The Zirconia Based Dental Ceramics market is witnessing significant growth due to the increasing adoption of advanced dental restorative materials that offer both strength and aesthetic appeal. The market outlook remains promising, supported by rising dental care awareness, technological advancements in digital dentistry, and the growing prevalence of tooth loss associated with aging populations.

The integration of CAD/CAM systems in dental laboratories and clinics has enhanced the precision and efficiency of dental restorations, further driving the adoption of zirconia ceramics. In addition, patients are increasingly opting for metal-free restorations, which provide superior biocompatibility and natural appearance compared to traditional materials.

The demand for zirconia-based ceramics is also bolstered by the growing focus on minimally invasive procedures and the expanding network of cosmetic dental practices worldwide As technological innovation continues to improve translucency, wear resistance, and customization capabilities, the market is expected to experience sustained expansion, establishing zirconia ceramics as a preferred material in modern dental restorations.

| Metric | Value |

|---|---|

| Zirconia Based Dental Ceramics Market Estimated Value in (2025 E) | USD 328.8 million |

| Zirconia Based Dental Ceramics Market Forecast Value in (2035 F) | USD 771.2 million |

| Forecast CAGR (2025 to 2035) | 8.9% |

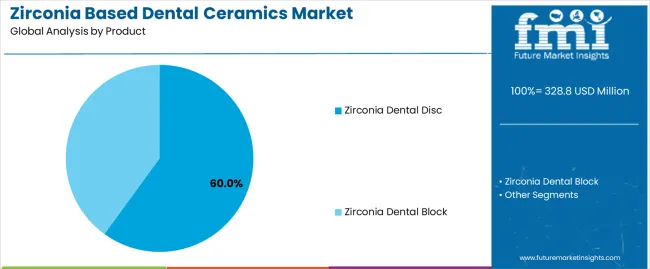

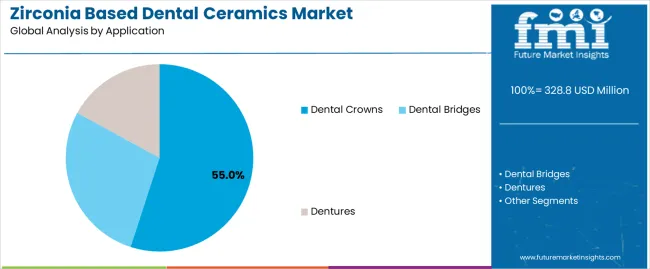

The market is segmented by Product and Application and region. By Product, the market is divided into Zirconia Dental Disc and Zirconia Dental Block. In terms of Application, the market is classified into Dental Crowns, Dental Bridges, and Dentures. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The zirconia dental disc segment is projected to hold 60.0% of the Zirconia Based Dental Ceramics market revenue share in 2025, making it the leading product segment. This dominance is driven by the superior mechanical strength and durability offered by zirconia dental discs, making them ideal for long-term restorations. The increasing utilization of CAD/CAM milling systems has enhanced the efficiency of fabricating crowns, bridges, and implants using zirconia discs.

These discs offer high precision, fracture resistance, and biocompatibility, which significantly improve clinical outcomes. Additionally, ongoing advancements in multilayered disc technology have improved translucency and color gradients, ensuring a natural aesthetic that aligns with patient expectations.

The growing acceptance of zirconia discs among dental professionals for their ease of processing and adaptability to complex restorations has further contributed to segment growth The cost-effectiveness of zirconia discs, combined with their high production consistency, continues to strengthen their position as the preferred material in restorative dentistry.

The dental crowns segment is expected to account for 55.0% of the Zirconia Based Dental Ceramics market revenue in 2025, maintaining its leadership among applications. The segment’s prominence is attributed to the widespread use of zirconia ceramics in permanent crown restorations due to their superior strength, aesthetics, and biocompatibility. Increased adoption of zirconia-based crowns has been driven by their natural tooth-like appearance and resistance to wear, which ensures long-term clinical performance.

The growing patient preference for metal-free restorations and the ability of zirconia crowns to integrate seamlessly with surrounding oral tissues have further supported their demand. The increasing use of chairside milling systems in dental clinics has accelerated crown fabrication, reducing treatment time and improving precision.

Additionally, advancements in monolithic zirconia formulations have enabled the production of crowns that combine both durability and translucency The segment continues to benefit from growing cosmetic dentistry trends and the expanding global population seeking reliable and aesthetic restorative solutions.

The below table presents the expected CAGR for the global zirconia based dental ceramics market over several semi-annual periods spanning from 2025 to 2035. In the first half (H1) of the decade from 2025 to 2035, the business is predicted to surge at a CAGR of 9.9%, followed by a slightly lower growth rate of 9.3% in the second half (H2) of the same decade.

| Particular | Value CAGR |

|---|---|

| H1 | 9.9% (2025 to 2035) |

| H2 | 9.3% (2025 to 2035) |

| H1 | 8.9% (2025 to 2035) |

| H2 | 8.4% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to decrease slightly to 8.9% in the first half and decrease moderately to 8.4% in the second half. In the first half (H1) the market witnessed a decrease of -100.00 BPS while in the second half (H2), the market witnessed an increase of -90.00 BPS.

Zirconia Remains a Leading Choice for Dental Professionals and Patients Due to Its Physical Properties.

Zirconia’s extraordinary durability has made it increasingly popular in the field of prosthetic dentistry. The physical properties of ZrO2 make it a ceramic material whose structural integrity ranks among the best encountered within dental sciences and is one of the strongest and most long-lasting substances available.

Its high tensile strength and resistance to abrasion contrast with other dental materials that might be better for certain restorations because they are less able to react adequately during processes under mechanical loads; zirconium dioxide will not succumb under such circumstances either.

This high durability leads to a prolonged lifespan of oral replacements and thus better client satisfaction thereby driving the demand for ceramic-based tooth replacement structures built from zirconia.

Compared to other types used in dentistry like glass ceramics or even alumina oxide sometimes employed solely in orthodontic brackets having weak compressive strengths ranging around 100-150MPa only, zirconia’s maximum load bearing capacity at 2000MPa sets it apart as an ideal material for situations where mechanical stress is a prime consideration.

In terms of chipping resistance, the latest form of zirconium dioxide that is used in one block and does not have any layer is believed to be better than other types of the same material.

Zirconia's high durability, which is characterized by its exceptional compressive strength, fracture toughness, and wear resistance is eventually a key driver of its popularity and increasing adoption in the dental ceramics market.

Integration of New Biomaterials is Revolutionizing the Zirconia Based Dental Ceramics Market

The marketplace of dental ceramics has been greatly influenced by advancements in biomaterials that have LED to innovative applications for ceramic materials used in dentistry. The recognition of these developments includes how they have improved performance, aesthetics, and biocompatibility; which make them more efficient and appealing for various forms of dental restoration.

One of the most important developments involves the enhancement of translucency in zirconia. While highly valued for strength and durability, traditionally, zirconia was limited aesthetic appeal due to its opacity. New formulations and advancements in biomaterials have overcome this limitation with the development of high-translucency and multilayer zirconia.

This zirconia is more closely adapted to the natural look of the teeth and are, thus, useful in both anterior and posterior restorations. Improved aesthetic properties are called for since patients are increasingly requesting restorations that should appear exactly like the rest of their teeth.

In conclusion, the continuous research and development in biomaterials test the properties of zirconia to their limits. Research into new formulations, processing, and applications brings about continuous advancements to this material. With this current R&D, the ceramics with a zirconia base will be abreast with the best in dental technology and will still be able to answer the clinical needs in constant evolution.

The Rising Dental Tourism is Positively Impacting Adoption of Zirconia-Based Dental Ceramics

Zirconia-based ceramics are being integrated with lower cost, high-quality care, and advanced technological options to help increase the adoption of the material even more as dental tourism-patients traveling to seek dental treatment outside of their local healthcare systems-grows in popularity.

Patients from highly priced countries often seek inexpensive destinations where they can access dental services, including zirconia-based restorations, at a fraction of the price. The latter have also been the trendiest because of their growing demand and technological advancement.

Thus, as more and more dental tourists are opting for cost-effective solutions but not at the cost of compromised quality, zirconia-based restorations have seen rapid traction in such regions, therefore driving up their market share.

Dental tourist destinations are modernized and always work toward quality care. Such materials often have to do with advanced materials based on zirconia, mostly for the property aspects. Zirconia restorations can be made with precision in foreign dental clinics because of the use of CAD/CAM technology, which is rapid.

With sophistication in technology comes a demand increase for quality dental solutions to be given to international patients. Zirconia is increasingly being used in dental tourism destinations because it is cost-effective and provides high-quality care and technology for patients.

Patients seeking affordable yet high-quality dental solutions contribute to the growing market for zirconia-based ceramics, influencing global dental practices to adopt these advanced materials.

Complex Fabrication Process is Contributing to Increased Cost of Manufacturing of Zirconia

The intricacy involved in producing zirconia restorations impacts both production efficiency and overall expense, which in turn affects pricing and market adoption. A number of factors from the fabrication process account for these higher costs, thus creating several problems for the manufacturers and affecting market dynamics.

The preparation of zirconia powder is a very complicated process that needs high-quality control. The powder must be synthesized through precise chemical processes to ensure uniformity in particle size and purity. Any deviation in the quality of the powder can result in defects in the final product; therefore, quality checks and handling are precise parameters that are considered.

This need for consistency in material characteristics complicates the process of manufacture, increasing labor costs, together with material waste, which in turn raises manufacturing costs.

The complex nature of its fabrication requires highly technical labor and expertise. Technicians must be skillful in handling highly sophisticated machinery, controlling intricate fabrication processes and performing detailed quality control.

Such requirements naturally imply higher labor costs as the need for skilled professionals arises, adding to the overall increase in cost during the manufacturing process of dental ceramics made of zirconia. Training and retaining skilled labor further adds to the cost burden that the manufacturers have to carry.

In conclusion, the increased cost of manufacturing zirconia-based dental ceramics due to the complex fabrication process affects market dynamics in several ways. Higher production costs can lead to higher prices for end consumers, potentially limiting market adoption, especially in price-sensitive segments.

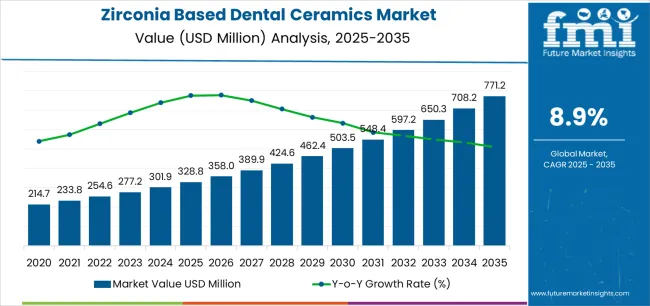

The global zirconia based dental ceramics industry recorded a CAGR of 7.6% during the historical period between 2020 and 2025. The growth of zirconia based dental ceramics industry was positive as it reached a value of USD 328.8 million in 2025 from USD 214.7 million in 2020.

The zirconia based dental ceramics has undergone significant development and a change in the last decades. From the originally introduced niche material, due to exceptional mechanical properties, strength, and aesthetic appearance, zirconia gained a leading position among traditional ceramics.

The early interest in its adoption was basically motivated by the need for strong solutions in the posterior restorations, where the high fracture toughness of zirconia was particularly welcome. The market for zirconia based dental ceramics also began to grow since the demand for metal-free restorations gained momentum with increasing developments in CAD/CAM technology.

Previously, zirconia was popularized for crown, bridge, and implant-based restorations due to its structural properties strength, and toughness, and displays natural aesthetics for individuals.

It can also be observed in market trends that the adoption rate of zirconia-based ceramics has been steadily growing, especially in high-demand regions for advanced dental treatments, such as North America and Europe.

With various key trends and developments within the dental industry, a robust increase is noted within the future market of zirconia-based dental ceramics. Zirconia ceramics continue to retain their prominence as the preferred material for dental procedures, with patient demand for good aesthetics and durable and biocompatible dental restoration products rising.

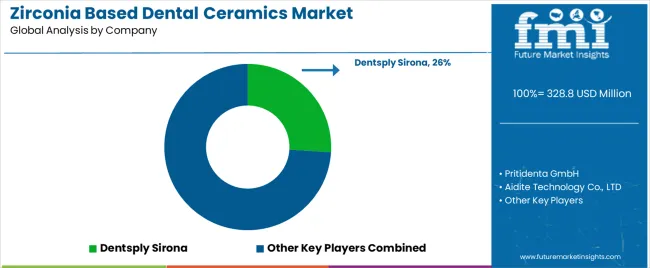

Tier 1 companies comprise market leaders with a market revenue of above USD 100 million capturing significant market share of 62.5% in global market. These companies are driving digital integration by expanding their use of CAD/CAM technology, which allows for the precise and specific fabrication of custom dental solutions.

Global expansion is another critical strategy, with efforts concentrated on penetrating emerging markets in Asia-Pacific and Latin America, where the demand for advanced dental care is growing. Prominent companies in tier 1 include 3M ESPE, GC America and SAGEMAX.

Tier 2 companies include mid-size players with revenue of USD 50 to 100 million having presence in specific regions and highly influencing the local market and holds around 24.4% market share.

The Tier 2 companies are prioritizing product differentiation by offering specialized or niche zirconia products that cater to specific clinical needs, such as highly aesthetic anterior restorations or cost-effective solutions for budget-conscious patients. Prominent companies in tier 2 include Huge Dental, Zirkonzahn, Pritidenta and KURARAY NORITAKE DENTAL INC.

Finally, Tier 3 companies, such as Glidewell Laboratories, Aurident and Dentsply Sirona. They specialize in specific products and cater to niche markets, adding diversity to the industry.

Overall, while Tier 1 companies are the primary drivers of the market, Tier 2 and 3 companies also make significant contributions, ensuring the zirconia based dental ceramics sales remains dynamic and competitive.

The section below covers the industry analysis for the zirconia based dental ceramics market for different countries. Market demand analysis on key countries in several regions of the globe, including North America, Asia Pacific, Europe, and others, is provided.

The United States is anticipated to remain at the forefront in North America, with a higher market share through 2035. In Asia Pacific, India is projected to witness a CAGR of 10.1% by 2035.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| USA | 2.8% |

| Germany | 2.8% |

| China | 8.9% |

| France | 4.5% |

| India | 10.1% |

| Spain | 5.2% |

| Australia | 4.1% |

| South Korea | 7.0% |

China zirconia based dental ceramics market is poised to exhibit a CAGR of 8.9% between 2025 and 2035. Currently, it holds the highest share in the East Asian market, and the trend is expected to continue during the forecast period.

Cost efficiency is possible through various factors that are advantageous to the Chinese manufacturers over their competitors, therefore allowing them to provide quality products at prices more economical to produce compared with other countries.

Reasons for such cost-effective production in China include relatively lower labor costs. Most of the Western countries have high labor costs, which form a significant portion of the cost of production, whereas China has skilled labor available at a relatively lower wage rate.

This allows the Chinese manufacturing company to remain competitive in price without compromising the quality of their zirconia-based dental ceramics. Increasing appeal to global buyers of Chinese ceramics based on zirconia enhances the dominance of China in the international market.

India’s zirconia based dental ceramics market is poised to exhibit a CAGR of 10.1% between 2025 and 2035. Currently, it holds the highest share in the South Asia & Pacific market, and the trend is expected to continue during the forecast period.

With easy access to information and public health programs, there is a complete change of attitude and emphasis on dental health within the last decade. The growing awareness encourages not only more people to seek routine care but also fosters the demand for quality restorations, such as those made from zirconia.

Several factors contribute to this heightened awareness. Educational campaigns LED by dental professionals, healthcare organizations, and government bodies have effectively highlighted the importance of oral hygiene and the long-term benefits of maintaining good dental health.

These messages usually emphasize the avoidance of the most ordinary dental problems, such as caries and periodontal disease, by regular check-ups. As people are giving more importance to dental health, demand for good quality, long-lasting, and attractive dental materials is also arising, which in turn propels the growth of the market.

South Korea's zirconia based dental ceramics market is poised to exhibit a CAGR of 7.0% between 2025 and 2035. Currently, it holds a significant share of the South Asia & Pacific market, and the trend is expected to continue during the forecast period.

It is this cultural emphasis on aesthetics that social media has brought into being, which now explains this new demand for cosmetic dental procedures. Appearance-enhancing dental treatments are gaining more popularity among South Koreans, such as zirconia crowns, preferred for their natural appearance and durability against conventional metal crowns.

Further, the disposable incomes are increasing that can be used by people to invest in cosmetic dentistry. A greater demand was felt for good dental aesthetics and awareness about the same, and so was the adoption of zirconia-based ceramics by dental practitioners in South Korea.

This change is driving the market, with individuals seeking these new advanced materials that can improve their overall appearance, which is part of the larger focus on aesthetic improvements in personal care.

The section contains information about the leading segments in the industry. By application, the dental crowns segment holds the highest market share of 46.7% in 2025.

| By Application | Dental Crowns |

|---|---|

| Value Share (2025) | 46.7% |

By Application, dental crowns have acquired a market share of 46.7% in the year 2025. Dental crowns have gained a significantly higher market share in the zirconia-based dental ceramics sector due to their exceptional characteristics and increasing demand for high-quality dental care.

The major reason for their acceptance is that they can offer a strong solution for most dental problems. Dental crowns are made use of in the treatment of highly destroyed teeth, either through decay, fracture, or in the case of root canal therapy; they help in maintaining the structural integrity of the tooth and not allowing any more damage. Because of this reason, the amount of dental crowns being adapted by the dental sector is very high.

Dental crowns provide a natural look to an individual, increasingly so with modern materials such as zirconia and porcelain. This material can closely resemble the looks of nature, elevating the satisfaction level in the patient and making them further confident with their results. Crowns also may be uniquely designed in shape and color for an exact fit among surrounding teeth to fit perfectly into the smile.

| By Product | Zirconia Dental Disc |

|---|---|

| Value Share (2025) | 72.1% |

By product, zirconia dental disc has acquired a market share of 72.1% in the year 2025. Zirconia dental disc manufactured from zirconia, or zirconium dioxide, boasts superior mechanical properties. It is one of the most potent dental materials; it has very good fracture toughness and very good resistance to wear and tear.

It means that zirconia dental discs are highly indicated in restorations called upon to endure major masticatory forces. The durability of zirconia assures that restorations coming from the discs will last for many years, thus ensuring a person is making the best decision regarding posterior and anterior restorations.

Additionally, zirconia is highly biocompatible or rather the human body highly tolerates it with only a minimum exposure for allergic reactions. This then makes it one of the most important properties in dental applications since it allows the materials to entail no adverse effects when in contact with the system of patients hence boosting their oral health status.

The market players are using strategies to stay competitive, such as product differentiation through innovative formulations, strategic partnerships with healthcare providers for distribution. Another key strategic focus of these companies is to actively look for strategic partners to bolster their product portfolios and expand their global market presence.

Recent Industry Developments in Zirconia Based Dental Ceramics Market

In terms of product, the industry is divided into zirconia dental disc and zirconia dental block.

In terms of application, the industry is segregated into dental crowns, dental bridges and dentures

Key countries of North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia and Middle East and Africa (MEA) have been covered in the report.

The global zirconia based dental ceramics market is estimated to be valued at USD 328.8 million in 2025.

The market size for the zirconia based dental ceramics market is projected to reach USD 771.2 million by 2035.

The zirconia based dental ceramics market is expected to grow at a 8.9% CAGR between 2025 and 2035.

The key product types in zirconia based dental ceramics market are zirconia dental disc and zirconia dental block.

In terms of application, dental crowns segment to command 55.0% share in the zirconia based dental ceramics market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Dental Repair Membranes for Implant Procedures Market Size and Share Forecast Outlook 2025 to 2035

Dental Cavity Filling Materials Market Size and Share Forecast Outlook 2025 to 2035

Dental Implant and Prosthetic Market Size and Share Forecast Outlook 2025 to 2035

Dental Imaging Equipment Market Forecast and Outlook 2025 to 2035

Dental Wounds Treatment Market Size and Share Forecast Outlook 2025 to 2035

Dental Radiometer Market Size and Share Forecast Outlook 2025 to 2035

Dental Anaesthetic Market Size and Share Forecast Outlook 2025 to 2035

Dental Diamond Bur Market Size and Share Forecast Outlook 2025 to 2035

Dental Laboratory Market Size and Share Forecast Outlook 2025 to 2035

Dental Matrix Systems Market Size and Share Forecast Outlook 2025 to 2035

Dental Permanent Cements Market Size and Share Forecast Outlook 2025 to 2035

Dental Bleaching Agent Market Size and Share Forecast Outlook 2025 to 2035

Dental Care Products Market Size and Share Forecast Outlook 2025 to 2035

Dental Etching Liquid Market Size and Share Forecast Outlook 2025 to 2035

Dental Sutures Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dental Hygiene Devices Market Size and Share Forecast Outlook 2025 to 2035

Dental Implantology Software Market Analysis - Size, Growth, & Forecast Outlook 2025 to 2035

Dental Veneers Market Size and Share Forecast Outlook 2025 to 2035

Dental X-Ray Systems Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dental Suction Systems Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA