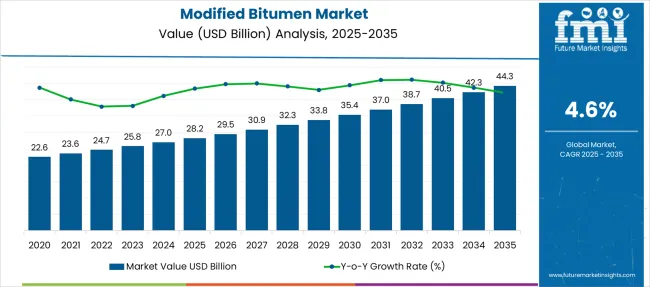

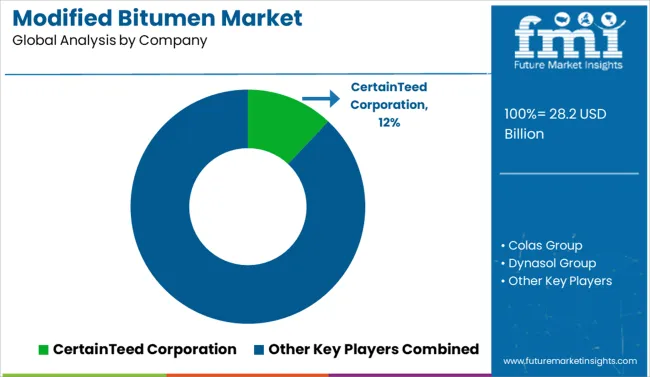

The Modified Bitumen Market is estimated to be valued at USD 28.2 billion in 2025 and is projected to reach USD 44.3 billion by 2035, registering a compound annual growth rate (CAGR) of 4.6% over the forecast period. This incremental expansion demonstrates a cumulative gain pattern with annual additions increasing from USD 1.3 billion between 2025 and 2026 to USD 2.0 billion between 2034 and 2035. A steady compounding effect is visible, which aligns with consistent demand from road surfacing and waterproofing applications. Government-backed infrastructure investments across India, Indonesia, and South Africa have supported this gradual but stable absolute growth.

By comparing the first half (2025–2030) and the second half (2030–2035), the market adds approximately USD 7.2 billion in the first five years and USD 8.9 billion in the latter half, implying an absolute opportunity skewed toward the post-2030 phase. This shift reflects improved adoption of polymer-modified bitumen and rising demand for longer-life asphalt in transportation corridors. Companies such as Shell and Owens Corning are introducing additive-enhanced bitumen variants, increasing value per ton sold. The market’s absolute expansion is also supported by emerging maintenance backlogs across Europe’s secondary roads, particularly in Spain and Poland, where modified bitumen is favored for its weather resilience and thermal cracking resistance.

The modified bitumen market captures about 35% of the roofing and waterproofing materials market, where its flexibility and weather resistance make it a preferred roofing membrane. Roughly 25% derives from commercial building construction, where preservation of roof integrity is critical. Approximately 20% is tied to infrastructure and civil engineering applications, including bridge decks and tunnels requiring enhanced waterproofing. The sealants and adhesives market contributes nearly 15%, as modified bitumen overlaps with asphalt-based sealant systems. The remaining 5% share comes from industrial flat-roof and flooring applications, where its durability and thermal performance support specialized surface protection even under heavy-load conditions.

The industry is undergoing a fundamental shift driven by polymer innovation, environmental concerns and infrastructure demand. Advancements in hybrid and SBS-modification technologies are delivering superior elasticity, thermal stability and UV resistance in paving and roofing applications. Recycled-content blends such as crumb-rubber and bio-based additives are reshaping the industry toward circular economy goals. Real-time performance monitoring systems and self-adhesive membranes are accelerating installation efficiency. As governments globally invest in road networks, airports and urban resilience projects, demand for durable, climate‑adapted materials is rising rapidly, particularly in the Asia Pacific, where urbanization and infrastructure expansion are fueling adoption and forcing legacy binder suppliers to adapt.

| Metric | Value |

|---|---|

| Modified Bitumen Market Estimated Value in (2025E) | USD 28.2 billion |

| Modified Bitumen Market Forecast Value in (2035F) | USD 44.3 billion |

| Forecast CAGR (2025 to 2035) | 4.6% |

The modified bitumen market is undergoing sustained expansion, driven by increasing demand for high-performance construction materials capable of withstanding extreme climatic conditions and mechanical stress. Innovations in polymer modification, combined with a growing emphasis on longevity and sustainability in infrastructure development, have expanded the material’s use in roofing, road paving, and industrial waterproofing.

Urbanization and government-led investments in smart cities and green buildings have accelerated adoption, particularly in emerging economies where infrastructure resilience is a growing priority. Additionally, the rising cost of maintenance and replacement has led to a greater preference for materials that offer long service life and energy efficiency.

Future growth is likely to be supported by advancements in recycling technology, environmental compliance standards, and the integration of modified bitumen systems in green building certifications..

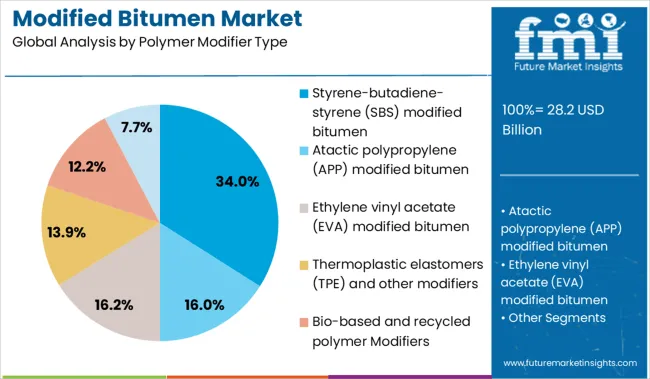

The polymer modified bitumen market is segmented by polymer modifier type, application type, end-use industry, and region. By polymer modifier type, the market includes styrene-butadiene-styrene (SBS) modified bitumen, SBS polymer grades and specifications, atactic polypropylene (APP) modified bitumen, ethylene vinyl acetate (EVA) modified bitumen, thermoplastic elastomers (TPE) and other modifiers, bio-based and recycled polymer modifiers, hybrid and multi-polymer systems, SBS-APP combination products, and polymer-rubber hybrid modifications.

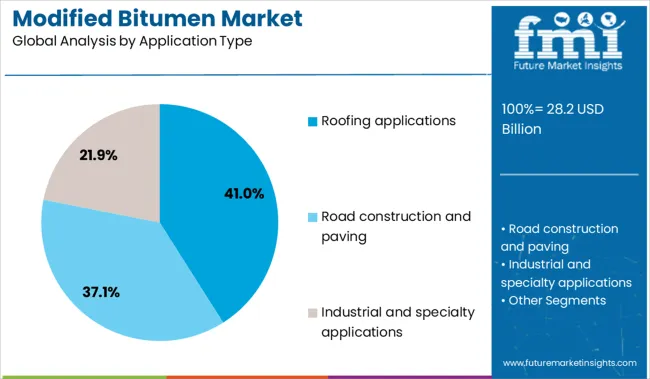

In terms of application type, it encompasses roofing applications, low-slope and flat roofing systems, steep-slope roofing applications, road construction and paving, highway and interstate applications, urban and municipal road systems, airport and industrial paving, above-grade waterproofing solutions, industrial and specialty applications, adhesives and sealants, coatings and protective systems, and pipe coating and corrosion protection.

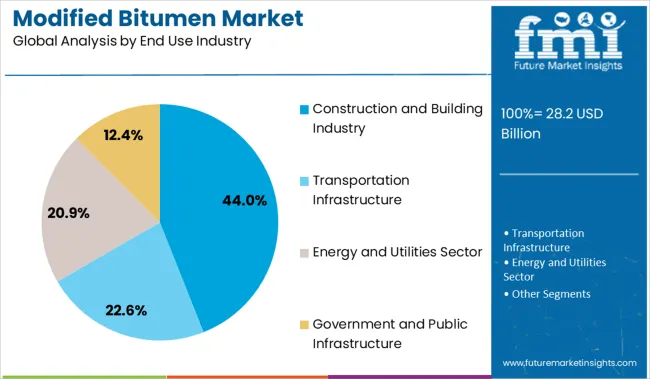

Based on end-use industry, the market covers construction and building industry, residential construction, commercial construction, industrial applications, transportation infrastructure, highway and road infrastructure, airport and port infrastructure, energy and utilities, power generation, oil and gas facilities, water and wastewater treatment, government and public infrastructure including federal and municipal projects, military and defense infrastructure, private and specialty markets, sports and recreation facilities, agricultural and rural infrastructure, and mining and extractive industries. Geographically, the market spans North America, Latin America, Western and Eastern Europe, Balkan and Baltic countries, Russia and Belarus, Central Asia, East Asia, South Asia and Pacific, and the Middle East and Africa.

Styrene-butadiene-styrene (SBS) modified bitumen is projected to account for 34.00% of total revenue in 2025, making it the leading polymer modifier type. This segment’s dominance is being driven by SBS's ability to enhance flexibility, durability, and resistance to thermal cracking-qualities essential for both hot and cold climates.

The elastomeric nature of SBS allows for better adhesion to substrates and improved waterproofing performance, particularly in roofing and paving applications. Its widespread acceptance is also supported by compatibility with various reinforcement materials and ease of application through conventional equipment. As infrastructure planners and construction engineers seek solutions that balance performance with cost-efficiency, SBS-modified bitumen continues to gain preference due to its proven track record in extending service life and reducing long-term maintenance costs..

Roofing applications are expected to hold 41.00% of the market revenue share in 2025, emerging as the top application area for modified bitumen. The growth of this segment is being attributed to the increasing need for durable, weather-resistant, and energy-efficient roofing systems across residential, commercial, and industrial buildings.

Modified bitumen is particularly well-suited for flat and low-slope roofs, where resistance to water pooling and UV degradation is critical. Advancements in torch-applied and cold-adhesive systems have improved installation efficiency and safety, contributing to greater adoption. Government incentives for reflective and cool roofing solutions in urban zones have reinforced the appeal of modified bitumen due to its compatibility with energy-saving coatings. As construction trends move toward high-performance, low-maintenance solutions, the roofing segment is expected to maintain its leadership position..

The construction and building industry is forecast to contribute 44.00% of the total modified bitumen market revenue in 2025, positioning it as the leading end-use industry. This segment’s leadership is supported by large-scale investments in urban development, infrastructure renewal, and residential housing projects globally.

Modified bitumen’s performance benefits, such as superior tensile strength, thermal stability, and ease of installation, align well with the construction sector’s need for cost-effective and reliable waterproofing materials. In commercial and institutional buildings, modified bitumen systems are increasingly being adopted as part of integrated roofing and insulation assemblies.

Regulatory focus on building envelope efficiency and the growing importance of lifecycle cost assessments have further reinforced its selection. As construction firms increasingly prioritize materials that meet sustainability benchmarks and withstand long-term structural stress, modified bitumen is expected to see continued adoption across diverse building formats..

The modified bitumen market is evolving with increased preference for SBS and APP polymer blends that offer superior resilience against rutting, cracking, and moisture intrusion. Warm-mix technologies are emerging as a key differentiator by reducing energy use and enabling faster application in urban zones. Lifecycle cost optimization, rather than upfront pricing, is shaping procurement strategies across road and roofing projects. Growing integration of modified binders into green infrastructure mandates, airport runways, and bridge overlays highlights a shift from conventional asphalt toward performance-grade solutions. Regional players are leveraging custom formulations to gain a competitive advantage.

Demand for modified bitumen products is growing as contractors and agencies prioritize solutions that balance cost and performance. Sales are being driven by the material’s proven ability to extend pavement life and reduce maintenance, making it a preferred choice for large-scale projects. Its resistance to cracking, rutting, and moisture damage ensures reliable results across highways, urban roads, and industrial roofing. In an environment of tighter budgets, long-life materials are gaining traction, prompting municipalities and commercial developers to adopt modified bitumen in rehabilitation and new construction initiatives increasingly.

Sales momentum in the modified bitumen market is building as innovative polymer-based and warm-mix solutions reshape project specifications. SBS and APP blends bring greater flexibility and heat resistance, making pavements stronger and longer-lasting without adding weight. Warm-mix technology cuts energy use during application and helps contractors meet environmental targets on-site. Urban renewal projects and modern road upgrades are creating demand for these advanced materials. Suppliers offering tailored formulations and hands-on technical guidance are quickly becoming preferred partners for contractors looking to deliver high-quality, future-ready infrastructure.

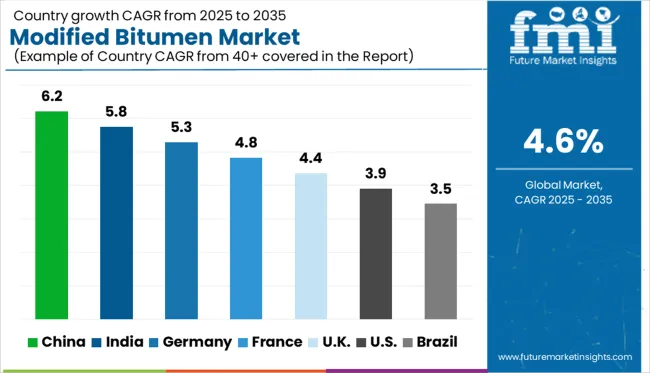

| Country | CAGR |

|---|---|

| China | 6.2% |

| India | 5.8% |

| Germany | 5.3% |

| France | 4.8% |

| UK | 4.4% |

| USA | 3.9% |

| Brazil | 3.5% |

The global modified bitumen market is projected to expand at a CAGR of 4.6% from 2025 to 2035, driven by the need for resilient road infrastructure and enhanced waterproofing solutions. BRICS economies dominate growth, led by China at 6.2%, powered by large-scale expressway networks, industrial corridors, and accelerated public infrastructure investment. India follows at 5.8%, supported by smart city developments, strategic highway programs, and rising allocation for climate-resilient road materials. OECD markets show moderate yet steady adoption. Germany posts 5.3% CAGR, reflecting investment in autobahn rehabilitation and strict energy-efficiency regulations for building envelopes. The UK grows at 4.4%, driven by municipal refurbishments and green roofing programs. The US lags slightly at 3.9%, reflecting selective adoption in suburban highways and commercial roofing retrofits rather than full-scale policy mandates.

The United States modified bitumen market is advancing at a 3.9% CAGR, indicating steady but measured growth. Demand is concentrated in regions with high-temperature exposure and heavy freight corridors, particularly across the Sun Belt where thermal cracking is a persistent challenge. While durability advantages are recognized, full-scale adoption remains cautious as many state transportation agencies prefer conventional asphalt for its lower upfront costs and established application practices. Current usage is strongest in urban resurfacing and select highway rehabilitation projects in southern and western states. Widespread transition will likely depend on clear lifecycle cost benefits and proven performance across diverse climates.

The United Kingdom’s modified bitumen market is growing at a 4.4% CAGR, driven by selective infrastructure upgrades and localized weather challenges. Demand is strongest in coastal areas and regions with high rainfall or freeze-thaw cycles, where performance-based materials are essential for durability. Adoption is gradually increasing in airport runways, highway shoulders, and logistics corridors, supported by local government approvals for polymer-modified binders in high-traffic zones. However, budget constraints and competitive bidding continue to limit broad adoption, keeping usage largely project-specific rather than nationwide. Municipal agencies often seek lifecycle cost justification before approving large-scale resurfacing programs, slowing market penetration.

Germany is witnessing a 5.3% CAGR, with steady YoY progress as investment grows in autobahn upgrades, bridge deck protection, and tunnel surfacing. Modified bitumen is being favored in infrastructure requiring high resistance to deformation from heavy transport loads. Public procurement frameworks are increasingly incorporating performance-grade requirements, particularly in federal highway programs. Regional engineering specifications are also aligning toward modified binders for long-haul roadways where consistency and resistance to shearing are critical. While not uniform across all Länder, state-level transport agencies are issuing more tenders that include polymer-based specifications. Domestic material testing protocols have also supported this shift, reinforcing trust in the long-term viability of SBS and APP blends in variable Central European conditions.

China leads with a 6.2% CAGR, reflecting the strongest YoY growth among top global markets. Demand is being driven by continuous expansion of high-density road networks across both inland provinces and coastal megacities. Modified bitumen is now the material of choice for multilane expressways, elevated ring roads, and logistics-intensive industrial zones. Provincial planning bureaus are increasing their reliance on SBS-based blends to meet load-bearing and cracking-resistance criteria under rising traffic volumes. Rapid construction cycles and large-scale resurfacing projects further support consumption. Domestic manufacturers have scaled operations, creating regional supply hubs that reduce material delays and project downtime. Cost efficiency and durability are now equally weighted in project decisions, pushing modified bitumen toward wider national adoption.

India is expanding its modified bitumen market at a 5.8% CAGR, with robust YoY growth driven by national highway construction, economic zone development, and state-funded road upgrades. High-temperature conditions in central and southern regions are increasing the preference for polymer-modified bitumen, especially in expressways and industrial corridors. Government agencies, including NHAI and state PWDs, are integrating modified grades into tender requirements to reduce early surface failures. Local producers are increasing output to support demand, often through region-specific formulations that address climatic variability. Growth is also being supported by mandates to reduce long-term maintenance cycles on strategic economic routes. Adoption is accelerating in states like Maharashtra, Gujarat, and Tamil Nadu, where freight and temperature extremes justify the performance premium.

The modified bitumen market is highly fragmented, driven by a combination of global energy corporations, polymer producers, and regional roofing system specialists. CertainTeed Corporation commands strong influence in North America, leveraging its broad product range for roofing and waterproofing applications built on SBS (styrene-butadiene-styrene) and APP (atactic polypropylene) technologies. Its brand strength and distribution network provide a competitive edge in residential and commercial segments.

Global energy leaders such as ExxonMobil, Shell Global, TotalEnergies SE, and Nynas AB play a foundational role by supplying base bitumen and integrating upstream production with downstream applications in roofing and paving. This vertical integration allows greater pricing flexibility and supply security. Roofing system innovators like Johns Manville, Polyglass USA, and Siplast (Icopal Group) differentiate through energy-efficient products, lighter installations, and advanced waterproofing solutions.

On the materials side, Dynasol Group, Kraton Corporation, and Versalis S.p.A. focus on polymer additives, improving elasticity, thermal stability, and resistance to high traffic or severe climates. Asian manufacturers such as LG Chem and Colas Group reinforce global competition, emphasizing R&D-driven formulations and export-oriented strategies. Competitive success increasingly depends on sustainability, low-VOC formulations, and ease-of-application systems aligned with green building regulations.

Key Developments in the Modified Bitumen Market

Recent strategies focus on product innovation for energy-efficient, climate-resilient roofing systems and eco-friendly paving solutions. Leaders like CertainTeed invest in advanced SBS- and APP-modified membranes for improved durability and reflective properties. ExxonMobil, Shell, and TotalEnergies strengthen integrated supply chains to stabilize raw material availability. Polymer specialists, including Kraton and Dynasol, develop bio-based elastomers and high-performance additives to meet stricter environmental standards. Asian players increase R&D spending on low-VOC products and expand distribution in high-growth markets. Digital tools for installation support and partnerships with construction firms are gaining traction for market differentiation.

| Item | Value |

|---|---|

| Quantitative Units | USD 28.2 Billion |

| Polymer Modifier Type | Styrene-butadiene-styrene (SBS) modified bitumen, SBS polymer grades and specifications, Atactic polypropylene (APP) modified bitumen, Ethylene vinyl acetate (EVA) modified bitumen, Thermoplastic elastomers (TPE) and other modifiers, Bio-based and recycled polymer Modifiers, Hybrid and multi-polymer systems, SBS-APP combination products, and Polymer-rubber hybrid modifications |

| Application Type | Roofing applications, Low-slope and flat roofing systems, Steep-slope roofing applications, Road construction and paving, Highway and interstate applications, Urban and municipal road systems, Airport and industrial paving, Above-grade waterproofing solutions, Industrial and specialty applications, Adhesives and sealants, Coatings and protective systems, and Pipe coating and corrosion protection |

| End Use Industry | Construction and Building Industry, Residential Construction Market, Commercial Construction Sector, Industrial Construction Applications, Transportation Infrastructure, Highway and Road Infrastructure, Airport Infrastructure Development, Port and Marine Infrastructure, Energy and Utilities Sector, Power Generation Facilities, Oil and Gas Infrastructure, Water and Wastewater Treatment, Government and Public Infrastructure, Federal and State Government Projects, Municipal and Local Government Applications, Military and Defense Infrastructure, Private and Specialty Markets, Sports and Recreation Facilities, Agricultural and Rural Infrastructure, and Mining and Extractive Industries |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | CertainTeed Corporation, Colas Group, Dynasol Group, Ergon Inc., ExxonMobil Corporation, Johns Manville, Kraton Corporation, LG Chem Ltd, MBTechnology, Nynas AB, Polyglass USA, Inc, Shell Global, Siplast (Icopal Group), TotalEnergies SE, and Versalis S.p.A |

| Additional Attributes | Dollar sales by modifier type, application method, and end-use sector; regional demand driven by infrastructure development, climate adaptability, and road durability standards; innovation in polymer blends, self-healing materials, and reflective coatings; cost dynamics influenced by crude oil prices and construction cycles; environmental impact from recyclability and emission levels; and emerging use cases in green roofing systems, high-traffic pavements, and waterproofing applications. |

The global modified bitumen market is estimated to be valued at USD 28.2 billion in 2025.

The market size for the modified bitumen market is projected to reach USD 44.3 billion by 2035.

The modified bitumen market is expected to grow at a 4.6% CAGR between 2025 and 2035.

The key product types in modified bitumen market are styrene-butadiene-styrene (sbs) modified bitumen, sbs polymer grades and specifications, atactic polypropylene (app) modified bitumen, ethylene vinyl acetate (eva) modified bitumen, thermoplastic elastomers (tpe) and other modifiers, bio-based and recycled polymer modifiers, hybrid and multi-polymer systems, sbs-app combination products and polymer-rubber hybrid modifications.

In terms of application type, roofing applications segment to command 41.0% share in the modified bitumen market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Polymer Modified Bitumen Market Forecast and Outlook 2025 to 2035

Modified Milk Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Modified Atmosphere Packaging Equipment Market Size and Share Forecast Outlook 2025 to 2035

Modified Soya Flour Market Size and Share Forecast Outlook 2025 to 2035

Modified Flour Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Modified Release Formulations Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Modified Starch Market Analysis - Size, Share, and Forecast 2024 to 2034

Modified lecithin Market

DNA-Modified Plant Extracts Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Organo-Modified Bentonite Market Growth - Trends & Forecast 2025 to 2035

Polyether Modified Polysiloxane Market Analysis – Share, Size, and Forecast 2025 to 2035

Competitive Overview of Active and Modified Atmospheric Packaging Companies

Active & Modified Atmospheric Packaging Market Trends & Forecast 2024-2034

Genetically Modified Food Market Analysis by Type, Trait, and Region through 2035

Bitumen Modifier Industry Analysis in Europe Size and Share Forecast Outlook 2025 to 2035

Bitumen Sprayer Market Size and Share Forecast Outlook 2025 to 2035

Bitumen Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Bitumen Emulsion Plants Market Size and Share Forecast Outlook 2025 to 2035

Bitumen Emulsifiers Market Size and Share Forecast Outlook 2025 to 2035

Bitumen and Asphalt Testing Services Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA