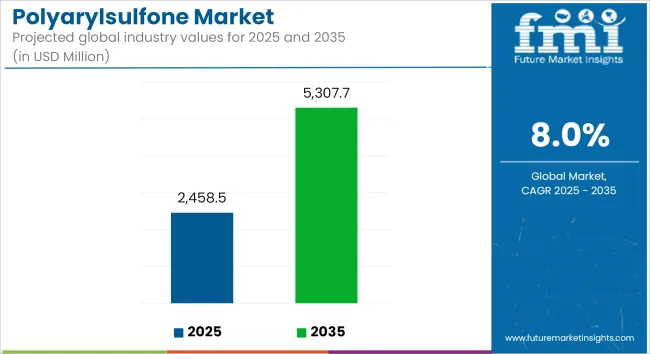

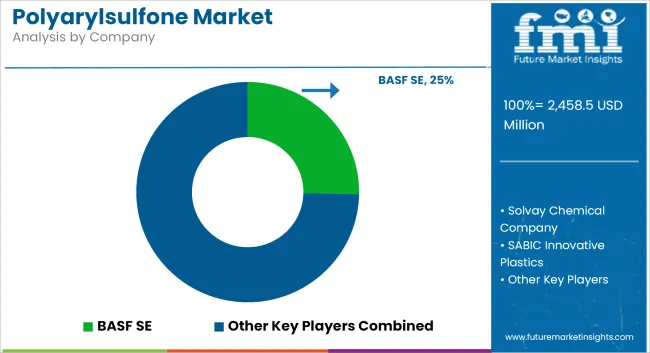

The global polyarylsulfone market is estimated at USD 2,458.5 million in 2025 and is forecast to expand to USD 5,307.7 million by 2035, registering a CAGR of 8.0%. Market growth is driven by increasing demand for high-performance thermoplastics in sterile medical equipment, filtration systems, and electrical insulation across regulated industries.

The polyarylsulfone (PAS) market is expanding steadily due to rising demand across sectors such as aerospace, automotive, electronics, and healthcare.

PAS is a high-performance thermoplastic known for its thermal resistance, dimensional stability, and mechanical durability, making it suitable for components exposed to harsh operational conditions.

Market Metrics

| Metric | Value |

|---|---|

| Market Size (2025E) | USD 2,458.5 Million |

| Market Value (2035F) | USD 5,307.7 Million |

| CAGR (2025 to 2035) | 8% |

A key development involves the integration of PAS in advanced medical devices. For instance, hospitals increasingly use sterilizable surgical instruments and dental tools made with PAS due to its ability to withstand repeated steam autoclaving.

Companies in the United States and Germany are manufacturing PAS-based reusable instruments, which contribute to reducing single-use plastic waste in healthcare settings.

In aerospace, PAS is replacing metals and conventional polymers in aircraft interiors and structural components. The material’s flame resistance and low smoke emission properties have led to its adoption in cabin panels and ventilation systems.

Leading aerospace manufacturers have incorporated PAS into lightweight ducting systems, which reduces overall aircraft weight and improves fuel efficiency.

The automotive sector uses PAS for under-the-hood components such as thermostat housings, oil pumps, and electrical connectors.

These parts must perform under high temperatures and exposure to fluids. As electric vehicle (EV) production increases in Europe and Asia-Pacific, PAS is being adopted for battery modules, charging plugs, and power distribution units.

In electronics, PAS is increasingly applied in components requiring high insulation properties and dimensional precision, such as semiconductor packaging and sensor housings.

The rise of 5G infrastructure in countries like China, South Korea, and Japan has driven demand for such applications.

Advancements in processing techniques are also boosting market uptake. Injection molding improvements and 3D printing compatibility have allowed manufacturers to create complex parts efficiently using PAS. Polymer producers are investing in blends and grades that offer reduced cycle times and improved surface finishes, enabling wider industrial use.

Though production costs remain a challenge due to specialized synthesis and limited feedstock availability, research into cost-effective production routes is ongoing. Companies are examining alternate sulfone monomers and green chemistry methods to improve supply security and affordability.

Polyethersulfone (PESU) is projected to account for approximately 42.7% of the market share in 2025 and is expected to grow at a CAGR of 7.8% through 2035. PESU exhibits high thermal stability, oxidative resistance, and dimensional consistency, making it suitable for membranes, housings, and structural parts. Its semi-crystalline nature supports tight-tolerance applications such as sterilizable containers, fluid path components, and under-the-hood electronics.

PESU is widely used in ultrafiltration and reverse osmosis membranes for medical and industrial water treatment. The segment benefits from recurring demand in the healthcare and food sectors, where regulatory compliance and performance repeatability are essential. Adoption is also rising in electrical insulators and circuit protection systems.

Regions such as North America and East Asia are investing in upgraded healthcare infrastructure and compact electronic devices, supporting demand for PESU-based engineered plastics.

The medical devices segment is projected to hold approximately 36.4% of the market share in 2025 and is expected to grow at a CAGR of 8.2% through 2035. Polyarylsulfones are preferred for reusable surgical instruments, sterilization trays, dental equipment, and implantable device components due to their ability to withstand repeated autoclaving, chemical disinfection, and radiation exposure.

Medical-grade variants offer stability in bio-reactive environments and comply with regulatory frameworks including ISO 10993 and USP Class VI. Market growth is driven by rising surgical volumes, demand for portable diagnostic tools, and replacement of metal parts with lighter polymer alternatives.

In the Asia Pacific and North America, hospital network expansions and public health spending are creating consistent procurement channels for injection-molded and extruded parts. Filtration and dialysis system applications further increase polymer use in high-purity liquid and gas processing segments within hospitals and clinical laboratories.

High Cost of Production and Material Sourcing

A big problem in the polyarylsulfone market is the high cost of making it and getting materials. Making polyarylsulfone needs special methods, and the materials can be pricey. This makes the overall cost higher, which means some uses, especially in industries careful with costs, might pass on it.

Also, polyarylsulfone is harder to find than other plastics, which might limit its use. Solving these cost problems with new ways of making and getting materials will be key for growing the market.

Expanding Applications in High-Performance Industries

Polyarylsulfone has great heat and strong properties. This helps in top-tier sectors. Cars now use polyarylsulfone for engine parts. Planes use it for strong parts that face hard conditions. Doctors use it more in tools that need cleaning and heat resistance. New ways to work with polyarylsulfone will help more sectors use it. This will bring a lot of growth chances for this useful material.

The polyarylsulfone marketin the USA is growing. This is due to more need for high-use plastics in medical tools, planes, and cars. PAS's great heat hold-up, does not break down with chemicals, and is safe for the body. This makes it good for surgery tools, dental stuff, and plane insides. The USA FDA and the EPA oversee this market.

Key trends are more PAS in medical parts that can be made clean again, growing use in light car parts, and more use in filter systems for cleaning water.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 8.2% |

In the UK, the polyarylsulfone marketis growing slowly. This growth is due to more focus on new engineering plastics in health and airplanes. Rules for fire safety and clean standards by the British Standards Institution (BSI) and the UK Medicines and Healthcare products Regulatory Agency (MHRA) play a big role.

Trends show there is a demand for these plastics in things like reusable surgery tools, clean medical trays, and high-heat parts for electronics and planes.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 7.8% |

The polyarylsulfone marketin the EU is growing bit by bit. Strict rules on safety help this. More use in medical fields and filters adds to the rise. Laws to cut plastic waste also play a part. The European Medicines Agency and the European Chemicals Agency set product standards, mainly for medical-grade materials.

Germany, France, and Italy are key players in this regional market. They have high demand from healthcare, car making, and water cleaning fields. PAS is becoming more common as a metal substitute in reusable and sterilizable medical items.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 8.0% |

Japan's polyarylsulfone marketis growing fast, driven by strong research in polymer science, great healthcare systems, and a focus on top-notch materials for precise tools. The Ministry of Health, Labour and Welfare and the Pharmaceuticals and Medical Devices Agency oversee this growth.

Trends show more use in dialysis filters, lab equipment that can be sterilized, and parts for electric vehicles (EV) batteries, plus progress in mixed PAS materials.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 8.1% |

The polyarylsulfone marketin South Korea is seeing strong growth. This is because more money is going into making medical devices, cars, and computer chips. The Korean Ministry of Food and Drug Safety and the Korea Testing Certification make sure products meet quality standards.

Key reasons for this growth include the need for PAS in surgical tools, clean cases, electronic parts, and hot water pipes. Local research is also helping make cheaper PAS mixes for wide use.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 8.0% |

The polyarylsulfone market is evolving through material innovation emphasizing both environmental impact and specialized performance. Recent introductions include biomass-balanced PESU that replaces a significant portion of fossil feedstock with renewable content, achieving identical performance across automotive, electronics, medical, and household sectors while reducing carbon footprint. Concurrently, new PPSU grades with enhanced whiteness and purity have emerged, tailored for biopharma and surgical tools to support sterilization and cleanliness standards without sacrificing durability.

These product developments signal a shift toward circularity and application-specific refinement. Market entities are investing in renewable feedstocks, green energy, and high-precision formulations. Competitive differentiation now involves balancing sustainability credentials with compliance to stringent purity and functional criteria in regulated end-use industries.

The market size was approximately USD 2,458.5 Million in 2025.

The market is projected to reach approximately USD 5,307.7 Million by 2035.

Key drivers include increasing demand from key end-user industries, technological advancements in material science leading to enhanced product qualities, and a growing emphasis on sustainable, high-performance polymers.

Asia-Pacific, North America, Europe, Latin America, and the Middle East & Africa are key contributors to the market.

The polyphenylsulfone (PPSU) segment is expected to lead due to its widespread use in applications such as aircraft interiors, medical and dental instruments, wire insulation, and pipefittings.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA