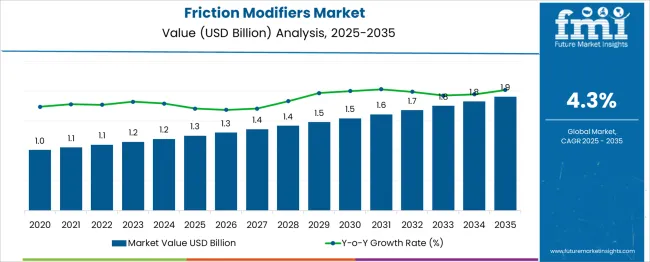

The Friction Modifiers Market is estimated to be valued at USD 1.3 billion in 2025 and is projected to reach USD 1.9 billion by 2035, registering a compound annual growth rate (CAGR) of 4.3% over the forecast period. Analyzing elasticity against macroeconomic indicators reveals a moderate correlation, as growth primarily depends on vehicle production cycles, industrial output, and crude oil price stability, influencing lubricant formulations. Between 2025 and 2030, increments are gradual, with values rising from USD 1.3 billion to 1.5 billion, accounting for 33% of the total uplift, reflecting relatively inelastic demand during periods of economic softening, given its role in essential automotive and industrial maintenance. The latter phase (2030–2035) adds USD 0.4 billion, supported by increased mobility, higher fuel efficiency norms, and broader adoption in hybrid and electric drivetrains, signaling stronger elasticity when regulatory frameworks tighten and energy costs fluctuate. Despite GDP-linked automotive cycles, friction modifiers exhibit defensive characteristics as base lubricant consumption persists even during economic contractions, making elasticity asymmetric, more responsive to expansionary phases than recessions. Annual growth averaging USD 0.05 billion highlights structural stability, while acceleration post-2030 reflects policy-induced efficiency mandates rather than discretionary demand, positioning this segment as moderately elastic with resilience under macroeconomic volatility.

| Metric | Value |

|---|---|

| Friction Modifiers Market Estimated Value in (2025 E) | USD 1.3 billion |

| Friction Modifiers Market Forecast Value in (2035 F) | USD 1.9 billion |

| Forecast CAGR (2025 to 2035) | 4.3% |

The friction modifiers market plays a specialized yet impactful role across multiple lubricant and additive ecosystems. In automotive engine oils friction modifiers account for roughly 12–14% of additive usage enabling reduced internal friction for improved fuel economy and lower emissions in passenger vehicles. Within the broader industrial lubricants market their share is more modest around 5–6% reflecting targeted use in industrial gear systems turbines and hydraulics where efficiency and wear resistance are significant concerns. In the grease and specialty lubricant domain they comprise about 7–8% serving heavy load applications such as automotive wheel bearings and high performance joints. For mining metalworking and heavy machinery lubricants friction modifiers represent 6–7% supporting operations in extreme load and abrasive conditions to extend equipment life.

In gear oils and transmission fluids friction modifiers make up about 9–10% essential for optimizing shift performance reducing gear chatter and protecting synchronizer components. While not the dominant additive in any single category friction modifiers deliver critical functional benefits in systems where reducing friction directly translates into performance and operational efficiency gains. Their strategic value continues to grow as OEM specifications tighten and advanced lubricant formulations gain traction.

The friction modifiers market is experiencing consistent growth due to rising demand for fuel-efficient and low-emission lubricants across automotive and industrial applications. Environmental regulations targeting reduced carbon emissions have intensified the focus on advanced lubricant formulations that optimize energy efficiency and wear protection.

Technological innovations in synthetic base oils and additive chemistry are enabling better viscosity control and thermal stability under extreme operating conditions. Manufacturers are prioritizing modifier compositions that enhance performance while remaining compatible with a wider range of metals and seals.

Ongoing R&D in biodegradable and renewable friction modifiers is also shaping the market’s future direction, with growing preference observed across electric mobility platforms and high-precision manufacturing environments.

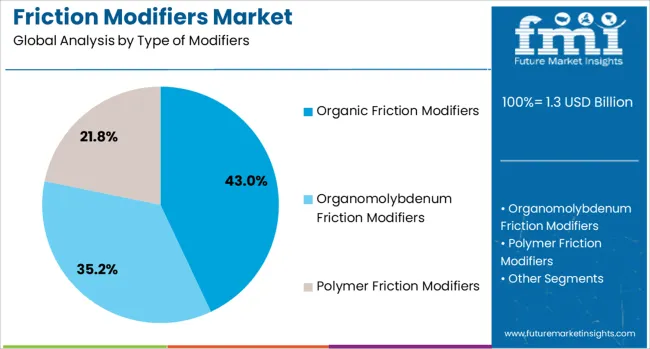

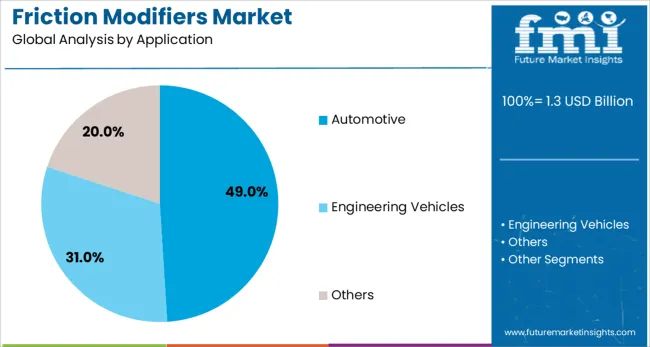

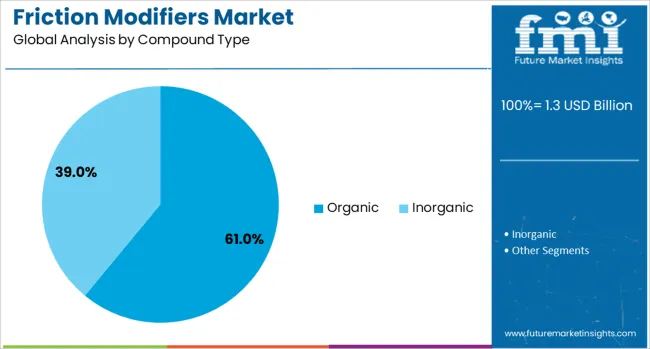

The friction modifiers market is segmented by type of modifiers, application, compound type, and geographic regions. The market of friction modifiers is divided into Organic Friction Modifiers, Organomolybdenum Friction Modifiers, and Polymer Friction Modifiers. In terms of application, the friction modifiers market is classified into Automotive, Engineering Vehicles, and Others. Based on the compound type, the friction modifiers market is segmented into Organic and Inorganic. Regionally, the friction modifiers industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Organic friction modifiers are projected to account for 43.00% of total revenue in 2025, making them the dominant type of modifier in the market. Their widespread adoption is being driven by compatibility with synthetic and bio-based lubricants, as well as their superior friction-reduction and wear-resistance characteristics.

The thermal and oxidative stability offered by organic compounds allows for consistent performance in high-temperature applications, especially in advanced engine formulations. Their effectiveness in reducing boundary friction without compromising lubrication integrity has made them the preferred choice for meeting modern fuel economy standards.

Additionally, the shift toward eco-friendly lubricants has further reinforced the demand for organic modifiers.

The automotive industry is expected to lead with a 49.00% share of the friction modifiers market in 2025, underscoring its status as the largest application segment. This growth is being influenced by stricter vehicle emission norms, the rise in electric and hybrid vehicle adoption, and the need to enhance driveline efficiency.

OEMs and lubricant formulators are increasingly deploying friction modifiers to meet stringent mileage and engine durability benchmarks. Integration of these additives in engine oils, transmission fluids, and greases is enabling smoother mechanical operations, reduced fuel consumption, and extended service intervals.

Automotive demand for performance-boosting lubricants is expected to continue growing alongside innovations in engine design and mobility technologies.

Organic compound-based friction modifiers are anticipated to hold a 61.00% revenue share in 2025, positioning them as the leading compound type. This segment’s dominance stems from the increasing use of esters, fatty acids, and amides that deliver enhanced lubricity and film formation.

Their tunable molecular structure enables precise control over frictional characteristics under varying load and temperature conditions. Additionally, organic compounds are favored for their biodegradability and low toxicity, aligning with sustainability targets in lubricant formulations.

Their compatibility with both mineral and synthetic oils has supported their adoption across diverse sectors, particularly where low-friction performance is critical. The ongoing shift toward low-viscosity, energy-efficient lubricants is likely to sustain high demand for organic friction modifiers.

Friction modifiers are additives used in lubricants, greases, and transmission fluids to control friction between surfaces, reducing energy loss and wear. These compounds are essential in automotive engines, industrial machinery, and power transmission systems for efficiency and durability enhancement. Growth has been influenced by rising demand for fuel economy improvement, stricter emission standards, and the need to extend equipment life. Manufacturers are investing in advanced organic and inorganic chemistries to deliver performance consistency across varied operating conditions. Expansion in electric vehicles and high-performance machinery further drives interest in specialized friction modification technologies.

Adoption of friction modifiers has been driven by increasing focus on reducing energy losses in automotive and industrial applications. Enhanced fuel economy in passenger cars and commercial vehicles requires optimized lubrication systems, reinforcing demand for these additives. The rising need for improved transmission performance in automatic and dual-clutch systems has accelerated usage. Industrial sectors rely on friction modifiers for reducing wear in heavy-duty machinery, minimizing downtime, and extending component life. Stringent emission norms globally have compelled lubricant formulators to incorporate advanced friction reduction solutions, making these additives integral to compliance strategies and operational efficiency improvements.

Market growth has been restricted by the complexity of developing friction modifiers that perform consistently under varying load, speed, and temperature conditions. Compatibility issues with base oils and other additive components create formulation challenges for lubricant manufacturers. High-performance organic friction modifiers often involve higher production costs, impacting pricing in cost-sensitive markets. Regulatory scrutiny of chemical compositions has added compliance costs, particularly for formulations containing metal-based compounds. Availability of counterfeit additives in certain regions creates risks of performance failure, reducing trust among end users. These factors collectively add barriers to large-scale adoption in emerging economies.

Significant opportunities exist in developing friction modifiers tailored for electric vehicle drivetrains, where unique lubrication requirements arise from high-speed gear systems and thermal constraints. Growth in wind power, aerospace, and robotics sectors creates additional demand for advanced lubrication systems incorporating friction modifiers. Adoption of environmentally compliant organic chemistries provides potential for targeting markets sensitive to regulatory frameworks. Development of multifunctional additives combining friction modification with antiwear and antioxidant properties offers differentiation in competitive lubricant markets. Strategic partnerships between additive suppliers and OEMs for co-developing optimized lubrication solutions present long-term growth avenues across mobility and industrial sectors.

Recent trends highlight the shift toward ashless, organic friction modifiers designed to deliver high performance while meeting environmental compliance standards. Blended additive packages that improve oxidation stability, thermal resistance, and friction reduction simultaneously are gaining adoption. Digital simulation and tribology modeling tools are being deployed to optimize additive concentration and predict real-world performance outcomes. Collaborative research between lubricant manufacturers and automotive OEMs is accelerating the development of EV-specific lubricant solutions. Increased use of nanomaterials and polymer-based friction modifiers in specialty lubricants reflects the growing demand for precision-engineered performance under extreme operating conditions.

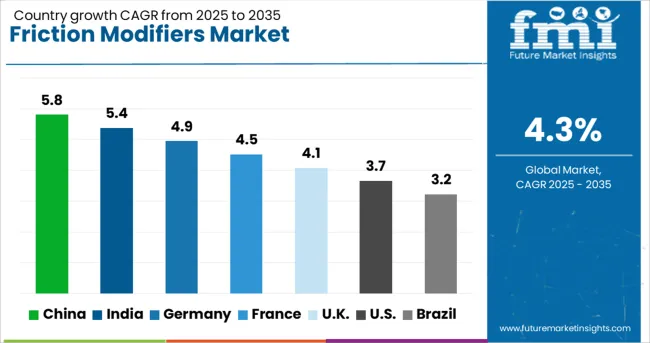

| Country | CAGR |

|---|---|

| China | 5.8% |

| India | 5.4% |

| Germany | 4.9% |

| France | 4.5% |

| UK | 4.1% |

| USA | 3.7% |

| Brazil | 3.2% |

The friction modifiers market is projected to grow globally at a CAGR of 4.3% from 2025 to 2035. Among the leading markets, China leads at 5.8%, followed by India at 5.4%, while France posts 4.5%, the United Kingdom records 4.1%, and the United States stands at 3.7%. These growth rates represent a premium of +35% for China and +26% for India versus the global baseline, whereas France remains slightly ahead at +5%, while the UK and US lag behind at –5% and –14%, respectively. Divergence is driven by rising automotive production, industrial lubrication demand, and regulatory emphasis on fuel efficiency in Asia-Pacific, while OECD nations maintain steady growth through high-performance lubricant adoption in transportation and manufacturing sectors. The analysis spans over 40 countries, with the top countries detailed below.

China is expected to achieve a CAGR of 5.8% through 2035, supported by robust automotive manufacturing, rapid adoption of advanced lubricants, and strong industrial growth. Friction modifiers play a critical role in reducing energy losses in engines and improving performance in high-stress applications. Demand is rising in both passenger vehicles and heavy-duty transportation, influenced by stringent fuel economy and emission regulations. Domestic additive producers are scaling production of organic friction modifiers and investing in research for nanotechnology-based solutions. The transition to electric mobility is creating new opportunities for low-friction drivetrain fluids, while partnerships with international lubricant companies are accelerating technology integration in domestic markets.

India is forecasted to grow at a CAGR of 5.4% through 2035, driven by increased demand for fuel-efficient vehicles, rising industrialization, and expansion of the automotive aftermarket. Friction modifiers are gaining traction in engine oils, transmission fluids, and industrial lubricants to enhance wear protection and improve energy efficiency. Domestic lubricant manufacturers are incorporating advanced organic and molybdenum-based additives to comply with emission norms and reduce energy losses in high-friction environments. The adoption of electric and hybrid vehicles is influencing formulation strategies, with companies focusing on low-viscosity fluids for thermal management and drivetrain efficiency. Strategic partnerships between OEMs and additive suppliers further reinforce localized production capabilities.

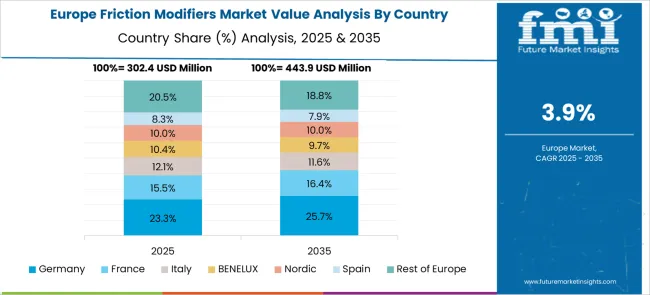

France is projected to record a CAGR of 4.5% through 2035, supported by increasing demand for advanced lubricants in automotive, aerospace, and industrial sectors. Friction modifiers are essential for meeting EU fuel efficiency targets and minimizing wear in high-performance engines. French additive producers are investing in R&D for metal-organic compounds and hybrid chemistries that provide superior anti-wear protection under extreme operating conditions. Integration of friction-reducing additives in industrial gear oils and metalworking fluids is expanding as manufacturers seek energy savings and longer equipment life. Growth in EV penetration also encourages the development of low-viscosity lubricants tailored for electrified powertrains.

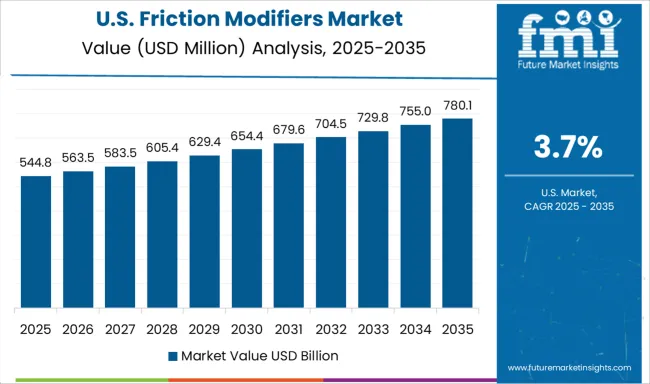

The United States is projected to grow at a CAGR of 3.7% through 2035, driven by regulatory mandates on fuel efficiency and strong demand for premium lubricants in the automotive and industrial sectors. Friction modifiers are increasingly used in synthetic oils for light vehicles, heavy-duty trucks, and advanced transmission systems. The rise of hybrid and electric vehicle platforms requires specialized formulations that offer thermal stability and improved energy transfer in electric drivetrains. Leading USA companies are focusing on additive chemistries such as organo-molybdenum and ashless compounds to meet evolving OEM requirements. Growth in the renewable energy and industrial automation sectors also adds incremental demand for low-friction lubricants.

The United Kingdom is expected to post a CAGR of 4.1% through 2035, driven by demand for fuel-efficient lubricants and strict environmental compliance in transportation and energy sectors. Automotive OEMs are adopting friction modifiers to achieve carbon reduction targets and extend engine life under high-performance conditions. Growth in wind energy and marine applications further boosts the adoption of specialty lubricants with friction-reducing additives. British suppliers are innovating with bio-based and ashless chemistries to align with sustainability goals and reduce environmental impact. Expansion of e-commerce distribution channels for aftermarket lubricants is improving accessibility, supporting steady adoption across vehicle maintenance services.

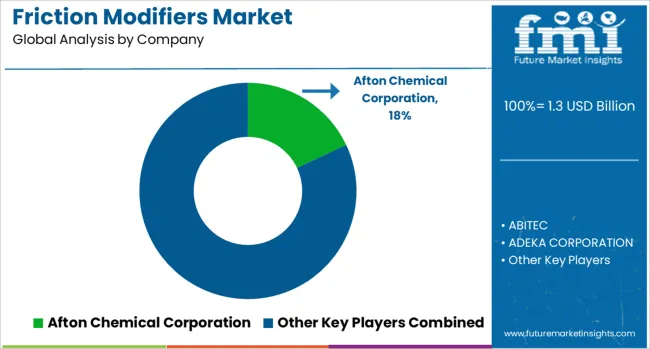

The friction modifiers market is dominated by specialty chemical manufacturers and lubricant additive suppliers that provide advanced formulations to improve fuel efficiency, reduce wear, and enhance performance in automotive, industrial, and metalworking applications. Afton Chemical Corporation leads with a strong portfolio of organic friction modifiers and ester-based chemistries for engine oils and transmission fluids. Lubrizol Corporation and BASF SE maintain competitive positions by developing high-performance additive technologies for passenger cars, heavy-duty vehicles, and industrial lubricants. Chevron Corporation and Royal Dutch Shell PLC leverage their integrated operations to incorporate proprietary friction modifiers into premium lubricants, ensuring strong market reach. Croda International PLC and ABITEC specialize in bio-based and sustainable friction modifiers targeting environmentally friendly lubricant formulations.

LANXESS focuses on polymeric and phosphorus-containing chemistries for high-load and extreme-temperature conditions, while BRB International BV offers tailored additive packages for OEM and aftermarket applications. Regional players such as Kings Industries, Inc., CSW Industrials Inc., and Multisol provide cost-effective solutions and blending services, strengthening supply chains for niche markets. Vanderbilt Chemicals, LLC supports industrial lubrication systems with solid and surface-active friction modifiers. Competitive differentiation is driven by additive efficiency, compatibility with low-viscosity lubricants, and compliance with OEM specifications such as ILSAC GF-6 and ACEA standards. Barriers to entry include high R&D costs, regulatory compliance for chemical formulations, and established relationships between additive suppliers and lubricant manufacturers. Strategic priorities include bio-based chemistries, low-SAPS (sulfated ash, phosphorus, sulfur) formulations for emissions compliance, and innovations for hybrid and electric vehicle lubrication systems.

In the friction modifiers market, efforts are centered on creating advanced additives that optimize fuel economy and minimize surface wear in critical applications. Producers are emphasizing bio-based and polymer-enhanced formulations to meet performance requirements for automotive and industrial uses. Partnerships with lubricant manufacturers and original equipment producers are being strengthened to support innovation and secure supply continuity. Geographic expansion through additional manufacturing facilities and regional distribution channels remains a key focus to meet growing demand efficiently. Organizations are also enhancing technical support offerings and delivering tailored solutions designed for engines, transmission systems, and various industrial equipment.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.3 Billion |

| Type of Modifiers | Organic Friction Modifiers, Organomolybdenum Friction Modifiers, and Polymer Friction Modifiers |

| Application | Automotive, Engineering Vehicles, and Others |

| Compound Type | Organic and Inorganic |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Afton Chemical Corporation, ABITEC, ADEKA CORPORATION, BASF SE, BRB International BV, Chevron Corporation, Croda International PLC, CSW Industrials Inc., F.I.L.A. Group, Kings Industries, Inc., LANXESS, Lubrizol Corporation, Multisol, Royal Dutch Shell PLC, and Vanderbilt Chemicals, LLC |

| Additional Attributes | Dollar sales by product type (organic friction modifiers, inorganic modifiers, polymer-based modifiers) and application (automotive lubricants, industrial oils, metalworking fluids, aerospace). Demand dynamics are driven by OEM mandates for fuel economy, stringent emission regulations, and the transition toward electric mobility requiring specialized lubricants. Regional trends show North America and Europe leading adoption of advanced additives for premium lubricants, while Asia-Pacific dominates in volume due to expanding automotive production. Innovation focuses on nanoparticle-based friction modifiers for ultra-low friction surfaces, ester-based biodegradable modifiers for sustainability, and multifunctional additives integrating anti-wear and energy-saving properties. |

The global friction modifiers market is estimated to be valued at USD 1.3 billion in 2025.

The market size for the friction modifiers market is projected to reach USD 1.9 billion by 2035.

The friction modifiers market is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types in friction modifiers market are organic friction modifiers, organomolybdenum friction modifiers and polymer friction modifiers.

In terms of application, automotive segment to command 49.0% share in the friction modifiers market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Friction Roller Conveyor Market Size and Share Forecast Outlook 2025 to 2035

Friction Pendulum Bearings Market Size and Share Forecast Outlook 2025 to 2035

Frictionless Remote Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Friction Tape Market Analysis Size and Share Forecast Outlook 2025 to 2035

Friction Modifier Additives Market Trends 2025 to 2035

High Friction Films Market Size and Share Forecast Outlook 2025 to 2035

Zero Friction Coatings Market Size and Share Forecast Outlook 2025 to 2035

Clutch Friction Plate Market

Organic Friction Modifier Additives Market 2022 to 2032

Continuous Friction Tester Market Size and Share Forecast Outlook 2025 to 2035

Automotive Brake Friction Products Market - Trends & Forecast 2025 to 2035

Gut Modifiers Market

Metal Modifiers Market Size and Share Forecast Outlook 2025 to 2035

Rheology Modifiers Market Size and Share Forecast Outlook 2025 to 2035

Leukotriene Modifiers Market Growth - Demand, Innovations & Forecast 2025 to 2035

Biologic Response Modifiers Market

Natural Taste Enhancers and Modifiers Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA