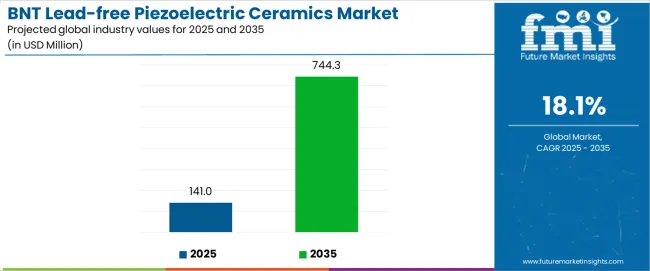

The BNT lead-free piezoelectric ceramics market is expected to grow from USD 141.0 million in 2025 to USD 744.3 million in 2035, at a CAGR of 18.1%. Production and material science form the backbone of this expansion, since the performance of bismuth sodium titanate depends directly on synthesis methods, property optimization, and environmental compliance. The shift away from lead zirconate titanate reflects the growing enforcement of RoHS and REACH regulations, which drive demand for eco-regulated alternatives in medical devices, consumer electronics, automotive sensors, and energy harvesting systems.

Synthesis methods shape the consistency and scalability of BNT ceramics. The solid-state reaction remains the most common approach, producing bulk materials suitable for actuators and transducers, though it requires high calcination temperatures that risk volatilization of sodium and bismuth. The sol-gel process offers superior chemical homogeneity and smaller particle size, making it attractive for thin films and multilayer structures, though scalability and cost remain limiting factors. Hydrothermal synthesis produces nanostructures with controlled morphology, enhancing dielectric response and electromechanical coupling, though its industrial deployment is still restricted by cost. Advanced methods such as spark plasma sintering and microwave-assisted sintering are increasingly studied to reduce processing temperature, limit grain coarsening, and improve domain structure stability.

Performance parameters define commercial adoption of BNT ceramics. The dielectric constant determines storage capacity for capacitor applications, while electromechanical coupling coefficients measure efficiency in energy conversion for actuators and sensors. The piezoelectric charge constant d33 is a key indicator of suitability for high-performance actuators and energy harvesting modules. BNT ceramics display strong ferroelectric behavior, and when modified with dopants such as barium, strontium, or potassium, they exhibit relaxor ferroelectric characteristics that improve fatigue resistance, temperature stability, and long-term reliability. Such improvements strengthen their position in industrial machinery, automotive monitoring, and portable electronics.

Challenges remain significant in production. High sintering temperatures increase energy consumption and contribute to compositional instability. Grain size distribution affects domain wall motion, which influences piezoelectric coefficients and electromechanical reliability. Phase stability issues, oxygen vacancies, and the volatility of alkali components reduce performance reproducibility, limiting mass adoption. Research efforts are increasingly directed toward compositional tuning, advanced sintering techniques, and hybrid material systems to overcome these barriers.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 141 million |

| Forecast Value in (2035F) | USD 744.3 million |

| Forecast CAGR (2025 to 2035) | 18.1% |

From 2030 to 2035, the market is forecast to grow from USD 274.3 million to USD 744.3 million, adding another USD 470 million, which constitutes 77.9% of the overall ten-year expansion. This period is expected to be characterized by the expansion of advanced medical imaging technologies and minimally invasive surgical devices, the development of next-generation automotive sensors and haptic feedback systems, and the growth of specialized applications for energy harvesting, structural health monitoring, and Internet of Things sensor networks. The growing adoption of green electronics principles and sustainable material sourcing will drive demand for BNT lead-free piezoelectric ceramics with enhanced performance characteristics and environmental safety credentials.

Between 2020 and 2025, the BNT lead-free piezoelectric ceramics market experienced steady growth, driven by increasing regulatory pressures on lead-based materials and growing recognition of bismuth sodium titanate (BNT) ceramics as viable alternatives for achieving piezoelectric performance in medical, automotive, and industrial applications. The market developed as device manufacturers and materials scientists recognized the potential for BNT-based ceramics to deliver competitive electromechanical coupling, support miniaturization objectives, and meet environmental compliance requirements while maintaining operational reliability. Technological advancement in composition optimization and processing techniques began emphasizing the critical importance of achieving stable piezoelectric properties and temperature performance in demanding application environments.

Market expansion is being supported by the increasing global enforcement of environmental regulations restricting hazardous substances driven by RoHS directives and REACH compliance requirements, alongside the corresponding need for advanced functional materials that can deliver reliable piezoelectric performance, enable innovative device designs, and maintain operational stability across medical ultrasound, automotive sensors, consumer electronics, and industrial actuator applications. Modern device manufacturers are increasingly focused on implementing lead-free ceramic solutions that can provide comparable performance to traditional lead-based materials, address environmental concerns, and ensure long-term supply chain security.

The growing emphasis on sustainable electronics and green manufacturing is driving demand for BNT lead-free piezoelectric ceramics that can support environmentally responsible production, enable compliance with global regulations, and provide comprehensive performance across diverse operating conditions. Electronics manufacturers' preference for materials that combine environmental safety with technical excellence and processing compatibility is creating opportunities for innovative BNT ceramic implementations. The rising influence of medical device innovation and automotive electrification is also contributing to increased adoption of lead-free piezoelectric materials that can provide superior sensing and actuation capabilities without compromising functionality or environmental standards.

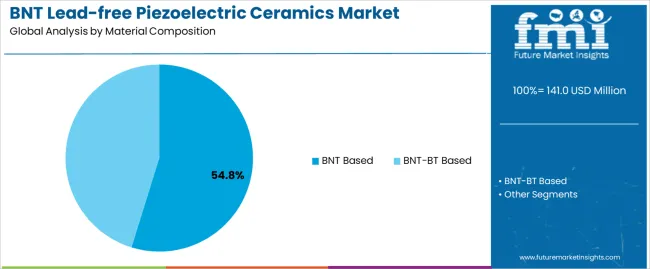

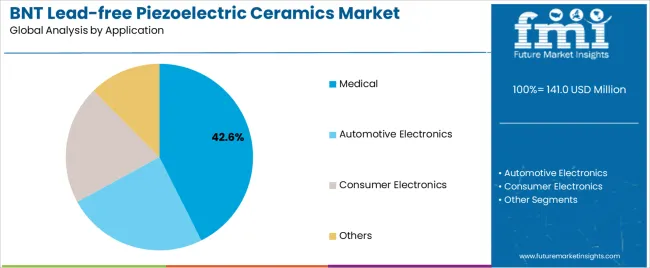

The market is segmented by material composition, application, and region. By material composition, the market is divided into BNT based and BNT-BT based. Based on application, the market is categorized into medical, automotive electronics, consumer electronics, and others. Regionally, the market is divided into East Asia, Europe, North America, South Asia, Latin America, Middle East & Africa, and Eastern Europe.

The BNT based segment is projected to maintain its leading position in the BNT lead-free piezoelectric ceramics market in 2025 with a 54.8% market share, reaffirming its role as the preferred material category for medical ultrasound transducers and high-precision sensor applications. Device manufacturers increasingly utilize pure BNT-based compositions for their excellent piezoelectric coefficients, thermal stability characteristics, and proven effectiveness in achieving high electromechanical coupling while supporting miniaturization requirements. BNT-based material technology's proven effectiveness and compositional versatility directly address the industry requirements for lead-free alternatives and sustainable manufacturing solutions across diverse medical device and industrial sensor platforms.

This material segment forms the foundation of modern lead-free piezoelectric technology, as it represents the composition with the greatest contribution to environmental compliance achievements and established performance record across multiple ultrasonic and sensing applications. Medical device industry investments in lead-free technologies continue to strengthen adoption among equipment manufacturers and component suppliers. With regulatory mandates requiring hazardous substance elimination and environmental safety, BNT-based ceramics align with both compliance objectives and performance requirements, making them the central component of comprehensive green electronics strategies.

The medical application segment is projected to represent the largest share of BNT lead-free piezoelectric ceramics demand in 2025 with a 42.6% market share, underscoring its critical role as the primary driver for lead-free ceramic adoption across ultrasound imaging systems, therapeutic ultrasound devices, and surgical instrument applications. Medical device manufacturers prefer BNT lead-free ceramics for healthcare equipment due to their exceptional biocompatibility, reliable piezoelectric performance, and ability to meet stringent regulatory standards while supporting advanced imaging resolution and therapeutic effectiveness. Positioned as essential materials for modern medical device manufacturing, BNT lead-free piezoelectric ceramics offer both technical advantages and regulatory compliance benefits.

The segment is supported by continuous innovation in medical ultrasound technology and the growing availability of optimized BNT ceramic compositions that enable superior imaging quality with enhanced sensitivity and reduced power consumption. Additionally, medical device manufacturers are investing in comprehensive material qualification programs to support increasingly stringent safety requirements and growing demand for environmentally safe components in healthcare equipment. As medical technology advances and environmental regulations strengthen, the medical application will continue to dominate the market while supporting advanced ceramic development and device performance optimization strategies.

The BNT lead-free piezoelectric ceramics market is advancing steadily due to increasing regulatory restrictions on lead-based materials driven by environmental protection legislation and growing adoption of sustainable electronics that require environmentally compliant piezoelectric solutions providing competitive performance characteristics and reliability across diverse medical diagnostics, automotive sensing, consumer electronics, and industrial automation applications. However, the market faces challenges, including performance gaps compared to traditional lead-based materials, higher manufacturing costs and processing complexity, and technical constraints related to temperature stability and long-term reliability in certain applications. Innovation in composition engineering and advanced processing technologies continues to influence product development and market expansion patterns.

The growing demand for advanced medical imaging is driving adoption of lead-free piezoelectric ceramics that address healthcare industry requirements including high-frequency ultrasound imaging, three-dimensional diagnostic capabilities, and portable medical devices for point-of-care applications. Medical ultrasound equipment requires advanced BNT ceramics that deliver superior acoustic impedance matching across multiple parameters while maintaining biocompatibility and signal clarity. Medical device manufacturers are increasingly recognizing the competitive advantages of lead-free piezoelectric materials for regulatory compliance and market differentiation, creating opportunities for innovative ceramic compositions specifically designed for next-generation medical imaging and therapeutic applications.

Modern automotive manufacturers are incorporating lead-free piezoelectric ceramics into advanced driver assistance systems, fuel injection systems, and structural health monitoring applications to enhance vehicle safety, optimize fuel efficiency, and support comprehensive vehicle electrification through environmentally compliant sensor and actuator technologies. Leading automotive suppliers are developing BNT-based sensors for pressure monitoring, implementing lead-free actuators for precision fuel injection, and advancing ceramic technologies that withstand automotive temperature extremes and vibration exposure. These applications improve vehicle performance while enabling new automotive opportunities, including autonomous driving sensors, electric vehicle battery monitoring, and predictive maintenance systems. Advanced automotive integration also allows manufacturers to support comprehensive environmental compliance objectives and supply chain sustainability beyond traditional performance metrics.

The expansion of Internet of Things networks, wireless sensor systems, and energy-autonomous devices is driving demand for BNT lead-free piezoelectric ceramics with optimized energy conversion efficiency, miniature form factors, and exceptional mechanical durability for vibration energy harvesting and self-powered sensing applications. These emerging applications require specialized ceramic compositions with enhanced piezoelectric voltage constants that exceed traditional requirements, creating innovative market segments with differentiated technical propositions. Manufacturers are investing in nanostructured ceramic development and advanced electrode designs to serve emerging IoT applications while supporting innovation in smart infrastructure, industrial monitoring, and environmental sensing systems.

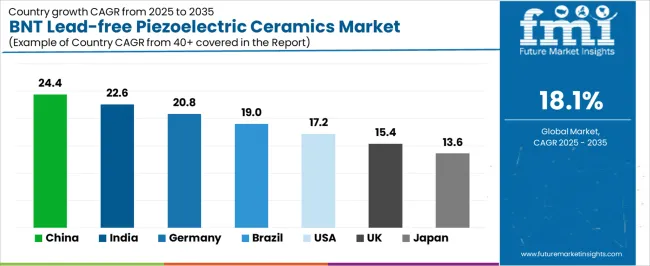

| Country | CAGR (2025-2035) |

|---|---|

| China | 24.4% |

| India | 22.6% |

| Germany | 20.8% |

| Brazil | 19.0% |

| USA | 17.2% |

| UK | 15.4% |

| Japan | 13.6% |

The BNT lead-free piezoelectric ceramics market is experiencing solid growth globally, with China leading at a 24.4% CAGR through 2035, driven by massive electronics manufacturing capacity, expanding medical device production, and strong government support for green manufacturing and environmental compliance. India follows at 22.6%, supported by growing electronics assembly industry, expanding healthcare infrastructure, and rising emphasis on sustainable manufacturing practices. Germany shows growth at 20.8%, emphasizing automotive sensor innovation, medical technology excellence, and strict environmental regulations driving lead-free adoption. Brazil demonstrates 19.0% growth, supported by expanding automotive electronics sector, growing medical device manufacturing, and increasing environmental awareness. The USA records 17.2%, focusing on advanced medical imaging systems, defense electronics applications, and sustainable material development. The UK exhibits 15.4% growth, emphasizing medical device innovation, aerospace applications, and environmental compliance. Japan shows 13.6% growth, supported by consumer electronics leadership, automotive sensor development, and material science innovation.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

Revenue from BNT lead-free piezoelectric ceramics in China is projected to exhibit exceptional growth with a CAGR of 24.4% through 2035, driven by the country's position as the world's largest electronics manufacturer, rapidly expanding medical device production capacity, and strong government policies promoting green manufacturing and environmental protection through material substitution programs. The country's comprehensive manufacturing infrastructure and increasing emphasis on environmental compliance are creating substantial demand for lead-free piezoelectric ceramic solutions. Major electronics manufacturers and specialized ceramics producers are establishing extensive production capabilities to serve both domestic markets and global supply chains.

Revenue from BNT lead-free piezoelectric ceramics in India is expanding at a CAGR of 22.6%, supported by the country's growing electronics manufacturing sector under Make in India initiatives, expanding healthcare infrastructure with increasing medical device adoption, and rising awareness of environmental compliance and sustainable manufacturing practices. The nation's developing industrial base and increasing technology capabilities are driving sophisticated material requirements throughout manufacturing sectors. International material suppliers and domestic manufacturers are establishing production and research facilities to address growing demand.

Revenue from BNT lead-free piezoelectric ceramics in Germany is expanding at a CAGR of 20.8%, supported by the country's automotive industry excellence, world-class medical technology sector, and stringent environmental regulations including RoHS and REACH directives driving comprehensive lead-free material adoption. Germany's engineering expertise and quality standards are driving demand for high-performance BNT ceramics throughout advanced manufacturing sectors. Leading ceramics manufacturers and research institutions are investing extensively in composition development and processing optimization.

Revenue from BNT lead-free piezoelectric ceramics in Brazil is expanding at a CAGR of 19.0%, supported by the country's significant automotive manufacturing presence, growing medical device sector, and increasing adoption of international environmental standards driven by export market requirements and sustainability initiatives. Brazil's expanding industrial capabilities and environmental consciousness are driving demand for compliant material solutions. International suppliers and regional distributors are investing in market development and technical support infrastructure.

Revenue from BNT lead-free piezoelectric ceramics in the USA is expanding at a CAGR of 17.2%, driven by the country's advanced medical imaging industry, significant defense electronics sector, and strong emphasis on sustainable materials research and development supported by federal research funding and environmental initiatives. The nation's technology leadership and regulatory environment are driving innovation in lead-free piezoelectric materials. Leading ceramics manufacturers and research institutions are investing in next-generation composition development and application optimization.

Revenue from BNT lead-free piezoelectric ceramics in the UK is growing at a CAGR of 15.4%, driven by the country's strong medical device innovation sector, significant aerospace industry presence, and comprehensive environmental regulations requiring hazardous substance elimination in electronics manufacturing. The UK's technology expertise and sustainability focus are supporting investment in lead-free ceramic technologies. Medical device manufacturers and aerospace suppliers are establishing material qualification programs and application development initiatives.

Revenue from BNT lead-free piezoelectric ceramics in Japan is expanding at a CAGR of 13.6%, supported by the country's consumer electronics industry leadership, automotive sensor expertise, and advanced materials research capabilities driving fundamental understanding and application development of BNT-based compositions. Japan's technological sophistication and quality consciousness are creating demand for optimized lead-free piezoelectric materials. Leading ceramics manufacturers and research institutions are investing in advanced processing technologies and property enhancement research.

The BNT lead-free piezoelectric ceramics market in Europe is projected to grow from USD 49.9 million in 2025 to USD 232.3 million by 2035, registering a CAGR of 16.6% over the forecast period. Germany is expected to maintain leadership with a 35.2% market share in 2025, moderating to 34.8% by 2035, supported by automotive electronics innovation, medical technology excellence, and strict RoHS/REACH enforcement.

The UK follows with 22.4% in 2025, projected at 21.9% by 2035, driven by medical device innovation, aerospace applications, and environmental compliance culture. France holds 16.7% in 2025, rising to 17.1% by 2035 on the back of automotive sensor development and medical imaging technology. Italy commands 12.3% in 2025, reaching 12.6% by 2035, while Spain accounts for 7.8% in 2025, rising to 8.1% by 2035 aided by growing automotive electronics and medical device manufacturing. Switzerland maintains 5.6% in 2025, up to 5.5% by 2035 due to precision medical device production. The Rest of Europe region, including Nordic countries with strong environmental standards, Central & Eastern European emerging manufacturing hubs, and other EU nations, is anticipated to hold 0.0% in 2025 and 0.0% by 2035, with growth distributed across listed markets reflecting concentration in established technology centers.

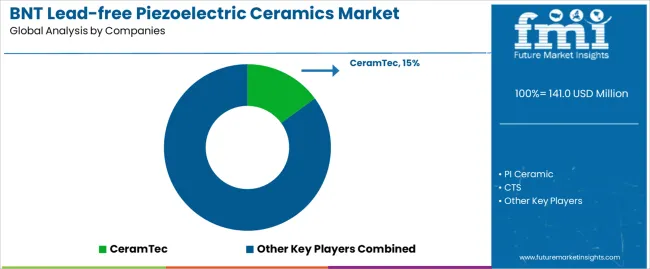

The BNT lead-free piezoelectric ceramics market is characterized by competition among specialized advanced ceramics manufacturers, material science innovators, and established piezoelectric component suppliers. Companies are investing in composition optimization research, processing technology development, application-specific formulation advancement, and customer technical support to deliver high-performance, environmentally compliant, and cost-effective BNT ceramic solutions. Innovation in dopant engineering, sintering optimization, and electrode integration technologies is central to strengthening market position and competitive advantage.

CeramTec leads the market as a global advanced ceramics manufacturer offering comprehensive piezoelectric ceramic solutions with focus on medical ultrasound transducers, automotive sensors, and industrial actuator applications. The company provides extensive material development capabilities and application engineering support for lead-free piezoelectric implementations across diverse industries. PI Ceramic specializes in piezoelectric ceramics and actuators with emphasis on precision positioning systems, ultrasonic motors, and sensor applications, offering both standard and customized BNT-based ceramic solutions.

CTS Corporation delivers electronic components and sensors including piezoelectric devices with focus on automotive applications, industrial sensing, and telecommunications equipment. The company provides lead-free piezoelectric solutions meeting environmental compliance requirements while maintaining performance standards for demanding applications.

BNT lead-free piezoelectric ceramics represent a specialized functional materials segment within advanced electronics and medical devices, projected to grow from USD 141 million in 2025 to USD 744.3 million by 2035 at a 18.1% CAGR. These environmentally compliant ceramic materials-primarily bismuth sodium titanate-based compositions for sensing and actuation-serve as critical functional components in medical ultrasound equipment, automotive electronics, consumer devices, and industrial sensors where lead-free operation, reliable piezoelectric performance, and environmental safety are essential. Market expansion is driven by environmental regulations restricting hazardous substances, growing medical device demand, advancing automotive electronics, and rising emphasis on sustainable materials across electronics and healthcare industries.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 141 million |

| Material Composition | BNT Based, BNT-BT Based |

| Application | Medical, Automotive Electronics, Consumer Electronics, Others |

| Regions Covered | East Asia, Europe, North America, South Asia, Latin America, Middle East & Africa, Eastern Europe |

| Countries Covered | China, India, Germany, Brazil, USA, UK, Japan, and 40+ countries |

| Key Companies Profiled | CeramTec, PI Ceramic, CTS |

| Additional Attributes | Dollar sales by material composition and application category, regional demand trends, competitive landscape, technological advancements in ceramic formulation, environmental compliance development, performance optimization, and sustainable manufacturing integration |

The global bnt lead-free piezoelectric ceramics market is estimated to be valued at USD 141.0 million in 2025.

The market size for the bnt lead-free piezoelectric ceramics market is projected to reach USD 744.3 million by 2035.

The bnt lead-free piezoelectric ceramics market is expected to grow at a 18.1% CAGR between 2025 and 2035.

The key product types in bnt lead-free piezoelectric ceramics market are bnt based and bnt-bt based.

In terms of application, medical segment to command 42.6% share in the bnt lead-free piezoelectric ceramics market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bio-ceramics and Hydroxyapatite Market 2025-2035

Pottery Ceramics Market Size and Share Forecast Outlook 2025 to 2035

Advanced Ceramics Market Analysis - Size, Share & Forecast 2025 to 2035

Electronic Ceramics Market Size and Share Forecast Outlook 2025 to 2035

Monolithic Ceramics Market Size and Share Forecast Outlook 2025 to 2035

Industrial Ceramics Market Growth – Trends & Forecast 2025 to 2035

3D Printing Ceramics Market Size and Share Forecast Outlook 2025 to 2035

Transparent Ceramics Market Size and Share Forecast Outlook 2025 to 2035

High-Temperature Ceramics Market Growth - Trends & Forecast 2025 to 2035

Zirconia-Based Dental Ceramics Market Trends - Growth & Forecast 2024 to 2034

Piezoelectric Devices Market Size and Share Forecast Outlook 2025 to 2035

Piezoelectric Materials Market Size and Share Forecast Outlook 2025 to 2035

Piezoelectric Sensors Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Piezoelectric Polymers Market Size and Share Forecast Outlook 2025 to 2035

Piezoelectric Accelerometer Market Size and Share Forecast Outlook 2025 to 2035

Breaking Down Market Share in Piezoelectric Sensors Manufacturing

Piezoelectric Ceramics Market Analysis by Type, Application and Region: Forecast for 2025 to 2035

Dental Piezoelectric Ultrasonic Unit Market Trends and Forecast 2025 to 2035

Automotive Piezoelectric Fuel Injectors Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA