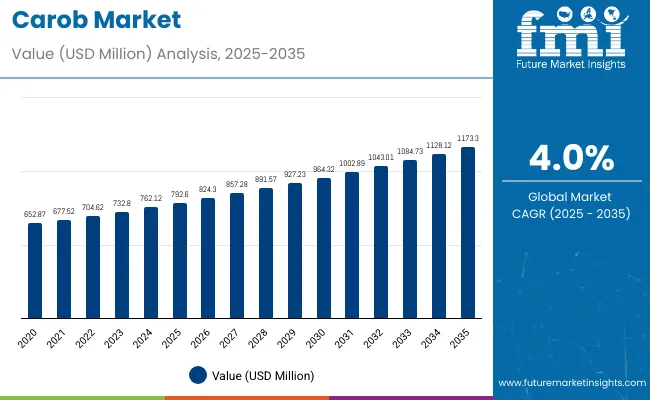

The carob market is valued at USD 792.6 million in 2025 and is projected to grow to USD 1,173.3 million by 2035, advancing at a CAGR of 4.0%.

| Metric | Value |

|---|---|

| Estimated Size (2025E) | USD 792.6 million |

| Projected Value (2035F) | USD 1,173. 3 million |

| CAGR (2025 to 2035) | 4.0% |

Factors driving this growth include the rising demand for caffeine-free and gluten-free food alternatives, increasing use of carob in bakery and confectionery applications, and the growing popularity of natural sweeteners. Additionally, the expansion of retail infrastructure in emerging economies and a rising health-conscious consumer base are contributing to the market’s expansion.

By 2030, the market is forecasted to reach USD 984.1 million, reflecting steady growth throughout the forecast period. The absolute dollar growth between 2025 and 2035 is expected to be around USD 380.7 million, indicating consistent and reliable expansion. Market growth is anticipated to accelerate in the latter half of the timeline, driven by increased adoption of carob in clean-label beverages, functional foods, gluten-free products, pet food formulations, and natural health supplements. This growth is further supported by rising consumer demand for caffeine-free, gluten-free, and plant-based alternatives across global markets.

Companies such as Australian Carobs Pty Ltd and Carob S.A. are strengthening their competitive positions through investments in advanced extraction technologies and scalable production systems. Innovation-driven procurement models are enabling expansion into pharmaceutical drug delivery, nutraceutical formulations, and premium cosmetic applications utilizing carob. The market performance will continue to be anchored by strict regulatory compliance, high purity standards, and commitments to sustainable sourcing practices across the global carob supply chain.

The market holds a significant share across multiple segments. It accounts for 35% of the gluten-free ingredients market, driven by its natural caffeine-free and gluten-free properties and growing use in bakery, confectionery, and specialty health products. The market contributes about 28% to the functional food and beverage ingredients sector, supported by increasing adoption in nutrition bars, beverages, and dietary supplements. Carob also holds close to 22% of the natural and organic personal care ingredients market, where its antioxidant and moisturizing properties are valued. In the pet food segment, carob captures around 18% of the market share, favored for its safety and nutritional benefits in specialty formulations.

The market is evolving with advancements in processing technologies improving flavor profiles and nutritional benefits. Producers are expanding product lines to include carob-based snacks, clean-label beverages, and natural sweeteners, supported by organic and fair-trade certifications. Collaborations with foodservice operators, health retailers, and online platforms are broadening market reach, driving consumer awareness, and reshaping traditional sweetener and functional ingredient categories.

The market is segmented by form, distribution channel, application, and region. By form, the market is bifurcated into solid and liquid. Based on distribution channel, the market is categorized into fitness stores, health stores, online stores and others (specialty stores, grocery chains, and departmental outlets). In terms of application, the market is divided into bakery products, dairy products, nutrition & supplements, pharmaceuticals, and others (pet food, beverages, and confectionery). Regionally, the market is classified in to North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, Middle East and Africa.

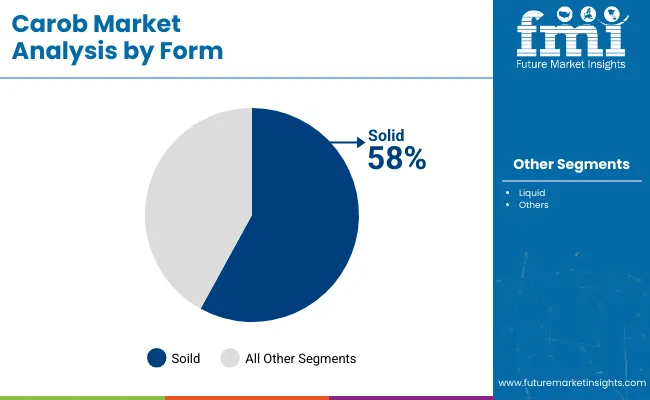

Solid carob is expected to dominate the form segment in 2025, holding a 58% market share. Its widespread use in bakery, confectionery, and pet food sectors is attributed to its advantages like ease of storage, low moisture content, and extended shelf life. This form serves as a natural substitute for cocoa powder in various food products, making it highly versatile. Solid carob’s popularity spans both retail and foodservice sectors, fueling steady growth in major consumer markets.

It is particularly favored for dry mix applications due to its stability and convenience. Additionally, solid carob offers cost-efficiency for bulk manufacturing, making it attractive to producers. Its low processing requirements further enhance its commercial adoption, positioning it as a preferred ingredient in packaged foods and baked snacks. These benefits collectively contribute to solid carob’s leading status in the market and its continued expansion across diverse food applications.

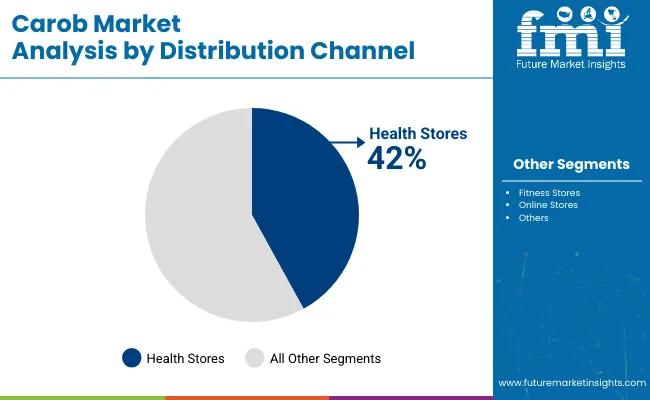

Health stores are poised to lead the distribution channel segment in 2025, capturing a 42% market share. These stores specifically target health-conscious consumers who prioritize functional, organic, and clean-label ingredients like carob. Carob’s natural sweetener qualities, caffeine-free profile, and suitability for diabetic-friendly diets align perfectly with health stores’ product offerings. Shoppers at these outlets seek certified and trustworthy products, which enhances carob’s visibility and shelf presence.

Health stores also emphasize organic and sugar-free carob variants, catering to niche consumer preferences. The availability of premium and specialty carob brands further strengthens the market in this segment. Additionally, in-store expert guidance helps build consumer confidence, encouraging repeat purchases. The growth of health stores distributing carob is particularly driven by rising demand in developed economies, where awareness of natural and functional ingredients continues to expand. This makes health stores a vital channel for carob adoption and sustained market growth.

From 2025 to 2035, rising consumer demand for natural, clean-label, and functional food and beverage products is driving significant growth in the carob market. Increasing preference for health-enhancing, organic, and sustainably sourced carob products has encouraged producers to invest in advanced extraction and processing technologies, enabling them to expand product portfolios and meet evolving consumer needs.

Growing Consumer Health Awareness Drives Market Growth

A steady rise in consumer interest in clean-label, gluten-free, and nutrient-rich products is a primary growth driver in the carob market. Consumers seek foods and beverages offering health benefits such as antioxidant support, caffeine-free alternatives, and digestive health. Brands are focusing on product quality by using innovative carob extracts and ensuring transparency in sourcing and production to satisfy these expectations.

Innovation in Product Development Expands Market Opportunities

Technological advancements in carob processing, flavor enhancement, and encapsulation have improved product stability, potency, and shelf life. The development of organic, allergen-free, and sustainably sourced carob products, along with quality certifications, appeals to environmentally conscious and health-driven consumers. These innovations create new opportunities for premium carob-based products, fueling sustained market expansion.

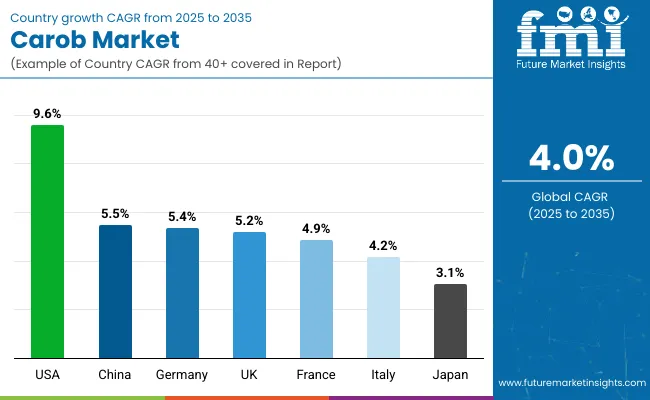

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 9.6% |

| China | 5.5% |

| Germany | 5.4% |

| United Kingdom | 5.2% |

| France | 4.9% |

| Italy | 4.2% |

| Japan | 3.1% |

The United States leads with a strong CAGR of 9.6%, driven by its robust consumer focus on gluten-free, caffeine-free, and clean-label products, along with expansion in pet food and functional beverages. China follows with a solid 5.5% CAGR, propelled by increasing plant-based nutrition interest and investments in processing technologies. Germany closely trails at 5.4%, supported by rising demand for diabetic-friendly and natural alternatives. The UK’s 5.2% CAGR reflects growing vegan and ethical consumption trends. France’s 4.9% CAGR is fueled by mediterranean diet influences and product innovations. Italy shows moderate growth at 4.2%, capitalizing on traditional culinary uses and sustainability trends. Japan reports the slowest but steady growth at 3.1%, driven by niche health supplements and gluten-free market segments.

The report covers an in-depth analysis of 40+ countries; seven top-performing OECD countries are highlighted below.

Revenue from carob in the U.S. is projected to grow at a CAGR of 9.6% from 2025 to 2035, leading global expansion driven by rising consumer demand for natural, gluten-free, and caffeine-free alternatives. This growth is supported by increasing use of carob in bakery, confectionery, and pet food formulations. Strong innovation in clean-label and organic product offerings enhances market penetration in both retail and foodservice channels.

The rising health consciousness of millennials and Gen Z fuels demand for diversified carob applications, including nutrition bars and functional beverages. Expansion of online and specialty store distribution networks further accelerates growth. Regulatory compliance and sustainable sourcing practices underpin market credibility. Increasing investment in production technologies supports scalability and quality improvements. Overall, the U.S. market sets a benchmark in product innovation and consumer adoption for carob worldwide.

Revenue from carob in China is expected to expand at a CAGR of 5.5% during 2025–2035, reflecting increasing consumer interest in plant-based nutrition and functional foods. Large-scale investment in advanced carob processing facilities is boosting production capacity and quality. The rise of online retail channels is facilitating broader product distribution, making carob powder, snacks, and sweetener alternatives more accessible. Government initiatives promoting dietary diversification and healthier lifestyles are driving demand.

China’s nutraceutical and health supplement sectors integrate carob for its antioxidant and gluten-free benefits. Partnerships between domestic processors and international suppliers enhance product innovation. Sustainable sourcing and organic certifications are gaining focus as consumers become environmentally conscious. These factors position China as a key player in carob production and consumption in Asia.

Sales of carob in Germany are projected to grow at a CAGR of 5.4% from 2025 to 2035, driven by consumer preference for natural, clean-label, and diabetic-friendly foods. Carob powder is increasingly used as a cocoa substitute in bakery and confectionery products, supporting healthier dietary choices. The sports nutrition segment integrates carob for its functional benefits, appealing to fitness enthusiasts. Retailers are expanding product ranges to include organic carob powders and snacks. Sustainability considerations influence both sourcing and packaging innovations within the market. Manufacturers focus on reducing sugar content by leveraging carob’s natural sweetness. The market also benefits from rising awareness of allergen-free products. Regulatory standards ensure consistent product quality, boosting consumer confidence in carob-based foods.

Revenue from carob in the United Kingdom is forecasted to grow at a CAGR of 5.2% from 2025 to 2035, propelled by demand for vegan, dairy-free, and ethical food products. Carob syrup and powder gain popularity in alternative sweeteners and bakery goods. Private label and premium organic products are expanding their footprint in supermarkets and health stores. Sustainability is a core value, with emphasis on fair-trade sourcing and reduced environmental impact. Consumer awareness of clean-label food influences purchasing decisions strongly. Carob’s versatility as a sugar substitute supports growth in confectionery and snacks. Collaboration with foodservice operators enriches innovation pipelines. These factors collectively boost market visibility and drive consistent sales growth.

Sales of carob in France are predicted to grow at a CAGR of 4.9% from 2025 to 2035, energized by interest in Mediterranean diets and flexitarian lifestyles. Carob is gaining visibility beyond health food niches through product innovations in beverages, chocolates, and spreads. Retail chains focusing on health and organic foods are expanding distribution. Flexitarian consumers contribute to moderate but steady market sales. Sustainable sourcing of carob raw materials strengthens the market’s ethical appeal. Traditional uses in specialty foods link heritage with modern health trends. Manufacturers invest in research to optimize flavor and nutritional profiles. Increasing health awareness among French consumers supports ongoing market acceptance.

Demand for carob in Italy is projected to grow at a CAGR of 4.2% from 2025 to 2035, leverages traditional culinary uses and increasing demand for natural sweeteners. Carob powder and products are gaining traction in bakery, confectionery, and dessert applications. Artisanal and regional producers emphasize product quality and organic certifications. Demand is supported by simplified supply chains focused on sustainability. Local recipes intertwine with modern health trends, driving regional consumer loyalty. Carob’s gluten-free and caffeine-free profile attracts health-conscious consumers. Premiumization of carob products enhances market positioning. Investment in processing technologies improves taste and shelf life, fostering wider adoption.

Revenue from carob in Japan is expected to grow steadily at a CAGR of 3.1% between 2025 and 2035, driven by niche demand in health supplements and gluten-free products. Carob is incorporated in functional foods, herbal remedies, and gluten-free bakery mixes. Nutraceutical companies collaborate with suppliers to create value-added products. Consumer interest in superfoods and traditional plant-based ingredients boosts market potential. Low allergenicity and caffeine-free characteristics appeal to sensitive consumer segments. Growth is supported by premium pricing strategies and product innovation. Japan’s increasing focus on natural health products fuels consistent but moderate expansion in the carob market.

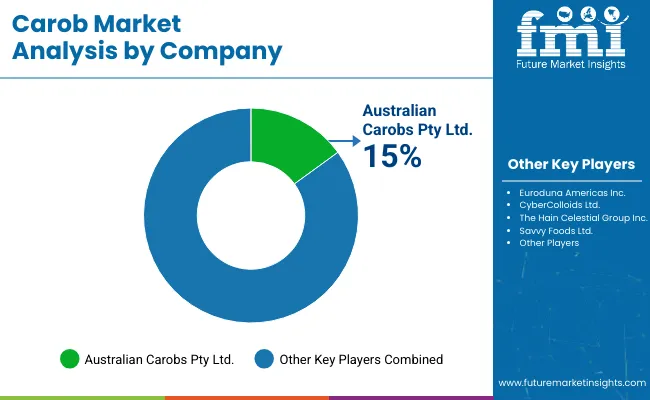

The market is highly fragmented, with numerous regional and niche players contributing to a diversified global supply chain. Leading companies such as Australian Carobs Pty Ltd., Euroduna Americas Inc., and Cyber Colloids Ltd. are competing on the grounds of product purity, sustainability, and functional health benefits. With carob being increasingly recognized as a caffeine-free, gluten-free, and antioxidant-rich alternative to cocoa, these players are actively capitalizing on evolving dietary preferences, particularly in Europe, North America, and Asia Pacific.

Strategically, top firms are focusing on vertical integration, clean-label certification, and expanding their reach through e-commerce and direct-to-consumer models. Innovation in carob powder processing, non-GMO sourcing, and sugar-free formulations has become central to portfolio differentiation. Australian Carobs Pty Ltd. and Carobs Australia Inc. have been investing in chemical-free cultivation, while companies like Frontier Co-op and The Hain Celestial Group Inc. are strengthening global distribution through strategic retail and specialty health food channels.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 792.6 million |

| Form | Solid, Liquid |

| Application | Bakery Products, Dairy Products, Nutrition & Supplements, Pharmaceuticals, Others (Pet Food, Beverages, and Confectionery) |

| Distribution Channel | Fitness Stores, Health Stores, Online Stores, Others (Specialty Stores, Grocery Chains, and Departmental Outlets) |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, South Asia , Pacific, East Asia, Middle East and Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia , and 40+ countries |

| Key Players | Australian Carobs Pty Ltd., Euroduna Americas Inc., Cyber Colloids Ltd., The Hain Celestial Group Inc., Savvy Foods Ltd., Carobs Australia Inc., Creta Carob, Lewis Confectionery Pty Ltd, Frontier Co-op, Oak Haven Inc . |

| Additional Attributes | Dollar sales and growth by form, distribution channel, and application; segment-wise market share analysis; country-wise market analysis; consumer preferences for natural and value-added carob products; innovations in product formulation and processing; and quality, traceability, and sustainable sourcing practices |

The global carob market is estimated to be valued at USD 792.6 million in 2025.

The market size for the carob market is projected to reach USD 1,173.2 million by 2035.

The carob market is expected to grow at a 4.0% CAGR between 2025 and 2035.

The key product types in carob market are solid and liquid.

In terms of distribution channel, via fitness stores segment to command 41.8% share in the carob market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA