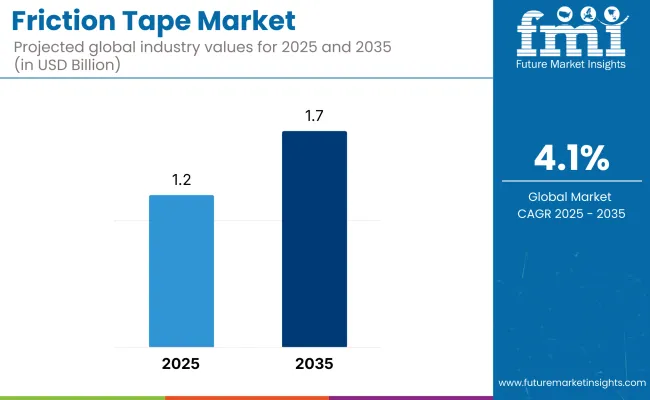

The friction tape market is expected to grow from USD 1.2 billion in 2025 to USD 1.7 billion by 2035, adding USD 0.5 billion over the ten-year period. This represents a 41.7% total market growth, supported by a compound annual growth rate (CAGR) of 4.1%.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1.2 billion |

| Industry Value (2035F) | USD 1.7 billion |

| CAGR (2025 to 2035) | 4.1% |

Over the forecast period, the market is projected to expand by a 1.4 multiple. In the first half of the decade (2025-2030), the market increases from USD 1.2 billion to USD 1.4 billion, contributing USD 0.2 billion, or 40.0% of the total decade’s growth. Growth in this period is driven by demand from electrical insulation, sports grip applications, and industrial bundling, particularly in North America and Asia Pacific. Cloth-backed tapes with high friction coefficients dominate due to their durability and performance under abrasion.

In the second half (2030-2035), the market rises from USD 1.4 billion to USD 1.7 billion, adding USD 0.3 billion, or 60.0% of the decade’s total growth. This phase benefits from rising adoption in renewable energy installations, EV manufacturing, and specialized industrial equipment maintenance, where enhanced tensile strength and heat resistance are critical. Eco-friendly, solvent-free adhesive formulations gain traction as sustainability regulations tighten across manufacturing industries.

From 2020 to 2024, the friction tape Market grew from USD 1.0 billion to USD 1.1 billion, driven by hardware-centric adoption in electrical insulation, wire harnessing, and sports equipment applications where abrasion resistance and grip enhancement are essential. During this period, the competitive landscape was dominated by adhesive and industrial tape manufacturers controlling nearly 70% of market revenue, with leaders such as Euro Tapes Pvt. Ltd., Medi Spare, and AVR Industries Private Limited focusing on durable cotton cloth-backed tapes with rubber-based adhesives.

Competitive differentiation relied on tensile strength, temperature resistance, and adhesion to irregular surfaces, while digital-enabled inventory tracking or usage analytics remained bundled into broader distributor offerings rather than acting as standalone revenue streams. Service-based models including custom printing and specialty roll conversion accounted for less than 10% of total market value, as most demand was met through standardized bulk supply channels.

Demand for friction tape will expand to USD 1.7 billion in 2035, and the revenue mix will shift as specialty formulations, eco-friendly adhesives, and smart-label integration grow to over 40% share. Traditional tape suppliers face rising competition from niche players offering fire-retardant, UV-resistant, and biodegradable friction tape solutions.

Rising demand for durable, non-slip insulation and protective wrapping solutions in electrical, industrial, and automotive applications is driving the growth of the friction tape market. Made from cloth impregnated with adhesive, friction tapes provide strong grip, abrasion resistance, and insulation, making them essential in environments where mechanical protection and electrical safety are critical. Their versatility in both repair and original equipment manufacturing has sustained consistent market adoption.

Cloth-backed rubber adhesive friction tapes have gained popularity due to their high tensile strength, flexibility, and ability to adhere securely to irregular surfaces. These tapes offer a combination of mechanical protection and insulation, making them suitable for binding electrical wires, protecting cable splices, and improving grip on tools and sports equipment. Their performance in high-friction and high-wear scenarios adds to their industrial utility.

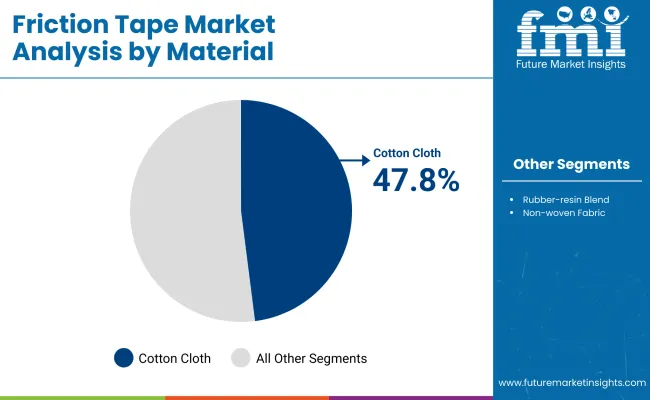

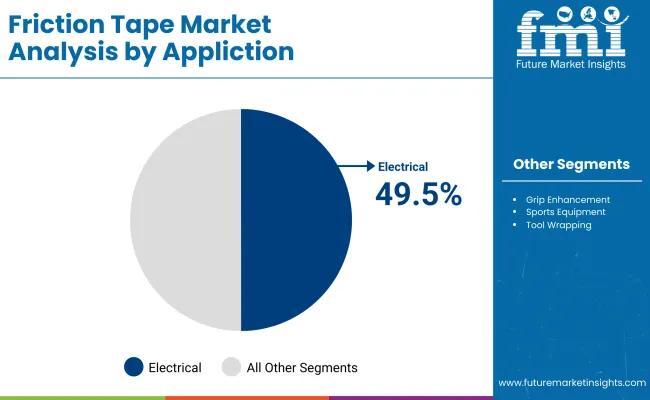

The market is segmented by material, application, adhesion strength, end-use industry, and region. Material segmentation includes cotton cloth, rubber-resin blend, and non-woven fabric, offering varied durability, flexibility, and moisture resistance for different usage environments. Application areas include electrical insulation, grip enhancement, sports equipment, and tool wrapping, each requiring specific mechanical strength and surface adhesion properties.

Adhesion strength is categorized into low tack, medium tack, and high tack, allowing selection based on ease of removal, secure bonding, or long-term durability. End-use industries include electrical, automotive, industrial maintenance, and sports, reflecting the tape’s utility in both functional and performance-enhancing roles. Regionally, the market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

The cotton cloth segment is expected to capture the highest share of 47.8% in the Friction Tape Market by 2025, supported by its superior tensile strength, abrasion resistance, and adaptability across various applications. Cotton cloth tapes provide a textured surface that enhances grip and withstands mechanical stress, making them ideal for wrapping, bundling, and reinforcement tasks in industrial and electrical settings.

Manufacturers are also advancing cotton cloth tape designs with enhanced flame retardancy and weather resistance to meet evolving safety regulations. This balance of mechanical performance and comfort handling continues to position cotton cloth as the preferred substrate for heavy-duty friction tape applications worldwide.

The electrical segment is projected to command a 49.5% share in 2025, driven by the growing need for reliable insulation and mechanical protection in wiring systems. Friction tapes are valued for their ability to maintain adhesion and insulation under varying temperature and moisture conditions, making them indispensable in electrical maintenance and repair work.

As industries expand infrastructure for power distribution, telecommunications, and renewable energy, the demand for tapes that combine mechanical strength with electrical safety is rising. This has led to higher adoption of friction tapes in both commercial installations and field servicing.

Electrical insulation applications are projected to hold a 39.3% market share by 2025, underscoring the critical importance of friction tapes in safeguarding electrical systems from shorts, arc faults, and premature component wear. This dominant share reflects their indispensable role in both preventive maintenance and new installations across residential, commercial, industrial, and transportation sectors. Friction tapes’ cloth-based backing offers exceptional flexibility, enabling secure wrapping around irregular, angled, or confined surfaces without creating air gaps that could compromise insulation performance.

Their proven ability to withstand challenging operating conditions ranging from high-vibration machinery and outdoor utility wiring to high-voltage equipment in power generation plants has positioned them as a trusted choice among electricians, OEMs, and maintenance teams worldwide. In addition, the adhesive properties are engineered to remain stable across varying temperatures, moisture exposure, and mechanical stress, which is particularly critical for environments where operational continuity is non-negotiable.

The high tack adhesion strength segment is projected to account for 51.2% of the adhesion strength category by 2025, reflecting its dominant role in applications that demand secure, long-lasting bonds even under challenging operating conditions. High tack friction tapes are valued for their ability to deliver instant and aggressive adhesion, gripping firmly to a wide variety of surfaces including rough, porous, or dusty substrates without the need for extensive surface preparation. This immediate bond formation is a critical advantage in time-sensitive maintenance and assembly tasks where reliability is non-negotiable.

In demanding environments such as heavy industrial machinery, automotive assembly lines, and outdoor electrical installations, adhesives are constantly subjected to vibration, thermal cycling, and environmental exposure including moisture, UV radiation, and particulate contamination. High tack formulations ensure that protective wraps, cable bundles, and insulation layers remain firmly in place despite these stressors, significantly reducing the risk of system failures, downtime, or costly rework.

Limited weather resistance and competition from advanced insulation materials constrain market growth, even as demand rises in electrical, automotive, and heavy industrial applications for durable, non-slip adhesive tapes that provide mechanical protection and enhanced grip.

Durability and Multi-functionality Driving Adoption in Electrical and Industrial Sectors

Friction tape remains a preferred solution in electrical wiring, automotive harnessing, and heavy equipment maintenance due to its strong adhesion, abrasion resistance, and ability to provide both insulation and mechanical grip. In electrical work, it serves as a protective overwrap for splices and terminals, adding an extra layer of wear resistance. In automotive and machinery applications, its textured surface helps secure connections and reduce slippage under vibration or load stress.

Weathering Limitations and Rising Alternatives in Specialty Applications

Despite its robust performance in many settings, friction tape is less suited for prolonged exposure to moisture, UV radiation, or extreme temperatures. Over time, its rubber-based adhesive can degrade, losing tackiness and leaving residue. In applications requiring long-term dielectric performance or flame resistance, alternatives such as PVC insulation tape, self-fusing silicone tape, and specialized polymer-based wraps are gaining preference.

Material Innovation and Niche Performance-focused Variants Emerging

A key trend in the friction tape market is the development of enhanced formulations with improved weather resistance, higher dielectric strength, and eco-friendlier adhesives. Manufacturers are introducing blends that resist drying and cracking while maintaining strong adhesion on varied surfaces.

The global friction tape market is witnessing steady growth, driven by rising demand for electrical insulation, automotive harness protection, and industrial sealing applications. The shift toward high-performance, flame-retardant, and eco-friendly adhesive formulations is pushing innovation in the sector.

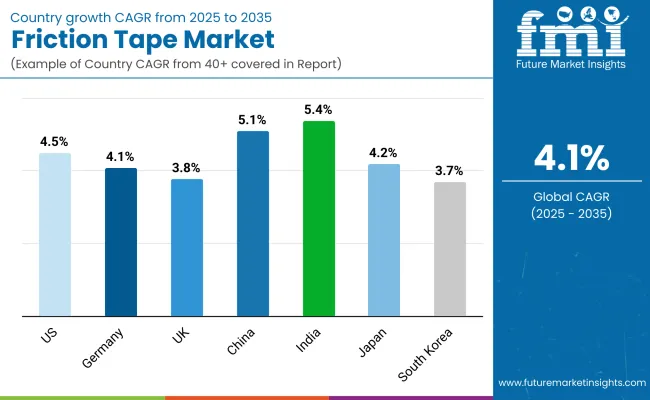

Asia-Pacific countries such as India and China are leading the growth momentum, fueled by large-scale infrastructure expansion, vehicle production, and electrification projects. In contrast, developed economies including the USA, UK, and Germany are focused on upgrading tape performance for safety compliance, vibration resistance, and sustainability goals. Manufacturers are increasingly adopting advanced coating, calendaring, and recyclable material technologies to meet regulatory and industry-specific requirements.

The friction tape market in the United States is poised for steady expansion, projected to grow at a CAGR of 4.5% between 2025 and 2035. This growth trajectory is anchored in rising demand from electrical contractors, automotive OEMs, and industrial maintenance service providers who increasingly prioritize insulation, bundling, and abrasion protection for wiring and cabling systems.

Upgraded safety codes and sustainability mandates are encouraging manufacturers to launch flame-retardant, moisture-resistant, and eco-friendly grades, thereby aligning with evolving regulatory frameworks. Adoption is also being spurred by modernization projects in industrial facilities, urban infrastructure upgrades, and vehicle electrification programs.

Germany’s friction tape market is forecast to advance at a CAGR of 4.1%, supported by its globally renowned automotive industry, robust renewable energy infrastructure, and precision-driven manufacturing base. Compliance with EU safety standards and the country’s engineering excellence are driving the demand for premium-grade tapes that offer superior adhesion, durability, and resistance to environmental wear.

Manufacturers are focusing on recyclable backings and solvent-free adhesive technologies to align with Germany’s leadership in circular economy initiatives. The adoption curve is being accelerated by investments in offshore wind farms, e-mobility, and automated production lines.

The United Kingdom’s friction tape market is anticipated to grow at a CAGR of 3.8% during 2025-2035, with demand emerging from construction, electrical retrofits, and the marine and defense sectors. Urban regeneration programs, electrification of transport systems, and naval infrastructure upgrades are creating new application avenues. Product innovation is centering on high-temperature, corrosion-resistant, and flame-retardant tapes to meet the harsh operational environments of marine vessels, industrial plants, and military assets. Government-backed safety codes and green building initiatives are also shaping procurement patterns.

China’s friction tape market is projected to witness the fastest industrial-scale adoption in Asia, with a CAGR of 5.1% driven by rapid manufacturing expansion, automotive production growth, and large-scale electrification projects. Local manufacturers are scaling production capacity through advanced coating and extrusion technologies, targeting both domestic and export markets.

Government investments in smart grid infrastructure, renewable energy, and high-speed rail are expanding tape usage across multiple verticals. In parallel, EV manufacturing hubs are pushing demand for high-voltage insulation tapes that meet UL and IEC compliance standards.

India’s friction tape market is forecast to record the highest CAGR among major economies, 5.4% between 2025 and 2035, propelled by power grid modernization, rural electrification drives, and expanding automotive harness production. Government-led infrastructure schemes and the shift toward e-mobility are widening usage in both utilities and transport.

SMEs in the country are leveraging cost-effective raw materials and enhanced tensile strength designs to cater to large-scale domestic and export orders. This is complemented by the Make in India initiative, which supports local manufacturing of industrial consumables.

Japan’s friction tape market is expected to rise at a CAGR of 4.2%, driven by electronics assembly, railway maintenance, and industrial machinery production. Compact roll designs and biodegradable adhesives are gaining traction to meet Japan’s emphasis on space efficiency and environmental stewardship. Rail and manufacturing sectors value high-friction, vibration-resistant grades for their precision and long-term durability.

South Korea’s friction tape market is projected to expand at a CAGR of 3.7%, anchored in shipbuilding, semiconductor fabrication, and industrial automation sectors. The country’s focus on high-value manufacturing is creating opportunities for premium-grade tapes with anti-static, high-adhesion, and abrasion-resistant properties. Shipyards, electronics cleanrooms, and smart factories are major end-users, driving the development of specialized products for each sector’s unique demands.

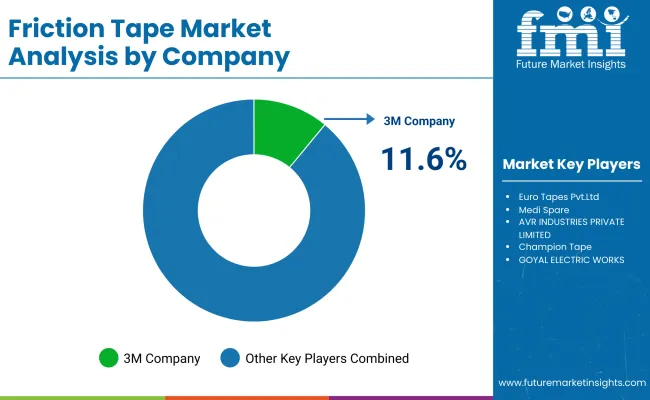

The friction tape market is moderately fragmented, with global adhesive leaders, electrical insulation specialists, and regionally focused tape manufacturers competing across automotive, electrical, and industrial maintenance sectors.

Global players such as 3M Company hold significant market share, driven by high-tensile cloth backings, abrasion resistance, and consistent electrical insulation performance. Their strategies increasingly emphasize heat-resistant formulations, solvent-free adhesives, and compliance with ASTM and IEC safety standards for wiring and harness applications.

Established mid-sized players including Euro Tapes Pvt. Ltd., AVR Industries Private Limited, and Champion Tape are expanding adoption through industrial-grade friction tapes designed for mechanical grip, bundling, and wire protection in automotive and heavy equipment manufacturing. These companies focus on durability under high-friction conditions, strong adhesion to irregular surfaces, and compatibility with both indoor and outdoor use.

Key Development of Friction Tape Market

| Item | Value |

|---|---|

| Quantitative Units | USD 1.2 Billion |

| By Material | Cotton Cloth, Rubber-resin Blend, and Non-woven Fabric |

| By Application | Electrical Insulation, Grip Enhancement, Sports Equipment, and Tool Wrapping |

| By Adhesion Strength | Low Tack, Medium Tack, and High Tack |

| By End-Use Industry | Electrical, Automotive, Industrial Maintenance, and Sports |

| Key Companies Profiled | Euro Tapes Pvt. Ltd., Medi Spare, AVR Industries Private Limited, Champion Tape, Goyal Electric Works, and 3M Company |

| Additional Attributes | Increasing demand for high-tensile friction tapes in electrical insulation and automotive harness applications, growing use in sports equipment for improved grip performance, adoption in industrial maintenance for tool and machinery wrapping, rising preference for cotton cloth-based tapes for durability, development of rubber-resin blends with enhanced adhesion, expanding use in low-tack variants for temporary applications, regulatory focus on safety compliance in electrical repairs, high demand from emerging markets in Asia-Pacific, customization in colors and widths for sports and branding, and replacement-driven demand in mature industrial hubs of North America and Europe |

The global friction tape market is estimated to be valued at USD 1.2 billion in 2025.

The market size for the friction tape market is projected to reach USD 1.7 billion by 2035.

The friction tape market is expected to grow at a CAGR of 4.1% between 2025 and 2035.

The key material segments in the friction tape market include cotton cloth, fiberglass, and synthetic fabric.

In terms of material, the cotton cloth segment is expected to account for the highest share of 47.8% in the friction tape market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Friction Roller Conveyor Market Size and Share Forecast Outlook 2025 to 2035

Friction Pendulum Bearings Market Size and Share Forecast Outlook 2025 to 2035

Frictionless Remote Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Friction Modifiers Market Size and Share Forecast Outlook 2025 to 2035

Friction Modifier Additives Market Trends 2025 to 2035

High Friction Films Market Size and Share Forecast Outlook 2025 to 2035

Zero Friction Coatings Market Size and Share Forecast Outlook 2025 to 2035

Clutch Friction Plate Market

Organic Friction Modifier Additives Market 2022 to 2032

Continuous Friction Tester Market Size and Share Forecast Outlook 2025 to 2035

Automotive Brake Friction Products Market - Trends & Forecast 2025 to 2035

Tape Unwinder Market Size and Share Forecast Outlook 2025 to 2035

Tape Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Tape Dispenser Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Tape Dispenser Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Tape Measure Market Size and Share Forecast Outlook 2025 to 2035

Tape Backing Materials Market Analysis by Material Type, Application, and Region through 2025 to 2035

Tape Stretching Line Market Analysis – Growth & Trends 2025 to 2035

Tapes Market Insights – Growth & Demand 2025 to 2035

Tape Banding Machine Market Overview - Demand & Growth Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA