Between 2025 and 2035, the global sulfone polymers market will experience steady growth, driven by demand in healthcare, aerospace, automotive, and electronics industries. Sulfone polymers are high-performance thermoplastic materials noted for excellent heat resistance, chemical stability and superior mechanical properties.

Its escalating implementation in medical devices, membranes, and electrical components is driving market growth. This is due to the anticipated increase in the demand for lightweight and durable materials in high-temperature environments and increasing regulatory requirements regarding safety and performance, which further drives the sulfone polymer adoption. Moreover, widespread adoption of advanced polymer processing technologies, recyclability, and sustainability initiatives are driving innovation and enhancing market competitiveness.

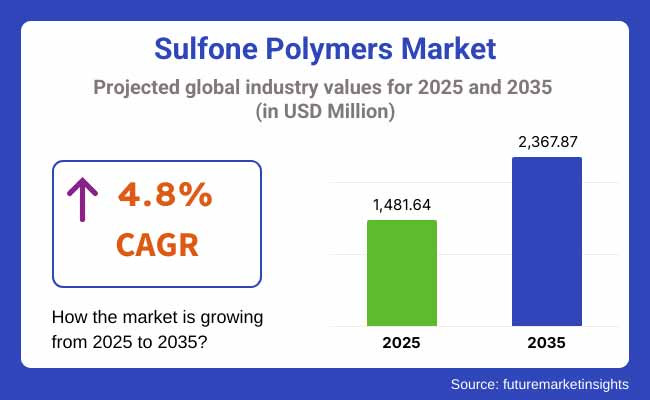

In 2025, the sulfone polymers market was valued at approximately USD 1,481.64 million. By 2035, it is projected to reach USD 2,367.87 million, reflecting a compound annual growth rate (CAGR) of 4.8%. The market’s growth is attributed to the increasing adoption of sulfone-based resins in aerospace components, advanced filtration systems, and high-performance medical applications.

Furthermore, the expansion of the electronics and semiconductor industries, along with the rising demand for high-temperature-resistant materials in industrial manufacturing, is driving market penetration. The continuous development of bio-based sulfone polymers and plastics, as well as enhanced production techniques, are also contributing to long-term market sustainability.

North America continues to be a significant market for sulfone polymers due to strong demand from the healthcare, aerospace, and electronics sectors. United States and Canada: High-material thermoplastics for electric medical devices and aircraft interiors. Market expansion is being propelled by key manufacturer presence, ongoing research related to advanced polymer formulations, and strict safety regulations.

Furthermore, increasing consumption of sulfone polymers in water purification systems, fuel cells, and 3D printing applications are further enhancing the market opportunities. This is also driving innovation in the region with the increased government funding for sustainable material development and recycling initiatives.

The sulfone polymer market in Europe can be segmented on the basis of application in industrial, commercial, automotive, semiconductors, and other fields. Leading regions for the production and uptake of sulfone-based materials in automotive, aerospace and healthcare include Germany, France and the UK. With increasing emphasis on sustainability and the development of bio-based polymer options, manufacturers are vying to deliver novel sulfone polymer solutions that are environmentally sustainable.

Additionally, the surge in demand for lightweight, high-strength materials in electric vehicles and industrial machinery is accelerating market growth. Additional trends that are impacting the direction the industry will take include the European Union’s initiatives focused on a circular economy and reduction in plastic waste.

The sulfone polymers market in the Asia-Pacific region is anticipated to grow at the fastest pace due to rapid industrialization, growing electronics manufacturing, and increasing healthcare infrastructure. For example, in countries like China, Japan, and India, high-performance polymer research and development, and investments are growing.

Regional demand is driven by growing penetration of sulfone-based membranes for water treatment, medical-grade plastics, and the consumer electronics market. Moreover, the growing automotive industry, along with the government initiatives to promote advanced material production, are augmenting the demand for the market. Asia-Pacific is a center for the innovation and large-scale manufacturing of sulfone polymer, due to the availability of cost-effective production facilities and a pool of skilled labor.

The sulfone polymers market will observe steady growth during the next decade with ongoing research in sulfone polymer technology, accelerating demand from a range of industries, and changing customer requirements for high-performance, robust, and recyclable materials.

To meet the varying applications, companies are concentrating on polymer formulation innovations, sustainability practices, and processing improvement techniques. Moreover, strategic partnerships, rising research funding and regulations promoting green materials are playing a role in the evolution of the industry.

Challenge

High Production Costs and Limited Raw Material Availability

However, challenges in the form of the high production cost caused by complex manufacturing methods and limited availability of raw materials restrain the growth of the sulfone polymers market. Due to their specialized nature, high-temperature processing, and stringent quality control measures, sulfone polymers are associated with high operating costs as compared to other imidization techniques. Furthermore, the reliance on certain petrochemical derivatives and sicknesses in the supply chain compounds cost pressures.

This will require companies to meet the challenge of finding ways to produce goods at a low cost, find alternative sources for raw materials, and find innovative recycling solutions that both reduce reliance on virgin materials while increasing the sustainability of the market.

Regulatory Compliance and Environmental Concerns

Manufacturers in the Sulfone polymers market are challenged with stringent environmental regulations regarding plastic, emissions management and waste management. Engagement with regulatory frameworks like REACH, FDA, and RoHS imposes an operational burden and necessitates ongoing investment in sustainable practices.

Additionally, the environmental impact of sulfone polymers, which do not biodegrade, has led to increased scrutiny by environmental advocacy groups and regulators. As regulations and market expectations evolve, companies need to take on research into bio-based alternatives, work on recyclability initiatives, and invest in green manufacturing technologies.

Opportunity

Growing Demand in Healthcare and Aerospace Sectors

The growing usage of sulfone polymers in high-performance industries, especially healthcare and aerospace, is a key driver for growth. In the health area, sulfone polymers are commonly used for a diversity of medical devices, plastic sterilization trays, and clinical diagnostic equipment. Likewise, in the aerospace industry, their properties of being lightweight and durable render them perfect for structural components and interior applications.

Similarly, these R&D based enhanced formulations and optimization of industrial applications that are compliant attract demand in these high-level market segments, leading to increased revenues for companies acting as the spearheads in the market space.

Advancements in High-Performance Polymer Engineering

Recent developments in polymer engineering are creating more opportunities for sulfone polymers in industries such as electronics, automotive, and water filtration. The creation of augmented grades with improved heat resistance, mechanical strength, and electrical isolation properties further stimulates innovation in high-performance applications.

The fibrous nanostructures of nano polymer composites are now being developed to augment the functional features of the sulfone polymers. In the changing market conditions, businesses with an eye on material innovation, engagement with end-use segments and sustainable product development will be ahead of the curve.

Sulfone polymers market aftermarket trends from 2020 till 2024 and future forecast (2025 to 2035): Between 2020 and 2024, the sulfone polymers market witnessed steady growth, driven by rising applications of sulfone polymers observed in medical, aerospace, and water purification industries. However, the market dynamics were negatively impacted by raw material price fluctuations, regulatory constraints, and supply chain disruptions. In response, companies focused on improving production efficiency, scaling sustainable sourcing initiatives, and investing in polymer processing technologies that drove operational competitiveness and supply chain resilience.

Trends expected for the sulfone polymers market in 2025 to 2035 with increasing awareness for sustainable materials among consumers, the eco-friendly sulfone polymers would gain more traction in the market over the forecast period. Next, the stage of evolution of the market will be built on innovations in polymer chemistry, AI-based materials optimization, and circular economy activities. Sustainable practices and next-gen digital transformation in manufacturing processes will drive market growth via companies focusing on high-performance product development across the board.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with existing environmental regulations |

| Technological Advancements | Growth in high-temperature-resistant sulfone polymer applications |

| Industry Adoption | Increased demand in the medical, aerospace, and automotive industries |

| Supply Chain and Sourcing | Dependence on petrochemical-derived raw materials |

| Market Competition | Dominance of established polymer manufacturers |

| Market Growth Drivers | Demand for high-performance engineering plastics |

| Sustainability and Energy Efficiency | Initial focus on recyclable polymer blends |

| Integration of Smart Monitoring | Limited AI-driven process optimization |

| Advancements in Product Innovation | Development of medical-grade and aerospace-grade sulfone polymers |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter global sustainability mandates and increased investment in biodegradable sulfone polymers |

| Technological Advancements | Advancements in AI-driven polymer engineering and nanotechnology-enhanced polymer formulations |

| Industry Adoption | Expansion into renewable energy, electronics, and advanced filtration systems |

| Supply Chain and Sourcing | Diversification into bio-based raw materials and circular economy-driven recycling initiatives |

| Market Competition | Rise of niche sustainable polymer startups and collaborative R&D partnerships |

| Market Growth Drivers | Emphasis on sustainability, energy efficiency, and next-generation polymer composites |

| Sustainability and Energy Efficiency | Large-scale adoption of energy-efficient production techniques and closed-loop recycling systems |

| Integration of Smart Monitoring | AI-enhanced predictive maintenance and smart manufacturing for cost-effective production |

| Advancements in Product Innovation | Introduction of bio-based and biodegradable sulfone polymer alternatives |

The USA dominates the sulfone polymers market, owing to the rising demand from aerospace, automotive, and healthcare sectors. The market is being driven by the rising use of high-performance polymers in medical applications, including surgical instruments and sterilization trays.

Furthermore, the growing lightweight material trend in the automotive & aerospace industries is also a factor boosting demand for sulfone polymers due to their superb thermal and chemical resistance characteristics. Major market players are devoting to research and development activities to advance their product portfolio, thereby bolstering their market position. Government regulations that favor sustainable and high-performance materials are also supporting growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.9% |

In the United Kingdom, sulfone polymers market is steadily growing owing to increased use of sulfone polymers in the electrical and electronics segment. Components such as connectors, switches, and insulators based on sulfone are in demand, owing to their high-temperature resistance and durability.

In addition, the increasing healthcare sector, coupled with rising consumption of polymer-based medical devices, is further estimated to boost market growth. The presence of cutting-edge manufacturing centers and collaboration between industry players and research institutions are driving product innovation. Continued government incentives supporting sustainable and advanced material technologies are also anticipated to drive further growth in the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.7% |

Germany, France, and Italy are the major contributors in the European Union, which is witnessing an average growth in demand for sulphone polymers in several end-use industries. Growing emphasis on energy efficiency and sustainability is expected to fuel the adoption of colosulfone products in renewable energy applications like fuel cells and battery components.

Furthermore, the stringent environmental regulations supporting the implementation of high-performance and recyclable polymers propel manufacturers to innovate. Aerospace, automotive, and medical industries are even more of a growing area of application in the region, thus turning into a key area for sulfone polymers in this region.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.8% |

With growing developments in electronics and the automotive industry, Japan's sulfone polymers market is expected to register robust growth over the forecast period. Market growth is being fueled by the rising production of advanced electronic devices such as smartphones, along with the country having a strong background in high-performance polymer technology.

Growing focus on EVs (electric vehicles) and fuel-efficient transportation is also propelling the demand for lightweight and durable materials like sulfone polymers. Additionally, the expansion of the market in Japan is supported by the presence of leading polymer manufacturers and uninterrupted development on material science.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.9% |

South Korea's sulfone polymer market is showing growth, with two major factors influencing the growth being the electronics and automotive sectors, along with the medical sector, where the advanced usage of sulfone polymers is gaining a foothold in the market in South Korea. Growing demands for high-performance thermoplastics in semiconductor production and medical device applications are driving the market growth further.

Furthermore, the demand for sustainable materials, as well as government initiatives favoring advanced manufacturing technologies, are encouraging the utilization of sulfone polymers. Moreover, this sector is also being pushed forward by the concentration of leading electronics manufacturers and research institutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.0% |

The surging need for high-performance, heat-resistant, and chemically stable polymers from a range of end-use industries is projected to propel the Sulfone polymers market in the years ahead. Sulfone polymers have a significantly high demand in automotive, healthcare, electrical & electronics, and industrial processing applications owing to their good mechanical strength, high-temperature resistance and exceptional chemical stability.

Additionally, the engineering industries are gradually expanding the application prospects for lightweight, high-strength, and environmentally friendly polymer materials. Additionally, ongoing R&D activities, developments in polymer processing along with the increasing emphasis on obtaining sustainable and recyclable sulfone-based substances, are driving the market expansion.

Polysulfone (PSU), Polyethersulfone (PESU), and Polyphenylsulfone (PPSU) polymers are segmented based on their applications, as per their advantages and durability. Due to high hydrolytic stability, impact resistance, and biocompatibility, Polysulfone polymers are widely used for medical devices, filtration membranes and aerospace components. Increasing demand for high-performance medical-grade materials, flame-retardant components, and lightweight thermoplastics is driving adoption.

Polyethersulfone (PESU) polymers have high-template strength, transparency and temperature resistance, and are suitable for pharmaceutical filtration, electrical connectors and food processing fields. The growing use of PESU polymers is supported by advances in membranes technology, biomedical engineering, and miniaturized electronic devices.

The PPSU polymers provide higher impact strength, excellent high temperature resistance, and sterilization ability and are becoming more popular in healthcare, aerospace and industrial fluid handling systems. The rising desire for autoclavable medical devices, reusable surgical instruments, and durable aerospace interiors, will drive the consumption of PPSU in these applications.

The sulfone polymers market is segmented based on end use and region. Automotive and transportation continue to be key user of sulfone polymers, harnessing their low-density frameworks, thermal stability, and fuel-saving advantages. As high-performance polymers are increasingly being integrated into electric vehicles (EVs) as well as under-the-hood components and structural reinforcements, the market is witnessing growth. Moreover, strict government regulations regarding emissions reduction and energy efficiency are encouraging the adoption of advanced polymeric materials in next-generation automotive designs.

Sulfone polymers are also driven by the healthcare industry, which uses them in medical-grade devices, diagnostic equipment, and sterilization trays. Market growth requires the high-durability, biocompatible materials required for surgical tools, dental instruments, and pharmaceutical filtration membranes. Increasing investments in healthcare infrastructure, advancements in biomedical engineering, and the growing awareness about infection control will further boost the demand for sulfone polymers in medical sector.

Circuit boards, semiconductor components, and electronic housings in the electrical & electronics segment are increasingly being manufactured from sulfone polymers. Other types of heat resistant, flame retarded, and dimensional stable materials are required as electrical gadgets are made smaller and denser. Furthermore, the rising 5G infrastructure, electric mobility market, and high-speed data centers are fuelling the demand for the sulfone-based polymers market.

Sulfone polymers are additionally advantageous in applications for consumer products and industrial processing, owing to their superior properties. They are like the Teflon® of household appliances, with mechanical properties making them well-suited for food packaging, chemical transportation, and food processing applications.

This is leading to broader acceptance of sulfone polymers within industrial and consumer product categories as continuing trend toward sustainable manufacturing, eco-friendly materials, and high-performance polymers lays accelerating foundation for sulfone polymers.

Increasing demand for advanced-grade thermoplastics in the aerospace, automotive, electronics, healthcare, and industrial sectors is influencing the increase in expansion of sulfone polymers market. This renders it a class of materials with very powerful performance characteristics where they outperform general plastics over a range of environments from thermal stability to chemical resistance to mechanical strength.

The companies are exploring the development of light-weight, high-strength bio-based sulfone polymers to meet sustainability initiatives and regulatory requirements. Some notable trends include developments in the mixing of polymers, more efficient manufacturing processes, and the rising application of medical devices, filtering membranes, and electrical elements. The market is also making strides with cost-effective methods of production and increased recyclability.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Solvay S.A. | 20-24% |

| BASF SE | 15-19% |

| Sumitomo Chemical | 12-16% |

| SABIC | 9-13% |

| RTP Company | 7-11% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Solvay S.A. | Leading producer of high-performance sulfone polymers with applications in aerospace, automotive, and medical devices. Focus on lightweight, durable, and sustainable solutions. |

| BASF SE | Specializes in advanced sulfone polymer materials with high chemical resistance and superior thermal performance for industrial and consumer applications. |

| Sumitomo Chemical | Develops innovative polymer solutions with a focus on enhancing durability, flexibility, and environmental sustainability in multiple industries. |

| SABIC | Offers high-performance sulfone polymers with unique formulations for healthcare, electronics, and transportation applications, emphasizing superior thermal stability. |

| RTP Company | Provides customized sulfone polymer compounds for diverse applications, integrating advanced material science and cutting-edge processing technologies. |

Key Company Insights

Solvay S.A. (20-24%)

Solvay S.A. is a key player in the sulfone polymers business due to its broad portfolio of high-performance polymers. The corporation invests significantly in research and development (R&D) to create innovative and sustainable polymer solutions. The company is driving market growth with a focus on aerospace, healthcare, and electronics industries. This level of collaboration with leading manufacturers helps ensure that advanced polymer technologies will be integrated into next-generation products. The company is also researching alternatives to sulfone polymer that are recyclable, as part of efforts to be compatible with global sustainability initiatives.

BASF SE (15-19%)

One of the leading companies in the sulfone polymers industry is BASF SE, which provides manufacturers with exceptionally durable and chemical-resistant materials. It uses its worldwide reach to serve sectors including automotive, healthcare, and industrial manufacturing. BASF is all about innovation, and the continuous effort to improve the performance properties of sulfone polymers is a reflection of this belief. The company also focused on process efficiencies, reducing costs, and broadening the applications for high-temperature environments.

Sumitomo Chemical (12-16%)

About Sumitomo Chemical Sumitomo Chemical is an industry leader in advanced sulfone polymer formulations, providing high-performance materials for industries in need of robust, heat-resistant thermoplastics. It is planning for production growth and investing in sustainable manufacturing. Its products serve electronics, filtration, and transportation applications. Sumitomo's expanding market share is bolstered by strategic alliances, advancements in polymer processing technologies, and a growing focus on eco-friendly solutions.

SABIC (9-13%)

SABIC's expertise is in sulfone polymers with high thermal stability and mechanical strength for demanding applications in medical devices, automotive components, and electrical equipment. The company provides innovation in lightweight and energy-efficient materials development. SABIC's investment and partnership with end-user industries for advanced research facilities, along with its growing market presence. It is dedicated to developing bio-based polymer solutions to help supply chain sustainability endeavors.

RTP Company (7-11%)

With the ability to custom-engineer sulfone polymer compounds, RTP Company offers materials specific to the needs of the end application. The company uses material science to provide valuable solutions for industrial, consumer, and medical markets. By focusing on product customization, performance enhancement of raw materials, and cost-effective processing techniques, RTP Company increases its relative competitiveness. It also invests in the development of specialty polymers with better impact resistance and flame retardancy.

Other Key Players (30-40% Combined)

Sulfone polymers market players are characterized with global and regional suppliers with emphasis on innovative product formulations, sustainability, and broadening the application spectrum. Key players include:

The overall market size for sulfone polymers market was USD 1,481.64 million in 2025.

The sulfone polymers market expected to reach USD 2,367.87 million in 2035.

The demand for the sulfone polymers market will be driven by increasing applications in aerospace, automotive, and medical industries, rising demand for high-performance and heat-resistant plastics, growing use in electrical and electronic components, advancements in polymer processing technologies, and expanding adoption in water filtration systems

The top 5 countries which drives the development of sulfone polymers market are USA, UK, Europe Union, Japan and South Korea.

Polysulfone and polyethersulfone polymers lead market growth to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Tons) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 6: Global Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 10: North America Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 12: North America Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 16: Latin America Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 18: Latin America Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 19: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 21: Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 22: Europe Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 23: Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 24: Europe Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 25: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Asia Pacific Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 27: Asia Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 28: Asia Pacific Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 29: Asia Pacific Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 30: Asia Pacific Market Volume (Tons) Forecast by End Use, 2018 to 2033

Table 31: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: MEA Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 33: MEA Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 34: MEA Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 35: MEA Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 36: MEA Market Volume (Tons) Forecast by End Use, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by End Use, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Tons) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 9: Global Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 13: Global Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 16: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 17: Global Market Attractiveness by End Use, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 27: North America Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 31: North America Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 34: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 35: North America Market Attractiveness by End Use, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 45: Latin America Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 49: Latin America Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 53: Latin America Market Attractiveness by End Use, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 56: Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 57: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 60: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 63: Europe Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 64: Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 65: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 66: Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 67: Europe Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 68: Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 69: Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 70: Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 71: Europe Market Attractiveness by End Use, 2023 to 2033

Figure 72: Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Asia Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 74: Asia Pacific Market Value (US$ Million) by End Use, 2023 to 2033

Figure 75: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Asia Pacific Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 78: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Asia Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 81: Asia Pacific Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 82: Asia Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 83: Asia Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 84: Asia Pacific Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 85: Asia Pacific Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 86: Asia Pacific Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 87: Asia Pacific Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 88: Asia Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 89: Asia Pacific Market Attractiveness by End Use, 2023 to 2033

Figure 90: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 91: MEA Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 92: MEA Market Value (US$ Million) by End Use, 2023 to 2033

Figure 93: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: MEA Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 96: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: MEA Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 99: MEA Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 100: MEA Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 101: MEA Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 102: MEA Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 103: MEA Market Volume (Tons) Analysis by End Use, 2018 to 2033

Figure 104: MEA Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 105: MEA Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 106: MEA Market Attractiveness by Product Type, 2023 to 2033

Figure 107: MEA Market Attractiveness by End Use, 2023 to 2033

Figure 108: MEA Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Polyarylsulfone Market - Growth & Demand 2025 to 2035

Polyethersulfone (PES) Market Size and Share Forecast Outlook 2025 to 2035

Diphenyl Sulfone Market Size and Share Forecast Outlook 2025 to 2035

Polyphenylsulfone Market Size and Share Forecast Outlook 2025 to 2035

Biopolymers Market Size and Share Forecast Outlook 2025 to 2035

Cast Polymers Market Size and Share Forecast Outlook 2025 to 2035

Fluoropolymers in Healthcare Market Insights - Size, Trends & Forecast 2025 to 2035

Emulsion Polymers Market Size and Share Forecast Outlook 2025 to 2035

Drilling Polymers Market Analysis, Growth, Applications and Outlook 2025 to 2035

Acetal Copolymers Market Growth - Trends & Forecast 2025 to 2035

Specialty Polymers Market Size and Share Forecast Outlook 2025 to 2035

Antiviral Polymers for Packaging Market

Cellulosic Polymers Market Size and Share Forecast Outlook 2025 to 2035

Conductive Polymers Market Size and Share Forecast Outlook 2025 to 2035

Ethylene Copolymers Market Analysis by Various Materials, Thickness Capacity Type Through 2035

Polyguanidine Polymers Market Size and Share Forecast Outlook 2025 to 2035

UV-Protecting Polymers Market Size and Share Forecast Outlook 2025 to 2035

Piezoelectric Polymers Market Size and Share Forecast Outlook 2025 to 2035

Cyclic Olefin Polymers (COP) Polymer Syringes Market Size and Share Forecast Outlook 2025 to 2035

Biodegradable Polymers Market Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA