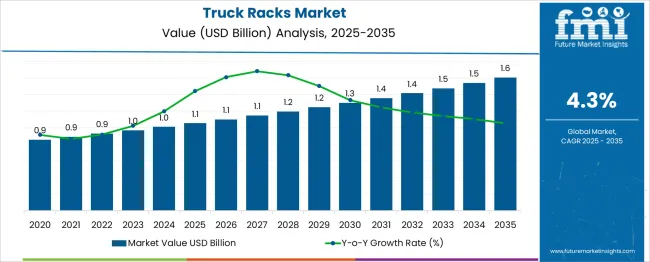

The truck racks market is estimated to be valued at USD 1.1 billion in 2025 and is projected to reach USD 1.6 billion by 2035, registering a compound annual growth rate (CAGR) of 4.3% over the forecast period.

The market is forecasted to reach USD 1.38 billion by 2030, representing a CAGR of 4.3%. Annual growth projections indicate values of USD 1.15 billion in 2026, USD 1.21 billion in 2027, USD 1.26 billion in 2028, and USD 1.32 billion in 2029. This consistent upward trend underscores the expanding adoption of truck racks among commercial fleets and recreational vehicle owners seeking efficient cargo solutions.

The rise in logistics operations, construction projects, and last-mile delivery services is a major contributor to aftermarket and OEM demand. Businesses prioritize racks to improve load efficiency and reduce transportation cycles, while outdoor enthusiasts seek modular solutions for activities such as biking and camping. Manufacturers are actively focusing on lightweight yet durable materials like aluminum, combined with corrosion-resistant coatings to ensure longevity and fuel efficiency.

Modular designs and quick-install systems are gaining prominence for their convenience and compatibility across vehicle models. Digital sales channels, particularly e-commerce, are strengthening market penetration by simplifying product access for both individual users and fleet managers. Dealer partnerships are also expanding pre-installed rack options in new vehicles. Emphasis on aerodynamic designs and adherence to load safety compliance is shaping product innovation strategies. Emerging markets offer untapped potential, presenting opportunities for manufacturers to differentiate through customization, competitive pricing, and expanded distribution networks, ensuring sustained growth across global regions.

| Metric | Value |

|---|---|

| Truck Racks Market Estimated Value in (2025E) | USD 1.1 billion |

| Truck Racks Market Forecast Value in (2035F) | USD 1.6 billion |

| Forecast CAGR (2025 to 2035) | 4.3% |

The Truck Racks Market represents a significant component of the automotive accessories industry, holding an estimated 8–10% share of the overall market in 2025. Its importance is underscored by the role truck racks play in maximizing cargo handling efficiency, which is vital for both commercial fleet operators and recreational users.

Within the pickup truck accessories segment, the share rises to approximately 15%, reflecting strong demand for practical storage solutions that support heavy-duty operations and outdoor lifestyle requirements. This dominance is reinforced by customization trends, as users seek adaptable racks that can cater to different load types and specialized activities. In the aftermarket vehicle equipment category, truck racks command nearly 12%, driven by frequent replacement and upgrades for durability and compliance with safety standards.

The market’s share growth is also influenced by the increasing use of modular rack systems with corrosion-resistant finishes, which ensure long-lasting performance. The rise of e-commerce platforms has further expanded accessibility, allowing manufacturers to tap into broader customer bases with direct-to-consumer strategies and competitive pricing.

OEM partnerships are strengthening, as many new vehicles now include pre-installed racks as part of value-added offerings. These dynamics highlight the segment’s strategic position within the automotive ecosystem, offering sustained revenue potential across global regions, especially as vehicle customization and load efficiency remain critical priorities.

The truck racks market is experiencing substantial expansion, supported by a rising demand for multifunctional vehicle storage solutions and increasing customization preferences among light-duty truck owners. Growth is being driven by the surge in recreational and commercial utility applications, where end users seek durable and versatile racks to optimize cargo transport without compromising vehicle performance.

Evolving consumer expectations in both professional and lifestyle-based use cases have prompted manufacturers to innovate lightweight, corrosion-resistant, and aerodynamically efficient products. Simultaneously, the expansion of e-commerce logistics and mobile service industries has elevated the demand for external vehicle storage systems, further boosting the market’s momentum.

Advances in manufacturing processes and modular design features have made truck racks more accessible and adaptable to varied terrain and usage conditions. With increasing investments in automotive accessories and a steady rise in light-duty truck sales, the market outlook remains strong, especially as end users demand long-term value, operational convenience, and installation flexibility from aftermarket vehicle enhancements.

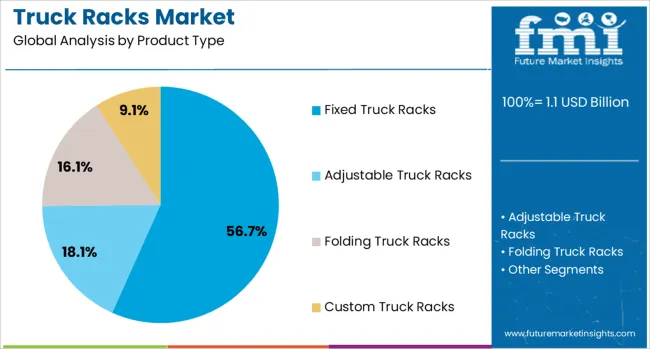

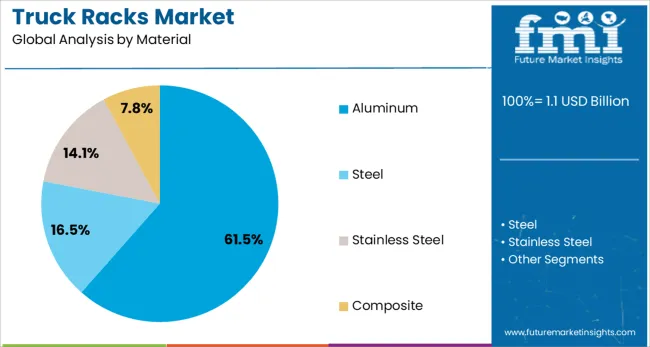

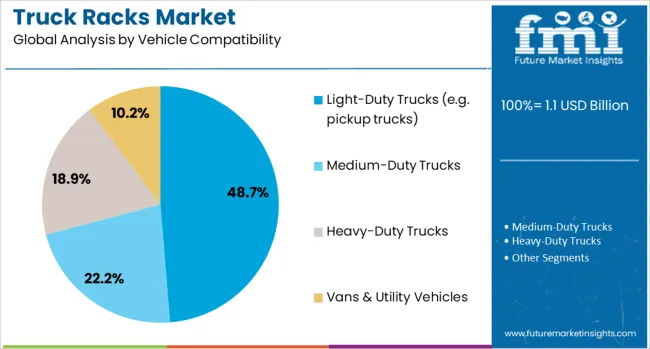

The truck racks market is segmented by product type, material, vehicle compatibility, application, and geographic regions. The truck racks market is divided by product type into Fixed Truck Racks, Adjustable Truck Racks, Folding Truck Racks, and Custom Truck Racks. The truck racks market is classified by material into Aluminum, Steel, Stainless Steel, and Composite. Based on vehicle compatibility, the truck racks market is segmented into Light-Duty Trucks (e.g., pickup trucks), Medium-Duty Trucks, Heavy-Duty Trucks, and Vans & Utility Vehicles. By application, the truck racks market is segmented into Construction & Building Materials, HVAC / Mechanical Services, Electrical / Utilities, Plumbing, Cargo Transport / General Hauling, Outdoor & Adventure Gear, and Other Applications (e.g., agriculture, forestry). Regionally, the truck racks industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The fixed truck racks segment is expected to contribute 56.7% of the overall truck racks market revenue in 2025, making it the leading product type. This segment's dominance is being driven by the preference for durable and permanent load-carrying solutions in professional utility applications. Fixed truck racks offer structural integrity, improved weight distribution, and long-term service reliability, which are critical features in construction, landscaping, and logistics sectors.

Their ability to support high payloads without compromising stability has made them ideal for transporting ladders, pipes, and bulky materials over long distances. Fixed racks have also gained traction due to minimal maintenance requirements and enhanced resistance to wear and tear, even under harsh operational conditions.

Manufacturers have focused on optimizing the design for compatibility with various truck bed sizes, while retaining ease of installation and integrated tie-down features. This combination of functional durability and load-handling efficiency has solidified fixed racks as the preferred choice for users seeking robust cargo solutions.

The aluminum segment is anticipated to hold 61.5% of the truck racks market revenue in 2025, establishing itself as the dominant material choice. The increasing adoption of aluminum is being influenced by its lightweight properties, which contribute to improved fuel efficiency and reduced vehicle load strain. Aluminum racks provide a strong balance between strength and weight, enabling users to maintain payload capacity while minimizing overall system weight.

Enhanced resistance to corrosion, particularly in environments exposed to moisture, salt, and chemicals, has made aluminum the material of choice for both commercial and recreational applications. The market has also benefited from advancements in aluminum extrusion techniques and modular construction methods, which have enabled easier customization and streamlined assembly.

The aesthetic appeal and long-term surface finish of aluminum racks have supported their integration in high-end vehicle upgrades. As sustainability and operational performance become key decision factors, aluminum continues to lead in offering low-maintenance and high-durability solutions.

Light duty trucks are projected to account for 48.7% of the total truck racks market revenue in 2025, marking their dominance in vehicle compatibility. This segment’s growth is being supported by the increasing utilization of pickup trucks for both commercial and lifestyle-oriented purposes. Light duty trucks serve as versatile platforms for users requiring additional cargo space for tools, equipment, or outdoor gear, especially in construction, agriculture, and adventure travel.

The rising popularity of do-it-yourself businesses and mobile trades has further intensified the demand for practical rack systems on compact and mid-size trucks. Manufacturers have responded by offering application-specific designs that seamlessly integrate with the vehicle’s body, ensuring stability without impeding visibility or access.

Enhanced consumer focus on customizing vehicles for utility, along with the rising trend of using pickups for both work and personal use, has significantly contributed to the segment’s leadership. The ease of installation and availability of compatible rack systems across leading light duty truck models continue to reinforce this segment’s market share.

Truck racks are witnessing strong demand due to their role in enhancing cargo capacity for commercial and recreational needs, with modular and durable designs gaining attention. Aftermarket growth is accelerating through customization options, aerodynamic features, and e-commerce-driven accessibility.

The adoption of truck racks has been influenced by the rising requirement for secure cargo transport across commercial and recreational applications. Pickup owners and fleet operators are emphasizing racks that allow compatibility with diverse accessories to enhance load capacity. This trend has strengthened because traditional storage solutions are considered insufficient for longer hauls and heavier loads. Aluminum and steel racks have been favored due to their durability and corrosion resistance, while adjustable and modular designs are viewed as crucial for convenience. The industry has experienced significant traction from contractors and outdoor enthusiasts, where transporting construction materials, ladders, or sporting gear has been prioritized as a cost-efficient and space-saving alternative to enclosed carriers.

The aftermarket segment for truck racks is gaining prominence as consumers are exploring advanced designs that support customization without permanent vehicle modifications. Vehicle-specific racks have been preferred to maintain structural integrity, and demand for aerodynamic options has intensified to improve fuel economy. Manufacturers have been focusing on user-friendly installation features to address consumer concerns related to complexity and time consumption. Lightweight racks with high load-bearing capacity are being promoted as premium offerings for heavy-duty pickups, while collapsible designs are considered appealing for urban users with limited storage space. E-commerce platforms have further accelerated accessibility, positioning aftermarket upgrades as a lucrative avenue for players aiming to capture individual and fleet-oriented buyers.

The truck racks segment is gaining traction due to increased adoption by commercial fleets and recreational users seeking enhanced cargo-carrying solutions. Businesses in logistics and construction industries prefer racks to maximize vehicle load efficiency, reduce multiple trips, and improve operational cost savings. Recreational users, especially in outdoor sports and adventure travel, are driving demand for customizable racks compatible with bikes, kayaks, and camping gear. The versatility of modern rack designs supports various applications, making them essential for both work and leisure vehicles. This trend is strengthening aftermarket sales as vehicle owners seek premium-quality racks with corrosion resistance and quick-install features.

Product development strategies are centered on introducing lightweight yet durable rack materials to enhance load capacity while ensuring fuel efficiency. Manufacturers are prioritizing racks with aerodynamic profiles and easy-install mechanisms to attract retail and commercial buyers. Expansion of e-commerce platforms for direct-to-consumer sales is improving market penetration, providing convenience for buyers and enabling suppliers to offer a wide range of customization options. Strategic alliances with automotive dealerships are also increasing the availability of pre-installed racks in new vehicles, creating steady revenue streams. These efforts are reshaping the competitive landscape, making innovative design and efficient distribution critical for sustained growth.

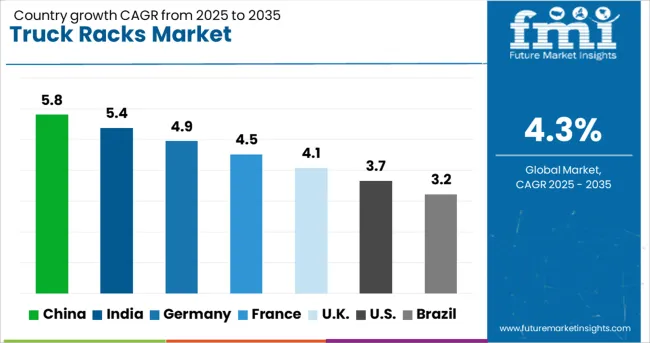

| Country | CAGR |

|---|---|

| China | 5.8% |

| India | 5.4% |

| Germany | 4.9% |

| France | 4.5% |

| UK | 4.1% |

| USA | 3.7% |

| Brazil | 3.2% |

The truck racks industry, projected to grow at a global CAGR of 4.3% from 2025 to 2035, demonstrates distinct growth patterns across leading economies. A 5.8% CAGR is being recorded in China, a BRICS member, supported by high pickup sales and infrastructure expansion, influencing demand for heavy-duty cargo accessories. India, another BRICS nation, is exhibiting a 5.4% CAGR, attributed to increasing commercial vehicle utilization and rising interest in aftermarket customization solutions. Germany, an OECD member, is maintaining a 4.9% CAGR, benefiting from a well-developed automotive ecosystem that prioritizes modular and aerodynamic rack designs for fuel efficiency. The United Kingdom, with a 4.1% CAGR, indicates steady adoption among contractors and leisure users focusing on collapsible and lightweight racks for space efficiency. The United States, an OECD member, is expanding at 3.7%, in mature market conditions with demand driven by replacement cycles and premium aftermarket offerings. High-growth opportunities are evident in BRICS economies, while developed regions show consistent demand supported by product diversification and e-commerce penetration. The report includes an in-depth analysis of over 40 countries, with the top five outlined for reference.

The United States is advancing space robotics through mission-specific integration across government and private sector launches. Robotic mechanisms are prioritized in deep-space research, payload docking, and ISS maintenance. Advanced command-and-control layers are being The CAGR in the United Kingdom increased from approximately 3.2% during 2020–2024 to 4.1% in 2025–2035, which signals a steady acceleration supported by aftermarket penetration and increased adoption among recreational vehicle users. This change was observed as consumers placed greater importance on modular and collapsible designs compatible with modern pickup models. The earlier phase recorded a moderate CAGR due to limited variety and higher pricing, which constrained demand outside the contractor segment. The second phase gained momentum because e-commerce integration simplified access, and fleet operators adopted racks for cost-efficient cargo handling. Manufacturers have started offering aerodynamic and lightweight racks that contribute to fuel efficiency, with consumer preferences for practicality and versatility.

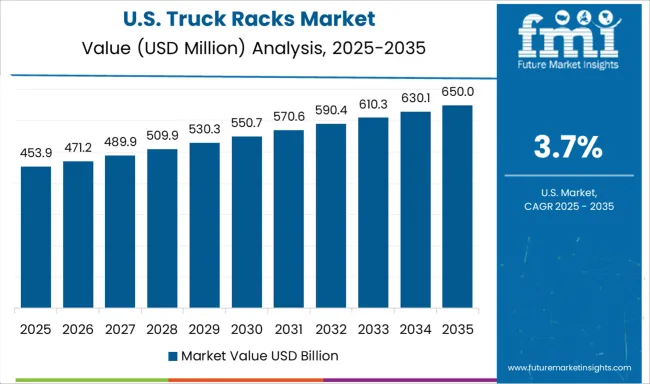

The CAGR in the United States rose from 3.1% during 2020–2024 to 3.7% for the 2025–2035 period, indicating incremental improvement driven by strong replacement demand and preference for premium aftermarket solutions. The initial phase remained slower because the market was mature with limited innovation beyond basic rack structures. The increase in the latter period was driven by a surge in pickup ownership among outdoor enthusiasts and contractors who sought heavy-duty yet lightweight racks. Collaborations between manufacturers and digital retail platforms supported convenient purchasing options, reducing reliance on dealership networks. Product differentiation through corrosion-resistant coatings and universal fitment solutions contributed to the improved adoption trend in the aftermarket category.

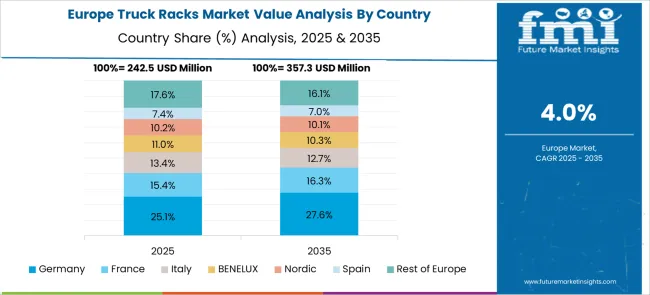

The robotic systems in Japan are shaped by their precision engineering legacy, used extensively in payload manipulation and narrow-orbit path tasks. Robotic units are being embedded into ISS operations and future lunar logistics. Japan's government emphasizes redundancy, real-time calibration, and multi-purpose functionality in robotic design. Robotics manufacturers are working with microelectronics and sensor firms to enhance in-orbit vision and feedback capabilities. Public funding has favored upgrades to robotic docking interfaces and tethered equipment to boost mission safety and hardware reuse. The CAGR in Germany advanced from about 4.3% between 2020–2024 to 4.9% between 2025–2035, supported by the integration of modular and aerodynamic designs into a market driven by fuel economy considerations. Early adoption rates were moderate because traditional fixed designs limited adaptability for different cargo profiles. Growth accelerated in the later phase due to demand from contractors, logistics providers, and private users seeking racks that enhance vehicle utility without permanent modifications. Regulatory focus on vehicle efficiency influenced the uptake of lightweight and drag-reducing models. The aftermarket category witnessed expansion as consumers increasingly valued solutions compatible with OEM quality standards.

The CAGR in China surged from 4.6% during 2020–2024 to 5.8% in 2025–2035, driven by rising pickup production and expanding logistics activity in domestic markets. Growth in the earlier stage was moderate because product availability was limited to major cities, restricting adoption in rural regions. The subsequent increase was influenced by aggressive marketing by regional manufacturers and growing demand for aftermarket upgrades tailored to commercial users. Advanced coatings and modular designs targeting durability and versatility were introduced as standard features. The rise of e-commerce platforms played a critical role in bridging accessibility gaps across provinces, accelerating purchase decisions for both individual and fleet buyers.

The CAGR in India moved upward from nearly 4.7% in 2020–2024 to 5.4% for 2025–2035, signifying strong traction supported by the rapid expansion of commercial vehicle fleets and the popularity of pickup-based cargo solutions. The early phase registered moderate growth as consumer awareness remained confined to urban hubs and large fleet operators. Momentum in the second phase emerged from e-commerce accessibility and the affordability of modular racks tailored for diverse payloads. Local manufacturers emphasized corrosion-resistant finishes and low-maintenance materials to cater to regional climatic conditions. Increased penetration among construction and agri-logistics users strengthened aftermarket growth as vehicle utility optimization became a cost-focused priority.

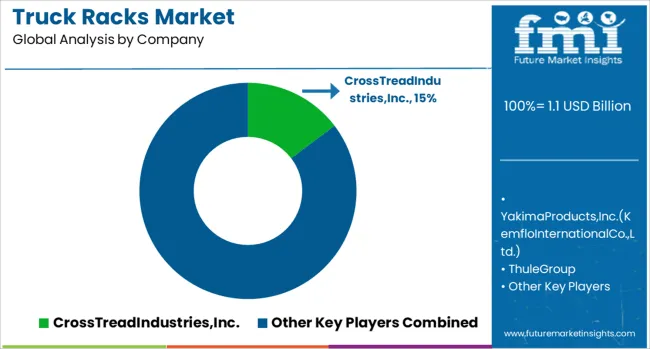

In the truck racks market, Cross Tread Industries, Inc. is known for heavy-duty steel and aluminum solutions catering to contractors and utility fleets, ensuring load security and compatibility with multiple truck models. Yakima Products, Inc., under Kemflo International Co., Ltd., emphasizes premium racks for recreational users, offering modular designs that support outdoor activities such as biking and kayaking. Thule Group focuses on high-strength racks with streamlined profiles, appealing to lifestyle consumers and commercial users alike. Rack, Inc. and Texas Truck Racks are emerging with innovative adjustable systems that simplify installation while ensuring cost efficiency for aftermarket buyers.

Magnum Manufacturing, Inc. specializes in lightweight aluminum headache racks, targeting safety-conscious fleets. Vanguard Manufacturing, Inc. and ProTech Industry are expanding through corrosion-resistant finishes and vehicle-specific designs to meet durability demands. Hauler Racks, Inc. continues to deliver anodized aluminum racks for weight-sensitive applications, while Holman (formerly Kargo Master, Inc.) leverages its expertise in upfitting to provide customizable solutions for fleet vehicles. Across these players, online sales platforms are transforming market access, enabling wider distribution and direct consumer engagement. Focus on aerodynamic efficiency, modular assembly, and compatibility with accessories like ladder stops and cargo tie-downs remains a shared strategy to strengthen global presence.

Manufacturers are focusing on lightweight materials like aluminum for fuel efficiency, modular designs for easy installation, and corrosion-resistant coatings for durability. Strategic priorities include expanding e-commerce integration, strengthening dealer partnerships, and offering customizable racks to cater to diverse load requirements. Emphasis on aerodynamic profiles and certified load security is shaping product development, while emerging regions present untapped opportunities.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.1 Billion |

| Product Type | Fixed Truck Racks, Adjustable Truck Racks, Folding Truck Racks, and Custom Truck Racks |

| Material | Aluminum, Steel, Stainless Steel, and Composite |

| Vehicle Compatibility | Light‑Duty Trucks (e.g. pickup trucks), Medium‑Duty Trucks, Heavy‑Duty Trucks, and Vans & Utility Vehicles |

| Application | Construction & Building Materials, HVAC / Mechanical Services, Electrical / Utilities, Plumbing, Cargo Transport / General Hauling, Outdoor & Adventure Gear, and Other Applications (e.g. agriculture, forestry) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | CrossTreadIndustries,Inc., YakimaProducts,Inc.(KemfloInternationalCo.,Ltd.), ThuleGroup, VanguardManufacturing,Inc., ProTechIndustry, HaulerRacks,Inc., Holman(formerlyKargoMaster,Inc.), Rack,Inc., TexasTruckRacks, and MagnumManufacturing,Inc. |

| Additional Attributes | Dollar sales, share by material type and application, regional demand trends, aftermarket vs OEM contribution, competitive positioning, pricing benchmarks, distribution channel performance, and innovation focus for modular and lightweight designs. |

The global truck racks market is estimated to be valued at USD 1.1 billion in 2025.

The market size for the truck racks market is projected to reach USD 1.6 billion by 2035.

The truck racks market is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types in truck racks market are fixed truck racks, adjustable truck racks, folding truck racks and custom truck racks.

In terms of material, aluminum segment to command 61.5% share in the truck racks market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Truck with Mast Market Size and Share Forecast Outlook 2025 to 2035

Truck Mounted Cranes Market Size and Share Forecast Outlook 2025 to 2035

Trucks Market Size and Share Forecast Outlook 2025 to 2035

Truck Loader Crane Market Size and Share Forecast Outlook 2025 to 2035

Truck Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Truck Bedliners Market Outlook- Trends & Forecast 2025 to 2035

Truck Mounted Knuckle Boom Cranes Market – Growth & Demand 2025 to 2035

Truck Platooning Market

Truck Mounted Concrete Mixer Market

Semi-Truck Market Size and Share Forecast Outlook 2025 to 2035

Hand Trucks And Dollies Market Size and Share Forecast Outlook 2025 to 2035

Food Truck Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dump Trucks Market Size and Share Forecast Outlook 2025 to 2035

Fire Truck Market Growth - Trends & Forecast 2025 to 2035

Heavy-Truck Composite Component Market Size and Share Forecast Outlook 2025 to 2035

Crane Trucks Market Size and Share Forecast Outlook 2025 to 2035

Mining Trucks Market Size and Share Forecast Outlook 2025 to 2035

Tanker Truck Market Size and Share Forecast Outlook 2025 to 2035

Bucket Trucks Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vacuum Truck Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA