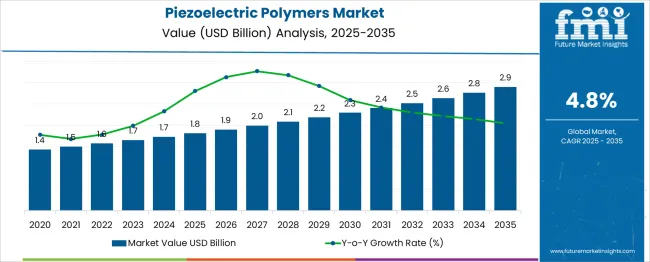

The Piezoelectric Polymers Market is estimated to be valued at USD 1.8 billion in 2025 and is projected to reach USD 2.9 billion by 2035, registering a compound annual growth rate (CAGR) of 4.8% over the forecast period.

From 2025 to 2030, the market increases from USD 1.4B to USD 1.9B, registering a net gain of USD 0.5B over five years. YoY growth is relatively steady: USD 1.4B (2025), USD 1.5B (2026, +7.1%), USD 1.6B (2027, +6.7%), USD 1.7B (2028, +6.3%), and flat at USD 1.7B in 2029 (0%). It resumes at USD 1.8B in 2030 (+5.9%). The early-phase plateau suggests stabilization in legacy applications such as acoustic transducers and sensors. Growth re-accelerates post-2030, reaching USD 2.9B by 2035—a USD 1.0B increase in five years. This trend aligns with expanded adoption in energy harvesting, wearable electronics, and biomedical microdevices. Studies in Nature Materials cite enhanced piezoelectric response in PVDF-TrFE copolymers and lead-free alternatives, enabling use in thin, flexible systems. OEM demand is growing for noise-free actuators and self-powered sensors in automotive, aerospace, and implantable devices. The market is moving from niche materials science to application-engineered commercial integration, signaling long-term value creation through 2035.

| Metric | Value |

|---|---|

| Piezoelectric Polymers Market Estimated Value in (2025 E) | USD 1.8 billion |

| Piezoelectric Polymers Market Forecast Value in (2035 F) | USD 2.9 billion |

| Forecast CAGR (2025 to 2035) | 4.8% |

The Piezoelectric Polymers Market is shaped by a range of end-use industries, with consumer electronics leading at approximately 25–30% of total demand. These polymers are widely used in smartphones, tablets, and wearables for functions like haptic feedback, touch-sensitive controls, and vibration sensing. The automotive sector follows closely with a 20–25% share, where piezoelectric polymers are integrated into pressure sensors, airbag systems, and active noise and vibration control components. Healthcare and medical devices account for 15–20% of the market, utilizing these materials in ultrasound transducers, biosensors, and non-invasive diagnostic equipment due to their flexibility and biocompatibility.

The industrial and automation segment holds around 15–18%, driven by applications in robotics, motion control, and structural health monitoring systems. Aerospace and defense represent roughly 10%, employing piezoelectric polymers for structural monitoring, pressure sensors, and vibration damping in aircraft and defense systems. Energy harvesting and smart textiles contribute 5–7%, as these polymers are used to convert mechanical movement into electrical energy in wearable devices and self-powered sensors.

The acoustic and ultrasonic device market makes up another 5–7%, especially in sonar, ultrasonic welding, and cleaning tools. This diverse application landscape highlights the growing relevance of piezoelectric polymers in flexible, energy-efficient, and miniaturized technologies across industries.

The piezoelectric polymers market is gaining strong traction as industries prioritize advanced sensing capabilities, energy harvesting, and flexible electronics. With increasing interest in low-power and lightweight materials, piezoelectric polymers are being favored for their mechanical flexibility, thermal stability, and electromechanical coupling efficiency. Technological advancements in organic and hybrid material processing have expanded the application potential of these polymers, particularly in miniaturized devices and biomedical systems.

The rise in smart wearables, implantable devices, and energy-scavenging components has further amplified demand across sectors such as healthcare, automotive, and consumer electronics. Strategic collaborations among material innovators, medtech companies, and electronics manufacturers are enabling scalable production of high-performance piezoelectric films and fibers.

The shift toward sustainable and non-toxic alternatives to ceramic-based piezo materials is supporting regulatory acceptance and commercialization. The market is expected to continue evolving with increased investments in printable electronics, next-generation sensors, and low-footprint energy solutions driven by the expanding scope of the Internet of Things and personalized medical technologies.

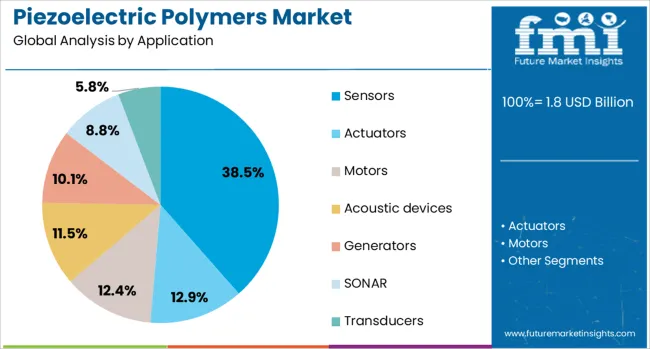

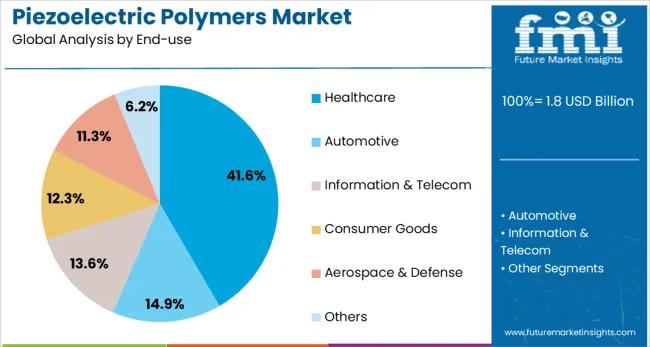

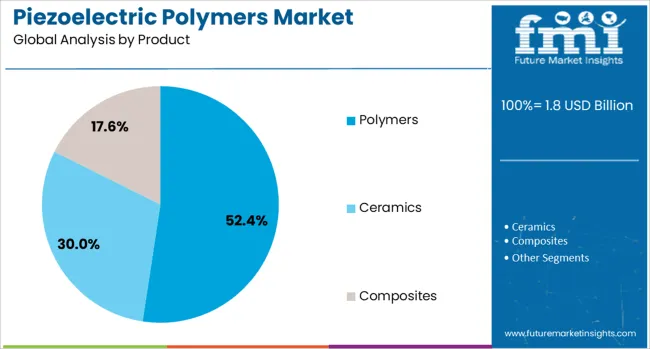

The piezoelectric polymers market is segmented by application, end-use, product, and geographic regions. The piezoelectric polymers market is divided into Sensors, Actuators, Motors, Acoustic devices, Generators, SONAR, and Transducers. The end-use market for piezoelectric polymers is classified into Healthcare, Automotive, Information & Telecom, Consumer Goods, Aerospace & Defense, and Others. The piezoelectric polymers market is segmented into Polymers, Ceramics, and Composites. Regionally, the piezoelectric polymers industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The sensors application segment is projected to account for 38.5% of the piezoelectric polymers market revenue share in 2025, establishing it as the leading application area. This growth is being driven by the rising demand for flexible and miniaturized sensors in sectors such as healthcare, automotive, and consumer electronics. The ability of piezoelectric polymers to convert mechanical stress into electrical signals with high precision has made them essential in wearable devices, structural health monitoring systems, and touch-responsive interfaces.

These materials enable real-time data acquisition in low-power environments and offer enhanced durability under dynamic conditions. The increasing adoption of remote patient monitoring, vibration sensors, and gesture recognition technologies has further boosted their integration into smart systems.

The compatibility of piezoelectric polymers with roll-to-roll processing and printable formats also supports mass production for sensor arrays. Their low acoustic impedance, biocompatibility, and adaptability to complex geometries have positioned them as a critical enabler for the future of intelligent sensing platforms.

The healthcare segment is expected to hold 41.6% of the total piezoelectric polymers market revenue in 2025, emerging as the dominant end-use industry. This leadership is being supported by the increasing application of piezoelectric polymers in diagnostic imaging, drug delivery systems, and implantable medical devices. These polymers offer a unique combination of flexibility, lightweight construction, and biocompatibility, making them ideal for integration into next-generation medical technologies.

Their use in ultrasound transducers, pressure sensors, and smart bandages has expanded with the growing demand for non-invasive, real-time health monitoring solutions. The rapid growth in telemedicine and wearable biosensing is also driving innovation in flexible piezoelectric materials that support continuous physiological data tracking.

Additionally, regulatory support for safe and reliable polymeric materials in medical devices has enabled broader clinical adoption. As healthcare systems move toward personalized and preventative care models, piezoelectric polymers are expected to play a key role in enhancing diagnostic precision and treatment efficacy across diverse clinical settings.

The polymers product segment is forecast to account for 52.4% of the piezoelectric polymers market revenue in 2025, maintaining its position as the leading product category. This dominance is being attributed to the superior processability, scalability, and design flexibility offered by polymer-based piezoelectric materials. These polymers, such as PVDF and its copolymers, provide high piezoelectric responses while being lightweight and mechanically robust, which makes them suitable for applications in flexible electronics, medical sensors, and energy harvesting devices.

The shift from traditional ceramic-based piezo materials to polymer alternatives is being accelerated by the need for conformable and resilient structures that can operate under varied environmental conditions. Additionally, advances in material science have enhanced the piezoelectric coefficients and thermal stability of these polymers, supporting their integration into high-performance electronic systems.

The growing focus on additive manufacturing and printed electronics is also expanding opportunities for polymer-based solutions. As innovation continues to push the boundaries of form factor and function, piezoelectric polymers are anticipated to remain central to the market's growth trajectory.

Adoption is growing rapidly in wearable devices, implants, and energy harvesting modules. Emerging opportunities focus on advanced PVDF composites, regional supplier networks, and application‑specific integration services.

Piezoelectric polymers such as PVDF and its copolymers are being employed increasingly in health care wearables, soft robotics, and energy capture systems. Films and lightweight transducers convert mechanical movement into electrical signals for heart rate monitors, motion trackers, or self‑powered sensors embedded in clothing or infrastructure. Ability to conform to curved surfaces enables seamless integration into human‑body interface devices or curved structural elements. These polymers are favored over rigid ceramics for flexibility, low weight, and biocompatibility. Industries including medical diagnostics, aerospace components, and consumer electronics are deploying PVDF‑based actuators and sensors where durability and form factor matter. This demand is supported by growing interest in low‑power smart devices and on‑body instrumentation.

Growth is being supported by development of PVDF‑TrFE blends, chitosan nanocomposite elastomers, and printed piezo films tailored for targeted applications. Providers are partnering with device makers, engineering labs, and material scientists to co‑design sensors or actuators for structural health monitoring, noise cancellation, or implantable electronics. Service offerings include pilot testing, calibration reporting, and materials-as‑a-service models that support usage tracking and lifecycle feedback. Regional manufacturing hubs near medical or electronics clusters help reduce lead times and support small-scale customization. Subscription-based composite supply and material regeneration programs enable scalable sourcing of piezo films. Collaborations across software platforms, energy harvesting integrators, and actuator manufacturers help embed polymer materials into end‑use solutions more efficiently.

Piezoelectric polymers must deliver reliable electrical output under mechanical deformation, creating a challenge when balancing sensitivity and flexibility. High-sensitivity copolymers can generate stronger signals under low-pressure inputs, but tend to become brittle or less stretchable. In contrast, elastomer-based films offer superior flexibility but require larger force to generate measurable output. The tradeoff affects application design in pressure-sensitive health patches, touch interfaces, or structural vibration sensors. Manufacturing consistency in dip-coating, corona poling, and film orientation becomes critical to achieve uniform performance across batches. Without precise processing and quality control, sensor outputs may vary across devices, reducing reliability in multi-sensor arrays. Manufacturers must refine polymer formulations and optimize mechanical-electrical coupling through material layering or controlled annealing. Poor balancing of sensitivity and flexibility limits adoption in flexible electronics or implantable sensor applications.

Between now and 2030, demand for battery-free sensing in wearable and IoT applications positions piezoelectric polymers as attractive energy-harvesting components. Thin-film PVDF variants and composite formulations can generate usable charge from human motion, ambient vibrations, or structural bending. Designers implement these films in self-powered switches, health-trackers, and maintenance sensors that operate without external power sources. Compared to conventional small batteries, piezoelectric polymer layers require no recharging and reduce maintenance. Utility increases in smart textiles, footfall-powered lights, and remote sensing installations in industrial assets. Key application areas include self-powered health patches, footstep sensors in smart floors, and vibration-capturing strips in machinery. Suppliers that can provide calibrated charge per movement event or vibration range gain preference. This energy harvesting opportunity supports growing demand for autonomous operation in remote or wearable systems, especially when energy budgets are tight.

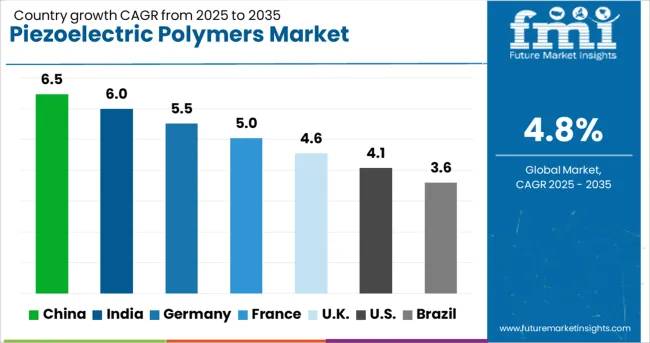

| Country | CAGR |

|---|---|

| China | 6.5% |

| India | 6.0% |

| Germany | 5.5% |

| France | 5.0% |

| UK | 4.6% |

| USA | 4.1% |

| Brazil | 3.6% |

Among BRICS nations, China leads with a projected CAGR of 6.5% from 2025 to 2035, driven by expanding use in flexible electronics, rapid growth in sensor-integrated wearables, and increased R&D funding for PVDF-based materials. India follows at 6.0%, supported by academic-industry collaborations, demand from energy harvesting applications, and integration of piezoelectric films in smart infrastructure projects. Within OECD countries, Germany shows 5.5% growth, fueled by innovations in automotive sensors, robotic components, and advancements in 3D printing of piezoelectric devices. France, at 5.0%, benefits from rising use in medical ultrasound transducers and aerospace components requiring lightweight actuation materials. The United Kingdom, with a CAGR of 4.6%, is leveraging piezoelectric polymers in smart textiles and has seen a notable increase in startup activity around printed sensor technology. The report covers detailed analysis of 40+ countries, and the top five countries have been shared as a reference.

The piezoelectric polymers market in China is expanding at a CAGR of 6.5%, driven by growth in wearable electronics, industrial automation, and smart sensor integration. Significant research investments are being made to improve polymer durability and sensitivity under mechanical stress. Domestic manufacturers are focusing on high-volume applications in robotics, energy harvesting, and flexible electronics. Rising demand for lightweight and cost-effective materials in consumer electronics is accelerating market growth. Strategic partnerships between universities and technology firms are producing advanced product designs that meet international performance standards. Supportive government initiatives are promoting smart manufacturing and sustainable innovation across sectors.

India is witnessing a CAGR of 6% in the piezoelectric polymers market, supported by increasing demand across medical diagnostics, structural monitoring, and portable electronics. Local companies are investing in cost-effective processing techniques to meet growing domestic needs. Adoption of sensors in agriculture, transportation, and healthcare is driving innovation. Technology parks and research incubators are enabling commercialization of smart polymer materials. Lightweight, flexible piezoelectric components are being used in health monitoring and wireless communication devices. Efforts are being made to improve performance under extreme weather conditions through simulation and collaborative testing.

Germany is experiencing a CAGR of 5.5% in the piezoelectric polymers market, driven by demand from advanced mobility, automation, and energy transition initiatives. High-performance polymers are being adopted in actuators, vibration sensors, and smart structures. Manufacturers are prioritizing compliance with EU regulations on sustainability and recycling. Automotive and aerospace sectors are deploying piezoelectric components in real-time monitoring systems. Collaborative R&D between academic institutions and Tier 1 suppliers is fueling material innovation. Government support for smart manufacturing is encouraging integration of these materials into dynamic environments.

The piezoelectric polymers market in France is advancing at a CAGR of 5%, supported by rising technological demand in aerospace, defense, and miniaturized electronics. Efforts are being directed toward development of low-profile acoustic devices and transducers. Research institutions are funding biodegradable piezoelectric materials for sustainable applications. Innovation hubs in Paris and Toulouse are supporting integration into energy-efficient healthcare and aerospace equipment. Startups are focused on wearable sensor systems using high-sensitivity polymer actuators. Environmental and recycling standards are influencing product development and lifecycle planning.

The United Kingdom is seeing a CAGR of 4.6% in the piezoelectric polymers market, driven by increasing applications in smart infrastructure, health technology, and clean energy systems. Universities and tech labs are working together to develop materials that efficiently convert mechanical stress into electrical signals. Smart city initiatives are enabling integration of polymer sensors into transport and utility systems. Innovations in haptic feedback for AR and VR are broadening market scope. Local manufacturers are pursuing low-carbon synthesis techniques aligned with national climate targets. Structural health monitoring of bridges and transit networks is utilizing lightweight piezoelectric materials for durability and precision.

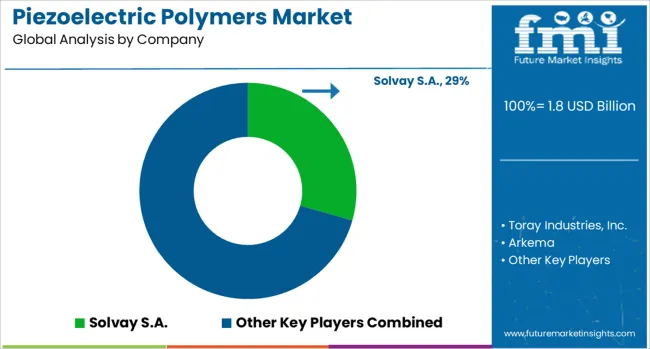

The piezoelectric polymers landscape is concentrated at the resin level and fragmented downstream. Dominant players are Arkema Piezotech, Solvay Solef PVDF, Daikin Fluorochemicals, and Kureha, since PVDF and PVDF-TrFE set the material baseline for films and laminates. Key players include TE Connectivity Measurement Specialties and a handful of film polarizers, converters, and sensor assemblers that turn resins into transducers for wearables, structural health monitoring, ultrasound, and energy harvesting. Emerging players are university spin-offs and niche startups focused on co-polymer tuning, inkjet printable inks, and flexible PCB integration, which is expected to raise performance per gram and lower drive voltage. Competition is defined by polymer purity, β-phase content, poling stability, thickness control below 10–28 µm, and supply security of fluoromonomers. Regional dynamics favor Europe and Japan at the resin core, while North America and China show breadth in device integration. Partnerships between resin suppliers and converters are used to lock in custom grades and application data packs. Pricing power sits with resin producers during tight HF and VDF value-chain conditions; device makers compete on packaging know-how, ASIC pairing, and reliability under humidity and heat.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.8 Billion |

| Application | Sensors, Actuators, Motors, Acoustic devices, Generators, SONAR, and Transducers |

| End-use | Healthcare, Automotive, Information & Telecom, Consumer Goods, Aerospace & Defense, and Others |

| Product | Polymers, Ceramics, and Composites |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Solvay S.A., Toray Industries, Inc., Arkema, Kureha Corporation, and Polyk Technologies |

| Additional Attributes | Dollar sales by polymer type such as PVDF and polyamide variants, by product configuration including films and fibers, and by industry use spanning medical, automotive, and consumer electronics; demand driven by rising wearable sensors, flexible device adoption, and energy harvesting needs; innovation in nanostructured and composite formulations; cost dynamics shaped by precursor availability and processing complexity; and emerging use in self-powered wearables and bio-integrated sensors. |

The global piezoelectric polymers market is estimated to be valued at USD 1.8 billion in 2025.

The market size for the piezoelectric polymers market is projected to reach USD 2.9 billion by 2035.

The piezoelectric polymers market is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in piezoelectric polymers market are sensors, actuators, motors, acoustic devices, generators, sonar and transducers.

In terms of end-use, healthcare segment to command 41.6% share in the piezoelectric polymers market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Piezoelectric Devices Market Size and Share Forecast Outlook 2025 to 2035

Piezoelectric Materials Market Size and Share Forecast Outlook 2025 to 2035

Piezoelectric Sensors Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Piezoelectric Accelerometer Market Size and Share Forecast Outlook 2025 to 2035

Piezoelectric Ceramics Market Analysis by Type, Application and Region: Forecast for 2025 to 2035

Breaking Down Market Share in Piezoelectric Sensors Manufacturing

Dental Piezoelectric Ultrasonic Unit Market Trends and Forecast 2025 to 2035

Automotive Piezoelectric Fuel Injectors Market Size and Share Forecast Outlook 2025 to 2035

KNN Lead-free Piezoelectric Ceramics Market Size and Share Forecast Outlook 2025 to 2035

BNT Lead-free Piezoelectric Ceramics Market Size and Share Forecast Outlook 2025 to 2035

Biopolymers Market Size and Share Forecast Outlook 2025 to 2035

Cast Polymers Market Size and Share Forecast Outlook 2025 to 2035

Fluoropolymers in Healthcare Market Insights - Size, Trends & Forecast 2025 to 2035

Sulfone Polymers Market Growth - Trends & Forecast 2025 to 2035

Emulsion Polymers Market Size and Share Forecast Outlook 2025 to 2035

Drilling Polymers Market Analysis, Growth, Applications and Outlook 2025 to 2035

Acetal Copolymers Market Growth - Trends & Forecast 2025 to 2035

Specialty Polymers Market Size and Share Forecast Outlook 2025 to 2035

Antiviral Polymers for Packaging Market

Cellulosic Polymers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA