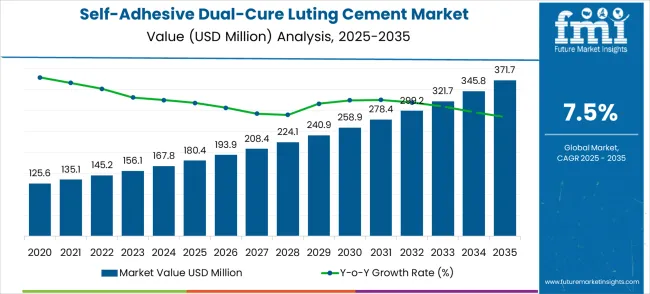

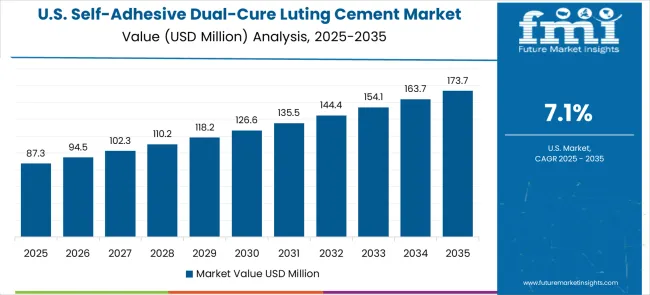

The self-adhesive dual-cure luting cement market is poised to expand from USD 180.4 million in 2025 to USD 371.7 million by 2035, advancing at a CAGR of 7.5%. The market exhibits strong growth momentum, driven by increasing adoption in restorative and prosthetic dental procedures. Early in the decade, demand is fueled by the need for simplified, efficient luting solutions that reduce procedure time while offering reliable bonding for crowns, bridges, inlays, and onlays. Rising awareness among dental practitioners and patients regarding minimally invasive procedures also contributes to the initial growth surge.

Between 2030 and 2035, growth momentum is reinforced by innovations in cement formulations, including improved adhesion to various substrates, reduced solubility, and enhanced mechanical properties. Expansion in private dental clinics, hospital chains, and emerging markets supports broader market penetration. Manufacturers are focusing on developing dual-cure systems with consistent performance and easy handling to enhance practitioner confidence and patient outcomes. The market’s sustained momentum reflects a combination of technological improvements, growing procedural volumes, and increased accessibility across regions.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 180.4 million |

| Forecast Value in (2035F) | USD 371.7 million |

| Forecast CAGR (2025 to 2035) | 7.5% |

The self-adhesive dual-cure luting cement market is segmented into restorative dentistry at 41%, prosthodontics (crowns, bridges, inlays) at 24%, orthodontic applications at 17%, endodontic post cementation at 11%, and specialized dental procedures at 7%. Restorative dentistry drives demand due to the need for strong, aesthetic, and efficient bonding solutions. Industry trends include advanced self-adhesive formulations that eliminate separate etching or priming steps, flowable and moisture-tolerant cements for easier handling, and color-stable options for improved clinical outcomes. Integration with digital dentistry and CAD/CAM workflows, along with dual-cure chemistry and bioactive components, is enhancing performance.

Market expansion is being supported by the increasing global demand for simplified bonding procedures and the corresponding need for versatile cementation materials that can provide reliable adhesion while reducing clinical steps and technique sensitivity across various restorative applications. Modern dental practitioners are increasingly focused on implementing bonding solutions that can streamline clinical workflows, reduce procedure time, and provide consistent performance across different restoration types and clinical conditions. Self-adhesive dual-cure luting cements' proven ability to deliver simplified application, reliable bonding, and versatile curing capabilities make them essential materials for contemporary restorative dentistry and efficient clinical practice.

The growing emphasis on clinical efficiency and procedure simplification is driving demand for self-adhesive dual-cure luting cements that can support streamlined workflows, reduce technique sensitivity, and enable predictable bonding outcomes without compromising restoration quality or longevity. Dental professionals' preference for materials that combine ease of use with reliable performance and clinical versatility is creating opportunities for innovative cement formulations. The rising influence of aesthetic dentistry and patient convenience demands is also contributing to increased adoption of self-adhesive dual-cure luting cements that can provide efficient bonding solutions while supporting high-quality aesthetic outcomes.

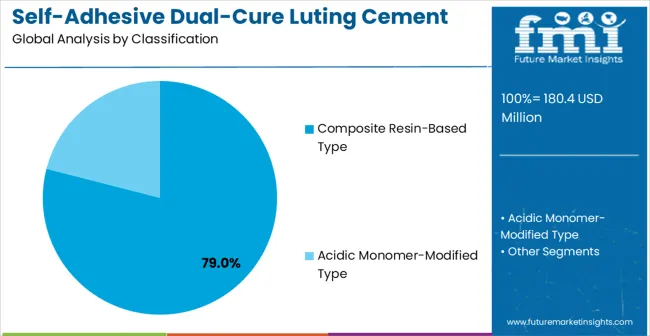

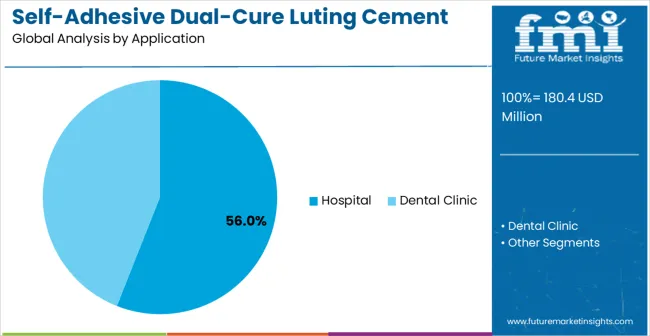

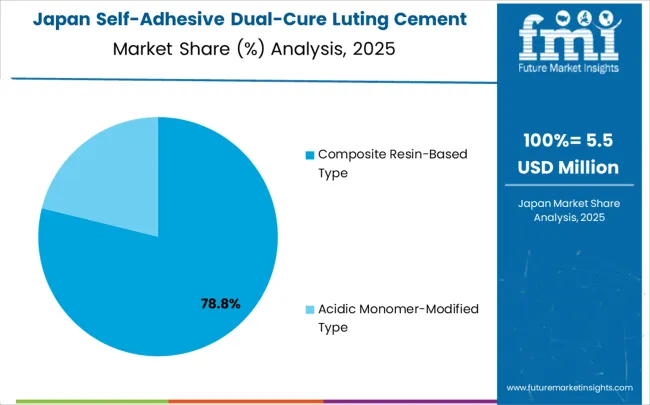

The self-adhesive dual-cure luting cement market is witnessing growth due to rising demand for efficient, easy-to-use dental adhesives. Composite resin-based cements dominate the material type segment with approximately 79% of the market share, offering high bond strength (30–35 MPa) and low polymerization shrinkage (<2%) suitable for crowns, bridges, and inlays. Hospitals lead the application segment with around 56% of the market, reflecting the high volume of restorative and prosthodontic procedures performed in clinical settings. Market growth is supported by increased dental procedure volumes, the adoption of minimally invasive techniques, and the need for reliable, long-lasting luting solutions.

Composite resin-based self-adhesive dual-cure luting cements hold approximately 79% of the material type market, making them the preferred option for dental restorations. These cements provide compressive strength exceeding 300 MPa and bond strength between 30–35 MPa, with polymerization shrinkage below 2%. Leading manufacturers include 3M ESPE, Ivoclar Vivadent, GC Corporation, and Kuraray Noritake. Their dual-curing capability ensures reliable polymerization even in areas with limited light access. The material’s high biocompatibility and compatibility with a wide range of indirect restorations make it ideal for hospital use and routine clinical procedures.

Hospitals account for approximately 56% of the application segment, reflecting the largest consumption of self-adhesive dual-cure luting cements. These facilities use cements for high-volume restorative procedures such as crowns, bridges, and prosthodontics, requiring strong adhesion and predictable polymerization. Key manufacturers include 3M ESPE, Ivoclar Vivadent, GC Corporation, and Kuraray Noritake. Segment growth is driven by increasing dental procedure volumes, rising patient awareness, and the preference for dual-cure cements that reduce chair time while ensuring reliable long-term performance. Hospitals continue to dominate due to procedural frequency and the need for standardized, high-quality materials.

The self-adhesive dual-cure luting cement market is advancing rapidly due to increasing demand for simplified bonding procedures and growing adoption of efficient clinical workflows that provide reliable cementation while reducing technique sensitivity and procedure complexity across diverse dental applications. The market faces challenges, including competition from conventional bonding systems, variability in substrate bonding performance, and the need for continuous formulation improvements. Innovation in adhesive chemistry and dual-cure technologies continues to influence product development and market expansion patterns.

The growing adoption of digital dentistry workflows and streamlined clinical procedures is driving demand for self-adhesive dual-cure luting cements that can support efficient restoration placement, reduce clinical steps, and provide reliable bonding for digitally manufactured restorations, including CAD/CAM crowns and bridges. Advanced digital workflows require simplified material systems while enabling more efficient treatment delivery and enhanced patient satisfaction across various restorative procedures and treatment complexities. Manufacturers are increasingly recognizing the competitive advantages of workflow-compatible cement systems for modern dental practice integration and efficiency optimization.

Modern self-adhesive dual-cure cement producers are incorporating bioactive components and smart material technologies to enhance clinical performance, provide therapeutic benefits, and ensure long-term restoration success for demanding dental applications. These technologies improve treatment outcomes while enabling new clinical possibilities, including remineralization support and bacterial resistance properties. Advanced material integration also allows practitioners to support enhanced patient care and treatment longevity beyond traditional cementation capabilities.

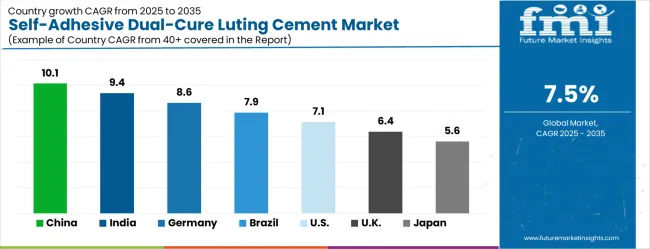

| Country | CAGR (2025-2035) |

|---|---|

| China | 10.1% |

| India | 9.4% |

| Germany | 8.6% |

| Brazil | 7.9% |

| USA | 7.1% |

| UK | 6.4% |

| Japan | 5.6% |

The self-adhesive dual-cure luting cement market is experiencing strong growth globally, with China leading at a 10.1% CAGR through 2035, driven by expanding healthcare infrastructure, growing dental care awareness, and significant investment in modern dental technology adoption. India follows at 9.4%, supported by increasing healthcare accessibility, a growing middle-class population, and a rising emphasis on advanced dental treatments and restorative procedures. Germany shows growth at 8.6%, emphasizing technological innovation and advanced dental material development. Brazil records 7.9%, focusing on healthcare infrastructure expansion and dental care accessibility improvement. The USA demonstrates 7.1% growth, driven by the established dental care market and advanced treatment adoption. The UK exhibits 6.4% growth, supported by healthcare system modernization and dental technology advancement. Japan shows 5.6% growth, priortizing on precision dental materials and advanced clinical applications.

The report covers an in-depth analysis of 40+ countries, Top-performing countries are highlighted below.

China leads with a 10.1% CAGR, well above the global 7.5%. Adoption is concentrated in Beijing, Shanghai, and Guangdong, where high-end dental clinics and prosthodontic laboratories dominate. Increasing use of dual-cure resin for zirconia crowns, inlays, and veneers drives demand. Suppliers such as 3M, GC Corporation, and Ivoclar Vivadent emphasize long working time, high bond strength, and color stability. Clinics integrating CAD/CAM workflows account for 30% of installations. Urban chains are expanding multi-location procurement agreements. Growing patient demand for durable and aesthetic restorations supports steady growth. Training programs in adhesive techniques have increased professional adoption rates.

India exhibits a 9.4% CAGR, above the global 7.5%. Maharashtra, Karnataka, and Delhi account for 48% of installations, mainly in private clinics and cosmetic dentistry centers. Growth is fueled by indirect restorations such as inlays, onlays, and veneers. Suppliers like 3M, Ivoclar Vivadent, and Kuraray focus on self-adhesive dual-cure cements suitable for semi-skilled operators. Pre-measured capsule systems are gaining adoption in urban clinics for consistency. Expansion of distributors in tier-2 cities has increased accessibility by 20%. Rising cosmetic dentistry awareness drives higher sales volumes in anterior restorations.

Germany records an 8.6% CAGR, above global 7.5%. Berlin, Hamburg, and Munich represent 52% of installations. Adoption is concentrated in prosthodontic laboratories and high-end dental clinics. Suppliers such as Ivoclar Vivadent, 3M, and Heraeus Kulzer offer low-shrinkage, high-bond-strength resin cements. Clinics using intraoral scanning for precise adhesive application represent 32% of installations. Minimally invasive procedures in urban clinics increase dual-cure usage. Continuing professional education covers 30% of dental practitioners. High-precision zirconia and ceramic restorations support adoption of color-stable and temperature-stable cements.

Brazil grows at 7.9% CAGR, above the global 7.5%. São Paulo, Rio de Janeiro, and Minas Gerais account for 50% of installations. Private dental clinics and prosthodontic labs lead adoption. Suppliers like 3M, GC Corporation, and Dentsply Sirona provide extended shelf-life and capsule-based products. Growth is fueled by anterior aesthetic restorations and rising dental tourism. Portable pre-measured capsules are increasingly used in 25% of smaller clinics for accuracy and efficiency. Seasonal peaks in cosmetic dentistry influence 22% of market activity. Clinics adopting dual-cure for metal-ceramic restorations account for 28% of installations.

The USA records a 7.1% CAGR, slightly below the global 7.5%. California, New York, and Texas account for 55% of installations, with high adoption in cosmetic and prosthodontic specialty clinics. Suppliers such as 3M, Ivoclar Vivadent, and Kerr emphasize handling efficiency and color stability. Self-adhesive dual-cure cements for posterior restorations represent 32% of installations. Clinics using automated mixing systems cover 28% of adoption. Digital workflow integration in high-volume urban clinics improves adhesive application precision. Patient preference for aesthetic longevity supports consistent growth.

The UK grows at a 6.4% CAGR, below the global 7.5%. London, Manchester, and Birmingham account for 50% of installations, concentrated in cosmetic and aesthetic restorative practices. Suppliers including Ivoclar Vivadent, 3M, and GC Corporation focus on color-matched dual-cure cements. Clinics specializing in ceramic veneers represent 35% of adoption. Ongoing professional training reaches 25% of practitioners. Pre-measured capsules are used in 28% of clinics to reduce variability in application. Adoption is increasing for time-efficient procedures, particularly in private dental practices.

Japan exhibits a 5.6% CAGR, below the global 7.5%. Tokyo, Osaka, and Kyoto account for 50% of installations, concentrated in high-precision dental clinics and prosthodontic labs. Suppliers such as GC Corporation, 3M, and Kuraray provide dual-cured, color-stable cements for zirconia and ceramic restorations. CAD/CAM integrated workflows are applied in 25% of installations. Pre-measured capsules are adopted in 28% of small urban clinics for accuracy. Minimally invasive adhesive techniques in anterior restorations contribute to 20% of usage. Slower new clinic openings compared with China and India limit market growth.

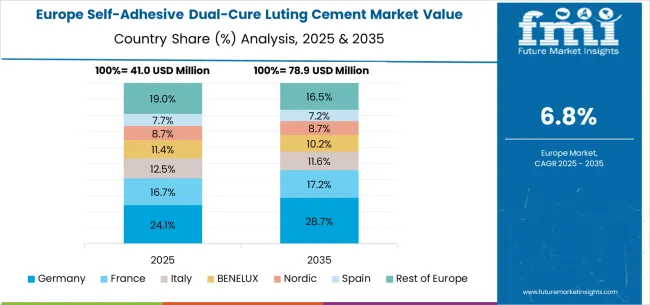

The self-adhesive dual-cure luting cement market in Europe is projected to grow from USD 41.9 million in 2025 to USD 86.3 million by 2035, registering a CAGR of 7.5% over the forecast period. Germany is expected to maintain its leadership position with a 30.8% market share in 2025, moderating slightly to 30.5% by 2035, supported by its strong dental industry, advanced material science capabilities, and comprehensive healthcare infrastructure serving major European markets.

The United Kingdom follows with a 23.9% share in 2025, projected to reach 24.1% by 2035, driven by robust healthcare system infrastructure, established dental care standards, and strong demand for advanced dental materials across the NHS and private dental sectors. France holds a 19.1% share in 2025, rising to 19.3% by 2035, supported by healthcare modernization programs and increasing adoption of aesthetic dental treatments in clinical practice. Italy records 11.6% in 2025, inching to 11.7% by 2035, with growth underpinned by healthcare infrastructure improvement and increasing emphasis on advanced dental care delivery. Spain contributes 8.4% in 2025, moving to 8.5% by 2035, supported by expanding healthcare access and dental technology adoption programs. The Netherlands maintains a 2.7% share in 2025, growing to 2.8% by 2035. The Rest of Europe region, including Nordic countries, Eastern Europe, Belgium, Switzerland, and Austria, is anticipated to gain momentum, expanding its collective share from 3.5% to 3.1% by 2035, attributed to increasing adoption of advanced dental materials in Nordic countries and growing dental care activities across Eastern European markets implementing healthcare modernization programs.

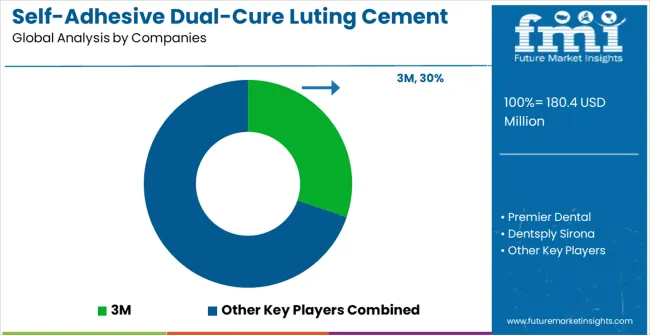

The self-adhesive dual-cure luting cement market is characterized by competition among established dental material manufacturers, specialized dental adhesive companies, and integrated oral care solution providers. Companies are investing in advanced adhesive chemistry research, clinical performance validation, biocompatibility enhancement, and comprehensive product portfolios to deliver consistent, high-performance, and safe dental bonding solutions. Innovation in dual-cure mechanisms, self-adhesive technologies, and ease-of-use features is central to strengthening market position and competitive advantage.

3M leads the market with a strong market share, offering comprehensive dental material solutions with a focus on adhesive technology innovation and clinical performance validation. Premier Dental provides specialized dental products with an emphasis on restorative materials and clinical education support. Dentsply Sirona delivers integrated dental solutions with a focus on comprehensive treatment workflows and material compatibility. Cosmedent specializes in aesthetic dental materials with emphasis on clinical excellence and practitioner education. Kulzer GmbH focuses on advanced dental materials and digital dentistry integration. Ivoclar Vivadent offers comprehensive restorative solutions with emphasis on aesthetic outcomes and clinical reliability.

Self-adhesive dual-cure luting cement represents a transformative advancement in restorative dentistry, offering simplified bonding procedures with reliable clinical performance. With the global market projected to grow from USD 180.4 million in 2025 to USD 371.7 million by 2035 at a 7.5% CAGR, this specialized dental material addresses critical needs for clinical efficiency, aesthetic outcomes, and procedural simplification. Scaling market penetration requires coordinated efforts across regulatory bodies, healthcare institutions, technology providers, material suppliers, and investment communities to accelerate adoption and innovation.

Healthcare Infrastructure Investment: Expand public dental care programs and modernize hospital dental departments with funding for advanced restorative equipment and materials procurement. Establish dedicated budgets for self-adhesive cement adoption in public healthcare institutions to demonstrate clinical efficacy and cost-effectiveness benefits.

Professional Training and Education: Fund continuing education programs for dental professionals on simplified bonding protocols and dual-cure cement applications. Develop certification pathways that validate practitioner competency in advanced bonding techniques, creating standardized training modules for dental schools and residency programs.

Regulatory Streamlining: Create expedited approval pathways for bioactive and smart material formulations while maintaining safety standards. Establish clear guidelines for clinical evidence requirements and post-market surveillance protocols that balance innovation encouragement with patient safety assurance.

Research and Development Support: Provide grants for clinical trials investigating long-term performance, biocompatibility, and therapeutic benefits of advanced cement formulations. Support university-industry partnerships focused on adhesive chemistry innovation and dual-cure mechanism optimization.

Quality Standards Development: Work with international standards organizations to harmonize testing protocols for bond strength, durability, and biocompatibility across global markets. Establish consistent quality benchmarks that enable reliable product comparison and clinical decision-making.

Clinical Evidence Development: Coordinate multi-center clinical studies demonstrating superior outcomes with self-adhesive dual-cure cements compared to conventional bonding systems. Publish evidence-based guidelines on optimal application techniques, material selection criteria, and performance expectations across different clinical scenarios.

Professional Education and Training: Develop comprehensive training curricula covering material science, clinical applications, and troubleshooting protocols. Create hands-on workshops and certification programs that build practitioner confidence in simplified bonding procedures while ensuring optimal clinical outcomes.

Market Positioning and Awareness: Lead messaging campaigns highlighting workflow efficiency benefits, reduced technique sensitivity, and improved patient satisfaction outcomes. Differentiate self-adhesive dual-cure technology from traditional multi-step bonding systems through targeted professional communications and case study dissemination.

Best Practice Development: Establish clinical protocols for different restoration types, substrate conditions, and patient populations. Create decision-making frameworks that help practitioners select appropriate cement formulations based on clinical requirements and aesthetic objectives.

Global Market Access: Facilitate international knowledge exchange through conferences, research collaborations, and technology transfer programs. Support emerging market development through educational partnerships and professional capacity building initiatives.

Integration with Digital Workflows: Develop software solutions that optimize cement selection based on restoration design, substrate characteristics, and curing light specifications. Create digital protocols that guide practitioners through simplified bonding procedures while ensuring consistent clinical outcomes.

Advanced Curing Technology: Provide LED curing systems optimized for dual-cure cement activation, ensuring complete polymerization in light-inaccessible areas. Develop smart curing devices that monitor polymerization progress and adjust light intensity automatically based on material requirements.

Delivery System Innovation: Create precision dispensing systems that ensure accurate cement placement, minimize waste, and reduce contamination risk. Develop ergonomic applicator designs that facilitate access to difficult restoration sites while maintaining material integrity.

Quality Control Solutions: Offer in-office testing equipment for bond strength verification and cement quality assessment. Develop portable devices that enable practitioners to validate material performance and troubleshoot bonding failures in real-time.

Training and Support Technology: Provide virtual reality training platforms for bonding procedure simulation and augmented reality guidance systems for complex restoration placements. Create mobile applications that deliver just-in-time technical support and troubleshooting assistance.

Product Portfolio Diversification: Develop specialized formulations for different clinical applications - high-strength versions for posterior restorations, aesthetic formulations for anterior applications, and bioactive variants for therapeutic benefits. Create modular product lines that address diverse practitioner preferences and patient needs.

Supply Chain Optimization: Establish regional manufacturing facilities to reduce logistics costs and improve product freshness. Develop cold-chain distribution networks that maintain material stability during transportation and storage, ensuring consistent clinical performance.

Clinical Support Services: Provide technical consultation services, on-site training programs, and performance guarantee protocols to accelerate adoption among hesitant practitioners. Offer case development support and clinical documentation services that demonstrate successful outcomes.

Quality Assurance and Traceability: Implement comprehensive quality management systems that track material performance from manufacturing through clinical application. Develop batch tracking capabilities that enable rapid response to performance issues and continuous improvement initiatives.

Collaborative Innovation: Partner with dental schools, research institutions, and clinical practices to develop next-generation formulations with enhanced bioactivity, improved aesthetics, and superior durability. Engage key opinion leaders in product development and clinical validation processes.

Clinical Protocol Development: Establish standardized procedures for different restoration types, ensuring consistent outcomes across multiple practitioners and treatment scenarios. Create quality metrics that track bonding success rates, restoration longevity, and patient satisfaction outcomes.

Practitioner Training Programs: Develop comprehensive education initiatives covering material science, clinical techniques, and troubleshooting protocols. Create mentorship programs pairing experienced users with practitioners new to self-adhesive dual-cure technology.

Procurement and Evaluation Systems: Establish evidence-based material selection criteria that balance clinical performance, cost-effectiveness, and workflow efficiency considerations. Develop vendor evaluation protocols that assess technical support quality, training resources, and long-term partnership potential.

Outcome Measurement and Reporting: Implement clinical tracking systems that monitor restoration performance, complication rates, and patient satisfaction metrics. Share aggregated outcomes data with professional associations and research institutions to advance clinical knowledge.

Innovation Partnerships: Collaborate with manufacturers on clinical studies, product development initiatives, and real-world evidence generation. Participate in beta testing programs for emerging technologies and provide feedback for product optimization.

Technology Innovation Funding: Support startups developing breakthrough adhesive chemistries, smart material formulations, and bioactive cement technologies that address unmet clinical needs. Provide venture capital for companies creating novel dual-cure mechanisms and enhanced bonding performance solutions.

Manufacturing Scale-up Investment: Finance production capacity expansion for established manufacturers responding to growing global demand. Support automation initiatives that improve product quality consistency while reducing manufacturing costs and delivery timelines.

Clinical Evidence Development: Fund comprehensive clinical studies demonstrating long-term performance, cost-effectiveness, and patient outcome benefits. Support real-world evidence generation initiatives that validate clinical superiority and economic value propositions.

Market Access and Distribution: Invest in distribution network expansion, particularly in high-growth emerging markets with developing dental care infrastructure. Support channel partner development and professional education programs that accelerate market penetration.

Digital Integration Ventures: Back companies developing software solutions that optimize cement selection, monitor clinical outcomes, and integrate bonding procedures with digital dentistry workflows. Support platforms that connect practitioners with technical expertise and peer learning opportunities.

Impact and Sustainability Focus: Deploy blended finance instruments that tie returns to measurable patient outcome improvements and healthcare access expansion. Support initiatives that reduce treatment complexity, improve clinical efficiency, and enhance global dental care accessibility.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 180.4 million |

| Material Type | Composite Resin-Based Type, Acidic Monomer-Modified Type |

| Application | Hospital, Dental Clinic |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | 3M, Premier Dental, Dentsply Sirona, Cosmedent, Kulzer GmbH, and Ivoclar Vivadent |

| Additional Attributes | Dollar sales by material type and application category, regional demand trends, competitive landscape, technological advancements in adhesive chemistry, dual-cure innovation, bioactive formulation development, and clinical performance optimization |

The global self-adhesive dual-cure luting cement market is estimated to be valued at USD 180.4 million in 2025.

The market size for the self-adhesive dual-cure luting cement market is projected to reach USD 371.7 million by 2035.

The self-adhesive dual-cure luting cement market is expected to grow at a 7.5% CAGR between 2025 and 2035.

The key product types in self-adhesive dual-cure luting cement market are composite resin-based type and acidic monomer-modified type.

In terms of application, hospital segment to command 56.0% share in the self-adhesive dual-cure luting cement market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Dual-Cure Luting Cements Market Size and Share Forecast Outlook 2025 to 2035

Cement Packaging Market Size and Share Forecast Outlook 2025 to 2035

Cement Consistometer Market Size and Share Forecast Outlook 2025 to 2035

Cement Paints Market Size and Share Forecast Outlook 2025 to 2035

Cement Sacks Market Growth – Demand & Forecast 2025 to 2035

Cement Kiln Co-Processing Fuels Market Growth – Trends & Forecast 2024-2034

Europe Cement Packaging Market Analysis – Trends & Forecast 2024-2034

North America Cement Packaging Industry Analysis – Trends & Forecast 2024-2034

Cement Boards Market

Cement and Mortar Testing Equipment Market Growth – Trends & Forecast 2018-2027

Biocement Market Size and Share Forecast Outlook 2025 to 2035

GCC Cement Market Growth – Trends & Forecast 2025 to 2035

Replacement Sheets Market Analysis - Size, Share & Forecast 2025 to 2035

Bone Cement Delivery System Market Trends – Growth & Forecast 2024-2034

Bone Cement Mixers Market

Green Cement Market Size and Share Forecast Outlook 2025 to 2035

Fiber Cement Market Analysis by Raw Materials, End User, Application, and Region through 2025 to 2035

Fiber Cement Board Market Growth - Trends & Forecast 2025 to 2035

Qatar Cement Market Analysis by Product Type, End Use, and Region Forecast Through 2025 to 2035

Competitive Overview of White Cement Market Share

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA