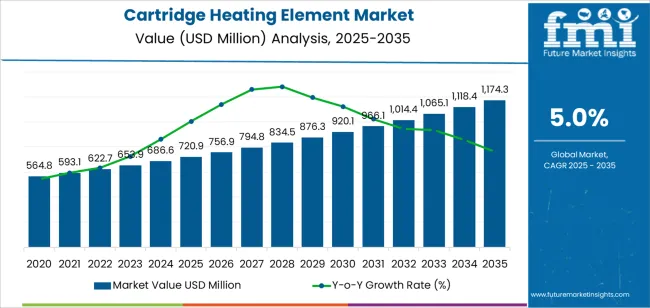

The cartridge heating element market is projected to grow from USD 720.9 million in 2025 to USD 1,174.2 million by 2035, reflecting a CAGR of 5%. This growth is driven by the increasing demand for efficient heating solutions across various industries, such as industrial manufacturing, food processing, automotive, and consumer appliances. Cartridge heaters are widely used for direct heat transfer in applications requiring precise temperature control, such as in plastic molding, semiconductor manufacturing, and medical equipment. Their versatility, ease of installation, and ability to provide uniform heat make them indispensable in several industrial processes.

The growing trend towards energy-efficient systems and automation in industrial applications will further fuel the demand for high-performance heating elements. Additionally, technological advancements in smart heating systems, improved materials for better heat resistance, and customization options are expected to enhance the performance of cartridge heating elements, driving their adoption. The market will also benefit from the rising demand for renewable energy technologies and electric vehicles, where precise heating solutions are becoming increasingly important.

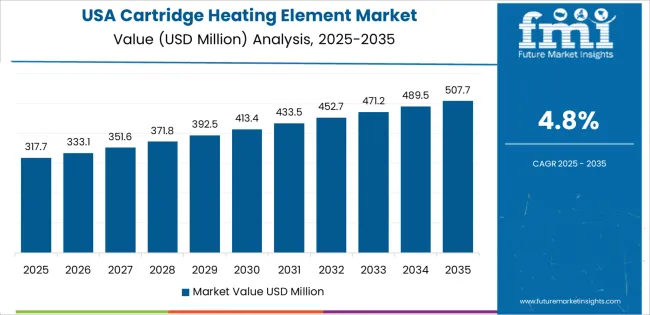

The 10-year growth comparison for the cartridge heating element market reflects steady and consistent expansion from 2025 to 2035, with the market increasing by USD 453.3 million over the decade. In the first phase, from 2025 to 2030, the market will grow from USD 720.9 million to USD 920 million, adding USD 199.1 million. This period will see significant demand from industries such as plastic molding, food processing, and automotive, where precise and energy-efficient heating solutions are critical. The drive for more sustainable technologies, alongside the continued expansion of industrial automation, will fuel this growth, as companies increasingly adopt advanced heating systems. The integration of smart technologies and improved materials for durability and heat resistance will further support the adoption of cartridge heating elements in various sectors.

The second phase, from 2030 to 2035, will see a stronger market growth, with the market expanding from USD 920 million to USD 1,174.2 million, contributing USD 254.2 million. This phase will benefit from the rise of renewable energy technologies, the continued push for electric vehicles, and the growing need for high-performance heating in medical equipment and semiconductor manufacturing. As these industries evolve, demand for precise and reliable heating solutions will continue to grow. The market will also see innovations in customizable heating systems and energy-efficient designs, contributing to accelerated growth during this period.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 720.9 million |

| Market Forecast Value (2035) | USD 1,174.2 million |

| Forecast CAGR (2025-2035) | 5% |

The cartridge heating element market is expanding as industries demand efficient, compact heating solutions capable of precise temperature control in constrained spaces. Cartridge heaters are widely used in manufacturing processes such as injection molding, extrusion, and food packaging, where targeted heating enhances product quality and process reliability. The market for cartridge heaters is projected to grow at a compound annual growth rate of around 5.5% through 2032.

Technological improvements and the push for energy efficiency further accelerate market growth. Advances in material science, higher watt densities, improved insulation, and smarter temperature control systems make cartridge heaters more effective in automated systems and Industry 4.0 environments. The rapid industrialization of regions such as Asia-Pacific creates strong demand from emerging manufacturing hubs. However, the presence of alternative heating technologies and the relatively high upfront cost of specialized cartridge heaters may restrain adoption in some sectors.

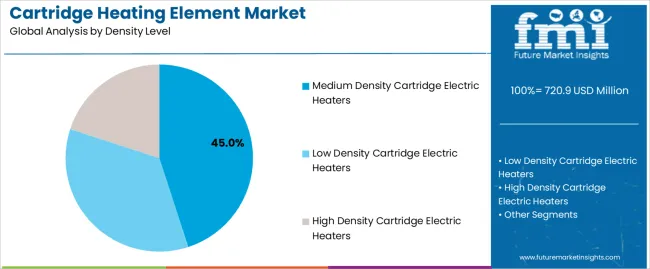

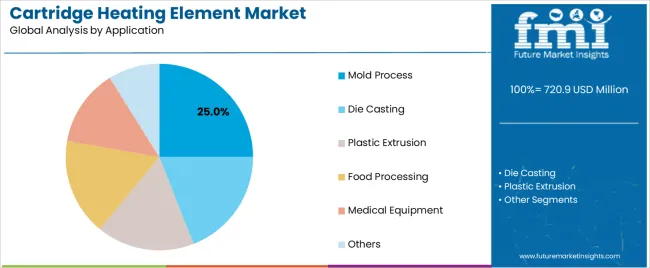

The cartridge heating element market is segmented by density level and application. The leading density level is medium density cartridge electric heaters, which account for 45% of the market share, while the dominant application segment is mold process, which holds 25% of the market share. These segments are pivotal in driving the market's growth, supported by the increasing demand for efficient and reliable heating solutions across industries that require precise thermal management.

The medium density cartridge electric heaters segment leads the cartridge heating element market, holding a 45% share. Medium density heaters offer a balanced performance, providing adequate heat for a wide range of industrial applications while maintaining an optimal temperature distribution. These heaters are widely used in applications where a moderate level of heat output is required, such as in plastic molding, packaging, and general industrial heating processes. Their versatility, reliability, and cost-effectiveness make them a popular choice for businesses looking for efficient thermal solutions.

Medium density cartridge heaters are especially beneficial in processes that demand consistent and uniform heat. This makes them ideal for use in machinery and equipment that require precise control over temperature, such as molds, dies, and extruders in various manufacturing processes. As the demand for high-performance heating solutions grows in industries like automotive, plastics, and food processing, medium density cartridge heaters are expected to maintain their leading position due to their ability to provide effective heating without excessive energy consumption.

The mold process application segment holds a leading share of 25% in the cartridge heating element market. Mold heating is a critical process in industries such as plastic molding, metal casting, and rubber manufacturing, where precise and consistent temperature control is essential for product quality and production efficiency. Cartridge heaters are widely used to heat molds and dies, ensuring that the materials being processed, such as plastics, metals, and composites, are heated evenly to the required temperature.

The dominance of the mold process application is driven by the widespread use of molds in industrial manufacturing, particularly in sectors such as automotive, electronics, and packaging. The demand for high-quality molded parts, coupled with the need for faster production times and lower energy consumption, continues to drive the adoption of cartridge heating elements in mold heating applications. As industries continue to advance in their requirements for precision and efficiency, the mold process segment is expected to remain a key application for cartridge heating elements, supporting its continued growth in the market.

The cartridge heating element market is experiencing steady expansion as more industrial processes and automated systems demand precise and efficient heating solutions. The move toward miniaturisation in manufacturing, coupled with the requirement for tight temperature control across sectors such as plastics, packaging, and electronics, is boosting uptake. Further, increasing global industrialisation particularly in Asia Pacific supports growth of equipment that uses cartridge heaters. At the same time, factors such as raw material cost volatility, competition from alternate heating technologies, and regulatory pressures around energy efficiency influence how the market is evolving.

Several factors are driving growth in the cartridge heating element market. First, the rising demand for automation in manufacturing is leading equipment designers to incorporate heating elements that deliver compact size, rapid responsiveness and reliable temperature control. Second, industries such as plastics processing, packaging, medical devices and electronics are expanding globally and require efficient heating solutions, which enhances demand. Third, energy efficiency and sustainability concerns are encouraging users to switch to more effective heating elements with better thermal conversion and lower wastage. Finally, increasing industrial investment and capacity expansions in emerging economies enhance market opportunities for heating element manufacturers.

Despite positive growth prospects, the cartridge heating element market faces several restraints. The initial cost of high performance heating elements including materials capable of high watt density and robust construction can be a barrier for smaller firms or cost sensitive projects. In addition, competition from other heating technologies (for example band heaters, infrared heaters or ceramic heaters) may limit adoption in some applications where those alternatives offer adequate performance at lower cost. Technical design challenges such as ensuring durability under high temperatures, managing electromagnetic interference, and achieving fast heat up times can complicate manufacturing. Moreover, regulatory requirements for safety, electromagnetic compatibility and energy efficiency vary across regions, increasing compliance complexity and potentially delaying adoption.

Several key trends are shaping the future of the cartridge heating element market. One trend is the development of high density cartridges and compact form factors to support ever smaller production machinery and processes. Another is the integration of "smart" features such as embedded sensors, remote monitoring or self regulating heating enabling predictive maintenance and improved process control. Material innovations such as advanced alloys, improved insulation and coatings are enhancing durability and performance. Also, as industrial digitalisation advances, heating elements are increasingly being incorporated into fully automated and connected systems, aligning with Industry 4.0 initiatives. Finally, growth in emerging markets, especially in Asia Pacific, continues to provide opportunities for manufacturers to expand geographic reach and tailor products to local industrial growth trajectories.

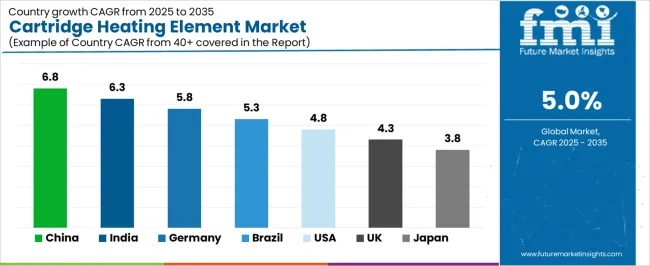

The cartridge heating element market is witnessing steady growth, driven by the increasing demand for industrial heating solutions in sectors such as manufacturing, electronics, automotive, and consumer goods. Cartridge heating elements are widely used for precise and efficient heating applications, particularly in equipment like 3D printers, packaging machines, and industrial ovens. As industries focus on improving energy efficiency and performance, the demand for high-quality heating elements is on the rise. The market is experiencing stronger growth in emerging economies like China and India, while developed regions like the USA and Germany continue to expand due to technological advancements and manufacturing innovation. This analysis explores the factors driving the growth of the cartridge heating element market in various countries.

| Country | CAGR (2025-2035) |

|---|---|

| China | 6.8% |

| India | 6.3% |

| Germany | 5.8% |

| Brazil | 5.3% |

| USA | 4.8% |

| United Kingdom | 4.3% |

| Japan | 3.8% |

China leads the cartridge heating element market with a CAGR of 6.8%. The country’s rapid industrialization, expansion of manufacturing sectors, and increasing demand for efficient and precise heating solutions are the primary drivers of this market growth. China’s manufacturing industries, particularly in electronics, automotive, and industrial machinery, rely heavily on advanced heating technologies to ensure smooth operations and high performance.

The increasing demand for energy-efficient heating systems and the expansion of sectors such as 3D printing, plastic molding, and packaging further fuel the demand for cartridge heating elements. China’s focus on modernizing its industrial infrastructure, combined with government support for technological advancements, positions the country as a major market for heating solutions. As industries continue to expand, the need for efficient, durable, and high-performance cartridge heating elements will remain strong.

India’s cartridge heating element market is growing at a CAGR of 6.3%. The country’s rapid industrial growth, particularly in manufacturing and the automotive sector, is driving the demand for efficient and reliable heating solutions. India’s increasing focus on automation and improving manufacturing processes is further fueling the demand for cartridge heating elements, which are widely used in applications such as plastic molding, packaging, and textile production.

The expanding demand for energy-efficient and cost-effective heating solutions is contributing to the adoption of cartridge heating elements in various industries. Moreover, India’s growing consumer electronics and 3D printing industries, which require precision heating for equipment and processes, are creating new opportunities in the market. As India continues to advance in industrialization and technology, the cartridge heating element market is expected to grow steadily.

Germany’s cartridge heating element market is projected to grow at a CAGR of 5.8%. The country’s strong industrial base, particularly in manufacturing, automotive, and electronics, is a key driver of demand for high-performance heating solutions. Germany’s focus on energy efficiency and sustainability in industrial processes is also contributing to the growth of this market, as businesses look for heating elements that provide reliable and energy-saving performance.

As one of Europe’s leaders in manufacturing and technology, Germany continues to invest in advanced heating solutions that meet the demands of high-tech industries. The growing trend of automation and digitalization in manufacturing processes, including additive manufacturing and plastic injection molding, further fuels the need for cartridge heating elements. Germany’s established infrastructure and commitment to innovation ensure continued market growth in the coming years.

Brazil’s cartridge heating element market is expected to grow at a CAGR of 5.3%. The growing industrialization in Brazil, particularly in the automotive and manufacturing sectors, is driving demand for efficient and precise heating solutions. As Brazil continues to modernize its manufacturing infrastructure and adopt more advanced technologies, the need for high-performance cartridge heating elements is increasing.

The expansion of Brazil’s industrial sectors, such as food processing, plastic molding, and packaging, is also supporting market growth. Brazil’s focus on improving energy efficiency and reducing operational costs further boosts the demand for advanced heating solutions. As the country invests in modernizing its industrial base, the demand for cartridge heating elements will continue to rise, particularly in the context of improving production efficiency.

The United States has a projected CAGR of 4.8% for the cartridge heating element market. The USA remains one of the largest markets for industrial heating solutions, with high demand across various sectors, including automotive, electronics, and manufacturing. The growing emphasis on energy-efficient heating technologies and the need for precision in industrial applications is driving the demand for cartridge heating elements in the USA

As the USA continues to lead in sectors like 3D printing, packaging, and plastic molding, the need for reliable and efficient heating systems is increasing. The shift toward automation and digital manufacturing processes is also contributing to the market growth. With strong investments in technology and manufacturing infrastructure, the USA market for cartridge heating elements is expected to experience steady growth over the coming years.

The United Kingdom’s cartridge heating element market is projected to grow at a CAGR of 4.3%. The UK’s growing focus on industrial automation, energy efficiency, and advanced manufacturing technologies is driving demand for high-performance heating solutions. As industries in the UK, including automotive, electronics, and medical devices, continue to adopt more energy-efficient technologies, the demand for cartridge heating elements is set to rise.

The UK’s emphasis on sustainability and reducing energy consumption in industrial processes is also contributing to the growth of the cartridge heating element market. As the market for advanced heating technologies expands, particularly in precision industries, the UK is expected to continue seeing steady growth in demand for these components. The country's strong industrial base and commitment to innovation ensure continued market expansion.

Japan’s cartridge heating element market is expected to grow at a CAGR of 3.8%. The country’s advanced manufacturing sector, particularly in electronics, automotive, and robotics, is driving the demand for high-quality heating solutions. As Japan continues to focus on automation and technological innovation, the need for precise and efficient heating systems is increasing, supporting the demand for cartridge heating elements.

Japan’s commitment to energy efficiency and sustainability in its industrial processes is also a key factor driving the market growth. The growing adoption of 3D printing and additive manufacturing technologies, which require precise heating for material processing, is further contributing to the market expansion. As Japan continues to invest in advanced manufacturing technologies, the demand for cartridge heating elements will remain steady, though at a slower pace compared to other regions.

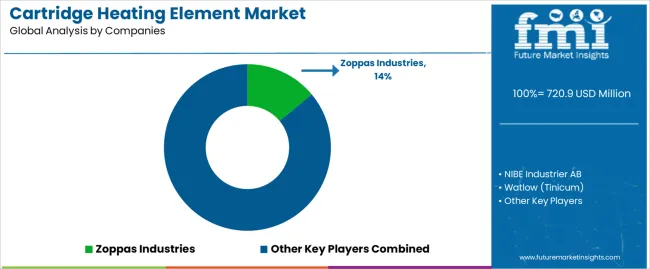

In the cartridge heating element market companies such as Zoppas Industries (holding approximately 14% market share), NIBE Industrier AB, Watlow, Tutco, Tempco Electric Heater Corporation, Nexthermal Corporation, Spirax Sarco Engineering plc, Hotset GmbH, Dalton Electric Heating, OMEGA (Spectris plc), Turk+Hillinger, Durex Industries, Ihne & Tesch, Industrial Heater Corp., Friedr. Freek GmbH and Wattco vie for position. The market is shaped by the demands of precise temperature control across plastics, packaging, chemical processing, and semiconductor related heating processes. Seminar data suggest that cartridge heaters constitute a critical sub segment given their compact form and rapid heat up capabilities. Regionally, Asia Pacific growth in manufacturing and automation boosts demand while established markets in North America and Europe maintain emphasis on quality and customisation.

Product brochures are used as key tools to articulate differences among offerings. One brochure may highlight uniform heat distribution across the cartridge, tight diameter tolerances (to fit injection moulding holes), high watt density per square inch and long service life. Another may focus on cost effective standard models, multiple diameter sizes, and quick ship delivery for OEM customers. Layouts commonly present heater diameter, length, terminations, sheath material, watt density, and application specific data (e.g., polymer melt zones, die cavities). The strategic message in brochures is crafted to address either high performance industrial users or value oriented customers. By aligning brochure messaging with target segments companies aim to position their heaters as the right fit whether for precision niche use or for volume industrial supply.

| Items | Details |

|---|---|

| Quantitative Units | USD Million |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Density Level | Medium Density Cartridge Electric Heaters, Low Density Cartridge Electric Heaters, High Density Cartridge Electric Heaters |

| Application | Mold Process, Die Casting, Plastic Extrusion, Food Processing, Medical Equipment, Others |

| Key Companies Profiled | Zoppas Industries, NIBE Industrier AB, Watlow (Tinicum), Tutco, Tempco Electric Heater Corporation, Nexthermal Corporation, Spirax-Sarco Engineering plc, Hotset GmbH, Dalton Electric Heating, OMEGA (Spectris plc), Turk+Hillinger, Durex Industries, Ihne & Tesch, Industrial Heater Corp., Friedr. Freek GmbH, Wattco |

| Additional Attributes | The market analysis includes dollar sales by density level and application categories. It also covers regional adoption trends across major markets such as Asia Pacific, Europe, and North America. The competitive landscape highlights key manufacturers in the cartridge heating element sector, focusing on innovations in heating technology for industrial, medical, and food processing applications. Trends in the growing demand for electric heaters in die casting, plastic extrusion, and mold processes are explored, along with energy efficiency and performance advancements. |

The global cartridge heating element market is estimated to be valued at USD 720.9 million in 2025.

The market size for the cartridge heating element market is projected to reach USD 1,174.3 million by 2035.

The cartridge heating element market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in cartridge heating element market are medium density cartridge electric heaters, low density cartridge electric heaters and high density cartridge electric heaters.

In terms of application, mold process segment to command 25.0% share in the cartridge heating element market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cartridges for RT-PCR Automatic Systems Market

Ink Cartridge Printer Market Size and Share Forecast Outlook 2025 to 2035

Ink-Cartridge Market Size and Share Forecast Outlook 2025 to 2035

Hi-fi Cartridges Market Size and Share Forecast Outlook 2025 to 2035

Air Dryer Cartridge Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Candle Filter Cartridges Market Size and Share Forecast Outlook 2025 to 2035

Membrane Filter Cartridge Market Size and Share Forecast Outlook 2025 to 2035

Heating Agents Market Size and Share Forecast Outlook 2025 to 2035

Heating and Cooling Market Size and Share Forecast Outlook 2025 to 2035

Heating Pad Market

Preheating Tunnel Furnace for Lithium Battery Market Size and Share Forecast Outlook 2025 to 2035

Self Heating Food Packaging Market Size and Share Forecast Outlook 2025 to 2035

Self-Heating Butter Knife Market Size and Share Forecast Outlook 2025 to 2035

Radiant Heating And Cooling Systems Market

Infrared Heating Pad Market Size and Share Forecast Outlook 2025 to 2035

District Heating and Cooling Market Size and Share Forecast Outlook 2025 to 2035

District Heating Market Size and Share Forecast Outlook 2025 to 2035

District Heating Pipeline Network Market Size and Share Forecast Outlook 2025 to 2035

Ductless Heating & Cooling Systems Market Size and Share Forecast Outlook 2025 to 2035

Flexible Heating Element Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA