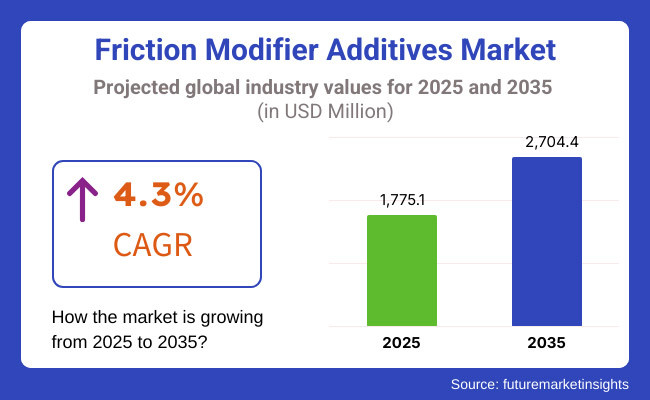

The Friction Modifier Additives Market is projected to grow from USD 1,775.1 million in 2025 to USD 2,704.4 million by 2035, reflecting a CAGR of 4.3% over the forecast period. The increasing demand for fuel efficiency, reduced emissions, and enhanced engine performance is driving market expansion.

Stringent environmental regulations, coupled with the rising adoption of low-viscosity lubricants, are further boosting demand for advanced friction modifiers. The growth of electric vehicles (EVs), hybrid technologies, and industrial machinery applications is reshaping the industry, fostering innovation in organic and nanotechnology-based friction modifiers for superior lubrication performance.

The friction modifier additives market is expanding due to advancements in lubrication technologies across automotive, industrial, and aerospace sectors. These additives enhance engine efficiency by reducing metal-to-metal contact, minimizing wear and tear, and optimizing fuel consumption.

In the automotive sector, stricter fuel economy regulations, such as CAFÉ standards in the USA and Euro 7 emission norms in Europe, are accelerating demand for friction-reducing lubricants. On the other hand, the industrial sector concurrently benefits from the rising trend of employing heavy machinery, high-performance lubricants in power generation, and manufacturing processes, which helps drive the overall market up. The rise of bio-based and biodegradable additives is making a breakthrough and is consistent with worldwide sustainability objectives.

The friction modifier additives market in North America is boosted by stringent fuel economy and emission standards initiated by the EPA and NHTSA. The trend for the automotive and industrial sectors to adopt environmentally friendly low-friction lubricants is becoming stronger with the implementation of these regulations that see a rise in efficiency and a decrease in carbon emissions.

In the region, the bio-based friction modifiers trend is on the rise, with environmentally friendly lubrication solutions gaining traction. Electric and hybrid vehicle (EV) is getting more and more popular in the USA and Canada which in turn boosts the lubricant with high-performance efficiency of drivetrains, gearboxes, and cooling systems, and thus longer market growth.

The EU carbon neutrality targets and imposed Euro 7 emission regulations are driving the move toward sustainable lubrication solutions in Europe. The region is strong in the consumption of organic and polymer-based friction modifiers with the top three importers being Germany, France, and the UK - the major industries shaping the market are automotive and industrial.

Diverse automakers are embracing the latest lubricant tech for the promotion of fuel consumption and engine wear reduction. New initiatives in renewable and biodegradable additives are arriving at the front, with producers choosing sustainable alternatives over traditional molybdenum- and phosphorus-based friction modifiers. Europe’s concentration on environmentally friendly industrial lubricants is predicted to result in regular market expansion.

Asia-Pacific is the fastest-expanding market, the driving force being the high automotive production rate in China, India, and Japan amid an increase in industrialization. The rise in disposable income and urbanization are the prime factors responsible for the demand for fuel-efficient vehicles, which in turn leads to higher friction modifier additives adoption in engine oils, transmission fluids, and industrial lubricants.

The region is also seeing visible changes in the production of electric vehicles, particularly in China, where public policies are in favor of sustainable automobile technology. With the expansion of industries like power generation, heavy machinery, and manufacturing, the demand for high-performance lubricants that include friction modifiers is growing, thus underlining Asia-Pacific's position as a leading market player.

Latin America experiences moderate growth in the market due to the increase of automotive manufacturing in Brazil, Mexico, and Argentina. Having higher ownership of vehicles and developing industrial sectors increases the demand for energy-efficient lubricants with friction modifiers to improve performance and, in turn, lower operational costs.

Governments in the area are promoting regulations that require constructors to make cars more fuel-efficient; this is a tendency that is also being adopted by the industries of lubrication technology. On the other hand, the aftermarket segment is also set to grow with the booming replacement additives aftermarket in both automotive and industrial sectors. Notably, issues such as political instability and dependence on externally sourced raw materials might bring botherance to the overall market expansion in the region.

The MEA market is steadily growing and mainly relies on the investments in energy production, mining, and heavy industries. The variation in the extreme weather conditions in the region such as high temperatures and sand exposure has necessitated high-performance lubricants with additional friction modifier additives. The automotive sector is experiencing growth also in the GCC countries where the increase in demand for luxury and commercial vehicles is causing a rise in lubrication innovation.

If we take Africa as an example, the increasing car ownership and improvement of infrastructure have resulted in more businesses selling aftermarket lubricants. Even though there exist challenges in terms of economic turbulence and political unrest, the area is likely to provide long-term opportunities in the industrial lubrication sector.

High Raw Material Costs and Supply Chain Disruption

The increases in raw materials such as molybdenum, phosphorus, and synthetic polymers are driving the costs up for production, causing trouble for friction modifier additive manufacturers. Global supply chain interruptions that have been caused by the geopolitical conflicts and trade bans have led to price fluctuations and delivery delays.

The variations in crude oil costs are affecting absolutely the cost of petroleum-based additives, which creates an environment of uncertainty in the market. To face these obstacles, companies are widening their supply chains, starting the domestic raw material production, and making a study of alternative materials. The turn to the recyclable and bio-based additives is seeing an increase as a motivating factor and a possible solution for the costs.

Regulatory Restrictions on Certain Additive Components

Strict environmental laws have made it impossible to use phosphorus, sulfur, and other elements metal-based additives in lubricant products. Through the legislation and by the authorities, governments, and regulatory bodies (especially in Europe and North America) are creating a framework of eco-friendly lubricant technologies to make the world cleaner and greener.

Though bio-based and synthetic polymers are making ground for the time being, their performance wear and durability properties have a long way to reach the ones found in traditional additives. Part-makers will have to channel resources into R&D so as to invent the following-generation additives that meet the norms imposed and remain cost-efficient, and friction-reducing across various fields.

The Growth in Electric and Hybrid Vehicle Lubrication Solutions

The increasing demand for low-friction lubricants that integrate energy efficiency and thermal management is directly related to the expansion of electric and hybrid vehicles. Quite simply, electric vehicle (EV) as opposed to the traditional internal combustion engine (ICE) requires specific lubricants to avoid wear in the gearbox, bearings, and cooling systems.

This is a welcome opportunity for manufacturers of friction modifier additives to produce new exclusive formulations dedicated to EVs which would imply better performance, longer life of the lubricant, and maximized thermal conductivity. The advent of connected vehicles and self-driving cars will go a step further in the development of lubrication technologies, which in turn will be the additive producer's income.

The Advancements in Nanotechnology-Based Friction Modifiers

The lubricant additive sector is undergoing a rise in the use of nanotechnology, which, in turn, is driving the potential for high-performance friction modifiers' growth. Nanoparticle-additives, which are masonry-like ceramics or carbon nanotubes, offer superior lubricant qualities, cut down friction, and provide considerably higher wear-resistance than the typical organic and inorganic modifiers.

These cleaner additives help in cutting back on fuel consumption, increasing engine longevity, and optimizing the performance of industrial machines. Aerospace, military, and performance automotive industries are adopting nanostructured lubricants for extreme operating conditions. Investing in research and development of nanotechnology in a company yields a competitive edge and unlocks the potential for energy-efficient, long-lasting lubrication.

The friction modifier additives market is a key player in making lubricants more efficient, and hence more durable, for use in various applications, including automotive, industrial, and machinery. The use of those products is targeted at cutting down on friction and wear, and at improving the fuel economy of the respective engines, transmissions, and hydraulic systems.

The growth is mainly due to the upsurge in the fuel-efficient vehicle market, strict environmental policies, and technological innovations in the lubricant sector. The pivot to low viscosity Recommendations, developments in bio-based and nanoparticle-based additives is getting more promising, whereas industries are focusing on sustainability and yielding partly better performance.

Comparative Market Analysis

| Market Shift | 2025 (Projected) |

|---|---|

| Regulatory Trends | Emission control regulations driving the demand for more fuel-efficient additives. |

| Technological Breakthroughs | Creation of molybdenum-based and friction modifiers of organic origin. |

| Sector-Specific Demand | Automotive and industrial machinery lead in consumption. |

| Sustainability & Circular Economy | Early transition to bio-based and environmentally-considerate additives. |

| Manufacturing & Supply Chain | A global supply chain that largely depends on the availability of raw materials (molybdenum, esters, etc.). |

| Market Growth Triggers | Increase in vehicle production, fuel efficiency requirements, and industrial automation. |

| Market Shift | 2035 (Forecasted) |

|---|---|

| Regulatory Trends | New, more stringent carbon neutrality goals mandating the use of sustainable, low-friction solutions. |

| Technological Breakthroughs | Establishment of nanoparticle-based, bio-based, and intelligent additive formulations. |

| Sector-Specific Demand | Integration into EV powertrains, robotics, and high-performance lubricants |

| Sustainability & Circular Economy | Adoption of biodegradable and non-toxic friction modifiers in green lubricants. |

| Manufacturing & Supply Chain | Localized production and closed-loop supply chains to lessen geopolitical risks. |

| Market Growth Triggers | Development of electric vehicles, robotics, and high-performance lubricants for special applications. |

The friction modifier additives market in the USA is on the rise, owing to the stringent emission regulations, increase in fuel efficiency standards, and the diversification of the lubricant industry. The driving forces for automobile makers are the Environmental Protection Agency (EPA) and Corporate Average Fuel Economy (CAFE) regulations which have mandated the use of low-friction additives in the engine oils and transmission fluids.

The rapid development in the industrial sector and the upsurge in the need for machinery that utilizes energy-efficient lubricants are also some of the factors propelling the market. The other added factor is the selling of electric and hybrid vehicles, which, in turn, is leading to the e-transmission fluids shift towards the requirement of low-friction properties.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 3.7% |

The UK friction modifier additives market is on the rise because of the implemented strict carbon emission targets, the increase in hybrid vehicle sales, and the trend towards the introduction of sustainable lubrication solutions. The UK's net-zero emissions policy and the ban of ICEs by 2035 are major factors in pushing the development of low friction, fuel-saving lubricants.

The rise of luxury and performance vehicles is a key factor in the demand for additives to friction that booster engine and transmission efficiency. The manufacturers of advanced lubricants are also experiencing the effect of the industrial sector's shift towards automation and the need for energy savings.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.1% |

The market for friction reducer components in Europe is on the upswing mainly because of the stringent Euro 7 emission regulations and technological improvements in lubricant formulations apart from the sturdy automotive sector. In Europe, car manufacturers are at the forefront with the production of more fuel-efficient and hybrid vehicles which translates to the need for low-friction engine and transmission fluids.

The utilization of top-tier lubricants in heavy equipment is justified by industrial automation and construction machinery's growth trending in the right direction along with the pathway that the EU sets for companies to attain sustainability marks. As a result, these factors stimulate the market for organic friction modifiers.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.4% |

The high-tech sector has played a significant role in the development of the friction modifier additives market in Japan which is also attributed to the fast rate of hybrid automotive vehicles in the country and the strength of the industrial sector. Japanese vehicle manufacturers are the ones who start using the most comprehensive and state-of-the-art technologies in the sector thus, they make a demand for low-friction engine oil and transmission oil.

The reduction of friction through the addition of advanced friction-reducing additives in machinery and equipment is the main reason behind Japan's thrust on precision engineering and industrial automation. Besides, the country's sustainability projects have been accompanying the use of bio-based friction modifiers.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.2% |

Organic Friction Modifiers Lead Due to Fuel Efficiency and Eco-Friendliness

The organic friction modifier additives, especially those of fatty acids and esters are the prevailing ones in the market due to their biodegradability, low sulfur fuel compatibility and the fuel economy benefits that they offer. These additives create a covering boundary layer, which results in decreased friction and wear in automotive and industrial lubricants.

The shift towards fully green and sustainable lubrication products, mainly in Europe and North America, has driven even more their application. Under the pressure of environmental agencies introducing tough fuel efficiency and emission regulations, car producers and lubricant makers are cognizant of the need to utilize these organic friction modifiers to increase the performance of the engine and subsequently decrease the oil change intervals.

MoDTC Gaining Popularity in High-Performance Lubricants

Among inorganic friction modifiers, Molybdenum Dithiocarbamate (MoDTC) is experiencing significant demand due to its superior anti-wear and friction-reducing properties. MoDTC is predominantly used in car and industrial lubricants concerning high temperature and high load such as heavy-duty diesel engine and transmission fluids.

MoDTC's capacity for working in challenging oxygen and pressure scenarios is the reason for it being a pivotal supplement in high-performance lubricants. In the course of the engine miniaturization and electrification trends, MoDTC is still the hero of the day, in terms of performance, durability, and efficiency in modern lubrication.

Automobile Lubricants Drive Market Growth with Rising Vehicle Demand

The automobile lubricants segment holds the key share of the market as a result of the expanding vehicle production globally, the increased utilization of synthetic lubricants, and also the enactment of restrictive emission regulations. Friction modifier additives occupy as much as 30 percent of the share in the application of oils for engines, oil for transmission fluids, and oil for gears.

The gradual progression toward high-performance, low-viscosity lubricants is evident, particularly in hybrid and electric vehicles, thus providing additional support to the market. The absolutely fast automotive boom in the Asia-Pacific region, particularly in China and India, highlights the key space for advanced friction-reducing additives in modern lubricants.

Industrial Lubricants Maintain Strong Demand for Equipment Efficiency

Industrial lubricants are a prominently specified and utilized segment, given that most factories demand exceptionally high performance lube solutions to minimize friction, deteriorate machinery and down time. Friction modifier additives are also used in hydraulic oils, gear oils as a protective element on compressor oils, thus ensuring the smooth operation of the equipment in manufacturing, construction, and mining.

The efficiency in energy and sustainability in the industries, especially in Europe and North America are the key factors that have been driving the push for advanced friction modifiers. Additionally, the advent of Industry 4.0 and automation is fueling the demand for lubricants with a higher standard, thereby fortifying this segment's growth.

In the lubricant and fuel additive industry friction modifier additives are a very important segment, targeted to get the most of the benefits from fuel energy, minimizing wear, and improving overall engine performance. They are characterized by applications in automobile lubricants, industrial oils, and aviation fluids.

The key drive of the market is the increase in the demand for fuel-efficient vehicles, strict emission regulations, and innovations in tribology (friction science). Some of the leaders in this market are Afton Chemical Corporation, The Lubrizol Corporation, Infineum International Limited, BASF SE, and Croda International Plc. Various regional players steer the growth of the market mostly in Asia-Pacific and North America.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Afton Chemical Corporation | 18-22% |

| The Lubrizol Corporation | 14-18% |

| Infineum International Limited | 12-16% |

| BASF SE | 10-14% |

| Croda International Plc | 6-10% |

| Other Companies (combined) | 35-45% |

| Company Name | Key Offerings/Activities |

|---|---|

| Afton Chemical Corporation | Develops high-performance friction modifiers for automotive and industrial lubricants. |

| The Lubrizol Corporation | Specializes in advanced tribology solutions for energy-efficient lubricants. |

| Infineum International Limited | Provides friction modifier additives for low-viscosity engine oils. |

| BASF SE | Offers chemical-based friction reduction solutions with a focus on sustainability. |

| Croda International Plc | Manufactures bio-based and synthetic ester-based friction modifiers. |

Key Company Insights

Afton Chemical Corporation

Afton Chemical has secured its position as the top player in synthetic lubricant additives, concentrating especially on the technological development of friction modification for automotive, industrial, and aviation purposes. The corporation produces organic and molybdenum-based friction modifiers enhancing fuel economy and reducing engine wear.

The company's research-based model is responsible for the production of low-viscosity additives specifically designed for evolving engine usage. Afton regards sustainability as a crucial aspect, thus, it opts for low-emission and biodegradable options that comply with tougher environmental standards. Besides that, the company has a solid presence in North America, Europe, and Asia, and it also stays on the truck of technological changes to broaden its market.

The Lubrizol Corporation

The Lubrizol Corporation is a key factor in the lubricant and fuel additives segment, providing high-performance tribological solutions that increase the effectiveness of energy and reduce emissions. Molybdenum-based and friction modifiers of the company are commonly utilized in engine oils, transmission fluids, and gear oils.

Long-term research of the company led to the success in creating new generation polymer-based friction modifiers which in turn boost wear protection. The strength of its global position and the strategic connections with automotive OEMs as well as industrial manufacturers enhances Lubrizol's market power. As sustainability becomes one of the main goals of the company, Lubrizol is consistently evolving bio-based and environmentally friendly additive technologies.

Infineum International Limited

Infineum is a specialized manufacturer of friction modifier additives for fuel-efficient, low viscosities engine oils, addressing mainly the automotive and heavy-duty industry. The company esters that are the basis of their friction modifiers and other organic substances that are used in the products. Infineum has always been the leading company when it comes to the compliance of regulations, and it ensures that its products are conforming to the latest API and ILSAC standards.

The company’s unique collaboration of ExxonMobil and Shell gives it solid financial backing and access to world markets. Infineum's advanced technology in hybrid and electric vehicle lubricants solidifies its position in the sector as a well-known supplier to the automotive industry.

BASF SE

BASF SE is a well-known chemical company that offers friction reduction solutions that are of high quality for lubricants, industrial fluids, and specialty applications. The company's use of metal-free, organic and nanotechnology twisted friction modifiers provides increased energy efficiency due to less mechanical wear.

The company aims for sustainable chemistry by developing additive solutions that are biodegradable and non-toxic. Together, the company’s robust global supply chain and production capabilities make it a trustworthy supplier of lubricant manufacturing all over the world. Additionally, BASF’s constant investments in green chemistry, as well as synthetic ester production, assert its open central role in the friction modifier additives sector.

Croda International Plc

Croda International is a top company in the bio-based and synthetic friction modifiers sector, which provides largely ester-based and polymeric additives that enhance efficiency and lubrication. The company, with its renewable chemistry focus, is the right partner for environmentally friendly lubricant formulations.

Croda's friction modifiers are used widely in automotive, industrial and aviation lubricants, and more as electric vehicle sales are soaring. Its robust commitment to becoming more sustainable and keeping abreast with the regulation gives it an overpowering strength in a market that often shifts to eco-friendly products.

Other Key Players

The global Friction Modifier Additives market is projected to reach USD 1,775.1 million by the end of 2025.

The market is anticipated to grow at a CAGR of 4.3% over the forecast period.

By 2035, the Friction Modifier Additives market is expected to reach USD 2,704.4 million.

The organic friction modifiers segment is expected to dominate due to their superior performance in reducing wear, enhancing fuel efficiency, and meeting stringent environmental regulations.

Key players in the market include The Lubrizol Corporation, Afton Chemical Corporation, BASF SE, Croda International Plc, and Infineum International Ltd.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Tons) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 10: North America Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 12: North America Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 16: Latin America Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 18: Latin America Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Western Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 21: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 22: Western Europe Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: Western Europe Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Eastern Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 28: Eastern Europe Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Eastern Europe Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia and Pacific Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 34: South Asia and Pacific Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 36: South Asia and Pacific Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: East Asia Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 40: East Asia Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 42: East Asia Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 46: Middle East and Africa Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 48: Middle East and Africa Market Volume (Tons) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Tons) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 9: Global Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 13: Global Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 16: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 17: Global Market Attractiveness by Application, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 27: North America Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 31: North America Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 34: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 35: North America Market Attractiveness by Application, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 45: Latin America Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 49: Latin America Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 53: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 56: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 57: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Western Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 63: Western Europe Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 66: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 67: Western Europe Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 70: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 71: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 72: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 74: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Eastern Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 81: Eastern Europe Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 85: Eastern Europe Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 88: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 89: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 90: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 92: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: South Asia and Pacific Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 99: South Asia and Pacific Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 103: South Asia and Pacific Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 106: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 107: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 110: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 113: East Asia Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 117: East Asia Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 120: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 121: East Asia Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 122: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 124: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 125: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 126: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 127: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 128: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 131: Middle East and Africa Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 135: Middle East and Africa Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 139: Middle East and Africa Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 142: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 143: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 144: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Organic Friction Modifier Additives Market 2022 to 2032

Friction Modifiers Market Size and Share Forecast Outlook 2025 to 2035

Friction Roller Conveyor Market Size and Share Forecast Outlook 2025 to 2035

Additives for Metalworking Fluids Market Size and Share Forecast Outlook 2025 to 2035

Friction Pendulum Bearings Market Size and Share Forecast Outlook 2025 to 2035

Frictionless Remote Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Friction Tape Market Analysis Size and Share Forecast Outlook 2025 to 2035

Additives for Floor Coatings Market

Ink Additives Market Growth – Trends & Forecast 2025 to 2035

Gut Modifiers Market

High Friction Films Market Size and Share Forecast Outlook 2025 to 2035

Zero Friction Coatings Market Size and Share Forecast Outlook 2025 to 2035

Seed Additives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Fuel Additives Market Segmentation based on Type, Application, and Region: Forecast for 2025 and 2035

Metal Modifiers Market Size and Share Forecast Outlook 2025 to 2035

Amine Additives in Paints and Coatings Market

Clutch Friction Plate Market

Impact Modifier Market Growth & Trends 2018-2028

Bitumen Modifier Industry Analysis in Europe Size and Share Forecast Outlook 2025 to 2035

Sensory Modifier Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA