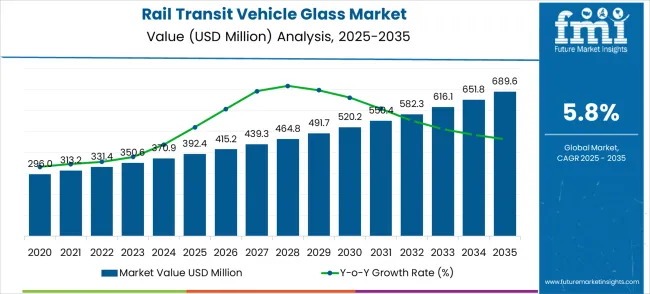

The rail transit vehicle glass market begins its decade journey from a USD 392.4 million foundation in 2025, setting the stage for substantial expansion ahead. The first half of the decade witnesses steady momentum building, with market value climbing from USD 415.2 million in 2026 to USD 550.4 million by 2030. This initial phase reflects growing high-speed rail development and increasing safety standards across global railway networks.

The latter half will witness accelerated growth dynamics, propelling the market from USD 582.3 million in 2031 to reach USD 689.6 million by 2035. Dollar additions during 2030-2035 outpace the earlier period, with annual increments averaging USD 27.8 million compared to USD 31.6 million in the first phase. This progression represents a 75.7% total value increase over the forecast decade.

Market maturation factors include expanding metro and high-speed rail infrastructure projects, increasing focus on energy efficiency through advanced glazing technologies, and passenger comfort enhancement initiatives. The 5.8% compound annual growth rate positions participants to capitalize on USD 297.2 million in additional market value creation. This trajectory signals robust opportunities for glass technology innovators, railway manufacturers, and specialized glazing solution providers across the global transportation landscape.

Market expansion unfolds through two distinct growth periods with different competitive characteristics for each phase. The 2025-2030 foundation period delivers USD 158.0 million in value additions, representing 40.3% growth from the baseline. Market dynamics during this phase center on high-speed rail expansion, safety glass standardization, and energy-efficient glazing adoption acceleration.

The 2030-2035 acceleration period generates USD 139.2 million in incremental value, reflecting 25.3% growth from the 2030 position. This phase exhibits mature market characteristics with enhanced competition, advanced glazing integration strategies, and geographic expansion initiatives. Dollar contributions shift from foundational infrastructure development to smart glass technology integration and passenger experience enhancement.

Competitive landscape evolution progresses from early market development to established glazing solution positioning. The first period emphasizes safety compliance and infrastructure modernization. The second period witnesses intensified competition for premium technology segments and integrated solution development across high-speed rail, subway, and light rail applications.

| Metric | Value |

|---|---|

| Market Value (2025) → | USD 392.4 million |

| Market Forecast (2035) ↑ | USD 689.6 million |

| Growth Rate ★ | 5.8% CAGR |

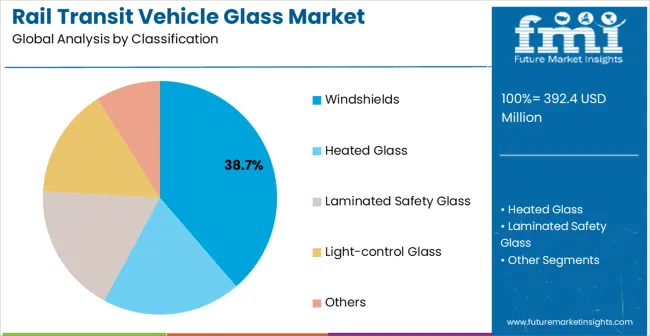

| Leading Segment → | Windshields |

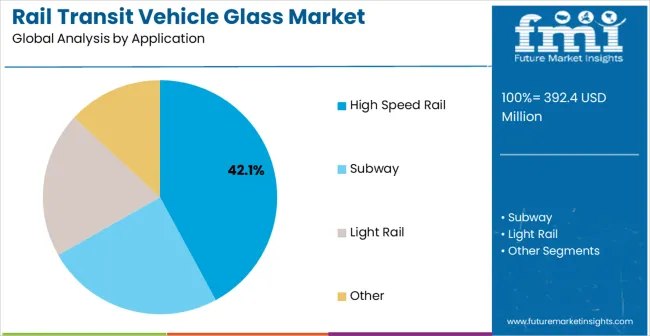

| Primary Application → | High Speed Rail |

Market expansion rests on four fundamental shifts driving rail transit glazing demand acceleration:

The growth faces headwinds from high material costs and complex certification requirements for specialized railway applications. Traditional glazing solutions maintain cost advantages for budget-constrained transit authorities. Technical complexity creates adoption barriers for less sophisticated railway operations and older rolling stock applications.

Primary Classification: Glass Type Distribution

Secondary Breakdown: Application Categories

Geographic Segmentation: Regional Market Distribution

Market Position: Windshields establish clear market leadership through critical safety functionality and advanced technology integration in rail transit applications. Aerodynamic design requirements necessitate specialized glazing solutions capable of withstanding high-speed operational stresses while maintaining optical clarity. Impact-resistant technologies provide protection against debris strikes and weather conditions during high-velocity operations.

Value Drivers: Advanced laminated construction enables superior impact resistance while maintaining structural integrity during emergency situations and operational incidents. Anti-reflective coatings improve operator visibility during varying lighting conditions and weather scenarios. Heating element integration prevents frost formation and maintains operational visibility during winter conditions and extreme weather events.

Competitive Advantages: Windshields offer comprehensive protection and visibility compared to alternative glazing solutions requiring additional safety features. Integration capabilities enable connection with vehicle control systems for automated defrosting and environmental management. Customizable configurations accommodate various vehicle designs and operational requirements across different rail transit applications.

Market Challenges: High manufacturing costs require significant investment compared to standard automotive glazing applications due to specialized performance requirements. Certification complexity involves extensive testing protocols for railway safety standards and international regulatory compliance. Replacement costs include specialized installation procedures and certified technician requirements for maintenance operations.

Strategic Market Importance: High-speed rail represents the primary demand driver for advanced glazing technologies across global railway infrastructure development projects. Operational speeds exceeding 300 km/h create specialized glazing requirements for structural integrity, aerodynamic performance, and passenger safety standards. Premium passenger experience expectations necessitate advanced glazing features including noise reduction and enhanced visibility capabilities.

Market Dynamics Q&A:

Business Logic: High-speed rail operations prioritize safety and passenger experience, making advanced glazing technologies essential for operational success and regulatory compliance. Technology integration reduces operational costs through energy efficiency while improving service quality and passenger satisfaction. Investment justification occurs through enhanced operational performance and reduced maintenance requirements over vehicle lifecycle.

Forward-looking Implications: Maglev and hyperloop technology development create opportunities for revolutionary glazing solutions with unprecedented performance requirements. International high-speed rail corridor development increases standardization needs for compatible glazing systems across multiple networks. Autonomous train operations demand enhanced visibility and sensor integration capabilities requiring advanced glazing technology development.

Growth Accelerators

Infrastructure investment acceleration drives rail transit expansion, requiring comprehensive glazing solutions across new rolling stock procurement and fleet modernization projects. Safety regulation enhancement mandates advanced glazing technologies for passenger protection and operational safety compliance. Passenger experience optimization initiatives prioritize comfort features through noise reduction, climate control, and visibility enhancement. Energy efficiency requirements drive adoption of advanced glazing technologies, reducing operational costs through improved thermal performance.

High material costs create adoption barriers for budget-constrained transit authorities and developing market railway operators. Certification complexity requires extensive testing and approval processes extending product development timelines and increasing market entry costs. Replacement market limitations restrict growth opportunities in mature railway networks with extended vehicle lifecycles. Technical specification diversity across different railway systems creates standardization challenges limiting economies of scale.

Smart glass integration enables dynamic opacity control and passenger comfort management through automated environmental response systems. Advanced coating technologies improve energy efficiency while maintaining structural performance requirements for high-speed operations. Modular glazing design facilitates flexible installation configurations accommodating diverse vehicle architectures and operational requirements. Predictive maintenance integration utilizes sensor technology for proactive glazing system monitoring and replacement scheduling optimization.

| Country | CAGR (2025-2035) |

|---|---|

| China | 7.8% |

| India | 7.3% |

| Germany | 6.7% |

| Brazil | 6.1% |

| USA | 5.5% |

| UK | 4.9% |

| Japan | 4.4% |

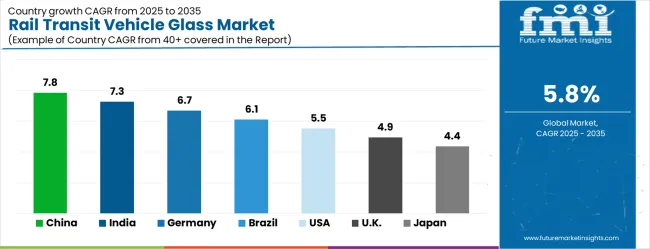

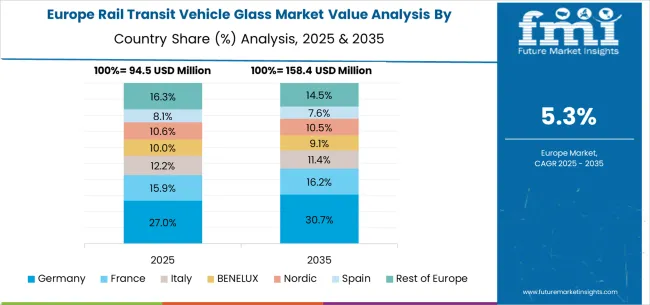

Global market dynamics reveal distinct performance tiers reflecting regional railway development priorities and infrastructure investment strategies. High-Growth Markets including China (7.8% CAGR) and India (7.3% CAGR) demonstrate aggressive railway infrastructure expansion with comprehensive glazing technology adoption. Technology Leaders such as Germany (6.7% CAGR) represent European engineering excellence with advanced glazing standard development. Steady Performers including Brazil (6.1% CAGR) and the United States (5.5% CAGR) show consistent growth aligned with rail transit modernization and urban transportation development. Mature Markets including the United Kingdom (4.9% CAGR) and Japan (4.4% CAGR) display moderate growth rates reflecting established infrastructure with a technology upgrade focus.

The rail transit vehicle glass market in China is projected to grow at a CAGR of 7.8% from 2025 to 2035. China’s massive urbanization, rapid expansion of high-speed rail networks, and investments in metro and light rail systems are major growth drivers. Rail transit operators are increasingly adopting advanced glass solutions, including laminated, tempered, and insulated glass, to enhance passenger safety, noise reduction, energy efficiency, and comfort. The government’s commitment to public transport and smart city initiatives further supports demand, especially for modern trains and metro fleets. Domestic glass manufacturers are scaling production capacities and investing in R&D to develop lightweight, anti-reflective, and high-strength solutions suitable for rail applications. The rising exports of Chinese rolling stock and collaborative projects with global rail vehicle manufacturers are increasing adoption of advanced glass products. The market growth is driven by the continuous development of high-speed rail corridors and urban transit networks, ensuring long-term opportunities for glass suppliers.

The rail transit vehicle glass market in India is anticipated to expand at a CAGR of 7.3% from 2025 to 2035. India’s metro rail and suburban transit systems are rapidly expanding to accommodate increasing urban mobility needs. Modern rail projects emphasize the adoption of high-performance glass for windows, doors, and interiors to improve passenger comfort, safety, and thermal insulation. Laminated, tempered, and smart glass solutions are gaining traction to reduce vibration, enhance visibility, and increase durability in harsh climatic conditions. Local manufacturers are gradually scaling up production, supported by government initiatives such as Smart Cities Mission and metro rail expansion programs. Partnerships with global suppliers are also helping Indian operators access high-quality and technologically advanced glass. The modernization of existing rail fleets and the push for lightweight, energy-efficient rail vehicles further support the adoption of advanced rail transit glass over the forecast period.

The rail transit vehicle glass market in Germany is projected to grow at a CAGR of 6.7% between 2025 and 2035. Germany’s highly developed rail infrastructure, including high-speed trains and regional transit networks, drives demand for advanced glass solutions. Safety, noise reduction, and energy efficiency are critical parameters, prompting adoption of tempered, laminated, and multi-layer insulated glass. German rail vehicle manufacturers, such as Siemens and Bombardier (now part of Alstom), integrate high-performance glass to meet stringent EU safety standards and passenger comfort requirements. The country’s focus on transportation and green mobility further enhances market opportunities, particularly for energy-efficient and lightweight glass. Continuous innovation in glass coatings, anti-scratch surfaces, and UV protection ensures that German rail vehicles maintain high-quality standards. Replacement and refurbishment of older train fleets provide consistent demand for advanced rail transit glass solutions, ensuring steady growth in the market.

The rail transit vehicle glass market in Brazil is projected to grow at a CAGR of 6.1% from 2025 to 2035. Brazil’s expanding urban rail systems, including metro and commuter trains, are increasing the demand for high-quality glass for safety, thermal insulation, and noise reduction. Laminated and tempered glass solutions are particularly critical in ensuring passenger protection and durability in high-traffic environments. Brazil’s public and private transit operators are modernizing fleets to enhance passenger experience and comply with safety regulations, further driving market adoption. While the local glass manufacturing industry is developing, a significant portion of advanced rail transit glass is imported from international suppliers. Government investment in urban mobility, metro extensions, and light rail projects continues to support steady market growth. The combination of fleet modernization, increased passenger volumes, and urbanization trends positions Brazil as a promising market for advanced rail transit vehicle glass solutions.

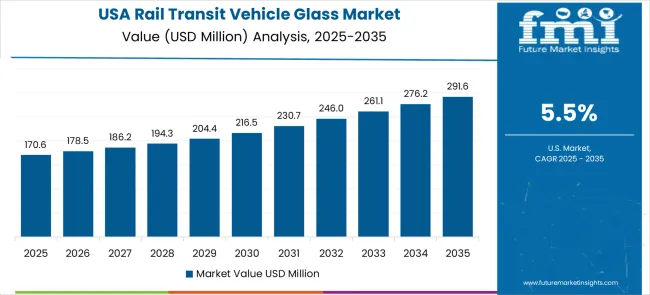

The rail transit vehicle glass market in the USA is expected to grow at a CAGR of 5.5% from 2025 to 2035. The country’s focus on expanding urban transit, light rail, and high-speed train corridors drives demand for advanced glass solutions. Rail transit glass is widely used in windows, doors, and interiors for passenger safety, noise control, thermal insulation, and energy efficiency. Laminated, tempered, and insulated glass solutions are preferred to meet Federal Railroad Administration (FRA) safety standards and improve passenger comfort. Replacement of aging rail fleets and upgrades to existing commuter and metro systems also contribute to consistent market growth. USA manufacturers and suppliers are increasingly investing in R&D to produce lightweight, durable, and scratch-resistant glass solutions for rail applications. The adoption of smart glass technologies in modern trains is emerging, further boosting market prospects over the forecast period.

The rail transit vehicle glass market in the UK is projected to grow at a CAGR of 4.9% from 2025 to 2035. The UK’s rail modernization programs, including metro, light rail, and intercity train upgrades, are driving the demand for advanced glass solutions. Laminated and tempered glass is widely adopted to ensure passenger safety, reduce noise, and enhance thermal insulation. The country’s focus on transport and modernization of legacy rail fleets increases the need for lightweight and durable glass. High-speed rail projects such as HS2 and upgrades to commuter trains further stimulate adoption. Local manufacturers collaborate with global suppliers to access high-performance glass products and coatings, including anti-reflective and UV-protective solutions. Refurbishments and replacements of older trains provide steady demand for advanced rail transit glass over the forecast period, ensuring market resilience and consistent growth.

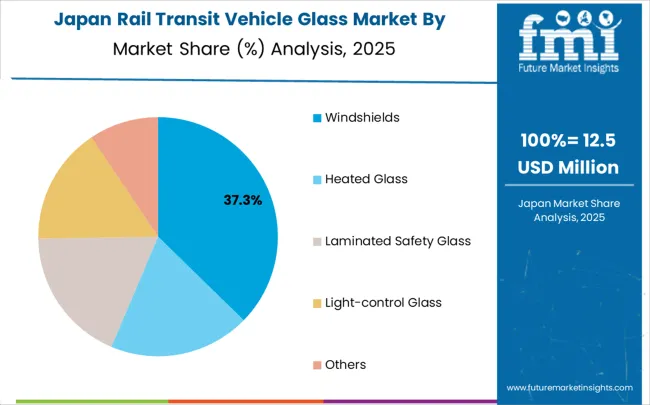

The rail transit vehicle glass market in Japan is forecast to grow at a CAGR of 4.4% from 2025 to 2035. Japan’s extensive high-speed rail network, metro systems, and advanced commuter trains require high-quality glass solutions for safety, thermal insulation, noise reduction, and passenger comfort. Laminated, tempered, and insulated glass is extensively adopted to withstand high-speed operation, vibration, and environmental stresses. Japanese rail manufacturers emphasize durability, lightweight materials, and energy efficiency in modern rolling stock, supporting steady demand for advanced rail transit glass. Replacement and refurbishment of aging train fleets, alongside continuous urban transit expansion, further contribute to market growth. Domestic innovation in coatings, scratch resistance, and smart glass integration ensures that rail vehicles meet both functional and aesthetic requirements. While the market is mature, ongoing infrastructure development and technological advancements in rail systems ensure adoption of high-performance glass solutions.

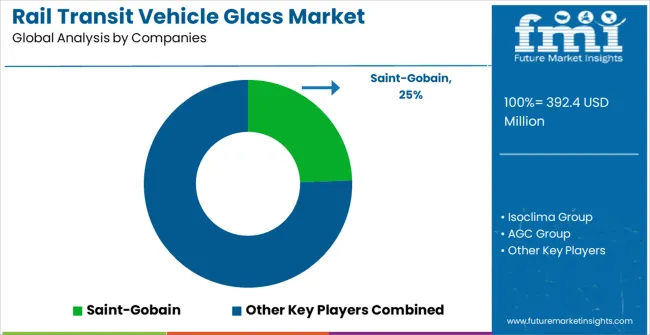

Market structure reflects moderate concentration with established global players maintaining significant positions while specialized technology providers serve specific application segments. Competition emphasizes technological innovation, comprehensive solution integration, and geographic market coverage expansion. Industry dynamics favor companies combining advanced glazing technology development with extensive manufacturing capabilities and international certification compliance.

Tier 1 - Global Technology Leaders: Companies like Saint-Gobain and AGC Group dominate through comprehensive product portfolios, global manufacturing networks, and continuous R&D investment in advanced glazing technologies. Competitive advantages include established OEM relationships, proven performance track records, and integrated solution capabilities spanning multiple transportation applications.

Tier 2 - Specialized Solution Providers: Organizations, including Isoclima Group and Glas Trösch focus on specific technology segments through specialized expertise and targeted market development. Competitive advantages include application-specific knowledge, flexible customization capabilities, and regional market specialization, enabling responsive customer service and technical support.

Tier 3 - Regional and Component Specialists: Companies, including Fuyao Group and regional suppliers, serve local markets through cost-competitive solutions and specialized manufacturing capabilities. Competitive advantages include local market knowledge, flexible production capacity, and partnership relationships with regional rolling stock manufacturers and railway operators.

The rail transit vehicle glass market is central to passenger safety, comfort, energy efficiency, and modern rail aesthetics. With growing urbanization, smart mobility initiatives, and mandates, the sector must balance lightweight design, crash resistance, thermal/acoustic insulation, and cost optimization. Coordinated action from governments, industry bodies, OEMs/railcar manufacturers, suppliers, and investors is essential to transition toward next-generation glass solutions that are climate-smart, digitally integrated, and passenger-centric.

| Item | Value |

|---|---|

| Quantitative Units | USD 689.6 million |

| Glass Type | Windshields, Heated Glass, Laminated Safety Glass, Light-control Glass, Others |

| Application | High Speed Rail, Subway, Light Rail, Other |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Germany, United Kingdom, France, Italy, Spain, Nordic, BENELUX, China, Japan, South Korea, India, ASEAN, Australia, New Zealand, Brazil, Chile, Kingdom of Saudi Arabia, GCC Countries, Turkey, South Africa |

| Key Companies Profiled | Saint-Gobain, Isoclima Group, AGC Group, Glas Trösch, NSG Group, Gauzy, Dellner, Romag, Fuyao Group, Jiangsu Tie, MAO Glass, Qingdao Jinjing |

| Additional Attributes | Dollar sales by glass type categories, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape analysis, adoption patterns across rail transit sectors, integration with smart transportation systems, energy efficiency innovations, safety compliance standards |

The global rail transit vehicle glass market is estimated to be valued at USD 392.4 million in 2025.

The market size for the rail transit vehicle glass market is projected to reach USD 689.6 million by 2035.

The rail transit vehicle glass market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in rail transit vehicle glass market are windshields, heated glass, laminated safety glass, light-control glass and others.

In terms of application, high speed rail segment to command 42.1% share in the rail transit vehicle glass market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Road-Rail Vehicles Market

Unmanned Railway Vehicle Washing Systems Market Size and Share Forecast Outlook 2025 to 2035

Vehicle-Mounted Payment Terminal Market Size and Share Forecast Outlook 2025 to 2035

Glass Rolling Forming Machine Market Size and Share Forecast Outlook 2025 to 2035

Glass Liquor Bottle Market Size and Share Forecast Outlook 2025 to 2035

Glass Bottles Market Forecast and Outlook 2025 to 2035

Vehicle Scanner Market Size and Share Forecast Outlook 2025 to 2035

Glass Laser Engraving Machine Market Size and Share Forecast Outlook 2025 to 2035

Glass Restoration Kit Market Size and Share Forecast Outlook 2025 to 2035

Vehicle-to-grid Market Size and Share Forecast Outlook 2025 to 2035

Transit Ticketing Market Size and Share Forecast Outlook 2025 to 2035

Railway Communication Equipment Market Size and Share Forecast Outlook 2025 to 2035

Glass Bottle and Container Market Forecast and Outlook 2025 to 2035

Railway Rolling Stock Market Forecast and Outlook 2025 to 2035

Glass Additive Market Forecast and Outlook 2025 to 2035

Glass Reactor Market Size and Share Forecast Outlook 2025 to 2035

Glass Cosmetic Bottle Market Size and Share Forecast Outlook 2025 to 2035

Railway System Market Size and Share Forecast Outlook 2025 to 2035

Glass & Metal Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Glass Product Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA