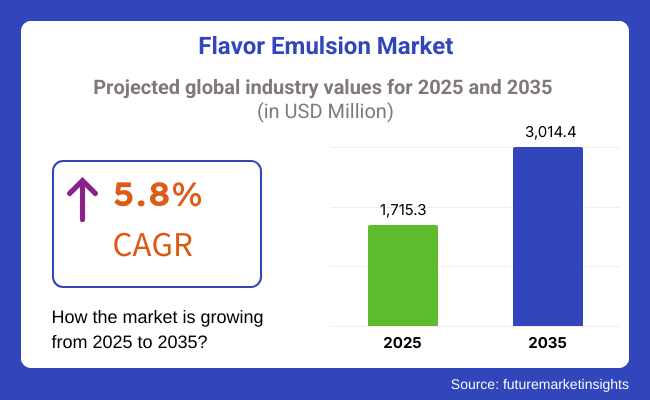

The flavor emulsion market is set for steady growth, with a valuation of USD 1,715.3 million projected in 2025. The overall market is predicted to witness a 5.8% CAGR throughout the forecast period from 2025 to 2035. Its net valuation is set to rise to USD 3,014.4 million in 2035.

Flavor emulsions are extensively used in the food and beverage sector to enhance the taste, smell, and stability of products. The emulsions facilitate the effective inclusion of oil-soluble flavors into water-based formulations, as well as the consistency of formulations and improved shelf life. The increasing demand for innovative and natural flavor solutions is accelerating the growth of this industry in different sectors, such as beverages, dairy, confectionery, and bakeries.

The consumer preference for clean-label and natural ingredients largely drives the expansion. Manufacturers are now predominantly working on the formulation of emulsions concerning organic, non-GMO, and allergen-free ingredients to meet the consumers' changing needs. Moreover, the growth of flavored water, energy drinks, and plant-based dairy alternatives, which is the functional beverage sector, is of immense importance to the progress.

The emulsion processing technology mainly advances all nanoscale emulsification techniques, which ensure flavor stability, solubility, and dispersion, thereby improving the performance of the product in different applications. The emulsions' ability to withstand their sensory characteristics under various processing conditions, such as pasteurization and carbonation, makes it totally desirable in the food and beverage sector.

However, the industry is confronted with challenges such as the complicated process of creating stable emulsions and the cost of the natural flavor sources. Also, the regulations regarding food additives and flavoring agents differ in various regions, thus affecting the manufacturers in terms of approvals and labeling requirements.

In spite of these challenges, there are numerous opportunities to grow. The continuous rise in the use of emulsions in functional food products, sugar-free drinks, and fortified nutrition drinks is set to create new paths. The latest tricks in encapsulation technology, as well as multifunctional flavor emulsions delivering health-promoting benefits, will also significantly bolster the growth over the next few years.

Between 2020 and 2024, there was consistent growth as demand for clean-label and natural foods and beverages increased in the food and beverage sector. These emulsions became popular as producers looked for ways to add taste, flavor, and stability to products, from soft drinks and alcoholic drinks to baked products to dairy products.

Growth in plant-based and functional drinks generated new prospects for these emulsions, particularly at mouthfeel improvement and off-note covering of alternative proteins and nutraceutical additives. Microencapsulation and emulsification technologies improved solubility, stability, and shelf life. Labeling of natural flavors regulatory hurdles, volatile raw material costs, and flavor consistency in different formulations were some barriers.

Before 2025 to 2035, the industry will evolve rapidly as emulsion science and flavor delivery advance and enhance product performance. Nanoemulsion technology will be more readily available for emulsion delivery and bioavailability, enabling easier flavor delivery in low-fat and lower-sugar foods.

Real-time consumer response and flavor profiling through AI will allow manufacturers to create very specific blends of flavor with tailor-made consumer preferences. Growth in ethically manufactured and botanically sourced emulsions will be fueled by growth in demand for sustainable and organic flavor ingredient sources. Sports beverages, protein beverages, and botanical beverages in among the functional food and beverage industries will provide new scope for expansion through experimentation. Transparency of natural flavor claims and clean-label demands will further serve to support consumer confidence and revenue share.

A Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Consolidated growth with demand for natural and clean-label flavor. | Technology innovation and custom flavor solutions are fuelling rapid growth. |

| Natural taste, clean-label materials, and product stability focus. | Functional benefits, precision delivery of flavor, and sustainability emphasis. |

| Beverage emulsions, dairy flavor, and bakery flavor emulsions. | Growth into plant-based, low-sugar, and functional food and beverage emulsions. |

| Demand in North America, Europe, and Asia-Pacific. | Deeper penetration into emerging markets and regional-specific flavors. |

| Natural flavor labeling and compliance with food safety laws. | Cleaner-label claims transparency and organic certifications. |

| Food and beverage firms, flavor firms, and direct suppliers. | Direct-to-manufacturer and online omnichannel distribution. |

| Improved microencapsulation and enhanced stability techniques. | Nanoemulsion technology, AI-driven flavor profiling, and real-time consumer feedback. |

| Flavor companies and specialty ingredient companies competition. | Market consolidation through mergers, acquisitions, and collaborative innovation. |

| Clean-label attributes, flavor stability, and natural focus. | Functional attributes, exact flavors, and environmentally responsible sourcing are the focus. |

There is continuous progress in the industry by the adherence of consumers to the natural, clean label and added flavor solutions that can be customized. Globally recognized food and beverage manufacturers are concentrating on stable water emulsions to enrich flavor longevity in products like carbonated drinks, flavored water, and ready-to-drink beverages.

Moreover, the use of these emulsions in pharmaceuticals and personal care products such as medications, oral care, and beauty products enables taste masking and ensures product consistency. Customization, adherence to regulations, and intertwined factors of the economy play an important role in the making of purchasing decisions.

The growing industry of plant-based and organic foods has pushed the trend of using natural emulsions based on plant extracts and essential oils. Sustainability, transparency, and innovation are essential driving forces for growth in the future.

The sales are growing as a result of the increased need for better taste profiles in beverages, confections, and processed foods. On the other hand, the compliance of regulatory authorities concerning food safety, ingredient transparency, and clean-label formulations is a dilemma. Corporations need to comply with international food standards, get necessary certificates, and keep the public informed to gain trust and marketing rights.

Supply chain disturbances, such as the lack of raw materials and the fluctuation of prices, trigger the increase of product costs and create product unavailability. The sourcing of natural ingredients, essential oils, and emulsifiers could be influenced by climate change and geopolitical issues. Companies ought to develop a supply chain plan that is not dependent on one supplier, look for eco-friendly materials, and upgrade their organization to fight against these threats.

The development of technology in food science and shifting consumer choices determine the industry situation. The customers are transferring to natural, organic, and allergen-free emulsions, which is the cause of the manufacturers being forced to change their products. Enterprises have to gasket in research and development, search for vegetable alternatives to emulsifiers, and utilize oscillation-based innovative technology in order to remain likable.

The possibility of storage instability and the concern of shelf-life are extra risks. Non-homogeneous emulsion properties can cause issues in product performance that lead to waste and customer dissatisfaction. Producers need to boost the formulation techniques, improve the processing conditions, and keep excellent quality control to ensure that the product remains consistent in different applications.

Recessions and changes in consumer expenditure on premium foods might decrease the demand. To maintain growth, the firms should pay attention to the cost, personalization, and widening their markets in the front line along with the business partners and the online trade, which is growing while they are absorbing the changes in the industry.

Although there are many different types of emulsions, including conventional and organic varieties, demand for both is being driven by consumers' increasing preference for natural ingredients, clean-label formulations, and improved product stability in food and beverage applications.

The organic segment is expected to register a share of 36.4% in 2025, owing to a 6.2% CAGR during the forecast period of 2025 to 2035. The growth is driven by rising consumer demand for natural and non-GMO flavor solutions in functional beverages, organic sauces, and plant-based dairy alternatives, the company said.

Givaudan, Symrise, and Sensient Technologies are all expanding their organic flavor emulsion portfolios to meet clean-label and USDA Organic certification standards. Organic citrus emulsions from the firm, for instance, are heavily featured in flavored sparkling waters and wellness drinks and offer a natural fruit taste that is free from artificial components while also bringing additional stability.

The largest share manifests from the conventional segment, with 63.6% of the share in 2025, and is expected to have a CAGR of 5.1% during the period from 2025 to 2035. Increasing consumption of dairy-based beverages, processed foods, and carbonated beverages with parallel demand for low-cost and high-performance emulsions to support the functional food matrix are also projected to contribute to adoption.

Some leading players in this segment are International Flavors & Fragrances (IFF), Takasago, and Kerry Group, with excipient emulsification technologies that enhance flavor solubility, stability, and sensory attributes. Crosslinking polymers such as IFF's proprietary emulsifiers can stabilize flavored energy drinks and ready-to-drink teas, for instance, by suspending ingredients, allowing them to stay in the beverage longer and reducing their chance of going rancid while on the shelf.

As trends activate natural and sustainable ingredients, organic flavor emulsions are gaining increased popularity. Nevertheless, the remarkable emulsifying power of traditional emulsions means that they are still used a lot for mass-market food and beverage applications through their significant cost-efficiency.

In terms of end-use, the industry is divided into Beverages and Sauces & Dressings, both of which have shown significant growth in demand for emulsion solutions due to their requirement for better stability and flavor retention, as well as solubility in liquid-based applications.

The beverage segment dominates and is projected to hold a share of 55.2% in 2025, with a CAGR of 5.6% from 2025 to 2035. The rising popularity of functional drinks, flavored waters, carbonated soft drinks & ready-to-drink teas is driving the requirement for stable emulsions.

Givaudan, Firmenich, and Symrise, among others, continue to innovate in oil-in-water emulsions that improve the dissolvability and mouthfeel of citrus, botanical, and tropical fruit flavors. Firmenich has developed advanced flavor encapsulation technologies that, for example, keep ingredients from separating in sports drinks and vitamin-infused waters.

Based on the segment, the sauces and dressings segment is expected to hold the maximum share of 44.8% in the year 2025 and is expected to grow with a CAGR of 4.9% from 2025 to 2035. Flavors that usually form emulsions, ethnic sauces, creamy dressings, and plant-based condiments will continue to grow in demand and will drive innovation in emulsified flavorful formulations.

The range of emulsions that IFF, Takasago, Sensient Technologies, and others are developing improves flavor stability in oil-based formulations such as mayonnaise, vinaigrettes, and spicy sauces, among other applications. IFF's proprietary emulsification technology disperses flavor compounds evenly, minimizing ingredient separation and prolonging the shelf life of refrigerated dressings.

Through Natural and clean-label products, as consumer preferences change, manufacturers have been investing in emulsion technologies that not only help retain flavor integrity but also support formulation robustness across beverage and sauce applications.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 5.8% |

| UK | 5.5% |

| France | 5.3% |

| Germany | 5.2% |

| Italy | 5% |

| South Korea | 5.6% |

| Japan | 5.1% |

| China | 6% |

| Australia | 5.3% |

| New Zealand | 5% |

The USA is anticipated to advance at a 5.8% CAGR during the 2025 to 2035 forecast period. It is fueled by growing demand among consumers for clean-label and natural products. Some firms, including Givaudan, have countered by scaling up their offerings of natural flavors, focusing on transparency and sustainability. The emerging trend of consumers focused on wellness and looking for foods with minimal processing has also stimulated the use of these emulsions.

Furthermore, the USA enjoys a strong regulatory environment favoring natural ingredient labeling, prompting manufacturers to include these emulsions. The plant-based and organic products trend has also supported growth.

The UK is expected to grow at a rate of 5.5% CAGR during the forecast period. Consumers are finding more products with natural ingredients, encouraging brands such as Treatt to come up with new solutions. The trend toward clean eating has picked up pace, which has resulted in greater demand for products with no artificial additives.

The high level of food labeling regulations in the UK has spurred companies into using emulsions as a way to satisfy customer demands for openness. Ready-to-drink beverages and healthier snacks have also fueled the use of these emulsions in tandem with the burgeoning wellness trend.

France is poised to experience a CAGR of 5.3% from 2025 to 2035. Consumers in France value the authenticity of the cuisine, and the desire for natural flavors has created a demand for flavor emulsions that meet this requirement, with companies such as Mane being at the forefront by creating flavor emulsions that prioritize origin and quality.

France also enjoys a rich heritage of artisanal food manufacturing with a prominent focus on flavor emulsions to ensure product integrity. The organic food industries and environmentally friendly consumers have also helped to promote the use of these emulsions in food and beverages.

Germany will grow at 5.2% CAGR in the forecast period. Natural flavors are widely used in Germany due to their focus on the quality and safety of food manufacturing. Symrise, a company based in Germany, has dominated the provision of emulsions consistent with Germany's quality standards.

The increasing number of vegetarians and vegans in Germany has also helped fuel demand for natural flavor solutions, where consumers want the true taste without giving up their diet. The trend has influenced manufacturers to add flavors to vegetarian products.

The Italian flavor emulsion market will expand at a CAGR of 5% during 2025 to 2035. The country's rich food culture gives immense importance to original flavors, with flavor emulsions being highly favored. Players such as Italfood have adopted such emulsions to make traditional products more authentic.

Italy's slow food culture, focusing on traditional and local foods, has contributed further to the need for natural flavors. The consumer trend of favoring products with explicit and concise lists of ingredients has resulted in manufacturers' use of these emulsions in keeping with the clean-label movement.

South Korea's flavor emulsion industry is projected to expand at a CAGR of 5.6% for the period under review. The Hallyu wave, which refers to Korean cultural influence, has stimulated interest in Korean cuisine worldwide, triggering demand for real flavors. Some of these players, such as CJ CheilJedang, have included these emulsions in an effort to retain traditional flavor profiles in new foods.

The wellness and health trend in South Korea has also prompted consumers to look for natural ingredients, driving the application of emulsions in healthy snacks and functional drinks. The government's encouragement of the food sector's innovation has also helped these emulsions find their place.

Japan is anticipated to expand at a 5.1% CAGR from 2025 through 2035. The demand for flavor emulsions has been stimulated by Japanese consumers' penchant for delicate and natural tastes. This demand has led businesses such as Takasago to create products that reflect this preference, maintaining the original taste.

The sales are also driven by the increasing desire for health and wellness, as consumers look for products that provide natural benefits. Flavor emulsions have been used in functional foods and beverages, consistent with the Japanese emphasis on preventive health.

China is expected to grow at 6% CAGR during the forecast period. Intensive urbanization and the rising middle class have promoted demand for high-quality and natural foodstuffs. Such has been the experience for firms like Huabao, which has tapped into the trend by launching emulsions that satisfy domestic consumers' tastes.

The government's efforts to enhance food safety and healthy eating have also stimulated the use of natural flavors further. The culture of traditional Chinese medicine has had a similar effect, with buyers demanding products with natural ingredients.

Australia is expected to register a 5.3% CAGR between 2025 and 2035. Natural products and the diverse food culture in the country have made way for greater utilization of flavor emulsions. Brands such as Flavor Makers have launched these emulsions to fulfill customers' demand for authenticity.

The clean-label trend is prevalent in Australia, where consumers look for products that contain no artificial additives. This demand has prompted manufacturers to use emulsions, especially in the beverage and dairy industries, where natural flavor is greatly desired.

New Zealand's flavor emulsion market is expected to grow at a CAGR of 5% during the forecast period. The country's focus on sustainability and natural products has driven the adoption of emulsions. Companies like Fresh As have utilized these emulsions to offer innovative products that align with consumer preferences.

The flavor emulsion market is on a growing trend due to the increasing demand for natural, stable, and water-soluble flavoring solutions in food, beverages, and medicines. The manufacturers are increasingly concentrating on these advanced emulsion technologies to meet consumer demands for flavor consistency, shelf stability, and clean-label formulations, as well as the modern consumer inclination towards a more natural and allergen-free ingredient.

The companies, namely Givaudan, Symrise, IFF, Kerry Group, and Sensient Technologies, are popular because of their immense portfolios, R&D investments, and worldwide distribution networks. Start-ups and niche providers have also initiated the introduction of plant-based emulsions, organic-certified flavors, and fat-reduction solutions to capture growing opportunities.

These major offerings include oil-in-water emulsions, microemulsions, and nanoemulsions for application in industries such as carbonated beverages, dairy, confectionery, and functional beverages. The companies are focusing on plant-based emulsifiers, encapsulation technology, and sugar-reduction innovations to accommodate clean-label and reduced calorie demands.

Strategic factors that dominate the competition include patented stabilization methods, sustainability programs, and regulatory compliance (FDA, EFSA, etc.). Key players are increasingly increasing product transparency, expanding production capacity, and cooperating with food and beverage manufacturers to develop customized and regional flavor solutions. With the increasing demand within Asia Pacific, North America, and Europe, companies are investing in localization strategies, direct partnerships, and digital sales platforms to strengthen their positioning.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Givaudan | 18-22% |

| International Flavors & Fragrances (IFF) | 14-18% |

| Symrise | 10-14% |

| Sensient Technologies | 8-12% |

| Kerry Group | 6-10% |

| Other Players (Combined) | 25-35% |

| Company Name | Key Offerings & Market Focus |

|---|---|

| Givaudan | Industrial premier in natural flavor emulsions, using strong global supply networks and advanced encapsulation techniques. |

| IFF | Purely customized flavor emulsion solutions that reflect its concern for sustainability and plant-based ingredients compete with clean-label trends in today's marketplace. |

| Symrise | It is possible to have an extremely heat-stable emulsion ready for beverage and confectionery applications requiring a long shelf life. |

| Sensient Technologies | Concentrate on color-flavor emulsions and incorporate wonderful natural extracts in combination with advanced dispersion technologies to enhance the various aspects of the product. |

| Kerry Group | Functional flavor emulsions the antioxidant properties towards the health & wellness beverage segment. |

Key Company Insights

Givaudan (18-22%)

A market leader and pioneer in natural and sustainable flavor emulsions, it is very strong in beverage and dairy applications.

IFF (14-18%)

Leads the way with plant-based emulsions and clean-label solutions spurred by increasing demand for natural ingredients.

Symrise (10-14%)

Famous for highly stable, long-lasting emulsions, especially in confectionery and bakery applications.

Sensient Technologies (8-12%)

Marries flavor and color innovation, producing novel, visually distinctive emulsions for food and beverages.

Kerry Group (6-10%)

Centers on functional flavor emulsions, combining nutritional value and antioxidant activity to promote health-oriented consumers.

Other Key Players

It's classified as Organic and Conventional.

It's classified as Bakery and Confectionery, Dairy Products, Sauces and Dressings, Beverages, Nutraceuticals, and Others (including Flavoring Agents and Animal Feed).

It's classified as B2B and B2C.

It's divided into North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa.

The industry is expected to generate USD 1,715.3 million in 2025, driven by demand for stable, long-lasting flavor solutions across beverages, dairy, and bakery products.

The market is projected to grow to USD 3,014.4 million by 2035, fueled by rising consumption of processed foods, innovations in emulsification technology, and a growing preference for natural and clean-label flavors. The market is expected to expand at a CAGR of 5.8%.

Key players include Givaudan, IFF, Symrise, Sensient Technologies, Kerry Group, Firmenich, Takasago International Corporation, Döhler Group, Mane, and Robertet Group.

North America and Europe present strong growth potential due to advanced food processing sectors, while East Asia and South Asia are emerging markets driven by increasing demand for flavored beverages and dairy products. Oceania and the Middle East & Africa also show steady expansion.

Conventional flavor emulsions remain dominant, especially in beverages and dairy applications. Organic variants are gaining traction with health-conscious consumers. B2B distribution channels lead the market, though B2C is expanding through retail and direct-to-consumer platforms.

Table 1: Global Market Value (US$ million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ million) Forecast by Nature, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 5: Global Market Value (US$ million) Forecast by End-use, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by End-use, 2018 to 2033

Table 7: Global Market Value (US$ million) Forecast by Distribution Channel, 2018 to 2033

Table 8: Global Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 9: North America Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ million) Forecast by Nature, 2018 to 2033

Table 12: North America Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 13: North America Market Value (US$ million) Forecast by End-use, 2018 to 2033

Table 14: North America Market Volume (MT) Forecast by End-use, 2018 to 2033

Table 15: North America Market Value (US$ million) Forecast by Distribution Channel, 2018 to 2033

Table 16: North America Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 17: Latin America Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ million) Forecast by Nature, 2018 to 2033

Table 20: Latin America Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 21: Latin America Market Value (US$ million) Forecast by End-use, 2018 to 2033

Table 22: Latin America Market Volume (MT) Forecast by End-use, 2018 to 2033

Table 23: Latin America Market Value (US$ million) Forecast by Distribution Channel, 2018 to 2033

Table 24: Latin America Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 25: Europe Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 26: Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 27: Europe Market Value (US$ million) Forecast by Nature, 2018 to 2033

Table 28: Europe Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 29: Europe Market Value (US$ million) Forecast by End-use, 2018 to 2033

Table 30: Europe Market Volume (MT) Forecast by End-use, 2018 to 2033

Table 31: Europe Market Value (US$ million) Forecast by Distribution Channel, 2018 to 2033

Table 32: Europe Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 33: East Asia Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 34: East Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 35: East Asia Market Value (US$ million) Forecast by Nature, 2018 to 2033

Table 36: East Asia Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 37: East Asia Market Value (US$ million) Forecast by End-use, 2018 to 2033

Table 38: East Asia Market Volume (MT) Forecast by End-use, 2018 to 2033

Table 39: East Asia Market Value (US$ million) Forecast by Distribution Channel, 2018 to 2033

Table 40: East Asia Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 41: South Asia Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 42: South Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 43: South Asia Market Value (US$ million) Forecast by Nature, 2018 to 2033

Table 44: South Asia Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 45: South Asia Market Value (US$ million) Forecast by End-use, 2018 to 2033

Table 46: South Asia Market Volume (MT) Forecast by End-use, 2018 to 2033

Table 47: South Asia Market Value (US$ million) Forecast by Distribution Channel, 2018 to 2033

Table 48: South Asia Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 49: Oceania Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 50: Oceania Market Volume (MT) Forecast by Country, 2018 to 2033

Table 51: Oceania Market Value (US$ million) Forecast by Nature, 2018 to 2033

Table 52: Oceania Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 53: Oceania Market Value (US$ million) Forecast by End-use, 2018 to 2033

Table 54: Oceania Market Volume (MT) Forecast by End-use, 2018 to 2033

Table 55: Oceania Market Value (US$ million) Forecast by Distribution Channel, 2018 to 2033

Table 56: Oceania Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 57: Middle East & Africa Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 58: Middle East & Africa Market Volume (MT) Forecast by Country, 2018 to 2033

Table 59: Middle East & Africa Market Value (US$ million) Forecast by Nature, 2018 to 2033

Table 60: Middle East & Africa Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 61: Middle East & Africa Market Value (US$ million) Forecast by End-use, 2018 to 2033

Table 62: Middle East & Africa Market Volume (MT) Forecast by End-use, 2018 to 2033

Table 63: Middle East & Africa Market Value (US$ million) Forecast by Distribution Channel, 2018 to 2033

Table 64: Middle East & Africa Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Figure 1: Global Market Value (US$ million) by Nature, 2023 to 2033

Figure 2: Global Market Value (US$ million) by End-use, 2023 to 2033

Figure 3: Global Market Value (US$ million) by Distribution Channel, 2023 to 2033

Figure 4: Global Market Value (US$ million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ million) Analysis by Nature, 2018 to 2033

Figure 10: Global Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 13: Global Market Value (US$ million) Analysis by End-use, 2018 to 2033

Figure 14: Global Market Volume (MT) Analysis by End-use, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 17: Global Market Value (US$ million) Analysis by Distribution Channel, 2018 to 2033

Figure 18: Global Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 21: Global Market Attractiveness by Nature, 2023 to 2033

Figure 22: Global Market Attractiveness by End-use, 2023 to 2033

Figure 23: Global Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ million) by Nature, 2023 to 2033

Figure 26: North America Market Value (US$ million) by End-use, 2023 to 2033

Figure 27: North America Market Value (US$ million) by Distribution Channel, 2023 to 2033

Figure 28: North America Market Value (US$ million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ million) Analysis by Nature, 2018 to 2033

Figure 34: North America Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 37: North America Market Value (US$ million) Analysis by End-use, 2018 to 2033

Figure 38: North America Market Volume (MT) Analysis by End-use, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 41: North America Market Value (US$ million) Analysis by Distribution Channel, 2018 to 2033

Figure 42: North America Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 45: North America Market Attractiveness by Nature, 2023 to 2033

Figure 46: North America Market Attractiveness by End-use, 2023 to 2033

Figure 47: North America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ million) by Nature, 2023 to 2033

Figure 50: Latin America Market Value (US$ million) by End-use, 2023 to 2033

Figure 51: Latin America Market Value (US$ million) by Distribution Channel, 2023 to 2033

Figure 52: Latin America Market Value (US$ million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ million) Analysis by Nature, 2018 to 2033

Figure 58: Latin America Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 61: Latin America Market Value (US$ million) Analysis by End-use, 2018 to 2033

Figure 62: Latin America Market Volume (MT) Analysis by End-use, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 65: Latin America Market Value (US$ million) Analysis by Distribution Channel, 2018 to 2033

Figure 66: Latin America Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Nature, 2023 to 2033

Figure 70: Latin America Market Attractiveness by End-use, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Europe Market Value (US$ million) by Nature, 2023 to 2033

Figure 74: Europe Market Value (US$ million) by End-use, 2023 to 2033

Figure 75: Europe Market Value (US$ million) by Distribution Channel, 2023 to 2033

Figure 76: Europe Market Value (US$ million) by Country, 2023 to 2033

Figure 77: Europe Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 78: Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ million) Analysis by Nature, 2018 to 2033

Figure 82: Europe Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 83: Europe Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 85: Europe Market Value (US$ million) Analysis by End-use, 2018 to 2033

Figure 86: Europe Market Volume (MT) Analysis by End-use, 2018 to 2033

Figure 87: Europe Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 88: Europe Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 89: Europe Market Value (US$ million) Analysis by Distribution Channel, 2018 to 2033

Figure 90: Europe Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 93: Europe Market Attractiveness by Nature, 2023 to 2033

Figure 94: Europe Market Attractiveness by End-use, 2023 to 2033

Figure 95: Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 96: Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: East Asia Market Value (US$ million) by Nature, 2023 to 2033

Figure 98: East Asia Market Value (US$ million) by End-use, 2023 to 2033

Figure 99: East Asia Market Value (US$ million) by Distribution Channel, 2023 to 2033

Figure 100: East Asia Market Value (US$ million) by Country, 2023 to 2033

Figure 101: East Asia Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 102: East Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 103: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: East Asia Market Value (US$ million) Analysis by Nature, 2018 to 2033

Figure 106: East Asia Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 107: East Asia Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 108: East Asia Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 109: East Asia Market Value (US$ million) Analysis by End-use, 2018 to 2033

Figure 110: East Asia Market Volume (MT) Analysis by End-use, 2018 to 2033

Figure 111: East Asia Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 112: East Asia Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 113: East Asia Market Value (US$ million) Analysis by Distribution Channel, 2018 to 2033

Figure 114: East Asia Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 115: East Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 116: East Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 117: East Asia Market Attractiveness by Nature, 2023 to 2033

Figure 118: East Asia Market Attractiveness by End-use, 2023 to 2033

Figure 119: East Asia Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 120: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia Market Value (US$ million) by Nature, 2023 to 2033

Figure 122: South Asia Market Value (US$ million) by End-use, 2023 to 2033

Figure 123: South Asia Market Value (US$ million) by Distribution Channel, 2023 to 2033

Figure 124: South Asia Market Value (US$ million) by Country, 2023 to 2033

Figure 125: South Asia Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 126: South Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 127: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia Market Value (US$ million) Analysis by Nature, 2018 to 2033

Figure 130: South Asia Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 131: South Asia Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 132: South Asia Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 133: South Asia Market Value (US$ million) Analysis by End-use, 2018 to 2033

Figure 134: South Asia Market Volume (MT) Analysis by End-use, 2018 to 2033

Figure 135: South Asia Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 136: South Asia Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 137: South Asia Market Value (US$ million) Analysis by Distribution Channel, 2018 to 2033

Figure 138: South Asia Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 139: South Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 140: South Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 141: South Asia Market Attractiveness by Nature, 2023 to 2033

Figure 142: South Asia Market Attractiveness by End-use, 2023 to 2033

Figure 143: South Asia Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 144: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 145: Oceania Market Value (US$ million) by Nature, 2023 to 2033

Figure 146: Oceania Market Value (US$ million) by End-use, 2023 to 2033

Figure 147: Oceania Market Value (US$ million) by Distribution Channel, 2023 to 2033

Figure 148: Oceania Market Value (US$ million) by Country, 2023 to 2033

Figure 149: Oceania Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 150: Oceania Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 151: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: Oceania Market Value (US$ million) Analysis by Nature, 2018 to 2033

Figure 154: Oceania Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 155: Oceania Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 156: Oceania Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 157: Oceania Market Value (US$ million) Analysis by End-use, 2018 to 2033

Figure 158: Oceania Market Volume (MT) Analysis by End-use, 2018 to 2033

Figure 159: Oceania Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 160: Oceania Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 161: Oceania Market Value (US$ million) Analysis by Distribution Channel, 2018 to 2033

Figure 162: Oceania Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 163: Oceania Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 164: Oceania Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 165: Oceania Market Attractiveness by Nature, 2023 to 2033

Figure 166: Oceania Market Attractiveness by End-use, 2023 to 2033

Figure 167: Oceania Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 168: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East & Africa Market Value (US$ million) by Nature, 2023 to 2033

Figure 170: Middle East & Africa Market Value (US$ million) by End-use, 2023 to 2033

Figure 171: Middle East & Africa Market Value (US$ million) by Distribution Channel, 2023 to 2033

Figure 172: Middle East & Africa Market Value (US$ million) by Country, 2023 to 2033

Figure 173: Middle East & Africa Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 174: Middle East & Africa Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 175: Middle East & Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East & Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East & Africa Market Value (US$ million) Analysis by Nature, 2018 to 2033

Figure 178: Middle East & Africa Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 179: Middle East & Africa Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 180: Middle East & Africa Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 181: Middle East & Africa Market Value (US$ million) Analysis by End-use, 2018 to 2033

Figure 182: Middle East & Africa Market Volume (MT) Analysis by End-use, 2018 to 2033

Figure 183: Middle East & Africa Market Value Share (%) and BPS Analysis by End-use, 2023 to 2033

Figure 184: Middle East & Africa Market Y-o-Y Growth (%) Projections by End-use, 2023 to 2033

Figure 185: Middle East & Africa Market Value (US$ million) Analysis by Distribution Channel, 2018 to 2033

Figure 186: Middle East & Africa Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 187: Middle East & Africa Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 188: Middle East & Africa Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 189: Middle East & Africa Market Attractiveness by Nature, 2023 to 2033

Figure 190: Middle East & Africa Market Attractiveness by End-use, 2023 to 2033

Figure 191: Middle East & Africa Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 192: Middle East & Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Flavor Emulsions Market Size and Share Forecast Outlook 2025 to 2035

Flavor Modulator Market Size and Share Forecast Outlook 2025 to 2035

Flavor Masking Agents Market Size and Share Forecast Outlook 2025 to 2035

Flavor Modulators Market Size and Share Forecast Outlook 2025 to 2035

Flavor Compounds Market Size and Share Forecast Outlook 2025 to 2035

Flavoring Cosmetic Formulation Agents Market Size and Share Forecast Outlook 2025 to 2035

Flavored Whiskey Market Size and Share Forecast Outlook 2025 to 2035

Flavored Butter And Oils Market Size and Share Forecast Outlook 2025 to 2035

Flavoring Oils Market Size and Share Forecast Outlook 2025 to 2035

Flavoring Agents Market Size and Share Forecast Outlook 2025 to 2035

Flavors for Pharmaceutical & Healthcare Applications Market Size and Share Forecast Outlook 2025 to 2035

Flavor Capsule Cigarette Market Analysis - Size, Share, and Forecast 2025 to 2035

Flavored Syrup Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Analysis and Growth Projections for Flavor and Flavor Enhancers Market

Flavored Yogurt Market Analysis by Form, Flavor, End Use and Distribution Channel Through 2035

Flavors and Fragrances Market Analysis by Type, Nature, Application, and Region through 2035

Flavored CBD Powder Market Growth - Innovations & Consumer Trends 2025 to 2035

Flavored Salt Market Insights - Seasoning Trends & Growth 2025 to 2035

Flavored Water Market Trends - Hydration & Wellness Demand 2025 to 2035

Flavor Drops Market Growth - Beverage & Functional Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA