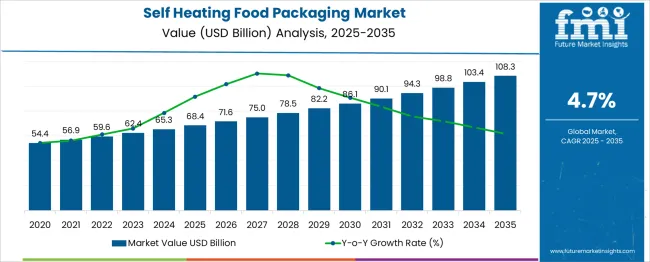

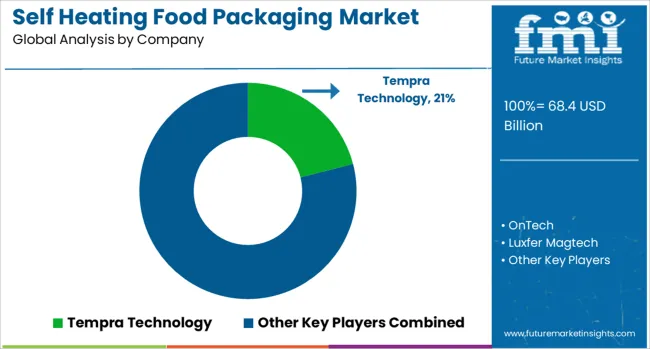

The self heating food packaging market is estimated to be valued at USD 68.4 billion in 2025 and is projected to reach USD 108.3 billion by 2035, registering a compound annual growth rate (CAGR) of 4.7% over the forecast period. A peak-to-trough analysis based on extended data from 2020 to 2035 reveals that the market value in 2020 stood at USD 54.4 billion, marking the starting point before consistent expansion. Following this, the market experienced steady growth, rising to USD 56.9 billion in 2021, USD 59.6 billion in 2022, and USD 62.4 billion in 2023, indicating gradual normalization and increasing adoption of self-heating packaging solutions. By 2024, the market further increased to USD 65.3 billion, setting a strong foundation for the forecast period beginning in 2025.

The peak projected for 2035 is USD 108.3 billion, marking a total increase of USD 53.9 billion from the 2020 value and demonstrating a growth multiplier of nearly 2 times over the 15 years. The initial half of the forecast period, from 2020 to 2027, contributes USD 17.2 billion to this growth, while the latter half adds USD 36.7 billion, reflecting a back-weighted growth trajectory. This pattern is driven by rising consumer demand for convenience foods, growing preference for ready-to-eat meals, and innovations in packaging technology that enhance portability and heating efficiency. Manufacturers focusing on improving material safety, thermal performance, and user-friendly designs are expected to capitalize on this expanding market opportunity.

| Metric | Value |

|---|---|

| Self Heating Food Packaging Market Estimated Value in (2025 E) | USD 68.4 billion |

| Self Heating Food Packaging Market Forecast Value in (2035 F) | USD 108.3 billion |

| Forecast CAGR (2025 to 2035) | 4.7% |

The self-heating food packaging market occupies a unique position within the global convenience packaging and ready-to-eat meals ecosystem, accounting for approximately 10–12% share of the overall active and intelligent packaging sector, driven by its ability to deliver on-the-go heating functionality without external appliances. Within the broader convenience food packaging segment, it holds around 6–8%, reflecting its niche application in military rations, outdoor activities, and premium travel meals. In the ready-meal solutions category, self-heating packs represent nearly 4–5%, as adoption is influenced by demand for portability and instant heating technology.

Growth is strongly supported by increasing consumer preference for hassle-free food experiences, rising outdoor recreation activities, and adoption in defense catering programs. Advanced chemical-based and flameless heating systems integrated into compact, lightweight packaging formats are enhancing safety and performance, boosting consumer confidence. E-commerce and direct-to-consumer distribution channels have further amplified visibility, allowing innovative brands to capture attention through premium positioning. Despite cost and regulatory challenges related to safety and environmental compliance, demand is accelerating as brands focus on recyclable materials and safer heating compounds. The market is expected to expand steadily, driven by applications in travel, emergency relief kits, and food service solutions targeting high-convenience segments, making self-heating packaging a critical innovation within the evolving global food packaging landscape.

The Self Heating Food Packaging market is undergoing rapid expansion as consumer demand for portable, on-the-go meals continues to rise across both developed and emerging regions. The market is being driven by increased urbanization, rising disposable incomes, and the need for convenient meal solutions without external heating sources. Advances in exothermic chemical reaction technology and packaging safety have enabled broader adoption across a variety of applications, from emergency rations to leisure and travel meals.

The ability of self heating packaging to offer immediate consumption without reliance on stoves, electricity, or microwaves is reshaping product development and distribution strategies. This trend is especially pronounced in regions with limited infrastructure access or high outdoor activity demand.

Innovation in packaging design and the integration of environmentally safer heating components are supporting long-term growth. As consumers increasingly prioritize convenience, shelf stability, and mobility, the market is expected to evolve further, with key stakeholders focusing on scalable production and diversified use cases..

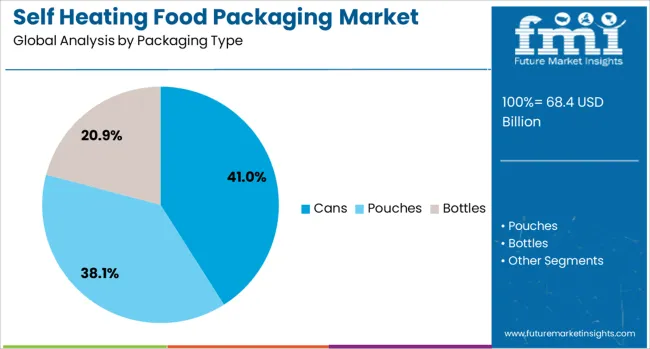

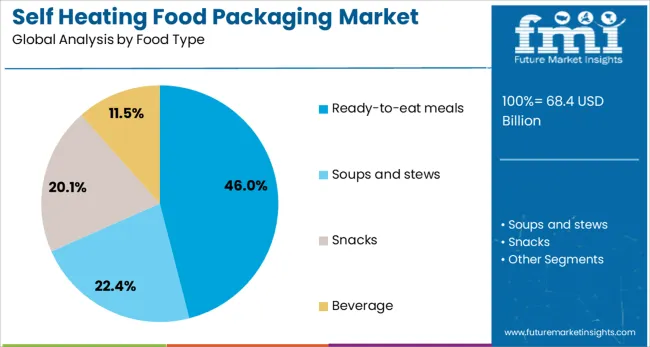

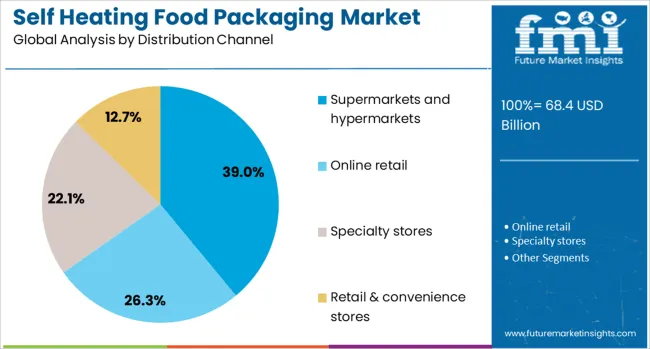

The self heating food packaging market is segmented by packaging type, food type, distribution channel, end use industry, and geographic regions. By packaging type, the self-heating food packaging market is divided into Cans, Pouches, and Bottles. In terms of food type, the self-heating food packaging market is classified into Ready-to-eat meals, Soups and stews, Snacks, and Beverages. The distribution channel of the self-heating food packaging market is segmented into Supermarkets and hypermarkets, Online retail, Specialty stores, and Retail & convenience stores. By end-use industry, the self-heating food packaging market is segmented into Military and defense, Outdoor and recreational, Food service, Healthcare and medical, and Household. Regionally, the self-heating food packaging industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The cans segment is projected to hold 41% of the self-heating food packaging market revenue share in 2025, making it the dominant packaging type. Growth in this segment has been primarily attributed to the structural integrity, durability, and thermal conductivity offered by cans, which are essential for safe and effective heat activation. Cans have been favored for their ability to sustain the exothermic reaction process without deforming or compromising user safety.

Additionally, the widespread availability of can-form packaging machinery and existing infrastructure for food preservation has supported efficient scalability in manufacturing. The robust nature of cans also makes them well-suited for outdoor use, military rations, and emergency supply kits.

Their long shelf life and ability to maintain food quality under variable environmental conditions have further solidified their position in the market. As demand for ready-to-consume products with reliable heating mechanisms continues to grow, cans are expected to maintain their competitive edge in the packaging segment..

The ready-to-eat meals segment is expected to account for 46% of the Self Heating Food Packaging market revenue share in 2025, making it the leading food type. The segment has been propelled by shifting consumer preferences toward meals that require minimal preparation time while maintaining nutritional balance and taste. The self heating capability has made this format especially popular among travelers, students, and professionals seeking convenience without sacrificing meal quality.

Ready-to-eat products have been designed to support varied dietary needs and regional palates, expanding their appeal across diverse demographic groups. As self-heating technology becomes more refined and efficient, manufacturers have been able to offer better portion control and reduce activation time, enhancing user experience.

The combination of convenience, portability, and increasing availability in both retail and specialty channels has enabled this segment to outperform traditional food formats. Its continued leadership is expected as urban lifestyles and time-constrained routines dominate global consumption patterns..

The supermarkets and hypermarkets segment is projected to contribute 39% of the Self Heating Food Packaging market revenue share in 2025, emerging as the leading distribution channel. This segment's leadership has been supported by its ability to provide consumers with immediate access to a wide array of self heating products under one roof.

The strong retail presence and established logistics of supermarkets and hypermarkets have facilitated widespread product availability and faster adoption in both metropolitan and secondary markets. Promotional visibility, product sampling, and shelf-level marketing in these retail formats have enhanced consumer awareness and trial rates.

Additionally, their centralized distribution systems have allowed manufacturers to scale efficiently while maintaining inventory levels across locations. As consumer interest in convenient meal formats continues to grow, supermarkets and hypermarkets are expected to remain the primary distribution channel, offering diverse selections and driving higher market penetration..

The self-heating food packaging market is expanding rapidly across defense, travel, and retail sectors, driven by demand for convenience and on-the-go solutions. Challenges in cost management and safety compliance remain critical factors for long-term growth.

The self-heating food packaging market is witnessing increased adoption as consumers seek convenient, ready-to-eat options that eliminate the need for external heating appliances. Outdoor enthusiasts, travelers, and military personnel are primary users, as these solutions ensure hot meals in remote or emergency situations. The growing trend of portable meal kits among urban professionals also drives demand. Premium food brands are introducing self-heating packs for instant soups, noodles, and beverages, catering to customers prioritizing ease of use. With consumers favoring functional packaging that combines portability with performance, this category is expanding within the broader convenience food ecosystem, attracting investment from innovative packaging companies and food manufacturers globally.

Defense and disaster relief agencies are among the largest consumers of self-heating packaging, using these solutions for rations in remote locations and during rescue missions. Military-grade packaging requires reliability, compact design, and quick activation, making it an essential component of field operations. Governments are allocating budgets for emergency preparedness programs, where self-heating meal kits serve as critical resources during natural disasters and large-scale evacuations. Manufacturers focusing on rugged, long-shelf-life products have gained significant traction in defense procurement. This segment not only provides steady demand but also drives technological improvements, ensuring compatibility with strict safety and operational standards.

Airlines, railways, and luxury travel operators are increasingly incorporating self-heating food packs to enhance passenger convenience without major infrastructure upgrades. This has opened opportunities in premium ready-to-eat offerings such as soups, coffee, and gourmet meals. Retail adoption is also rising, with brands launching self-heating kits through supermarkets and e-commerce platforms targeting consumers looking for quick meals during outdoor activities or long commutes. The emphasis on convenience and time-saving features strengthens penetration in developed markets, while developing regions see gradual uptake through camping and trekking segments. This multi-channel expansion reflects growing brand interest in high-value travel and hospitality applications.

Despite strong demand drivers, the market faces challenges related to production costs and compliance with stringent safety standards. Incorporating heating elements and heat-resistant materials increases packaging expenses compared to conventional options. Additionally, the handling of chemical heating agents requires adherence to food-grade and environmental regulations across regions. Manufacturers are investing in safer formulations, leak-proof designs, and recyclable materials to address these concerns. Rising raw material prices and transportation costs also influence profitability, prompting companies to explore partnerships and localized production strategies. Overcoming these constraints is essential for scaling operations and maintaining competitive advantage in this specialized segment.

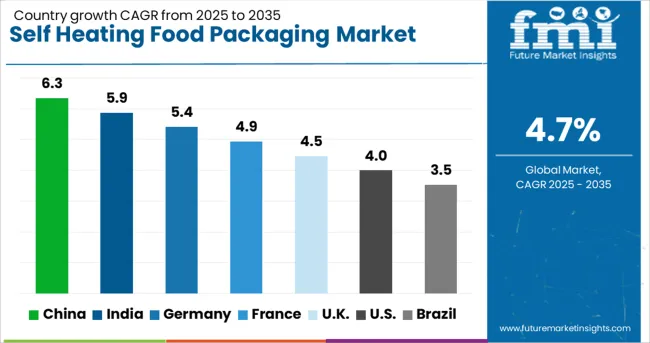

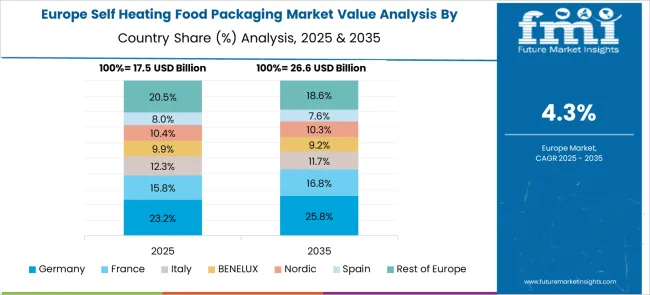

The self-heating food packaging market is projected to grow globally at a CAGR of 4.7% from 2025 to 2035, supported by rising demand for portable meal solutions, convenience-driven consumption, and expanding adoption across travel and defense sectors. China leads with a CAGR of 6.3%, fueled by strong growth in e-commerce meal kits and increased use in outdoor recreation and emergency supplies. India follows at 5.9%, driven by rising disposable incomes, growing camping culture, and expanding defense procurement for self-heating rations. Germany records 5.4%, supported by premium travel services and adoption in retail convenience food segments. France posts 4.9%, benefitting from innovation in ready-to-eat meal packaging targeting tourism and luxury travel sectors, while the United States grows at 4.0%, reflecting steady demand from military, aviation, and outdoor recreation segments. The analysis spans more than 40 countries, with these five representing key markets shaping product development, distribution strategies, and sector-specific opportunities in the self-heating food packaging industry.

China is projected to post a CAGR of 6.3% during 2025–2035, up from an estimated 5.5% during 2020–2024, outperforming the global average of 4.7%. This rise is linked to surging e-commerce meal kit sales, strong adoption in outdoor recreation, and significant use in disaster relief supplies. Domestic innovation in safe heating mechanisms and packaging durability has further stimulated demand. Travel and hospitality operators are also integrating self-heating packs into premium onboard meal offerings, while the defense sector continues to be a major consumer. Enhanced supply chain networks and the presence of cost-efficient manufacturers strengthen China’s dominance in this category.

India is forecasted to achieve a CAGR of 5.9% from 2025–2035, up from approximately 5.1% during 2020–2024, driven by evolving consumption habits and strong demand from military and outdoor lifestyle segments. Increased disposable incomes and greater acceptance of convenient meal solutions support growth. Government-backed programs for armed forces rations and rising popularity of trekking and camping have amplified adoption. Brands are leveraging e-commerce and quick-commerce channels to distribute self-heating products widely. Cost-sensitive consumers are encouraging localized production of affordable yet efficient solutions, which positions India as a high-potential market for global and domestic players targeting convenience-driven food ecosystems.

Germany is projected to register a CAGR of 5.4% during 2025–2035, higher than its estimated 4.6% in 2020–2024, reflecting increasing consumer interest in premium convenience products and safety-certified self-heating packs. Adoption in travel, railway catering, and luxury tourism segments has grown steadily. Strict compliance requirements for chemical-based heating components have spurred innovation in safer formulations. The outdoor recreation culture, coupled with demand for compact, ready-to-eat solutions, positions Germany as a key European market. Brands are also tapping into retail networks and online platforms to meet demand from health-conscious and convenience-seeking consumers.

France is expected to post a CAGR of 4.9% for 2025–2035, up from about 4.3% during 2020–2024, driven by expansion in tourism, luxury travel, and gourmet ready-meal offerings. Self-heating packaging is gaining prominence in train catering and leisure travel as operators seek convenient meal solutions without additional infrastructure. Increased consumer preference for on-the-go dining during outdoor activities further adds to demand. The French defense sector continues to procure self-heating rations for field operations, contributing to steady consumption. Strategic partnerships with travel service providers and the launch of recyclable, eco-safe packs remain critical growth enablers for manufacturers targeting premium segments.

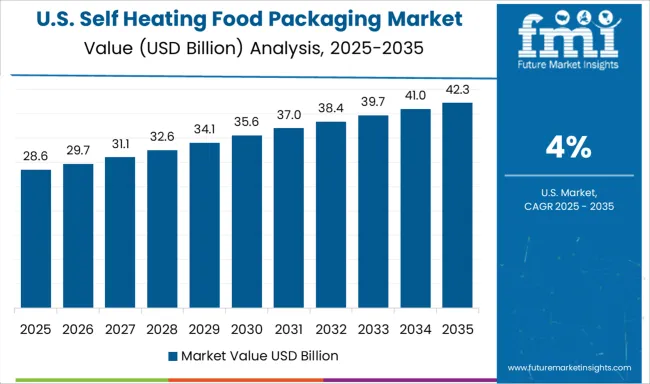

The USA is projected to grow at 4.0% CAGR during 2025–2035, improving from around 3.6% during 2020–2024, reflecting consistent demand from defense, aviation, and outdoor recreation sectors. While mature in structure, this market benefits from continuous upgrades in military rations and partnerships with emergency preparedness programs. Adoption in e-commerce-driven ready-meal kits is rising as consumers prioritize convenience during travel and outdoor activities. Innovations in flameless heating systems and recyclable packs have encouraged renewed consumer interest. Growth remains moderate due to high manufacturing costs and strict safety regulations but is supported by premium positioning and retail partnerships.

The self-heating food packaging market is defined by a combination of specialized innovators and established solution providers, including Tempra Technology, OnTech, Luxfer Magtech, 42 Degrees Company, and HeatGen, LLC. These companies compete on heating efficiency, portability, and consumer safety, targeting applications in defense rations, emergency relief, premium travel services, and outdoor recreation. Tempra Technology is recognized for developing advanced thermal-control systems, enabling consistent heating performance for beverages and ready-to-eat meals. OnTech has pioneered packaging formats that integrate safe chemical heating elements, positioning itself as a key supplier for military and outdoor markets. Luxfer Magtech focuses on high-performance flameless heating technology widely adopted in defense meal kits, with proven expertise in lightweight and durable solutions for extreme conditions. 42 Degrees Company emphasizes innovation in consumer-ready self-heating packs for coffee and specialty drinks, leveraging design aesthetics and functional heating reliability to appeal to premium retail segments.

HeatGen, LLC is driving innovation with its patented heating modules for various liquid and solid food applications, offering customization for brand partnerships in convenience and on-the-go meal solutions. The competitive environment is characterized by high product development costs and stringent compliance with food safety regulations. Strategic priorities include enhancing heating efficiency, reducing activation times, and integrating recyclable materials to meet environmental standards. Companies are forming partnerships with food manufacturers, defense procurement agencies, and emergency service providers to secure large-scale contracts and expand distribution through e-commerce channels. Future growth will depend on scaling production while maintaining safety compliance, improving affordability for mass markets, and exploring emerging opportunities in travel, retail, and disaster-relief applications globally.

Key strategies and drivers for 2024 and 2025 in the self-heating food packaging market focus on expanding adoption in defense, disaster relief, and premium travel sectors, driven by demand for convenience and portability. Manufacturers are prioritizing safer flameless heating technology, recyclable materials, and compact designs to meet regulatory and consumer expectations.

Partnerships with e-commerce platforms and food brands enhance visibility and distribution, while localized production reduces costs for emerging markets. Rising outdoor recreation trends, combined with growing demand for ready-to-eat meals, further fuel market growth, positioning innovation in efficiency and safety as critical for competitive advantage.

| Item | Value |

|---|---|

| Quantitative Units | USD 68.4 Billion |

| Packaging Type | Cans, Pouches, and Bottles |

| Food Type | Ready-to-eat meals, Soups and stews, Snacks, and Beverage |

| Distribution Channel | Supermarkets and hypermarkets, Online retail, Specialty stores, and Retail & convenience stores |

| End Use Industry | Military and defense, Outdoor and recreational, Food service, Healthcare and medical, and Household |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Tempra Technology, OnTech, Luxfer Magtech, 42 Degrees Company, and HeatGen, LLC |

The global self heating food packaging market is estimated to be valued at USD 68.4 billion in 2025.

The market size for the self heating food packaging market is projected to reach USD 108.3 billion by 2035.

The self heating food packaging market is expected to grow at a 4.7% CAGR between 2025 and 2035.

The key product types in self heating food packaging market are cans, pouches and bottles.

In terms of food type, ready-to-eat meals segment to command 46.0% share in the self heating food packaging market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Self-ligating Ceramic Brackets Market Size and Share Forecast Outlook 2025 to 2035

Self-sealing Ziplock Bag Market Size and Share Forecast Outlook 2025 to 2035

Self-service Billiards System Market Size and Share Forecast Outlook 2025 to 2035

Self-propelled Orchard Top-cutting Machines Market Forecast and Outlook 2025 to 2035

Self-healing Network Market Size and Share Forecast Outlook 2025 to 2035

Self-administered Biologics Market Size and Share Forecast Outlook 2025 to 2035

Self-fusing Silicone Tape Market Size and Share Forecast Outlook 2025 to 2035

Self-administered Parenteral Market Size and Share Forecast Outlook 2025 to 2035

Self-Adhesive Dual-Cure Luting Cement Market Size and Share Forecast Outlook 2025 to 2035

Self-service Analytics Market Size and Share Forecast Outlook 2025 to 2035

Self-Compacting Concrete Market Size and Share Forecast Outlook 2025 to 2035

Self-adhesive Tear Tape Market Size and Share Forecast Outlook 2025 to 2035

Self-Adhesive Labels Market Size and Share Forecast Outlook 2025 to 2035

Self-Healing Concrete Market Size and Share Forecast Outlook 2025 to 2035

Self-repairing Polymers Market Size and Share Forecast Outlook 2025 to 2035

Self Cooled Transformer Market Size and Share Forecast Outlook 2025 to 2035

Self Sensing Nanocomposites Market Size and Share Forecast Outlook 2025 to 2035

Self-Lubricating Bearings Market Size and Share Forecast Outlook 2025 to 2035

Self - Locking Trays Market Size and Share Forecast Outlook 2025 to 2035

Self-urinary Infection Testing Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA