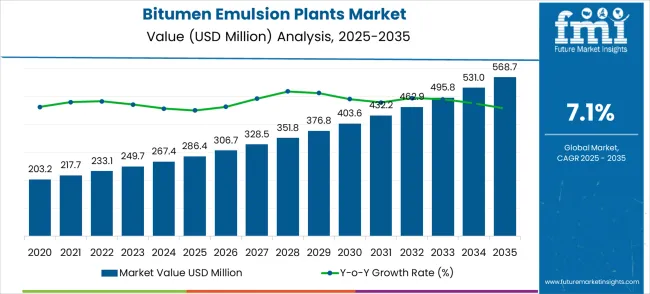

The global bitumen emulsion plants market is expected to grow from USD 286.4 million in 2025 to approximately USD 568.7 million by 2035, recording an absolute increase of USD 282.3 million over the forecast period. This translates into a total growth of 98.5%, with the market forecast to expand at a compound annual growth rate (CAGR) of 7.1% between 2025 and 2035. The overall market size is expected to grow by nearly 1.99X during the same period, supported by increasing infrastructure development activities and growing demand for sustainable road construction technologies across various regional markets.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 286.4 million |

| Market Forecast Value (2035) | USD 568.7 million |

| Forecast CAGR (2025–2035) | 7.1% |

Between 2025 and 2030, the bitumen emulsion plants market is projected to expand from USD 286.4 million to USD 403.6 million, resulting in a value increase of USD 117.2 million, which represents 41.5% of the total forecast growth for the decade. This phase of growth will be shaped by rising infrastructure development across emerging economies, increasing adoption of eco-friendly road construction techniques, and growing investments in highway construction projects. Road construction companies are investing in advanced emulsion plant technologies to improve operational efficiency and produce high-quality bitumen emulsions for various applications.

From 2030 to 2035, the market is forecast to grow from USD 403.6 million to USD 568.7 million, adding another USD 165.1 million, which constitutes 58.5% of the overall ten-year expansion. This period is expected to be characterized by expansion of smart city projects in developing countries, integration of automated control systems in emulsion plants, and development of specialized emulsion formulations for advanced road construction applications. The growing focus on sustainable construction practices will drive demand for efficient and environmentally compliant bitumen emulsion plant solutions across multiple infrastructure sectors.

Market expansion is being supported by the rapid infrastructure development across developing economies and the corresponding need for reliable road construction and maintenance systems in urban and rural areas. Modern construction operations require precise emulsion production capabilities and quality control to ensure optimal road performance and durability. The superior efficiency and environmental benefits of bitumen emulsion plants make them essential components in sustainable construction projects where cost-effectiveness and environmental compliance are critical.

The growing emphasis on sustainable construction practices and environmental compliance is driving demand for advanced emulsion plant technologies from certified manufacturers with proven track records of reliability and performance. Construction operators are increasingly investing in high-quality emulsion plants that offer lower operational costs and reduced maintenance requirements over extended service periods. Regulatory requirements and industry standards are establishing performance benchmarks that favor precision-engineered bitumen emulsion plant solutions with advanced automation capabilities.

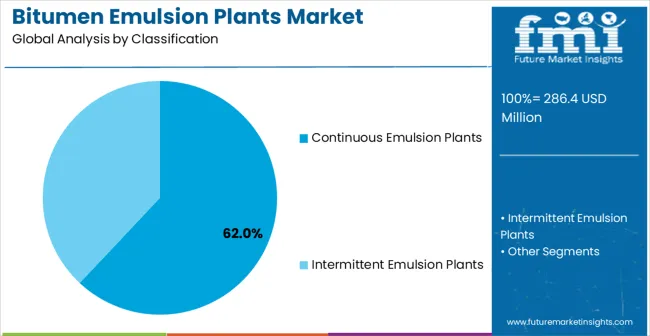

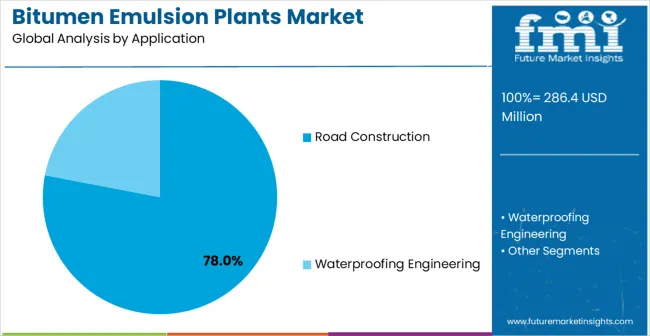

The market is segmented by plant type, application, and region. By plant type, the market is divided into continuous emulsion plants and intermittent emulsion plants configurations. Based on application, the market is categorized into road construction, waterproofing engineering, airport construction, railway construction, and others. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

Continuous emulsion plants are projected to account for 62% of the bitumen emulsion plants market in 2025. This leading share is supported by the increasing demand for high-volume emulsion production in large-scale infrastructure projects and growing preference for automated production systems. Continuous plants provide superior production efficiency and consistent emulsion quality, making them the preferred choice for highway construction, airport projects, and major urban infrastructure developments. The segment benefits from technological advancements that have improved the automation and control systems while reducing manual intervention requirements.

Modern continuous emulsion plants incorporate advanced mixing technologies, automated dosing systems, and sophisticated quality control mechanisms that ensure consistent emulsion properties throughout the production process. These innovations have significantly improved production efficiency while reducing total cost of ownership through higher output rates and elimination of batch-to-batch variations. The highway construction and major infrastructure sectors particularly drive demand for continuous plants, as these projects require large volumes of consistent-quality emulsions to maintain construction schedules and quality standards.

The segment's growth is further accelerated by the increasing complexity of modern construction projects that demand precise emulsion specifications and consistent production rates. Continuous plants offer superior flexibility in adjusting emulsion properties in real-time, allowing contractors to meet varying project requirements without production interruptions. The integration of advanced control systems enables operators to monitor multiple parameters simultaneously, including temperature control, mixing ratios, and viscosity measurements, ensuring optimal emulsion characteristics for specific applications.

Road construction applications are expected to represent 78% of bitumen emulsion plants demand in 2025. This dominant share reflects the critical role of bitumen emulsions in modern road construction techniques and the need for high-quality emulsion production equipment capable of supporting various pavement technologies. Road construction projects require reliable and efficient emulsion plants for surface treatments, cold mix applications, and maintenance operations. The segment benefits from ongoing expansion of road infrastructure in developing countries and increasing adoption of sustainable pavement technologies requiring specialized emulsion formulations.

Highway and urban road construction operations demand exceptional emulsion quality to ensure pavement durability and performance under varying traffic and climate conditions. These applications require plants capable of producing different emulsion grades, handling various aggregate types, and maintaining consistent quality standards throughout construction projects. The growing emphasis on sustainable construction practices, particularly in urban areas and environmentally sensitive regions, drives consistent demand for advanced emulsion production equipment. Emerging markets in Asia-Pacific, Latin America, and Africa contribute significantly to market growth as governments invest in modern road infrastructure to support economic development.

The road construction segment's dominance is reinforced by the increasing adoption of cold mix technologies that require high-quality emulsions for optimal performance. These applications demand precise control over emulsion properties, including particle size distribution, stability, and breaking characteristics, which can only be achieved through advanced production equipment. Modern road construction projects also require plants capable of producing specialty emulsions for specific applications such as micro-surfacing, slurry seals, and fog seals, each requiring different formulations and production parameters.

The bitumen emulsion plants market is advancing steadily due to increasing infrastructure development and growing recognition of sustainable construction technology importance. However, the market faces challenges including high initial equipment costs, need for skilled technical personnel, and varying emulsion specifications across different regional markets. Standardization efforts and certification programs continue to influence equipment quality and market development patterns.

The primary growth drivers include massive infrastructure development programs worldwide, particularly in emerging economies where governments are investing heavily in highway networks and urban road systems. The increasing adoption of sustainable construction practices has created substantial demand for emulsion plants that can produce eco-friendly formulations while maintaining superior performance characteristics. Additionally, the growing emphasis on cold mix technologies in road construction is driving demand for advanced emulsion production equipment capable of producing specialized formulations for various applications including micro-surfacing, chip seals, and fog seals.

Key market restraints include the substantial capital investment required for advanced emulsion plants, which can be prohibitive for smaller construction companies. The complexity of modern emulsion production systems requires skilled technical personnel for operation and maintenance, creating workforce challenges in many regions. Additionally, varying regional specifications and quality standards for bitumen emulsions create barriers to standardization and increase compliance costs for manufacturers operating across multiple markets.

The growing deployment of automated control systems and digital monitoring interfaces is enabling real-time production optimization and quality control capabilities in emulsion plant installations. Advanced sensors and automated dosing systems provide continuous monitoring of production parameters while optimizing emulsion properties and extending equipment service life. These technologies are particularly valuable for large construction projects that require consistent emulsion quality and minimal production downtime. The integration of IoT sensors and cloud-based monitoring platforms allows operators to track plant performance remotely and implement predictive maintenance strategies.

Modern plant manufacturers are incorporating advanced design technologies and materials that improve energy efficiency while reducing environmental impact through lower emissions and waste generation. Integration of heat recovery systems and advanced mixing technologies enables precise emulsion production and significant energy savings compared to traditional systems. Advanced materials and manufacturing techniques also support development of more durable and corrosion-resistant plant components for demanding construction environments. The trend toward sustainable construction practices has led to increased demand for plants capable of incorporating recycled materials and producing bio-based emulsion formulations.

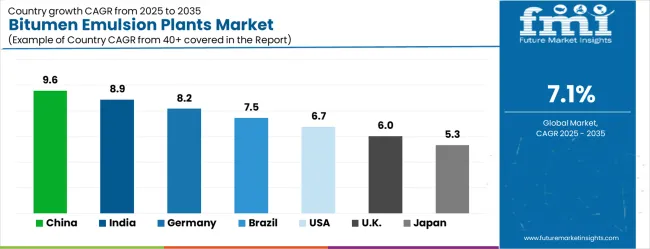

| Country | CAGR (2025–2035) |

|---|---|

| China | 9.6% |

| India | 8.9% |

| Germany | 8.2% |

| Brazil | 7.5% |

| United States | 6.7% |

| United Kingdom | 6.0% |

| Japan | 5.3% |

The bitumen emulsion plants market is growing rapidly, with China leading at a 9.6% CAGR through 2035, driven by massive infrastructure development, development programs, and highway construction projects. India follows at 8.9%, supported by rising infrastructure investments in road networks and increasing adoption of sustainable construction technologies. Germany records strong growth at 8.2%, emphasizing precision engineering, environmental compliance, and advanced automation capabilities.

Brazil grows steadily at 7.5%, integrating emulsion plants into expanding highway networks and urban infrastructure projects. The United States shows moderate growth at 6.7%, focusing on infrastructure modernization and road maintenance programs. The United Kingdom maintains steady expansion at 6.0%, supported by infrastructure upgrade initiatives. Japan demonstrates stable growth at 5.3%, emphasizing technological innovation and construction excellence.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

Demand for bitumen emulsion plants in China is projected to exhibit the highest growth rate with a CAGR of 9.6% through 2035, driven by massive infrastructure development programs and extensive highway construction projects across urban and rural regions. The country's Belt and Road Initiative and domestic infrastructure modernization programs are creating significant demand for high-capacity emulsion plant systems. Major construction companies are establishing comprehensive emulsion production facilities to support large-scale road construction operations and meet stringent quality requirements.

China's rapid urbanization and industrial growth necessitate continuous expansion of transportation networks, creating sustained demand for advanced emulsion plant technologies. The government's focus on sustainable construction practices and environmental compliance is driving adoption of energy-efficient and automated emulsion plants. Furthermore, the country's strategic emphasis on infrastructure export and international construction projects is spurring domestic manufacturers to develop world-class emulsion plant technologies that meet global standards.

Revenue from bitumen emulsion plants in India is expanding at a CAGR of 8.9%, supported by increasing infrastructure investments across national highway networks and growing adoption of sustainable road construction technologies. The country's National Infrastructure Pipeline and smart city development programs are driving demand for modern emulsion plants capable of producing high-quality emulsions for various pavement applications. Construction companies are investing in advanced plant technologies to improve operational efficiency and comply with environmental regulations.

India's ambitious highway expansion programs under the Bharatmala Pariyojana and Pradhan Mantri Gram Sadak Yojana are creating unprecedented demand for high-capacity emulsion plants. The government's focus on rural road connectivity and urban infrastructure development is generating sustained market opportunities for both domestic and international plant manufacturers. Additionally, the country's increasing emphasis on sustainable construction practices and adoption of international quality standards is driving demand for advanced emulsion plants equipped with automated control systems and environmental compliance features.

Bitumen emulsion plants market in Germany is projected to grow at a CAGR of 8.2%, supported by the country's emphasis on precision engineering and advanced construction technologies. German construction companies are implementing high-performance emulsion plants that meet stringent quality standards and environmental requirements. The market is characterized by focus on automation, advanced materials, and compliance with comprehensive environmental regulations. Germany's leadership in engineering excellence and technological innovation continues to drive demand for state-of-the-art emulsion plants that incorporate advanced automation, energy-efficient designs, and environmental compliance features.

The country's construction industry prioritizes equipment reliability, operational efficiency, and long-term cost-effectiveness, creating demand for premium emulsion plant solutions. Furthermore, Germany's role as a technology hub for construction equipment manufacturing positions the country as both a significant market for advanced emulsion plants and a source of innovative plant technologies for global markets. The emphasis on sustainable construction practices and carbon footprint reduction is driving adoption of energy-efficient emulsion plants with heat recovery systems and optimized mixing technologies.

Revenue from bitumen emulsion plants in Brazil is growing at a CAGR of 7.5%, driven by expanding highway networks and increasing infrastructure development across metropolitan and rural regions. The country's infrastructure investment programs are supporting adoption of modern emulsion plants to improve construction efficiency and road quality. Construction companies are adopting advanced plant technologies to support growing infrastructure requirements and environmental compliance standards. Brazil's vast territory and growing economy necessitate continuous expansion of transportation infrastructure, creating sustained demand for reliable emulsion plant systems.

The government's Pro-Infra program and other infrastructure initiatives are generating significant opportunities for emulsion plant manufacturers. Additionally, Brazil's hosting of major international events and growing industrial sector are driving demand for high-quality road construction and maintenance, requiring advanced emulsion production capabilities. The country's focus on sustainable development and environmental protection is also influencing procurement decisions toward eco-friendly emulsion plant technologies that reduce environmental impact while maintaining superior construction performance.

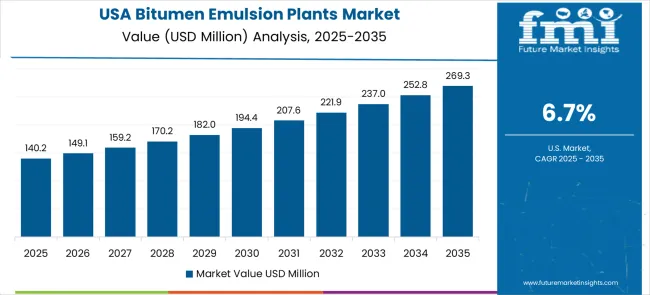

Bitumen emulsion plants in the United States is expanding at a CAGR of 6.7%, driven by ongoing infrastructure modernization and increasing emphasis on road maintenance and rehabilitation programs. Construction companies are upgrading existing facilities with advanced emulsion plants that provide improved production capabilities and reduced operational costs. The market benefits from replacement demand and facility expansion programs across multiple state transportation departments. The Infrastructure Investment and Jobs Act is providing substantial funding for highway and bridge improvements, creating significant opportunities for emulsion plant manufacturers.

The focus on sustainable construction practices and environmental compliance is driving adoption of advanced emulsion plants with energy-efficient designs and emission control systems. Additionally, the aging infrastructure in many states requires extensive maintenance and rehabilitation work, creating sustained demand for high-quality emulsion production capabilities. State transportation departments are increasingly specifying advanced emulsion technologies for pavement preservation and maintenance applications, driving demand for specialized plant configurations that can produce various emulsion grades for different applications.

Demand for bitumen emulsion plants in the United Kingdom is projected to grow at a CAGR of 6.0%, supported by ongoing infrastructure upgrade programs and highway maintenance initiatives. Construction operators are investing in reliable emulsion plants that provide consistent production capabilities and meet environmental compliance requirements. The market is characterized by focus on equipment reliability, operational efficiency, and regulatory compliance across diverse construction applications. The UK's Road Investment Strategy and local authority infrastructure programs are driving sustained demand for modern emulsion plants.

Brexit-related infrastructure investments and the government's commitment to leveling up regional economies are creating new opportunities for road construction and improvement projects. The UK's emphasis on sustainable construction practices and carbon footprint reduction is driving adoption of energy-efficient emulsion plants with advanced environmental controls. Additionally, the country's aging road infrastructure requires extensive maintenance and rehabilitation work, creating consistent demand for high-quality emulsion production capabilities that can support various surface treatment and pavement preservation applications.

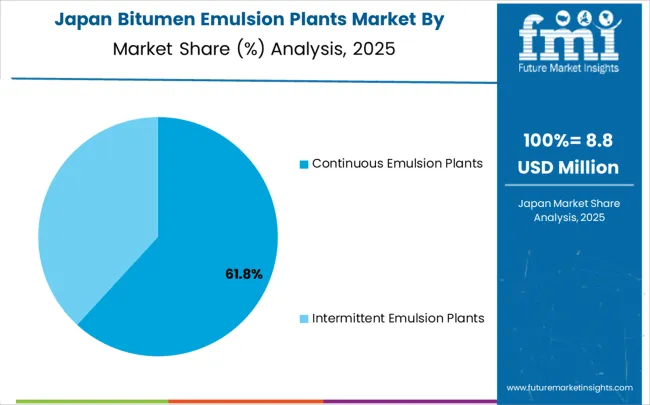

Bitumen emulsion plant market in Japan is experiencing steady growth, with a CAGR of 5.3%, driven by the country’s strong focus on technological innovation, precision engineering, and excellence in construction equipment. Japanese manufacturers are at the forefront of developing advanced emulsion plant technologies that prioritize energy efficiency, environmental sustainability, and operational reliability. These plants incorporate state-of-the-art process control systems, automated monitoring, and precision components to ensure consistent product quality and optimized performance across diverse construction applications.

The market’s growth is further supported by nationwide initiatives that promote construction excellence, infrastructure modernization, and the adoption of innovative plant solutions. These programs emphasize high-quality standards, reliability, and efficiency in operations, enabling Japanese construction companies to meet stringent environmental and regulatory requirements. Advanced automation and digital integration in emulsion plants help reduce energy consumption, minimize emissions, and enhance operational safety, making them a critical component of modern infrastructure projects.

Japanese manufacturers continuously invest in research and development to improve plant design, optimize chemical mixing processes, and enhance material handling efficiency. This commitment to continuous innovation ensures that bitumen emulsion plants not only meet current construction demands but also anticipate future industry requirements, positioning Japan as a global leader in precision-engineered, high-performance infrastructure equipment.

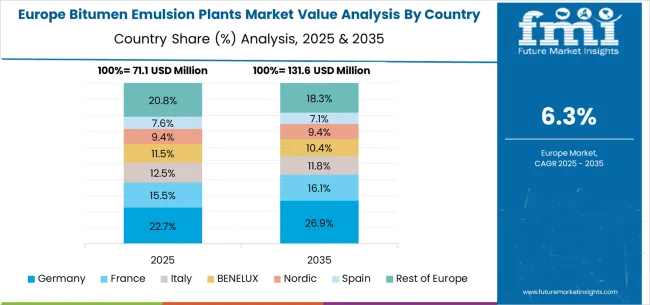

The bitumen emulsion plants market in Europe is projected to grow from USD 74.8 million in 2025 to USD 148.2 million by 2035, registering a CAGR of 7.3% over the forecast period. Germany is expected to maintain its leadership with a 31.2% share in 2025, supported by its strong construction industry and advanced infrastructure requirements. The United Kingdom follows with 22.5% market share, driven by ongoing infrastructure modernization and highway upgrade programs.

France holds 18.7% of the European market, benefiting from highway expansion projects and urban infrastructure investments. Italy and Spain collectively represent 19.1% of regional demand, with growing focus on road maintenance and sustainable construction applications. The Rest of Europe region accounts for 8.5% of the market, supported by infrastructure development in Eastern European countries and Nordic construction sectors.

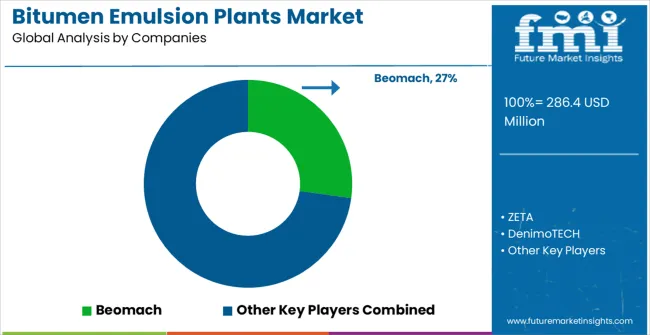

The bitumen emulsion plants market is defined by competition among established construction equipment manufacturers, specialized emulsion plant companies, and regional engineering firms. Companies are investing in advanced automation technologies, product innovation, standardized quality systems, and technical support capabilities to deliver reliable, efficient, and cost-effective emulsion plant solutions. Strategic partnerships, technological advancement, and geographic expansion are central to strengthening product portfolios and market presence.

Beomach, operating globally, offers comprehensive emulsion plant solutions with focus on precision engineering, reliability, and technical support services. ZETA, multinational, provides advanced plant systems with emphasis on automation and digital integration capabilities. Denimo, European-based, delivers specialized plant solutions for infrastructure applications with focus on performance and durability. TECHU offers comprehensive emulsion plant technologies with standardized procedures and global service support.

Vialab provides industrial emulsion plant systems with emphasis on custom solutions and technical expertise. Vimpo Makine delivers specialized plant equipment with focus on high-performance applications. ENH Engineering offers comprehensive plant solutions for demanding construction environments. Massenza provides advanced plant systems with global manufacturing and service capabilities.

E-MAK, Alltech, MBA Plant, Ammann Group, and Meg Makina offer specialized emulsion plant expertise, regional manufacturing capabilities, and technical support across global and regional networks.

The bitumen emulsion plants market underpins infrastructure development, sustainable construction, road quality improvement, and efficient pavement technologies. With sustainability mandates, stricter environmental compliance, and demand for high-quality emulsion production, the sector must balance cost competitiveness, production reliability, and technological integration. Coordinated contributions from governments, industry bodies, OEMs/technology integrators, suppliers, and investors will accelerate the transition toward energy-efficient, digitally monitored, and environmentally compliant emulsion plant systems.

| Item | Value |

|---|---|

| Quantitative Units | USD 286.4 million |

| Plant Type | Continuous Emulsion Plants, Intermittent Emulsion Plants |

| Application | Road Construction, Waterproofing Engineering |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Germany, India, China, United Kingdom, Japan, Brazil, and other 40+ countries |

| Key Companies Profiled | Beomach, ZETA, Denimo, TECHU, Vialab, Vimpo Makine, ENH Engineering, Massenza, E-MAK, Alltech, MBA Plant, Ammann Group, Meg Makina |

| Additional Attributes | Dollar sales by plant type and application, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established manufacturers and emerging suppliers, buyer preferences for automated versus conventional systems, integration with digital monitoring and control technologies, innovations in mixing technologies and automation processes for enhanced production efficiency and quality control, and adoption of smart plant solutions with embedded sensors and remote monitoring capabilities for improved operational performance. |

The global bitumen emulsion plants market is estimated to be valued at USD 286.4 million in 2025.

The market size for the bitumen emulsion plants market is projected to reach USD 568.7 million by 2035.

The bitumen emulsion plants market is expected to grow at a 7.1% CAGR between 2025 and 2035.

The key product types in bitumen emulsion plants market are continuous emulsion plants and intermittent emulsion plants.

In terms of application, road construction segment to command 78.0% share in the bitumen emulsion plants market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bitumen Modifier Industry Analysis in Europe Size and Share Forecast Outlook 2025 to 2035

Bitumen Sprayer Market Size and Share Forecast Outlook 2025 to 2035

Bitumen Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Bitumen Emulsifiers Market Size and Share Forecast Outlook 2025 to 2035

Bitumen and Asphalt Testing Services Market

Modified Bitumen Market Size and Share Forecast Outlook 2025 to 2035

Polymer Modified Bitumen Market Forecast and Outlook 2025 to 2035

Emulsion Polymers Market Size and Share Forecast Outlook 2025 to 2035

Emulsion Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Emulsion Explosive Market Growth – Trends & Forecast 2025 to 2035

Meat Emulsions Market Growth - Demand & Industry Insights 2025 to 2035

Flavor Emulsions Market Size and Share Forecast Outlook 2025 to 2035

Bakery Emulsions Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Flavor Emulsion Market Analysis by Nature, End-Use, Distribution Channel, and Region - Growth, trends and forecast from 2025 to 2035

Acrylic Emulsions Market Size and Share Forecast Outlook 2025 to 2035

Polymer Emulsions Market Size and Share Forecast Outlook 2025 to 2035

Polymer Emulsion Market Growth - Trends & Forecast 2025 to 2035

Beverage Emulsion Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

UK Polymer Emulsion Market Insights – Size, Share & Industry Growth 2025-2035

Modularised Emulsion Plant Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA