The bitumen modifier industry in Europe is experiencing consistent growth. Increasing infrastructure investments, stringent environmental regulations, and rising demand for high-performance road materials are driving market expansion. Current industry trends indicate a strong shift toward sustainable and durable solutions, with emphasis on reducing lifecycle costs and enhancing pavement longevity.

The adoption of advanced modifiers is being supported by technological innovation and the modernization of existing road networks across European countries. Government initiatives focusing on energy efficiency and green construction are further encouraging the use of polymer-modified bitumen. The future outlook remains positive, with steady demand anticipated from large-scale infrastructure renewal projects and the ongoing development of smart transportation systems.

Growth rationale is reinforced by continued research into eco-friendly modifier formulations, improved recyclability, and performance optimization under variable climatic conditions These factors collectively ensure that the European bitumen modifier industry remains well-positioned for long-term, stable growth.

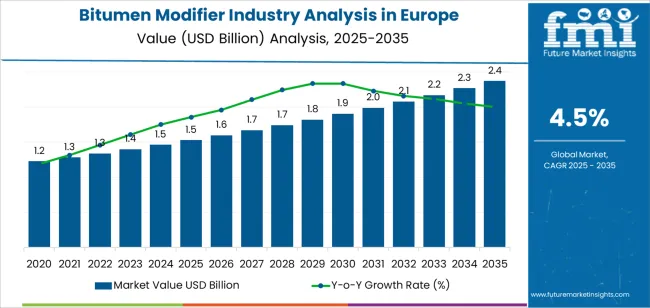

| Metric | Value |

|---|---|

| Bitumen Modifier Industry Analysis in Europe Estimated Value in (2025 E) | USD 1.5 billion |

| Bitumen Modifier Industry Analysis in Europe Forecast Value in (2035 F) | USD 2.4 billion |

| Forecast CAGR (2025 to 2035) | 4.5% |

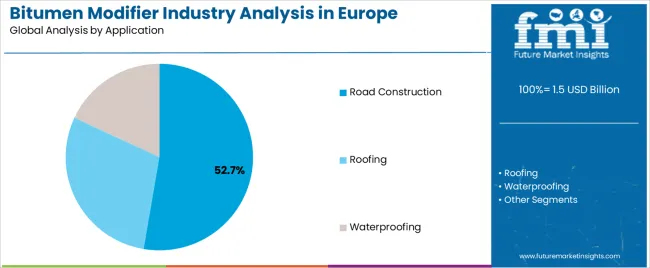

The market is segmented by Product Type and Application and region. By Product Type, the market is divided into Thermoplastic Polymers/Plastomers, Elastomers, Thermoplastic Elastomers, Thermosetting Polymers, and Chemical Modifiers. In terms of Application, the market is classified into Road Construction, Roofing, and Waterproofing. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

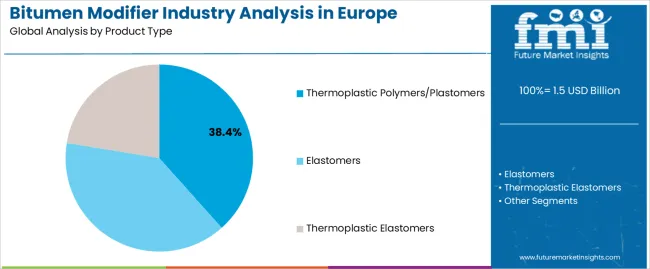

The thermoplastic polymers/plastomers segment, accounting for 38.40% of the product type category, has emerged as the leading product type owing to its superior flexibility, thermal stability, and resistance to deformation. Its application has been preferred in both new road constructions and rehabilitation projects due to improved durability and enhanced performance under high traffic loads.

The segment’s dominance is being sustained by ongoing technological advancements that enable efficient blending with bitumen and compatibility with diverse asphalt compositions. Producers are focusing on cost-effective production processes and quality control to ensure consistency across large-scale projects.

The increasing shift toward polymer-modified solutions, combined with strong regulatory endorsement for sustainable infrastructure materials, is expected to further strengthen the share of thermoplastic polymers/plastomers in the European bitumen modifier industry over the forecast period.

The road construction segment, holding 52.70% of the application category, continues to dominate the European bitumen modifier industry due to extensive public and private infrastructure development initiatives. The segment’s growth has been supported by the need for durable, weather-resistant road surfaces capable of withstanding heavy vehicle loads and extreme climatic conditions.

Adoption is being driven by government-funded road modernization programs, including trans-European transport networks and urban mobility upgrades. The integration of modified bitumen in highway and airport pavement construction has enhanced service life and reduced maintenance costs.

Continuous investment in green and smart infrastructure projects, along with the use of advanced testing and monitoring technologies, is anticipated to sustain demand within this segment The steady expansion of transport infrastructure across Europe ensures that road construction remains the most influential application in shaping the regional bitumen modifier market landscape.

Revenue in Europe to Expand Nearly 1.6X through 2035

The Europe bitumen modifier industry revenue is set to expand around 1.6x through 2035, amid a 2.5% spike in anticipated CAGR compared to the historical one. This is due to a variety of factors, including increasing infrastructure development initiatives, rising demand for enhanced road quality, and advancements in bitumen modification technologies.

Sales of bitumen modifiers in Europe are also expected to rise due to stringent regulations mandating the use of high-quality road construction materials. By 2035, the total industry revenue is set to reach USD 2,276.7 million.

Other Factors Propelling Growth of Bitumen Modifier Industry in Europe include:

Growing awareness about the benefits of modified bitumen in enhancing road durability and performance is set to drive demand. Rapid urbanization and the necessity of contemporary transportation networks are likely to augment growth.

Rising heavy load traffic and extreme weather conditions, as well as improvements in additive formulations would propel demand. Rise in building renovation projects is another crucial factor expected to boost sales.

Robust regulatory guidelines requiring the use of modified bitumen in waterproofing and road construction are anticipated to spur demand. Increasing demand for sustainable pavements, including sustainable bitumen solutions, is likely to aid sales. Development of advanced bitumen modification technology is expected to push growth.

Shift toward bitumen modifiers made for bio-based and recycled materials is anticipated to create new opportunities of manufacturers. Growing popularity of modified bitumen roofing systems and increasing preference for polymer-modified bitumen are also likely to support demand.

Ongoing development of novel bitumen modifiers with improved features and advancements in nanotechnology & construction materials are expected to bolster sales. Lastly, rising demand for chemical modifiers for bitumen is anticipated to drive growth.

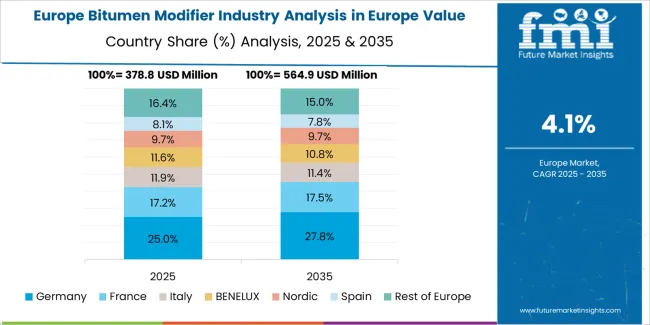

Germany is Becoming a Hub for Bitumen Modifier Manufacturers

As per the latest analysis, Germany is expected to remain a highly lucrative pocket for bitumen modifier manufacturers across Europe. It is set to hold around 18.2% of the Europe bitumen modifier industry share in 2035. This is attributed to the following factors:

Germany possesses a highly advanced technological landscape characterized by non-stop innovation and research & developments in bitumen modifiers. This technological expertise enables German producers to broaden cutting-edge products with greater performance traits, meeting the evolving needs of the industry.

Germany's strategic geographical location inside the heart of Europe performs a pivotal position in its dominance. The country connects to neighboring European countries, serving as a central logistics hub and facilitating systematic transportation and distribution networks for bitumen modifiers. This strategic benefit permits German companies to efficiently cater to the various wishes of customers throughout the continent, similarly consolidating their marketplace function.

Thermoplastic Polymers/Plastomers Remain Top Selling Product Types in Europe

As per the report, thermoplastic polymers/plastomers segment is expected to dominate the Europe bitumen modifier industry, with a volume share of about 38.1% in 2025. This is attributable to the increasing demand for durable and flexible road surfaces and the versatility and effectiveness of thermoplastic polymers/plastomers in enhancing bitumen properties.

Thermoplastic polymer/plastomers are widely used as bitumen modifiers across Europe. This can be attributed to their better flexibility, adhesion, and higher durability as compared to other material types.

Thermoplastic polymers/plastomers offer cost-effectiveness and ease of manufacture. This is making them the preferred choice for various bitumen modification applications across Europe.

Thermoplastic elastomers, on the other hand, are anticipated to witness a higher demand, rising at 5.4% CAGR during the forecast period. This surge in demand can be attributed to their unique properties, such as flexibility, durability, and resilience, which make them ideal for various applications in the modification of bitumen.

Bitumen modifiers are becoming ideal solutions for increasing the performance of bitumen. These modifiers increase bitumen's flexibility, durability, and adhesion, fueling their demand across regions like Europe.

Bitumen modifiers help meet the various requirements of road construction, airfields, and railway tracks. Hence, expansion of these sectors will likely propel bitumen modifier sales in Europe.

Increasing infrastructure projects across nations in Europe are anticipated to boost the demand for bitumen modifiers. Growing need for durable and sustainable infrastructure solutions in Europe is another key factor expected to boost sales growth.

The industry is witnessing the introduction of innovative products and technologies such as thermoplastic polymers and elastomers. This will likely support industry expansion through 2035.

Sales of bitumen modifiers across Europe grew at a CAGR of 2.0% between 2020 and 2025. Total industry revenue reached about USD 1,402.1 million in 2025. In the forecast period, the Europe bitumen modifier industry is projected to expand at a CAGR of 4.5%.

| Historical CAGR (2020 to 2025) | 2.0% |

|---|---|

| Forecast CAGR (2025 to 2035) | 4.5% |

The European bitumen modifier industry witnessed sluggish growth between 2020 and 2025. This was due to the impact of the COVID-19 pandemic, which resulted in decreased road construction activities. On the other hand, increased demand for enhanced road infrastructure and construction projects provided impetus for industry growth.

Demand for bitumen modifiers in Europe is anticipated to rise steadily over the next ten years, with total valuation reaching USD 2,276.7 million by 2035. This is attributable to factors like increasing road construction and maintenance activities and rising need for high-quality construction materials.

The increasing heavy load traffic and extreme weather conditions are necessitating the use of bitumen modifiers across Europe. These modifiers have the ability to significantly enhance bitumen performance.

Growing awareness about the superior quality of modified bitumen is expected to foster industry growth. Modified bitumen offers enhanced pavement performance and longevity. As a result, it is gaining wider popularity across Europe, thereby positively impacting bitumen modifier sales.

Expansion of transport infrastructure is expected to create need for high-quality modified bitumen. Similarly, growing demand for eco-friendly and recycled polymers is transforming the bitumen modification industry.

Rising Heavy Load Traffic and Extreme Weather Conditions Fueling demand

Infrastructure faces increasing challenges due to heavier traffic loads and more extreme weather conditions caused by climate change. This increases the need for additives like bitumen modifiers that enhance the durability of bitumen which is used in construction.

Modifiers such as polymer modifiers and chemical enhancers improve the resilience of roads, runways, and railways, increasing their lifespan and reducing maintenance costs. The demand for these modifiers is expected to rise as governments and private sectors invest in infrastructure durability to overcome these challenges.

Extreme weather events like droughts, heatwaves, and storms have become more frequent, impacting public health, water resources, agriculture, and infrastructure across Europe. The increasing occurrence of extreme weather conditions due to climate change is set to drive demand for bitumen modifiers.

Bitumen modifiers enhance infrastructure durability, offering solutions to combat damage caused by heatwaves, storms, and floods. As a result, their adoption is increasing steadily across Europe, and the trend will likely persist during the next ten years.

Rising Demand for Building Renovation Fostering Sales Growth

The rising building renovation and remodeling trend significantly influences the bitumen modifier industry, particularly in roofing and waterproofing applications. As older structures require refurbishment, there's a heightened need for durable and reliable roofing and waterproofing solutions, including bitumen modifiers.

Modified bitumen, known for its enhanced performance and longevity, has become a preferred choice in renovation applications. This is due to its superior qualities compared to traditional bitumen.

Governments and private organizations across Europe are promoting sustainable construction practices. They are investing in infrastructure renewal projects, including the restoration of roofs and waterproofing systems. This is expected to propel bitumen modifier demand.

Superior Quality of Modified Bitumen Creating Growth Prospects

The superior quality of modified bitumen compared to standard bitumen is a significant growth driver of the industry. Modified bitumen offers enhanced durability, flexibility, and resistance to aging and weathering. These qualities make it highly desirable for a wide range of applications, including road construction, roofing, waterproofing, and many more.

The increasing demand for infrastructure solutions that can withstand harsh environmental conditions and heavy traffic loads is expected to fuel sales of bitumen modifiers. Modified bitumen's ability to resist cracking, rutting, and other forms of damage makes it particularly attractive for road construction projects.

Roads built with modified bitumen experience reduced maintenance needs and longer service lives, resulting in cost savings for governments and project owners. Hence, growing need for modified bitumen due to its excellent properties will play a key role in fueling bitumen modifier demand across Europe.

In roofing applications, modified bitumen provides superior waterproofing capabilities, protecting buildings from water infiltration and weather-related damage. This results in longer-lasting roofs with fewer leaks and repairs, making it a preferred choice for commercial and residential construction projects.

Fluctuating Crude Oil Prices

Fluctuating crude oil prices significantly restrain the bitumen modifier industry in Europe. These price fluctuations create market instability as businesses struggle to predict and manage their expenses effectively.

When crude oil prices rise unexpectedly, manufacturers face increased production costs, leading to higher product prices and reduced profit margins. When oil prices decline, pressure to lower product prices to remain competitive may further impact profitability.

The fluctuation directly impacts the cost of bitumen production, affecting the profitability of additives used for bitumen modification. Market instability arises from the unpredictable nature of oil price fluctuations, making it difficult for manufacturers to plan and invest in research and development.

Occupational Health Hazards

The occupational health hazards, particularly burn and respiratory irritation linked to hot bitumen handling, significantly restrain industry growth. This restraint stems from several factors, such as strict safety regulations requiring substantial investments in personal protective equipment, including heat-resistant clothing, gloves, safety glasses, and face shields.

Bitumen product makers need to follow safety rules and report about any risky additives used. They should also mention hazards from other materials. The amount of additives varies, and documents for paving, roofing, and asphalt sectors explain how these affect safety downstream.

The necessity for robust safety measures and stringent regulatory compliance presents a formidable obstacle to players in promoting and selling bitumen additives. The industry's growth prospects remain constrained without adequate measures to address these occupational hazards, hindering its widespread adoption across the construction industry.

Concerted efforts toward enhancing workplace safety and mitigating health risks are imperative to foster sustainable growth and ensure the well-being of industry workers. Hence, key players will need to address these issues to stay ahead of the competition.

The table below highlights key countries’ bitumen modifier industry revenues. Germany, Russia, and France are expected to remain the top three consumers of bitumen modifiers, with expected valuations of USD 2.4 million, USD 367.4 million, and USD 363.0 million, respectively, in 2035.

| Countries | Projected Bitumen Modifier Industry Revenue (2035) |

|---|---|

| Germany | USD 2.4 million |

| Russia | USD 367.4 million |

| France | USD 363.0 million |

| Spain | USD 287.9 million |

| United Kingdom | USD 269.4 million |

The table below shows the estimated growth rates of the top five countries. The Czech Republic, Norway, and Austria are set to record high CAGRs of 6.8%, 6.4%, and 6.0%, respectively, through 2035.

| Countries | Expected Bitumen Modifier CAGR (2025 to 2035) |

|---|---|

| Czech Republic | 6.8% |

| Norway | 6.4% |

| Austria | 6.0% |

| Spain | 5.6% |

| Russia | 5.2% |

Germany’s bitumen modifier industry is estimated to be valued at USD 2.4 million by 2035. It will likely record steady growth during the forecast period, with overall demand for bitumen modifiers rising at 3.5% CAGR.

Thermoplastic polymers/plastomers and elastomers are increasingly utilized in Germany. These materials offer superior performance and durability, making them the preferred choice for bitumen modification.

The country's robust infrastructure projects and high construction activities demand high-quality modifiers, driving industry growth. Germany's focus on sustainable development aligns with the eco-friendly nature of bitumen modifiers, further boosting their adoption. Favorable government initiatives and policies promoting infrastructure development and sustainability initiatives in Germany are expected to propel industry growth.

As per the latest report, Russia’s bitumen modifier industry size is anticipated to reach USD 367.4 million by 2035. Sales of bitumen modifiers in Russia are predicted to surge at 5.2% CAGR throughout the forecast period.

Russia's continuous focus on upgrading its transportation infrastructure is leading to a surge in road construction and maintenance activities across the country. This increased emphasis on building and renovating roads to accommodate growing traffic volumes and ensure smoother transportation networks is significantly boosting demand for bitumen modifiers.

Bitumen modifiers are crucial in enhancing the durability, resilience, and performance of asphalt pavements. They are particularly ideal for regions such as Russia, which is prone to harsh weather conditions like frost, snow, and heavy rainfall.

Russia's government is actively investing in infrastructure development to stimulate economic growth and foster regional connectivity. This is expected to provide impetus for the growth of bitumen modifier industry.

Through various initiatives and funding programs, such as the Federal Road Fund and National Infrastructure Projects, substantial investments are being made in the expansion, modernization, and rehabilitation of road networks nationwide. These investments are set to create opportunities for the adoption of advanced road construction technologies and materials, including bitumen modifiers.

France’s bitumen modifier industry size is projected to reach USD 363.0 million by 2035. Over the forecast period, demand for bitumen modifiers in France is set to rise at 3.8% CAGR.

France has stringent regulations and quality standards governing road construction materials. The government mandates the use of high-quality, durable materials to ensure the longevity and safety of infrastructure projects.

Bitumen modifiers that meet quality standards and offer superior performance in terms of durability, weather resistance, and pavement life expectancy are in high demand among contractors and road authorities.

France is at the forefront of technological advancements in road construction and maintenance. There's a growing trend toward adopting innovative solutions and technologies to address the challenges associated with aging infrastructure, climate change, and sustainability. This will likely foster sales growth in the country.

Bitumen modifier manufacturers in France are investing in research and development to develop advanced formulations. For instance, they are developing modifiers with improved properties such as enhanced elasticity, fatigue resistance, and reduced environmental impact. This will help them to stay ahead of the competition.

Innovation-driven companies that offer tailored solutions to address specific challenges faced by road construction projects in France are likely to experience sustained growth. Similarly, companies using sustainable materials are expected to gain momentum in countries like France.

The United Kingdom bitumen modifier industry value is projected to total USD 269.4 million by 2035. Over the projected period, sales of bitumen modifiers in the United Kingdom are set to rise at 4.2% CAGR.

The United Kingdom's stringent regulations on road safety and environmental standards drive the demand for advanced bitumen modifiers. They are not only used in road construction but also in other sectors such as airports, households, and roofing. Government initiatives promoting sustainable infrastructure development and innovation in construction materials create a conducive environment for industry growth.

The United Kingdom's commitment to investing in research and development fosters the adoption of novel bitumen modification technologies. This will further improve the nation’s bitumen modifier industry share through 2035.

The nation's ongoing urbanization and infrastructure development projects, including road expansions, maintenance, and renovation, are set to fuel demand for high-performance bitumen modifiers. Bitumen modifiers also find extensive use in airport runway construction, household roofing, and various industrial applications. These versatile applications drive bitumen modifier sales, as they enhance the durability, flexibility, and longevity of asphalt pavements and other bitumen-based products.

The section below shows the thermoplastic polymers/plastomers segment dominating the Europe industry. It is set to grow at a CAGR of 4.3% through 2035. Based on application, the road construction segment is estimated to exhibit a CAGR of 4.1% from 2025 to 2035.

| Top Segment (Product Type) | Thermoplastic Polymers/Plastomers |

|---|---|

| Predicted CAGR (2025 to 2035) | 4.3% |

As per the latest analysis, thermoplastic polymers remain the most commonly used bitumen modifiers across Europe. This can be attributed to their multiple advantages, including durability, elasticity, strength, and cost-effectiveness.

Demand for thermoplastic polymers/plastomers as bitumen modifiers is projected to grow at 4.3% CAGR during the forecast period. The target segment is estimated to generate revenue worth USD 1.5 million in 2025.

Thermoplastic polymers/plastomers offer excellent flexibility and durability, making them ideal for enhancing the performance and longevity of bitumen. Their ease of use and compatibility with various bitumen formulations contribute to their widespread adoption.

Thermoplastic polymers/plastomers exhibit superior resistance to environmental factors such as temperature variations and moisture. This is further enhancing their suitability for diverse applications. Their versatility and ability to improve key properties of bitumen, including elasticity and adhesion, position them as the preferred choice among manufacturers and end-users alike.

| Top Segment (Application) | Road Construction |

|---|---|

| Projected CAGR (2025 to 2035) | 4.1% |

Bitumen modifier usage is expected to remain high in road construction, with the target progressing at 4.1% CAGR during the forecast period. It is set to attain a valuation of USD 1,651.9 million by 2035.

The extensive network of roads across Europe necessitates a constant demand for bitumen modifiers to enhance road quality and durability. This is expected to boost the target segment.

Road construction projects often require specific characteristics such as improved resistance to heavy traffic loads and extreme weather conditions. Bitumen modifiers provide these characteristics.

Growing emphasis on infrastructure development, including road expansion and maintenance initiatives, will likely drive demand for bitumen modifiers in road construction applications. Their versatility and effectiveness in enhancing road performance make them indispensable in this sector.

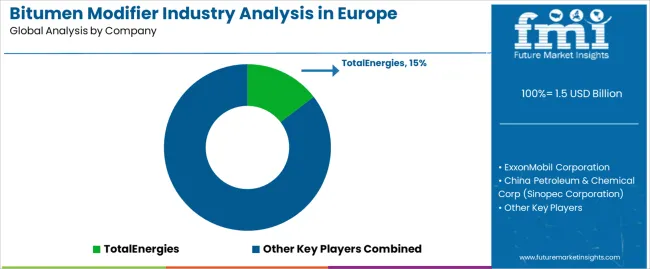

The Europe bitumen modifier industry is consolidated, with leading players accounting for about 75% to 80% of the share. TotalEnergies, ExxonMobil Corporation, China Petroleum & Chemical Corp (Sinopec Corporation), BASF SE, Sika AG, Evonik Industries AG, Honeywell International, Arkema S.A., KRATON Corporation, Innospec Inc., Connect Chemicals, The DOW Company, DuPont, Zydex Group, and ValoChem are the leading manufacturers of bitumen modifiers listed in the report.

Innovation is becoming a key tool for bitumen modifier manufacturers to stay head of the competition. They are constantly creating new bitumen modifiers to meet specific needs of end users. Similarly, rising emphasis on sustainability is prompting players to explore new bio-based and recycled materials.

Several players are also looking to expand their expertise and reach through partnerships, acquisitions, collaborations, mergers, and facility expansions. They are also increasing their bitumen modifier production capacities to boost their revenue.

Recent Developments in Bitumen Modifier Industry:

| Attribute | Details |

|---|---|

| Estimated Industry Size (2025) | USD 1,459.2 million |

| Projected Industry Size (2035) | USD 2,276.7 million |

| Anticipated Growth Rate (2025 to 2035) | 4.5% |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Value (USD million) and Volume (tons) |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Key Segments Covered | Product Type, Application, Region |

| Regions Covered | Germany; France; Italy; United Kingdom; Spain; Russia; Austria; Czech Republic; Norway; Rest of Europe |

| Key Countries Covered | Germany, France, Italy, England, Scotland, Wales, Northern Ireland, Spain, Russia, Austria, Czech Republic, Norway, Rest of Europe |

| Key Companies Profiled | TotalEnergies; ExxonMobil Corporation; China Petroleum & Chemical Corp (Sinopec Corporation); BASF SE; Sika AG; Evonik Industries AG; Honeywell International; Arkema S.A.; KRATON Corporation; Innospec Inc.; Connect Chemicals; The DOW Company; DuPont; Zydex Group; ValoChem |

The global bitumen modifier industry analysis in europe is estimated to be valued at USD 1.5 billion in 2025.

The market size for the bitumen modifier industry analysis in europe is projected to reach USD 2.4 billion by 2035.

The bitumen modifier industry analysis in europe is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in bitumen modifier industry analysis in europe are thermoplastic polymers/plastomers, _polyethylene, _polyvinyl chloride, _polystyrene, _ethyl vinyl acetate, _atactic polypropylene (app), _others (pu, pmma), elastomers, _natural rubber, _crumb rubber, _synthetic rubber, thermoplastic elastomers, _styrenic block copolymers, _polyolefin blends, _thermoplastic polyurethane, _others (eva, peba), thermosetting polymers, _phenolic resins, _epoxy resins, _urea formaldehyde resins, _melamine formaldehyde resins, _polyurea resins, chemical modifiers, _phosphorous compounds, _maleic anhydride, _elemental sulphur, _fatty amine derivatives and _others.

In terms of application, road construction segment to command 52.7% share in the bitumen modifier industry analysis in europe in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bitumen Sprayer Market Size and Share Forecast Outlook 2025 to 2035

Bitumen Emulsion Plants Market Size and Share Forecast Outlook 2025 to 2035

Bitumen Emulsifiers Market Size and Share Forecast Outlook 2025 to 2035

Bitumen Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Bitumen and Asphalt Testing Services Market

Modified Bitumen Market Size and Share Forecast Outlook 2025 to 2035

Polymer Modified Bitumen Market Forecast and Outlook 2025 to 2035

Gut Modifiers Market

Metal Modifiers Market Size and Share Forecast Outlook 2025 to 2035

Impact Modifier Market Growth & Trends 2018-2028

Sensory Modifier Market Size and Share Forecast Outlook 2025 to 2035

Rheology Modifiers Market Size and Share Forecast Outlook 2025 to 2035

Friction Modifiers Market Size and Share Forecast Outlook 2025 to 2035

Adhesive Modifier Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Friction Modifier Additives Market Trends 2025 to 2035

Leukotriene Modifiers Market Growth - Demand, Innovations & Forecast 2025 to 2035

Organic Friction Modifier Additives Market 2022 to 2032

Biologic Response Modifiers Market

Natural Taste Enhancers and Modifiers Market

Europe Cruise Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA