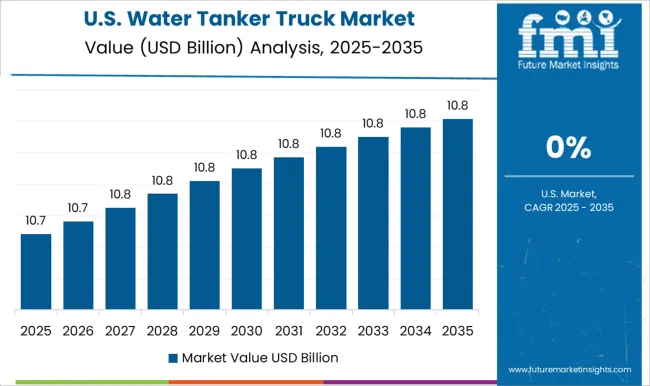

The water tanker truck market in the United States is projected to grow at a CAGR of 3.4% from 2025 to 2035. The USA market for water tanker trucks is driven by the growing need for water distribution in the agricultural, industrial, and construction sectors. The country’s expanding population and increasing water supply requirements in urban and rural areas are further contributing to the market’s growth. Additionally, the rising demand for water tanker trucks to support emergency water supply needs in drought-prone regions and during natural disasters is expected to increase the demand for these vehicles.

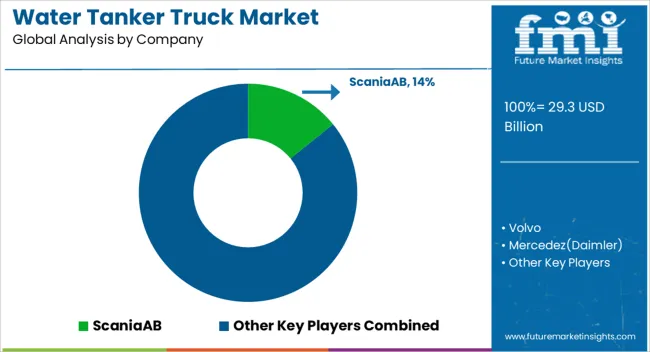

The water tanker truck market is rapidly growing, driven by the increasing demand for efficient water transportation solutions across various sectors, including agriculture, municipal services, and industrial applications. Leading players in this market include Scania AB, Volvo, Mercedes (Daimler), MAN, Hyundai Motor Company, Iveco, Dongfeng Motor Corporation, Tata Motors Limited, The Knapheide Manufacturing Company, and Custom Truck One Source.

Scania AB and Volvo dominate the market, holding a significant share due to their extensive product portfolios and global presence. Both companies are recognized for their high-quality trucks that cater to diverse industrial and municipal needs. Mercedes (Daimler) and MAN also play pivotal roles in the market, offering a wide range of water tanker trucks that meet the demands of firefighting, water supply, and agricultural applications. Hyundai Motor Company and Iveco provide innovative alternatives, focusing on fuel efficiency and advanced technology to cater to urban and rural water transportation needs.

In emerging markets, Dongfeng Motor Corporation and Tata Motors Limited are key players, offering cost-effective water tanker trucks that are tailored to local requirements and infrastructure. The Knapheide Manufacturing Company and Custom Truck One Source specialize in custom-built water tanker trucks, providing specialized solutions for industries such as firefighting, municipal services, and agriculture.

Scania AB

Volvo Trucks

Mercedes-Benz Trucks (Daimler Truck)

MAN Truck & Bus

Hyundai Motor Company

Iveco

Dongfeng Motor Corporation

Tata Motors Limited

The Knapheide Manufacturing Company

Custom Truck One Source

| Item | Value |

|---|---|

| Quantitative Units | USD Billion |

| Product | Rigid tanker trucks and Articulated tanker trucks |

| Capacity | 5,001 - 10,000 gallons, Below 5,000 gallons, 10,000 - 15,000 gallons, and Above 15,000 gallons |

| Application | Construction, Municipal water supply, Mining, Waste management, Military & defense, and Others |

| End Use | Government, Industrial, Commercial, and Agriculture |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Scania AB; Volvo Trucks; Mercedes-Benz Trucks (Daimler Truck); MAN Truck & Bus; Hyundai Motor Company; Iveco; Dongfeng Motor Corporation; Tata Motors Limited; The Knapheide Manufacturing Company; Custom Truck One Source. |

| Additional Attributes | Dollar sales by product type (water tank trucks, firefighting water trucks, municipal water trucks, agricultural water trucks) and end-use segments (municipalities, agriculture, industrial applications, firefighting). Demand dynamics are driven by the increasing need for water transportation in urbanized areas, agricultural irrigation systems, and emergency response applications. Regional trends show strong growth in Asia-Pacific, North America, and Europe, fueled by infrastructure development, the rise in industrial applications, and the need for efficient water distribution systems in emerging economies. |

The global water tanker truck market is estimated to be valued at USD 29.3 billion in 2025.

The market size for the water tanker truck market is projected to reach USD 43.4 billion by 2035.

The water tanker truck market is expected to grow at a 4.0% CAGR between 2025 and 2035.

The key product types in water tanker truck market are rigid tanker trucks and articulated tanker trucks.

In terms of capacity, 5,001 - 10,000 gallons segment to command 32.5% share in the water tanker truck market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Tanker Truck Market Size and Share Forecast Outlook 2025 to 2035

Water Vapor Permeability Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Truck with Mast Market Size and Share Forecast Outlook 2025 to 2035

Water and Waste Water Treatment Chemical Market Size and Share Forecast Outlook 2025 to 2035

Water-cooled Walk-in Temperature & Humidity Chamber Market Size and Share Forecast Outlook 2025 to 2035

Waterless Bathing Solution Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Waterborne UV Curable Resin Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Chemical Market Size and Share Forecast Outlook 2025 to 2035

Water Adventure Tourism Market Forecast and Outlook 2025 to 2035

Water Packaging Market Forecast and Outlook 2025 to 2035

Water Soluble Bag Market Size and Share Forecast Outlook 2025 to 2035

Water Leak Sensors Market Size and Share Forecast Outlook 2025 to 2035

Water-soluble Packaging Market Size and Share Forecast Outlook 2025 to 2035

Truck Mounted Cranes Market Size and Share Forecast Outlook 2025 to 2035

Water Leak Detection System for Server Rooms and Data Centers Market Size and Share Forecast Outlook 2025 to 2035

Water and Wastewater Treatment Equipment Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Market Size and Share Forecast Outlook 2025 to 2035

Water Underfloor Heating Thermostat Market Size and Share Forecast Outlook 2025 to 2035

Water Activity Meter Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA