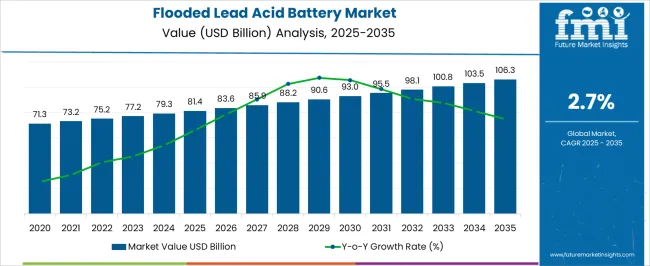

The Flooded Lead Acid Battery Market is estimated to be valued at USD 81.4 billion in 2025 and is projected to reach USD 106.3 billion by 2035, registering a compound annual growth rate (CAGR) of 2.7% over the forecast period. A peak-to-trough analysis reveals gradual and consistent growth throughout the forecast period, with moderate fluctuations driven by changes in demand, technological advancements, and market maturity.

Between 2025 and 2030, the market grows from USD 81.4 billion to USD 93.0 billion, contributing USD 11.6 billion in growth, with a CAGR of 2.8%. This early-phase growth is driven by the continued demand for flooded lead acid batteries in sectors such as automotive, energy storage, and uninterruptible power supplies (UPS), where these batteries remain popular due to their cost-effectiveness and reliability. The market experiences steady demand for flooded lead acid batteries as industries continue to use them for backup power solutions and in electric vehicle applications.

From 2030 to 2035, the market expands from USD 93.0 billion to USD 106.3 billion, contributing USD 13.3 billion in growth, with a slightly lower CAGR of 2.5%. This deceleration indicates the market is approaching maturity, as more energy-efficient alternatives and lithium-ion batteries gain traction. Despite this, the market remains stable due to the established infrastructure and cost advantages of flooded lead acid batteries. The peak-to-trough analysis shows sustained growth with a gradual slowdown as new technologies emerge.

| Metric | Value |

|---|---|

| Flooded Lead Acid Battery Market Estimated Value in (2025 E) | USD 81.4 billion |

| Flooded Lead Acid Battery Market Forecast Value in (2035 F) | USD 106.3 billion |

| Forecast CAGR (2025 to 2035) | 2.7% |

The flooded lead acid battery market is experiencing renewed momentum due to increasing demand for reliable energy storage in grid stability, backup power, and industrial operations. As power outages and voltage fluctuations persist across developing regions, end users are prioritizing battery systems with proven longevity and cost-effectiveness.

Flooded lead acid batteries continue to be preferred in applications where maintenance accessibility is feasible, offering robust performance in both cyclic and standby modes. Infrastructure development projects and the expansion of telecommunication and utility networks are also contributing to stable demand.

Environmental regulations promoting battery recycling have strengthened the product’s position within circular economy initiatives. The market outlook remains positive as industries seek dependable power storage solutions that can operate under variable load conditions and harsh environments without compromising reliability or safety.

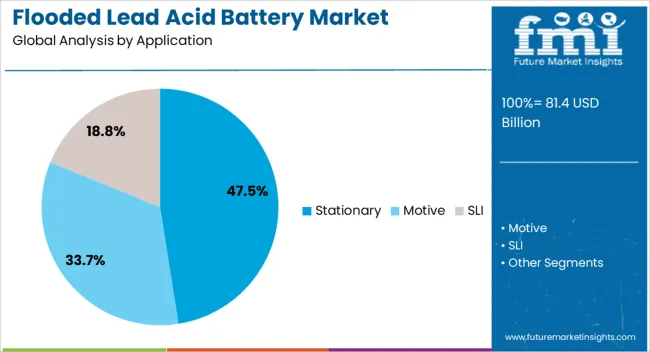

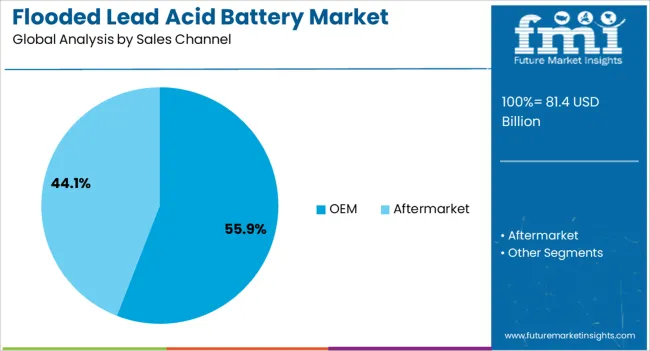

The flooded lead acid battery market is segmented by application, sales channel, and geographic regions. By application, the flooded lead acid battery market is divided into Stationary, Motive, and SLI. In terms of sales channel, the flooded lead acid battery market is classified into OEM and Aftermarket. Regionally, the flooded lead acid battery industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The stationary application segment is expected to account for 47.50% of total revenue by 2025, positioning it as the leading application area. This dominance is attributed to the segment’s critical role in backup power systems, grid support, and stationary energy storage in data centers, telecommunication towers, and control rooms.

Flooded lead acid batteries are widely used in stationary configurations due to their ability to deliver consistent voltage output, deep discharge tolerance, and extended service life under controlled charging conditions. Their suitability for uninterruptible power systems and infrastructure resilience has further fueled their adoption.

As utilities and large enterprises emphasize power continuity and fault tolerance, the stationary segment continues to lead the market owing to its reliability, scalability, and cost effectiveness.

The OEM sales channel segment is projected to hold 55.90% of the total market revenue by 2025, making it the most dominant distribution route. Long term supplier agreements, bulk procurement advantages, and custom integration of flooded lead acid batteries into original equipment such as backup systems, telecom units, and energy control systems drive this growth.

OEMs are increasingly collaborating with battery manufacturers to develop application-specific configurations that optimize lifecycle and performance. The assurance of product compatibility, factory testing, and direct service support has encouraged institutional buyers and system integrators to source through OEM channels.

As demand increases for standardized and high-performance energy storage solutions across sectors, OEM partnerships remain the preferred path for large-scale deployment, reinforcing this channel’s leadership in the market.

The flooded lead acid battery market is expanding as demand for affordable, reliable, and efficient energy storage solutions grows. These batteries are widely used in applications such as backup power systems, automotive, and renewable energy storage due to their cost-effectiveness and long track record of reliability. Despite the increasing adoption of newer technologies like lithium-ion batteries, flooded lead acid batteries remain a popular choice due to their affordability and ease of maintenance. As industries continue to seek dependable power solutions, the market for flooded lead acid batteries is expected to grow steadily.

The primary driver behind the growth of the flooded lead acid battery market is their affordability and reliability. These batteries provide a cost-effective solution for various energy storage needs, particularly in backup power systems, off-grid energy storage, and automotive applications. Their long lifespan and well-established technology make them a trusted option for industries that need consistent power performance. The automotive industry continues to use flooded lead acid batteries in conventional vehicles for starting, lighting, and ignition (SLI), while the renewable energy sector increasingly relies on them for storing energy in off-grid systems. As the need for low-cost energy storage solutions rises across multiple sectors, the demand for flooded lead acid batteries will continue to grow.

The flooded lead acid battery market faces several challenges, primarily related to lower energy efficiency and the maintenance needs of these systems. Compared to newer technologies, such as lithium-ion, flooded lead acid batteries have lower energy density and shorter lifespan, which can limit their appeal for applications requiring compact and long-lasting energy storage solutions. Additionally, these batteries require regular maintenance, including water level monitoring and electrolyte replacement, which increases operational costs and labor. Despite these challenges, their affordability and proven performance in many industries continue to drive their use, though addressing efficiency and maintenance concerns remains critical for market expansion.

The flooded lead acid battery market offers significant growth opportunities, especially in the renewable energy sector. As more consumers and businesses adopt solar and wind energy systems, the need for effective and affordable energy storage solutions grows. Flooded lead acid batteries are commonly used in off-grid energy storage applications, providing a cost-effective way to store power for use when generation is low or unavailable. With increasing demand for energy storage solutions in the renewable energy sector, there are significant opportunities for flooded lead acid batteries to be integrated into these systems, offering a reliable and affordable storage option for renewable energy users.

A key trend in the flooded lead acid battery market is the ongoing advancements in battery design and the implementation of better recycling practices. Manufacturers are focusing on improving the overall design of flooded lead acid batteries, enhancing their durability, and extending their life expectancy. Newer plate structures and better electrolyte management are being developed to improve performance and reduce maintenance requirements. Improvements in recycling processes are helping to address disposal concerns, making it easier to recycle lead-acid batteries and recover valuable materials for reuse. These innovations are helping to maintain the relevance of flooded lead acid batteries in the face of competition from other technologies.

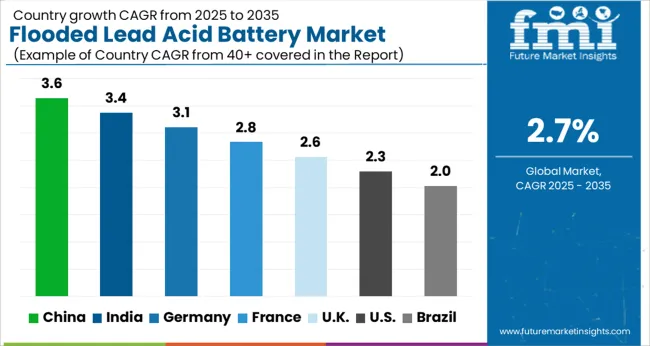

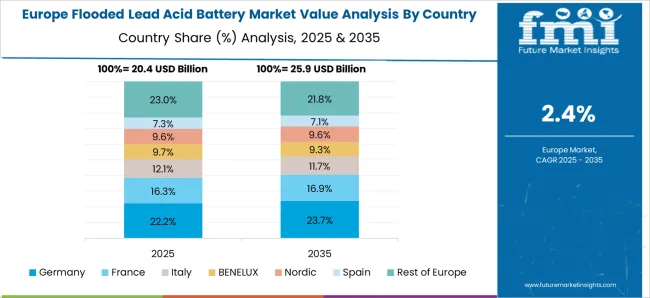

The flooded lead acid battery market is projected to grow at a global CAGR of 2.7% from 2025 to 2035, driven by increasing demand for energy storage solutions across various sectors. China leads with 3.6% growth, supported by industrialization and a push for renewable energy. India follows at 3.4%, fueled by the growth in energy demand and the automotive sector. France, the UK, and the USA show steady growth, driven by government initiatives for renewable energy adoption, the rise in electric vehicles, and the growing need for backup power solutions. The market is evolving in both developed and developing countries due to the increasing adoption of energy-efficient solutions and storage technologies. The analysis includes over 40+ countries, with the leading markets detailed below.

The flooded lead acid battery market in China is projected to grow at a CAGR of 3.6% through 2035. The rapid industrialization, combined with strong demand for automotive and energy storage solutions, significantly contributes to the market's expansion. As China continues to develop its manufacturing and renewable energy sectors, the need for reliable and cost-effective energy storage solutions drives the demand for flooded lead acid batteries. Government incentives promoting cleaner energy solutions and advancements in battery technologies are accelerating market growth. The growing electric vehicle (EV) and hybrid vehicle sectors in China further increase demand for flooded lead acid batteries, bolstering market prospects.

Demand of flooded lead acid battery in India is growing at a CAGR of 3.4% through 2035. The rise in industrial activities, increasing energy demand, and growing automotive sector are primary drivers of market growth. India’s push toward renewable energy and off-grid solutions further increases the need for reliable energy storage. With the increasing penetration of electric vehicles and the demand for backup power in both urban and rural areas, the adoption of flooded lead acid batteries is expected to rise. Additionally, the country’s focus on improving the power grid infrastructure and storage systems further strengthens the market outlook.

Sale of flooded lead acid battery in France is expanding at a CAGR of 2.8% through 2035. As part of its broader push for renewable energy adoption, France’s energy storage needs are expected to increase, driving demand for flooded lead acid batteries. The growing automotive sector, particularly the rise in electric and hybrid vehicles, is also a significant factor in the market's growth. The French government’s regulations and incentives for cleaner energy solutions and the increasing focus on energy efficiency are accelerating the use of energy storage solutions. The growing need for backup power in residential and commercial sectors further strengthens the demand for flooded lead acid batteries.

The flooded lead acid battery market in the United Kingdom is projected to grow at a CAGR of 2.6% through 2035. The growing adoption of renewable energy systems, particularly solar power, is boosting demand for reliable and cost-effective energy storage solutions, where flooded lead acid batteries are commonly used. The rise in the electric vehicle market, alongside the government’s focus on green energy and carbon reduction, is expected to further drive market growth. The increasing need for backup power in both residential and commercial sectors, along with the growing industrial activities, strengthens the demand for flooded lead acid batteries in the UK

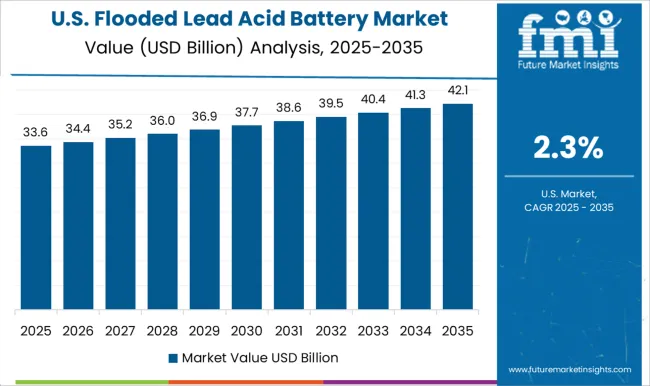

The USA flooded lead acid battery market is expected to grow at a CAGR of 2.3% through 2035. The steady demand for flooded lead acid batteries is supported by the growth of industrial sectors, particularly in automotive, telecommunications, and energy storage applications. The rising adoption of electric vehicles and the ongoing push for clean energy solutions are key drivers of the market. The demand for backup power systems in residential and commercial sectors, as well as the need for affordable and reliable energy storage solutions, continues to support the market’s steady growth in the USA

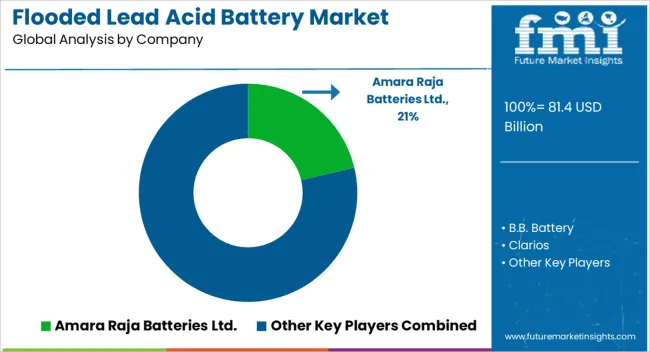

The flooded lead acid battery market features leading companies that supply reliable energy storage across automotive, industrial, motive power, and stationary uses. Amara Raja Energy & Mobility Ltd. has a strong presence in automotive and industrial batteries in India and export markets. Clarios is prominent in automotive SLI, producing conventional flooded and enhanced flooded batteries for global OEM and aftermarket customers. Crown Battery provides long-life flooded deep-cycle batteries for golf carts, renewable energy, and industrial equipment. C&D Technologies, Inc. supplies telecom, UPS, and data center systems and also offers flooded stationary cells. East Penn Manufacturing (Deka) produces a wide range of flooded automotive and industrial batteries. EnerSys serves motive power and reserve power markets with flooded and VRLA product lines.

Exide Industries Ltd. manufactures automotive and industrial lead acid batteries. Furukawa Battery and GS Yuasa Corporation provide automotive and industrial lead acid offerings across Asia and globally. HOPPECKE supplies vented flooded OPzS cells and other industrial lead acid systems. Leoch International Technology Limited produces flooded SLI and deep cycle batteries for transportation and motive applications. Trojan Battery Company is a leading provider of flooded deep cycle batteries for motive, marine, and renewable energy uses.

| Item | Value |

|---|---|

| Quantitative Units | USD 81.4 Billion |

| Application | Stationary, Motive, and SLI |

| Sales Channel | OEM and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Amara Raja Batteries Ltd., B.B. Battery, Clarios, Crown battery, C&D Technologies Inc., Contemporary Amperex Technology Co., Limited, East Penn Manufacturing Company, Inc., EnerSys, Exide Industries Limited, Furukawa Battery Co., Ltd., GS Yuasa Corporation, HOPPECKE Battery GmbH & Co. KG., Johnson Controls International, Leoch International Technology Limited Inc., NorthStar Battery Company, Robert Bosh GmbH, Trojan Battery Company, and Varta AG |

| Additional Attributes | Dollar sales by product type (automotive batteries, industrial batteries, UPS batteries, deep-cycle batteries) and end-use segments (automotive, industrial, telecommunications, energy storage, backup power). Demand dynamics are driven by the growing need for reliable energy storage solutions in automotive, industrial, and renewable energy sectors, with increasing energy demands for backup power systems. Regional trends highlight strong growth in North America, Europe, and Asia-Pacific, with North America and Europe leading in industrial and automotive battery applications. |

The global flooded lead acid battery market is estimated to be valued at USD 81.4 billion in 2025.

The market size for the flooded lead acid battery market is projected to reach USD 106.3 billion by 2035.

The flooded lead acid battery market is expected to grow at a 2.7% CAGR between 2025 and 2035.

The key product types in flooded lead acid battery market are stationary, telecommunications, UPS, control & switchgear, others, motive, SLI, automobiles and motorcycles.

In terms of sales channel, OEM segment is expected to command 55.9% share in the flooded lead acid battery market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Lead Smelting and Refining Market Size and Share Forecast Outlook 2025 to 2035

Lead Management Market Size and Share Forecast Outlook 2025 to 2035

Lead Mining Software Market Size and Share Forecast Outlook 2025 to 2035

Lead Intelligence Software Market Size and Share Forecast Outlook 2025 to 2035

Lead Capture Software Market Size and Share Forecast Outlook 2025 to 2035

Lead Scoring Software Market Size and Share Forecast Outlook 2025 to 2035

Lead-to-Account Matching and Routing Software Market Size and Share Forecast Outlook 2025 to 2035

Leadership Development Program Market Analysis - Size, Share, and Forecast 2025 to 2035

Lead Market Growth - Trends & Forecast 2025 to 2035

Examining Market Share Trends in Leadership Development Programs

Lead Zirconate Titanate Market Size & Trends 2025

Lead Stearate Market

Leadscrew Market

Lead Acid Battery Market Size and Share Forecast Outlook 2025 to 2035

Lead Acid Battery Recycling Market Size and Share Forecast Outlook 2025 to 2035

KNN Lead-free Piezoelectric Ceramics Market Size and Share Forecast Outlook 2025 to 2035

BNT Lead-free Piezoelectric Ceramics Market Size and Share Forecast Outlook 2025 to 2035

Online Leadership Development Program Market Forecast and Outlook 2025 to 2035

Custom Leadership Development Program Market Growth, Trends and Forecast from 2025 to 2035

Europe Leadership Development Program Market - Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA