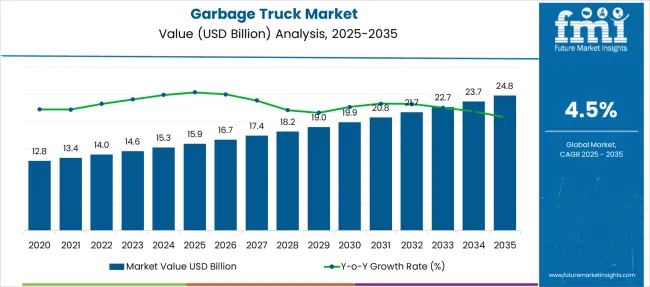

The Garbage Truck Market is estimated to be valued at USD 15.9 billion in 2025 and is projected to reach USD 24.8 billion by 2035, registering a compound annual growth rate (CAGR) of 4.5% over the forecast period. This growth represents a market expansion factor of 1.56. Based on the trajectory, the market growth curve can be characterized as moderately linear with a steady slope, indicating a structurally stable but mature demand profile.

By 2030, the market is expected to reach approximately USD 19.8 billion, accounting for nearly USD 3.9 billion in new value during the first half of the decade. The remaining USD 5.0 billion is projected to emerge from 2030 to 2035, contributing 56% of the overall increase. This pattern suggests a slightly steeper slope in the latter half due to growing municipal fleet upgrades and integration of automated side-loader systems in waste collection contracts.

Vendors such as Heil Environmental and McNeilus Truck and Manufacturing have introduced electric variants with low-noise propulsion systems and smart compaction features. Demand from local governments and private contractors is being supported by policy-driven vehicle electrification, route optimization software, and rising landfill diversion targets. Market performance is expected to follow a predictable upward curve shaped by replacement cycles and regional fleet regulations.

| Metric | Value |

|---|---|

| Garbage Truck Market Estimated Value in (2025E) | USD 15.9 billion |

| Garbage Truck Market Forecast Value in (2035F) | USD 24.8 billion |

| Forecast CAGR (2025 to 2035) | 4.5% |

Electric and hybrid trucks are gaining prominence as municipalities and waste management firms shift to low-emission alternatives and comply with stricter environmental regulations. Smart fleet technologies, including IoT‑based sensors and AI‑driven route optimization, are improving collection efficiency and reducing fuel consumption.

Automation features such as robotic arms and semi-autonomous operation are enabling safer, more streamlined collection processes. Hydrogen fuel cell prototypes are gaining traction in regions investing in hydrogen infrastructure. Asia Pacific leads market growth while North America and Europe maintain strong adoption, prompting traditional manufacturers to innovate or risk decline.

The garbage truck market holds approximately 48% of the waste management equipment market, as rear loaders, front loaders, and side loaders are essential for residential and industrial waste collection. It accounts for around 42% of the municipal utility vehicles market, where it serves routine sanitation operations in urban and semi-urban regions.

In the environmental services and sanitation market, the share of this sector reaches 36%, supporting routine solid waste clearance. The market contributes close to 28% of the urban infrastructure and public works vehicles segment, often purchased by city councils for fleet upgrades. Around 18% of the commercial vehicles market is linked to garbage trucks, as private operators and contractors adopt automated and electric variants for long-term service contracts.

Municipalities and private operators are increasingly focusing on improving operational efficiency and environmental compliance, which has heightened demand for modern garbage truck fleets. Shifts toward sustainable practices and emission regulations are pushing the adoption of electric and alternative fuel-powered trucks, while vehicle automation and digitization are enhancing safety and productivity. The growing complexity of waste segregation and recycling requirements is also influencing equipment design and technology integration.

Market growth is expected to be supported by government funding for smart city projects, stricter regulatory frameworks, and the replacement of aging fleets. With a strong push toward sustainability and smart waste collection systems, the market is positioned for steady expansion across both developed and developing regions.

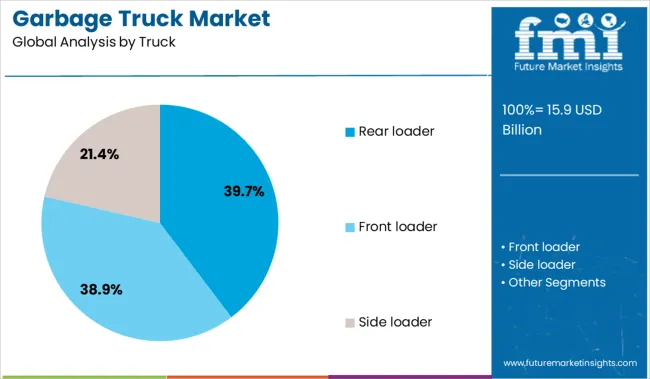

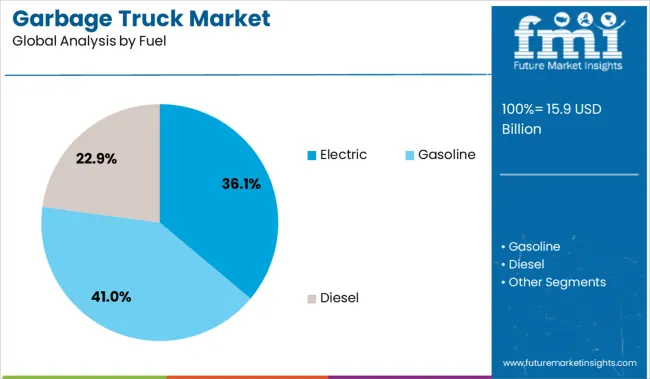

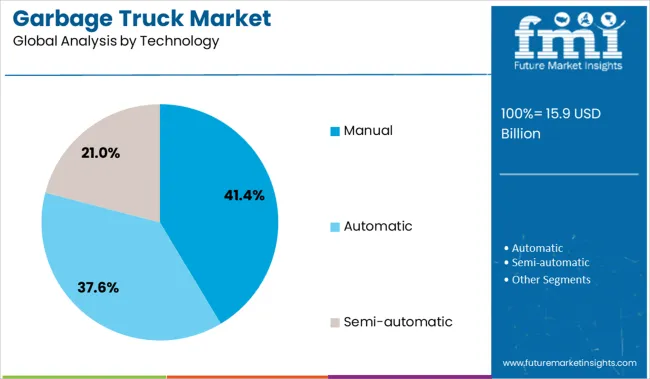

The garbage truck market is segmented by truck type, fuel, technology, end use, and region. By truck type, it includes rear loader, front loader, and side loader, each serving different waste collection requirements. Fuel segmentation comprises electric, gasoline, and diesel-powered models, reflecting the shift toward alternative energy solutions. Based on technology, the market is divided into manual, automatic, and semi-automatic systems, catering to varied operational preferences. End-use categories include municipal and industrial applications, highlighting distinct demand patterns. Geographically, the market spans North America, Latin America, Western and Eastern Europe, Balkan and Baltic countries, Russia and Belarus, Central Asia, East Asia, South Asia and Pacific, and the Middle East and Africa.

The rear loader segment leads the truck category with a market share of 39.7%, reflecting its widespread use in residential and commercial waste collection due to its simple design and high loading efficiency. Its popularity stems from its compatibility with manual labor and the ability to operate in narrow urban streets, making it suitable for dense metropolitan areas.

Rear loaders are known for their versatility in handling mixed and bagged waste, contributing to their continued demand in municipal contracts. Additionally, the availability of various capacity configurations allows operators to optimize routes and reduce fuel consumption. Manufacturers are also integrating advanced compaction technologies and ergonomic improvements to boost performance and worker safety. The segment’s steady adoption rate is expected to persist, supported by the need for reliable and cost-effective waste collection solutions in both developed and emerging markets.

Electric garbage trucks hold a significant 36.1% share within the fuel category, driven by the global shift toward cleaner transportation alternatives and increasing pressure to reduce carbon emissions. These vehicles are gaining traction among municipal bodies due to their low operational noise, reduced maintenance needs, and eligibility for government subsidies.

Technological advancements in battery performance, charging infrastructure, and vehicle range have made electric garbage trucks more practical for daily operations. Operators are also motivated by long-term cost savings and compliance with low-emission zones and sustainability targets.

As urban centers move toward electrification of public services, the electric segment is projected to see continued growth, particularly in regions with supportive policy environments and strong environmental mandates. The integration of electric drivetrains in existing chassis formats further accelerates adoption without requiring major operational overhauls.

The manual technology segment dominates the market with a 41.4% share, reflecting its continued relevance in traditional waste collection systems where automation adoption remains limited. Manual garbage trucks are preferred for their simplicity, ease of maintenance, and lower upfront costs, particularly in regions with high labor availability and budget constraints.

These systems allow for flexible waste handling, especially in communities where infrastructure for automated bins is not yet standardized. Although automation and smart features are gaining attention, manual trucks continue to serve as the backbone of municipal waste collection fleets in many parts of the world.

Their adaptability to varying collection conditions and compatibility with rear loader configurations further support their use. While a gradual transition to semi-automated systems is anticipated, the manual segment is expected to retain a substantial presence, especially in cost-sensitive and infrastructure-constrained markets.

From 2025 to 2035, waste management fleets adopted dynamic routing systems to improve collection efficiency, reduce operational costs, and enhance service reliability. This shift positions manufacturers providing trucks with built-in telematics and route intelligence as key enablers of efficiency-focused waste management operations.

The steady increase in municipal and industrial waste generation has been identified as the primary catalyst for growth in the garbage truck market. In 2024, a United Nations projection of rising waste tonnage prompted municipalities globally to expand fleet capacities. By 2025, commercial and residential collection services were expected to upgrade vehicles with larger capacities and improved compaction features to accommodate the surge.

These developments indicate that consistent waste stream expansion, not short-term urban peaks, is fueling procurement cycles. Manufacturers providing high-capacity, durable trucks with enhanced load-handling features are therefore well-positioned to capture sustained demand from waste management operators.

In 2024, waste management companies began integrating route optimization platforms with garbage trucks to streamline collection schedules, leading to reported reductions in fuel use and improved pick-up reliability. By 2025, dynamic routing solutions were being embedded directly into truck telematics systems, allowing real-time rerouting around road closures and high-traffic zones.

These implementations demonstrate that when route planning software is incorporated with vehicle systems, operational efficiency is significantly enhanced. Fleet operators that adopt trucks equipped with built-in route intelligence and connectivity are being positioned to gain a competitive advantage, offering faster service with lower operational overhead and improved fleet productivity.

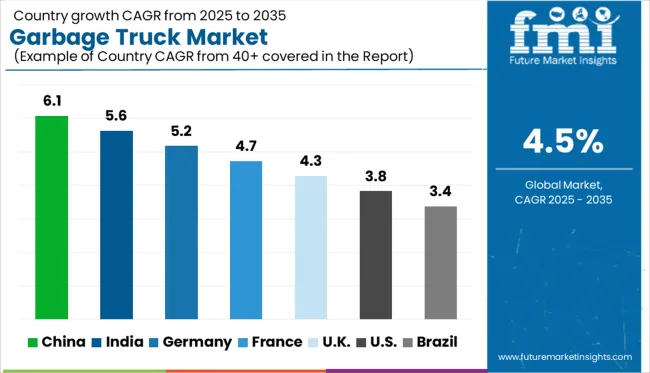

| Countries | CAGR |

|---|---|

| China | 6.1% |

| India | 5.6% |

| Germany | 5.2% |

| France | 4.7% |

| UK | 4.3% |

| USA | 3.8% |

| Brazil | 3.4% |

The global garbage truck market, growing at a 4.5% CAGR, reflects distinct trends across OECD and ASEAN regions. OECD economies such as Germany, France, and the United Kingdom emphasize automation and low-emission technology. Germany shows 5.2% growth through connected fleet systems, while France at 4.7% focuses on municipal green initiatives. The UK records 4.3%, driven by replacement of aging fleets with compliant models. ASEAN markets including Indonesia, Thailand, and Vietnam experience rising demand supported by infrastructure development and government-backed programs for clean fuel vehicles. Adoption of electric and hybrid garbage trucks in ASEAN is slower due to cost barriers but accelerates in urban hubs.

China is expected to lead the garbage truck market with a 6.1% CAGR, driven by urbanization-led waste generation and clean energy mandates. Electric garbage trucks dominate new municipal procurements, supported by subsidies for green fleets. Advanced hydraulic systems and automation for bin lifting are standard in city fleets. Domestic manufacturers are also exporting to Southeast Asian markets, leveraging cost-competitive designs.

India is projected to grow at 5.6% CAGR, supported by smart city programs and rising municipal waste volumes. Adoption of compact garbage trucks is high in congested urban zones, while hydraulic tipper trucks serve large municipal areas. Government funding promotes electric garbage truck pilots in metropolitan cities. Local manufacturers offer CNG and battery-powered variants for compliance with emission standards.

Germany is forecast to expand its garbage truck market at a 5.2% CAGR, driven by sustainability mandates and investments in fully electric waste collection vehicles. Local authorities deploy automated side-loading trucks for efficiency in urban waste handling. German manufacturers lead in producing zero-emission trucks equipped with telematics for route optimization. Battery-swapping solutions are also being piloted to minimize downtime.

France is projected to grow at a 4.7% CAGR, supported by EU emission standards and local commitments to low-carbon mobility. Municipal agencies are transitioning to hybrid and electric garbage trucks for household waste collection. Compact, noise-reduced trucks are gaining popularity in residential zones. Fleet modernization includes telematics and safety sensors to improve efficiency and operator safety.

The UK market is expected to grow at 4.3%, shaped by environmental regulations and aging fleet replacement cycles. Councils and private waste operators are investing in electric and low-emission trucks to comply with clean air zone policies. Demand for rear-loading trucks remains strong in commercial collection, while automated variants see adoption in high-density urban areas.

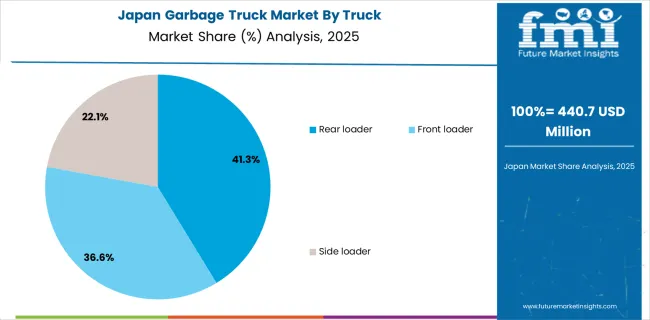

In 2025, the garbage truck market in Japan is expected to generate USD 440.7 million, accounting for roughly 2.8% of the global market valued at USD 15.9 billion. Rear loaders lead with a 41.3% market share due to their effectiveness in densely populated residential areas. Front loaders follow at 36.6%, commonly used for collecting industrial and commercial waste. Side loaders hold 22.1%, gaining traction where automation and curbside efficiency are priorities in municipal systems.

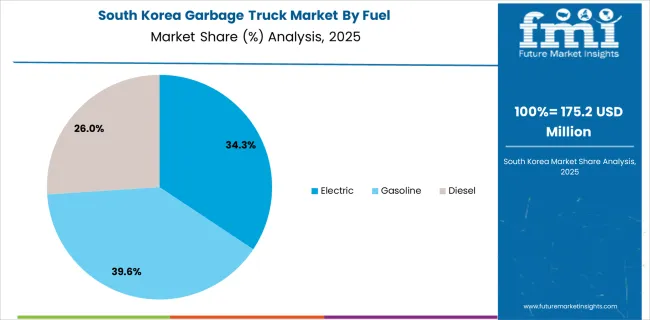

The garbage truck market in South Korea is projected to generate USD 175.2 million in revenue in 2025, contributing roughly 1.1% to the global market worth USD 15.9 billion. Gasoline-powered models hold the highest share at 39.6%, driven by widespread servicing infrastructure and affordable acquisition costs. Electric trucks account for 34.3%, reflecting national investment in battery-powered public vehicles. Diesel variants comprise 26.0%, showing reduced usage due to emission restrictions.

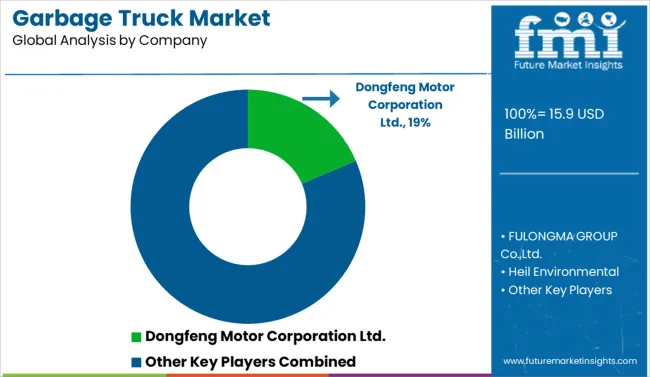

The garbage truck market is moderately consolidated, led by Dongfeng Motor Corporation Ltd. with an 18.6% market share. The company holds a dominant position through its diversified waste collection vehicle portfolio, extensive manufacturing capabilities, and strong presence in municipal fleet contracts.

Dominant player status is held exclusively by Dongfeng Motor Corporation Ltd. Key players include FULONGMA GROUP Co., Ltd., Heil Environmental, Kirchhoff Group, Mack Trucks (AB Volvo), McNeilus Truck and Manufacturing Inc., Peterbilt, Terberg Environmental, and XCMG Group - each offering specialized refuse truck solutions, including rear-load, front-load, and automated side-load systems integrated with advanced compaction and safety technologies.

Emerging players are currently limited in this market due to high entry barriers and the dominance of established OEMs with long-standing municipal partnerships. Market demand is driven by rising urban waste generation, increasing public investment in modern waste management infrastructure, and the growing transition toward electric and low-emission refuse collection fleets.

Recent Industry Developments

| Item | Value |

|---|---|

| Quantitative Units | USD 15.9 Billion |

| Truck | Rear loader, Front loader, and Side loader |

| Fuel | Electric, Gasoline, and Diesel |

| Technology | Manual, Automatic, and Semi-automatic |

| End Use | Municipal and Industrial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Dongfeng Motor Corporation Ltd., FULONGMA GROUP Co.,Ltd., Heil Environmental, Kirchhoff Group, Mack Trucks (AB Voloo), McNeilus Truck and Manufacturing Inc., Peterbilt, Shandong Wuzheng Group Co., Ltd., Terberg Environmental, and XCMG Group |

| Additional Attributes | Dollar sales by truck type (rear-loader, front-loader, side-loader, roll-off), regional demand trends, competitive landscape, buyer preferences for electric and hybrid versus diesel models, integration with telematics and route-optimization systems, innovations in automated loading mechanisms and zero-emission garbage truck designs. |

The global garbage truck market is estimated to be valued at USD 15.9 billion in 2025.

The market size for the garbage truck market is projected to reach USD 24.8 billion by 2035.

The garbage truck market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in garbage truck market are rear loader, front loader and side loader.

In terms of fuel, electric segment to command 36.1% share in the garbage truck market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Garbage Bags Market Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among Garbage Bag Companies

Electric Garbage Van Market Analysis by Product type, Loading Capacity, End User and Region from 2025 to 2035

United States Garbage Bags Market Size and Share Forecast Outlook 2025 to 2035

United States Scented Garbage Bags Market Size and Share Forecast Outlook 2025 to 2035

Truck Mounted Cranes Market Size and Share Forecast Outlook 2025 to 2035

Trucks Market Size and Share Forecast Outlook 2025 to 2035

Truck Loader Crane Market Size and Share Forecast Outlook 2025 to 2035

Truck Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Truck Racks Market Size and Share Forecast Outlook 2025 to 2035

Truck Bedliners Market Outlook- Trends & Forecast 2025 to 2035

Truck Mounted Knuckle Boom Cranes Market – Growth & Demand 2025 to 2035

Truck Platooning Market

Truck Mounted Concrete Mixer Market

Semi-Truck Market Size and Share Forecast Outlook 2025 to 2035

Hand Trucks And Dollies Market Size and Share Forecast Outlook 2025 to 2035

Food Truck Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dump Trucks Market Size and Share Forecast Outlook 2025 to 2035

Fire Truck Market Growth - Trends & Forecast 2025 to 2035

Heavy-Truck Composite Component Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA