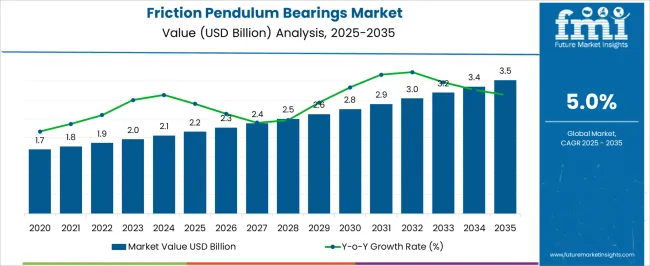

The friction pendulum bearings market is expected to witness steady expansion over the next decade, reaching USD 2.2 billion in 2025 and growing to USD 3.5 billion by 2035, at a CAGR of 5.0%. This growth is driven by rising investments in earthquake-resistant infrastructure, as friction pendulum bearings play a critical role in seismic isolation for bridges, high-rise buildings, and industrial facilities.

The market benefits from increasing urban development in seismic-prone regions, where governments and private developers are prioritizing structural safety and resilience. Advancements in bearing design, such as multi-stage isolation systems and durable composite materials, are further enhancing performance, making adoption more attractive for large-scale construction projects. Demand is also supported by retrofitting initiatives in older infrastructure to meet modern safety standards.

| Metric | Value |

|---|---|

| Friction Pendulum Bearings Market Estimated Value in (2025 E) | USD 2.2 billion |

| Friction Pendulum Bearings Market Forecast Value in (2035 F) | USD 3.5 billion |

| Forecast CAGR (2025 to 2035) | 5.0% |

The friction pendulum bearings market is gaining traction globally due to the rising emphasis on seismic resilience in both public and private infrastructure. The growing occurrence of high-magnitude earthquakes and the increasing vulnerability of aging structures have driven the adoption of advanced base isolation systems. Friction pendulum bearings, known for their energy dissipation capacity and re-centering ability, are being integrated into buildings, bridges, and industrial facilities to mitigate seismic impact.

Regulatory mandates and building codes in seismic-prone regions are reinforcing the deployment of these systems in new constructions and retrofitting projects. Infrastructure development initiatives in emerging economies, combined with modernization efforts in developed nations, are further accelerating demand.

Innovations in bearing geometry and materials, along with enhanced testing standards, are contributing to improved performance and lifecycle costs The long-term outlook remains positive as government-funded projects and private investments prioritize earthquake-resilient designs, positioning friction pendulum bearings as a core element in next-generation structural safety frameworks.

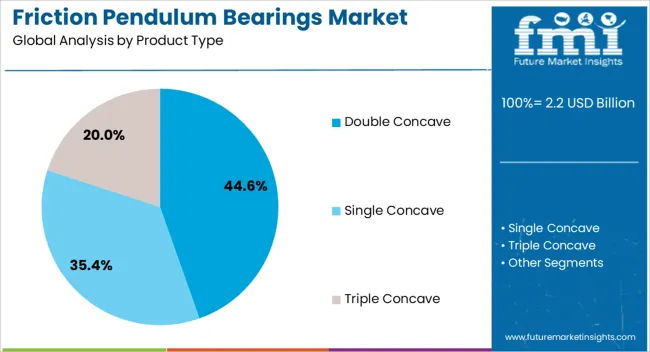

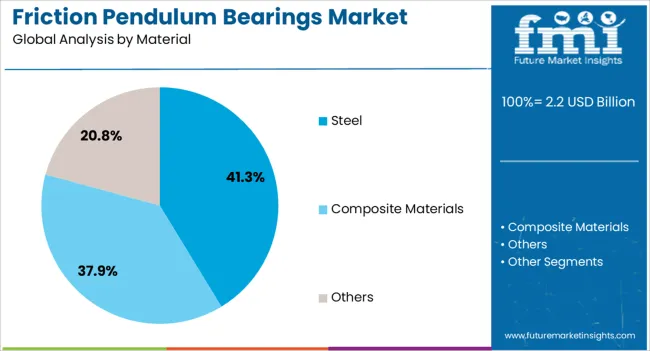

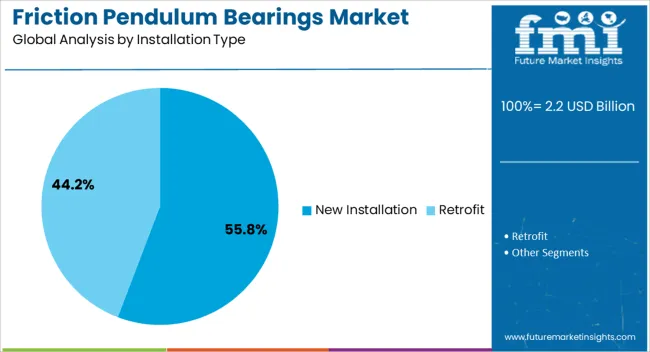

The friction pendulum bearings market is segmented by product type, material, installation type, load capacity, and geographic regions. By product type, friction pendulum bearings market is divided into Double Concave, Single Concave, and Triple Concave. In terms of material, friction pendulum bearings market is classified into Steel, Composite Materials, and Others. Based on installation type, friction pendulum bearings market is segmented into New Installation and Retrofit. By load capacity, friction pendulum bearings market is segmented into Medium Load Capacity, Low Load Capacity, and High Load Capacity. Regionally, the friction pendulum bearings industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The double concave product type is expected to account for 44.6% of the total revenue share in the friction pendulum bearings market in 2025. The dominance of this subsegment is driven by its enhanced displacement capacity and the ability to support multi-directional movements during seismic events. Double concave bearings are increasingly favored in large-span structures and high-rise buildings due to their superior energy dissipation characteristics and reduced horizontal acceleration transmission.

Their symmetrical design allows consistent re-centering after seismic activity, reducing structural misalignment and post-event maintenance. Demand has been further supported by their compatibility with varied load conditions and ease of customization based on structural geometry.

Widespread adoption in major infrastructure projects, particularly in regions with high seismic vulnerability, is reinforcing their position as a preferred bearing type. As engineers continue to favor long-term durability and high-performance base isolation systems, the double concave configuration is expected to maintain its leadership in the product category.

Steel is projected to hold 41.3% of the revenue share in the friction pendulum bearings market by 2025. The prevalence of steel in this segment is attributed to its high load-bearing capacity, durability, and resilience under cyclic loading conditions commonly experienced during seismic events. Steel-based bearings offer uniform performance over prolonged service periods and exhibit minimal wear under high-pressure contact, making them suitable for critical infrastructure.

The material’s compatibility with advanced fabrication techniques and surface treatments enhances the frictional interface, allowing precise control over energy dissipation. Its favorable thermal properties and ability to maintain mechanical integrity in extreme environmental conditions further support adoption.

Cost-effectiveness and global availability of steel have enabled manufacturers to scale production efficiently, meeting the growing demand across both developed and emerging construction markets. As performance standards continue to evolve, steel remains a core material choice in the development of robust and reliable seismic isolation bearings.

New installations are expected to contribute 55.8% of the total revenue share in the friction pendulum bearings market in 2025, reflecting the increasing integration of seismic base isolation in modern construction projects. The strong growth of this segment is being supported by government regulations that mandate earthquake-resistant designs for new infrastructure, especially in seismically active regions.

Urban expansion, coupled with rising investment in smart city development and transportation infrastructure, has created a substantial pipeline for projects utilizing base-isolated structural systems. New installations offer the advantage of seamless integration of friction pendulum bearings during the early design and construction phases, ensuring optimal load distribution and displacement control.

Project developers and civil engineers are increasingly specifying these systems to minimize downtime and reduce lifecycle repair costs after seismic activity. As urban planning continues to prioritize resilience and sustainability, the uptake of friction pendulum bearings in newly constructed assets is anticipated to grow further, reinforcing this segment’s leading position.

Friction pendulum bearings are positioned to gain share where performance verification, lifecycle cost, and service continuity matter most. Broader uptake will be achieved through clearer codes, certified testing, and buyer education that reduces procurement risk.

Seismic isolation demand has been supported by performance based design, tighter drift limits, and lifecycle serviceability expectations across buildings and long span bridges. Friction pendulum bearings are specified where predictable hysteretic damping, re centering capability, and bidirectional isolation are required. It is believed that design teams prioritize displacement capacity, allowable friction coefficient range, and temperature stability during tender evaluations. Codes such as ASCE 7, Eurocode 8, and AASHTO guides have reinforced specification clarity with displacement checks and testing envelopes. Pipeline visibility has been shaped by public infrastructure programs and private high rise projects in seismic zones. In an opinionated reading, winning bids will emphasize performance under combined vertical loads, pulse effects, and long duration motions while showing lifecycle cost evidence.

Demand has been catalyzed by qualification regimes that include prototype testing, component level certification, and factory acceptance testing. It is argued that buyers ask for third party witnessing, test reports at varied force levels, and inspection protocols covering sliding surfaces and spherical geometry. Preapproved vendor lists are used to reduce procurement risk and to standardize spare parts. Codes and guidelines such as EN 1337, AASHTO, and ASCE 41 are cited during reviews to justify detailing, displacement capacity, and re centering behavior. It has been observed that tenders reward quality documentation, calibration records, and traceability. It is held that suppliers who publish independent test curves, acceptance bandwidths, and consistent maintenance checklists will see higher specification rates across bridges and essential facilities.

Competitive advantage has been linked to material choices, machining precision, and surface finishing repeatability. Low friction sliding materials with controlled wear characteristics are paired with stainless steel or nickel plated interfaces to manage coefficient stability across temperatures. It is maintained that economies of scale come from modular geometries, standard pin sizes, and interchangeable sliding elements. Order pooling across bridges and building portfolios has lowered unit costs and improved delivery reliability. Vendors that publish maintenance intervals, replacement kits, and training schedules reduce lifecycle uncertainty for owners and insurers. It is argued that price competition remains healthy where localized machining, qualified welding, and certified heat treatment are established, while premium pricing persists for high displacement units and projects needing stringent documentation packages.

Barriers have been observed in retrofit constraints, supply chain gaps, and skills for installation and inspection. Budget committees in jurisdictions are price led, limiting use beyond landmark projects. Opportunities are visible in hospital networks, data centers, industrial plants, and transportation corridors that prioritize continuity of operations. Regional traction is strongest in North America, Japan, Italy, Turkey, Chile, and New Zealand where codes and familiarity are established. It is expected that consortium bidding, owner education, and inspector training will accelerate approvals and shorten procurement cycles. A pragmatic view suggests that friction pendulum bearings will secure share where hazard levels, serviceability targets, and downtime costs are quantified, while alternative bearings will persist where initial price, simpler detailing, and tight schedules dominate decisions.

| Country | CAGR |

|---|---|

| China | 6.8% |

| India | 6.3% |

| Germany | 5.8% |

| France | 5.3% |

| UK | 4.8% |

| USA | 4.3% |

| Brazil | 3.8% |

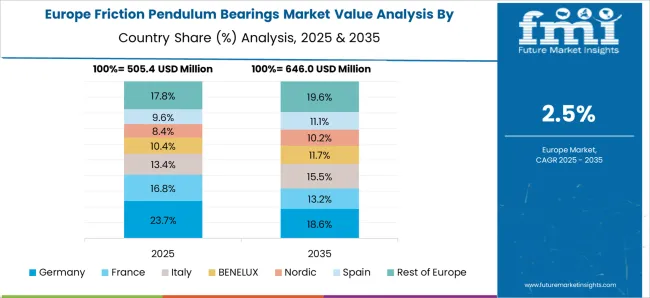

The friction pendulum bearings market is projected to expand globally at a CAGR of 5.0% from 2025 to 2035, with China leading at 6.8% as large bridge corridors, high rise programs, and code backed base isolation specifications are funded across priority provinces. India follows at 6.3%, supported by metro viaduct packages, hospital networks, and continuity requirements for essential facilities. France achieves 5.3%, aided by renewal of transport assets and performance based design for energy and public buildings. The UK posts 4.8% as procurement guidance favors certified isolation hardware and lower post event downtime. The USA maintains 4.3% as approvals prioritize tested sliding interfaces, documented maintenance regimes, and reliable re centering behavior across bridges, healthcare, and data infrastructure. An opinionated view suggests these shares will hold as lifecycle evidence, inspection readiness, and specification clarity are emphasized.

The CAGR for the China friction pendulum bearings market was around 5.4% during 2020–2024 and improved to 6.8% for the 2025–2035 period. The uptick has been linked to wider use of performance based design, stronger acceptance of re centering isolation, and procurement that favors qualified sliding interfaces with traceable testing. Provincial funding for transport corridors and public facilities has expanded witnessed prototype tests and vendor prequalification lists. Owners have emphasized displacement capacity, temperature stability of friction coefficients, and documented maintenance programs that satisfy insurer expectations. Localized machining capacity and stocked spare kits have shortened delivery schedules and reduced lifecycle uncertainty. An opinionated view holds that China will continue to outpace the global baseline as inspection readiness, retrofit packages for strategic bridges, and clear acceptance criteria support steady unit placements.

The CAGR for the India friction pendulum bearings market was around 5.0% during 2020–2024 and improved to 6.3% for 2025–2035. Growth has been supported by state funded transport packages, hospital networks prioritizing service continuity, and data infrastructure seeking predictable re centering under pulse type motions. Tender committees have required proven hysteretic behavior, sliding material stability, and inspection friendly detailing with calibration records. Local fabrication partnerships and installer training have lowered delivery risk and reduced commissioning delays. Standardized module geometries, pooled procurement across corridors, and clearer maintenance intervals have improved budgeting accuracy for owners. An opinionated assessment suggests that India will hold a premium over the global average as downtime avoidance, verifiable displacement capacity, and third party witnessed testing continue to shape specification outcomes.

The CAGR for the France friction pendulum bearings market was around 4.2% during 2020–2024 and improved to 5.3% for 2025–2035. Adoption has been guided by Eurocode 8 provisions, rigorous prototype testing, and emphasis on displacement checks for near fault motions. Owners have requested documented maintenance, spare kits, and calibration records to satisfy insurer and auditor requirements. Retrofit initiatives for selected bridges and hospitals have widened tender activity and created repeat orders for standardized sizes. Supply partners publishing acceptance bandwidths, wear characteristics, and friction coefficient ranges have seen higher shortlist rates. An opinionated reading is that France will sustain mid single digit growth as code clarity, witnessed testing, and transparent OPEX planning give buyers confidence to prioritize re centering isolation over conventional bearings in essential facilities.

The CAGR for the United Kingdom friction pendulum bearings market was around 3.8% during 2020–2024 and improved to 4.8% for 2025–2035. The shift has been linked to clearer procurement guidance, stronger acceptance of factory witnessed tests, and attention to friction coefficient stability across temperatures. Public asset renewal and lessons from seismic assessments of lifeline structures have strengthened specification choices. Vendor prequalification, documented maintenance plans, and inspection protocols have reduced perceived risk and improved schedule certainty. Owners are pricing downtime more explicitly, which favors re centering isolation with predictable hysteretic behavior. A reasoned view is that the United Kingdom will maintain this improved trajectory as guidance documents mature and retrofit packages expand beyond landmark projects.

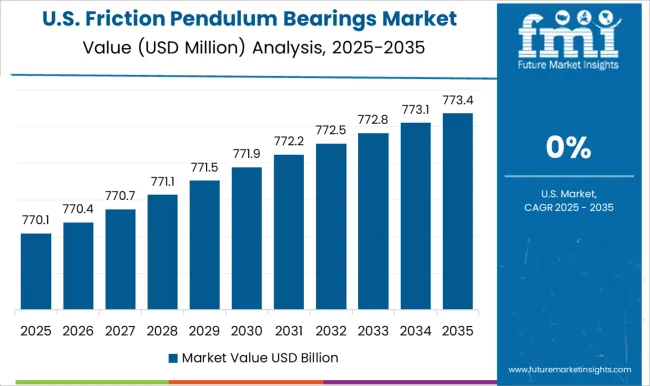

The CAGR for the United States friction pendulum bearings market was around 3.4% during 2020–2024 and improved to 4.3% for 2025–2035. Adoption has been guided by AASHTO and ASCE provisions, with buyers emphasizing displacement capacity, vertical load interaction, and wear characteristics of sliding materials under temperature variation. Larger programs in seismic states have accelerated factory testing and third party witnessing to tighten acceptance envelopes. Owners have requested maintenance plans, training, and spares to manage lifecycle uncertainty and assure re occupancy targets. Vendors offering calibration records, field inspection checklists, and stocked replacement kits have gained share in essential facilities. An opinionated view suggests a gradual step up will continue as insurers and public agencies quantify downtime costs more rigorously.

The friction pendulum bearings space has been shaped by specialized isolation suppliers with deep testing capability, rigorous documentation, and broad project references. Earthquake Protection Systems is viewed as a category shaper through high-displacement, multi-stage pendulum concepts and extensive full-scale qualification programs. FIP Industriale strengthens European coverage with code driven designs, witnessed factory tests, and lifecycle service packages. Bridgestone Corporation contributes through a wide isolation portfolio that pairs sliding systems with complementary bearings for complex bridge and building interfaces. Mageba expands reach across transport corridors and public facilities with standardized modules, traceable QA records, and site support. Dynamic Isolation Systems focuses on high hazard applications with custom geometries and documented re-centering behavior. Nippon Steel Engineering Co., Ltd. brings large infrastructure execution capacity, procurement credibility, and field training for operators.

Maurer SE differentiates with precision machining, surface finishing repeatability, and integration with expansion joints on long-span assets. Tensa reinforces tender competitiveness in Europe and selected export markets with tested sliding materials, spare kits, and maintenance schedules. Competitive positioning is influenced by proven hysteretic curves, friction coefficient stability across temperatures, certification to AASHTO and Eurocode frameworks, and the ability to deliver prequalified, inspection-ready hardware at predictable lead times. An opinionated read is that vendors publishing complete acceptance envelopes, calibration records, and clear OPEX guidance will keep winning specifications in hospitals, data centers, and lifeline bridges.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.2 Billion |

| Product Type | Double Concave, Single Concave, and Triple Concave |

| Material | Steel, Composite Materials, and Others |

| Installation Type | New Installation and Retrofit |

| Load Capacity | Medium Load Capacity, Low Load Capacity, and High Load Capacity |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | EarthquakeProtectionSystems(EPS), FIPIndustriale, BridgestoneCorporation, Mageba, DynamicIsolationSystems(DIS), NipponSteelEngineeringCo.,Ltd., MaurerSE, and Tensa |

| Additional Attributes | Dollar sales growth trends, share by application, regional share outlook, competitor share mapping, procurement share from infrastructure projects, pricing trends, regulatory impact, innovation pipeline. |

The global friction pendulum bearings market is estimated to be valued at USD 2.2 billion in 2025.

The market size for the friction pendulum bearings market is projected to reach USD 3.5 billion by 2035.

The friction pendulum bearings market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in friction pendulum bearings market are double concave, single concave and triple concave.

In terms of material, steel segment to command 41.3% share in the friction pendulum bearings market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Friction Roller Conveyor Market Size and Share Forecast Outlook 2025 to 2035

Frictionless Remote Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Friction Modifiers Market Size and Share Forecast Outlook 2025 to 2035

Friction Tape Market Analysis Size and Share Forecast Outlook 2025 to 2035

Friction Modifier Additives Market Trends 2025 to 2035

High Friction Films Market Size and Share Forecast Outlook 2025 to 2035

Zero Friction Coatings Market Size and Share Forecast Outlook 2025 to 2035

Clutch Friction Plate Market

Organic Friction Modifier Additives Market 2022 to 2032

Continuous Friction Tester Market Size and Share Forecast Outlook 2025 to 2035

Automotive Brake Friction Products Market - Trends & Forecast 2025 to 2035

Sensor Bearings Market Insights - Growth & Forecast 2025 to 2035

Marine Bearings Market Growth - Trends & Forecast 2025 to 2035

Thrust Bearings Market

Linear Bearings Market

Polymer Bearings Market Size and Share Forecast Outlook 2025 to 2035

Camshaft Bearings Market

Elastomeric Bearings Market Size and Share Forecast Outlook 2025 to 2035

Miniature Ball Bearings Market Analysis by Type, End-use and Region: Forecast for 2025 to 2035

ASEAN Automotive Bearings Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA