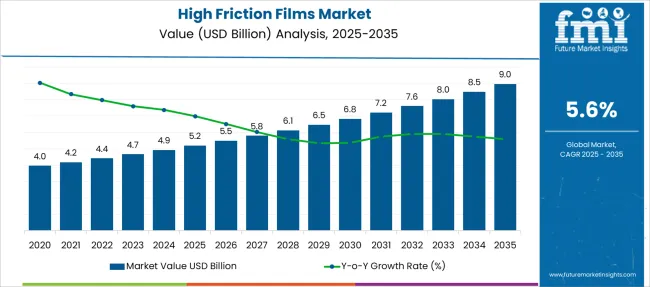

The High Friction Films Market is estimated to be valued at USD 5.2 billion in 2025 and is projected to reach USD 9.0 billion by 2035, registering a compound annual growth rate (CAGR) of 5.6% over the forecast period.

| Metric | Value |

|---|---|

| High Friction Films Market Estimated Value in (2025 E) | USD 5.2 billion |

| High Friction Films Market Forecast Value in (2035 F) | USD 9.0 billion |

| Forecast CAGR (2025 to 2035) | 5.6% |

The high friction films market is witnessing sustained expansion, driven by increasing demand for anti-slip and enhanced grip solutions across packaging, industrial processing, and labeling applications. Advancements in film engineering and surface treatment technologies are improving friction characteristics without compromising mechanical strength or clarity.

Sustainability goals are influencing product design, leading manufacturers to develop recyclable and lower-gauge variants that maintain functional integrity. The rise in e-commerce and automated logistics is also elevating the need for reliable high-friction packaging to prevent slippage during transit.

Regulatory guidelines around product safety and handling efficiency in sectors such as food, pharmaceuticals, and electronics are further accelerating adoption. Looking ahead, innovations in surface modification techniques and the shift toward mono-material films are expected to enhance cost-efficiency, recyclability, and overall market competitiveness.

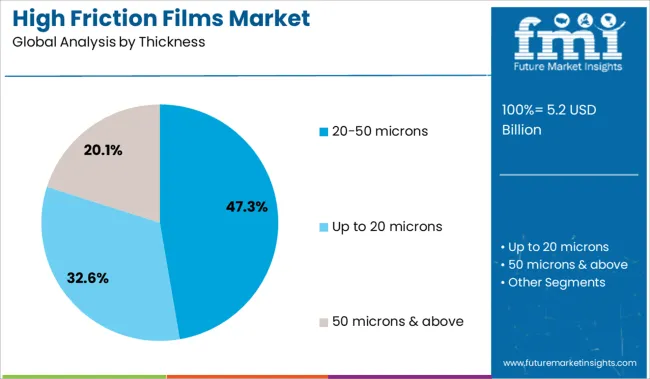

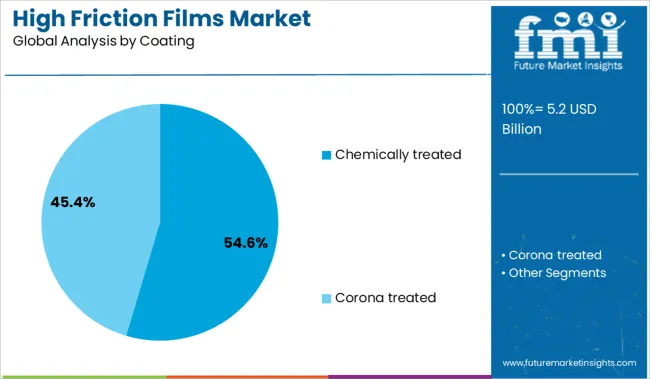

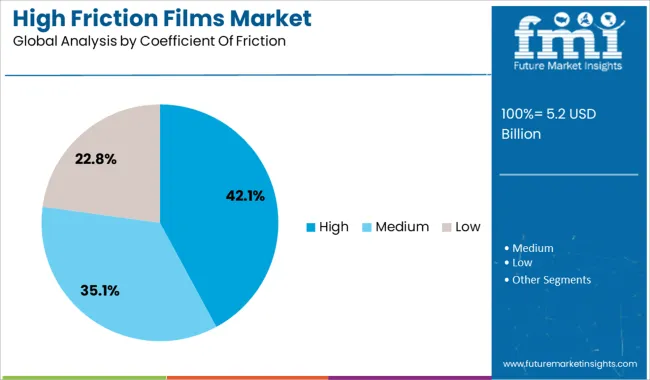

The market is segmented by Thickness, Coating, Coefficient Of Friction, and End Use Industry and region. By Thickness, the market is divided into 20-50 microns, Up to 20 microns, and 50 microns & above. In terms of Coating, the market is classified into Chemically treated and Corona treated. Based on Coefficient Of Friction, the market is segmented into High, Medium, and Low. By End Use Industry, the market is divided into Food Industry, Chemical & Fertilizers Industry, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The 20-50 microns thickness range is anticipated to contribute 47.3% of the total revenue in the high friction films market by 2025, positioning it as the leading thickness segment. This range has gained preference due to its optimal balance between strength and flexibility, making it suitable for high-speed packaging and labeling operations.

Its lightweight profile contributes to lower material usage and reduced production costs without sacrificing functional performance. The segment’s growth is also supported by its compatibility with various substrates and converting methods, offering operational advantages in both manual and automated environments.

Increased application in consumer goods packaging, particularly for transport-sensitive items, has reinforced its market dominance.

Chemically treated coatings are projected to account for 54.6% of the revenue share in 2025, making this the leading coating technology within the high friction films market. This leadership is being driven by the ability of chemical treatments to achieve consistent surface energy profiles and enhanced durability across film types.

These treatments allow for precise control of the coefficient of friction, critical for applications requiring anti-skid or controlled release performance. The scalability of chemical coating methods and their compatibility with recyclable base materials have further accelerated adoption, especially in environmentally sensitive industries.

Continuous improvements in coating formulations are enabling multifunctional films that combine grip enhancement with thermal, barrier, or printability properties, making chemically treated variants a preferred choice across diverse applications.

Films with a high coefficient of friction are expected to represent 42.1% of market revenue in 2025, establishing this as the leading segment by friction profile. This dominance stems from increasing reliance on films that provide maximum surface grip for product stabilization and slip prevention.

In supply chain-intensive sectors such as logistics, food packaging, and pharmaceuticals, high friction films are being favored for their ability to reduce in-transit shifting, thereby minimizing damage and liability. The shift toward faster production speeds and automated handling systems has intensified the need for films with enhanced traction properties.

Additionally, greater awareness of workplace safety and packaging efficiency has prompted end-users to prioritize high friction specifications in their material procurement strategies.

The ability to possess high coefficient of friction so that it keeps bags and products stable during transportation and improves stacking during handling or storage is expected to drive the demand of global high friction films over the forecast period. The factor which is expected to upsurge the demand of high friction films is its capability of shrinkage over a wide range from 0.1% to as high as 75%. Therefore, they are highly versatile.

These films have very good printability and have excellent ink and metal adhesion, which makes them suitable for the manufacturers in order to promote their products. In addition, these films have very good optical and thermal properties.

Thus, high friction films can withstand wide range of temperature, therefore, it prevents the product from damage. High friction films market is growing with increase in industries and manufacturing units, where bulk packaging is required.

High friction films are suitable for industries, such as food industries, chemical & fertilizers, and others. It will drive the global high friction films market during the forecast period. These films are economically feasible, and therefore, it is anticipated that the global high friction films market will enjoy a healthy growth during the forecast period.

Based on regions, the global high friction films market is divided into seven regions namely:

The APEJ region is expected to play a pivotal role in driving growth of the global high friction films market over the forecast period, due to growing food and fertilizer industries in this region. China and India are especially expected to drive the APEJ market due to presence of prominent manufacturers. The APEJ region is expected to witness high growth over the forecast period.

North America and Western European regions are anticipated to witness moderate growth over the forecast period due to availability of various alternatives. Latin America is expected to witness average growth due to recession in the region and less investment in industrial infrastructure.

Eastern Europe is expected to witness sluggish growth due to the effects of recession. MEA region is expected to witness below average growth due to higher dependency on imports and exports. Japan is expected to witness average growth during the forecast period.

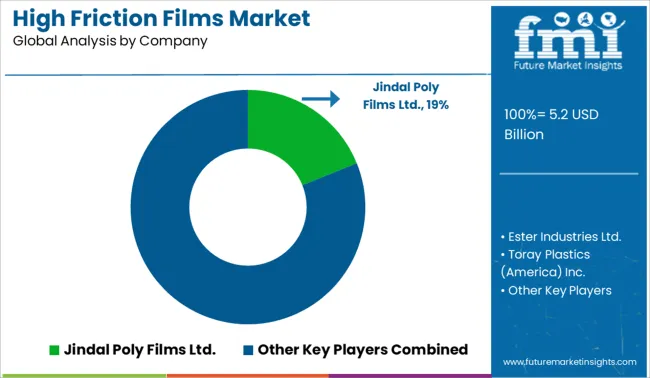

The key players operating in the global high friction films market are - Ester Industries Ltd., Toray Plastics (America) Inc., FlexFilms Ltd., Jindal Poly Films Ltd., TEKRA, A Division of EIS, Inc., SKC Inc. and among others.

The research report presents a comprehensive assessment of the market and contains thoughtful insights, facts, historical data, and statistically supported and industry-validated market data. It also contains projections using a suitable set of assumptions and methodologies. The research report provides analysis and information according to market segments such as geographies, application, and industry.

The global high friction films market is estimated to be valued at USD 5.2 billion in 2025.

The market size for the high friction films market is projected to reach USD 9.0 billion by 2035.

The high friction films market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in high friction films market are 20-50 microns, up to 20 microns and 50 microns & above.

In terms of coating, chemically treated segment to command 54.6% share in the high friction films market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

High Protein Powders Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

High Purity Gas Flow Meter Market Size and Share Forecast Outlook 2025 to 2035

High Purity Flow Meter Market Size and Share Forecast Outlook 2025 to 2035

High Performance Permanent Magnet Market Size and Share Forecast Outlook 2025 to 2035

High Airtight Storage Cabinets Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Porcelain Bushing Market Size and Share Forecast Outlook 2025 to 2035

High Purity Process Systems for Semiconductor Market Size and Share Forecast Outlook 2025 to 2035

High Octane Racing Fuel Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Air-cooled Battery Compartment Market Size and Share Forecast Outlook 2025 to 2035

High Temperature NiMH Battery Market Size and Share Forecast Outlook 2025 to 2035

High Current Power Supply for Electrophoresis Market Size and Share Forecast Outlook 2025 to 2035

High Voltage Cable Termination Market Size and Share Forecast Outlook 2025 to 2035

High Security Wedge Barricades Market Size and Share Forecast Outlook 2025 to 2035

High Purity Chemical Filters Market Size and Share Forecast Outlook 2025 to 2035

High Performance Liquid Chromatography-Tandem Mass Spectrometry System Market Size and Share Forecast Outlook 2025 to 2035

High-vacuum Fiber Feedthrough Flanges Market Size and Share Forecast Outlook 2025 to 2035

High Pressure Grease Hose Market Size and Share Forecast Outlook 2025 to 2035

High Performing Matting Agent Market Size and Share Forecast Outlook 2025 to 2035

High Reliability Oscillators Market Size and Share Forecast Outlook 2025 to 2035

High-performance Dual-core Processor Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA