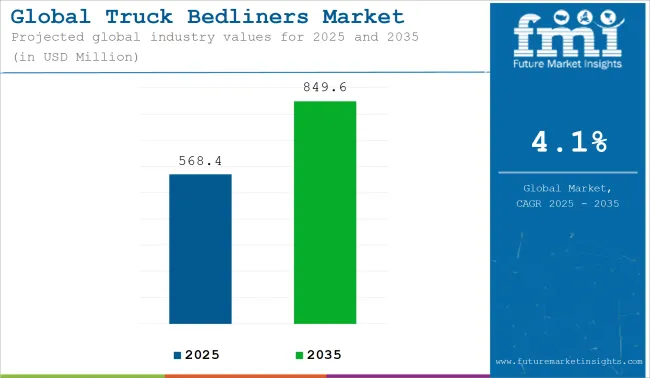

The global truck bedliners market is estimated to reach USD 568.4 million in 2025 and is projected to expand to USD 849.6 million by 2035, registering a compound annual growth rate (CAGR) of 4.1% over the forecast period. Growth has been attributed to product upgrades in liner durability, vehicle-specific custom fitting, and aftermarket enhancements tailored for pickup trucks across North America and select Asia-Pacific markets.

In 2024, Lasfit Liners introduced a new series of TPE-based truck bed liners compatible with the Ford F-150 and Toyota Tacoma. The company emphasized their liners’ flexibility and all-weather resistance, with design tailored for precise edge-to-edge coverage.

Product documentation confirmed integration with OE cargo features and included anti-skid properties for tool and equipment retention. Lasfit stated that the liners were independently validated for UV resistance and abrasion mitigation across a range of service conditions.

Similar developments were confirmed by Rhino Linings, whose spray-on bedliners continue to be marketed for heavy-duty applications in both personal and commercial vehicle segments. The company has emphasized corrosion protection and adhesion performance, with recent materials featuring improved elasticity and surface uniformity. According to the Mattiacio Group, which provides Rhino Linings installations in the USA, the adoption of these coatings has grown across both original dealer installs and second-owner retrofits.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 568.4 Million |

| Projected Market Size in 2035 | USD 849.6 Million |

| CAGR (2025 to 2035) | 4.1% |

Herculiner also expanded its product offering in 2024 with a focus on DIY brush-on kits. These were introduced with reformulated compounds for better surface bonding and solvent resistance, targeted at mid-tier consumer applications. Company announcements have cited a broader distribution strategy through retail chains, reinforcing accessibility in suburban and rural regions.

Vehicle model cycles have influenced liner form factor development. With the 2024 Toyota Tacoma redesign, liner manufacturers accelerated the rollout of vehicle-specific SKUs to maintain aftermarket compatibility. Pre-launch leaks on enthusiast forums such as Tacoma4G suggested that bedliner vendors had early access to CAD specifications, allowing synchronized market entry alongside OEM releases.

Going forward, demand will be shaped by pickup utility in urban logistics, agriculture, and recreation. The market is expected to continue transitioning toward non-PVC formulations and sustainable materials while maintaining focus on vehicle compatibility, fitment efficiency, and surface integrity across varying climatic conditions.

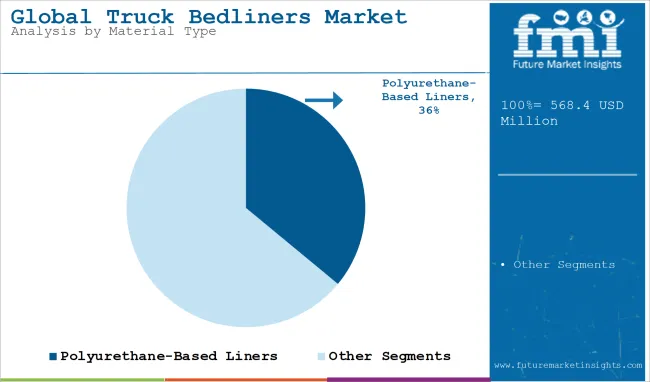

Polyurethane-based truck bedliners are estimated to account for approximately 36% of the global market share in 2025 and are projected to grow at a CAGR of 4.3% through 2035. These bedliners offer excellent impact absorption, corrosion resistance, and chemical protection, making them highly suitable for pickup trucks used in construction, agriculture, and industrial transport. Polyurethane coatings are preferred for their seamless spray-on application, strong adhesion to metal substrates, and long-lasting finish under harsh weather conditions.

OEMs and aftermarket players continue to innovate in UV-stable and low-VOC polyurethane formulations to meet durability expectations while aligning with regional environmental regulations. The segment remains a top choice among fleet operators and utility vehicle users seeking extended truck bed life and lower maintenance costs.

Commercial purpose applications are projected to account for approximately 42% of the global truck bedliners market share in 2025 and are expected to grow at a CAGR of 4.2% through 2035. The rise in small and mid-size enterprise activity, last-mile delivery operations, and utility-based transport in North America, Latin America, and Southeast Asia continues to drive demand for reinforced and high-load-tolerant bedliner solutions.

Truck owners prioritize bedliners that reduce cargo slippage, protect against denting and corrosion, and support the long-term integrity of the vehicle body under repetitive heavy use. Spray-on and drop-in liner formats tailored for commercial fleets, combined with advancements in custom fitment and fast-curing technologies, further strengthen the commercial segment’s dominance in the global market.

Material Durability, Installation Complexity, and Market Saturation

The truck bed liners market is facing several challenges among them material durability, cost-performance trade-off, and aftermarket competition. Spray-on and drop-in bed liners claim to provide impact resistance, UV stability, and chemical protection-but cheap formulations sometimes fail under extreme temperatures or heavy cargo impact or sustained UV exposure, leading to discoloration, peeling, or cracking.

Plus, installation - particularly for spray-on bed liners - is so complex that the application is often best left to a pro, to ensure even coating and adhesion; this can eliminate DIY buyers. In addition, North American market saturation and slow penetration in emerging cost-sensitive markets limit volume growth - the continuing OEM-integrated Bedliners trend also destroys aftermarket purchases.

Off-Road Vehicle Customization, Fleet Protection Demand, and Material Innovation

Despite these challenges, the truck bed liners market faces several challenges, including rising raw material prices, compatibility with various truck models, and evolving regulations on material use. Ruggedized, low-maintenance truck beds are in demand, driving adoption of polyurethane, polyuria, and hybrid polymer-based liners, particularly in North America, South Africa, Australia, and select parts of Latin America.

As e-commerce logistics and construction industries expand their light commercial vehicle fleets, demand is increasing for abrasion-resistant, corrosion-proof bed liners that help protect resale value and lower maintenance costs. Moreover, material innovation, which includes sustainable coatings, recyclable thermoplastics, along with antimicrobial or noise-dampening attributes, is setting the stage for premium product differentiation in the OEM and aftermarket channels, alike.

USA truck bed liners market growth is steady and supported by solid sales of pickup trucks, the trend of customization of vehicles and the rising requirement of protective aftermarket accessories. Polyurethane spray-on bed liners are incredibly popular, protecting trucks from cargo slippage, degradation, and corrosion. Due to the growing use of fleet and utility trucks, this is also driving OEMs to incorporate factory-installed liners.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.2% |

In the United Kingdom, the market is gaining momentum as light commercial vehicles and double-cab pickups gain popularity across agricultural, construction, and delivery sectors. The focus on cargo protection and vehicle longevity is leading to a rise in demand for drop-in and spray-on liners, especially among small fleet owners and rural users.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.0% |

Across the European Union, the truck bedliners market is growing gradually, driven by rising sales of electric utility vehicles, increased use of pickup trucks for business and recreation, and growing availability of liner customization services. Countries like Germany, France, and Spain are witnessing increasing adoption of bedliner coatings in commercial transport and lifestyle trucks.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.1% |

Japan is a niche but stable market, powered by demand for compact pickup segment models and mini trucks (or kei trucks) for agriculture, construction and light logistics. Smaller cargo vehicles usually use drop-in bed liners or rubber mats to prevent abrasions and are easier to maintain.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.0% |

In South Korea, increasing production of lifestyle pickups and utility vehicles is contributing to a slowly growing pickup market. This is fueled by rising consumer interest in off-roading, camping and outdoor recreation. Younger buyers and aftermarket service providers are increasingly demanding spray-on bed liners that have aesthetic and anti-corrosive properties.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.2% |

Selectivity and customization are major drivers of the truck bed liners market as it remains an expanding target for consumers who increasingly use pickup trucks for personal and commercial purposes. As bed liners provide protection to cargo, corrosion resistance, and durability, consumers and fleet operators are purchasing such products in large numbers.

Research continues on UV-stable polymer materials, custom-fit drop-in and spray-on derivatives, and environmentally conscious protective coatings to suit specific needs. The market is segmented into drop-in, spray-on and bed mat formats. Firms are improving offerings by consolidating aftermarket and OEM channels, and increasing distribution in emerging regions.

Other Key Players

The overall market size for the truck bedliners market was USD 568.4 Million in 2025.

The truck bedliners market is expected to reach USD 849.6 Million in 2035.

Growth is driven by the rising demand for pickup trucks in commercial and personal transportation, increasing consumer focus on vehicle protection and aesthetics, growing adoption of spray-on bedliners, and advancements in durable, anti-corrosive coating technologies.

The top 5 countries driving the development of the truck bedliners market are the USA, Canada, Mexico, Australia, and South Africa.

Spray-out bedliners and polyurethane materials are expected to command a significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Truck Mounted Cranes Market Size and Share Forecast Outlook 2025 to 2035

Trucks Market Size and Share Forecast Outlook 2025 to 2035

Truck Loader Crane Market Size and Share Forecast Outlook 2025 to 2035

Truck Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Truck Racks Market Size and Share Forecast Outlook 2025 to 2035

Truck Mounted Knuckle Boom Cranes Market – Growth & Demand 2025 to 2035

Truck Platooning Market

Truck Mounted Concrete Mixer Market

Semi-Truck Market Size and Share Forecast Outlook 2025 to 2035

Hand Trucks And Dollies Market Size and Share Forecast Outlook 2025 to 2035

Food Truck Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dump Trucks Market Size and Share Forecast Outlook 2025 to 2035

Fire Truck Market Growth - Trends & Forecast 2025 to 2035

Heavy-Truck Composite Component Market Size and Share Forecast Outlook 2025 to 2035

Crane Trucks Market Size and Share Forecast Outlook 2025 to 2035

Mining Trucks Market Size and Share Forecast Outlook 2025 to 2035

Tanker Truck Market Size and Share Forecast Outlook 2025 to 2035

Bucket Trucks Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vacuum Truck Market Size and Share Forecast Outlook 2025 to 2035

Pallet Truck Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA