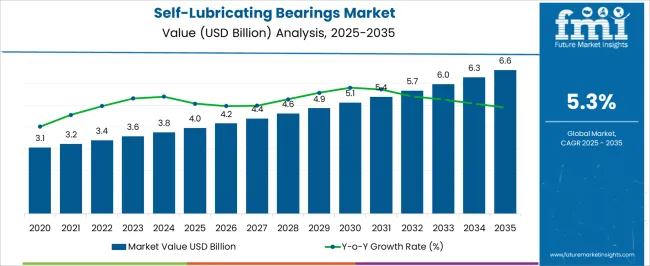

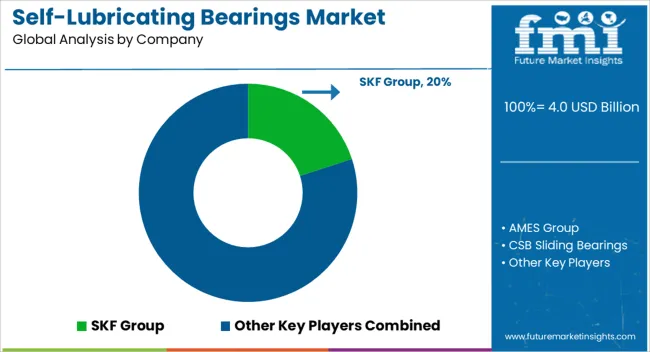

The self-lubricating bearings market is estimated to be valued at USD 4.0 billion in 2025 and is projected to reach USD 6.6 billion by 2035, registering a compound annual growth rate (CAGR) of 5.3% over the forecast period. An acceleration and deceleration pattern analysis shows steady growth, with initial acceleration followed by stabilization as the market matures.

Between 2025 and 2030, the market grows from USD 4.0 billion to USD 5.1 billion, contributing USD 1.1 billion in growth, with a CAGR of 5.3%. This early-phase acceleration is driven by increasing demand for self-lubricating bearings in industries such as automotive, industrial machinery, and aerospace, where low-maintenance, high-performance components are crucial for improving operational efficiency and reducing downtime.

The rise in automation and the focus on energy-efficient machinery also boost the demand for self-lubricating solutions. From 2030 to 2035, the market continues to expand, moving from USD 5.1 billion to USD 6.6 billion, contributing USD 1.5 billion in growth, with a slightly lower CAGR of 4.9%. This deceleration reflects the market maturing as self-lubricating bearings become more standardized, with widespread adoption in established industries. Despite the slower growth rate, demand remains strong due to the increasing need for maintenance-free, durable components across various applications. The overall pattern shows initial strong acceleration, followed by more stable growth as the market reaches maturity.

| Metric | Value |

|---|---|

| Self-Lubricating Bearings Market Estimated Value in (2025 E) | USD 4.0 billion |

| Self-Lubricating Bearings Market Forecast Value in (2035 F) | USD 6.6 billion |

| Forecast CAGR (2025 to 2035) | 5.3% |

Adoption has been supported by advancements in material science and surface engineering that enable these bearings to operate efficiently under high loads and extreme conditions without external lubrication. Industry announcements and technical bulletins have highlighted the benefits of reduced downtime, lower operating costs, and extended service life, all of which are increasingly prioritized across manufacturing, automotive, and energy sectors.

The future outlook remains promising, as industrial automation, sustainability mandates, and design flexibility continue to shape procurement decisions. According to company product updates and investor communications, demand is also rising in emerging markets where infrastructure development and industrial machinery modernization are gaining momentum. Additionally, the push for lighter and cleaner machinery has positioned self-lubricating bearings as a preferred solution across several engineering domains.

The self-lubricating bearings market is segmented by product type, material, load capacity, friction, durability, end use, and geographic regions. By product type, the self-lubricating bearings market is divided into Bushings, Plain bearings, Thrust bearings, Linear bearings, and Other (sliding bearings, etc). In terms of material, the self-lubricating bearings market is classified into Metallic Bearings and Non-Metallic Bearings. Based on load capacity, the self-lubricating bearings market is segmented into 100 N/mm2-500 N/mm2, Below 100 N/mm2, and Above 100 N/mm2. By friction, the self-lubricating bearings market is segmented into low-friction bearings, medium-friction bearings, and high-friction bearings. By durability, the self-lubricating bearings market is segmented into Medium durability, Low durability, and High durability.

By end use, the self-lubricating bearings market is segmented into Automotive, Industrial machinery, Energy & renewables, Medical devices and robotics, and Others (aerospace, marine, etc.). Regionally, the self-lubricating bearings industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

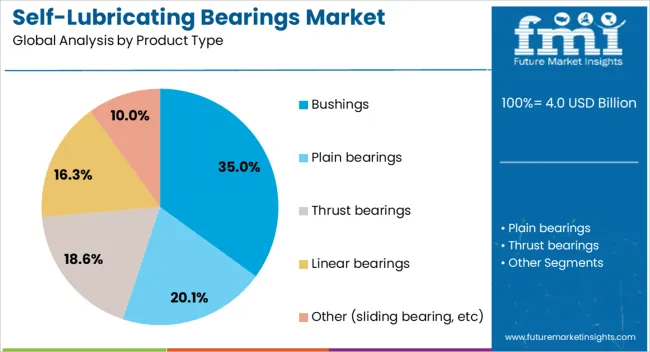

The bushings segment is expected to account for 35.0% of the Self-Lubricating Bearings market revenue share in 2025, making it the dominant product type. This leading position is being driven by their widespread application across industrial machinery, automotive systems, and heavy equipment, where compact and durable bearing solutions are essential. Bushings are being selected due to their ability to operate reliably in high-load and high-speed conditions without requiring lubrication, reducing maintenance efforts and downtime.

Engineering publications and product specifications have emphasized their versatility in design, allowing use in rotating, oscillating, and linear movements. Manufacturers are increasingly incorporating self-lubricating bushings into compact systems where accessibility for lubrication is limited, improving overall system reliability.

The segment’s prominence has also been supported by the cost-efficiency and long life offered by these components, making them a preferred choice in cost-sensitive applications.

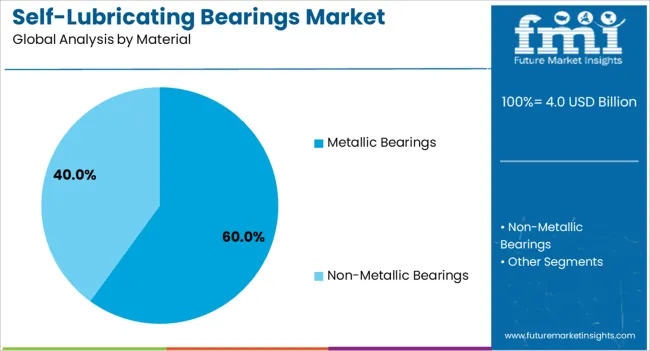

The metallic bearings segment is projected to lead the market with a 60.0% revenue share in 2025, supported by its ability to handle higher loads and resist extreme operating environments. This preference is being influenced by developments in metallurgy and coating technologies, as highlighted in technical whitepapers and industry bulletins, which have enhanced the wear resistance and thermal stability of metallic self-lubricating components.

Metallic bearings are being adopted in critical applications such as aerospace, heavy-duty industrial machines, and power generation equipment, where high precision and reliability are non-negotiable. Investor updates and company brochures have further emphasized their long operational life and ability to maintain performance under minimal or no lubrication. The segment’s growth has also been strengthened by growing end-user confidence in metallic bearings due to their field-proven durability and engineering flexibility.

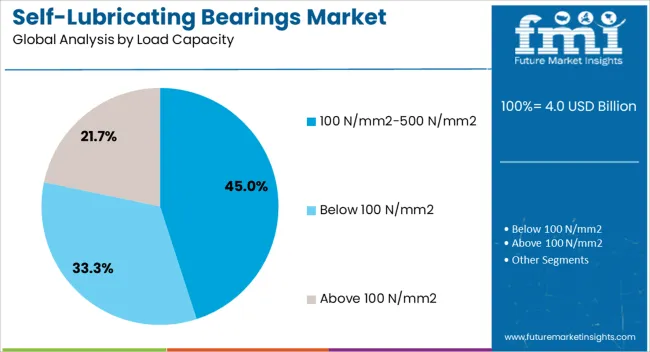

The 100 N/mm2 to 500 N/mm2 load capacity segment is expected to capture 45.0% of the market’s revenue share in 2025, establishing it as the leading load capacity range. This is being attributed to the segment’s alignment with a wide range of mid to heavy-duty applications across industries such as construction, mining, automotive, and manufacturing.

According to design engineering reports and application case studies, self-lubricating bearings with this load range offer an ideal balance between strength, lifespan, and versatility. These bearings are being integrated into equipment where high mechanical stress and demanding duty cycles are common, delivering consistent performance without requiring scheduled maintenance.

The growing shift toward automation and smart machinery has also encouraged manufacturers to deploy components with robust load-handling capacity to avoid costly downtimes. These operational and economic benefits have firmly positioned the 100 N/mm2 to 500 N/mm2 segment as a high-demand category within the self-lubricating bearings market.

The self-lubricating bearings market is expanding due to the growing demand for maintenance-free and durable components in various industries, including automotive, aerospace, and industrial machinery. These bearings, which reduce the need for external lubrication, offer significant benefits in terms of performance, reliability, and cost-effectiveness. The increasing adoption of automation and the rising need for high-performance parts in challenging environments are driving the growth of this market. Despite challenges like high production costs and limited availability of certain materials, innovations in material science and bearing technology continue to fuel the market’s expansion.

Technological advancements in materials and design are key drivers of the self-lubricating bearings market. These bearings are engineered using advanced composite materials and lubricating polymers, which enhance their durability and performance in demanding applications. Industries such as automotive and aerospace are increasingly adopting self-lubricating bearings due to their ability to reduce downtime and maintenance needs, ultimately improving operational efficiency. The ability of these bearings to operate without traditional lubrication systems also reduces environmental impact and ensures better performance in harsh conditions. As the demand for energy-efficient and high-performance components increases, the adoption of self-lubricating bearings is expected to rise in sectors that prioritize operational excellence.

One of the challenges for the self-lubricating bearings market is the high cost of specialized materials required to produce these bearings. While the long-term cost savings due to reduced maintenance and increased lifespan are significant, the initial investment in self-lubricating bearings can be prohibitive, especially for small to medium-sized enterprises. Additionally, the limited availability of certain high-performance materials may lead to supply chain constraints, further impacting the affordability and scalability of production. Overcoming these cost barriers and ensuring access to quality materials will be key to supporting the continued growth of the self-lubricating bearings market.

The rise of automation and smart technologies across industries presents significant opportunities for the self-lubricating bearings market. As manufacturing processes become more automated and machinery operates under heavier loads and faster speeds, the need for bearings that can withstand these conditions without the need for regular lubrication increases. This is especially true in industries such as robotics, automotive, and manufacturing, where minimizing maintenance is critical to improving overall productivity. Moreover, the growing demand for high-performance materials that can withstand extreme temperatures and pressure further supports the adoption of self-lubricating bearings in applications requiring high reliability and efficiency.

The trend toward more customized and application-specific bearing designs is shaping the self-lubricating bearings market. Manufacturers are increasingly offering bearings that are tailored to meet the unique needs of specific applications, such as those in harsh environments or those requiring precise performance characteristics. Advances in computer-aided design (CAD) and simulation technologies are allowing for more accurate predictions of bearing performance, which in turn drives innovation in bearing design. This shift toward customization is expected to enhance the performance of self-lubricating bearings and open up new market segments, including emerging industries that require specialized solutions.

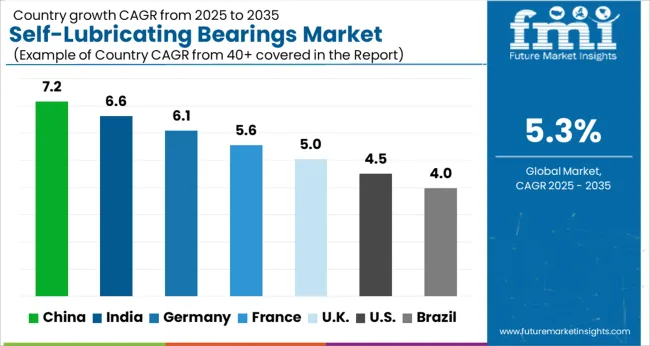

The global self-lubricating bearings market is projected to grow at a CAGR of 5.3% from 2025 to 2035. China leads at 7.2%, followed by India at 6.6%, and France at 5.6%, while the United Kingdom records 5.0% and the United States posts 4.5%. Divergence reflects local catalysts: increasing adoption of self-lubricating bearings in industries like manufacturing, automotive, and aerospace in China and India, while more mature markets like the United States and the United Kingdom experience slower growth due to established infrastructure. The analysis includes over 40+ countries, with the leading markets detailed below.

Demand for self-lubricating bearings in China is growing at a 7.2% CAGR through 2035. China’s rapidly expanding manufacturing and automotive industries are major drivers behind the demand for self-lubricating bearings. The need for high-performance, low-maintenance bearings in various industrial applications, including machinery, automotive, and aerospace, is increasing as China moves toward advanced manufacturing techniques. As the country focuses on reducing downtime and improving the lifespan of industrial equipment, the adoption of self-lubricating bearings continues to rise. Therowing adoption of electric vehicles and renewable energy technologies in China is driving the need for efficient bearing solutions.

Sale of self-lubricating bearings in India is projected to grow at a 6.6% CAGR through 2035. India’s rapidly expanding automotive, machinery, and manufacturing sectors are key drivers behind this growth. As the country’s industries continue to modernize and improve efficiency, the need for advanced, low-maintenance bearing solutions is rising. The Indian government’s focus on improving infrastructure and industrial productivity further accelerates the adoption of self-lubricating bearings. The rise of electric vehicles in India is pushing for more advanced bearing solutions that are efficient and durable, contributing to the market’s growth.

Demand for self-lubricating bearings in France is growing at a 5.6% CAGR through 2035. France’s established automotive and industrial machinery sectors are key drivers of the self-lubricating bearings market. As industries focus on improving efficiency, reducing maintenance costs, and extending the lifespan of machinery, the demand for self-lubricating bearings is rising. France’s growing aerospace and renewable energy industries are also contributing to market expansion, with these sectors seeking high-performance bearing solutions. The increasing focus on automation and advanced manufacturing techniques in France is further driving the adoption of self-lubricating bearings.

The UK self-lubricating bearings market is expected to grow at a 5.0% CAGR through 2035. The market is primarily driven by the need for high-performance bearings in industries such as automotive, aerospace, and manufacturing. As the UK continues to focus on improving industrial efficiency and reducing maintenance downtime, the demand for self-lubricating bearings is increasing. The rise of electric vehicles and the growing focus on renewable energy solutions are further driving the adoption of efficient, long-lasting bearing systems. The UK’s increasing emphasis on advanced manufacturing technologies contributes to the market’s growth.

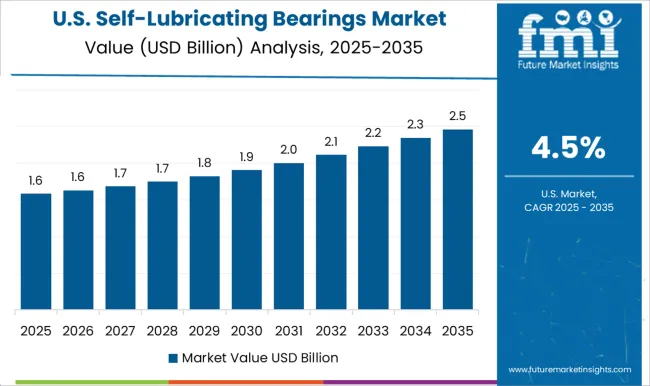

Demand for self-lubricating bearings in the USA is projected to grow at a 4.5% CAGR through 2035. The USA market is driven by the increasing demand for efficient and durable bearing solutions in industries such as automotive, aerospace, and industrial machinery. The growth of automation and robotics in manufacturing is contributing to the increased adoption of self-lubricating bearings to reduce maintenance and improve equipment efficiency. Additionally, the shift towards electric vehicles and renewable energy technologies is driving the need for high-performance bearing solutions in the USA market.

The self-lubricating bearings market is driven by leading manufacturers specializing in providing high-performance bearings designed to operate without the need for external lubrication, offering benefits such as reduced maintenance, increased reliability, and cost savings. SKF Group is a market leader, offering a wide range of self-lubricating bearings that focus on reducing friction and extending bearing life in demanding applications, from automotive to industrial machinery. AMES Group and CSB Sliding Bearings specialize in self-lubricating solutions that cater to a variety of industries, offering cost-effective and highly durable bearing materials. Daido Metal Co., Ltd. and GGB Bearing Technology provide advanced self-lubricating bearings that are known for their high performance and long service life, specifically designed for high-load and high-speed applications. GKN Sinter Metals offers self-lubricating sintered bearings that are known for their ability to handle high temperatures and reduce wear in automotive and industrial machinery applications.

igus GmbH is recognized for its expertise in producing self-lubricating plastic bearings, which are used extensively in applications requiring high resistance to wear and corrosion. NSK Ltd. and NTN Corporation provide high-performance bearings with built-in lubrication systems, ideal for reducing friction and preventing maintenance downtime in various industrial applications. OILES Corporation specializes in self-lubricating bearings made from high-quality materials such as metal and plastic, offering products that cater to both light-duty and heavy-duty applications. RBC Bearings Incorporated and Saint-Gobain Performance Plastics provide self-lubricating bearings used in automotive, aerospace, and industrial applications, offering superior wear resistance and performance. Technymon Global Bearing Technologies and TriStar Plastics Corp. offer self-lubricating bearings that are known for their smooth operation and long life, targeting markets requiring specialized applications such as marine and high-load machinery. Zhejiang SF Oilless Bearing Co., Ltd. is a prominent player in the Chinese market, offering affordable yet high-performance self-lubricating bearings suitable for a range of industries.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.0 Billion |

| Product Type | Bushings, Plain bearings, Thrust bearings, Linear bearings, and Other (sliding bearing, etc) |

| Material | Metallic Bearings and Non-Metallic Bearings |

| Load Capacity | 100 N/mm2-500 N/mm2, Below 100 N/mm2, and Above 100 N/mm2 |

| Friction | Low friction bearings, Medium friction bearings, and High friction bearings |

| Durability | Medium durability, Low durability, and High durability |

| End Use | Automotive, Industrial machinery, Energy & renewables, Medical devices and robotics, and Others (aerospace, marine, etc.) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | SKF Group, AMES Group, CSB Sliding Bearings, Daido Metal Co., Ltd., GGB Bearing Technology, GKN Sinter Metals, igus GmbH, NSK Ltd., NTN Corporation, OILES Corporation, RBC Bearings Incorporated, Saint-Gobain Performance Plastics, Technymon Global Bearing Technologies, TriStar Plastics Corp., and Zhejiang SF Oilless Bearing Co., Ltd. |

| Additional Attributes | Dollar sales by product type (metallic self-lubricating bearings, plastic self-lubricating bearings, composite self-lubricating bearings) and end-use segments (automotive, industrial machinery, aerospace, marine, robotics). Demand dynamics are influenced by the growing need for maintenance-free, durable bearing solutions in high-performance applications, as well as the increasing adoption of automation and machinery requiring high reliability and minimal downtime. Regional trends show strong growth in North America and Europe, driven by industrial automation and the demand for energy-efficient, low-maintenance solutions, while Asia-Pacific is expanding rapidly due to growing industrial activities and automotive production. |

The global self-lubricating bearings market is estimated to be valued at USD 4.0 billion in 2025.

The market size for the self-lubricating bearings market is projected to reach USD 6.6 billion by 2035.

The self-lubricating bearings market is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types in self-lubricating bearings market are bushings, plain bearings, thrust bearings, linear bearings and other (sliding bearing, etc).

In terms of material, metallic bearings segment to command 60.0% share in the self-lubricating bearings market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Sensor Bearings Market Insights - Growth & Forecast 2025 to 2035

Marine Bearings Market Growth - Trends & Forecast 2025 to 2035

Thrust Bearings Market

Linear Bearings Market

Polymer Bearings Market Size and Share Forecast Outlook 2025 to 2035

Camshaft Bearings Market

Elastomeric Bearings Market Size and Share Forecast Outlook 2025 to 2035

Miniature Ball Bearings Market Analysis by Type, End-use and Region: Forecast for 2025 to 2035

ASEAN Automotive Bearings Market Size and Share Forecast Outlook 2025 to 2035

Automotive Wheel Bearings Market

Friction Pendulum Bearings Market Size and Share Forecast Outlook 2025 to 2035

Automotive Engine Bearings Market

High Speed Rolling Bearings Market Size and Share Forecast Outlook 2025 to 2035

High Efficiency Rolling Bearings Market Size and Share Forecast Outlook 2025 to 2035

High Precision Heavy Load Bearings Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA