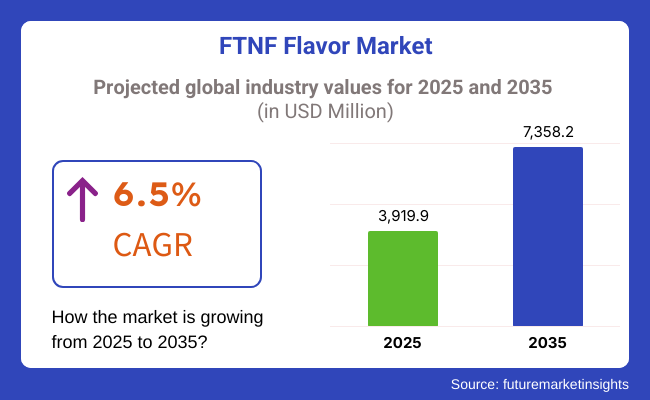

The FTNF Flavor Market is set to witness a consistent rise in the demand for FTNF (From The Named Fruit) flavors. By 2025, these flavors are estimated to be valued at USD 3,919.9 million. A CAGR of 6.5% is expected to be displayed by the overall industry during the forecast period spanning from 2025 to 2035. The net valuation that is anticipated will be USD 7,358.2 million in the year 2035.

The authenticity, purity, and natural taste profile of the FTNF flavors are guaranteed as they originate directly from the fruits themselves. The food and beverage industry is a significant sector where these flavors are used, especially in juices, soft drinks, dairy, and confectionery, where natural labeling and clean ingredients are prioritized. The surge in consumer demand for natural and minimally processed food inputs is a significant factor driving the growth of this sector.

The major contributors to the development are the clean-label trend and the transparent ingredient sourcing practice, which is gaining momentum. More and more consumers are looking for food and beverage products without artificial additives and synthetic flavors, which is the reason why companies have decided to switch to these flavors in the first place. The backing of the government through policies like supporting natural components and stricter labeling provisions are the factors that are persuading food manufacturers to upgrade their recipes using FTNF-certified flavors.

On the other hand, the improvements seen in the extraction and flavor preservation capabilities are also a good influence as these advancements are further contributing towards the sector's growth. Methods such as cold-press extraction, supercritical CO2 extraction, and enzymatic processing are the main factors that improve the quality and stability of these flavors; therefore, these techniques have their broader use in premium food and beverage formulations.

Nevertheless, there are some challenges, such as the high costs of production when it comes to these flavors and the supply chain constraints that stem from the seasonal availability of fruits. In addition, manufacturers may find it difficult to provide consistent flavors while satisfying the regulations that differ in varying regions.

Nonetheless, the high expansion rates of the sector make it inevitable that significant changes will appear to mitigate these hurdles. The adoption of these flavors can be regarded as a suitable approach to the problem of the increasing demand for organic and non-GMO foods.

Furthermore, the trajectory of new functional and plant-based food products gaining FTNF flavor is the one expected for the subsequent leap. The sphere is well-equipped for prolonged progress as long as consumer choices are swaying towards natural and health-focused foods.

During 2020 to 2024, there was strong growth fueled by rising consumer interest in natural and authentic flavors. Consumers demanded clean-label products with clear sourcing and natural ingredients, compelling food and beverage companies to embrace these flavors to improve taste profiles without the use of artificial additives. The vegetable food and beverages segment increased, with FTNF flavors being utilized to achieve taste authenticity and sensory profile. New extraction technologies and better flavor technology allowed manufacturers to simulate the actual taste of fruits much better. The marketplace also benefited from increasing health-oriented consumerism, with these flavors positioned well with the growing demand for natural and lightly processed ingredients.

Though there were challenges faced by supply chain disruption and regulation for labeling and ingredient disclosure, there would be a steady expansion during 2025 to 2035 with the drivers of technological improvement and changing consumer preferences.

Extraction and formulation technologies will continue to improve flavor consistency and provide room for including functional benefits, e.g., immune system improvement and gut wellness. Artificial intelligence and machine learning would be the driving forces behind flavor creation and sensitivity in the marketplace. Sustainability will also be the focus area, with companies using green production processes to minimize wastage. The regulatory guidance will become stricter, with a focus on transparency and authenticity of the name of flavors.

A Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Natural and clean-label flavor focus | Transition towards functional and health-supportive flavors |

| Fueled by natural and plant-based ingredient demand | Technology and functional innovation fueled sustained growth |

| Enhanced extraction and flavor duplication methods | Flavor creation with AI and enhanced consistency |

| Clean-label and plant-based product expansion | Functional benefits such as immune system support and gut health are in the limelight. |

| Enhanced regulation of natural ingredient sourcing and transparency | Global standards harmonization and enhanced transparency |

| The first steps towards artificial additive elimination and enhanced sourcing | Emphasizing strongly on environmentally friendly production and waste minimization |

The industry is seeing heightened demand with the shift of consumer inclination towards natural, clean-label, and real flavors across all sectors.

Within the beverage industry, these flavors are utilized on a broad scale in juices, flavored water, and fizzy beverages to sustain real taste profiles. These flavors are used in the bakery and confectionery industry for fruit-filled pastries, jams, and candies, with regulatory compliance and natural sourcing being a major point of emphasis.

The frozen desserts and dairy industry requires stability and intense fruit flavors for yogurts, ice creams, and plant-based alternatives. In the pharmaceutical industry, these flavors are essential to mask bitterness in syrups and supplements. In contrast, in personal care, they add fragrance and attractiveness to oral care and skin care products

With increasing consumer education around clean-label ingredients, manufacturers are investing in cutting-edge extraction methods to ensure purity, traceability, and sustainability, which makes these flavors an integral part of the changing flavor landscape.

The industry is flourishing because of the increasing consumer demand for natural and authentic taste experiences in food and beverages. However, regulatory issues like labeling, ingredient authenticity, and organic certification, as well as compliance risks, come along with them. Enterprises should follow strict food safety rules and be transparent.

The production of the company is highly affected by supply chain risks like the non-availability of fruits in season as well as the dependence on a specific type of fruit. The vagaries of weather, crop diseases, and geopolitical conflicts can impact price and supply predictions. As a way of countering such adversities, businesses can look into diversifying their sourcing methods, committing to sustainable farming practices, and strengthening their ties with suppliers.

The transition in consumer taste towards products that carry the clean label, and those that are made with fewer ingredients has a consequent effect on old product formulations. Nowadays, people are more inclined towards sugar-free, allergy-free, and non-GMO foods, which has led to further product developments. Enterprises are expected to put money into Research and Development to come up with concomitant separation processes that do not hinder these flavors from remaining intact and stable.

Issues like storage, preservation, and transportation are significant impediments to the quality and the product's shelf life. The challenge of keeping natural flavors stable without the help of artificial preservatives requires intricate formulation techniques. The quality control mechanisms must be comprehensive, the packaging must be the best, and it should be a cold chain so as to be able to deliver intact flavors during the distribution phase.

Natural FTNF Flavors is a major category segment in the FTNF (From The Named Fruit) Flavor Market that holds a staggering share of 63.5% in 2025, The Natural FTNF Flavors segment of the FTNF (From The Named Fruit) flavor market is anticipated to hold maximum share of 63.5% in 2025, in comparison to its counterpart segment, Synthetic FTNF Flavors represented 36.5% in 2025.

Natural FTNF Flavors hold the largest market share, owing to the rising consumer inclination towards clean-label, plant-based, and minimally processed product ingredients. These flavors are obtained directly from the named fruit or botanical source, which is exciting for use in beverages, confectionery, dairy, and functional foods alike. Dominant companies such as Symrise, Givaudan, and International Flavors & Fragrances (IFF) are advancing their portfolios with more FTNF extracts sourced from citrus, berries, and tropical fruits. This is further driven by the growing demand for organic and non-GMO ingredients in the food and beverage industry.

Alternatively, Synthetic FTNF Flavors, accounting for 36.5% of the FTNF Flavors market, are an important segment of the industry, offering cost advantages, stability, and flavor profile consistency. Such flavors find use in applications that require natural sourcing but are prohibitively expensive or impractical, such as carbonated beverages, processed snacks, and pharmaceutical formulations. Company investments in synthetic innovations via FTNF flavors such as Firmenich and Takasago that deliver a high-quality nature-identical alternative to the fruit profile will only continue.

With growing consumer preference for natural and sustainable ingredients, manufacturers are investing in technologies to improve the processes for extraction and introduce more advanced extraction methods and also sustainable sourcing, which alone is expected to contribute significantly to making Natural FTNF Flavors readily available and economical for the consumers which is expected to drive the market further.

With a 34.0% share of the global market, the Beverage segment is the largest, attributed to the growing preference for natural fruit flavors across carbonated drinks, flavored water, energy drinks, and alcoholic beverages. This trend in clean-label/plant-based beverages led brands such as The Coca-Cola Company, PepsiCo, and Nestlé to add Natural FTNF Flavors extracted from citrus, berries, and tropical fruits to their portfolio. Also fueling the trend toward FTNF flavors is increasing consumer demand for functional beverages such as kombucha, probiotic drinks, and herbal infusions.

The Dairy segment accounts for 18.5% of the Dairy Market share, driven by the growing demand for flavored dairy products like yogurt, milk-based beverages, and plant-based dairy products. Brands such as Danone, Arla Foods, and Chobani have embraced Mike's FTNF flavors, particularly from natural sources like vanilla, berries, and tropical fruits, to boost taste without sacrificing their natural or organic label. As the plant-based dairy market grows, brands producing almond, oat, and soy milk are starting to include FTNF flavors as well, to enhance sensory appeal and product differentiation.

With consumers increasingly drawn towards products with natural ingredients and openness in ingredient sourcing, FTNF flavors have become a significant growth contributor within the beverage and dairy sector, prompting manufacturers to direct investments toward the sustainable sourcing of raw materials while exploring innovative extraction methods.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.8% |

| UK | 6.2% |

| France | 6.0% |

| Germany | 5.9% |

| Italy | 5.7% |

| South Korea | 6.5% |

| Japan | 5.8% |

| China | 7.2% |

| Australia | 6.0% |

| New Zealand | 5.5% |

The USA is expected to grow at a CAGR of 6.8% during the period 2025 to 2035. The growth is spurred by rising consumer need for natural and genuine flavors in food and beverages. McCormick & Company, among other companies, has reacted by broadening its natural flavor offerings with a focus on transparency and clean-label products. Growth in health-focused consumers looking for minimally processed foods has also driven the adoption of these flavors.

Secondly, the USA market enjoys a strong regulatory system that favors natural ingredient labeling, which pushes companies to use these flavors. The movement toward plant-based and organic products has also driven growth in the market, with brands using these flavors to create more appealing products without artificial additives.

In the UK, the FTNF flavor market is expected to register a CAGR of 6.2% during the forecast period. Consumers are looking for products with natural ingredients, and this has encouraged brands such as Treatt to develop better flavoring solutions. The clean-eating trend has picked up pace, and this has resulted in increased demand for products that are free from synthetic additives.

The UK 's strict food labeling laws have pushed manufacturers to implement FTNF flavors to satisfy consumers' demands for openness. The trend of ready-to-drink and health-oriented snacks has also fueled the use of these flavors, complementing the wellness trend that is on the rise.

France's FTNF flavor market is anticipated to record a CAGR of 6.0% from 2025 to 2035. French consumers' fondness for authenticity in the culinary context has resulted in a taste for natural flavors. Manufacturers such as Mane have created flavors that satisfy this demand, with a focus on the significance of origin and quality.

The French market is also assisted by a well-established culture of artisanal food production, whereby these flavors are important to preserve product integrity. The growing markets for organic foods and environmental-conscious consumers have further supported the uptake of these flavors across different food and beverage applications.

Germany is expected to register a CAGR of 5.9% in the forecast period. The focus of the country on the quality and safety of food production has resulted in higher application of natural flavors. Symrise, a German entity, has been at the forefront of providing FTNF flavors in accordance with the strict criteria of the German market.

The increasing number of vegetarians and vegans in Germany has also fueled the demand for natural flavor solutions as consumers look for true taste experiences without sacrificing their dietary preferences. This trend has prompted manufacturers to incorporate these flavors into plant-based foods.

Italy is predicted to develop at a CAGR of 5.7% between 2025 and 2035. Italy's deep food culture emphasizes the importance of natural flavors, so these flavors are highly attractive. Players such as Italfood have adopted these flavors to improve conventional products naturally.

The Italian slow food movement, which focuses on local and traditional food, has also contributed to the increased demand for natural flavors. The consumers' choice of products with transparent and simple ingredient lists has prompted manufacturers to use FTNF flavors, following the clean-label trend.

South Korea's FTNF flavor market is projected to develop at a CAGR of 6.5% during the decade. The Korean cultural wave, or Hallyu wave, has spurred interest in Korean cuisine globally, propelling demand for natural flavors. Firms such as CJ CheilJedang have used FTNF flavors to preserve original tastes in new food products.

The wellness and health trend in South Korea has also influenced consumers to look for natural ingredients, pushing the application of FTNF flavors in health-focused snacks and functional drinks. Government assistance to the food sector's innovation has also enabled the integration of such flavors.

Japan's FTNF flavor industry is predicted to advance at a 5.8% CAGR during the period 2025 to 2035. The Japanese consumer's love for minimal yet genuine flavors has influenced the growth of the industry. Takasago, among other companies, has come up with offerings that satisfy this craving while keeping traditional tastes intact.

The industry is further affected by increased concern with health and well-being, and the customer looks for products providing natural value. FTNF flavor has also been found to be applicable in foods and drinks for functionalities that are in line with Japan's preventive-oriented healthcare awareness.

China's FTNF flavor industry is expected to grow at a CAGR of 7.2% during the forecast period. Urbanization and a developing middle class have raised demand for natural and premium foodstuffs. Firms such as Huabao have taken advantage of this by selling FTNF flavors that are responsive to local tastes.

The efforts by the government to enhance food safety and encourage healthy consumption have additionally spurred the use of natural flavors. The success of traditional Chinese medicine has also made an impact, with the public opting for products that include natural ingredients.

Australia's FTNF flavor market is expected to expand at a CAGR of 6.0% between 2025 and 2035. Food diversity and a focus on natural products in the country have made consumers embrace FTNF flavors. Flavor Makers has been at the forefront of bringing these flavors, which have helped satisfy consumers' demand for authenticity.

The clean-label movement is popular in Australia, where consumers look for products that contain no artificial additives. The desire has promoted companies to use FTNF flavorings, especially in the beverage and dairy industries, where natural flavor commands high regard.

New Zealand's FTNF flavor industry is forecasted to develop at a CAGR of 5.5% throughout the forecast period. The nation's emphasis on sustainability and natural products has contributed to the popularity of FTNF flavors. Such firms as Fresh As have employed these flavors to present innovative items that appeal to customers.

The increasing food exports happening in New Zealand have also impacted the application of FTNF flavors since foreign consumers believe that the nation is pure and of natural quality. This image has prompted domestic producers to ensure high standards by using FTNF flavors in their products.

The FTNF flavor market is rapidly developing, with rising consumer demand for natural, clean-label, authentic fruit-based flavorings for food and beverages. FTNF flavors are prepared exclusively from the fruit mentioned in the name, thereby maintaining purity, regulatory compliance, and improved sensory profiles. This industry is extending due to the increasing preference for natural flavors over synthetic ones and a stringent food labeling regime.

Dominating players include Givaudan, International Flavors and Fragrances (IFF), Symrise, Kerry Group, and Firmenich-together, owing to massive R&D investment, worldwide supply chains, and strategic partnerships with food and beverage manufacturers. Startups and niche providers are innovating emergent consumer trends in flavor profiles based on exotic fruit, organic certified extracts, and advanced concentrating technologies.

Key offerings include FTNF fruit extracts, concentrates, essential oils, and distillates intended for juices, dairy, confectionery, and alcoholic beverages, among others. Companies are concentrating on cold extraction, vacuum distillation, and enzymatic processing modes to keep fruit stable and authentic as well as obtain a slightly longer shelf life. Some of the factors contributing to the competition are transparency of sourcing, regulatory approvals (FDA, EFSA), sustainability initiatives, and Introduction of innovations in encapsulation technology. Players are reforming their flavor portfolios by adding value through the addition of natural flavors and improving their supply chains through alliances with fruit farmers for quality and regular supplies. The regions of Asia-Pacific and North America are experiencing a quicker share growth, therefore increasing investments in regional production, direct sourcing, and flavor-customization solutions to enhance their marketing investment.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Givaudan | 18-22% |

| International Flavors & Fragrances (IFF) | 14-18% |

| Symrise | 10-14% |

| Kerry Group | 8-12% |

| Firmenich | 6-10% |

| Other Players (Combined) | 25-35% |

| Company Name | Key Offerings & Market Focus |

|---|---|

| Givaudan | Leader in FTNF citrus, berry, and tropical flavoring based on sustainable sourcing and state-of-the-art cold extraction. |

| IFF | Manufactures high-purity FTNF flavors through enzymatic and vacuum distillation methods for clean-label and organic product ranges. |

| Symrise | Has expertise in bespoke FTNF flavor solutions with excellent applications in the beverage, dairy, and confectionery industries. |

| Kerry Group | We specialize in high-intensity, natural FTNF fruit flavors for functional foods and RTD beverage use. |

| Firmenich | Blends FTNF flavors with botanical extracts, delivering multi-dimensional taste experiences in high-end product categories. |

Key Company Insights

Givaudan (18-22%)

Leadership in citrus-based FTNF flavors through investment in sustainability and state-of-the-art extraction techniques to build authenticity.

IFF (14-18%)

Special emphasis on enzymatic extraction and organic-certified FTNF flavors to maintain regulatory compliance and top-notch sensory quality.

Symrise (10-14%)

Delivers tailor-made FTNF solutions, capturing regional flavor choices and venturing into health and wellness applications.

Kerry Group (8-12%)

Leads innovation in high-intensity fruit flavors with stable, long-shelf-life FTNF formulations for RTD and dairy markets.

Firmenich (6-10%)

Blends FTNF flavors with botanicals to produce distinctive flavor profiles for premium and functional foods.

Other Key Players

It's classified as Natural FTNF Flavors and Synthetic FTNF Flavors.

It's classified as Dairy, Bakery, Confectionery, Snack, Beverage, and Other applications.

It's divided into North America, Latin America, Europe, East Asia, South Asia, and the Middle East and Africa.

The industry is expected to generate USD 3,919.9 million in 2025, driven by rising demand for clean-label products and natural flavor solutions across food and beverage sectors.

The market is projected to grow to USD 7,358.2 million by 2035, fueled by increasing consumer preference for natural ingredients and consistent innovation in flavor extraction and formulation technologies. The market is expected to expand at a CAGR of 6.5%.

Key players include Givaudan, International Flavors & Fragrances (IFF), Symrise, Kerry Group, Firmenich, Takasago International Corporation, Döhler Group, Mane, Robertet Group, and Treatt PLC.

North America and Europe represent mature markets with strong demand for natural and organic products, while East Asia and South Asia are witnessing rapid growth driven by expanding food processing industries and shifting consumer tastes.

Natural FTNF flavors dominate the market, particularly in applications such as beverages, dairy, and bakery products. Synthetic FTNF flavors still hold relevance in cost-sensitive markets, while demand for natural alternatives continues to surge globally.

Table 1 : Global Market Value (US$ million) Forecast by Region, 2018 to 2033

Table 2 : Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3 : Global Market Value (US$ million) Forecast by Type, 2018 to 2033

Table 4 : Global Market Volume (MT) Forecast by Type, 2018 to 2033

Table 5 : Global Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 6 : Global Market Volume (MT) Forecast by Application, 2018 to 2033

Table 7 : North America Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 8 : North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 9 : North America Market Value (US$ million) Forecast by Type, 2018 to 2033

Table 10 : North America Market Volume (MT) Forecast by Type, 2018 to 2033

Table 11 : North America Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 12 : North America Market Volume (MT) Forecast by Application, 2018 to 2033

Table 13 : Latin America Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 14 : Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 15 : Latin America Market Value (US$ million) Forecast by Type, 2018 to 2033

Table 16 : Latin America Market Volume (MT) Forecast by Type, 2018 to 2033

Table 17 : Latin America Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 18 : Latin America Market Volume (MT) Forecast by Application, 2018 to 2033

Table 19 : Europe Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 20 : Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 21 : Europe Market Value (US$ million) Forecast by Type, 2018 to 2033

Table 22 : Europe Market Volume (MT) Forecast by Type, 2018 to 2033

Table 23 : Europe Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 24 : Europe Market Volume (MT) Forecast by Application, 2018 to 2033

Table 25 : East Asia Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 26 : East Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 27 : East Asia Market Value (US$ million) Forecast by Type, 2018 to 2033

Table 28 : East Asia Market Volume (MT) Forecast by Type, 2018 to 2033

Table 29 : East Asia Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 30 : East Asia Market Volume (MT) Forecast by Application, 2018 to 2033

Table 31 : South Asia Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 32 : South Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 33 : South Asia Market Value (US$ million) Forecast by Type, 2018 to 2033

Table 34 : South Asia Market Volume (MT) Forecast by Type, 2018 to 2033

Table 35 : South Asia Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 36 : South Asia Market Volume (MT) Forecast by Application, 2018 to 2033

Table 37 : Oceania Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 38 : Oceania Market Volume (MT) Forecast by Country, 2018 to 2033

Table 39 : Oceania Market Value (US$ million) Forecast by Type, 2018 to 2033

Table 40 : Oceania Market Volume (MT) Forecast by Type, 2018 to 2033

Table 41 : Oceania Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 42 : Oceania Market Volume (MT) Forecast by Application, 2018 to 2033

Table 43 : Middle East and Africa Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 44 : Middle East and Africa Market Volume (MT) Forecast by Country, 2018 to 2033

Table 45 : Middle East and Africa Market Value (US$ million) Forecast by Type, 2018 to 2033

Table 46 : Middle East and Africa Market Volume (MT) Forecast by Type, 2018 to 2033

Table 47 : Middle East and Africa Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 48 : Middle East and Africa Market Volume (MT) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ million) by Type, 2023 to 2033

Figure 2: Global Market Value (US$ million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ million) Analysis by Type, 2018 to 2033

Figure 9: Global Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 12: Global Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 13: Global Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 16: Global Market Attractiveness by Type, 2023 to 2033

Figure 17: Global Market Attractiveness by Application, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ million) by Type, 2023 to 2033

Figure 20: North America Market Value (US$ million) by Application, 2023 to 2033

Figure 21: North America Market Value (US$ million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ million) Analysis by Type, 2018 to 2033

Figure 27: North America Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 30: North America Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 31: North America Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 34: North America Market Attractiveness by Type, 2023 to 2033

Figure 35: North America Market Attractiveness by Application, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ million) by Type, 2023 to 2033

Figure 38: Latin America Market Value (US$ million) by Application, 2023 to 2033

Figure 39: Latin America Market Value (US$ million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ million) Analysis by Type, 2018 to 2033

Figure 45: Latin America Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 48: Latin America Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 49: Latin America Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 53: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Europe Market Value (US$ million) by Type, 2023 to 2033

Figure 56: Europe Market Value (US$ million) by Application, 2023 to 2033

Figure 57: Europe Market Value (US$ million) by Country, 2023 to 2033

Figure 58: Europe Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 59: Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 60: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Europe Market Value (US$ million) Analysis by Type, 2018 to 2033

Figure 63: Europe Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 64: Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 65: Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 66: Europe Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 67: Europe Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 68: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 69: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 70: Europe Market Attractiveness by Type, 2023 to 2033

Figure 71: Europe Market Attractiveness by Application, 2023 to 2033

Figure 72: Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: East Asia Market Value (US$ million) by Type, 2023 to 2033

Figure 74: East Asia Market Value (US$ million) by Application, 2023 to 2033

Figure 75: East Asia Market Value (US$ million) by Country, 2023 to 2033

Figure 76: East Asia Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 77: East Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 78: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: East Asia Market Value (US$ million) Analysis by Type, 2018 to 2033

Figure 81: East Asia Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 82: East Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 83: East Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 84: East Asia Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 85: East Asia Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 86: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 87: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 88: East Asia Market Attractiveness by Type, 2023 to 2033

Figure 89: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 90: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia Market Value (US$ million) by Type, 2023 to 2033

Figure 92: South Asia Market Value (US$ million) by Application, 2023 to 2033

Figure 93: South Asia Market Value (US$ million) by Country, 2023 to 2033

Figure 94: South Asia Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 95: South Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 96: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia Market Value (US$ million) Analysis by Type, 2018 to 2033

Figure 99: South Asia Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 100: South Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 101: South Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 102: South Asia Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 103: South Asia Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 104: South Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 105: South Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 106: South Asia Market Attractiveness by Type, 2023 to 2033

Figure 107: South Asia Market Attractiveness by Application, 2023 to 2033

Figure 108: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 109: Oceania Market Value (US$ million) by Type, 2023 to 2033

Figure 110: Oceania Market Value (US$ million) by Application, 2023 to 2033

Figure 111: Oceania Market Value (US$ million) by Country, 2023 to 2033

Figure 112: Oceania Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 113: Oceania Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 114: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: Oceania Market Value (US$ million) Analysis by Type, 2018 to 2033

Figure 117: Oceania Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 118: Oceania Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 119: Oceania Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 120: Oceania Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 121: Oceania Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 122: Oceania Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 123: Oceania Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 124: Oceania Market Attractiveness by Type, 2023 to 2033

Figure 125: Oceania Market Attractiveness by Application, 2023 to 2033

Figure 126: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 127: Middle East and Africa Market Value (US$ million) by Type, 2023 to 2033

Figure 128: Middle East and Africa Market Value (US$ million) by Application, 2023 to 2033

Figure 129: Middle East and Africa Market Value (US$ million) by Country, 2023 to 2033

Figure 130: Middle East and Africa Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 131: Middle East and Africa Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Market Value (US$ million) Analysis by Type, 2018 to 2033

Figure 135: Middle East and Africa Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 138: Middle East and Africa Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 139: Middle East and Africa Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 142: Middle East and Africa Market Attractiveness by Type, 2023 to 2033

Figure 143: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 144: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Flavor Modulator Market Size and Share Forecast Outlook 2025 to 2035

Flavor Emulsions Market Size and Share Forecast Outlook 2025 to 2035

Flavor Modulators Market Size and Share Forecast Outlook 2025 to 2035

Flavor Masking Agents Market Size and Share Forecast Outlook 2025 to 2035

Flavor Compounds Market Size and Share Forecast Outlook 2025 to 2035

Flavoring Cosmetic Formulation Agents Market Size and Share Forecast Outlook 2025 to 2035

Flavored Whiskey Market Size and Share Forecast Outlook 2025 to 2035

Flavored Butter And Oils Market Size and Share Forecast Outlook 2025 to 2035

Flavoring Oils Market Size and Share Forecast Outlook 2025 to 2035

Flavoring Agents Market Size and Share Forecast Outlook 2025 to 2035

Flavors for Pharmaceutical & Healthcare Applications Market Size and Share Forecast Outlook 2025 to 2035

Flavor Capsule Cigarette Market Analysis - Size, Share, and Forecast 2025 to 2035

Flavored Syrup Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Analysis and Growth Projections for Flavor and Flavor Enhancers Market

Flavored Yogurt Market Analysis by Form, Flavor, End Use and Distribution Channel Through 2035

Flavors and Fragrances Market Analysis by Type, Nature, Application, and Region through 2035

Flavor Emulsion Market Analysis by Nature, End-Use, Distribution Channel, and Region - Growth, trends and forecast from 2025 to 2035

Flavored Water Market Trends - Hydration & Wellness Demand 2025 to 2035

Flavored Salt Market Insights - Seasoning Trends & Growth 2025 to 2035

Flavor Drops Market Growth - Beverage & Functional Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA