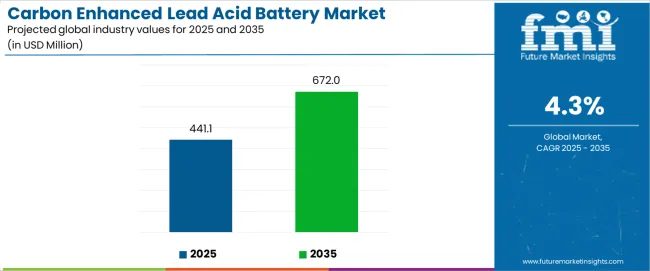

The carbon enhanced lead acid battery market is projected to increase from USD 441.1 million in 2025 to USD 672 million in 2035, expanding at a CAGR of 4.3 percent. Carbon modification in lead acid systems enhances charge acceptance, reduces sulfation, and extends service life, positioning these batteries as a practical alternative in applications requiring cost-effective yet advanced storage. Adoption cycles demonstrate a steady progression as industrial and mobility sectors integrate these batteries into hybrid power, backup systems, and automotive support functions.

The most significant applications lie in start-stop vehicle systems, where carbon enhanced batteries improve recharge efficiency under frequent cycling. Hybrid vehicles also represent a rising demand source, as the enhanced cycle life of carbon modified designs offsets limitations of traditional flooded or AGM lead acid units. Stationary energy storage forms another expanding segment, where carbon integration supports grid stabilization, telecom backup, and renewable energy smoothing. These applications favor the technology due to lower capital cost compared with lithium-ion while offering enhanced durability relative to conventional lead acid.

Lifecycle cost dynamics drive adoption decisions. Although the upfront cost is marginally higher than standard lead acid batteries, lower maintenance requirements and extended cycle life translate into reduced replacement frequency. This economic advantage is particularly valued in commercial fleets, industrial equipment, and off-grid renewable systems. For vehicle manufacturers, the balance between affordability and improved energy performance makes carbon enhanced batteries a practical bridge technology, particularly in cost-sensitive regions.

Regional adoption follows a differentiated path. Asia Pacific leads in both manufacturing and demand due to high vehicle production volumes and growing infrastructure investment in backup and renewable power storage. Europe is adopting these batteries primarily in automotive and industrial applications where emissions regulations encourage fuel efficiency and partial electrification. North America demonstrates demand concentrated in data centers, telecoms, and fleets with strong aftermarket potential. Latin America and Africa remain emerging regions, where affordability and reliability are valued over advanced lithium-based technologies, providing long-term demand prospects.

| Period | Primary Revenue Buckets | Share | Notes |

|---|---|---|---|

| Today | New battery sales (negative, positive, dual plate) | 46% | Capex-led, replacement-driven purchases |

| Replacement & aftermarket batteries | 24% | End-of-life replacements, upgrade cycles | |

| OEM partnerships & bundled solutions | 18% | Integrated with equipment, system packages | |

| Maintenance & monitoring services | 8% | Battery management systems, health monitoring | |

| Emergency & backup applications | 4% | Critical power, uninterruptible supply | |

| Future (3-5 yrs) | Advanced carbon-enhanced systems | 38-42% | Superior cycle life, fast charging capability |

| Renewable energy integration | 22-26% | Solar storage, grid stabilization applications | |

| Smart battery management solutions | 15-18% | IoT connectivity, predictive maintenance, analytics | |

| OEM & system integration | 12-15% | Bundled offerings, turnkey solutions | |

| Replacement & retrofit market | 10-12% | Technology upgrades, performance enhancement | |

| Monitoring & optimization services | 5-7% | Performance tracking, lifecycle management |

| Metric | Value |

|---|---|

| Market Value (2025) | USD 441.1 million |

| Market Forecast (2035) | USD 672 million |

| Growth Rate | 4.3% CAGR |

| Leading Electrode Type | Negative Plate Battery |

| Primary Application | Automotive Segment |

The carbon enhanced lead acid battery market demonstrates strong fundamentals with negative plate battery systems capturing a dominant share through advanced carbon integration capabilities and charge acceptance optimization. Automotive applications drive primary demand, supported by increasing start-stop vehicle adoption and advanced battery requirements. Geographic expansion remains concentrated in developed markets with established automotive infrastructure, while emerging economies show accelerating adoption rates driven by renewable energy deployment and telecommunications network expansion.

Design for performance, not just cost

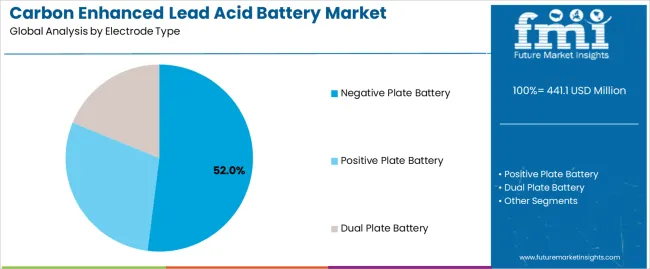

Primary Classification: The market segments by electrode type into positive plate battery, negative plate battery, and dual plate battery, representing the evolution from basic lead acid technology to sophisticated carbon-enhanced solutions for comprehensive energy storage optimization.

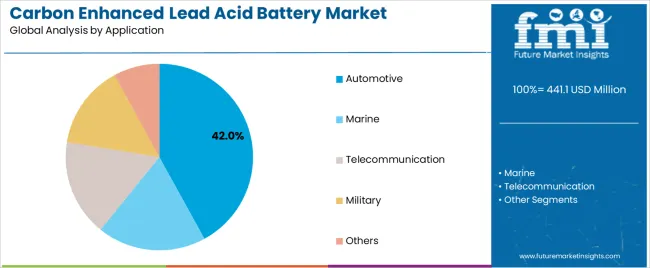

Secondary Classification: Application segmentation divides the carbon enhanced lead acid battery market into marine, automotive, telecommunication, military, and others categories, reflecting distinct requirements for power delivery, cycle life expectations, and operational environment standards.

Regional Classification: Geographic distribution covers North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, and Middle East & Africa, with developed markets leading adoption while emerging economies show accelerating growth patterns driven by infrastructure development and renewable energy expansion programs.

The segmentation structure reveals technology progression from standard lead acid batteries toward sophisticated carbon-enhanced systems with improved charge acceptance and cycle life capabilities, while application diversity spans from automotive start-stop systems to renewable energy storage requiring specialized performance characteristics.

Market Position: Negative Plate Battery systems command the leading position in the carbon enhanced lead acid battery market with 52% market share through advanced performance features, including superior charge acceptance, enhanced cycle life optimization, and partial state-of-charge resilience that enable energy storage systems to achieve optimal performance across diverse automotive and stationary applications.

Value Drivers: The segment benefits from industry preference for proven enhancement technology that provides consistent performance improvement, reduced sulfation susceptibility, and operational efficiency optimization without requiring significant system infrastructure modifications. Advanced carbon integration enables improved high-rate partial-state-of-charge cycling, faster recharge capabilities, and extended battery life, where performance reliability and cost-effectiveness represent critical application requirements.

Competitive Advantages: Negative Plate Battery systems differentiate through proven cycle life reliability, consistent charge acceptance characteristics, and integration with renewable energy systems that enhance application effectiveness while maintaining optimal power delivery standards suitable for diverse automotive and stationary storage applications.

Key market characteristics:

Positive Plate Battery systems maintain a 28% market position in the carbon enhanced lead acid battery market due to their specialized performance properties and niche advantages. These systems appeal to applications requiring enhanced positive plate durability with competitive performance for specific operating conditions. Market growth is driven by specialty applications, emphasizing corrosion resistance and high-temperature operation through optimized electrode designs.

Dual Plate Battery systems capture 20% market share through comprehensive enhancement requirements in premium applications, maximum performance scenarios, and advanced energy storage installations. These applications demand combined carbon integration capable of delivering optimal performance across both electrodes while providing effective cycle life and charge acceptance capabilities.

Market Context: Automotive applications demonstrate the highest market share in the carbon enhanced lead acid battery market with 42% share due to widespread adoption of start-stop vehicle technology and increasing focus on fuel efficiency optimization, emission reduction, and automotive power system applications that maximize vehicle performance while maintaining cost-effectiveness standards.

Appeal Factors: Automotive manufacturers prioritize battery durability, cycle life performance, and integration with existing vehicle electrical systems that enable reliable start-stop functionality across diverse driving conditions. The segment benefits from substantial OEM adoption and regulatory pressure that emphasizes the importance of fuel-saving technologies for emission compliance and efficiency improvement applications.

Growth Drivers: Vehicle electrification trends incorporate start-stop systems as standard equipment for fuel economy enhancement, while stringent emission regulations increase demand for proven battery technologies that comply with performance standards and minimize system complexity.

Market Challenges: Varying vehicle requirements and operating conditions may limit battery standardization across different vehicle platforms or climate scenarios.

Application dynamics include:

Telecommunication applications capture 26% market share through specialized power requirements in cellular towers, network equipment, and communications infrastructure. These installations demand reliable backup power systems capable of supporting critical communications while providing effective deep-cycle performance and temperature resilience capabilities.

Marine applications account for 18% market share through unique power requirements in recreational boats, commercial vessels, and maritime equipment requiring deep-cycle capabilities for electronics and auxiliary power.

Military applications hold 8% market share, including defense communications, portable power systems, and tactical equipment requiring reliable energy storage with rugged performance characteristics.

Other applications capture 6% market share through varied requirements in industrial equipment, renewable energy storage, and specialty power systems requiring carbon-enhanced battery performance.

| Category | Factor | Impact | Why It Matters |

|---|---|---|---|

| Driver | Start-stop vehicle proliferation & fuel efficiency mandates (emission regulations, OEM adoption) | ★★★★★ | Automotive industry shift toward micro-hybrid systems requires batteries with superior cycle life; carbon enhancement essential for start-stop performance. |

| Driver | Renewable energy storage growth (solar installations, off-grid systems) | ★★★★★ | Expanding solar and wind deployment creates demand for cost-effective energy storage; carbon-enhanced batteries offer improved partial state-of-charge performance. |

| Driver | Telecommunications infrastructure expansion (5g rollout, tower densification) | ★★★★☆ | Growing cellular networks require reliable backup power; demand for batteries with extended life and improved deep-discharge recovery. |

| Restraint | Competition from lithium-ion technology (energy density, weight advantages) | ★★★★☆ | Lithium alternatives capture premium segments despite cost; challenges carbon-enhanced lead acid in weight-sensitive and high-performance applications. |

| Restraint | Lead price volatility & environmental concerns (raw material costs, recycling regulations) | ★★★☆☆ | Fluctuating lead prices impact margins; increasing environmental scrutiny and recycling compliance creates operational complexity. |

| Trend | Smart battery management integration (IoT connectivity, cloud monitoring) | ★★★★★ | Digital transformation enabling real-time monitoring and predictive maintenance; connectivity and data analytics become value differentiators. |

| Trend | Sustainable manufacturing & circular economy (recycling optimization, carbon footprint reduction) | ★★★★☆ | Environmental responsibility driving production innovation; enhanced recycling programs and sustainable sourcing become competitive advantages. |

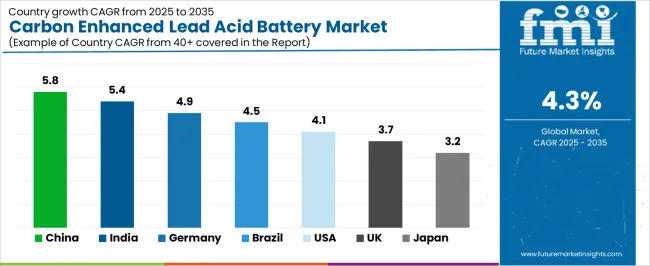

p>The carbon enhanced lead acid battery market demonstrates varied regional dynamics with Growth Leaders including China (5.8% growth rate) and India (5.4% growth rate) driving expansion through automotive production growth and renewable energy initiatives. Steady Performers encompass Germany (4.9% growth rate), Brazil (4.5% growth rate), and developed regions, benefiting from established automotive industries and telecommunications infrastructure. Mature Markets feature United States (4.1% growth rate) and developed regions, where established vehicle fleets and energy storage applications support consistent growth patterns.

p>The carbon enhanced lead acid battery market demonstrates varied regional dynamics with Growth Leaders including China (5.8% growth rate) and India (5.4% growth rate) driving expansion through automotive production growth and renewable energy initiatives. Steady Performers encompass Germany (4.9% growth rate), Brazil (4.5% growth rate), and developed regions, benefiting from established automotive industries and telecommunications infrastructure. Mature Markets feature United States (4.1% growth rate) and developed regions, where established vehicle fleets and energy storage applications support consistent growth patterns.

Regional synthesis reveals East Asian markets leading adoption through automotive manufacturing expansion and renewable energy deployment, while South Asian countries maintain strong growth supported by telecommunications infrastructure development and off-grid power requirements. North American and European markets show steady expansion driven by start-stop vehicle adoption and energy storage integration trends.

| Region/Country | 2025-2035 Growth | How to win | What to watch out |

|---|---|---|---|

| China | 5.8% | Focus on OEM partnerships and cost-effective solutions | Local competition; pricing pressures |

| India | 5.4% | Lead with affordable renewable storage and telecom solutions | Infrastructure gaps; distribution challenges |

| Germany | 4.9% | Provide premium quality and automotive integration | Strict regulations; lithium competition |

| Brazil | 4.5% | Value-oriented models with local support | Economic volatility; import duties |

| United States | 4.1% | Offer performance data and application expertise | Market maturity; technology alternatives |

| United Kingdom | 3.7% | Push renewable integration and backup power solutions | Brexit impacts; regulatory changes |

| Japan | 3.2% | Premium quality and automotive OEM relationships | Market saturation; conservative adoption |

China establishes fastest market growth through aggressive automotive production expansion and comprehensive renewable energy infrastructure development, integrating carbon enhanced lead acid batteries as standard components in start-stop vehicles and solar energy storage installations. The country's 5.8% growth rate reflects automotive industry modernization and renewable energy deployment programs that mandate the use of advanced battery technology in vehicle production and power generation facilities. Growth concentrates in major manufacturing hubs, including Guangdong, Jiangsu, and Zhejiang provinces, where automotive and battery manufacturing showcases integrated production capabilities that appeal to OEMs seeking cost-effective performance enhancement and domestic supply security.

Chinese manufacturers are developing competitive carbon-enhanced battery solutions that combine domestic production advantages with proven performance characteristics, including enhanced cycle life capabilities and improved charge acceptance features. Distribution channels through automotive supply chains and renewable energy system integrators expand market access, while government support for new energy vehicles and solar power supports adoption across diverse automotive and stationary storage segments.

Strategic Market Indicators:

In Delhi, Mumbai, and Bangalore, automotive manufacturers and telecommunications operators are implementing carbon enhanced lead acid batteries as standard power solutions for vehicle applications and network infrastructure, driven by increasing vehicle production and telecommunications expansion programs that emphasize the importance of reliable energy storage capabilities. The carbon enhanced lead acid battery market holds a 5.4% growth rate, supported by automotive industry development and infrastructure investment programs that promote advanced battery technology for transportation and communications applications. Indian industries are adopting carbon-enhanced systems that provide consistent performance improvements and cost-effectiveness, particularly appealing in growth markets where value and reliability represent critical procurement requirements.

Market expansion benefits from growing automotive sector capabilities and expanding renewable energy deployment that enable adoption of enhanced battery technology for diverse applications. Technology adoption follows patterns established in conventional lead acid batteries, where proven performance and competitive pricing drive purchase decisions and market penetration.

Market Intelligence Brief:

Germany establishes market leadership through comprehensive automotive engineering programs and advanced manufacturing technology development, integrating carbon enhanced lead acid batteries across premium start-stop vehicles and specialized applications. The country's 4.9% growth rate reflects established automotive industry relationships and mature technology adoption that supports widespread use of high-performance battery systems in vehicle production and industrial applications. Growth concentrates in major automotive centers, including Baden-Württemberg, Bavaria, and Lower Saxony, where vehicle manufacturing showcases sophisticated battery integration that appeals to OEMs seeking proven performance capabilities and quality assurance.

German automotive manufacturers leverage established supply chain networks and comprehensive testing capabilities, including validation programs and quality standards that create technology leadership and performance benchmarks. The carbon enhanced lead acid battery market benefits from mature automotive standards and engineering requirements that mandate performance validation while supporting innovation advancement and efficiency optimization.

Market Intelligence Brief:

Brazil's market expansion benefits from diverse automotive production, including start-stop vehicle manufacturing in São Paulo and telecommunications infrastructure development, and renewable energy programs that increasingly incorporate carbon-enhanced batteries for vehicle applications and backup power solutions. The country maintains a 4.5% growth rate, driven by rising automotive production activity and increasing recognition of advanced battery technology benefits, including improved cycle life and enhanced reliability.

Market dynamics focus on cost-effective carbon-enhanced solutions that balance performance improvements with affordability considerations important to Brazilian automotive manufacturers and infrastructure operators. Growing vehicle production and telecommunications deployment creates continued demand for reliable battery systems in OEM installations and replacement markets.

Strategic Market Considerations:

United States establishes market leadership through comprehensive automotive programs and advanced telecommunications infrastructure, integrating carbon enhanced lead acid batteries across start-stop vehicles and critical backup power applications. The country's 4.1% growth rate reflects established automotive market presence and mature battery technology adoption that supports widespread use of enhanced systems in vehicle production and stationary applications. Growth concentrates in major automotive manufacturing regions where battery systems showcase proven deployment that appeals to OEMs seeking reliable performance and cost-effectiveness.

American automotive manufacturers leverage established supplier relationships and comprehensive performance testing capabilities, including validation programs and quality assurance that create competitive advantages and market standards. The carbon enhanced lead acid battery market benefits from mature automotive supply chains and replacement market networks that support technology adoption while maintaining quality requirements and performance optimization.

Market Intelligence Brief:

United Kingdom's mature automotive and telecommunications markets demonstrate comprehensive carbon enhanced lead acid battery deployment with documented performance effectiveness in vehicle applications and network infrastructure through integration with existing systems and quality frameworks. The country leverages established automotive engineering expertise and telecommunications standards to maintain a 3.7% growth rate. Major manufacturing and telecommunications centers showcase standardized battery integration where enhanced systems provide improved performance and reliability for automotive and infrastructure applications.

British industries prioritize proven performance and reliability in battery selection, creating demand for validated carbon-enhanced systems with established track records and quality assurance. The carbon enhanced lead acid battery market benefits from mature supply chain infrastructure and quality standards that mandate performance verification while supporting appropriate technology adoption.

Market Intelligence Brief:

Japan's market maintains a 3.2% growth rate through established automotive manufacturing infrastructure and advanced quality standards, where carbon enhanced lead acid batteries represent proven technology in vehicle production and specialized applications. The country benefits from comprehensive automotive industry presence and rigorous performance requirements that support consistent demand for high-quality battery systems.

Market characteristics include preference for proven reliability, precise manufacturing quality, and long-term performance validation that align with Japanese automotive standards and quality expectations. Distribution through established automotive supply chains provides comprehensive OEM and aftermarket coverage.

Strategic Market Considerations:

The carbon enhanced lead acid battery market in Europe is projected to grow from USD 132.3 million in 2025 to USD 201.6 million by 2035, registering a CAGR of 4.3% over the forecast period. Germany is expected to maintain its leadership position with a 36.8% market share in 2025, increasing slightly to 37.2% by 2035, supported by its advanced automotive manufacturing infrastructure and major vehicle production centers including Stuttgart, Munich, and Wolfsburg.

United Kingdom follows with a 22.4% share in 2025, projected to reach 22.8% by 2035, driven by comprehensive automotive supply chain programs and telecommunications infrastructure development. France holds a 18.6% share in 2025, expected to reach 18.9% by 2035 through automotive production and renewable energy integration requirements. Italy commands a 12.8% share, while Spain accounts for 9.4% in 2025. The rest of Europe region is anticipated to maintain stability, with its collective share moving from 6.6% to 6.5% by 2035, attributed to steady battery adoption in Nordic countries and emerging Eastern European automotive manufacturing programs implementing technology modernization.

| Stakeholder | What they actually control | Typical strengths | Typical blind spots |

|---|---|---|---|

| Global platforms | Manufacturing scale, OEM relationships, distribution networks | Broad availability, proven reliability, multi-region supply | Innovation speed; market agility |

| Technology innovators | Carbon formulation expertise; advanced manufacturing; performance optimization | Latest technology first; superior cycle life claims | Scale limitations; cost structure |

| Regional specialists | Local market knowledge, responsive service, distribution partnerships | "Close to customer" support; market adaptation; pragmatic pricing | Technology gaps; international presence |

| OEM-focused suppliers | Automotive relationships, quality systems, validation expertise | Lowest total cost; design-in advantage; volume contracts | Aftermarket presence; product diversity |

| Application specialists | Vertical expertise, customized solutions, technical support | Win specialized applications; deep domain knowledge | Scalability limitations; narrow market focus |

| Item | Value |

|---|---|

| Quantitative Units | USD million |

| Electrode Type | Positive Plate Battery, Negative Plate Battery, Dual Plate Battery |

| Application | Marine, Automotive, Telecommunication, Military, Others |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, Middle East & Africa |

| Countries Covered | United States, China, Germany, India, United Kingdom, Japan, Brazil, France, Italy, Spain, and 20+ additional countries |

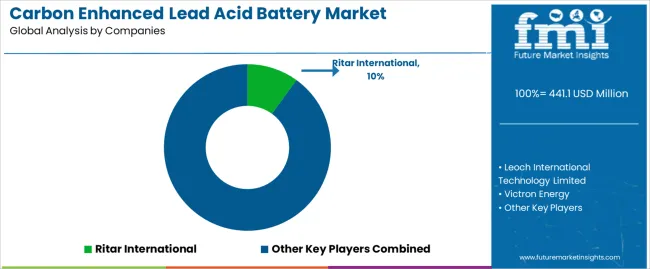

| Key Companies Profiled | Ritar International, Leoch, Victron Energy, Orion, UKB, KIJO Group, MCA, Cam BRAVA, EverExceed Industrial, Canbat Technologies, KINGPOWER BATTERY |

| Additional Attributes | Dollar sales by electrode type and application categories, regional adoption trends across East Asia, South Asia Pacific, and North America, competitive landscape with battery manufacturers and automotive suppliers, customer preferences for cycle life performance and charge acceptance optimization, integration with battery management systems and monitoring platforms, innovations in carbon enhancement technology and manufacturing processes, and development of application-specific battery solutions with enhanced performance and operational optimization capabilities. |

The global carbon enhanced lead acid battery market is estimated to be valued at USD 441.1 million in 2025.

The market size for the carbon enhanced lead acid battery market is projected to reach USD 672.0 million by 2035.

The carbon enhanced lead acid battery market is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types in carbon enhanced lead acid battery market are negative plate battery, positive plate battery and dual plate battery.

In terms of application, automotive segment to command 42.0% share in the carbon enhanced lead acid battery market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Lead Acid Battery Market Size and Share Forecast Outlook 2025 to 2035

Lead Acid Battery Recycling Market Size and Share Forecast Outlook 2025 to 2035

Flooded Lead Acid Battery Market Size and Share Forecast Outlook 2025 to 2035

Advanced Lead Acid Battery Market Size and Share Forecast Outlook 2025 to 2035

Automotive Lead Acid Battery Market Size and Share Forecast Outlook 2025 to 2035

Stationary Lead Acid Battery Storage Market Size and Share Forecast Outlook 2025 to 2035

Motorcycle Lead Acid Battery Market - Trends & Forecast 2025 to 2035

Carbon Dioxide Enhanced Oil Recovery (CO2 EOR) Market Analysis by Application, Source and Region: Forecast from 2025 to 2035

Two-Wheeler Lead Acid Batteries Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Solid State Battery Silicon Carbon Negative Electrode Market Size and Share Forecast Outlook 2025 to 2035

Lead-free Brass Rods Market Size and Share Forecast Outlook 2025 to 2035

Carbon Capture and Sequestration Market Forecast Outlook 2025 to 2035

Carbon Dioxide Incubators Market Size and Share Forecast Outlook 2025 to 2035

Acid Resistant Pipe Market Forecast and Outlook 2025 to 2035

Battery Operated Light Market Forecast and Outlook 2025 to 2035

Carbon-negative Cement Market Size and Share Forecast Outlook 2025 to 2035

Carbon Tetrabromide Market Size and Share Forecast Outlook 2025 to 2035

Carbon Steel Market Size and Share Forecast Outlook 2025 to 2035

Carbon Brush Market Size and Share Forecast Outlook 2025 to 2035

Acid Coil Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA